Key Insights

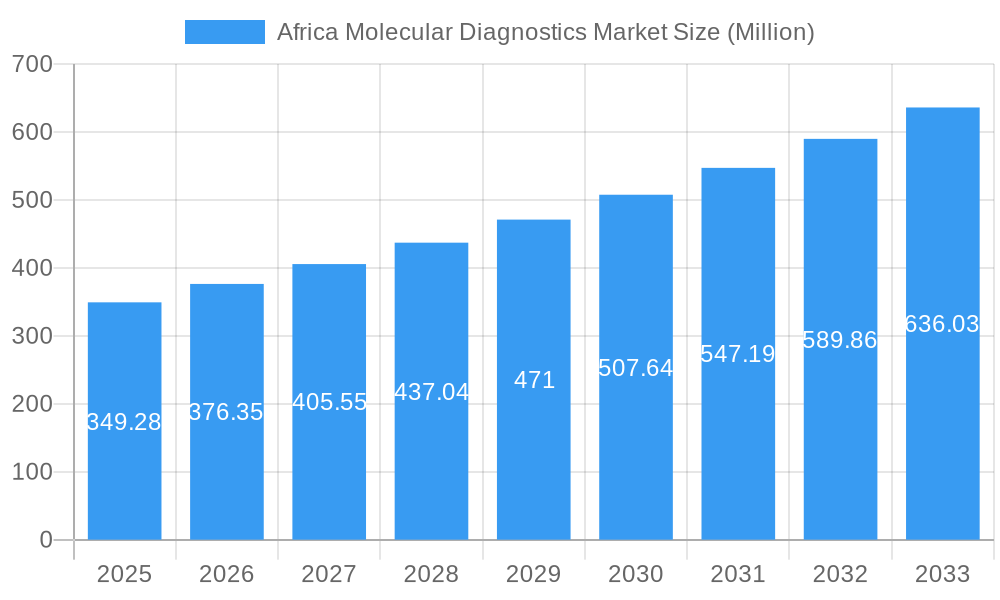

The Africa Molecular Diagnostics Market is poised for significant expansion, projected to reach $349.28 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.64% expected throughout the forecast period of 2025-2033. This growth is primarily fueled by an increasing prevalence of infectious diseases across the continent, a rising awareness of personalized medicine and pharmacogenomics, and a growing demand for accurate and early disease detection. Investments in healthcare infrastructure and a greater focus on laboratory automation are also contributing factors. Technological advancements, particularly in areas like In Situ Hybridization, Mass Spectrometry, and PCR, are enhancing diagnostic capabilities and accessibility, thereby driving market penetration.

Africa Molecular Diagnostics Market Market Size (In Million)

The market's expansion is further supported by strategic initiatives aimed at improving healthcare access and diagnostics in underserved regions. Key application areas such as infectious diseases, oncology, and pharmacogenomics are witnessing substantial growth, driven by the need for targeted therapies and precise disease management. The instruments and reagents segments are expected to dominate the product landscape due to their integral role in molecular diagnostic workflows. Hospitals and diagnostic laboratories are the primary end-users, leveraging these advanced technologies for improved patient outcomes. Geographically, while South Africa and Nigeria are leading the market, the "Rest of Africa" segment presents significant untapped potential, indicating future growth opportunities as healthcare systems mature.

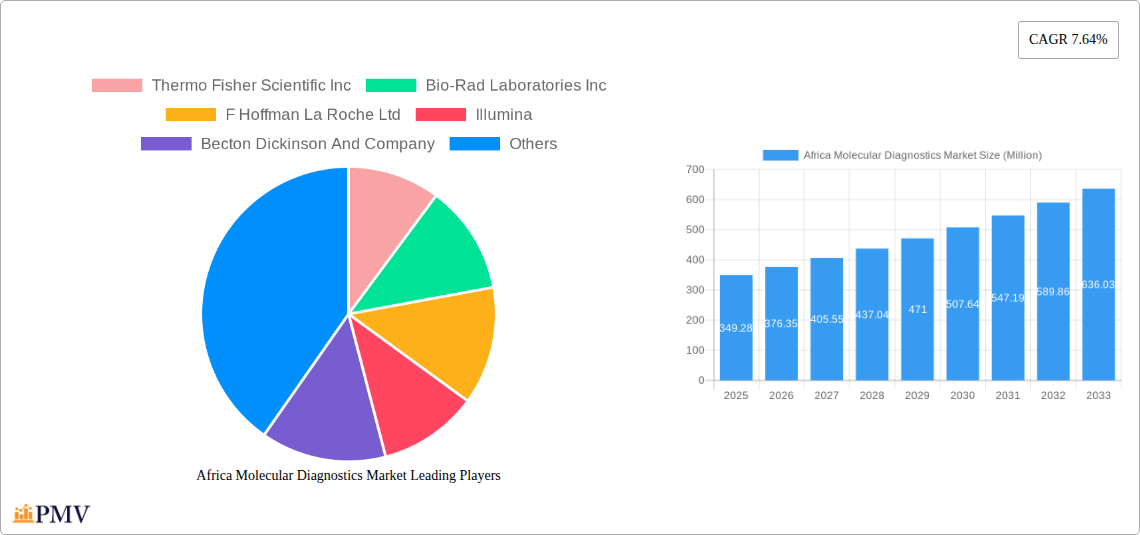

Africa Molecular Diagnostics Market Company Market Share

This in-depth report provides a strategic analysis of the Africa Molecular Diagnostics Market, encompassing market structure, industry trends, dominant segments, product innovations, and future outlook. With a study period from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report offers valuable insights for stakeholders seeking to understand and capitalize on the burgeoning molecular diagnostics landscape in Africa. The report leverages current data and expert analysis to deliver actionable intelligence, focusing on high-ranking keywords such as "Africa molecular diagnostics," "infectious disease testing Africa," "oncology diagnostics Africa," "PCR technology Africa," and "biotechnology market Africa."

Africa Molecular Diagnostics Market Market Structure & Competitive Dynamics

The Africa Molecular Diagnostics Market is characterized by a moderate to high level of concentration, with key global players such as Thermo Fisher Scientific Inc, Bio-Rad Laboratories Inc, F Hoffman La Roche Ltd, Illumina, Becton Dickinson And Company, Abbott Laboratories, Agilent Technologies Inc, Qiagen NV, Sysmex Corporation, Myriad Genetics, Hologic Corporation, Danaher Corporation (Beckman Coulter Inc), and Biomerieux Sa holding significant market share. The innovation ecosystem is rapidly evolving, driven by increased R&D investments and strategic collaborations aimed at developing more sensitive, rapid, and cost-effective diagnostic solutions for the African continent. Regulatory frameworks are in varying stages of development across different African nations, posing both opportunities and challenges for market entry and expansion. Product substitutes are evolving, with advancements in point-of-care testing and multiplex assays challenging traditional molecular diagnostic methods. End-user trends indicate a growing demand for molecular diagnostics in infectious disease management, oncology, and genetic disease screening, reflecting a rising awareness of the importance of precision medicine. Mergers and acquisitions (M&A) activities are expected to play a crucial role in consolidating the market and expanding the reach of leading companies. For instance, recent M&A deals in the global molecular diagnostics sector, valued in the hundreds of millions, signal a trend towards strategic consolidation that will likely influence the African market.

- Market Concentration: Moderate to high, dominated by multinational corporations.

- Innovation Ecosystem: Growing, fueled by R&D and partnerships for localized solutions.

- Regulatory Frameworks: Developing, with variations across countries impacting market access.

- Product Substitutes: Emerging, including point-of-care and multiplex platforms.

- End-User Trends: Increasing demand in infectious diseases, oncology, and genetic testing.

- M&A Activities: Expected to increase for market consolidation and expansion, with significant deal values globally.

Africa Molecular Diagnostics Market Industry Trends & Insights

The Africa Molecular Diagnostics Market is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of approximately 8-10% over the forecast period. This expansion is primarily fueled by a confluence of factors, including the increasing burden of infectious diseases such as HIV, tuberculosis, and malaria, which necessitate accurate and rapid diagnostic capabilities. The growing prevalence of non-communicable diseases, particularly cancer, is also a significant driver, as molecular diagnostics play a crucial role in early detection, personalized treatment, and monitoring therapeutic response. Technological disruptions are reshaping the market, with the continuous advancements in Polymerase Chain Reaction (PCR) technology, next-generation sequencing (NGS), and digital PCR offering enhanced sensitivity, specificity, and throughput. The adoption of these advanced technologies is expected to accelerate across the continent, driven by efforts to improve healthcare infrastructure and reduce diagnostic turnaround times.

Consumer preferences are shifting towards more personalized and targeted healthcare solutions. Patients and healthcare providers are increasingly seeking molecular diagnostic tests that can provide actionable information for precise treatment strategies, particularly in oncology and pharmacogenomics. This trend is fostering the demand for sophisticated genetic testing and companion diagnostics. Competitive dynamics are intensifying as both established global players and emerging local companies vie for market share. Strategic partnerships and collaborations with local research institutions and healthcare providers are becoming essential for understanding and addressing the unique healthcare needs of various African regions. Market penetration is steadily increasing, albeit with significant disparities between urban and rural areas and across different countries. Government initiatives aimed at strengthening public health systems, improving disease surveillance, and expanding access to advanced medical technologies are also providing a significant impetus for market growth. The rising disposable income and growing middle class in several African nations are contributing to increased healthcare expenditure, further bolstering the demand for molecular diagnostic services and products. The integration of molecular diagnostics into routine clinical practice is a key trend, moving beyond specialized laboratories to hospital settings and even point-of-care applications, thereby improving accessibility and affordability of advanced diagnostics. The focus on infectious disease outbreaks and pandemic preparedness, amplified by recent global health events, has also heightened the urgency and investment in molecular diagnostic capabilities across Africa.

Dominant Markets & Segments in Africa Molecular Diagnostics Market

The infectious diseases segment stands out as a dominant application within the Africa Molecular Diagnostics Market, driven by the persistent high prevalence of diseases like HIV, tuberculosis, malaria, and emerging infectious threats. The need for rapid, accurate, and scalable diagnostic solutions for these conditions is paramount.

- Technology: PCR technology is the most dominant technology, owing to its versatility, established infrastructure, and cost-effectiveness for detecting a wide range of pathogens. Its widespread use in diagnosing infectious diseases and its adaptability to various laboratory settings make it a cornerstone of molecular diagnostics in Africa.

- Application:

- Infectious Diseases: This segment commands the largest market share due to the significant disease burden and the critical need for timely and accurate diagnosis of endemic and epidemic-prone illnesses.

- Oncology: Growing awareness of cancer and the increasing adoption of personalized medicine are propelling the oncology segment. Molecular diagnostics enable precise tumor profiling for targeted therapies and early detection.

- Microbiology and Genetic Disease Screening: Essential for newborn screening, inherited disease diagnosis, and understanding microbial resistance patterns.

- Product: Reagents form a substantial portion of the market due to their consumables nature and frequent use in diagnostic procedures. Instruments, particularly PCR machines and sequencers, are crucial for enabling these tests.

- End User: Laboratories, including public health laboratories, private diagnostic labs, and research institutions, are the primary end-users, accounting for the largest market share. Hospitals are also significant consumers, especially for in-house testing and critical care diagnostics.

- Geography: South Africa currently holds a dominant position in the Africa Molecular Diagnostics Market, owing to its well-established healthcare infrastructure, higher healthcare expenditure, and significant investment in research and development. Nigeria, with its large population and growing healthcare sector, represents a significant and rapidly expanding market. The Rest of Africa, encompassing a diverse range of countries with varying levels of development, presents substantial untapped potential for market growth. Key drivers for dominance in these regions include:

- South Africa: Advanced healthcare infrastructure, robust research capabilities, and government support for diagnostics.

- Nigeria: Large population, increasing healthcare investment, and growing awareness of advanced diagnostics.

- Rest of Africa: Growing demand for essential diagnostics, improving healthcare access, and increasing foreign direct investment in the healthcare sector.

Africa Molecular Diagnostics Market Product Innovations

Product innovations in the Africa Molecular Diagnostics Market are largely focused on developing cost-effective, user-friendly, and high-throughput solutions tailored to the specific needs of the continent. Key advancements include the development of multiplex assays capable of simultaneously detecting multiple pathogens or biomarkers, thereby improving efficiency and reducing costs. Innovations in sample preparation technologies and the miniaturization of instruments are leading to more portable and point-of-care diagnostic devices, crucial for expanding access in remote or resource-limited settings. Furthermore, the integration of artificial intelligence and machine learning with molecular diagnostic platforms is enhancing data analysis and diagnostic accuracy, particularly in complex areas like oncology. These innovations aim to bridge the gap in diagnostic accessibility and provide accurate disease insights for better patient management.

Report Segmentation & Scope

This report segments the Africa Molecular Diagnostics Market across several key categories to provide a comprehensive understanding of its landscape.

- Technology: This segmentation includes In Situ Hybridization, Chips and Microarrays, Mass Spectrometry (MS), Sequencing, PCR, and Other Technologies. PCR is expected to maintain its leading position due to its widespread application and cost-effectiveness, while Sequencing is poised for significant growth driven by advancements in genomic research and personalized medicine.

- Application: The market is analyzed across Infectious Diseases, Oncology, Pharmacogenomics, Microbiology and Genetic Disease Screening, Human Leukocyte Antigen Typing, and Blood Screening. Infectious Diseases and Oncology are projected to remain the largest segments, driven by high disease burdens and increasing demand for precision medicine.

- Product: This includes Instruments, Reagents, and Other Products. Reagents are anticipated to hold a substantial market share due to their consumable nature, while Instruments, particularly those for PCR and sequencing, are expected to see steady growth.

- End User: The market is segmented into Hospitals, Laboratories, and Other End Users. Laboratories, encompassing public and private diagnostic facilities, are expected to dominate, followed by hospitals seeking to enhance their in-house diagnostic capabilities.

- Geography: The report covers South Africa, Nigeria, and the Rest of Africa. South Africa is projected to continue leading, with Nigeria and the Rest of Africa exhibiting high growth potential due to increasing healthcare investment and expanding market access.

Key Drivers of Africa Molecular Diagnostics Market Growth

The Africa Molecular Diagnostics Market is propelled by several interconnected factors. The escalating burden of infectious diseases like HIV, tuberculosis, and malaria necessitates advanced diagnostic tools for effective management and control. Simultaneously, the rising incidence of non-communicable diseases, particularly cancer, is driving demand for molecular diagnostics for early detection, prognosis, and personalized treatment strategies. Significant investments in healthcare infrastructure and a growing focus on public health initiatives across various African nations are creating a more conducive environment for the adoption of molecular diagnostics. Technological advancements, including the development of more sensitive, rapid, and affordable PCR and sequencing technologies, are making these tests more accessible and practical for the African context. Furthermore, increasing awareness among healthcare professionals and the public about the benefits of precision medicine and targeted therapies is a critical growth accelerator.

Challenges in the Africa Molecular Diagnostics Market Sector

Despite the promising growth trajectory, the Africa Molecular Diagnostics Market faces several significant challenges. The high cost of advanced diagnostic instruments and reagents remains a considerable barrier, particularly in low-income countries and for many public healthcare systems. Inadequate healthcare infrastructure, including a shortage of skilled personnel, limited electricity supply, and a lack of cold chain facilities, can hinder the widespread implementation and effective utilization of molecular diagnostic technologies. Complex and fragmented regulatory landscapes across different African nations can also present hurdles for market entry and product registration. Supply chain disruptions, including issues with importing reagents and maintaining consistent availability of testing materials, are also a concern. Finally, competition from established global players and the need for localized solutions that are adapted to the specific disease profiles and economic realities of Africa present ongoing challenges for market participants.

Leading Players in the Africa Molecular Diagnostics Market Market

- Thermo Fisher Scientific Inc

- Bio-Rad Laboratories Inc

- F Hoffman La Roche Ltd

- Illumina

- Becton Dickinson And Company

- Abbott Laboratories

- Agilent Technologies Inc

- Qiagen NV

- Sysmex Corporation

- Myriad Genetics

- Hologic Corporation

- Danaher Corporation (Beckman Coulter Inc )

- Biomerieux Sa

Key Developments in Africa Molecular Diagnostics Market Sector

- 2023: Launch of new, more affordable PCR-based diagnostic kits for common infectious diseases in sub-Saharan Africa, aiming to improve accessibility.

- 2023: Strategic partnerships formed between global molecular diagnostics companies and local African research institutions to develop disease-specific diagnostic solutions.

- 2022: Increased government funding for public health laboratories in Nigeria to upgrade molecular diagnostic capabilities for enhanced disease surveillance.

- 2022: Introduction of point-of-care molecular diagnostic platforms in rural South Africa for rapid testing of critical infectious diseases.

- 2021: Expansion of sequencing services for oncology applications in Kenya, supporting the growing demand for personalized cancer treatment.

Strategic Africa Molecular Diagnostics Market Market Outlook

The strategic outlook for the Africa Molecular Diagnostics Market is exceptionally positive, driven by a confluence of increasing healthcare expenditure, a growing disease burden, and rapid technological advancements. Key growth accelerators include the expansion of molecular diagnostics into primary healthcare settings, the development of innovative, low-cost diagnostic platforms, and the establishment of robust public-private partnerships. The rising awareness and adoption of personalized medicine and companion diagnostics, particularly in oncology, will further fuel market growth. Strategic opportunities lie in addressing unmet needs in infectious disease diagnosis, investing in local manufacturing and distribution networks, and developing diagnostics tailored to the specific genetic and environmental factors prevalent in Africa. The market is poised for significant expansion, offering lucrative prospects for companies that can adapt their offerings to the unique demands and opportunities of the African continent.

Africa Molecular Diagnostics Market Segmentation

-

1. Technology

- 1.1. In Situ Hybridization

- 1.2. Chips and Microarrays

- 1.3. Mass Spectrometry (MS)

- 1.4. Sequencing

- 1.5. PCR

- 1.6. Other Technologies

-

2. Application

- 2.1. Infectious Diseases

- 2.2. Oncology

- 2.3. Pharmacogenomics

- 2.4. Microbiology and Genetic Disease Screening

- 2.5. Human Leukocyte Antigen Typing

- 2.6. Blood Screening

-

3. Product

- 3.1. Instruments

- 3.2. Reagents

- 3.3. Other Products

-

4. End User

- 4.1. Hospitals

- 4.2. Laboratories

- 4.3. Other End Users

-

5. Geography

- 5.1. South Africa

- 5.2. Nigeria

- 5.3. Rest of Africa

Africa Molecular Diagnostics Market Segmentation By Geography

- 1. South Africa

- 2. Nigeria

- 3. Rest of Africa

Africa Molecular Diagnostics Market Regional Market Share

Geographic Coverage of Africa Molecular Diagnostics Market

Africa Molecular Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Point-of-Care Diagnostics in the Region; Increasing Burden of Bacterial and Viral Diseases; Technological Advancements in Molecular Diagnostics Space

- 3.3. Market Restrains

- 3.3.1. High Cost of Disease Diagnostics; Lack of Trained Healthcare Professionals

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Witness a Strong Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. In Situ Hybridization

- 5.1.2. Chips and Microarrays

- 5.1.3. Mass Spectrometry (MS)

- 5.1.4. Sequencing

- 5.1.5. PCR

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infectious Diseases

- 5.2.2. Oncology

- 5.2.3. Pharmacogenomics

- 5.2.4. Microbiology and Genetic Disease Screening

- 5.2.5. Human Leukocyte Antigen Typing

- 5.2.6. Blood Screening

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Instruments

- 5.3.2. Reagents

- 5.3.3. Other Products

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Hospitals

- 5.4.2. Laboratories

- 5.4.3. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. South Africa

- 5.5.2. Nigeria

- 5.5.3. Rest of Africa

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.6.2. Nigeria

- 5.6.3. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. South Africa Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. In Situ Hybridization

- 6.1.2. Chips and Microarrays

- 6.1.3. Mass Spectrometry (MS)

- 6.1.4. Sequencing

- 6.1.5. PCR

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infectious Diseases

- 6.2.2. Oncology

- 6.2.3. Pharmacogenomics

- 6.2.4. Microbiology and Genetic Disease Screening

- 6.2.5. Human Leukocyte Antigen Typing

- 6.2.6. Blood Screening

- 6.3. Market Analysis, Insights and Forecast - by Product

- 6.3.1. Instruments

- 6.3.2. Reagents

- 6.3.3. Other Products

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Hospitals

- 6.4.2. Laboratories

- 6.4.3. Other End Users

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. South Africa

- 6.5.2. Nigeria

- 6.5.3. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Nigeria Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. In Situ Hybridization

- 7.1.2. Chips and Microarrays

- 7.1.3. Mass Spectrometry (MS)

- 7.1.4. Sequencing

- 7.1.5. PCR

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infectious Diseases

- 7.2.2. Oncology

- 7.2.3. Pharmacogenomics

- 7.2.4. Microbiology and Genetic Disease Screening

- 7.2.5. Human Leukocyte Antigen Typing

- 7.2.6. Blood Screening

- 7.3. Market Analysis, Insights and Forecast - by Product

- 7.3.1. Instruments

- 7.3.2. Reagents

- 7.3.3. Other Products

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Hospitals

- 7.4.2. Laboratories

- 7.4.3. Other End Users

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. South Africa

- 7.5.2. Nigeria

- 7.5.3. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Rest of Africa Africa Molecular Diagnostics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. In Situ Hybridization

- 8.1.2. Chips and Microarrays

- 8.1.3. Mass Spectrometry (MS)

- 8.1.4. Sequencing

- 8.1.5. PCR

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infectious Diseases

- 8.2.2. Oncology

- 8.2.3. Pharmacogenomics

- 8.2.4. Microbiology and Genetic Disease Screening

- 8.2.5. Human Leukocyte Antigen Typing

- 8.2.6. Blood Screening

- 8.3. Market Analysis, Insights and Forecast - by Product

- 8.3.1. Instruments

- 8.3.2. Reagents

- 8.3.3. Other Products

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Hospitals

- 8.4.2. Laboratories

- 8.4.3. Other End Users

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. South Africa

- 8.5.2. Nigeria

- 8.5.3. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Thermo Fisher Scientific Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Bio-Rad Laboratories Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 F Hoffman La Roche Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Illumina

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Becton Dickinson And Company

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Abbott Laboratories

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Agilent Technologies Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Qiagen NV

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Sysmex Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Myriad Genetics

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Hologic Corporation

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Danaher Corporation (Beckman Coulter Inc )

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Biomerieux Sa

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.1 Thermo Fisher Scientific Inc

List of Figures

- Figure 1: Africa Molecular Diagnostics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Molecular Diagnostics Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Molecular Diagnostics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Africa Molecular Diagnostics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Africa Molecular Diagnostics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: Africa Molecular Diagnostics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Africa Molecular Diagnostics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Africa Molecular Diagnostics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Africa Molecular Diagnostics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Africa Molecular Diagnostics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Africa Molecular Diagnostics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Africa Molecular Diagnostics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: Africa Molecular Diagnostics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Africa Molecular Diagnostics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Africa Molecular Diagnostics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Africa Molecular Diagnostics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Africa Molecular Diagnostics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 16: Africa Molecular Diagnostics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 17: Africa Molecular Diagnostics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Africa Molecular Diagnostics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Africa Molecular Diagnostics Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 20: Africa Molecular Diagnostics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Africa Molecular Diagnostics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 22: Africa Molecular Diagnostics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Africa Molecular Diagnostics Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Africa Molecular Diagnostics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Molecular Diagnostics Market?

The projected CAGR is approximately 7.64%.

2. Which companies are prominent players in the Africa Molecular Diagnostics Market?

Key companies in the market include Thermo Fisher Scientific Inc, Bio-Rad Laboratories Inc, F Hoffman La Roche Ltd, Illumina, Becton Dickinson And Company, Abbott Laboratories, Agilent Technologies Inc, Qiagen NV, Sysmex Corporation, Myriad Genetics, Hologic Corporation, Danaher Corporation (Beckman Coulter Inc ), Biomerieux Sa.

3. What are the main segments of the Africa Molecular Diagnostics Market?

The market segments include Technology, Application, Product, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 349.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Point-of-Care Diagnostics in the Region; Increasing Burden of Bacterial and Viral Diseases; Technological Advancements in Molecular Diagnostics Space.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Witness a Strong Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Disease Diagnostics; Lack of Trained Healthcare Professionals.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Molecular Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Molecular Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Molecular Diagnostics Market?

To stay informed about further developments, trends, and reports in the Africa Molecular Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence