Key Insights

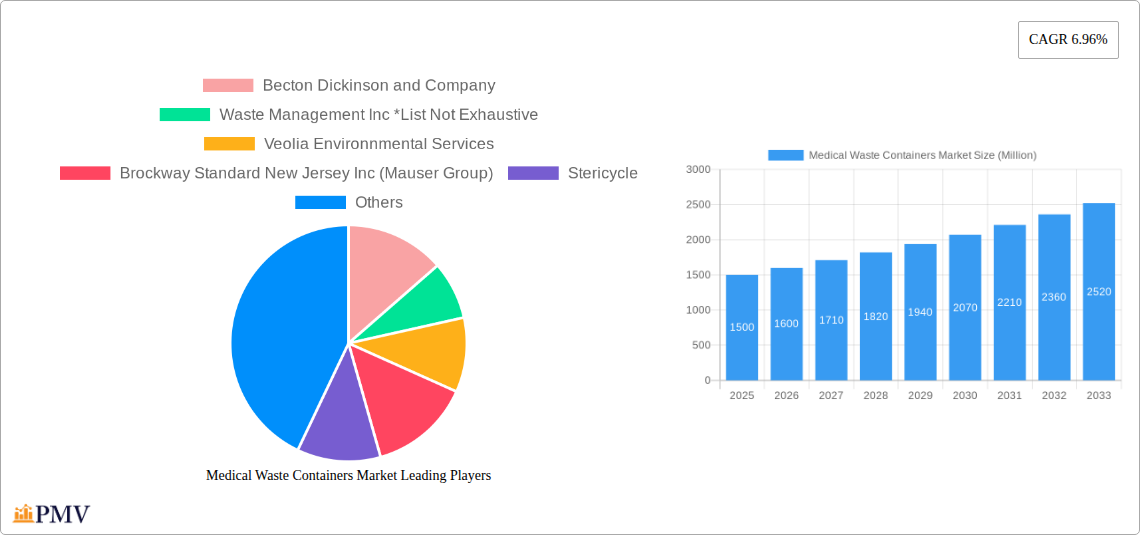

The global Medical Waste Containers Market is poised for significant expansion, projected to reach a substantial market size with a Compound Annual Growth Rate (CAGR) of 6.96% during the forecast period of 2025-2033. This robust growth is primarily fueled by a confluence of escalating healthcare expenditures, an increasing global burden of infectious diseases, and a heightened emphasis on stringent waste management regulations across developed and developing economies. The rising awareness regarding the health hazards associated with improper medical waste disposal, coupled with advancements in container technology that offer enhanced safety and containment, are further propelling market demand. Furthermore, the burgeoning volume of diagnostic procedures and surgical interventions worldwide contributes to a greater generation of medical waste, directly impacting the need for reliable and compliant disposal solutions. The market is segmented across various waste types, product categories, and end-user segments, indicating a diverse and evolving landscape driven by specific needs and regulatory frameworks.

Medical Waste Containers Market Market Size (In Billion)

The market's trajectory is strongly influenced by critical drivers such as the increasing prevalence of chronic diseases, the continuous development of novel medical treatments including chemotherapy, and the growing adoption of advanced waste segregation and treatment technologies. Trends such as the shift towards sustainable and eco-friendly container materials, the integration of smart features for tracking and compliance, and the increasing outsourcing of medical waste management services by healthcare facilities are shaping the market's future. However, restraints such as the high initial investment costs for advanced waste management infrastructure and the challenges in consistent regulatory enforcement in certain regions could pose hurdles. Key players like Becton Dickinson and Company, Waste Management Inc., and Stericycle are actively innovating and expanding their presence to cater to the dynamic needs of the market, focusing on product development, strategic collaborations, and geographical expansion to capitalize on growth opportunities.

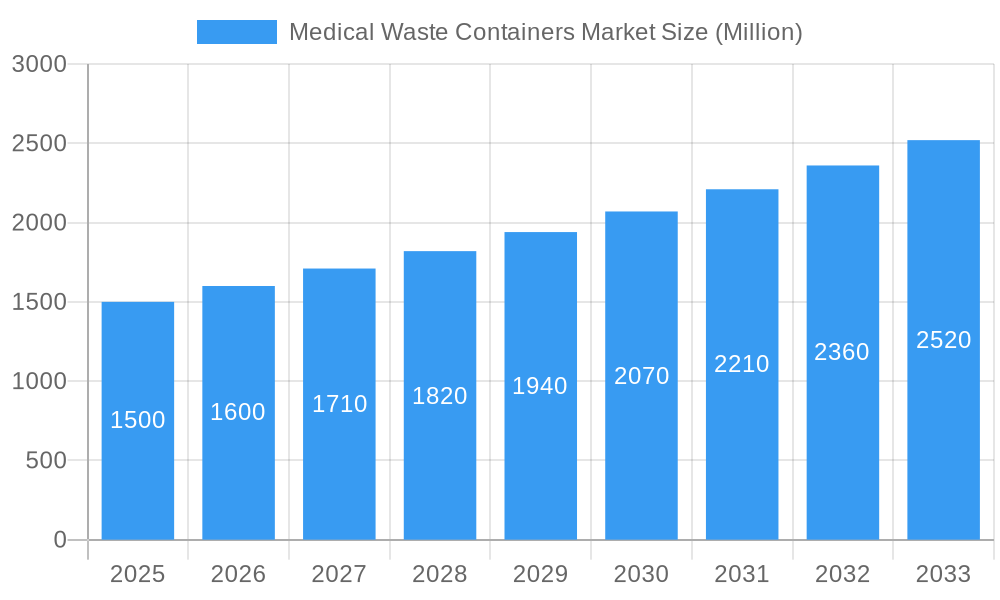

Medical Waste Containers Market Company Market Share

This detailed market research report offers an in-depth analysis of the global Medical Waste Containers Market, providing crucial insights into market dynamics, growth drivers, segmentation, competitive landscape, and future outlook. Covering the Study Period: 2019–2033, with Base Year: 2025, Estimated Year: 2025, and Forecast Period: 2025–2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the evolving healthcare waste management solutions landscape. The report delves into critical segments including Type of Waste (General Medical Waste, Infectious and Hazardous Medical Waste, Biomedical Medical Waste, Other Types of Waste), Product (Chemotherapy Containers, Biohazardous Medical Waste Containers, Sharps Medical Waste Containers, Resource, Others), and End User (Hospitals and Private Clinics, Pharmacies, Academic Research Institutes, Other End Users). Unlock actionable intelligence to navigate the medical waste disposal market, biomedical waste management, and regulated medical waste sectors.

Medical Waste Containers Market Market Structure & Competitive Dynamics

The Medical Waste Containers Market exhibits a moderately concentrated structure, with key players like Becton Dickinson and Company and Waste Management Inc. holding significant market share. The innovation ecosystem is driven by increasing regulatory stringency and a growing emphasis on safe and compliant disposal of infectious medical waste. Product substitutes, such as reusable containers and advanced incineration technologies, present evolving challenges, yet the demand for specialized, single-use containers remains robust. End-user trends indicate a rising preference for containers with enhanced safety features and sustainability certifications, particularly within hospitals and private clinics and pharmacies. Mergers and acquisitions (M&A) are strategic tools for expansion and portfolio enhancement. For instance, the acquisition of smaller regional players by larger entities bolsters their geographical reach and service offerings. While specific M&A deal values are not publicly available for all transactions, the trend signifies consolidation and a drive for market leadership in medical waste containment solutions. The market share for leading companies is estimated to be around 15-20% for top players, with a significant portion held by mid-tier and smaller specialized manufacturers. The ongoing drive for biohazardous medical waste containers and sharps medical waste containers further fuels competitive strategies.

Medical Waste Containers Market Industry Trends & Insights

The Medical Waste Containers Market is poised for significant growth, driven by an escalating global healthcare burden, increasing prevalence of chronic diseases, and a surge in the volume of biomedical waste. The CAGR for this market is projected to be between 5.5% and 6.5% over the forecast period. Stringent government regulations regarding the safe handling and disposal of infectious and hazardous medical waste are paramount growth accelerators. The growing awareness among healthcare professionals and institutions about the potential health hazards associated with improper waste management further fuels demand for certified medical waste containers. Technological advancements are leading to the development of more durable, leak-proof, and puncture-resistant containers, enhancing safety during transport and disposal. The trend towards sustainability is also influencing the market, with manufacturers exploring the use of recycled materials and developing products that minimize environmental impact. Consumer preferences are shifting towards solutions that offer convenience, compliance, and cost-effectiveness. The competitive landscape is characterized by intense rivalry, with companies focusing on product innovation, strategic partnerships, and market expansion to gain a competitive edge in the healthcare waste management industry. The increasing adoption of chemotherapy containers and specialized containment for potent pharmaceutical waste underscores the need for tailored solutions.

Dominant Markets & Segments in Medical Waste Containers Market

The Medical Waste Containers Market is dominated by a few key segments and regions. In terms of Type of Waste, Infectious and Hazardous Medical Waste commands the largest market share due to the critical need for secure containment to prevent disease transmission and environmental contamination. The rising number of surgical procedures and the increasing use of diagnostics contribute significantly to this segment's dominance.

- Key Drivers for Infectious and Hazardous Medical Waste Segment Dominance:

- Strict regulatory mandates for handling infectious materials.

- Heightened global focus on infection control and public health.

- Increased diagnostic testing and research activities generating hazardous byproducts.

In the Product segment, Biohazardous Medical Waste Containers and Sharps Medical Waste Containers are the leading categories. Biohazardous Medical Waste Containers are essential for containing materials contaminated with pathogens, while Sharps Medical Waste Containers are crucial for preventing needlestick injuries and the spread of blood-borne diseases. The widespread use of syringes and needles in healthcare settings globally underpins the consistent demand for these products.

- Key Drivers for Biohazardous and Sharps Medical Waste Containers:

- Ubiquitous use of syringes, needles, and other sharp medical devices.

- High risk of injury and infection associated with sharps.

- Regulatory requirements for puncture-resistant sharps containers.

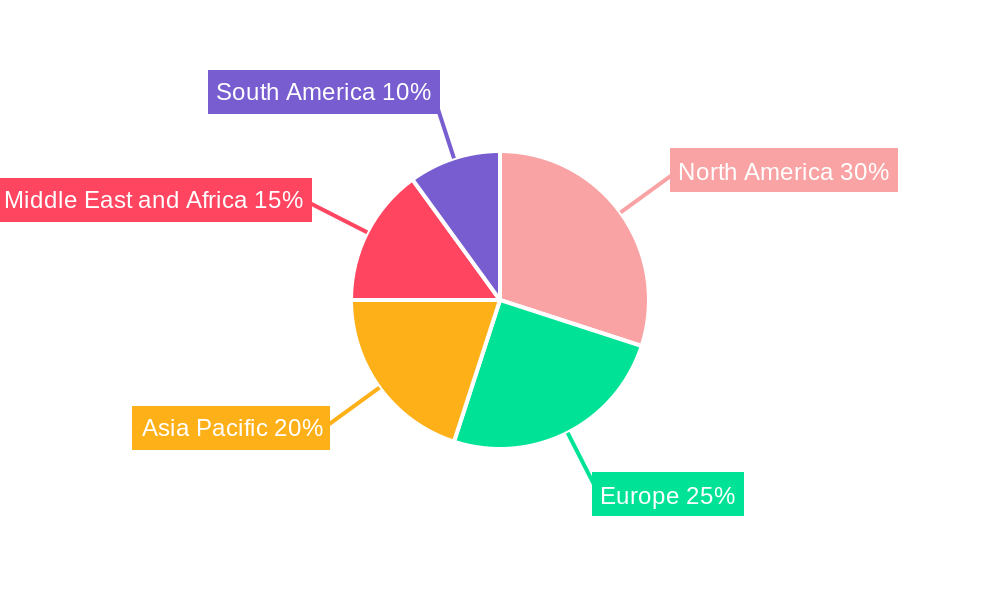

Geographically, North America and Europe are currently the dominant markets for Medical Waste Containers, owing to well-established healthcare infrastructures, stringent regulatory frameworks, and high healthcare expenditure. However, the Asia-Pacific region is expected to witness the fastest growth due to rapid urbanization, increasing healthcare access, and a growing awareness of proper waste management practices in emerging economies. Among End Users, Hospitals and Private Clinics constitute the largest segment, accounting for a substantial portion of the market. Their high volume of medical procedures and patient care necessitates a continuous and substantial supply of medical waste containers.

- Key Drivers for Hospital and Private Clinic Dominance:

- Highest volume of medical waste generation.

- Need for compliance with diverse waste disposal protocols.

- Significant investment in healthcare infrastructure and safety equipment.

Medical Waste Containers Market Product Innovations

Product innovation in the Medical Waste Containers Market is primarily focused on enhancing safety, convenience, and sustainability. Manufacturers are developing containers with advanced locking mechanisms, improved sealing technologies to prevent leaks, and materials that offer superior puncture and impact resistance. The integration of antimicrobial additives is a growing trend, particularly for biohazardous medical waste containers, to inhibit microbial growth. Furthermore, there's a growing emphasis on lightweight yet durable designs to reduce transportation costs and environmental footprint. The development of specialized containers for specific waste streams, such as chemotherapy containers with enhanced containment capabilities, reflects a commitment to addressing niche market needs and improving safety protocols.

Report Segmentation & Scope

This comprehensive report segments the Medical Waste Containers Market based on critical parameters to provide a granular analysis.

- Type of Waste: The report delves into General Medical Waste, Infectious and Hazardous Medical Waste, Biomedical Medical Waste, and Other Types of Waste. The Infectious and Hazardous Medical Waste segment is projected to lead the market with a significant market share of approximately 40-45% by 2025, driven by stringent regulations.

- Product: Segmentation includes Chemotherapy Containers, Biohazardous Medical Waste Containers, Sharps Medical Waste Containers, Resource, and Others. The Biohazardous Medical Waste Containers segment is anticipated to hold a substantial market share, estimated at 30-35% by 2025, owing to their widespread application in hospitals and clinics.

- End User: Key end-user segments are Hospitals and Private Clinics, Pharmacies, Academic Research Institutes, and Other End Users. Hospitals and Private Clinics are expected to represent the largest end-user segment, estimated at over 50% of the market by 2025, due to the sheer volume of medical waste generated.

Key Drivers of Medical Waste Containers Market Growth

The Medical Waste Containers Market is propelled by several key growth drivers, ensuring a robust upward trajectory. A primary driver is the escalating global healthcare expenditure, leading to increased medical procedures and, consequently, a higher generation of medical waste. Stringent regulatory frameworks worldwide, mandating safe and compliant disposal of infectious and hazardous medical waste, also play a pivotal role. The increasing awareness of the environmental and health risks associated with improper waste management is fostering a greater demand for specialized containment solutions. Furthermore, technological advancements in material science and container design are leading to the development of more efficient, safer, and sustainable products, catering to the evolving needs of healthcare facilities. The rising incidence of chronic diseases and the expanding healthcare infrastructure in emerging economies are further contributing to market expansion.

Challenges in the Medical Waste Containers Market Sector

Despite the positive growth outlook, the Medical Waste Containers Market faces several challenges that can hinder its full potential. One significant barrier is the cost of compliance with increasingly stringent regulations, which can be a substantial burden for smaller healthcare facilities and in developing regions. Fluctuations in raw material prices, particularly for plastics used in container manufacturing, can impact profit margins and lead to price volatility. The supply chain disruptions, as witnessed in recent global events, can affect the availability and timely delivery of essential medical waste containment products. Moreover, the existence of product substitutes, such as reusable containers and advanced waste treatment technologies, presents a competitive pressure, although the demand for single-use, specialized containers remains strong. The counterfeit market for medical supplies, including waste containers, also poses a risk to patient safety and market integrity.

Leading Players in the Medical Waste Containers Market Market

- Becton Dickinson and Company

- Waste Management Inc.

- Veolia Environnmental Services

- Brockway Standard New Jersey Inc (Mauser Group)

- Stericycle

- Bemis Manufacturing Company

- Thermo Fisher Scientific Inc.

- Medgen Medical Products

- Cardinal Health Inc.

- Bondtech Corporation

- Sharps Compliance Inc.

- Daniels Health

Key Developments in Medical Waste Containers Market Sector

- August 2022: Brightmark partnered with Jamar Health Products to recycle plastic medical waste. Brightmark provides a sustainable and circular solution for recycling and converting Jamar's proprietary PATRAN slide sheets into low-carbon fuels. This development highlights the growing focus on circular economy principles and sustainable waste management practices within the medical waste sector.

- April 2022: Stericycle, Inc. launched its new SafeShield antimicrobial medical waste containers, a line of high-quality, standardized containers specifically designed for storing and transporting regulated medical waste (RMW). This product launch signifies a commitment to enhancing safety features and offering standardized solutions for regulated medical waste, directly addressing market demand for secure containment.

Strategic Medical Waste Containers Market Market Outlook

The strategic outlook for the Medical Waste Containers Market is exceptionally positive, driven by enduring global healthcare trends and a heightened focus on safety and environmental stewardship. The increasing demand for robust medical waste disposal solutions in emerging economies presents significant growth accelerators. Manufacturers are strategically investing in research and development to introduce innovative products with enhanced safety features, improved biodegradability, and greater cost-efficiency. Partnerships and collaborations between waste management companies and healthcare providers are expected to become more prevalent, fostering integrated solutions. The ongoing digital transformation within the healthcare sector also offers opportunities for smart waste management systems, including trackable medical waste containers. Overall, the market is poised for sustained expansion, with strategic opportunities lying in catering to niche segments like chemotherapy waste management and expanding geographical reach in underserved regions.

Medical Waste Containers Market Segmentation

-

1. Type of Waste

- 1.1. General Medical Waste

- 1.2. Infectious and Hazardous Medical Waste

- 1.3. Biomedical Medical Waste

- 1.4. Other Types of Waste

-

2. Product

- 2.1. Chemotherapy Containers

- 2.2. Biohazardous Medical Waste Containers

- 2.3. Sharps Medical Waste Containers

- 2.4. Resource

- 2.5. Others

-

3. End User

- 3.1. Hospitals and Private Clinics

- 3.2. Pharmace

- 3.3. Academic Research Institutes

- 3.4. Other End Users

Medical Waste Containers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Medical Waste Containers Market Regional Market Share

Geographic Coverage of Medical Waste Containers Market

Medical Waste Containers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investment in Innovation of Novel Medical Waste Container; Increasing Medical Waste and Rising Illnesses Due to Untreated Medical Waste; Establishment of Government Policies for Conservation of the Environment

- 3.3. Market Restrains

- 3.3.1. Breaking of Containers leading to Spread of Illness

- 3.4. Market Trends

- 3.4.1. Biomedical Waste is Expected to Hold Significant Share in the Market Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Waste Containers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Waste

- 5.1.1. General Medical Waste

- 5.1.2. Infectious and Hazardous Medical Waste

- 5.1.3. Biomedical Medical Waste

- 5.1.4. Other Types of Waste

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Chemotherapy Containers

- 5.2.2. Biohazardous Medical Waste Containers

- 5.2.3. Sharps Medical Waste Containers

- 5.2.4. Resource

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals and Private Clinics

- 5.3.2. Pharmace

- 5.3.3. Academic Research Institutes

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type of Waste

- 6. North America Medical Waste Containers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Waste

- 6.1.1. General Medical Waste

- 6.1.2. Infectious and Hazardous Medical Waste

- 6.1.3. Biomedical Medical Waste

- 6.1.4. Other Types of Waste

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Chemotherapy Containers

- 6.2.2. Biohazardous Medical Waste Containers

- 6.2.3. Sharps Medical Waste Containers

- 6.2.4. Resource

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals and Private Clinics

- 6.3.2. Pharmace

- 6.3.3. Academic Research Institutes

- 6.3.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type of Waste

- 7. Europe Medical Waste Containers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Waste

- 7.1.1. General Medical Waste

- 7.1.2. Infectious and Hazardous Medical Waste

- 7.1.3. Biomedical Medical Waste

- 7.1.4. Other Types of Waste

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Chemotherapy Containers

- 7.2.2. Biohazardous Medical Waste Containers

- 7.2.3. Sharps Medical Waste Containers

- 7.2.4. Resource

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals and Private Clinics

- 7.3.2. Pharmace

- 7.3.3. Academic Research Institutes

- 7.3.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type of Waste

- 8. Asia Pacific Medical Waste Containers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Waste

- 8.1.1. General Medical Waste

- 8.1.2. Infectious and Hazardous Medical Waste

- 8.1.3. Biomedical Medical Waste

- 8.1.4. Other Types of Waste

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Chemotherapy Containers

- 8.2.2. Biohazardous Medical Waste Containers

- 8.2.3. Sharps Medical Waste Containers

- 8.2.4. Resource

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals and Private Clinics

- 8.3.2. Pharmace

- 8.3.3. Academic Research Institutes

- 8.3.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type of Waste

- 9. Middle East and Africa Medical Waste Containers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Waste

- 9.1.1. General Medical Waste

- 9.1.2. Infectious and Hazardous Medical Waste

- 9.1.3. Biomedical Medical Waste

- 9.1.4. Other Types of Waste

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Chemotherapy Containers

- 9.2.2. Biohazardous Medical Waste Containers

- 9.2.3. Sharps Medical Waste Containers

- 9.2.4. Resource

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals and Private Clinics

- 9.3.2. Pharmace

- 9.3.3. Academic Research Institutes

- 9.3.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type of Waste

- 10. South America Medical Waste Containers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Waste

- 10.1.1. General Medical Waste

- 10.1.2. Infectious and Hazardous Medical Waste

- 10.1.3. Biomedical Medical Waste

- 10.1.4. Other Types of Waste

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Chemotherapy Containers

- 10.2.2. Biohazardous Medical Waste Containers

- 10.2.3. Sharps Medical Waste Containers

- 10.2.4. Resource

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals and Private Clinics

- 10.3.2. Pharmace

- 10.3.3. Academic Research Institutes

- 10.3.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type of Waste

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Waste Management Inc *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Veolia Environnmental Services

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brockway Standard New Jersey Inc (Mauser Group)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Stericycle

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bemis Manufacturing Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thermo Fisher Scientific Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Medgen Medical Products

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cardinal Health Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bondtech Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sharps Compliance Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Daniels Health

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Medical Waste Containers Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Medical Waste Containers Market Revenue (undefined), by Type of Waste 2025 & 2033

- Figure 3: North America Medical Waste Containers Market Revenue Share (%), by Type of Waste 2025 & 2033

- Figure 4: North America Medical Waste Containers Market Revenue (undefined), by Product 2025 & 2033

- Figure 5: North America Medical Waste Containers Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Medical Waste Containers Market Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America Medical Waste Containers Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Medical Waste Containers Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Medical Waste Containers Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Medical Waste Containers Market Revenue (undefined), by Type of Waste 2025 & 2033

- Figure 11: Europe Medical Waste Containers Market Revenue Share (%), by Type of Waste 2025 & 2033

- Figure 12: Europe Medical Waste Containers Market Revenue (undefined), by Product 2025 & 2033

- Figure 13: Europe Medical Waste Containers Market Revenue Share (%), by Product 2025 & 2033

- Figure 14: Europe Medical Waste Containers Market Revenue (undefined), by End User 2025 & 2033

- Figure 15: Europe Medical Waste Containers Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Medical Waste Containers Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Medical Waste Containers Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Medical Waste Containers Market Revenue (undefined), by Type of Waste 2025 & 2033

- Figure 19: Asia Pacific Medical Waste Containers Market Revenue Share (%), by Type of Waste 2025 & 2033

- Figure 20: Asia Pacific Medical Waste Containers Market Revenue (undefined), by Product 2025 & 2033

- Figure 21: Asia Pacific Medical Waste Containers Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Asia Pacific Medical Waste Containers Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Asia Pacific Medical Waste Containers Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Medical Waste Containers Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Medical Waste Containers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Medical Waste Containers Market Revenue (undefined), by Type of Waste 2025 & 2033

- Figure 27: Middle East and Africa Medical Waste Containers Market Revenue Share (%), by Type of Waste 2025 & 2033

- Figure 28: Middle East and Africa Medical Waste Containers Market Revenue (undefined), by Product 2025 & 2033

- Figure 29: Middle East and Africa Medical Waste Containers Market Revenue Share (%), by Product 2025 & 2033

- Figure 30: Middle East and Africa Medical Waste Containers Market Revenue (undefined), by End User 2025 & 2033

- Figure 31: Middle East and Africa Medical Waste Containers Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Medical Waste Containers Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Medical Waste Containers Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Medical Waste Containers Market Revenue (undefined), by Type of Waste 2025 & 2033

- Figure 35: South America Medical Waste Containers Market Revenue Share (%), by Type of Waste 2025 & 2033

- Figure 36: South America Medical Waste Containers Market Revenue (undefined), by Product 2025 & 2033

- Figure 37: South America Medical Waste Containers Market Revenue Share (%), by Product 2025 & 2033

- Figure 38: South America Medical Waste Containers Market Revenue (undefined), by End User 2025 & 2033

- Figure 39: South America Medical Waste Containers Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Medical Waste Containers Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Medical Waste Containers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical Waste Containers Market Revenue undefined Forecast, by Type of Waste 2020 & 2033

- Table 2: Global Medical Waste Containers Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 3: Global Medical Waste Containers Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Medical Waste Containers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Medical Waste Containers Market Revenue undefined Forecast, by Type of Waste 2020 & 2033

- Table 6: Global Medical Waste Containers Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 7: Global Medical Waste Containers Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global Medical Waste Containers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Medical Waste Containers Market Revenue undefined Forecast, by Type of Waste 2020 & 2033

- Table 13: Global Medical Waste Containers Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 14: Global Medical Waste Containers Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Medical Waste Containers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Medical Waste Containers Market Revenue undefined Forecast, by Type of Waste 2020 & 2033

- Table 23: Global Medical Waste Containers Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 24: Global Medical Waste Containers Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global Medical Waste Containers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Medical Waste Containers Market Revenue undefined Forecast, by Type of Waste 2020 & 2033

- Table 33: Global Medical Waste Containers Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 34: Global Medical Waste Containers Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 35: Global Medical Waste Containers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Medical Waste Containers Market Revenue undefined Forecast, by Type of Waste 2020 & 2033

- Table 40: Global Medical Waste Containers Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 41: Global Medical Waste Containers Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 42: Global Medical Waste Containers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Medical Waste Containers Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Waste Containers Market?

The projected CAGR is approximately 4.53%.

2. Which companies are prominent players in the Medical Waste Containers Market?

Key companies in the market include Becton Dickinson and Company, Waste Management Inc *List Not Exhaustive, Veolia Environnmental Services, Brockway Standard New Jersey Inc (Mauser Group), Stericycle, Bemis Manufacturing Company, Thermo Fisher Scientific Inc, Medgen Medical Products, Cardinal Health Inc, Bondtech Corporation, Sharps Compliance Inc, Daniels Health.

3. What are the main segments of the Medical Waste Containers Market?

The market segments include Type of Waste, Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Investment in Innovation of Novel Medical Waste Container; Increasing Medical Waste and Rising Illnesses Due to Untreated Medical Waste; Establishment of Government Policies for Conservation of the Environment.

6. What are the notable trends driving market growth?

Biomedical Waste is Expected to Hold Significant Share in the Market Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Breaking of Containers leading to Spread of Illness.

8. Can you provide examples of recent developments in the market?

In August 2022, Brightmark partnered with Jamar Health Products to recycle plastic medical waste. Brightmark provides a sustainable and circular solution for recycling and converting Jamar's proprietary PATRAN slide sheets into low-carbon fuels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Waste Containers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Waste Containers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Waste Containers Market?

To stay informed about further developments, trends, and reports in the Medical Waste Containers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence