Key Insights

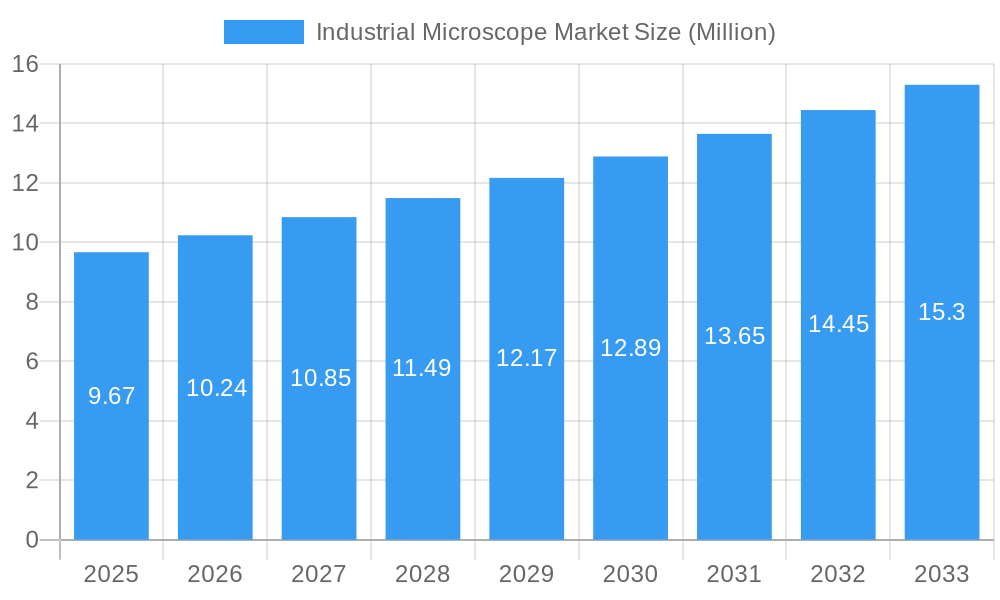

The global industrial microscope market is poised for substantial growth, projected to reach approximately USD 9.67 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.82% through 2033. This expansion is fueled by a confluence of advancements in microscopy technologies, increasing adoption across diverse industries, and a growing demand for high-resolution imaging solutions. Electron microscopy, particularly Transmission Electron Microscopy (TEM) and Scanning Electron Microscopy (SEM), is expected to lead revenue generation due to its unparalleled ability to visualize nanoscale structures. Optical microscopy, with its versatile applications and cost-effectiveness, will continue to hold a significant market share, especially in routine quality control and inspection processes. Scanning Probe Microscopy (SPM), including Atomic Force Microscopy (AFM), is gaining traction for its unique capabilities in surface analysis and manipulation, further driving market dynamics. The market's momentum is significantly influenced by escalating investments in nanotechnology research and development, critical for creating next-generation materials and devices. The life sciences sector, with its increasing need for detailed cellular and molecular imaging, alongside the robust semiconductor industry's demand for precise defect detection and process control, are key growth engines. Material science applications, enabling the characterization of novel materials with enhanced properties, also contribute substantially to market expansion.

Industrial Microscope Market Market Size (In Million)

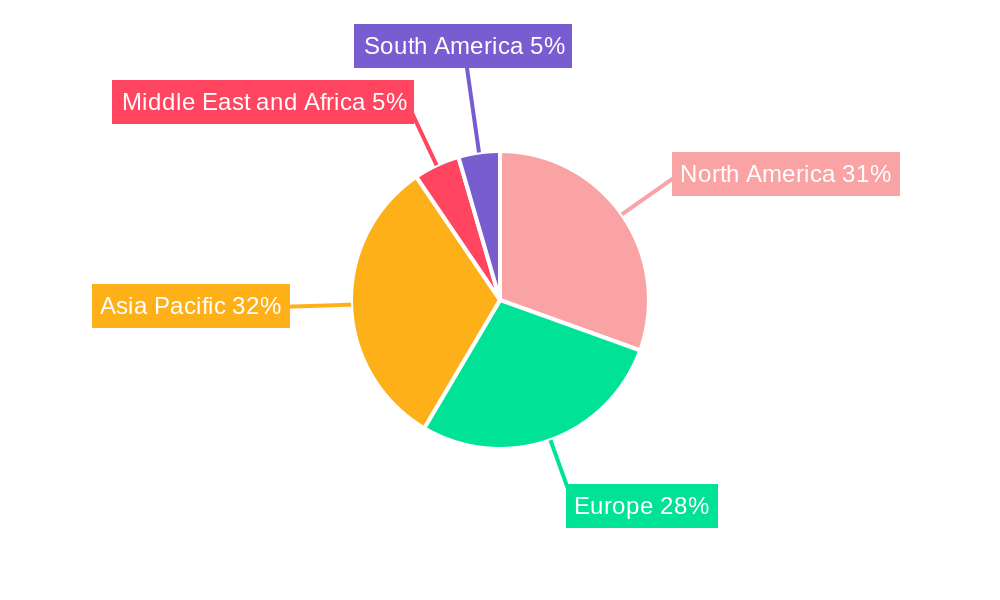

The industrial microscope market's trajectory is further shaped by emerging trends such as the integration of artificial intelligence (AI) and machine learning (ML) for automated image analysis and faster data interpretation. Advancements in digital microscopy, offering enhanced image capture, storage, and sharing capabilities, are also driving adoption. However, certain factors may temper this growth. The high initial cost of advanced microscopy systems, especially for high-end electron microscopes, can be a significant restraint for small and medium-sized enterprises. Stringent regulatory requirements in certain applications, particularly in pharmaceuticals and medical devices, necessitate rigorous validation and calibration, adding to operational costs. Furthermore, the availability of skilled personnel for operating and maintaining sophisticated microscopy equipment can be a challenge in some regions. Geographically, North America and Europe currently dominate the market, driven by strong research infrastructure, significant R&D spending, and a well-established industrial base. However, the Asia Pacific region, led by China and Japan, is emerging as a rapidly growing market due to increasing industrialization, government initiatives supporting technological advancements, and a burgeoning manufacturing sector, particularly in semiconductors and electronics.

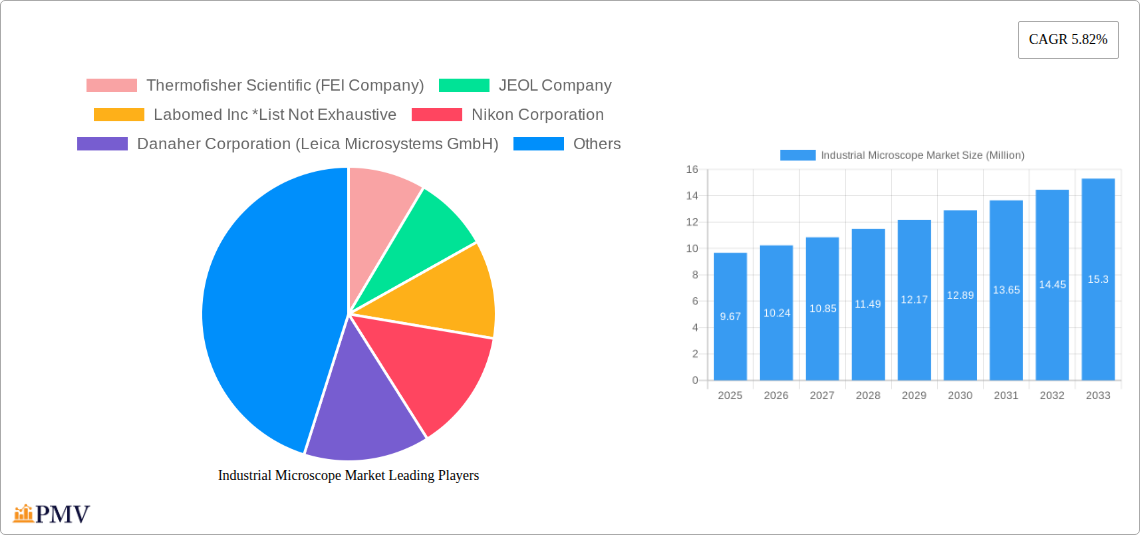

Industrial Microscope Market Company Market Share

Unlock critical insights into the global industrial microscope market, a sector poised for significant expansion driven by advancements in nanotechnology, life science research, semiconductor manufacturing, and material science applications. This comprehensive report provides an exhaustive analysis from 2019 to 2033, with a deep dive into the base year 2025 and a robust forecast period of 2025–2033. Explore the competitive landscape, emerging trends, dominant segments, and key innovations shaping this dynamic industry.

Industrial Microscope Market Market Structure & Competitive Dynamics

The industrial microscope market exhibits a moderate to high degree of market concentration, with key players like Thermofisher Scientific (FEI Company), JEOL Company, Nikon Corporation, Danaher Corporation (Leica Microsystems GmbH), and Carl Zeiss dominating significant market shares. Innovation ecosystems are robust, fueled by substantial R&D investments, particularly in electron microscopy and scanning probe microscopy. Regulatory frameworks, while present, generally support technological advancement, especially in life science and semiconductor applications. Product substitutes are limited, with higher resolution and advanced analytical capabilities of industrial microscopes providing a distinct advantage. End-user trends reveal an increasing demand for high-throughput imaging and integrated analytical solutions, driving the adoption of advanced microscopy techniques. Mergers and acquisitions (M&A) activities, such as Thermofisher Scientific's acquisition of FEI Company, continue to consolidate the market and enhance competitive advantages. The estimated M&A deal value in recent years is in the range of several hundred million dollars, reflecting strategic consolidation.

Industrial Microscope Market Industry Trends & Insights

The industrial microscope market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This upward trajectory is primarily fueled by the escalating demand for high-resolution imaging in critical sectors like semiconductor inspection, nanotechnology research, and biotechnology. The relentless pursuit of miniaturization in the electronics industry necessitates increasingly sophisticated inspection tools, directly benefiting the electron microscopy segment. Furthermore, groundbreaking discoveries in life sciences, including drug discovery, disease diagnostics, and cellular research, are heavily reliant on advanced microscopy. The market penetration of industrial microscopes is steadily increasing across both established and emerging economies as research institutions and manufacturing facilities upgrade their analytical capabilities. Technological disruptions, such as the development of faster acquisition speeds, AI-powered image analysis, and cryo-electron microscopy (cryo-EM) for biological samples, are revolutionizing research possibilities and driving market adoption. Consumer preferences are shifting towards integrated solutions that offer not only superior imaging but also advanced elemental analysis and three-dimensional reconstruction capabilities. Competitive dynamics are characterized by intense innovation, with companies vying to offer cutting-edge solutions with enhanced user-friendliness and data processing power. The growing importance of non-destructive testing and quality control in various industries further propels the demand for specialized industrial microscopes.

Dominant Markets & Segments in Industrial Microscope Market

The Electron Microscopy segment is poised to maintain its dominance within the industrial microscope market, driven by its unparalleled resolution and analytical capabilities, crucial for nanotechnology and semiconductor applications. North America and Europe currently lead in market share, owing to strong research infrastructure and high adoption rates in the life science and material science sectors.

Dominant Segment: Electron Microscopy

- Key Drivers:

- Increasing demand for high-resolution imaging in semiconductor defect analysis and advanced material characterization.

- Significant investments in nanotechnology research and development globally.

- Advancements in cryo-electron microscopy for biological sample analysis.

- Market Dynamics: This segment is characterized by continuous innovation in electron source technology, detector sensitivity, and vacuum systems. Companies are focusing on developing compact and user-friendly electron microscopes.

- Key Drivers:

Dominant Application: Nanotechnology

- Key Drivers:

- The burgeoning field of nanotechnology requires precise visualization and manipulation at the atomic and molecular level.

- Development of novel nanomaterials for various industries, including electronics, medicine, and energy.

- The need for characterization of nanoscale structures and properties.

- Market Dynamics: This application segment benefits from the overlap with electron microscopy and scanning probe microscopy, where detailed nanoscale analysis is paramount.

- Key Drivers:

Dominant End User: Academic and Research Organizations

- Key Drivers:

- Extensive research activities in universities and institutions drive the demand for sophisticated analytical tools.

- Government funding for scientific research and development.

- The need for cutting-edge microscopes for groundbreaking discoveries across various disciplines.

- Market Dynamics: This segment is a primary consumer of high-end and specialized industrial microscopes, often investing in the latest technologies to maintain a competitive edge in research.

- Key Drivers:

Leading Regional Market: North America

- Key Drivers:

- Robust healthcare and life sciences industries fueling demand for diagnostic and research microscopes.

- Leading semiconductor manufacturing and research hubs.

- Significant government and private funding for scientific exploration.

- Market Dynamics: A mature market with high adoption rates for advanced microscopy solutions, driven by innovation and a strong R&D ecosystem.

- Key Drivers:

Industrial Microscope Market Product Innovations

Recent product innovations in the industrial microscope market focus on enhanced resolution, faster imaging speeds, and integrated analytical capabilities. Developments in electron microscopy, such as improved electron optics and detector technology, are enabling unprecedented detail in material science and life science research. For instance, advancements in scanning probe microscopy are leading to atomic-level surface analysis. Furthermore, the integration of artificial intelligence (AI) for automated image analysis and interpretation is becoming a key competitive advantage, streamlining workflows for researchers and quality control engineers. These innovations are driving the adoption of industrial microscopes in emerging applications and reinforcing their position as indispensable tools.

Report Segmentation & Scope

This report meticulously segments the industrial microscope market to provide a granular understanding of its dynamics. The segmentation includes:

- Type: The market is analyzed across Electron Microscopy, Optical Microscopy, Scanning Probe Microscopy, and Others. Electron microscopy, with its superior resolution, is projected to hold the largest market share, followed by optical microscopy for routine inspections. Scanning probe microscopy is crucial for nanoscale surface analysis.

- Application: Key applications covered include Nanotechnology, Life Science, Semiconductor, Material Science, and Others. The semiconductor and life science sectors are expected to exhibit the highest growth rates due to continuous innovation and demand for precision.

- End User: The report categorizes end users into Hospitals, Clinics and Diagnostic Laboratories, Academic and Research Organizations, and Others. Academic and research organizations, alongside the semiconductor industry, represent the largest end-user segments.

Key Drivers of Industrial Microscope Market Growth

The industrial microscope market is propelled by several key drivers. Technologically, the relentless advancement in imaging resolution and analytical capabilities, particularly in electron microscopy, is paramount. The growing demand for high-resolution imaging in nanotechnology and semiconductor inspection fuels consistent growth. Economically, increasing R&D investments in life sciences and material science research by both public and private sectors contribute significantly. Regulatory drivers, such as stringent quality control mandates in the pharmaceutical and electronics industries, also necessitate the adoption of sophisticated industrial microscopes. For example, the push for smaller and more powerful electronic components directly translates to a higher demand for advanced semiconductor inspection tools.

Challenges in the Industrial Microscope Market Sector

Despite its growth, the industrial microscope market faces certain challenges. High acquisition and maintenance costs of advanced electron microscopes can be a barrier for smaller research institutions and companies. Stringent quality control and compliance requirements in regulated industries, while a driver, also add complexity to product development and adoption. Supply chain disruptions for specialized components can impact manufacturing timelines and availability. Furthermore, the need for highly skilled operators to utilize and interpret data from complex industrial microscopes presents a talent acquisition challenge. Intense competition among major players can lead to pricing pressures, particularly in the more commoditized segments of optical microscopy.

Leading Players in the Industrial Microscope Market Market

- Thermofisher Scientific (FEI Company)

- JEOL Company

- Labomed Inc

- Nikon Corporation

- Danaher Corporation (Leica Microsystems GmbH)

- Tescan Orsay Holding AS

- Hitachi High-Tech Corporation

- Carl Zeiss

- Park Systems

- Olympus Corporation

- Bruker Corporation

Key Developments in Industrial Microscope Market Sector

- May 2022: Scientists at Columbia University in New York City developed a high-speed 3D microscope for the diagnosis of cancers and other diseases with real-time imaging within the living body. This innovation has the potential to revolutionize medical diagnostics and research.

- April 2022: The state-of-the-art cryo-transmission electron microscope by Thermofisher Scientific Inc. was inaugurated at the Centre for Cellular and Molecular Biology (CCMB). This microscope will help scientists to accelerate potential cures, drug discoveries, and diagnostic research by enabling high-resolution imaging of biological samples.

Strategic Industrial Microscope Market Market Outlook

The industrial microscope market is set for sustained growth, driven by ongoing technological advancements and expanding applications across critical industries. The increasing focus on nanotechnology, personalized medicine, and advanced materials will continue to propel the demand for high-resolution and analytical microscopy solutions. Strategic opportunities lie in developing more integrated and AI-driven microscope systems that offer enhanced user experience and data interpretation capabilities. Furthermore, the expanding market in emerging economies, coupled with increasing R&D investments, presents significant growth potential. Companies that can offer cost-effective, versatile, and innovative industrial microscope solutions are well-positioned to capitalize on these market dynamics.

Industrial Microscope Market Segmentation

-

1. Type

- 1.1. Electron Microscopy

- 1.2. Optical Microscopy

- 1.3. Scanning Probe Microscopy

- 1.4. Others

-

2. Application

- 2.1. Nanotechnology

- 2.2. Life Science

- 2.3. Semiconductor

- 2.4. Material Science

- 2.5. Others

-

3. End User

- 3.1. Hospitals, Clinics and Diagnostic Laboratories

- 3.2. Academic and Research Organizations

- 3.3. Others

Industrial Microscope Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Industrial Microscope Market Regional Market Share

Geographic Coverage of Industrial Microscope Market

Industrial Microscope Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements in the Field of Microscopy; Increasing Demand for Focus on Nanotechnology and Life Science Research

- 3.3. Market Restrains

- 3.3.1. High Cost of Advanced Microscopy Devices

- 3.4. Market Trends

- 3.4.1. Electron Microscopy is Expected to Witness a Rapid Growth in the Microscopy Device Market During Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Microscope Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electron Microscopy

- 5.1.2. Optical Microscopy

- 5.1.3. Scanning Probe Microscopy

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Nanotechnology

- 5.2.2. Life Science

- 5.2.3. Semiconductor

- 5.2.4. Material Science

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals, Clinics and Diagnostic Laboratories

- 5.3.2. Academic and Research Organizations

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Industrial Microscope Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Electron Microscopy

- 6.1.2. Optical Microscopy

- 6.1.3. Scanning Probe Microscopy

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Nanotechnology

- 6.2.2. Life Science

- 6.2.3. Semiconductor

- 6.2.4. Material Science

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals, Clinics and Diagnostic Laboratories

- 6.3.2. Academic and Research Organizations

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Industrial Microscope Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Electron Microscopy

- 7.1.2. Optical Microscopy

- 7.1.3. Scanning Probe Microscopy

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Nanotechnology

- 7.2.2. Life Science

- 7.2.3. Semiconductor

- 7.2.4. Material Science

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals, Clinics and Diagnostic Laboratories

- 7.3.2. Academic and Research Organizations

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Industrial Microscope Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Electron Microscopy

- 8.1.2. Optical Microscopy

- 8.1.3. Scanning Probe Microscopy

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Nanotechnology

- 8.2.2. Life Science

- 8.2.3. Semiconductor

- 8.2.4. Material Science

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals, Clinics and Diagnostic Laboratories

- 8.3.2. Academic and Research Organizations

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Industrial Microscope Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Electron Microscopy

- 9.1.2. Optical Microscopy

- 9.1.3. Scanning Probe Microscopy

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Nanotechnology

- 9.2.2. Life Science

- 9.2.3. Semiconductor

- 9.2.4. Material Science

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals, Clinics and Diagnostic Laboratories

- 9.3.2. Academic and Research Organizations

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Industrial Microscope Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Electron Microscopy

- 10.1.2. Optical Microscopy

- 10.1.3. Scanning Probe Microscopy

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Nanotechnology

- 10.2.2. Life Science

- 10.2.3. Semiconductor

- 10.2.4. Material Science

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals, Clinics and Diagnostic Laboratories

- 10.3.2. Academic and Research Organizations

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thermofisher Scientific (FEI Company)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 JEOL Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Labomed Inc *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nikon Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Danaher Corporation (Leica Microsystems GmbH)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tescan Orsay Holding AS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hitachi High-Tech Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Carl Zeiss

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Park Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Olympus Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bruker Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Thermofisher Scientific (FEI Company)

List of Figures

- Figure 1: Global Industrial Microscope Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Industrial Microscope Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Industrial Microscope Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Industrial Microscope Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Industrial Microscope Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Industrial Microscope Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Industrial Microscope Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Industrial Microscope Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Industrial Microscope Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Industrial Microscope Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Industrial Microscope Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Industrial Microscope Market Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Industrial Microscope Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Industrial Microscope Market Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Industrial Microscope Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Industrial Microscope Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Industrial Microscope Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Industrial Microscope Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Industrial Microscope Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Industrial Microscope Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Industrial Microscope Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Industrial Microscope Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Industrial Microscope Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Industrial Microscope Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Industrial Microscope Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Industrial Microscope Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Industrial Microscope Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Industrial Microscope Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Industrial Microscope Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Industrial Microscope Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East and Africa Industrial Microscope Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Industrial Microscope Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Industrial Microscope Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Industrial Microscope Market Revenue (Million), by Type 2025 & 2033

- Figure 35: South America Industrial Microscope Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Industrial Microscope Market Revenue (Million), by Application 2025 & 2033

- Figure 37: South America Industrial Microscope Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Industrial Microscope Market Revenue (Million), by End User 2025 & 2033

- Figure 39: South America Industrial Microscope Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Industrial Microscope Market Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Industrial Microscope Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Microscope Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Industrial Microscope Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Industrial Microscope Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Industrial Microscope Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Industrial Microscope Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Industrial Microscope Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Industrial Microscope Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Industrial Microscope Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Industrial Microscope Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Industrial Microscope Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Industrial Microscope Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Industrial Microscope Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Industrial Microscope Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Industrial Microscope Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Industrial Microscope Market Revenue Million Forecast, by End User 2020 & 2033

- Table 25: Global Industrial Microscope Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Industrial Microscope Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Industrial Microscope Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Industrial Microscope Market Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global Industrial Microscope Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Industrial Microscope Market Revenue Million Forecast, by Type 2020 & 2033

- Table 40: Global Industrial Microscope Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Industrial Microscope Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Industrial Microscope Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Industrial Microscope Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Microscope Market?

The projected CAGR is approximately 5.82%.

2. Which companies are prominent players in the Industrial Microscope Market?

Key companies in the market include Thermofisher Scientific (FEI Company), JEOL Company, Labomed Inc *List Not Exhaustive, Nikon Corporation, Danaher Corporation (Leica Microsystems GmbH), Tescan Orsay Holding AS, Hitachi High-Tech Corporation, Carl Zeiss, Park Systems, Olympus Corporation, Bruker Corporation.

3. What are the main segments of the Industrial Microscope Market?

The market segments include Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements in the Field of Microscopy; Increasing Demand for Focus on Nanotechnology and Life Science Research.

6. What are the notable trends driving market growth?

Electron Microscopy is Expected to Witness a Rapid Growth in the Microscopy Device Market During Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Advanced Microscopy Devices.

8. Can you provide examples of recent developments in the market?

In May 2022, Scientists at Columbia University in New York City developed a high-speed 3D microscope for the diagnosis of cancers and other diseases with real-time imaging within the living body.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Microscope Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Microscope Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Microscope Market?

To stay informed about further developments, trends, and reports in the Industrial Microscope Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence