Key Insights

The global Aspiration & Biopsy Needles Market is projected for significant expansion, forecasted to reach a market size of $12.48 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 10.13% through 2033. This growth is driven by the increasing incidence of chronic diseases, especially cancers, necessitating early and accurate diagnosis. Advancements in imaging technologies (ultrasound, CT, MRI) are promoting minimally invasive diagnostic techniques, enhancing patient outcomes and diagnostic accuracy. The market is also supported by the rise of personalized medicine and the demand for precise tissue sampling for molecular analysis.

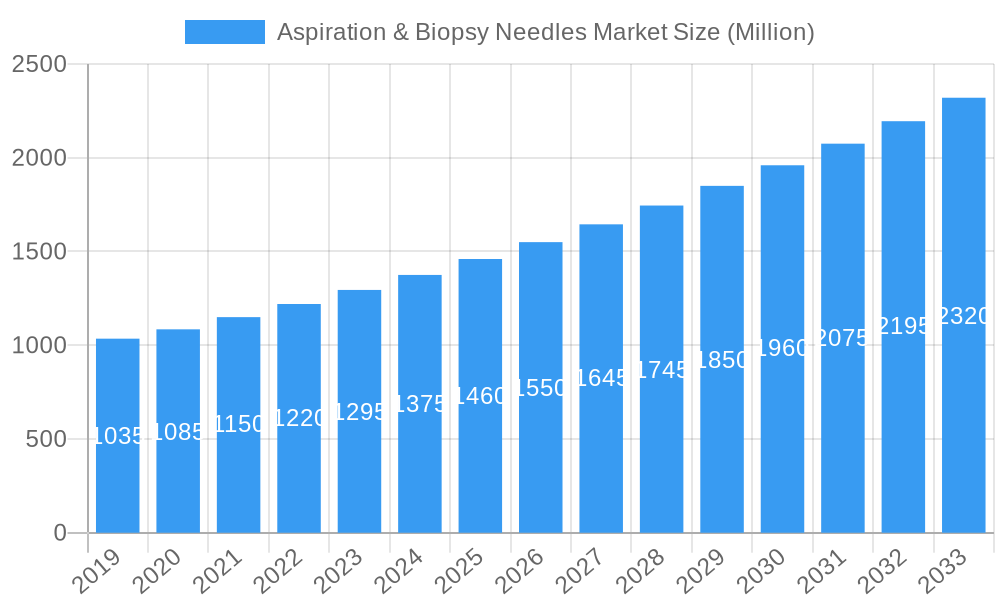

Aspiration & Biopsy Needles Market Market Size (In Billion)

The market features dynamic product innovation and strategic collaborations. Key product segments include Core Needle Biopsy (CNB), Vacuum-Assisted Biopsy (VAB), and aspiration needles. Primary end-users are hospitals, surgical centers, diagnostic clinics, and pathology laboratories. North America is expected to dominate due to its advanced healthcare infrastructure and high disease burden. The Asia Pacific region is anticipated to exhibit the fastest growth, fueled by expanding healthcare access, increased medical technology investment, and rising awareness of early disease detection. While regulatory hurdles and high costs of advanced systems present challenges, technological progress and global healthcare expenditure are mitigating these factors.

Aspiration & Biopsy Needles Market Company Market Share

Aspiration & Biopsy Needles Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock critical insights into the burgeoning Aspiration & Biopsy Needles Market with this in-depth industry report. Covering the period from 2019 to 2033, with a detailed analysis of the Base Year 2025 and Forecast Period 2025–2033, this report provides a granular view of market size, trends, key players, and future projections. Our analysis delves into the intricate dynamics influencing the biopsy needle market, aspiration needle market, cancer diagnosis needles, and minimally invasive biopsy tools. We dissect market segmentation by Product (Biopsy Needles including CNB Needles and VAB Needles, Aspiration Needles), Application (Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Wound Application, Other Application), Procedures (Image-guided Procedures, Ultrasound-guided Procedures, Stereotactic Procedures, CT-guided Procedures, MRI-guided Procedures, Other Procedures), and End User (Hospitals and Surgical Centers, Diagnostic Clinics and Pathology Laboratories, Other End Users). This report is an essential resource for stakeholders seeking to understand growth drivers, competitive landscapes, and emerging opportunities in this vital segment of the medical device industry.

Aspiration & Biopsy Needles Market Market Structure & Competitive Dynamics

The Aspiration & Biopsy Needles Market exhibits a moderately concentrated structure, characterized by the presence of established global medical device manufacturers and a growing number of specialized players. Innovation ecosystems are robust, driven by continuous research and development focused on enhancing patient outcomes, reducing invasiveness, and improving diagnostic accuracy for conditions like breast cancer biopsy, lung cancer biopsy, and prostate cancer biopsy. Regulatory frameworks, primarily governed by bodies like the FDA and EMA, play a crucial role in market access and product development, ensuring safety and efficacy of biopsy devices and aspiration syringes.

Product substitutes, while limited in the core functionality of tissue acquisition, exist in the form of less invasive imaging techniques and alternative diagnostic pathways. However, the definitive diagnostic power of biopsy needles remains paramount. End-user trends are shifting towards greater demand for minimally invasive procedures, driven by patient preference for faster recovery times and reduced discomfort. This fuels the adoption of advanced image-guided biopsy techniques.

Mergers and acquisitions (M&A) activities are a notable aspect of the market, with larger companies acquiring innovative startups or complementary product portfolios to expand their market share and technological capabilities. Recent M&A deal values are estimated to be in the range of tens to hundreds of millions, reflecting strategic consolidation. Key players actively vie for market share through product differentiation, strategic partnerships, and global expansion.

- Market Concentration: Moderately concentrated with key global players holding significant shares.

- Innovation Ecosystems: Driven by R&D in minimally invasive techniques and diagnostic accuracy.

- Regulatory Frameworks: Stringent regulations ensure safety and efficacy, impacting market entry.

- Product Substitutes: Limited but evolving with advancements in imaging technologies.

- End-User Trends: Growing preference for minimally invasive needle biopsy procedures.

- M&A Activities: Active consolidation to gain market share and technological advantages.

Aspiration & Biopsy Needles Market Industry Trends & Insights

The Aspiration & Biopsy Needles Market is poised for significant expansion, driven by a confluence of factors including increasing global cancer incidence, advancements in diagnostic imaging, and a growing preference for minimally invasive surgical procedures. The projected Compound Annual Growth Rate (CAGR) for the forecast period is anticipated to be in the range of 7.5% to 8.5%, reflecting a healthy and sustained growth trajectory. Market penetration of advanced biopsy needle systems and fine needle aspiration (FNA) needles is steadily increasing across both developed and emerging economies.

A primary growth driver is the escalating burden of cancer worldwide. Organizations like the WHO report rising cancer rates, necessitating accurate and timely diagnosis. This directly translates to a higher demand for biopsy and aspiration needles for tissue sampling and pathological analysis, particularly for prevalent cancers such as breast cancer diagnosis, lung cancer diagnosis, and prostate cancer diagnosis. The increasing prevalence of these conditions ensures a consistent and growing patient pool requiring diagnostic procedures involving these essential medical instruments.

Technological disruptions are continuously reshaping the market. The integration of artificial intelligence (AI) with imaging modalities like CT and MRI is improving the precision and guidance for biopsy procedures, leading to the development of more sophisticated image-guided biopsy needles. Innovations in needle design, such as enhanced sharpness, improved sample collection mechanisms, and reduced tissue distortion, are also key trends. For example, the development of vacuum-assisted biopsy devices and automated biopsy systems enhances sample yield and procedural efficiency, thereby driving adoption by healthcare professionals.

Consumer preferences are increasingly leaning towards minimally invasive techniques due to shorter recovery times, reduced pain, and lower risk of complications. This trend strongly favors the adoption of percutaneous biopsy needles and ultrasound-guided biopsy needles over more invasive surgical biopsies. Patients are actively seeking out procedures that minimize their hospital stay and allow for a quicker return to daily activities. This patient-centric approach is a significant impetus for manufacturers to focus on developing user-friendly and less traumatic needle biopsy instruments.

Competitive dynamics in the biopsy needle market are characterized by a strong emphasis on product innovation, strategic partnerships, and expanding distribution networks. Companies are investing heavily in R&D to develop novel biopsy catheters and aspiration tools that offer superior performance, safety, and ease of use. The market also sees a growing trend of collaborations between medical device manufacturers and healthcare institutions to drive clinical adoption and gather real-world evidence for new technologies. Furthermore, the expanding healthcare infrastructure in developing nations is opening new avenues for market growth, as access to advanced diagnostic tools like biopsy needles for lung cancer and biopsy needles for breast cancer becomes more widespread. The overall industry is witnessing a strategic focus on providing comprehensive solutions for cancer diagnosis and intervention, including specialized needles for specific anatomical sites and cancer types, further solidifying the market's growth potential.

Dominant Markets & Segments in Aspiration & Biopsy Needles Market

The Aspiration & Biopsy Needles Market displays distinct dominance across various geographical regions and market segments, driven by specific healthcare trends and disease prevalence. North America currently leads the market in terms of revenue, owing to its well-established healthcare infrastructure, high adoption rate of advanced medical technologies, and a significant prevalence of cancer cases requiring diagnostic procedures. The United States, in particular, represents a substantial portion of this market share. This dominance is further bolstered by robust reimbursement policies and a strong presence of leading medical device manufacturers.

Within the Product segmentation, Biopsy Needles collectively hold the larger market share. This segment is further divided into CNB Needles (Core Needle Biopsy Needles) and VAB Needles (Vacuum-Assisted Biopsy Needles). CNB needles are widely used due to their ability to retrieve larger tissue samples for more accurate histological analysis, making them a cornerstone in the diagnosis of various cancers. VAB needles are gaining significant traction, especially in breast imaging, due to their capacity to obtain larger tissue cores with minimal invasiveness and reduced needle manipulation, enhancing both diagnostic yield and patient comfort. Aspiration Needles, while smaller in market share, remain crucial for cytological analysis, particularly in diagnosing conditions like thyroid nodules and lymph node metastases.

The Application segment is prominently dominated by Breast Cancer. The high incidence of breast cancer globally and the routine screening programs in place contribute to a substantial demand for biopsy needles for diagnostic purposes. Following closely is Lung Cancer, driven by increasing rates of lung cancer, especially adenocarcinoma, and the widespread use of CT scans for early detection, which often necessitates CT-guided lung biopsy. Prostate Cancer also represents a significant application, with prostate biopsy needles being a standard tool in diagnosis, further propelled by advancements in MRI-guided biopsies. Colorectal Cancer and Wound Application also contribute to the market, albeit with a smaller share compared to the leading cancer applications.

In terms of Procedures, Image-guided Procedures command the largest market share. This encompasses a broad range of techniques where imaging technology is used to guide the needle to the target lesion. Ultrasound-guided Procedures are highly prevalent due to the accessibility, portability, and cost-effectiveness of ultrasound machines, making them a go-to method for palpable lesions and certain internal organs. CT-guided Procedures are critical for deep-seated lesions and lung biopsies, offering excellent visualization of anatomical structures. Stereotactic Procedures are primarily used for breast biopsies, particularly for calcifications or non-palpable lesions identified on mammography. MRI-guided Procedures are gaining prominence for specific applications, such as prostate biopsies, offering superior soft-tissue contrast.

The End User segment is dominated by Hospitals and Surgical Centers. These institutions are equipped with advanced infrastructure, a high volume of surgical and diagnostic procedures, and the financial capacity to invest in state-of-the-art biopsy equipment. They perform a vast majority of invasive diagnostic procedures. Diagnostic Clinics and Pathology Laboratories also represent a significant end-user segment, as they are central to sample processing and analysis following biopsies.

- Dominant Region: North America (USA leading).

- Dominant Product Segment: Biopsy Needles (CNB Needles, VAB Needles).

- Key Application: Breast Cancer, followed by Lung Cancer and Prostate Cancer.

- Leading Procedure: Image-guided Procedures (including Ultrasound-guided and CT-guided).

- Primary End User: Hospitals and Surgical Centers.

Aspiration & Biopsy Needles Market Product Innovations

The Aspiration & Biopsy Needles Market is experiencing a surge of product innovations aimed at enhancing diagnostic accuracy, procedural efficiency, and patient comfort. Manufacturers are focusing on developing advanced core biopsy needles with improved sample acquisition capabilities and reduced tissue artifact. Vacuum-assisted biopsy devices, like the recently introduced Mammotome DualCore system, are revolutionizing tissue collection by offering larger specimen volumes with fewer needle insertions. Furthermore, the integration of finer gauges and sharper tips in fine needle aspiration (FNA) needles minimizes patient discomfort and reduces the risk of complications. Innovations in prostate biopsy needles, such as those from Cambridge Enterprise with integrated anesthesia delivery, are addressing specific procedural challenges like infection risk. These developments are not only improving the quality of diagnostic samples but also making biopsy procedures more patient-friendly, driving market growth and competitive advantage.

Report Segmentation & Scope

This comprehensive report segments the Aspiration & Biopsy Needles Market to provide a detailed understanding of its dynamics. The market is analyzed by:

- Product: This segmentation includes Biopsy Needles, further categorized into CNB Needles (Core Needle Biopsy Needles) and VAB Needles (Vacuum-Assisted Biopsy Needles), alongside Aspiration Needles. The CNB needle segment is projected to experience robust growth due to its widespread use in obtaining histological samples. VAB needles are expected to see a higher CAGR, driven by technological advancements and increasing adoption in specific applications like breast biopsies. Aspiration needles are crucial for cytological analysis and are anticipated to maintain steady growth.

- Application: Key applications analyzed include Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Wound Application, and Other Applications. The Breast Cancer segment dominates due to high incidence and routine screening. Lung and Prostate Cancer applications are expected to show significant growth, driven by early detection initiatives and advancements in imaging-guided biopsies.

- Procedures: This segmentation covers Image-guided Procedures, Ultrasound-guided Procedures, Stereotactic Procedures, CT-guided Procedures, MRI-guided Procedures, and Other Procedures. Image-guided procedures, encompassing various modalities, hold the largest share. Ultrasound-guided and CT-guided procedures are expected to witness substantial growth due to their versatility and accessibility.

- End User: The report analyzes Hospitals and Surgical Centers, Diagnostic Clinics and Pathology Laboratories, and Other End Users. Hospitals and Surgical Centers are the largest end-users, followed by diagnostic facilities.

The scope of the report extends to providing market size estimations, growth projections, and competitive landscape analysis for each of these segments throughout the study period of 2019–2033, with a focus on the Base Year 2025 and the Forecast Period 2025–2033.

Key Drivers of Aspiration & Biopsy Needles Market Growth

The Aspiration & Biopsy Needles Market is propelled by several interconnected drivers. A primary factor is the escalating global burden of cancer, necessitating accurate and timely diagnostic tools. Advancements in medical imaging technologies, such as high-resolution CT, MRI, and ultrasound, enhance the precision of image-guided biopsy procedures, thereby increasing the demand for specialized needles. The growing preference for minimally invasive diagnostic techniques among patients and clinicians, due to reduced recovery times and lower complication rates, also significantly fuels market expansion. Furthermore, favorable reimbursement policies in various regions for diagnostic procedures and continuous product innovation by key manufacturers are crucial growth accelerators. The increasing focus on early cancer detection through screening programs further amplifies the need for effective biopsy and aspiration needles.

Challenges in the Aspiration & Biopsy Needles Market Sector

Despite the promising growth trajectory, the Aspiration & Biopsy Needles Market faces several challenges. Stringent regulatory approval processes for new medical devices can lead to extended product launch timelines and significant development costs, impacting market entry for smaller players. Issues related to supply chain disruptions, as evidenced by recent global events, can affect the availability and cost of raw materials and finished products. The high cost associated with advanced biopsy systems and imaging equipment can be a barrier to adoption, particularly in resource-limited healthcare settings. Moreover, the development of alternative, less invasive diagnostic technologies, although not yet a direct substitute for definitive tissue diagnosis, presents a long-term competitive pressure. Intense competition among established players and emerging entrants also drives down profit margins in certain product categories.

Leading Players in the Aspiration & Biopsy Needles Market Market

- Inrad Inc

- Merit Medical Systems

- Becton Dickinson and Company (BD)

- Argon Medical Devices Inc

- Cook Group Incorporated

- Cardinal Health Inc

- Hakko Co Ltd

- Conmed Corporation

- Dr Japan Co Ltd

- Boston Scientific Corporation

- Olympus Corporation

- Medtronic plc

Key Developments in Aspiration & Biopsy Needles Market Sector

- November 2022: Cambridge Enterprise introduced the Cambridge Prostate Biopsy Device (CamPROBE), aiming to reduce the infection risk associated with conventional transrectal biopsies. This innovative device features an integrated needle for localized anesthesia delivery.

- August 2022: Mammotome unveiled its groundbreaking Mammotome DualCore biopsy system, marking the company's debut in the dual-stage core biopsy instrument market. With its lightweight, ergonomic, and intelligent design, the device not only minimizes needle movements and vibrations but also enhances the overall patient experience.

Strategic Aspiration & Biopsy Needles Market Market Outlook

The strategic outlook for the Aspiration & Biopsy Needles Market is exceptionally positive, driven by ongoing technological advancements and a growing global emphasis on proactive healthcare. The increasing adoption of minimally invasive techniques, coupled with the rising incidence of cancer globally, will continue to be the primary growth accelerators. Future market potential lies in the development of even more intelligent biopsy systems that integrate advanced imaging, AI-driven guidance, and real-time feedback mechanisms. Strategic opportunities include expanding into emerging markets with burgeoning healthcare infrastructures and addressing unmet needs in specific cancer applications or patient populations. Collaborations between device manufacturers, research institutions, and healthcare providers will be pivotal in driving innovation and ensuring wider access to these critical diagnostic tools, shaping a future characterized by improved patient outcomes and more efficient diagnostic pathways.

Aspiration & Biopsy Needles Market Segmentation

-

1. Product

-

1.1. Biopsy Needles

- 1.1.1. CNB Needles

- 1.1.2. VAB Needles

- 1.2. Aspiration Needles

-

1.1. Biopsy Needles

-

2. Application

- 2.1. Breast Cancer

- 2.2. Lung Cancer

- 2.3. Colorectal Cancer

- 2.4. Prostate Cancer

- 2.5. Wound Application

- 2.6. Other Application

-

3. Procedures

- 3.1. Image-guided Procedures

- 3.2. Ultrasound-guided Procedures

- 3.3. Stereotactic Procedures

- 3.4. CT-guided Procedures

- 3.5. MRI-guided Procedures

- 3.6. Other Procedures

-

4. End User

- 4.1. Hospitals and Surgical Centers

- 4.2. Diagnostic Clinics and Pathology Laboratories

- 4.3. Other End Users

Aspiration & Biopsy Needles Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Aspiration & Biopsy Needles Market Regional Market Share

Geographic Coverage of Aspiration & Biopsy Needles Market

Aspiration & Biopsy Needles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer; Cancer Awareness Initiatives Undertaken by Governments and Global Health Organizations; Increasing Preference for Minimally Invasive Biopsies

- 3.3. Market Restrains

- 3.3.1. Risk of Infections Associated with the Use of Aspiration and Biopsy Needles

- 3.4. Market Trends

- 3.4.1. Breast Cancer Segment is Expected to Experience Significant Growth Over the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aspiration & Biopsy Needles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Biopsy Needles

- 5.1.1.1. CNB Needles

- 5.1.1.2. VAB Needles

- 5.1.2. Aspiration Needles

- 5.1.1. Biopsy Needles

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Breast Cancer

- 5.2.2. Lung Cancer

- 5.2.3. Colorectal Cancer

- 5.2.4. Prostate Cancer

- 5.2.5. Wound Application

- 5.2.6. Other Application

- 5.3. Market Analysis, Insights and Forecast - by Procedures

- 5.3.1. Image-guided Procedures

- 5.3.2. Ultrasound-guided Procedures

- 5.3.3. Stereotactic Procedures

- 5.3.4. CT-guided Procedures

- 5.3.5. MRI-guided Procedures

- 5.3.6. Other Procedures

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Hospitals and Surgical Centers

- 5.4.2. Diagnostic Clinics and Pathology Laboratories

- 5.4.3. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Aspiration & Biopsy Needles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Biopsy Needles

- 6.1.1.1. CNB Needles

- 6.1.1.2. VAB Needles

- 6.1.2. Aspiration Needles

- 6.1.1. Biopsy Needles

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Breast Cancer

- 6.2.2. Lung Cancer

- 6.2.3. Colorectal Cancer

- 6.2.4. Prostate Cancer

- 6.2.5. Wound Application

- 6.2.6. Other Application

- 6.3. Market Analysis, Insights and Forecast - by Procedures

- 6.3.1. Image-guided Procedures

- 6.3.2. Ultrasound-guided Procedures

- 6.3.3. Stereotactic Procedures

- 6.3.4. CT-guided Procedures

- 6.3.5. MRI-guided Procedures

- 6.3.6. Other Procedures

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Hospitals and Surgical Centers

- 6.4.2. Diagnostic Clinics and Pathology Laboratories

- 6.4.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Aspiration & Biopsy Needles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Biopsy Needles

- 7.1.1.1. CNB Needles

- 7.1.1.2. VAB Needles

- 7.1.2. Aspiration Needles

- 7.1.1. Biopsy Needles

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Breast Cancer

- 7.2.2. Lung Cancer

- 7.2.3. Colorectal Cancer

- 7.2.4. Prostate Cancer

- 7.2.5. Wound Application

- 7.2.6. Other Application

- 7.3. Market Analysis, Insights and Forecast - by Procedures

- 7.3.1. Image-guided Procedures

- 7.3.2. Ultrasound-guided Procedures

- 7.3.3. Stereotactic Procedures

- 7.3.4. CT-guided Procedures

- 7.3.5. MRI-guided Procedures

- 7.3.6. Other Procedures

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Hospitals and Surgical Centers

- 7.4.2. Diagnostic Clinics and Pathology Laboratories

- 7.4.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Aspiration & Biopsy Needles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Biopsy Needles

- 8.1.1.1. CNB Needles

- 8.1.1.2. VAB Needles

- 8.1.2. Aspiration Needles

- 8.1.1. Biopsy Needles

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Breast Cancer

- 8.2.2. Lung Cancer

- 8.2.3. Colorectal Cancer

- 8.2.4. Prostate Cancer

- 8.2.5. Wound Application

- 8.2.6. Other Application

- 8.3. Market Analysis, Insights and Forecast - by Procedures

- 8.3.1. Image-guided Procedures

- 8.3.2. Ultrasound-guided Procedures

- 8.3.3. Stereotactic Procedures

- 8.3.4. CT-guided Procedures

- 8.3.5. MRI-guided Procedures

- 8.3.6. Other Procedures

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Hospitals and Surgical Centers

- 8.4.2. Diagnostic Clinics and Pathology Laboratories

- 8.4.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Aspiration & Biopsy Needles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Biopsy Needles

- 9.1.1.1. CNB Needles

- 9.1.1.2. VAB Needles

- 9.1.2. Aspiration Needles

- 9.1.1. Biopsy Needles

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Breast Cancer

- 9.2.2. Lung Cancer

- 9.2.3. Colorectal Cancer

- 9.2.4. Prostate Cancer

- 9.2.5. Wound Application

- 9.2.6. Other Application

- 9.3. Market Analysis, Insights and Forecast - by Procedures

- 9.3.1. Image-guided Procedures

- 9.3.2. Ultrasound-guided Procedures

- 9.3.3. Stereotactic Procedures

- 9.3.4. CT-guided Procedures

- 9.3.5. MRI-guided Procedures

- 9.3.6. Other Procedures

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Hospitals and Surgical Centers

- 9.4.2. Diagnostic Clinics and Pathology Laboratories

- 9.4.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Aspiration & Biopsy Needles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Biopsy Needles

- 10.1.1.1. CNB Needles

- 10.1.1.2. VAB Needles

- 10.1.2. Aspiration Needles

- 10.1.1. Biopsy Needles

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Breast Cancer

- 10.2.2. Lung Cancer

- 10.2.3. Colorectal Cancer

- 10.2.4. Prostate Cancer

- 10.2.5. Wound Application

- 10.2.6. Other Application

- 10.3. Market Analysis, Insights and Forecast - by Procedures

- 10.3.1. Image-guided Procedures

- 10.3.2. Ultrasound-guided Procedures

- 10.3.3. Stereotactic Procedures

- 10.3.4. CT-guided Procedures

- 10.3.5. MRI-guided Procedures

- 10.3.6. Other Procedures

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Hospitals and Surgical Centers

- 10.4.2. Diagnostic Clinics and Pathology Laboratories

- 10.4.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Inrad Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merit Medical Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Becton Dickinson and Company (BD)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Argon Medical Devices Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cook Group Incorporated

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cardinal Health Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hakko Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Conmed Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dr Japan Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Boston Scientific Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Olympus Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Medtronic plc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Inrad Inc

List of Figures

- Figure 1: Global Aspiration & Biopsy Needles Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Aspiration & Biopsy Needles Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Aspiration & Biopsy Needles Market Revenue (billion), by Product 2025 & 2033

- Figure 4: North America Aspiration & Biopsy Needles Market Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Aspiration & Biopsy Needles Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Aspiration & Biopsy Needles Market Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Aspiration & Biopsy Needles Market Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Aspiration & Biopsy Needles Market Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Aspiration & Biopsy Needles Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Aspiration & Biopsy Needles Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Aspiration & Biopsy Needles Market Revenue (billion), by Procedures 2025 & 2033

- Figure 12: North America Aspiration & Biopsy Needles Market Volume (K Unit), by Procedures 2025 & 2033

- Figure 13: North America Aspiration & Biopsy Needles Market Revenue Share (%), by Procedures 2025 & 2033

- Figure 14: North America Aspiration & Biopsy Needles Market Volume Share (%), by Procedures 2025 & 2033

- Figure 15: North America Aspiration & Biopsy Needles Market Revenue (billion), by End User 2025 & 2033

- Figure 16: North America Aspiration & Biopsy Needles Market Volume (K Unit), by End User 2025 & 2033

- Figure 17: North America Aspiration & Biopsy Needles Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: North America Aspiration & Biopsy Needles Market Volume Share (%), by End User 2025 & 2033

- Figure 19: North America Aspiration & Biopsy Needles Market Revenue (billion), by Country 2025 & 2033

- Figure 20: North America Aspiration & Biopsy Needles Market Volume (K Unit), by Country 2025 & 2033

- Figure 21: North America Aspiration & Biopsy Needles Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Aspiration & Biopsy Needles Market Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Aspiration & Biopsy Needles Market Revenue (billion), by Product 2025 & 2033

- Figure 24: Europe Aspiration & Biopsy Needles Market Volume (K Unit), by Product 2025 & 2033

- Figure 25: Europe Aspiration & Biopsy Needles Market Revenue Share (%), by Product 2025 & 2033

- Figure 26: Europe Aspiration & Biopsy Needles Market Volume Share (%), by Product 2025 & 2033

- Figure 27: Europe Aspiration & Biopsy Needles Market Revenue (billion), by Application 2025 & 2033

- Figure 28: Europe Aspiration & Biopsy Needles Market Volume (K Unit), by Application 2025 & 2033

- Figure 29: Europe Aspiration & Biopsy Needles Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Aspiration & Biopsy Needles Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Aspiration & Biopsy Needles Market Revenue (billion), by Procedures 2025 & 2033

- Figure 32: Europe Aspiration & Biopsy Needles Market Volume (K Unit), by Procedures 2025 & 2033

- Figure 33: Europe Aspiration & Biopsy Needles Market Revenue Share (%), by Procedures 2025 & 2033

- Figure 34: Europe Aspiration & Biopsy Needles Market Volume Share (%), by Procedures 2025 & 2033

- Figure 35: Europe Aspiration & Biopsy Needles Market Revenue (billion), by End User 2025 & 2033

- Figure 36: Europe Aspiration & Biopsy Needles Market Volume (K Unit), by End User 2025 & 2033

- Figure 37: Europe Aspiration & Biopsy Needles Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Europe Aspiration & Biopsy Needles Market Volume Share (%), by End User 2025 & 2033

- Figure 39: Europe Aspiration & Biopsy Needles Market Revenue (billion), by Country 2025 & 2033

- Figure 40: Europe Aspiration & Biopsy Needles Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Europe Aspiration & Biopsy Needles Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Aspiration & Biopsy Needles Market Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Aspiration & Biopsy Needles Market Revenue (billion), by Product 2025 & 2033

- Figure 44: Asia Pacific Aspiration & Biopsy Needles Market Volume (K Unit), by Product 2025 & 2033

- Figure 45: Asia Pacific Aspiration & Biopsy Needles Market Revenue Share (%), by Product 2025 & 2033

- Figure 46: Asia Pacific Aspiration & Biopsy Needles Market Volume Share (%), by Product 2025 & 2033

- Figure 47: Asia Pacific Aspiration & Biopsy Needles Market Revenue (billion), by Application 2025 & 2033

- Figure 48: Asia Pacific Aspiration & Biopsy Needles Market Volume (K Unit), by Application 2025 & 2033

- Figure 49: Asia Pacific Aspiration & Biopsy Needles Market Revenue Share (%), by Application 2025 & 2033

- Figure 50: Asia Pacific Aspiration & Biopsy Needles Market Volume Share (%), by Application 2025 & 2033

- Figure 51: Asia Pacific Aspiration & Biopsy Needles Market Revenue (billion), by Procedures 2025 & 2033

- Figure 52: Asia Pacific Aspiration & Biopsy Needles Market Volume (K Unit), by Procedures 2025 & 2033

- Figure 53: Asia Pacific Aspiration & Biopsy Needles Market Revenue Share (%), by Procedures 2025 & 2033

- Figure 54: Asia Pacific Aspiration & Biopsy Needles Market Volume Share (%), by Procedures 2025 & 2033

- Figure 55: Asia Pacific Aspiration & Biopsy Needles Market Revenue (billion), by End User 2025 & 2033

- Figure 56: Asia Pacific Aspiration & Biopsy Needles Market Volume (K Unit), by End User 2025 & 2033

- Figure 57: Asia Pacific Aspiration & Biopsy Needles Market Revenue Share (%), by End User 2025 & 2033

- Figure 58: Asia Pacific Aspiration & Biopsy Needles Market Volume Share (%), by End User 2025 & 2033

- Figure 59: Asia Pacific Aspiration & Biopsy Needles Market Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific Aspiration & Biopsy Needles Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Pacific Aspiration & Biopsy Needles Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Aspiration & Biopsy Needles Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Aspiration & Biopsy Needles Market Revenue (billion), by Product 2025 & 2033

- Figure 64: Middle East and Africa Aspiration & Biopsy Needles Market Volume (K Unit), by Product 2025 & 2033

- Figure 65: Middle East and Africa Aspiration & Biopsy Needles Market Revenue Share (%), by Product 2025 & 2033

- Figure 66: Middle East and Africa Aspiration & Biopsy Needles Market Volume Share (%), by Product 2025 & 2033

- Figure 67: Middle East and Africa Aspiration & Biopsy Needles Market Revenue (billion), by Application 2025 & 2033

- Figure 68: Middle East and Africa Aspiration & Biopsy Needles Market Volume (K Unit), by Application 2025 & 2033

- Figure 69: Middle East and Africa Aspiration & Biopsy Needles Market Revenue Share (%), by Application 2025 & 2033

- Figure 70: Middle East and Africa Aspiration & Biopsy Needles Market Volume Share (%), by Application 2025 & 2033

- Figure 71: Middle East and Africa Aspiration & Biopsy Needles Market Revenue (billion), by Procedures 2025 & 2033

- Figure 72: Middle East and Africa Aspiration & Biopsy Needles Market Volume (K Unit), by Procedures 2025 & 2033

- Figure 73: Middle East and Africa Aspiration & Biopsy Needles Market Revenue Share (%), by Procedures 2025 & 2033

- Figure 74: Middle East and Africa Aspiration & Biopsy Needles Market Volume Share (%), by Procedures 2025 & 2033

- Figure 75: Middle East and Africa Aspiration & Biopsy Needles Market Revenue (billion), by End User 2025 & 2033

- Figure 76: Middle East and Africa Aspiration & Biopsy Needles Market Volume (K Unit), by End User 2025 & 2033

- Figure 77: Middle East and Africa Aspiration & Biopsy Needles Market Revenue Share (%), by End User 2025 & 2033

- Figure 78: Middle East and Africa Aspiration & Biopsy Needles Market Volume Share (%), by End User 2025 & 2033

- Figure 79: Middle East and Africa Aspiration & Biopsy Needles Market Revenue (billion), by Country 2025 & 2033

- Figure 80: Middle East and Africa Aspiration & Biopsy Needles Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Aspiration & Biopsy Needles Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Aspiration & Biopsy Needles Market Volume Share (%), by Country 2025 & 2033

- Figure 83: South America Aspiration & Biopsy Needles Market Revenue (billion), by Product 2025 & 2033

- Figure 84: South America Aspiration & Biopsy Needles Market Volume (K Unit), by Product 2025 & 2033

- Figure 85: South America Aspiration & Biopsy Needles Market Revenue Share (%), by Product 2025 & 2033

- Figure 86: South America Aspiration & Biopsy Needles Market Volume Share (%), by Product 2025 & 2033

- Figure 87: South America Aspiration & Biopsy Needles Market Revenue (billion), by Application 2025 & 2033

- Figure 88: South America Aspiration & Biopsy Needles Market Volume (K Unit), by Application 2025 & 2033

- Figure 89: South America Aspiration & Biopsy Needles Market Revenue Share (%), by Application 2025 & 2033

- Figure 90: South America Aspiration & Biopsy Needles Market Volume Share (%), by Application 2025 & 2033

- Figure 91: South America Aspiration & Biopsy Needles Market Revenue (billion), by Procedures 2025 & 2033

- Figure 92: South America Aspiration & Biopsy Needles Market Volume (K Unit), by Procedures 2025 & 2033

- Figure 93: South America Aspiration & Biopsy Needles Market Revenue Share (%), by Procedures 2025 & 2033

- Figure 94: South America Aspiration & Biopsy Needles Market Volume Share (%), by Procedures 2025 & 2033

- Figure 95: South America Aspiration & Biopsy Needles Market Revenue (billion), by End User 2025 & 2033

- Figure 96: South America Aspiration & Biopsy Needles Market Volume (K Unit), by End User 2025 & 2033

- Figure 97: South America Aspiration & Biopsy Needles Market Revenue Share (%), by End User 2025 & 2033

- Figure 98: South America Aspiration & Biopsy Needles Market Volume Share (%), by End User 2025 & 2033

- Figure 99: South America Aspiration & Biopsy Needles Market Revenue (billion), by Country 2025 & 2033

- Figure 100: South America Aspiration & Biopsy Needles Market Volume (K Unit), by Country 2025 & 2033

- Figure 101: South America Aspiration & Biopsy Needles Market Revenue Share (%), by Country 2025 & 2033

- Figure 102: South America Aspiration & Biopsy Needles Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Procedures 2020 & 2033

- Table 6: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Procedures 2020 & 2033

- Table 7: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 9: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 12: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 13: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Procedures 2020 & 2033

- Table 16: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Procedures 2020 & 2033

- Table 17: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 19: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: United States Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United States Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Canada Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Canada Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Mexico Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Mexico Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 28: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 29: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 31: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Procedures 2020 & 2033

- Table 32: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Procedures 2020 & 2033

- Table 33: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by End User 2020 & 2033

- Table 34: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 35: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Germany Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Germany Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: United Kingdom Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: United Kingdom Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: France Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: France Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Italy Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Italy Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Spain Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Spain Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 50: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 51: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 52: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 53: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Procedures 2020 & 2033

- Table 54: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Procedures 2020 & 2033

- Table 55: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by End User 2020 & 2033

- Table 56: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 57: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 58: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 59: China Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: China Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Japan Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Japan Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: India Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: India Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Australia Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Australia Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: South Korea Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: South Korea Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: Rest of Asia Pacific Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Rest of Asia Pacific Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 72: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 73: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 74: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 75: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Procedures 2020 & 2033

- Table 76: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Procedures 2020 & 2033

- Table 77: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by End User 2020 & 2033

- Table 78: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 79: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 80: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 81: GCC Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: GCC Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: South Africa Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: South Africa Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 85: Rest of Middle East and Africa Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: Rest of Middle East and Africa Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Product 2020 & 2033

- Table 88: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 89: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Application 2020 & 2033

- Table 90: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 91: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Procedures 2020 & 2033

- Table 92: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Procedures 2020 & 2033

- Table 93: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by End User 2020 & 2033

- Table 94: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 95: Global Aspiration & Biopsy Needles Market Revenue billion Forecast, by Country 2020 & 2033

- Table 96: Global Aspiration & Biopsy Needles Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 97: Brazil Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 98: Brazil Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: Argentina Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 100: Argentina Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Rest of South America Aspiration & Biopsy Needles Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 102: Rest of South America Aspiration & Biopsy Needles Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aspiration & Biopsy Needles Market?

The projected CAGR is approximately 10.13%.

2. Which companies are prominent players in the Aspiration & Biopsy Needles Market?

Key companies in the market include Inrad Inc, Merit Medical Systems, Becton Dickinson and Company (BD), Argon Medical Devices Inc, Cook Group Incorporated, Cardinal Health Inc, Hakko Co Ltd, Conmed Corporation, Dr Japan Co Ltd, Boston Scientific Corporation, Olympus Corporation, Medtronic plc.

3. What are the main segments of the Aspiration & Biopsy Needles Market?

The market segments include Product, Application, Procedures, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.48 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer; Cancer Awareness Initiatives Undertaken by Governments and Global Health Organizations; Increasing Preference for Minimally Invasive Biopsies.

6. What are the notable trends driving market growth?

Breast Cancer Segment is Expected to Experience Significant Growth Over the Forecast Period..

7. Are there any restraints impacting market growth?

Risk of Infections Associated with the Use of Aspiration and Biopsy Needles.

8. Can you provide examples of recent developments in the market?

November 2022: Cambridge Enterprise introduced the Cambridge Prostate Biopsy Device (CamPROBE), aiming to reduce the infection risk associated with conventional transrectal biopsies. This innovative device features an integrated needle for localized anesthesia delivery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aspiration & Biopsy Needles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aspiration & Biopsy Needles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aspiration & Biopsy Needles Market?

To stay informed about further developments, trends, and reports in the Aspiration & Biopsy Needles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence