Key Insights

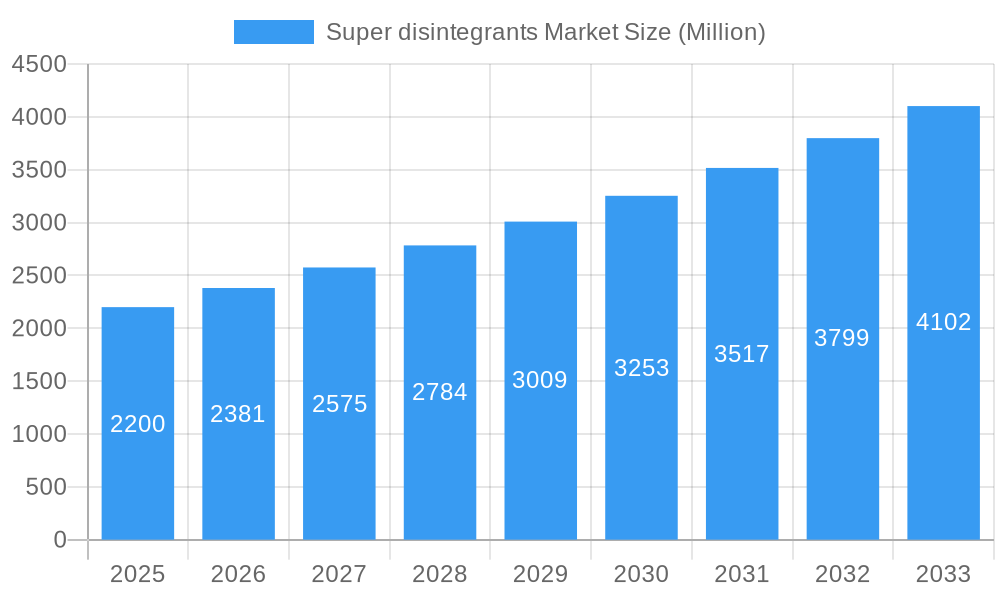

The global Superdisintegrants Market is projected for robust expansion, reaching an estimated market size of $2,200 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 8.10% through 2033. This significant growth is primarily propelled by the escalating demand for advanced drug delivery systems that ensure rapid disintegration and enhanced bioavailability of oral solid dosage forms like tablets and capsules. Key drivers include the rising prevalence of chronic diseases such as neurological disorders, gastrointestinal ailments, and oncology, which necessitate efficient and timely therapeutic interventions. Furthermore, the continuous innovation in pharmaceutical formulations, particularly the development of novel synthetic superdisintegrants like crospovidone and modified starches, is contributing significantly to market upliftment. The increasing focus on patient compliance and the growing preference for patient-friendly dosage forms further underscore the market's upward trajectory.

Super disintegrants Market Market Size (In Billion)

The market is segmented across various product types, with synthetic superdisintegrants dominating due to their superior efficacy and versatility. Within this segment, modified starch and modified cellulose are anticipated to witness substantial growth, driven by their cost-effectiveness and wide applicability. Natural superdisintegrants also hold a notable share, reflecting a growing trend towards bio-based and sustainable pharmaceutical excipients. Regionally, North America and Europe are expected to maintain their leadership positions, owing to advanced healthcare infrastructure, high R&D investments, and the presence of major pharmaceutical companies. However, the Asia Pacific region is poised for the fastest growth, fueled by increasing healthcare expenditure, a burgeoning generic drug market, and a growing number of pharmaceutical manufacturing facilities. Restraints such as stringent regulatory approvals for novel excipients and the competitive pricing pressures from established players are present but are largely outweighed by the strong market drivers.

Super disintegrants Market Company Market Share

Here's an SEO-optimized, detailed report description for the Super Disintegrants Market:

This in-depth report provides a definitive analysis of the global super disintegrants market, a crucial component in pharmaceutical formulation for enhanced drug delivery and efficacy. Our research spans from 2019-2033, with a detailed focus on the base year 2025 and a robust forecast period of 2025-2033. We meticulously examine market dynamics, key growth drivers, emerging trends, and the competitive landscape, offering actionable insights for stakeholders in the pharmaceutical and allied industries. The super disintegrants market size is projected for significant expansion, driven by increasing demand for orally disintegrating tablets (ODTs) and advancements in drug formulation technologies.

Super Disintegrants Market Market Structure & Competitive Dynamics

The super disintegrants market structure is characterized by a moderate level of concentration, with key players investing heavily in research and development to create novel and efficient disintegrants. The innovation ecosystem thrives on the development of superior disintegrant functionalities, such as faster dissolution times and improved compressibility. Regulatory frameworks, particularly those governing pharmaceutical excipients, play a pivotal role in shaping market entry and product approvals. Product substitutes, while present, often lack the superior performance characteristics of advanced super disintegrants. End-user trends indicate a growing preference for patient-friendly dosage forms, directly fueling demand for super disintegrants. Mergers and acquisitions (M&A) activities, valued in the millions of dollars, are strategically undertaken by leading companies like Ashland Global Holdings Inc. and BASF SE to expand their product portfolios and market reach. Key market share insights will be detailed, alongside an analysis of M&A deal values impacting the pharmaceutical excipients market.

Super Disintegrants Market Industry Trends & Insights

The super disintegrants industry trends are shaped by several interconnected factors driving substantial market growth. A significant trend is the escalating prevalence of chronic diseases, such as neurological disorders and oncology, necessitating the development of more effective and patient-compliant drug delivery systems, consequently boosting super disintegrants demand. Technological disruptions, including advancements in spray drying and granulation techniques, are enabling the creation of super disintegrants with enhanced properties. Consumer preferences are increasingly leaning towards orally disintegrating tablets (ODTs) and fast-dissolving tablets, which significantly rely on high-performance super disintegrants to achieve rapid disintegration upon contact with saliva, thus enhancing patient adherence and convenience. The super disintegrants market CAGR is expected to witness robust growth, reflecting these positive trends. Market penetration of super disintegrants is projected to rise as pharmaceutical manufacturers prioritize improved bioavailability and patient experience. The competitive dynamics within the super disintegrant industry are evolving, with a focus on product differentiation through superior disintegration profiles and cost-effectiveness. The estimated market size is projected to reach hundreds of millions of dollars by the end of the forecast period.

Dominant Markets & Segments in Super Disintegrants Market

The super disintegrants market exhibits significant regional dominance, with North America and Europe emerging as leading markets due to their well-established pharmaceutical industries and high healthcare expenditure. Within these regions, the United States and Germany spearhead adoption.

Product Type Dominance:

- Synthetic Superdisintegrants currently hold the largest market share.

- Crospovidone is a key driver due to its excellent water uptake and swelling capabilities, making it highly effective in rapidly disintegrating tablets. Its widespread use in various therapeutic areas contributes significantly to its market dominance.

- Modified Cellulose (e.g., Croscarmellose Sodium) is also a dominant sub-segment, valued for its high swelling capacity and low cost.

- Modified Starch offers good disintegrant properties and cost-effectiveness, making it a popular choice.

- Calcium Silicates and Ion Exchange Resins are also significant contributors, finding applications in specific formulations.

- Natural Superdisintegrants are gaining traction due to the growing demand for "clean label" ingredients and their perceived safety and sustainability.

- Synthetic Superdisintegrants currently hold the largest market share.

Formulation Dominance:

- Tablets represent the most dominant formulation for super disintegrants, accounting for the lion's share of the market. The development of orally disintegrating tablets (ODTs) and fast-dissolving tablets has amplified this dominance. The tablet excipients market is intrinsically linked to the super disintegrants market.

- Capsules also utilize super disintegrants, albeit to a lesser extent, primarily to aid in the dissolution of capsule contents.

Therapeutic Area Dominance:

- Neurological Diseases and Gastrointestinal Diseases are leading therapeutic areas driving the demand for super disintegrants, owing to the large patient populations and the need for efficient drug delivery for managing these chronic conditions.

- Oncology is a rapidly growing segment, with a focus on improving the palatability and ease of administration of cancer medications, especially in pediatric oncology.

- Others, including cardiovascular diseases and pain management, also contribute to market demand.

Super Disintegrants Market Product Innovations

Recent product innovations in the super disintegrants market focus on developing excipients with enhanced functionalities, such as superior compressibility, improved flow properties, and greater water absorption capacities. Companies like DuPont and Roquette Freres are investing in creating next-generation super disintegrants that offer faster disintegration times, leading to quicker drug release and improved bioavailability. These innovations are crucial for developing more patient-friendly dosage forms, particularly for pediatric and geriatric populations. The competitive advantage lies in offering tailored solutions for specific drug formulations and therapeutic needs, ensuring seamless integration into existing manufacturing processes.

Report Segmentation & Scope

This comprehensive report segments the super disintegrants market based on key parameters to provide granular insights.

- Product Type: The market is analyzed across Natural Superdisintegrants and Synthetic Superdisintegrants, with the latter further segmented into Modified Starch, Modified Cellulose, Crospovidone, Calcium Silicates, and Ion Exchange Resins, alongside an Others category. Growth projections and market sizes for each sub-segment are meticulously detailed.

- Formulation: The analysis covers Tablets and Capsules, with a focus on the dominant role of tablets in the market.

- Therapeutic Area: The report examines market dynamics across Neurological Diseases, Gastrointestinal Diseases, Oncology, and Others, highlighting the specific needs and growth potential within each area.

Key Drivers of Super Disintegrants Market Growth

The super disintegrants market growth is propelled by a confluence of technological advancements and evolving healthcare demands. The increasing prevalence of chronic diseases worldwide fuels the need for efficient and patient-friendly drug delivery systems, directly impacting the demand for super disintegrants. Technological innovations in pharmaceutical formulation, such as the development of orally disintegrating tablets (ODTs) and fast-dissolving tablets, require high-performance disintegrants to ensure rapid dissolution and enhanced bioavailability. Economic factors, including rising healthcare expenditure in emerging economies, are also contributing to market expansion. Regulatory support for novel drug delivery systems further incentivizes the use of advanced super disintegrants.

Challenges in the Super Disintegrants Market Sector

Despite robust growth, the super disintegrants market faces several challenges. Stringent regulatory hurdles for novel excipients can delay product development and market entry. Supply chain complexities, particularly for natural super disintegrants, can lead to price volatility and availability issues. Intense competition among established and emerging players exerts downward pressure on pricing. Furthermore, the development of orally disintegrating formulations requires careful optimization, and any failure in disintegration can lead to product recalls, impacting market confidence. Quantifiable impacts of these challenges on market dynamics are thoroughly analyzed.

Leading Players in the Super Disintegrants Market Market

- Ashland Global Holdings Inc.

- Asahi Kasei Corporation

- DFE Pharma

- Merck KGaA

- BASF SE

- DuPont

- Corel Pharma Chem

- JRS Pharma

- Roquette Freres

Key Developments in Super Disintegrants Market Sector

- 2024: Launch of novel, highly efficient synthetic superdisintegrant by BASF SE, enhancing tablet hardness and disintegration time.

- 2023: Ashland Global Holdings Inc. acquired a key player in specialized pharmaceutical excipients, expanding its super disintegrants portfolio.

- 2023: DFE Pharma introduced a new grade of superdisintegrant tailored for ODT applications, improving patient compliance.

- 2022: Roquette Freres announced significant investment in R&D for natural-based superdisintegrants, aligning with market demand for sustainable ingredients.

- 2022: DuPont expanded its pharmaceutical excipients division, focusing on innovative solutions for drug delivery, including advanced superdisintegrants.

Strategic Super Disintegrants Market Market Outlook

The super disintegrants market is poised for continued expansion, driven by persistent demand for improved drug delivery and patient compliance. Key growth accelerators include the rising global burden of chronic diseases, the increasing adoption of patient-centric dosage forms like ODTs, and ongoing advancements in pharmaceutical manufacturing technologies. Strategic opportunities lie in developing customized superdisintegrants for specialized therapeutic areas and exploring the potential of bio-based and sustainable disintegrant options. Collaborations between excipient manufacturers and pharmaceutical companies will be crucial for driving innovation and capturing market share in this dynamic sector. The future outlook remains highly promising.

Super disintegrants Market Segmentation

-

1. Product Type

- 1.1. Natural Superdisintegrants

-

1.2. Synthetic Superdisintegrants

- 1.2.1. Modified Starch

- 1.2.2. Modified Cellulose

- 1.2.3. Crospovidone

- 1.2.4. Calcium Silicates

- 1.2.5. Ion Exchange Resins

- 1.3. Others

-

2. Formulation

- 2.1. Tablets

- 2.2. Capsules

-

3. Therapeutic Area

- 3.1. Neurological Diseases

- 3.2. Gastrointestinal Diseases

- 3.3. Oncology

- 3.4. Others

Super disintegrants Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of World

Super disintegrants Market Regional Market Share

Geographic Coverage of Super disintegrants Market

Super disintegrants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Orally Disintegrating Tablets; Increase Healthcare Expenditure and Awareness; Rising Prevalence Of Chronic Conditions With Increasing Number Of Pediatric And Geriatric Population

- 3.3. Market Restrains

- 3.3.1. Concerns About the Safety and Quality of Product

- 3.4. Market Trends

- 3.4.1. Natural Superdisintegrants segment to register significant growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Super disintegrants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Natural Superdisintegrants

- 5.1.2. Synthetic Superdisintegrants

- 5.1.2.1. Modified Starch

- 5.1.2.2. Modified Cellulose

- 5.1.2.3. Crospovidone

- 5.1.2.4. Calcium Silicates

- 5.1.2.5. Ion Exchange Resins

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Formulation

- 5.2.1. Tablets

- 5.2.2. Capsules

- 5.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 5.3.1. Neurological Diseases

- 5.3.2. Gastrointestinal Diseases

- 5.3.3. Oncology

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Super disintegrants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Natural Superdisintegrants

- 6.1.2. Synthetic Superdisintegrants

- 6.1.2.1. Modified Starch

- 6.1.2.2. Modified Cellulose

- 6.1.2.3. Crospovidone

- 6.1.2.4. Calcium Silicates

- 6.1.2.5. Ion Exchange Resins

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Formulation

- 6.2.1. Tablets

- 6.2.2. Capsules

- 6.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 6.3.1. Neurological Diseases

- 6.3.2. Gastrointestinal Diseases

- 6.3.3. Oncology

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Super disintegrants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Natural Superdisintegrants

- 7.1.2. Synthetic Superdisintegrants

- 7.1.2.1. Modified Starch

- 7.1.2.2. Modified Cellulose

- 7.1.2.3. Crospovidone

- 7.1.2.4. Calcium Silicates

- 7.1.2.5. Ion Exchange Resins

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Formulation

- 7.2.1. Tablets

- 7.2.2. Capsules

- 7.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 7.3.1. Neurological Diseases

- 7.3.2. Gastrointestinal Diseases

- 7.3.3. Oncology

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Super disintegrants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Natural Superdisintegrants

- 8.1.2. Synthetic Superdisintegrants

- 8.1.2.1. Modified Starch

- 8.1.2.2. Modified Cellulose

- 8.1.2.3. Crospovidone

- 8.1.2.4. Calcium Silicates

- 8.1.2.5. Ion Exchange Resins

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Formulation

- 8.2.1. Tablets

- 8.2.2. Capsules

- 8.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 8.3.1. Neurological Diseases

- 8.3.2. Gastrointestinal Diseases

- 8.3.3. Oncology

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of World Super disintegrants Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Natural Superdisintegrants

- 9.1.2. Synthetic Superdisintegrants

- 9.1.2.1. Modified Starch

- 9.1.2.2. Modified Cellulose

- 9.1.2.3. Crospovidone

- 9.1.2.4. Calcium Silicates

- 9.1.2.5. Ion Exchange Resins

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Formulation

- 9.2.1. Tablets

- 9.2.2. Capsules

- 9.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 9.3.1. Neurological Diseases

- 9.3.2. Gastrointestinal Diseases

- 9.3.3. Oncology

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Ashland Global Holdings Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Asahi Kasei Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 DFE Pharma

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Merck KGaA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 BASF SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 DuPont

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Corel Pharma Chem*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 JRS Pharma

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Roquette Freres

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Ashland Global Holdings Inc

List of Figures

- Figure 1: Global Super disintegrants Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Super disintegrants Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Super disintegrants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Super disintegrants Market Revenue (Million), by Formulation 2025 & 2033

- Figure 5: North America Super disintegrants Market Revenue Share (%), by Formulation 2025 & 2033

- Figure 6: North America Super disintegrants Market Revenue (Million), by Therapeutic Area 2025 & 2033

- Figure 7: North America Super disintegrants Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 8: North America Super disintegrants Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Super disintegrants Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Super disintegrants Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Super disintegrants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Super disintegrants Market Revenue (Million), by Formulation 2025 & 2033

- Figure 13: Europe Super disintegrants Market Revenue Share (%), by Formulation 2025 & 2033

- Figure 14: Europe Super disintegrants Market Revenue (Million), by Therapeutic Area 2025 & 2033

- Figure 15: Europe Super disintegrants Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 16: Europe Super disintegrants Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Super disintegrants Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Super disintegrants Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Super disintegrants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Super disintegrants Market Revenue (Million), by Formulation 2025 & 2033

- Figure 21: Asia Pacific Super disintegrants Market Revenue Share (%), by Formulation 2025 & 2033

- Figure 22: Asia Pacific Super disintegrants Market Revenue (Million), by Therapeutic Area 2025 & 2033

- Figure 23: Asia Pacific Super disintegrants Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 24: Asia Pacific Super disintegrants Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Super disintegrants Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of World Super disintegrants Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Rest of World Super disintegrants Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of World Super disintegrants Market Revenue (Million), by Formulation 2025 & 2033

- Figure 29: Rest of World Super disintegrants Market Revenue Share (%), by Formulation 2025 & 2033

- Figure 30: Rest of World Super disintegrants Market Revenue (Million), by Therapeutic Area 2025 & 2033

- Figure 31: Rest of World Super disintegrants Market Revenue Share (%), by Therapeutic Area 2025 & 2033

- Figure 32: Rest of World Super disintegrants Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of World Super disintegrants Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Super disintegrants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Super disintegrants Market Revenue Million Forecast, by Formulation 2020 & 2033

- Table 3: Global Super disintegrants Market Revenue Million Forecast, by Therapeutic Area 2020 & 2033

- Table 4: Global Super disintegrants Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Super disintegrants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Super disintegrants Market Revenue Million Forecast, by Formulation 2020 & 2033

- Table 7: Global Super disintegrants Market Revenue Million Forecast, by Therapeutic Area 2020 & 2033

- Table 8: Global Super disintegrants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Super disintegrants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Super disintegrants Market Revenue Million Forecast, by Formulation 2020 & 2033

- Table 14: Global Super disintegrants Market Revenue Million Forecast, by Therapeutic Area 2020 & 2033

- Table 15: Global Super disintegrants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Super disintegrants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Global Super disintegrants Market Revenue Million Forecast, by Formulation 2020 & 2033

- Table 24: Global Super disintegrants Market Revenue Million Forecast, by Therapeutic Area 2020 & 2033

- Table 25: Global Super disintegrants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Super disintegrants Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Super disintegrants Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Super disintegrants Market Revenue Million Forecast, by Formulation 2020 & 2033

- Table 34: Global Super disintegrants Market Revenue Million Forecast, by Therapeutic Area 2020 & 2033

- Table 35: Global Super disintegrants Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Super disintegrants Market?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the Super disintegrants Market?

Key companies in the market include Ashland Global Holdings Inc, Asahi Kasei Corporation, DFE Pharma, Merck KGaA, BASF SE, DuPont, Corel Pharma Chem*List Not Exhaustive, JRS Pharma, Roquette Freres.

3. What are the main segments of the Super disintegrants Market?

The market segments include Product Type, Formulation, Therapeutic Area.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Orally Disintegrating Tablets; Increase Healthcare Expenditure and Awareness; Rising Prevalence Of Chronic Conditions With Increasing Number Of Pediatric And Geriatric Population.

6. What are the notable trends driving market growth?

Natural Superdisintegrants segment to register significant growth.

7. Are there any restraints impacting market growth?

Concerns About the Safety and Quality of Product.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Super disintegrants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Super disintegrants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Super disintegrants Market?

To stay informed about further developments, trends, and reports in the Super disintegrants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence