Key Insights

The North America Dental Equipment Market is projected to experience significant growth, reaching an estimated 11.72 billion by 2024 and exhibiting a Compound Annual Growth Rate (CAGR) of 5.97% through 2033. This expansion is driven by heightened dental awareness, increasing demand for advanced oral healthcare, and continuous technological innovations, including digital dentistry and AI-powered diagnostics. Rising dental conditions, a focus on preventive and cosmetic dentistry, growing disposable incomes, and improved healthcare infrastructure are further accelerating market development across the United States, Canada, and Mexico.

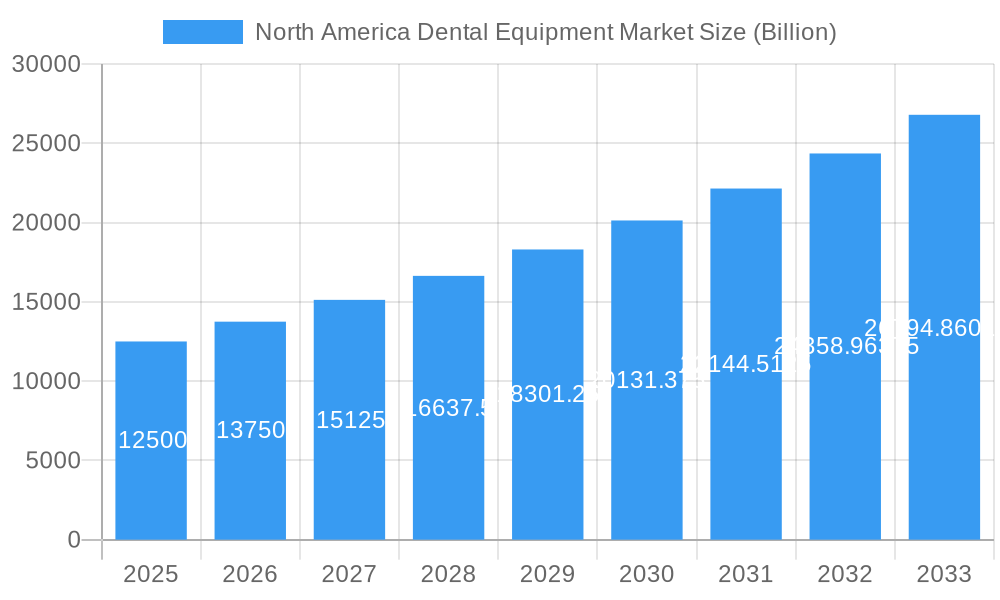

North America Dental Equipment Market Market Size (In Billion)

Key market segments include "General and Diagnostics Equipment," with dental lasers and radiology equipment in high demand, and "Dental Consumables," driven by restorative and aesthetic procedures such as dental implants and crowns. The "Treatment" segment highlights strong growth in orthodontics, endodontics, periodontics, and prosthodontics. Hospitals and clinics are major end-users, reflecting broad adoption across healthcare settings. The United States, Canada, and Mexico represent a pivotal region due to robust healthcare expenditure and advanced dental practices.

North America Dental Equipment Market Company Market Share

This comprehensive market report offers in-depth analysis and actionable strategies for stakeholders in the North America Dental Equipment Market. Covering the period from 2019 to 2033, with a base year of 2024, the report examines market structure, industry trends, dominant segments, product innovations, and growth drivers. It provides essential insights for navigating this dynamic market effectively.

North America Dental Equipment Market Market Structure & Competitive Dynamics

The North America Dental Equipment Market exhibits a moderate to high level of market concentration, with several global giants and a growing number of specialized players vying for market share. Key players like Dentsply Sirona, Envista Holdings Corporation, and Patterson Companies Inc. hold significant sway, influencing innovation and pricing strategies. The innovation ecosystem is robust, fueled by continuous research and development in areas like AI-powered diagnostics, CAD/CAM technology, and advanced dental lasers. Regulatory frameworks, particularly in the United States and Canada, play a crucial role, dictating product approvals and market access. Product substitutes are emerging, particularly in less invasive treatment modalities, putting pressure on traditional equipment manufacturers. End-user trends indicate a preference for integrated digital solutions, minimally invasive procedures, and personalized patient care. Mergers and acquisitions (M&A) activity has been a notable feature, with strategic consolidations aimed at expanding product portfolios and market reach. For instance, M&A deal values have frequently exceeded hundreds of millions of dollars, underscoring the strategic importance of acquiring complementary technologies and customer bases.

North America Dental Equipment Market Industry Trends & Insights

The North America Dental Equipment Market is poised for significant growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This upward trajectory is primarily fueled by increasing prevalence of dental caries and periodontal diseases, coupled with a rising demand for cosmetic dentistry and preventive oral care. Technological disruptions are at the forefront, with the integration of Artificial Intelligence (AI) in diagnostics, 3D printing for custom dental prosthetics, and the widespread adoption of digital radiography significantly enhancing treatment precision and efficiency. Consumer preferences are evolving towards aesthetic appeal and minimal discomfort, driving the demand for advanced dental lasers, CAD/CAM systems, and biocompatible dental materials. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on value-added services. Market penetration of digital dental technologies is steadily increasing across all segments, from general diagnostics to specialized treatments like orthodontics and endodontics. The growing emphasis on oral health as an integral part of overall well-being is also contributing to market expansion. Furthermore, an aging population in North America is expected to drive demand for restorative and prosthetic dental solutions, further bolstering market growth. The market is also experiencing a shift towards home-based dental care solutions and teledentistry, especially post-pandemic, presenting new avenues for growth and innovation.

Dominant Markets & Segments in North America Dental Equipment Market

The United States dominates the North America Dental Equipment Market, accounting for an estimated xx Billion USD in 2025, driven by its advanced healthcare infrastructure, high disposable income, and a large patient pool. Within the product segmentation, General and Diagnostics Equipment is expected to hold the largest market share, projected to reach xx Billion USD by 2025. This dominance is further segmented by:

- Radiology Equipment:

- Intra-oral Radiology Equipment: Driven by increasing adoption in general dental practices for routine diagnostics, this sub-segment is experiencing steady growth. Key drivers include technological advancements leading to higher resolution images and reduced radiation exposure.

- Extra Oral Radiology Equipment: With the increasing demand for more comprehensive diagnostic tools like CBCT scanners for complex cases, this segment is also showing strong momentum.

- Dental Chair and Equipment: Essential for all dental procedures, this segment remains a foundational pillar of the market. Innovations in ergonomic design and integrated technology are key growth factors.

- Dental Consumables: This segment is also experiencing significant growth, with Dental Implants leading the charge, driven by an aging population and increased awareness about implant-supported prosthetics. Dental Biomaterial is also a key contributor, fueled by the demand for biocompatible and aesthetically pleasing restorative materials.

- Other Dental Devices: This category encompasses a range of specialized instruments and emerging technologies.

In terms of Treatment, Orthodontics is a significant growth area, with a rising demand for clear aligners and accelerated treatment options. Endodontics and Prosthodontics also contribute substantially due to the prevalence of dental issues requiring these interventions.

Geographically, while the United States leads, Canada and Mexico are also crucial markets, exhibiting steady growth driven by improving healthcare access and increasing dental expenditure.

North America Dental Equipment Market Product Innovations

Product innovations in the North America Dental Equipment Market are characterized by a strong focus on digitalization, automation, and patient comfort. Advanced dental lasers, such as soft tissue lasers for minimally invasive gum surgeries and hard tissue lasers for cavity preparation, are gaining traction due to their precision and reduced recovery times. AI-powered diagnostic tools are revolutionizing radiology, offering enhanced image analysis and early detection capabilities. Furthermore, the development of biocompatible and aesthetically superior dental biomaterials, alongside advancements in CAD/CAM technology for same-day crown fabrication, underscores the market's commitment to delivering superior patient outcomes and efficient clinical workflows.

Report Segmentation & Scope

This report meticulously segments the North America Dental Equipment Market across several key dimensions. The Product segmentation includes General and Diagnostics Equipment (further categorized into Dental Laser, Radiology Equipment, Dental Chair and Equipment, and Other General and Diagnostic equipment), Dental Consumables (including Dental Biomaterial, Dental Implants, Crowns and Bridges, and Other Dental Consumables), and Other Dental Devices. The Treatment segmentation covers Orthodontic, Endodontic, Peridontic, and Prosthodontic procedures. The End User segment analyzes the market share of Hospitals, Clinics, and Other End Users. Geographically, the report provides detailed insights into the United States, Canada, and Mexico. Each segment is analyzed for its market size, growth projections, and competitive dynamics, offering a comprehensive view of market potential and strategic opportunities within each category.

Key Drivers of North America Dental Equipment Market Growth

The growth of the North America Dental Equipment Market is propelled by several interconnected factors. A primary driver is the increasing prevalence of dental disorders such as dental caries, periodontal diseases, and malocclusion, necessitating advanced treatment solutions. The growing awareness among the population regarding the importance of oral hygiene and its impact on overall health is also a significant catalyst. Technological advancements, including the integration of AI, 3D printing, and digital imaging technologies, are enhancing treatment precision, patient experience, and practice efficiency, thereby driving demand for sophisticated equipment. Furthermore, favorable reimbursement policies and increased healthcare spending in North America contribute to the expansion of the dental equipment market.

Challenges in the North America Dental Equipment Market Sector

Despite the positive growth trajectory, the North America Dental Equipment Market faces certain challenges. High initial investment costs for advanced dental technologies can be a barrier for smaller dental practices, limiting market penetration. Stringent regulatory approvals and compliance requirements for medical devices can also prolong product launch timelines and increase development expenses. Moreover, the persistent issue of counterfeit dental products and the growing threat of cybersecurity breaches impacting digital dental records pose significant risks to market players and patient data. The economic downturns and the potential for decreased discretionary spending on elective dental procedures can also impact market growth.

Leading Players in the North America Dental Equipment Market Market

- A-Dec Inc

- Midmark Corp

- Biolase Inc

- 3M

- Dentsply Sirona

- GC Corporation

- Envista Holdings Corporation

- Patterson Companies Inc

- Carestream Health Inc

- Planmeca OY

Key Developments in North America Dental Equipment Market Sector

- 2023: Launch of next-generation AI-powered intraoral scanners by leading manufacturers, offering enhanced accuracy and workflow efficiency.

- 2023: Significant investment in R&D for biocompatible regenerative materials, focusing on advanced dental biomaterials for tissue regeneration.

- 2022: Acquisition of a specialized dental laser company by a major dental equipment manufacturer to expand its minimally invasive treatment portfolio.

- 2022: Introduction of innovative clear aligner systems with enhanced predictive modeling for orthodontics.

- 2021: Increased focus on cybersecurity solutions for digital dental practices amidst rising data protection concerns.

Strategic North America Dental Equipment Market Market Outlook

The strategic outlook for the North America Dental Equipment Market is exceptionally promising, driven by a confluence of technological innovation, evolving consumer preferences, and increasing healthcare investments. The growing demand for personalized and minimally invasive dental treatments will continue to fuel the adoption of advanced technologies such as CAD/CAM systems and dental lasers. Strategic opportunities lie in the expansion of digital dentistry solutions, including teledentistry platforms and AI-driven diagnostic tools, which can improve accessibility and affordability of care. Furthermore, the untapped potential in emerging markets within North America and the growing emphasis on preventive oral healthcare present significant avenues for market growth and strategic partnerships.

North America Dental Equipment Market Segmentation

-

1. Product

-

1.1. General and Diagnostics Equipment

-

1.1.1. Dental Laser

- 1.1.1.1. Soft Tissue Lasers

- 1.1.1.2. Hard Tissue Lasers

-

1.1.2. Radiology Equipment

- 1.1.2.1. Extra Oral Radiology Equipment

- 1.1.2.2. Intra-oral Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. Other General and Diagnostic equipment

-

1.1.1. Dental Laser

-

1.2. Dental Consumables

- 1.2.1. Dental Biomaterial

- 1.2.2. Dental Implants

- 1.2.3. Crowns and Bridges

- 1.2.4. Other Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostics Equipment

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Peridontic

- 2.4. Prosthodontic

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End Users

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Dental Equipment Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Dental Equipment Market Regional Market Share

Geographic Coverage of North America Dental Equipment Market

North America Dental Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The aging demographic in North America requires more dental services

- 3.2.2 including complex procedures like implants

- 3.2.3 extractions

- 3.2.4 and periodontal treatments. This shift significantly drives the demand for advanced dental equipment

- 3.3. Market Restrains

- 3.3.1 The dental equipment industry is subject to strict regulations from organizations like the FDA and Health Canada

- 3.3.2 which can complicate the manufacturing and approval processes.

- 3.4. Market Trends

- 3.4.1. A preference for minimally invasive procedures is likely to increase the demand for specialized instruments and equipment that support such techniques

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Dental Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostics Equipment

- 5.1.1.1. Dental Laser

- 5.1.1.1.1. Soft Tissue Lasers

- 5.1.1.1.2. Hard Tissue Lasers

- 5.1.1.2. Radiology Equipment

- 5.1.1.2.1. Extra Oral Radiology Equipment

- 5.1.1.2.2. Intra-oral Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. Other General and Diagnostic equipment

- 5.1.1.1. Dental Laser

- 5.1.2. Dental Consumables

- 5.1.2.1. Dental Biomaterial

- 5.1.2.2. Dental Implants

- 5.1.2.3. Crowns and Bridges

- 5.1.2.4. Other Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostics Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Peridontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Dental Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. General and Diagnostics Equipment

- 6.1.1.1. Dental Laser

- 6.1.1.1.1. Soft Tissue Lasers

- 6.1.1.1.2. Hard Tissue Lasers

- 6.1.1.2. Radiology Equipment

- 6.1.1.2.1. Extra Oral Radiology Equipment

- 6.1.1.2.2. Intra-oral Radiology Equipment

- 6.1.1.3. Dental Chair and Equipment

- 6.1.1.4. Other General and Diagnostic equipment

- 6.1.1.1. Dental Laser

- 6.1.2. Dental Consumables

- 6.1.2.1. Dental Biomaterial

- 6.1.2.2. Dental Implants

- 6.1.2.3. Crowns and Bridges

- 6.1.2.4. Other Dental Consumables

- 6.1.3. Other Dental Devices

- 6.1.1. General and Diagnostics Equipment

- 6.2. Market Analysis, Insights and Forecast - by Treatment

- 6.2.1. Orthodontic

- 6.2.2. Endodontic

- 6.2.3. Peridontic

- 6.2.4. Prosthodontic

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Clinics

- 6.3.3. Other End Users

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Dental Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. General and Diagnostics Equipment

- 7.1.1.1. Dental Laser

- 7.1.1.1.1. Soft Tissue Lasers

- 7.1.1.1.2. Hard Tissue Lasers

- 7.1.1.2. Radiology Equipment

- 7.1.1.2.1. Extra Oral Radiology Equipment

- 7.1.1.2.2. Intra-oral Radiology Equipment

- 7.1.1.3. Dental Chair and Equipment

- 7.1.1.4. Other General and Diagnostic equipment

- 7.1.1.1. Dental Laser

- 7.1.2. Dental Consumables

- 7.1.2.1. Dental Biomaterial

- 7.1.2.2. Dental Implants

- 7.1.2.3. Crowns and Bridges

- 7.1.2.4. Other Dental Consumables

- 7.1.3. Other Dental Devices

- 7.1.1. General and Diagnostics Equipment

- 7.2. Market Analysis, Insights and Forecast - by Treatment

- 7.2.1. Orthodontic

- 7.2.2. Endodontic

- 7.2.3. Peridontic

- 7.2.4. Prosthodontic

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Clinics

- 7.3.3. Other End Users

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Dental Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. General and Diagnostics Equipment

- 8.1.1.1. Dental Laser

- 8.1.1.1.1. Soft Tissue Lasers

- 8.1.1.1.2. Hard Tissue Lasers

- 8.1.1.2. Radiology Equipment

- 8.1.1.2.1. Extra Oral Radiology Equipment

- 8.1.1.2.2. Intra-oral Radiology Equipment

- 8.1.1.3. Dental Chair and Equipment

- 8.1.1.4. Other General and Diagnostic equipment

- 8.1.1.1. Dental Laser

- 8.1.2. Dental Consumables

- 8.1.2.1. Dental Biomaterial

- 8.1.2.2. Dental Implants

- 8.1.2.3. Crowns and Bridges

- 8.1.2.4. Other Dental Consumables

- 8.1.3. Other Dental Devices

- 8.1.1. General and Diagnostics Equipment

- 8.2. Market Analysis, Insights and Forecast - by Treatment

- 8.2.1. Orthodontic

- 8.2.2. Endodontic

- 8.2.3. Peridontic

- 8.2.4. Prosthodontic

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Clinics

- 8.3.3. Other End Users

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 A-Dec Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Midmark Corp

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Biolase Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 3M

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Dentsply Sirona

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 GC Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Envista Holdings Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Patterson Companies Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Carestream Health Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Planmeca OY

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 A-Dec Inc

List of Figures

- Figure 1: North America Dental Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Dental Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Dental Equipment Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: North America Dental Equipment Market Volume K Units Forecast, by Product 2020 & 2033

- Table 3: North America Dental Equipment Market Revenue billion Forecast, by Treatment 2020 & 2033

- Table 4: North America Dental Equipment Market Volume K Units Forecast, by Treatment 2020 & 2033

- Table 5: North America Dental Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: North America Dental Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 7: North America Dental Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Dental Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 9: North America Dental Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: North America Dental Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 11: North America Dental Equipment Market Revenue billion Forecast, by Product 2020 & 2033

- Table 12: North America Dental Equipment Market Volume K Units Forecast, by Product 2020 & 2033

- Table 13: North America Dental Equipment Market Revenue billion Forecast, by Treatment 2020 & 2033

- Table 14: North America Dental Equipment Market Volume K Units Forecast, by Treatment 2020 & 2033

- Table 15: North America Dental Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 16: North America Dental Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 17: North America Dental Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: North America Dental Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 19: North America Dental Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: North America Dental Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 21: North America Dental Equipment Market Revenue billion Forecast, by Product 2020 & 2033

- Table 22: North America Dental Equipment Market Volume K Units Forecast, by Product 2020 & 2033

- Table 23: North America Dental Equipment Market Revenue billion Forecast, by Treatment 2020 & 2033

- Table 24: North America Dental Equipment Market Volume K Units Forecast, by Treatment 2020 & 2033

- Table 25: North America Dental Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 26: North America Dental Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 27: North America Dental Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: North America Dental Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: North America Dental Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: North America Dental Equipment Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: North America Dental Equipment Market Revenue billion Forecast, by Product 2020 & 2033

- Table 32: North America Dental Equipment Market Volume K Units Forecast, by Product 2020 & 2033

- Table 33: North America Dental Equipment Market Revenue billion Forecast, by Treatment 2020 & 2033

- Table 34: North America Dental Equipment Market Volume K Units Forecast, by Treatment 2020 & 2033

- Table 35: North America Dental Equipment Market Revenue billion Forecast, by End User 2020 & 2033

- Table 36: North America Dental Equipment Market Volume K Units Forecast, by End User 2020 & 2033

- Table 37: North America Dental Equipment Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: North America Dental Equipment Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: North America Dental Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: North America Dental Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Dental Equipment Market?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the North America Dental Equipment Market?

Key companies in the market include A-Dec Inc, Midmark Corp , Biolase Inc, 3M, Dentsply Sirona, GC Corporation, Envista Holdings Corporation, Patterson Companies Inc, Carestream Health Inc, Planmeca OY.

3. What are the main segments of the North America Dental Equipment Market?

The market segments include Product, Treatment, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.72 billion as of 2022.

5. What are some drivers contributing to market growth?

The aging demographic in North America requires more dental services. including complex procedures like implants. extractions. and periodontal treatments. This shift significantly drives the demand for advanced dental equipment.

6. What are the notable trends driving market growth?

A preference for minimally invasive procedures is likely to increase the demand for specialized instruments and equipment that support such techniques.

7. Are there any restraints impacting market growth?

The dental equipment industry is subject to strict regulations from organizations like the FDA and Health Canada. which can complicate the manufacturing and approval processes..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Dental Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Dental Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Dental Equipment Market?

To stay informed about further developments, trends, and reports in the North America Dental Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence