Key Insights

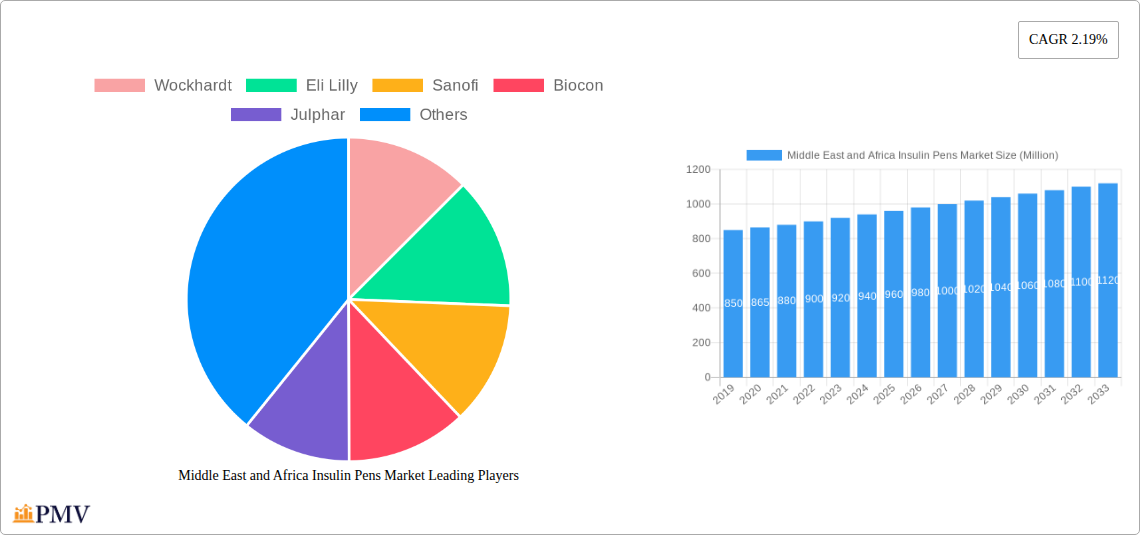

The Middle East and Africa (MEA) Insulin Pens Market is poised for steady growth, projected to reach a value of USD 1.02 billion. This expansion is underpinned by a Compound Annual Growth Rate (CAGR) of 2.19% from 2019 to 2033. The primary drivers fueling this market include the increasing prevalence of diabetes across the region, a growing awareness among patients and healthcare professionals regarding advanced insulin delivery systems, and the expanding accessibility of these devices through healthcare initiatives and improved distribution networks. Furthermore, the rising disposable incomes in several MEA nations contribute to greater affordability of these potentially life-saving technologies, making them more accessible to a wider patient base. The market is segmented into Disposable Insulin Pens and Cartridges in Reusable Pens, with both segments expected to contribute to overall market value.

Middle East and Africa Insulin Pens Market Market Size (In Million)

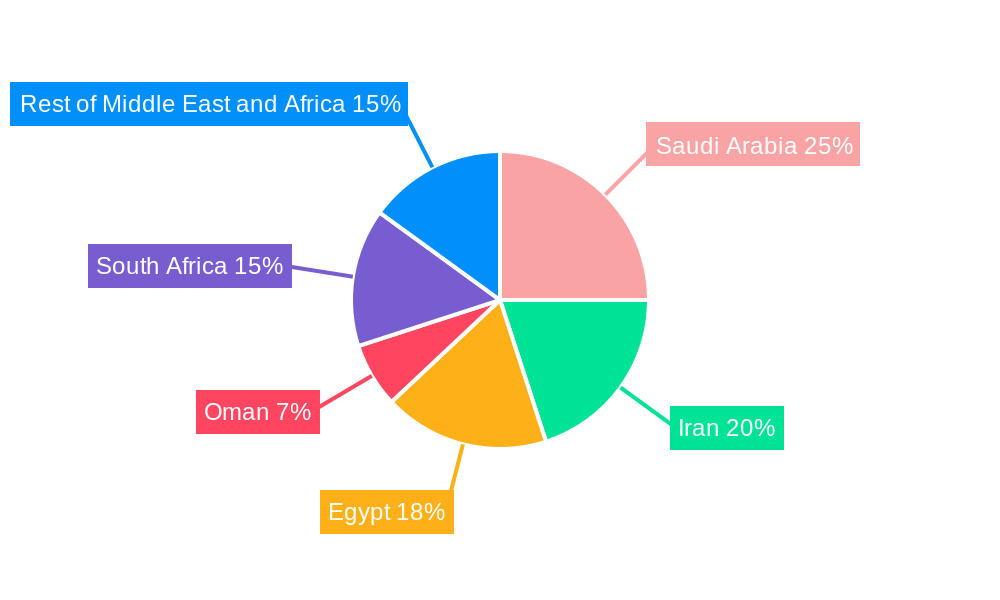

The MEA region's insulin pen market is characterized by a strong presence of leading global pharmaceutical companies alongside emerging local players, indicating a competitive yet expanding landscape. Key regions within MEA, including Saudi Arabia, Iran, Egypt, Oman, and South Africa, are witnessing significant adoption of insulin pen technology due to their respective burdens of diabetes and focused public health programs. While the market enjoys robust growth drivers, it also faces certain restraints. These include the initial cost of insulin pens and cartridges, which can be a barrier in lower-income segments of the population, and the availability of traditional insulin delivery methods like vials and syringes. However, ongoing efforts to enhance diabetes management and the continuous innovation in insulin delivery devices are expected to overcome these challenges, solidifying the growth trajectory of the MEA insulin pens market in the coming years.

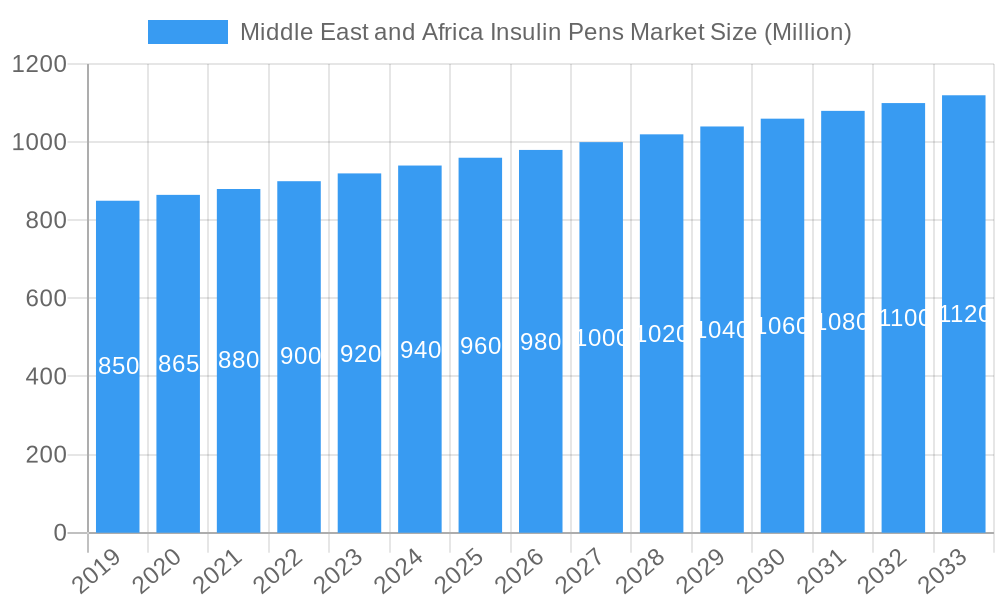

Middle East and Africa Insulin Pens Market Company Market Share

This detailed report provides an in-depth analysis of the Middle East and Africa (MEA) Insulin Pens Market, offering critical insights into market dynamics, growth drivers, segmentation, and competitive landscape. Leveraging high-ranking keywords such as "insulin pens MEA," "diabetes management Africa," "pharmaceutical market Saudi Arabia," and "insulin delivery devices Egypt," this report is meticulously crafted for industry professionals, investors, and stakeholders seeking a strategic advantage. The study encompasses a comprehensive historical period (2019-2024), a base year of 2025, an estimated year of 2025, and a detailed forecast period from 2025 to 2033. The MEA insulin pens market is projected to witness a significant Compound Annual Growth Rate (CAGR) during the forecast period, driven by rising diabetes prevalence and increasing adoption of advanced insulin delivery systems.

Middle East and Africa Insulin Pens Market Market Structure & Competitive Dynamics

The Middle East and Africa insulin pens market exhibits a moderately concentrated structure, with key players like Novo Nordisk, Eli Lilly, and Sanofi holding significant market share. Innovation ecosystems are actively developing, fueled by government initiatives promoting local manufacturing and R&D. Regulatory frameworks across the region vary, with some countries establishing robust approval processes while others are still evolving. Product substitutes include traditional insulin vials and syringes, but the convenience and improved glycemic control offered by insulin pens are increasingly driving their adoption. End-user trends indicate a growing preference for user-friendly and discreet insulin delivery solutions. Mergers and acquisitions (M&A) activities, while not as prevalent as in developed markets, are expected to play a role in market consolidation and expansion. For instance, the collaboration between Eli Lilly and EVA Pharma in December 2022, focused on expanding access to insulin in low- to middle-income African countries, highlights strategic partnerships aimed at market penetration. The overall market share analysis reveals a dynamic landscape where innovation, affordability, and accessibility are paramount.

Middle East and Africa Insulin Pens Market Industry Trends & Insights

The MEA insulin pens market is poised for substantial growth, driven by a confluence of factors. A primary growth driver is the escalating prevalence of diabetes across the Middle East and Africa. This alarming trend, fueled by changing lifestyles, dietary habits, and a rise in obesity rates, directly translates into a larger patient pool requiring effective diabetes management solutions, with insulin pens emerging as a preferred choice. Technological disruptions are also playing a pivotal role. The development of smarter insulin pens, offering features like dose tracking and connectivity, is enhancing patient compliance and therapeutic outcomes. Furthermore, the increasing disposable incomes in several MEA nations are enabling a greater segment of the population to access advanced medical devices like insulin pens, moving away from more basic alternatives. Consumer preferences are increasingly shifting towards convenience and ease of use, attributes where insulin pens excel over traditional methods. This is particularly relevant in diverse geographies with varying levels of healthcare infrastructure and patient literacy. Competitive dynamics are characterized by a strategic focus on market penetration in emerging economies and the introduction of cost-effective solutions to cater to a broader patient base. The market penetration of insulin pens is still relatively low in many African nations, presenting a significant opportunity for market expansion. The CAGR for the MEA insulin pens market is projected to be robust, reflecting the underlying demand and the industry's response to it. The industry is also observing a growing emphasis on patient education and support programs to foster wider adoption and ensure optimal utilization of insulin pens.

Dominant Markets & Segments in Middle East and Africa Insulin Pens Market

Within the Middle East and Africa insulin pens market, certain regions and product segments exhibit dominant growth and adoption patterns. Saudi Arabia stands out as a leading geography due to its well-developed healthcare infrastructure, high prevalence of diabetes, and a population with higher disposable income, enabling greater access to premium medical devices like insulin pens. Government initiatives focused on improving chronic disease management further bolster its dominance. The economic policies supporting healthcare sector development and the readily available pharmaceutical supply chain contribute significantly to this leadership.

In terms of product segmentation, Disposable Insulin Pens currently hold a dominant position. Their pre-filled nature and single-use convenience appeal strongly to patients seeking simplicity and eliminating the need for cartridge changes. This segment is driven by ease of use, portability, and reduced risk of contamination, making it an attractive option for a wide patient demographic.

The Rest of Middle East and Africa segment, while fragmented, represents a crucial area for future growth. Countries like Egypt and South Africa, with their large populations and rising diabetes rates, are key markets within this broader segment. Economic policies aimed at increasing healthcare access and affordability are critical drivers here. While infrastructure challenges persist in some African nations, the increasing focus on diabetes management and the potential for partnerships, as exemplified by the Eli Lilly and EVA Pharma collaboration, are paving the way for significant expansion.

- Key Drivers for Saudi Arabia's Dominance:

- High diabetes prevalence and aging population.

- Advanced healthcare infrastructure and access to technology.

- Government investment in chronic disease management programs.

- High per capita healthcare expenditure.

- Key Drivers for Disposable Insulin Pens Dominance:

- User-friendliness and convenience for patients.

- Elimination of cartridge handling and potential for errors.

- Portability and discreetness for on-the-go use.

- Lower initial cost compared to reusable pen devices.

- Key Drivers for Rest of Middle East and Africa Growth:

- Increasing diabetes burden in populous nations like Egypt and South Africa.

- Government focus on improving access to essential medicines and devices.

- Potential for partnerships to enhance affordability and local manufacturing.

- Growing awareness about diabetes management technologies.

Middle East and Africa Insulin Pens Market Product Innovations

Product innovations in the MEA insulin pens market are largely centered on enhancing user experience and therapeutic efficacy. Manufacturers are focusing on developing pens with more precise dosing mechanisms, improved ergonomic designs for easier handling, and integration with digital health platforms for better diabetes management. The introduction of longer-acting insulin formulations compatible with pen devices further expands treatment options. Competitive advantages stem from offering a combination of affordability, reliability, and user-centric features, catering to the diverse needs and economic realities of the MEA region.

Report Segmentation & Scope

The Middle East and Africa Insulin Pens Market is segmented by Product into Disposable Insulin Pens and Cartridges in Reusable Pens. The Disposable Insulin Pens segment is projected to lead market share due to its inherent convenience and ease of use, with an estimated market size of over USD 1,500 Million by 2025. The Cartridges in Reusable Pens segment, while smaller, is expected to witness steady growth as reusable pen devices become more accessible and patients seek personalized insulin therapy. Geographically, the market is segmented into Saudi Arabia, Iran, Egypt, Oman, South Africa, and the Rest of Middle East and Africa. Saudi Arabia is expected to hold a significant market share, driven by high diabetes prevalence and advanced healthcare systems. Egypt and South Africa are anticipated to be key growth markets within the "Rest of Middle East and Africa" category, owing to their large populations and increasing focus on diabetes management.

Key Drivers of Middle East and Africa Insulin Pens Market Growth

The growth of the Middle East and Africa insulin pens market is propelled by several critical factors. The escalating prevalence of diabetes across the region, driven by lifestyle changes and genetic predispositions, creates a substantial and growing patient base requiring insulin therapy. The increasing adoption of advanced insulin delivery systems, such as insulin pens, over traditional methods is a significant trend, offering enhanced convenience, accuracy, and patient adherence. Government initiatives and favorable healthcare policies aimed at improving diabetes management and increasing access to essential medical devices further support market expansion. Furthermore, the growing awareness among patients and healthcare providers about the benefits of insulin pens, including improved glycemic control and better quality of life, is a key accelerator.

Challenges in the Middle East and Africa Insulin Pens Market Sector

Despite the promising growth outlook, the MEA insulin pens market faces several challenges. Affordability remains a significant barrier, particularly in low-income countries within Africa, where the cost of insulin pens can be prohibitive for a large segment of the population. Limited healthcare infrastructure and distribution networks in some remote regions can hinder the accessibility of insulin pens and related supplies. Regulatory hurdles and varying approval processes across different MEA countries can also slow down market entry and product adoption. Counterfeit products pose a risk to patient safety and erode market trust. Finally, lack of widespread patient education and awareness regarding the proper use and benefits of insulin pens can limit uptake.

Leading Players in the Middle East and Africa Insulin Pens Market Market

- Wockhardt

- Eli Lilly

- Sanofi

- Biocon

- Julphar

- Novo Nordisk

- Other Company Share Analyse

Key Developments in Middle East and Africa Insulin Pens Market Sector

- December 2022: Eli Lilly and Company and EVA Pharma announced a collaboration to deliver a sustainable supply of high-quality, affordable human and analog insulin to at least one million people living with type-1 and type-2 diabetes in low- to middle-income countries, most of which are in Africa. Lilly was likely to supply its active pharmaceutical ingredient for insulin at a significantly reduced price to EVA Pharma. Lilly was also expected to provide a technology transfer to enable EVA Pharma to formulate, fill, and finish insulin vials and cartridges, establishing the company as a trusted manufacturer of these lifesaving products in Africa. This development is expected to significantly boost insulin pen accessibility and affordability in African markets.

- October 2022: The Ministry of Industry and Advanced Technology announced the signing of a pair of memoranda of understanding worth AED 260 million (USD 70.8 million) between major pharmaceutical and medical device companies in the UAE. The partnerships were in line with the National Strategy for Industry and Advanced Technology and the ICV Program, which aimed to attract investors and manufacturers to the UAE's pharmaceutical and medical equipment sectors, among others. Under a separate MoU, PureHealth and Gulf Pharmaceutical Industries Company were expected to establish the first factory in the Middle East to produce glargine for the treatment of diabetes. This move signifies a regional push towards self-sufficiency in pharmaceutical manufacturing, potentially impacting the production and supply of insulin pens and cartridges.

Strategic Middle East and Africa Insulin Pens Market Market Outlook

The strategic outlook for the Middle East and Africa insulin pens market is overwhelmingly positive, with significant growth accelerators in place. The expanding diabetes epidemic, coupled with increasing healthcare expenditure and government focus on chronic disease management, will continue to drive demand. Strategic opportunities lie in developing and distributing more affordable insulin pen solutions, particularly for low- and middle-income countries in Africa, building upon initiatives like the Eli Lilly and EVA Pharma collaboration. Partnerships between global manufacturers and local players will be crucial for market penetration and establishing robust supply chains. Furthermore, the integration of digital health technologies and smart insulin pens presents a significant avenue for enhancing patient outcomes and creating differentiated product offerings. The market is poised for substantial expansion as accessibility improves and the benefits of modern insulin delivery become more widely recognized.

Middle East and Africa Insulin Pens Market Segmentation

-

1. Product

- 1.1. Disposable Insulin Pens

- 1.2. Cartridges in Reusable Pens

-

2. Geography

- 2.1. Saudi Arabia

- 2.2. Iran

- 2.3. Egypt

- 2.4. Oman

- 2.5. South Africa

- 2.6. Rest of Middle East and Africa

Middle East and Africa Insulin Pens Market Segmentation By Geography

- 1. Saudi Arabia

- 2. Iran

- 3. Egypt

- 4. Oman

- 5. South Africa

- 6. Rest of Middle East and Africa

Middle East and Africa Insulin Pens Market Regional Market Share

Geographic Coverage of Middle East and Africa Insulin Pens Market

Middle East and Africa Insulin Pens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Increasing diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Disposable Insulin Pens

- 5.1.2. Cartridges in Reusable Pens

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Saudi Arabia

- 5.2.2. Iran

- 5.2.3. Egypt

- 5.2.4. Oman

- 5.2.5. South Africa

- 5.2.6. Rest of Middle East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.3.2. Iran

- 5.3.3. Egypt

- 5.3.4. Oman

- 5.3.5. South Africa

- 5.3.6. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Saudi Arabia Middle East and Africa Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Disposable Insulin Pens

- 6.1.2. Cartridges in Reusable Pens

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Saudi Arabia

- 6.2.2. Iran

- 6.2.3. Egypt

- 6.2.4. Oman

- 6.2.5. South Africa

- 6.2.6. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Iran Middle East and Africa Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Disposable Insulin Pens

- 7.1.2. Cartridges in Reusable Pens

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Saudi Arabia

- 7.2.2. Iran

- 7.2.3. Egypt

- 7.2.4. Oman

- 7.2.5. South Africa

- 7.2.6. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Egypt Middle East and Africa Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Disposable Insulin Pens

- 8.1.2. Cartridges in Reusable Pens

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Saudi Arabia

- 8.2.2. Iran

- 8.2.3. Egypt

- 8.2.4. Oman

- 8.2.5. South Africa

- 8.2.6. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Oman Middle East and Africa Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Disposable Insulin Pens

- 9.1.2. Cartridges in Reusable Pens

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Saudi Arabia

- 9.2.2. Iran

- 9.2.3. Egypt

- 9.2.4. Oman

- 9.2.5. South Africa

- 9.2.6. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South Africa Middle East and Africa Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Disposable Insulin Pens

- 10.1.2. Cartridges in Reusable Pens

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Saudi Arabia

- 10.2.2. Iran

- 10.2.3. Egypt

- 10.2.4. Oman

- 10.2.5. South Africa

- 10.2.6. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Middle East and Africa Middle East and Africa Insulin Pens Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Disposable Insulin Pens

- 11.1.2. Cartridges in Reusable Pens

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Saudi Arabia

- 11.2.2. Iran

- 11.2.3. Egypt

- 11.2.4. Oman

- 11.2.5. South Africa

- 11.2.6. Rest of Middle East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Wockhardt

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Eli Lilly

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Sanofi

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Biocon

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Julphar

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Novo Nordisk

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Other Company Share Analyse

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 Wockhardt

List of Figures

- Figure 1: Middle East and Africa Insulin Pens Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Insulin Pens Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Product 2020 & 2033

- Table 14: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 15: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 21: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Product 2020 & 2033

- Table 26: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 27: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Product 2020 & 2033

- Table 32: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 33: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 34: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 35: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Product 2020 & 2033

- Table 38: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 39: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 40: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 41: Middle East and Africa Insulin Pens Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Middle East and Africa Insulin Pens Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Insulin Pens Market?

The projected CAGR is approximately 2.19%.

2. Which companies are prominent players in the Middle East and Africa Insulin Pens Market?

Key companies in the market include Wockhardt, Eli Lilly, Sanofi, Biocon, Julphar, Novo Nordisk, Other Company Share Analyse.

3. What are the main segments of the Middle East and Africa Insulin Pens Market?

The market segments include Product, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.02 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Increasing diabetes prevalence.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

December 2022: Eli Lilly and Company and EVA Pharma announced a collaboration to deliver a sustainable supply of high-quality, affordable human and analog insulin to at least one million people living with type-1 and type-2 diabetes in low- to middle-income countries, most of which are in Africa. Lilly was likely to supply its active pharmaceutical ingredient for insulin at a significantly reduced price to EVA Pharma. Lilly was also expected to provide a technology transfer to enable EVA Pharma to formulate, fill, and finish insulin vials and cartridges, establishing the company as a trusted manufacturer of these lifesaving products in Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Insulin Pens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Insulin Pens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Insulin Pens Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Insulin Pens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence