Key Insights

The Latin America Insulin Medication Market is projected for robust growth, with a current market size estimated at USD 4.71 billion. This expansion is fueled by a compound annual growth rate (CAGR) of 3.48%, indicating a steady and significant upward trajectory. The market is driven by a confluence of factors, including the increasing prevalence of diabetes across the region, rising healthcare expenditure, and growing awareness regarding the management of this chronic condition. Technological advancements in insulin delivery systems, such as next-generation insulin pens and pumps, are also playing a crucial role in enhancing patient compliance and treatment efficacy, thereby boosting market demand. Furthermore, an expanding geriatric population, which is more susceptible to diabetes, contributes to the sustained growth of the insulin medication market.

Latin America Insulin Medication Market Market Size (In Billion)

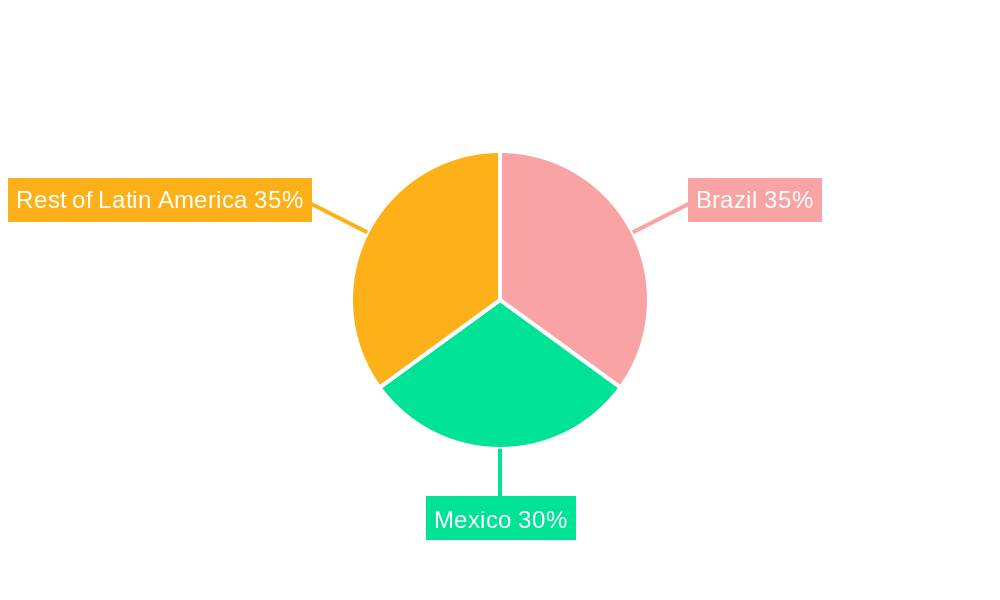

The market segmentation reveals a dynamic landscape with Insulin Drugs, Oral Anti-Diabetes Drugs, and Non-insulin Injectable Drugs all contributing to the overall market value. Geographically, Brazil and Mexico are identified as key markets, likely representing significant portions of the regional demand due to their large populations and established healthcare infrastructures. The "Rest of Latin America" segment also presents substantial untapped potential for growth. Key players such as Novo Nordisk, Eli Lilly, Sanofi, and AstraZeneca are actively engaged in research and development, product launches, and strategic collaborations to capture market share. However, challenges such as the high cost of advanced insulin formulations, reimbursement issues, and varying levels of healthcare access across different countries may present some restraints to the market's full potential. Nevertheless, the overarching trend points towards a market poised for sustained expansion driven by unmet medical needs and improving healthcare access.

Latin America Insulin Medication Market Company Market Share

This in-depth report provides a detailed analysis of the Latin America Insulin Medication Market, offering critical insights into market size, growth drivers, competitive landscape, and future trends. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this research is essential for stakeholders looking to capitalize on the burgeoning opportunities in this vital healthcare sector. Our analysis leverages high-ranking keywords such as "Latin America diabetes drugs," "insulin market Brazil," "oral anti-diabetes Mexico," and "injectable diabetes medication LATAM" to ensure maximum search visibility.

Latin America Insulin Medication Market Market Structure & Competitive Dynamics

The Latin America Insulin Medication Market is characterized by a moderate to high market concentration, driven by the presence of major global pharmaceutical players and a growing number of local manufacturers. The innovation ecosystem is robust, fueled by significant R&D investments in novel drug formulations, delivery systems, and the exploration of advanced therapeutic targets. Regulatory frameworks across countries like Brazil and Mexico are evolving, with bodies like Anvisa playing a crucial role in approving new treatments, as evidenced by the approval of tirzepatide. Product substitutes are present, particularly in the oral anti-diabetes segment, yet the unique efficacy of insulin and newer injectable non-insulin medications continues to solidify their market position. End-user trends highlight an increasing demand for more convenient and effective diabetes management solutions, driving the adoption of newer technologies. Mergers and acquisitions (M&A) activities are anticipated to play a significant role in market consolidation, with potential deal values ranging from tens to hundreds of millions of dollars as companies seek to expand their product portfolios and geographical reach. Key players are actively pursuing strategic partnerships and collaborations to strengthen their market share and accelerate product development pipelines, aiming for market leadership within the forecast period.

Latin America Insulin Medication Market Industry Trends & Insights

The Latin America Insulin Medication Market is experiencing a dynamic surge, driven by a confluence of escalating diabetes prevalence, increasing healthcare expenditure, and a growing awareness of advanced treatment options. The market growth drivers are multifaceted, with the rising incidence of Type 1 and Type 2 diabetes across the region acting as the primary catalyst. This surge in diabetes cases is linked to changing lifestyles, dietary habits, and an aging population, leading to a projected Compound Annual Growth Rate (CAGR) of approximately 7-9% for the overall market during the forecast period. Technological disruptions are profoundly shaping the market, with a significant push towards biosimilars, novel insulin analogs with improved pharmacokinetic profiles, and the development of smart insulin pens and continuous glucose monitoring (CGM) systems enhancing patient adherence and treatment efficacy. The consumer preferences are shifting towards more personalized and less invasive treatment modalities. Patients are actively seeking oral anti-diabetes drugs for their convenience and, increasingly, non-insulin injectable drugs that offer enhanced glycemic control and weight management benefits, such as GLP-1 receptor agonists. Competitive dynamics are intensifying as established pharmaceutical giants like Novo Nordisk, Sanofi, and Eli Lilly compete with emerging local players and biotech firms. The market penetration of advanced therapies is steadily increasing, albeit with regional disparities, influenced by factors such as affordability, insurance coverage, and physician prescribing patterns. The demand for innovative diabetes management solutions, including oral insulin and advanced injectable therapies, represents a significant growth avenue, projected to contribute substantially to market expansion within the forecast horizon.

Dominant Markets & Segments in Latin America Insulin Medication Market

The Latin America Insulin Medication Market is segmented by Type into Insulin Drugs, Oral Anti-Diabetes Drugs, and Non-insulin Injectable Drugs, and by Geography into Brazil, Mexico, and the Rest of Latin America.

Brazil stands out as the dominant geographical market, driven by its large population, increasing healthcare infrastructure investment, and a growing burden of diabetes.

- Key Drivers for Brazil's Dominance:

- High prevalence of diabetes, estimated to be over 10% of the adult population.

- Government initiatives focused on chronic disease management and increasing access to essential medicines.

- Significant presence of major pharmaceutical companies and active regulatory approvals.

- Growing adoption of advanced insulin formulations and injectable therapies.

Mexico represents another significant market, with a robust healthcare system and a growing demand for effective diabetes treatments.

- Key Drivers for Mexico's Growth:

- Substantial prevalence of diabetes and obesity, key risk factors for insulin resistance.

- Expansion of private healthcare facilities and increasing insurance coverage for diabetes management.

- Active pipeline of new drug approvals and increasing awareness among healthcare professionals.

The Rest of Latin America, encompassing countries like Argentina, Colombia, and Chile, presents a collective growing market, albeit with varying levels of development and access.

- Key Drivers for Rest of Latin America:

- Rising disposable incomes and improving healthcare access in key nations.

- Increasing focus on preventative healthcare and diabetes awareness campaigns.

- Growing interest in innovative treatments, particularly for managing Type 2 diabetes.

Within the Type segmentation:

- Insulin Drugs continue to hold a substantial market share due to their critical role in managing both Type 1 and advanced Type 2 diabetes. The market is witnessing a shift towards long-acting and rapid-acting insulin analogs, offering improved patient convenience and glycemic control.

- Oral Anti-Diabetes Drugs represent a significant and growing segment, particularly for early-stage Type 2 diabetes management. The introduction of newer oral agents with improved efficacy and reduced side effects continues to drive adoption.

- Non-insulin Injectable Drugs, including GLP-1 receptor agonists and SGLT-2 inhibitors, are experiencing rapid growth. These drugs offer not only glycemic control but also significant benefits in weight management and cardiovascular risk reduction, making them increasingly attractive for patients and physicians. The market size for this segment is projected to witness the highest CAGR within the forecast period.

Latin America Insulin Medication Market Product Innovations

Product innovations in the Latin America Insulin Medication Market are centered on enhancing efficacy, improving patient convenience, and addressing unmet clinical needs. Key developments include advanced insulin analogs with more predictable absorption profiles, novel oral formulations offering improved bioavailability, and innovative injectable non-insulin therapies demonstrating superior glycemic control and metabolic benefits. The development of biosimilar insulins is also gaining traction, promising increased affordability and accessibility. Furthermore, integration with digital health platforms and smart delivery devices is transforming patient care, enabling better self-management and personalized treatment regimens. These innovations are crucial for capturing market share and addressing the escalating burden of diabetes across the region.

Report Segmentation & Scope

This report meticulously segments the Latin America Insulin Medication Market to provide granular insights. The segmentation by Type encompasses:

- Insulin Drugs: This segment includes all forms of insulin, from traditional to advanced analogs, vital for Type 1 and advanced Type 2 diabetes management. Market size is projected to reach approximately \$1,800 million by 2025, with a moderate CAGR.

- Oral Anti-Diabetes Drugs: This segment covers a wide range of oral medications, including metformin, sulfonylureas, and DPP-4 inhibitors, primarily for Type 2 diabetes. The market size is estimated at \$1,500 million in 2025, exhibiting steady growth.

- Non-insulin Injectable Drugs: This rapidly expanding segment includes GLP-1 receptor agonists and other injectable non-insulin agents, offering metabolic benefits. Market size is projected to reach \$1,200 million in 2025, with the highest growth forecast.

The segmentation by Geography includes:

- Brazil: The largest market, projected to reach \$1,700 million by 2025, driven by high prevalence and access initiatives.

- Mexico: A significant market, estimated at \$1,100 million in 2025, with strong growth potential.

- Rest of Latin America: This aggregated segment is projected to reach \$1,300 million in 2025, representing a collective growing opportunity.

Key Drivers of Latin America Insulin Medication Market Growth

Several key factors are propelling the growth of the Latin America Insulin Medication Market. The increasing prevalence of diabetes, driven by demographic shifts and lifestyle changes, is the primary growth engine. Rising healthcare expenditure across the region, coupled with government initiatives to improve diabetes care access, further fuels market expansion. Technological advancements in drug development, such as novel insulin formulations and effective non-insulin injectables, are enhancing treatment efficacy and patient outcomes, thus driving demand. The growing awareness among patients and healthcare professionals about the long-term complications of uncontrolled diabetes and the benefits of advanced therapies also contributes significantly to market growth.

Challenges in the Latin America Insulin Medication Market Sector

Despite the promising growth trajectory, the Latin America Insulin Medication Market faces several challenges. Affordability and access remain significant barriers, particularly in lower-income countries within the region, limiting the uptake of expensive novel therapies. Regulatory hurdles and complex approval processes can delay the market entry of new drugs. Supply chain disruptions and logistical complexities can impact the consistent availability of medications. Intense competition from both established and generic players exerts pressure on pricing. Furthermore, limited patient education and awareness regarding the management of diabetes and the benefits of newer treatment modalities can hinder optimal treatment adherence and market penetration.

Leading Players in the Latin America Insulin Medication Market Market

- Novo Nordisk

- Sanofi

- Eli Lilly

- Merck and Co

- Pfizer

- Takeda

- Janssen Pharmaceuticals

- AstraZeneca

- Novartis

- Bristol Myers Squibb

- Boehringer Ingelheim

- Astellas

- Other Companies

Key Developments in Latin America Insulin Medication Market Sector

- September 2023: Anvisa, Brazil's federal health regulator, approved tirzepatide. This injectable medication is designed to enhance blood sugar management in adults diagnosed with Type 2 diabetes. Manufactured by the renowned U.S. pharmaceutical company Eli Lilly, tirzepatide is marketed under the brand name Mounjaro. This approval signifies a major advancement in diabetes treatment accessibility in Brazil.

- March 2022: Oramed announced ORMD-0801 (a new molecule) is being evaluated in two pivotal Phase 3 trials and can be the first oral insulin capsule with the most convenient and safest way to deliver insulin therapy. This drug is expected to be a game-changer in the insulin and oral anti-diabetes drugs markets. Oramed also develops an oral GLP-1 (Glucagon-like peptide-1) analog capsule (ORMD-0901). These developments highlight a significant push towards oral delivery solutions, addressing a key patient preference.

Strategic Latin America Insulin Medication Market Market Outlook

The strategic outlook for the Latin America Insulin Medication Market is overwhelmingly positive, driven by robust underlying demographic and epidemiological trends. The projected increase in diabetes prevalence across the region presents a sustained demand for effective treatment solutions. Key growth accelerators include the expanding middle class, leading to increased healthcare expenditure and purchasing power, alongside proactive government policies aimed at enhancing chronic disease management. The market is poised for significant expansion due to the ongoing innovation in insulin analogs, the rise of biosimilars to improve affordability, and the growing adoption of non-insulin injectable drugs offering comprehensive metabolic benefits. Strategic opportunities lie in developing localized market entry strategies, forging partnerships with regional healthcare providers, and investing in patient education programs to drive demand for advanced therapies and ensure successful market penetration within the forecast period.

Latin America Insulin Medication Market Segmentation

-

1. Type

- 1.1. Insulin Drugs

- 1.2. Oral Anti-Diabetes Drugs

- 1.3. Non-insulin Injectable Drugs

-

2. Geography

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Rest of Latin America

Latin America Insulin Medication Market Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Rest of Latin America

Latin America Insulin Medication Market Regional Market Share

Geographic Coverage of Latin America Insulin Medication Market

Latin America Insulin Medication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Oral Anti-Diabetic Drugs have the Highest Market Share in Current Year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Insulin Medication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insulin Drugs

- 5.1.2. Oral Anti-Diabetes Drugs

- 5.1.3. Non-insulin Injectable Drugs

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Mexico

- 5.3.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Insulin Medication Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Insulin Drugs

- 6.1.2. Oral Anti-Diabetes Drugs

- 6.1.3. Non-insulin Injectable Drugs

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Mexico

- 6.2.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Mexico Latin America Insulin Medication Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Insulin Drugs

- 7.1.2. Oral Anti-Diabetes Drugs

- 7.1.3. Non-insulin Injectable Drugs

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Mexico

- 7.2.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of Latin America Latin America Insulin Medication Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Insulin Drugs

- 8.1.2. Oral Anti-Diabetes Drugs

- 8.1.3. Non-insulin Injectable Drugs

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Mexico

- 8.2.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Pfizer

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Takeda

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Janssen Pharmaceuticals

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Eli Lilly

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Sanofi

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Merck and Co

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 AstraZeneca

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Novartis

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Bristol Myers Squibb

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Novo Nordisk

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Boehringer Ingelheim

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Other Companie

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Astellas

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.1 Pfizer

List of Figures

- Figure 1: Latin America Insulin Medication Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Insulin Medication Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Insulin Medication Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Latin America Insulin Medication Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Latin America Insulin Medication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Latin America Insulin Medication Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: Latin America Insulin Medication Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Insulin Medication Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Latin America Insulin Medication Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Latin America Insulin Medication Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Latin America Insulin Medication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Latin America Insulin Medication Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: Latin America Insulin Medication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Latin America Insulin Medication Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Latin America Insulin Medication Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Latin America Insulin Medication Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Latin America Insulin Medication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Latin America Insulin Medication Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: Latin America Insulin Medication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Latin America Insulin Medication Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Latin America Insulin Medication Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Latin America Insulin Medication Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Latin America Insulin Medication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Latin America Insulin Medication Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Latin America Insulin Medication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Latin America Insulin Medication Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Insulin Medication Market?

The projected CAGR is approximately 3.48%.

2. Which companies are prominent players in the Latin America Insulin Medication Market?

Key companies in the market include Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Sanofi, Merck and Co, AstraZeneca, Novartis, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Other Companie, Astellas.

3. What are the main segments of the Latin America Insulin Medication Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.71 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Oral Anti-Diabetic Drugs have the Highest Market Share in Current Year.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

September 2023: Anvisa, Brazil's federal health regulator, approved tirzepatide. This injectable medication is designed to enhance blood sugar management in adults diagnosed with Type 2 diabetes. Manufactured by the renowned U.S. pharmaceutical company Eli Lilly, tirzepatide is marketed under the brand name Mounjaro.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Insulin Medication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Insulin Medication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Insulin Medication Market?

To stay informed about further developments, trends, and reports in the Latin America Insulin Medication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence