Key Insights

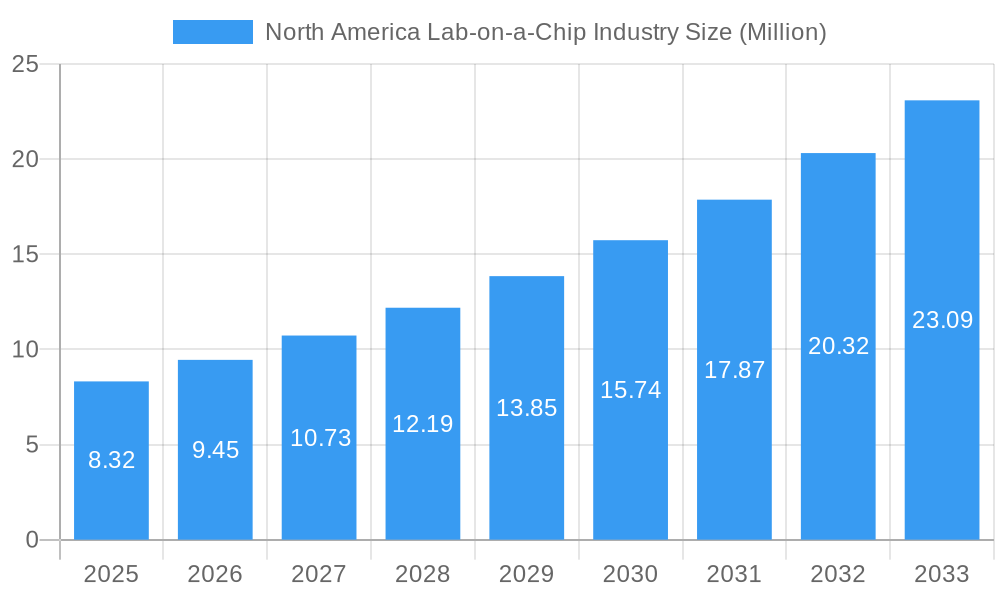

The North America Lab-on-a-Chip market is poised for significant expansion, projected to reach \$8.32 million in value. This impressive growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 13.63%, indicating a dynamic and rapidly evolving industry. The primary drivers for this surge include the increasing demand for rapid and accurate clinical diagnostics, the accelerating pace of drug discovery and development, and the expanding applications within genomics and proteomics research. Furthermore, the growing prevalence of chronic diseases, coupled with a heightened focus on personalized medicine, necessitates advanced analytical solutions that lab-on-a-chip technologies excel at providing. The market is witnessing a strong adoption of microfluidic-based devices, including lab-on-a-chip systems and microarrays, across various applications.

North America Lab-on-a-Chip Industry Market Size (In Million)

The market's expansion is further bolstered by technological advancements that enhance the sensitivity, portability, and cost-effectiveness of these devices. Key trends include the integration of artificial intelligence and machine learning for data analysis, the development of point-of-care diagnostic solutions, and the increasing use of these technologies in academic and research institutes for fundamental scientific exploration. While the growth trajectory is largely positive, the market faces certain restraints. These include the high initial investment required for sophisticated lab-on-a-chip instrumentation and the need for stringent regulatory approvals for new diagnostic applications. However, the persistent innovation and the growing recognition of the efficiency and diagnostic capabilities of these platforms by biotechnology and pharmaceutical companies, hospitals, and diagnostic centers are expected to outweigh these challenges, ensuring sustained market growth throughout the forecast period.

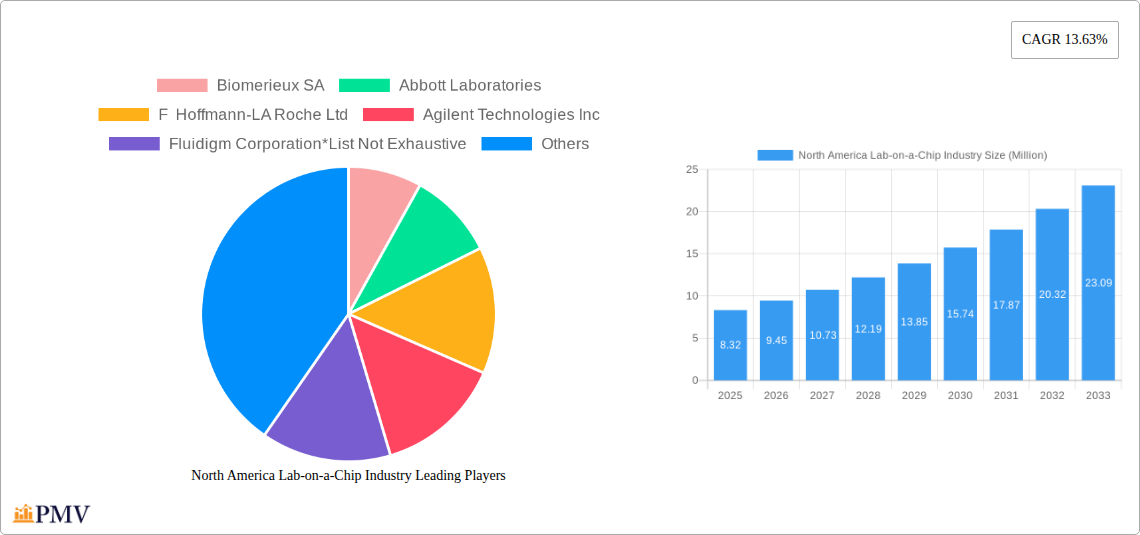

North America Lab-on-a-Chip Industry Company Market Share

North America Lab-on-a-Chip Industry Market Analysis: Trends, Opportunities, and Competitive Landscape 2019-2033

This comprehensive report delves into the dynamic North America Lab-on-a-Chip (LOC) industry, offering in-depth analysis and actionable insights for stakeholders. Spanning the historical period of 2019–2024 and projecting growth through 2033, with a base and estimated year of 2025, this study explores market structure, competitive dynamics, key trends, dominant segments, product innovations, growth drivers, challenges, and strategic outlook. Leveraging high-ranking keywords such as "lab-on-a-chip," "microfluidics," "point-of-care diagnostics," "genomics," "drug discovery," and "biotechnology," this report is meticulously crafted to enhance search visibility and engage a broad industry audience. Discover market size estimations in the billions, CAGR projections, and the strategic implications of emerging technologies for market leaders and new entrants.

North America Lab-on-a-Chip Industry Market Structure & Competitive Dynamics

The North America Lab-on-a-Chip industry is characterized by a moderately concentrated market structure, with a blend of established global players and specialized innovators vying for market share. Key companies such as Thermo Fisher Scientific, Danaher Corporation (Beckman Coulter Inc.), Agilent Technologies Inc., and Illumina Inc. command significant portions of the market due to their extensive product portfolios, robust R&D investments, and strong distribution networks. Innovation ecosystems are vibrant, driven by academic research institutions and venture capital funding, fostering the development of novel microfluidic applications and miniaturized analytical systems. Regulatory frameworks, while generally supportive of innovation, present challenges in terms of product approval timelines and compliance standards for medical devices. Product substitutes, while not directly replacing the core functionality, include traditional benchtop instruments and complex laboratory assays. End-user trends point towards an increasing demand for faster, more portable, and cost-effective diagnostic and analytical solutions, fueling the adoption of LOC technologies. Mergers and acquisitions (M&A) activities are significant drivers of consolidation and strategic expansion. For instance, M&A deals in the past have ranged from tens of millions to hundreds of millions of dollars, reflecting the strategic importance of acquiring advanced LOC capabilities and market access. The market share of leading players is estimated to be in the range of 5-15% each for the top five, with the remaining share distributed among numerous smaller entities.

North America Lab-on-a-Chip Industry Industry Trends & Insights

The North America Lab-on-a-Chip industry is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15-18% over the forecast period (2025–2033). This surge is primarily driven by the escalating demand for point-of-care (POC) diagnostics, enabling faster and more accessible testing outside traditional laboratory settings. Technological disruptions, particularly advancements in microfluidics, sensor integration, and multiplexing capabilities, are revolutionizing the performance and applications of LOC devices. Consumer preferences are shifting towards personalized medicine and rapid disease detection, creating significant opportunities for LOC solutions in clinical diagnostics and genomics. The competitive dynamics are intensifying, with companies focusing on developing integrated platforms that combine sample preparation, reaction, and detection on a single chip. Increased investment in R&D by key players, amounting to hundreds of millions of dollars annually, is fostering innovation in areas such as single-cell analysis, infectious disease detection, and cancer biomarker identification. Market penetration is steadily increasing across various end-user segments, including biotechnology and pharmaceutical companies, hospitals and diagnostics centers, and academic and research institutes. The integration of artificial intelligence (AI) and machine learning (ML) with LOC data analysis is another emerging trend, promising enhanced diagnostic accuracy and predictive capabilities. The increasing prevalence of chronic diseases and the growing need for efficient disease management further bolster the market. Regulatory bodies like the FDA are also streamlining approval processes for certain innovative medical technologies, albeit with stringent efficacy and safety requirements.

Dominant Markets & Segments in North America Lab-on-a-Chip Industry

The United States unequivocally dominates the North America Lab-on-a-Chip market, contributing an estimated 70-75% of the regional market value. This dominance is underpinned by several key drivers:

- Advanced Healthcare Infrastructure: The U.S. boasts a sophisticated healthcare system with extensive adoption of advanced diagnostic technologies and a high per capita healthcare spending, facilitating the integration of LOC solutions.

- Strong R&D Ecosystem: A thriving ecosystem of leading research institutions, universities, and well-funded biotechnology and pharmaceutical companies drives continuous innovation and early adoption of novel LOC technologies.

- Significant Investment in Life Sciences: Government funding and private venture capital investment in life sciences and medical device innovation are substantial, propelling research and commercialization efforts.

- Favorable Regulatory Environment (for Innovation): While rigorous, the FDA's framework provides pathways for innovative medical devices, encouraging companies to develop and launch new LOC products.

Within the product segments, Instruments represent the largest market share, estimated at 40-45%, due to the substantial upfront investment required for sophisticated LOC platforms. However, the Reagents and Consumables segment is experiencing the highest growth rate, driven by the recurring need for disposable components for LOC devices.

In terms of applications, Clinical Diagnostics holds the largest market share, estimated at over 50%, owing to the widespread use of LOC for disease detection, monitoring, and personalized medicine. The Drug Discovery segment, estimated at 20-25%, is also a significant contributor, leveraging LOC for high-throughput screening and in-vitro testing. Genomics and Proteomics applications, while smaller, are experiencing rapid expansion due to the increasing demand for rapid and efficient sequencing and analysis.

Among end-users, Biotechnology and Pharmaceutical Companies are major consumers, investing heavily in LOC for R&D, drug development, and companion diagnostics. Hospitals and Diagnostics Centers are increasingly adopting LOC for point-of-care testing and improved patient outcomes, representing a substantial and growing segment. Academic and Research Institutes remain crucial for foundational research and early-stage development.

North America Lab-on-a-Chip Industry Product Innovations

Product innovations in the North America Lab-on-a-Chip industry are rapidly transforming healthcare and research. Companies are developing highly integrated microfluidic devices capable of performing complex biological assays with minimal sample volume and reduced assay times. Innovations include the miniaturization of PCR, immunoassays, and cell sorting on a single chip, enabling rapid and accurate diagnostics at the point of care. The integration of advanced sensors, such as electrochemical, optical, and micro-electromechanical systems (MEMS), enhances detection sensitivity and specificity. These advancements offer significant competitive advantages by providing portable, user-friendly, and cost-effective solutions for a wide range of applications, from infectious disease screening to cancer biomarker detection and genetic analysis.

Report Segmentation & Scope

This report segmentizes the North America Lab-on-a-Chip market across several key dimensions. The Type segmentation includes Lab-on-a-chip and Microarray technologies, with Lab-on-a-chip holding a dominant market share. The Product segmentation covers Instruments, Reagents and Consumables, and Software and Services, with Instruments currently leading in market value but Reagents and Consumables exhibiting faster growth. The Application segmentation categorizes the market into Clinical Diagnostics, Drug Discovery, Genomics and Proteomics, and Other Applications, with Clinical Diagnostics being the largest segment. The End User segmentation divides the market into Biotechnology and Pharmaceutical Companies, Hospitals and Diagnostics Centers, and Academic and Research Institutes, each representing significant market shares and growth trajectories. Geographically, the report focuses on the United States, Canada, and Mexico, with the United States being the predominant market. Market sizes for each segment are projected to grow significantly, with Compound Annual Growth Rates (CAGRs) varying based on adoption rates and technological advancements.

Key Drivers of North America Lab-on-a-Chip Industry Growth

The growth of the North America Lab-on-a-Chip industry is propelled by several interconnected factors. Technological advancements in microfluidics, miniaturization, and sensor technology are enabling the development of more sophisticated and efficient LOC devices. The increasing demand for point-of-care diagnostics and personalized medicine is a significant market pull, driven by the need for rapid, accessible, and accurate disease detection and monitoring. Growing healthcare expenditure and the rising prevalence of chronic diseases globally necessitate more efficient diagnostic tools, further fueling LOC adoption. Furthermore, supportive government initiatives and increasing R&D investments in the life sciences sector are fostering innovation and market expansion. The drive for cost reduction in healthcare services also encourages the adoption of LOC technologies, which can offer more economical testing solutions compared to traditional laboratory methods.

Challenges in the North America Lab-on-a-Chip Industry Sector

Despite its promising growth, the North America Lab-on-a-Chip industry faces several challenges. Stringent regulatory hurdles and lengthy approval processes for novel medical devices can impede market entry and commercialization, representing a significant barrier. High upfront costs associated with the development and manufacturing of complex LOC devices can also deter smaller companies and research institutions. Integration challenges with existing laboratory workflows and infrastructure can limit widespread adoption. Furthermore, technical limitations, such as potential for micro-clogging, sample matrix effects, and the need for sophisticated user training, can impact performance and reliability. Intense competition from established diagnostic methods and the emergence of alternative technologies also pose a threat. Supply chain disruptions and the need for specialized manufacturing capabilities can also present obstacles.

Leading Players in the North America Lab-on-a-Chip Industry Market

- Biomerieux SA

- Abbott Laboratories

- F Hoffmann-LA Roche Ltd

- Agilent Technologies Inc

- Fluidigm Corporation

- Bio-Rad Laboratories

- PerkinElmer Inc

- Sysmex Corporation

- Illumina Inc

- Thermo Fisher Scientific

- Danaher Corporation (Beckman Coulter Inc )

Key Developments in North America Lab-on-a-Chip Industry Sector

- May 2022: Invitae, a California-based medical genetics company, launched a new testing package for neuro-developmental disorders (NDDs) in children. This package includes chromosomal microarray analysis, analysis for fragile X-related disorders, and a next-generation-sequencing panel of over 200 genes associated with NDDs, indicating advancements in genetic testing using sophisticated analytical platforms.

- January 2022: Illumina, Inc. entered into an international joint research project with the National Cancer Center Japan to analyze the blood-based genomic profile and clinical information of nasopharyngeal carcinoma patients using high-throughput DNA sequencing. This highlights the growing application of advanced sequencing technologies, often integrated with microfluidic principles, in cancer research and diagnostics.

Strategic North America Lab-on-a-Chip Industry Market Outlook

The strategic outlook for the North America Lab-on-a-Chip industry is exceptionally bright, driven by an accelerated adoption trajectory across multiple sectors. Growth accelerators include the burgeoning demand for portable and decentralized diagnostic solutions, particularly in the wake of global health challenges, and the continuous innovation in genomic and proteomic analysis tools. The increasing focus on precision medicine and the need for rapid disease detection and management will further propel market expansion. Strategic opportunities lie in developing integrated platforms that offer end-to-end solutions from sample to result, enhancing user experience and data analysis. Partnerships between technology providers, healthcare institutions, and pharmaceutical companies will be crucial for driving innovation and market penetration. The potential for AI-driven diagnostics on LOC devices represents a significant future growth avenue, promising enhanced accuracy and predictive capabilities, thus shaping the future of healthcare delivery in North America.

North America Lab-on-a-Chip Industry Segmentation

-

1. Type

- 1.1. Lab-on-a-chip

- 1.2. Microarray

-

2. Product

- 2.1. Instruments

- 2.2. Reagents and Consumables

- 2.3. Software and Services

-

3. Application

- 3.1. Clinical Diagnostics

- 3.2. Drug Discovery

- 3.3. Genomics and Proteomics

- 3.4. Other Applications

-

4. End User

- 4.1. Biotechnology and Pharmaceutical Companies

- 4.2. Hospitals and Diagnostics Centers

- 4.3. Academic and Research Institutes

-

5. Geography

- 5.1. United States

- 5.2. Canada

- 5.3. Mexico

North America Lab-on-a-Chip Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Lab-on-a-Chip Industry Regional Market Share

Geographic Coverage of North America Lab-on-a-Chip Industry

North America Lab-on-a-Chip Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Application of Proteomics And Genomics in Cancer Research; Technological Advances in the Materials in Microfluidics; Growth of Personalized Medicine

- 3.3. Market Restrains

- 3.3.1. Lack of Standardization; Availability of Alternative Technologies

- 3.4. Market Trends

- 3.4.1. Microarray are Anticipated to Hold Significant Share in the Studied Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Lab-on-a-Chip Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lab-on-a-chip

- 5.1.2. Microarray

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instruments

- 5.2.2. Reagents and Consumables

- 5.2.3. Software and Services

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Clinical Diagnostics

- 5.3.2. Drug Discovery

- 5.3.3. Genomics and Proteomics

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Biotechnology and Pharmaceutical Companies

- 5.4.2. Hospitals and Diagnostics Centers

- 5.4.3. Academic and Research Institutes

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Lab-on-a-Chip Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lab-on-a-chip

- 6.1.2. Microarray

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Instruments

- 6.2.2. Reagents and Consumables

- 6.2.3. Software and Services

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Clinical Diagnostics

- 6.3.2. Drug Discovery

- 6.3.3. Genomics and Proteomics

- 6.3.4. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Biotechnology and Pharmaceutical Companies

- 6.4.2. Hospitals and Diagnostics Centers

- 6.4.3. Academic and Research Institutes

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. United States

- 6.5.2. Canada

- 6.5.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Lab-on-a-Chip Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lab-on-a-chip

- 7.1.2. Microarray

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Instruments

- 7.2.2. Reagents and Consumables

- 7.2.3. Software and Services

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Clinical Diagnostics

- 7.3.2. Drug Discovery

- 7.3.3. Genomics and Proteomics

- 7.3.4. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Biotechnology and Pharmaceutical Companies

- 7.4.2. Hospitals and Diagnostics Centers

- 7.4.3. Academic and Research Institutes

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. United States

- 7.5.2. Canada

- 7.5.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Lab-on-a-Chip Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lab-on-a-chip

- 8.1.2. Microarray

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Instruments

- 8.2.2. Reagents and Consumables

- 8.2.3. Software and Services

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Clinical Diagnostics

- 8.3.2. Drug Discovery

- 8.3.3. Genomics and Proteomics

- 8.3.4. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Biotechnology and Pharmaceutical Companies

- 8.4.2. Hospitals and Diagnostics Centers

- 8.4.3. Academic and Research Institutes

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. United States

- 8.5.2. Canada

- 8.5.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Biomerieux SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Abbott Laboratories

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 F Hoffmann-LA Roche Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Agilent Technologies Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Fluidigm Corporation*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Bio-Rad Laboratories

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 PerkinElmer Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Sysmex Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Illumina Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Thermo Fisher Scientific

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Danaher Corporation (Beckman Coulter Inc )

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Biomerieux SA

List of Figures

- Figure 1: North America Lab-on-a-Chip Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Lab-on-a-Chip Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 3: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 4: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 5: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 7: North America Lab-on-a-Chip Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: North America Lab-on-a-Chip Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 9: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 11: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 13: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 15: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 16: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 17: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 19: North America Lab-on-a-Chip Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 20: North America Lab-on-a-Chip Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 21: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 26: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 27: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 28: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 29: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 30: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 31: North America Lab-on-a-Chip Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 32: North America Lab-on-a-Chip Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 33: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 35: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 37: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 39: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 40: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 41: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 42: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 43: North America Lab-on-a-Chip Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 44: North America Lab-on-a-Chip Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 45: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 47: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Lab-on-a-Chip Industry?

The projected CAGR is approximately 13.63%.

2. Which companies are prominent players in the North America Lab-on-a-Chip Industry?

Key companies in the market include Biomerieux SA, Abbott Laboratories, F Hoffmann-LA Roche Ltd, Agilent Technologies Inc, Fluidigm Corporation*List Not Exhaustive, Bio-Rad Laboratories, PerkinElmer Inc, Sysmex Corporation, Illumina Inc, Thermo Fisher Scientific, Danaher Corporation (Beckman Coulter Inc ).

3. What are the main segments of the North America Lab-on-a-Chip Industry?

The market segments include Type, Product, Application, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Application of Proteomics And Genomics in Cancer Research; Technological Advances in the Materials in Microfluidics; Growth of Personalized Medicine.

6. What are the notable trends driving market growth?

Microarray are Anticipated to Hold Significant Share in the Studied Market.

7. Are there any restraints impacting market growth?

Lack of Standardization; Availability of Alternative Technologies.

8. Can you provide examples of recent developments in the market?

May 2022: Invitae, a California-based medical genetics company that plans to open a new laboratory and production facility in Morrisville, commercially launched a new testing package for neuro-developmental disorders (NDDs) in children. The package includes chromosomal microarray analysis, analysis for fragile X-related disorders, and a next-generation-sequencing panel of 200-plus genes in which variants are associated with NDDs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Lab-on-a-Chip Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Lab-on-a-Chip Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Lab-on-a-Chip Industry?

To stay informed about further developments, trends, and reports in the North America Lab-on-a-Chip Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence