Key Insights

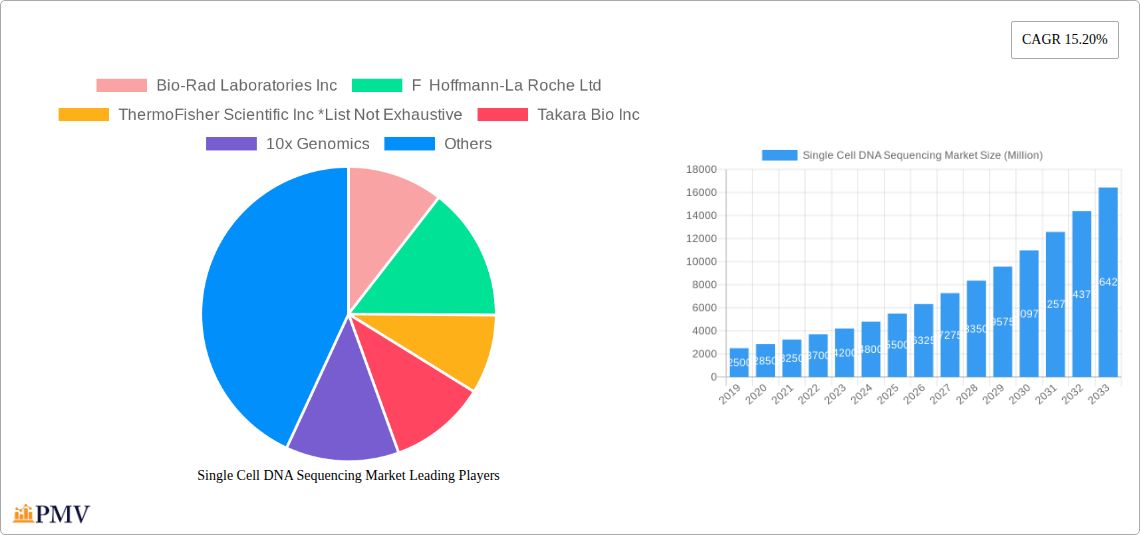

The Single Cell DNA Sequencing Market is projected for significant expansion, with an estimated market size of $7.5 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 15.2% through 2033. This growth is propelled by advancements in genomic technologies, a deeper understanding of cellular heterogeneity in diseases, and the rising demand for personalized medicine. Key market segments include Instruments and Reagents, essential for single-cell analysis. Foundational technologies such as Sequencing, PCR, and Microarray are driving innovation and expanding application areas. Primary applications driving market growth are Cancer research, followed by Immunology and Microbiology, crucial for dissecting complex biological systems. The competitive landscape features established companies like Thermo Fisher Scientific Inc., Illumina Inc., and Bio-Rad Laboratories Inc., alongside innovative entrants like 10x Genomics and Oxford Nanopore Technologies plc, fostering technological breakthroughs and strategic collaborations.

Single Cell DNA Sequencing Market Market Size (In Billion)

Geographically, North America and Europe lead the Single Cell DNA Sequencing Market due to robust research infrastructure, high technology adoption, and substantial life science investments. The Asia Pacific region is experiencing rapid growth, supported by government R&D initiatives, an increasing number of research institutions, and a rising prevalence of chronic diseases. High sequencing technology costs and the need for specialized expertise are potential restraints, though ongoing innovation and the development of accessible platforms are expected to mitigate these challenges. The market's trajectory indicates that single-cell DNA sequencing will become an indispensable tool in diagnostics, drug discovery, and fundamental biological research, facilitating more targeted therapeutic interventions.

Single Cell DNA Sequencing Market Company Market Share

This comprehensive report provides an in-depth analysis of the Single Cell DNA Sequencing Market, a critical sector for advancements in personalized medicine, drug discovery, and biological research. The market is characterized by its dynamic technology, widespread adoption, and competitive innovation. Our analysis covers the period from 2019 to 2033, with 2025 as the base year and projected market size of $7.5 billion, and a CAGR of 15.2%. We analyze market segmentation by Product (Instruments, Reagents), Technology (Sequencing, PCR, Microarray, Others), and Application (Cancer, Immunology, Microbiology, Others), offering actionable insights.

Single Cell DNA Sequencing Market Market Structure & Competitive Dynamics

The Single Cell DNA Sequencing Market exhibits a moderately concentrated structure, with key players investing heavily in research and development to maintain a competitive edge. Innovation ecosystems are flourishing, fueled by collaborations between academic institutions and commercial entities, leading to breakthroughs in single-cell sequencing technology. Regulatory frameworks, while evolving, are becoming more established, influencing product approvals and market entry strategies. Product substitutes, such as bulk DNA sequencing and other omics technologies, exist but are increasingly being complemented or superseded by the high-resolution insights offered by single-cell approaches. End-user trends point towards a growing demand for precise diagnostic tools and personalized therapeutic interventions, particularly in oncology and immunology. Mergers and acquisitions (M&A) are a notable aspect of market dynamics, with significant M&A deal values (e.g., estimated in the hundreds of Millions USD) indicating strategic consolidation and expansion efforts by leading companies. Market share distribution is dynamic, with prominent players like Illumina Inc., ThermoFisher Scientific Inc., and 10x Genomics holding substantial positions.

Single Cell DNA Sequencing Market Industry Trends & Insights

The Single Cell DNA Sequencing Market is poised for substantial growth, driven by an escalating need for high-resolution biological insights and advancements in genomic technologies. The market's compound annual growth rate (CAGR) is projected to be robust, estimated to be between 15-20% during the forecast period. Technological disruptions, particularly in next-generation sequencing (NGS) platforms and single-cell analysis workflows, are revolutionizing research capabilities, enabling deeper understanding of cellular heterogeneity. Consumer preferences are shifting towards personalized medicine, where single-cell data plays a pivotal role in tailoring treatments for diseases like cancer. Competitive dynamics are characterized by intense innovation in assay development, data analysis software, and high-throughput instrumentation. The increasing accessibility and affordability of DNA sequencing technologies, coupled with their expanded applications in microbiology and complex disease research, are further propelling market penetration. The ability to analyze individual cells provides unparalleled resolution for identifying rare cell populations, understanding developmental biology, and mapping intricate cellular interactions, thereby unlocking new therapeutic avenues and diagnostic strategies. The growing volume of genomic data generated by single-cell platforms necessitates sophisticated bioinformatic tools, creating a symbiotic growth relationship. Furthermore, the expanding research into the human microbiome and its impact on health and disease is opening up novel applications for single-cell genomics, particularly in understanding microbial community dynamics at an individual cell level.

Dominant Markets & Segments in Single Cell DNA Sequencing Market

The Single Cell DNA Sequencing Market sees North America dominating the regional landscape, driven by robust government funding for biomedical research, a high prevalence of chronic diseases, and the presence of leading research institutions and biotechnology companies. Within North America, the United States holds a significant market share due to substantial investments in genomics research and the early adoption of advanced DNA sequencing technologies.

Product Segment Dominance: The Instruments segment is a major contributor to market revenue, owing to the high cost of advanced sequencers and analytical platforms. However, the Reagents segment is experiencing rapid growth, propelled by the increasing number of experiments and consumables required for single-cell DNA sequencing.

- Key Drivers: Technological advancements in instrument miniaturization and sensitivity, development of novel reagent kits for specific applications, and increasing research expenditure in genomics.

Technology Segment Dominance: Sequencing technologies, particularly NGS-based single-cell DNA sequencing, are the most dominant. However, PCR-based technologies, including real-time PCR (RT-PCR), play a crucial role in sample preparation and amplification for single-cell analysis, showing consistent growth.

- Key Drivers: Advancements in sequencing accuracy and throughput, development of specialized PCR enzymes and kits for low-input samples, and the integration of these technologies in comprehensive workflows.

Application Segment Dominance: Cancer research and diagnostics represent the largest and fastest-growing application segment. The ability to identify tumor heterogeneity, track clonal evolution, and develop targeted therapies makes single-cell DNA sequencing invaluable in oncology. Immunology is another significant segment, with applications in understanding immune cell diversity, response to pathogens, and autoimmune diseases.

- Key Drivers: Increasing incidence of cancer globally, advancements in precision oncology, growing understanding of the immune system's role in health and disease, and the demand for personalized treatment strategies.

Single Cell DNA Sequencing Market Product Innovations

Product innovations in the Single Cell DNA Sequencing Market are primarily focused on enhancing throughput, accuracy, and ease of use. Leading companies are developing integrated platforms that streamline the entire workflow from cell isolation to data analysis. Innovations include novel microfluidic devices for efficient cell capture, advanced library preparation kits designed for low cell numbers and high DNA yield, and more sophisticated bioinformatic tools for interpreting complex single-cell genomic data. These advancements offer distinct competitive advantages by enabling researchers to gain deeper insights into cellular heterogeneity, identify rare cell populations, and accelerate drug discovery and diagnostic development.

Report Segmentation & Scope

This report meticulously segments the Single Cell DNA Sequencing Market to provide granular insights.

- Product: The market is segmented into Instruments (e.g., sequencers, cell sorters) and Reagents (e.g., library preparation kits, enzymes).

- Technology: Key technologies analyzed include Sequencing, PCR, Microarray, and Others (e.g., single-cell isolation techniques).

- Application: The report categorizes applications into Cancer, Immunology, Microbiology, and Others (e.g., developmental biology, neuroscience). Each segment is analyzed for its market size, growth projections, and competitive dynamics.

Key Drivers of Single Cell DNA Sequencing Market Growth

Several key factors are driving the growth of the Single Cell DNA Sequencing Market.

- Technological Advancements: Continuous innovation in NGS platforms, microfluidics, and PCR technologies is enhancing the sensitivity, throughput, and affordability of single-cell analysis.

- Increasing Research & Development Spending: Growing investments from both public and private sectors in understanding complex biological systems, particularly in areas like cancer and immunology, are fueling demand for single-cell solutions.

- Rise of Personalized Medicine: The paradigm shift towards personalized diagnostics and therapeutics necessitates high-resolution genomic data at the cellular level, making single-cell DNA sequencing indispensable.

- Growing Incidence of Chronic Diseases: The escalating burden of diseases like cancer, autoimmune disorders, and infectious diseases necessitates advanced diagnostic and therapeutic tools, where single-cell insights are crucial.

Challenges in the Single Cell DNA Sequencing Market Sector

Despite robust growth, the Single Cell DNA Sequencing Market faces several challenges.

- High Cost of Instrumentation and Consumables: The initial investment for advanced DNA sequencing instruments and the recurring cost of reagents can be prohibitive for some research institutions and smaller companies.

- Complex Data Analysis: The sheer volume and complexity of data generated from single-cell experiments require specialized bioinformatic expertise and infrastructure, posing a barrier to widespread adoption.

- Standardization and Reproducibility: Ensuring consistent and reproducible results across different labs and experimental conditions remains a challenge for single-cell methodologies.

- Regulatory Hurdles: While expanding, regulatory frameworks for single-cell diagnostic applications are still evolving, potentially slowing down the translation of research findings into clinical practice.

Leading Players in the Single Cell DNA Sequencing Market Market

- Bio-Rad Laboratories Inc

- F Hoffmann-La Roche Ltd

- ThermoFisher Scientific Inc

- Takara Bio Inc

- 10x Genomics

- BGI

- BD

- PacBio

- Illumina Inc

- Fluidigm Corporation

- QIAGEN

- Oxford Nanopore Technologies plc

Key Developments in Single Cell DNA Sequencing Market Sector

- March 2022: Kaneka Corporation launched KANEKA RT-PCR Kit 'SARS-CoV-2 (Omicron/Delta) ver.2', a real-time PCR test kit capable of simultaneously detecting the Omicron (BA.1), 'Stealth' Omicron (BA.2), and Delta variants of COVID-19.

- March 2022: Sengenics announced the commercial launch of the i-Ome Protein Array Kit. The i-Ome Protein Array Kit contains slide-based, high-density protein microarrays comprising 1600+ immobilized, full-length, correctly folded human proteins.

Strategic Single Cell DNA Sequencing Market Market Outlook

The Single Cell DNA Sequencing Market is set to experience significant growth acceleration, fueled by increasing adoption in clinical diagnostics, drug development, and a deeper understanding of cellular mechanisms in health and disease. Strategic opportunities lie in the development of more integrated, user-friendly platforms, advanced bioinformatic solutions for data interpretation, and expansion into emerging applications like neuroscience and infectious disease research. Partnerships and collaborations between technology providers, research institutions, and pharmaceutical companies will be crucial for translating research breakthroughs into tangible clinical benefits and driving market expansion. The growing demand for precision medicine will continue to be a primary growth accelerator, positioning single-cell DNA sequencing as a cornerstone technology for the future of healthcare.

Single Cell DNA Sequencing Market Segmentation

-

1. Product

- 1.1. Instruments

- 1.2. Reagents

-

2. Technology

- 2.1. Sequencing

- 2.2. PCR

- 2.3. Microarray

- 2.4. Others

-

3. Application

- 3.1. Cancer

- 3.2. Immunology

- 3.3. Microbiology

- 3.4. Others

Single Cell DNA Sequencing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Single Cell DNA Sequencing Market Regional Market Share

Geographic Coverage of Single Cell DNA Sequencing Market

Single Cell DNA Sequencing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High R&D Investments in the Single cell Genomics; Growing Number of SCG Centers and Core Facilities

- 3.3. Market Restrains

- 3.3.1. Analytical Challenges Related to Single-cell Genome Sequencing

- 3.4. Market Trends

- 3.4.1. PCR Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Single Cell DNA Sequencing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Instruments

- 5.1.2. Reagents

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Sequencing

- 5.2.2. PCR

- 5.2.3. Microarray

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Cancer

- 5.3.2. Immunology

- 5.3.3. Microbiology

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Single Cell DNA Sequencing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Instruments

- 6.1.2. Reagents

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Sequencing

- 6.2.2. PCR

- 6.2.3. Microarray

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Cancer

- 6.3.2. Immunology

- 6.3.3. Microbiology

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Single Cell DNA Sequencing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Instruments

- 7.1.2. Reagents

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Sequencing

- 7.2.2. PCR

- 7.2.3. Microarray

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Cancer

- 7.3.2. Immunology

- 7.3.3. Microbiology

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Single Cell DNA Sequencing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Instruments

- 8.1.2. Reagents

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Sequencing

- 8.2.2. PCR

- 8.2.3. Microarray

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Cancer

- 8.3.2. Immunology

- 8.3.3. Microbiology

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Single Cell DNA Sequencing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Instruments

- 9.1.2. Reagents

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Sequencing

- 9.2.2. PCR

- 9.2.3. Microarray

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Cancer

- 9.3.2. Immunology

- 9.3.3. Microbiology

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Single Cell DNA Sequencing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Instruments

- 10.1.2. Reagents

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Sequencing

- 10.2.2. PCR

- 10.2.3. Microarray

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Cancer

- 10.3.2. Immunology

- 10.3.3. Microbiology

- 10.3.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bio-Rad Laboratories Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 F Hoffmann-La Roche Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ThermoFisher Scientific Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Takara Bio Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 10x Genomics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BGI

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PacBio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Illumina Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fluidigm Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 QIAGEN

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Oxford Nanopore Technologies plc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Bio-Rad Laboratories Inc

List of Figures

- Figure 1: Global Single Cell DNA Sequencing Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Single Cell DNA Sequencing Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Single Cell DNA Sequencing Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Single Cell DNA Sequencing Market Revenue (billion), by Technology 2025 & 2033

- Figure 5: North America Single Cell DNA Sequencing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Single Cell DNA Sequencing Market Revenue (billion), by Application 2025 & 2033

- Figure 7: North America Single Cell DNA Sequencing Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Single Cell DNA Sequencing Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Single Cell DNA Sequencing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Single Cell DNA Sequencing Market Revenue (billion), by Product 2025 & 2033

- Figure 11: Europe Single Cell DNA Sequencing Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Single Cell DNA Sequencing Market Revenue (billion), by Technology 2025 & 2033

- Figure 13: Europe Single Cell DNA Sequencing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Single Cell DNA Sequencing Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Single Cell DNA Sequencing Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Single Cell DNA Sequencing Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Single Cell DNA Sequencing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Single Cell DNA Sequencing Market Revenue (billion), by Product 2025 & 2033

- Figure 19: Asia Pacific Single Cell DNA Sequencing Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific Single Cell DNA Sequencing Market Revenue (billion), by Technology 2025 & 2033

- Figure 21: Asia Pacific Single Cell DNA Sequencing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Single Cell DNA Sequencing Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Asia Pacific Single Cell DNA Sequencing Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Single Cell DNA Sequencing Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Single Cell DNA Sequencing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Single Cell DNA Sequencing Market Revenue (billion), by Product 2025 & 2033

- Figure 27: Middle East and Africa Single Cell DNA Sequencing Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Single Cell DNA Sequencing Market Revenue (billion), by Technology 2025 & 2033

- Figure 29: Middle East and Africa Single Cell DNA Sequencing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Middle East and Africa Single Cell DNA Sequencing Market Revenue (billion), by Application 2025 & 2033

- Figure 31: Middle East and Africa Single Cell DNA Sequencing Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East and Africa Single Cell DNA Sequencing Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Single Cell DNA Sequencing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Single Cell DNA Sequencing Market Revenue (billion), by Product 2025 & 2033

- Figure 35: South America Single Cell DNA Sequencing Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: South America Single Cell DNA Sequencing Market Revenue (billion), by Technology 2025 & 2033

- Figure 37: South America Single Cell DNA Sequencing Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: South America Single Cell DNA Sequencing Market Revenue (billion), by Application 2025 & 2033

- Figure 39: South America Single Cell DNA Sequencing Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Single Cell DNA Sequencing Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Single Cell DNA Sequencing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Product 2020 & 2033

- Table 13: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Product 2020 & 2033

- Table 23: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 24: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Product 2020 & 2033

- Table 33: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 34: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 35: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Product 2020 & 2033

- Table 40: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 41: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 42: Global Single Cell DNA Sequencing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Single Cell DNA Sequencing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Single Cell DNA Sequencing Market?

The projected CAGR is approximately 12.2%.

2. Which companies are prominent players in the Single Cell DNA Sequencing Market?

Key companies in the market include Bio-Rad Laboratories Inc, F Hoffmann-La Roche Ltd, ThermoFisher Scientific Inc *List Not Exhaustive, Takara Bio Inc, 10x Genomics, BGI, BD, PacBio, Illumina Inc, Fluidigm Corporation, QIAGEN, Oxford Nanopore Technologies plc.

3. What are the main segments of the Single Cell DNA Sequencing Market?

The market segments include Product, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.95 billion as of 2022.

5. What are some drivers contributing to market growth?

High R&D Investments in the Single cell Genomics; Growing Number of SCG Centers and Core Facilities.

6. What are the notable trends driving market growth?

PCR Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Analytical Challenges Related to Single-cell Genome Sequencing.

8. Can you provide examples of recent developments in the market?

In March 2022, Kaneka Corporation launched KANEKA RT-PCR Kit 'SARS-CoV-2 (Omicron/Delta) ver.2', a real-time PCR test kit capable of simultaneously detecting the Omicron (BA.1), 'Stealth' Omicron (BA.2), and Delta variants of COVID-19.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Single Cell DNA Sequencing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Single Cell DNA Sequencing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Single Cell DNA Sequencing Market?

To stay informed about further developments, trends, and reports in the Single Cell DNA Sequencing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence