Key Insights

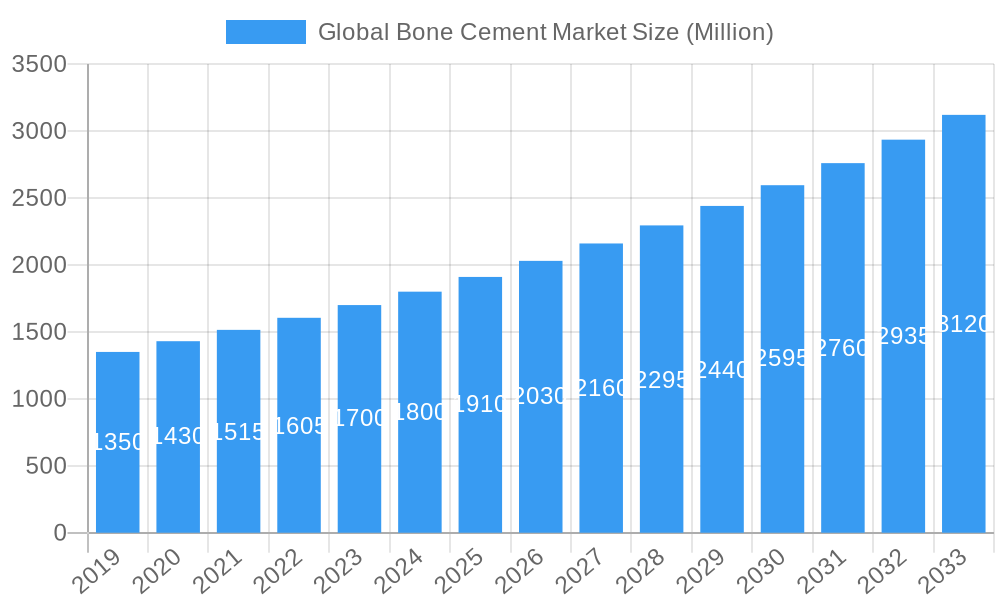

The global bone cement market is projected to reach USD 1.17 billion by 2025, exhibiting a robust CAGR of 5.72%. This expansion is primarily driven by the rising incidence of orthopedic procedures, particularly arthroplasty surgeries (knee, shoulder, and hip replacements). Advancements in biomaterials and surgical techniques are enhancing patient outcomes and increasing bone cement adoption. An aging global population and a surge in bone disorders also contribute to heightened demand. Polymethyl Methacrylate (PMMA) cement is expected to retain its market dominance due to proven efficacy and cost-effectiveness. Innovations in Glass Polyalkenoate Cement and Calcium Phosphate Cement are emerging as viable alternatives for bone regeneration and improved biocompatibility.

Global Bone Cement Market Market Size (In Billion)

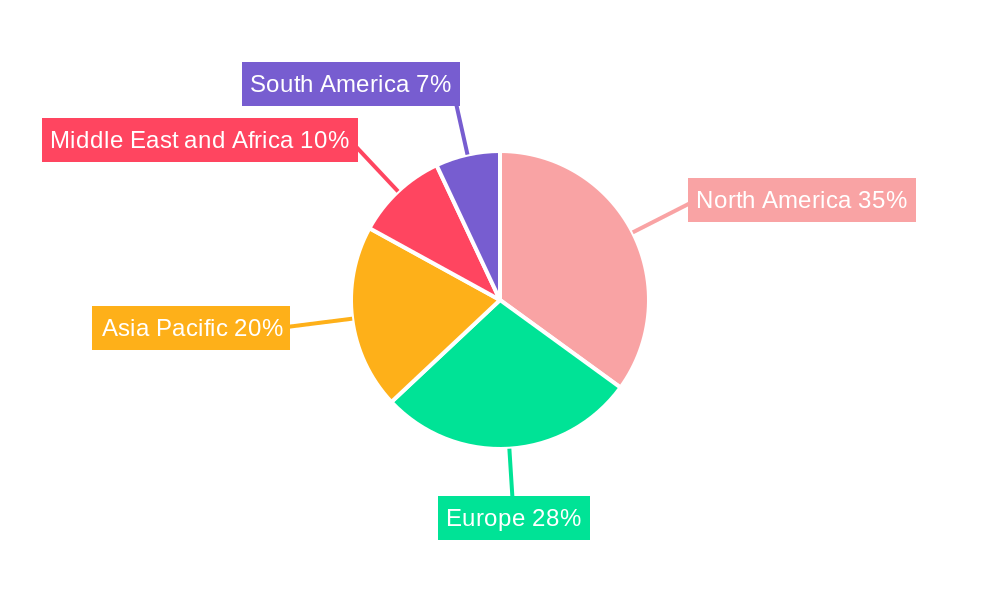

Strategic investments in research and development by leading companies like Johnson & Johnson (Depuy Synthes), Stryker, and Zimmer Biomet are further fueling market growth through novel formulations and expanded product lines. North America is anticipated to lead the market, supported by high healthcare spending and a substantial volume of orthopedic surgeries. Europe and Asia Pacific demonstrate strong growth potential, with the latter benefiting from improved healthcare access and a growing medical tourism sector. Key market restraints include stringent regulatory approvals and the risk of infection, underscoring the need for continuous innovation in antimicrobial properties and surgical protocols.

Global Bone Cement Market Company Market Share

Global Bone Cement Market: Comprehensive Analysis & Forecast

This report offers a detailed analysis of the global bone cement market, providing critical insights into market size, segmentation, trends, and the competitive landscape. Covering the base year of 2025, this report is an essential resource for understanding the dynamics of orthopedic bone cement, surgical cement, and biomaterials for bone repair. Explore market segments including Polymethyl Methacrylate (PMMA) Cement, Glass Polyalkenoate Cement, and Calcium Phosphate Cement, with a focus on applications like Arthroplasty, specifically Total Knee Arthroplasty, Total Shoulder Arthroplasty, and Total Hip Arthroplasty.

Global Bone Cement Market Market Structure & Competitive Dynamics

The global bone cement market is characterized by a moderate to high level of concentration, with key players like Heraeus Holding, Arthrex Inc, Smith & Nephew, Cardinal Health, Merck KGaA, Johnson & Johnson (Depuy Synthes), Exactech, Stryker, DJO Global, and Zimmer Biomet holding significant market share. The innovation ecosystem thrives on continuous research and development focused on biocompatibility, improved mechanical properties, and reduced complications. Regulatory frameworks, such as FDA approvals and CE marking, play a crucial role in market access and product lifecycle. Product substitutes, while limited in direct competition for primary applications, include alternative fixation methods. End-user trends are driven by an aging global population, increasing prevalence of orthopedic conditions, and a growing demand for minimally invasive surgical procedures. Merger and acquisition (M&A) activities, such as strategic partnerships and smaller company acquisitions aimed at expanding product portfolios or geographical reach, are also key to market evolution. The market's growth is influenced by the demand for advanced bone graft materials and the increasing adoption of joint replacement surgeries worldwide.

Global Bone Cement Market Industry Trends & Insights

The global bone cement market is experiencing robust growth, driven by several multifaceted trends. A primary growth accelerator is the escalating prevalence of age-related musculoskeletal disorders, including osteoarthritis and osteoporosis, which directly fuels the demand for orthopedic implants and the bone cements used for their fixation. The increasing volume of joint replacement surgeries, particularly total knee arthroplasty (TKA) and total hip arthroplasty (THA), represents a significant market penetration opportunity. Technological advancements are continuously shaping the industry, with a focus on developing bone cements with enhanced biocompatibility, faster setting times, improved radiopacity for better surgical visualization, and the ability to deliver therapeutic agents like antibiotics to reduce infection rates. The integration of calcium phosphate cement (CPC) and other bioresorbable materials is gaining traction, offering a promising alternative to traditional PMMA cements in specific applications due to their osteoconductive properties. Consumer preferences are increasingly leaning towards treatments that offer faster recovery times and reduced risk of complications, thereby encouraging the adoption of advanced bone cement formulations. Competitive dynamics are characterized by intense R&D efforts to differentiate product offerings, strategic collaborations between manufacturers and research institutions, and a focus on expanding market reach into emerging economies. The CAGR for the bone cement market is projected to be a healthy xx% over the forecast period, reflecting sustained demand and innovation.

Dominant Markets & Segments in Global Bone Cement Market

The global bone cement market exhibits distinct regional dominance and segment leadership. North America, particularly the United States, stands as a dominant market due to high healthcare expenditure, advanced healthcare infrastructure, a large aging population, and a high rate of orthopedic surgeries. The Polymethyl Methacrylate (PMMA) Cement segment continues to hold a substantial market share owing to its long-standing history, established efficacy, and widespread use in arthroplasty procedures. However, the Calcium Phosphate Cement (CPC) segment is demonstrating significant growth potential, driven by its biocompatibility and osteoconductive properties, making it increasingly favored for bone regeneration applications and revision surgeries.

In terms of applications, Arthroplasty remains the largest segment. Within arthroplasty:

- Total Knee Arthroplasty (TKA): Driven by the high incidence of knee osteoarthritis and an aging demographic, TKA procedures are a major consumer of bone cement. Economic policies supporting healthcare access and infrastructure development in developed nations contribute to this segment's strength.

- Total Hip Arthroplasty (THA): Similar to TKA, THA is a cornerstone of orthopedic surgery, with bone cement being integral for prosthetic fixation. Technological advancements in implant design and surgical techniques further bolster its demand.

- Total Shoulder Arthroplasty (TSA): While a smaller segment compared to knee and hip replacements, TSA is experiencing growth due to increased diagnosis of shoulder pathologies and the desire for improved quality of life among the elderly.

The "Others" application segment, encompassing applications beyond major arthroplasties such as spinal fusion, fracture fixation, and craniofacial reconstruction, is also showing promising growth. This expansion is fueled by the versatility of bone cements and their increasing use in specialized orthopedic and reconstructive procedures.

Global Bone Cement Market Product Innovations

Product innovations in the bone cement market are primarily focused on enhancing biocompatibility, improving mechanical strength, and incorporating advanced functionalities. Polymethyl Methacrylate (PMMA) cements are being refined for faster curing times and improved radiopacity, aiding surgeons in precise placement. The development of bioresorbable bone cements, particularly those based on calcium phosphate, is a significant trend. These materials offer osteoconductive properties, promoting natural bone regeneration and potentially eliminating the need for permanent implants in some cases. Innovations also include antibiotic-eluting bone cements designed to combat post-operative infections, a major concern in orthopedic surgery. These advancements aim to reduce patient recovery times, minimize complications, and ultimately improve surgical outcomes, providing a distinct competitive advantage.

Report Segmentation & Scope

The Global Bone Cement Market is meticulously segmented to provide a granular view of its dynamics. The Product segmentation includes:

- Polymethyl Methacrylate (PMMA) Cement: Expected to maintain a dominant share due to its established applications in arthroplasty, with projected growth driven by advancements in its formulation and delivery systems.

- Glass Polyalkenoate Cement: A niche segment with potential for growth in specialized applications due to its bioactivity, though its market size is currently smaller.

- Calcium Phosphate Cement: Anticipated to witness the highest growth rate due to its biocompatibility and osteoconductive properties, finding increasing use in bone regeneration and revision surgeries.

The Application segmentation covers:

- Arthroplasty: The largest segment, encompassing Total Knee Arthroplasty, Total Shoulder Arthroplasty, and Total Hip Arthroplasty, driven by the rising incidence of degenerative joint diseases and an aging global population.

- Others: This segment includes spinal fusion, fracture fixation, and craniofacial reconstruction, showing substantial growth as bone cement finds broader applications in complex orthopedic and reconstructive procedures.

Key Drivers of Global Bone Cement Market Growth

Several key factors are propelling the growth of the global bone cement market. Firstly, the increasing prevalence of orthopedic conditions such as osteoarthritis and osteoporosis, exacerbated by an aging population worldwide, directly drives demand for joint replacement surgeries, a primary application for bone cement. Secondly, advancements in surgical techniques and implant technology are leading to a higher number of successful orthopedic procedures, further boosting cement usage. Thirdly, growing healthcare expenditure and improved access to advanced medical facilities, particularly in emerging economies, are making these treatments more accessible. Finally, continuous innovation in biomaterials and product development, leading to cements with enhanced biocompatibility, biodegradability, and therapeutic functionalities (e.g., antibiotic delivery), are creating new market opportunities and driving adoption.

Challenges in the Global Bone Cement Market Sector

Despite its promising growth, the global bone cement market faces several challenges. Stringent regulatory approvals for new bone cement formulations and manufacturing processes can lead to extended time-to-market and increased development costs. The potential for post-operative complications, such as infection and loosening of implants, remains a concern, necessitating the development of more advanced cements and ongoing research into their long-term efficacy. High manufacturing costs and the need for specialized infrastructure can also limit market entry for smaller players. Furthermore, competitive pressures from established players and the ongoing development of alternative fixation methods or advanced biologics can impact market share dynamics. Supply chain disruptions and the fluctuating costs of raw materials also pose a threat to sustained growth.

Leading Players in the Global Bone Cement Market Market

- Heraeus Holding

- Arthrex Inc

- Smith & Nephew

- Cardinal Health

- Merck KGaA

- Johnson & Johnson (Depuy Synthes)

- Exactech

- Stryker

- DJO Global

- Zimmer Biomet

Key Developments in Global Bone Cement Market Sector

- July 2022: GRAFTYS SA, a specialist in resorbable bone cement for orthopedic surgery, successfully completed an investment round of 2.0 Million Euro with its existing shareholders. This funding is intended to accelerate commercial development and facilitate new product launches.

- May 2022: KPower Bhd's subsidiary, Granulab (M) Sdn Bhd, launched Malaysia's first halal-certified synthetic bone cement, Prosteomax. This innovative synthetic calcium phosphate bone cement has received halal certification from the Islamic Development Department of Malaysia (Jakim) and is registered with the Malaysian Medical Device Authority for orthopedic, craniofacial, dental, and maxillofacial applications.

Strategic Global Bone Cement Market Market Outlook

The strategic outlook for the global bone cement market is highly positive, driven by persistent demographic trends and continuous technological advancements. The increasing global burden of orthopedic diseases, coupled with a growing desire for improved quality of life among aging populations, ensures a sustained demand for bone cement. The market's future trajectory will be shaped by the increasing adoption of bioresorbable and drug-eluting bone cements, offering enhanced patient outcomes and reduced complication rates. Strategic opportunities lie in expanding market penetration in emerging economies, where the demand for advanced orthopedic solutions is rapidly growing. Collaborations between research institutions and manufacturers will be crucial for driving innovation in areas such as regenerative medicine and personalized orthopedic care, further solidifying the market's growth potential.

Global Bone Cement Market Segmentation

-

1. Product

- 1.1. Polymethyl Methacrylate (PMMA) Cement

- 1.2. Glass Polyalkenoate Cement

- 1.3. Calcium Phosphate Cement

-

2. Application

-

2.1. Arthroplasty

- 2.1.1. Total Knee Arthroplasty

- 2.1.2. Total Shoulder Arthroplasty

- 2.1.3. Total Hip Arthroplasty

- 2.2. Others

-

2.1. Arthroplasty

Global Bone Cement Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Bone Cement Market Regional Market Share

Geographic Coverage of Global Bone Cement Market

Global Bone Cement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidence of Sports Injuries and Road Traffic Accidents; Rising Geriatric Population; Increasing Demand in the Field of Regenerative Medicine

- 3.3. Market Restrains

- 3.3.1. Unfavourable Reimbursement Scenarios and High Cost Required for Launching New Products

- 3.4. Market Trends

- 3.4.1. Polymethyl Methacrylate (PMMA) Cement is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bone Cement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Polymethyl Methacrylate (PMMA) Cement

- 5.1.2. Glass Polyalkenoate Cement

- 5.1.3. Calcium Phosphate Cement

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Arthroplasty

- 5.2.1.1. Total Knee Arthroplasty

- 5.2.1.2. Total Shoulder Arthroplasty

- 5.2.1.3. Total Hip Arthroplasty

- 5.2.2. Others

- 5.2.1. Arthroplasty

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Global Bone Cement Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Polymethyl Methacrylate (PMMA) Cement

- 6.1.2. Glass Polyalkenoate Cement

- 6.1.3. Calcium Phosphate Cement

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Arthroplasty

- 6.2.1.1. Total Knee Arthroplasty

- 6.2.1.2. Total Shoulder Arthroplasty

- 6.2.1.3. Total Hip Arthroplasty

- 6.2.2. Others

- 6.2.1. Arthroplasty

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Global Bone Cement Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Polymethyl Methacrylate (PMMA) Cement

- 7.1.2. Glass Polyalkenoate Cement

- 7.1.3. Calcium Phosphate Cement

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Arthroplasty

- 7.2.1.1. Total Knee Arthroplasty

- 7.2.1.2. Total Shoulder Arthroplasty

- 7.2.1.3. Total Hip Arthroplasty

- 7.2.2. Others

- 7.2.1. Arthroplasty

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Global Bone Cement Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Polymethyl Methacrylate (PMMA) Cement

- 8.1.2. Glass Polyalkenoate Cement

- 8.1.3. Calcium Phosphate Cement

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Arthroplasty

- 8.2.1.1. Total Knee Arthroplasty

- 8.2.1.2. Total Shoulder Arthroplasty

- 8.2.1.3. Total Hip Arthroplasty

- 8.2.2. Others

- 8.2.1. Arthroplasty

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Global Bone Cement Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Polymethyl Methacrylate (PMMA) Cement

- 9.1.2. Glass Polyalkenoate Cement

- 9.1.3. Calcium Phosphate Cement

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Arthroplasty

- 9.2.1.1. Total Knee Arthroplasty

- 9.2.1.2. Total Shoulder Arthroplasty

- 9.2.1.3. Total Hip Arthroplasty

- 9.2.2. Others

- 9.2.1. Arthroplasty

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Global Bone Cement Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Polymethyl Methacrylate (PMMA) Cement

- 10.1.2. Glass Polyalkenoate Cement

- 10.1.3. Calcium Phosphate Cement

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Arthroplasty

- 10.2.1.1. Total Knee Arthroplasty

- 10.2.1.2. Total Shoulder Arthroplasty

- 10.2.1.3. Total Hip Arthroplasty

- 10.2.2. Others

- 10.2.1. Arthroplasty

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Heraeus Holding

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arthrex Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Smith & Nephew

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cardinal Health

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Merck KGaA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Johnson & Johnson (Depuy Synthes)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Exactech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Stryker

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DJO Global

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zimmer Biomet

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Heraeus Holding

List of Figures

- Figure 1: Global Global Bone Cement Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Global Bone Cement Market Revenue (billion), by Product 2025 & 2033

- Figure 3: North America Global Bone Cement Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Global Bone Cement Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Global Bone Cement Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Global Bone Cement Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Global Bone Cement Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Global Bone Cement Market Revenue (billion), by Product 2025 & 2033

- Figure 9: Europe Global Bone Cement Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Global Bone Cement Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Global Bone Cement Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Global Bone Cement Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Global Bone Cement Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Global Bone Cement Market Revenue (billion), by Product 2025 & 2033

- Figure 15: Asia Pacific Global Bone Cement Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Global Bone Cement Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Global Bone Cement Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Global Bone Cement Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Global Bone Cement Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Global Bone Cement Market Revenue (billion), by Product 2025 & 2033

- Figure 21: Middle East and Africa Global Bone Cement Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East and Africa Global Bone Cement Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Middle East and Africa Global Bone Cement Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Global Bone Cement Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Global Bone Cement Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Global Bone Cement Market Revenue (billion), by Product 2025 & 2033

- Figure 27: South America Global Bone Cement Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: South America Global Bone Cement Market Revenue (billion), by Application 2025 & 2033

- Figure 29: South America Global Bone Cement Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Global Bone Cement Market Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Global Bone Cement Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bone Cement Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Bone Cement Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Bone Cement Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Bone Cement Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Global Bone Cement Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Bone Cement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Bone Cement Market Revenue billion Forecast, by Product 2020 & 2033

- Table 11: Global Bone Cement Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Bone Cement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Bone Cement Market Revenue billion Forecast, by Product 2020 & 2033

- Table 20: Global Bone Cement Market Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Global Bone Cement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Bone Cement Market Revenue billion Forecast, by Product 2020 & 2033

- Table 29: Global Bone Cement Market Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Bone Cement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Bone Cement Market Revenue billion Forecast, by Product 2020 & 2033

- Table 35: Global Bone Cement Market Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Bone Cement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Global Bone Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Bone Cement Market?

The projected CAGR is approximately 5.72%.

2. Which companies are prominent players in the Global Bone Cement Market?

Key companies in the market include Heraeus Holding, Arthrex Inc, Smith & Nephew, Cardinal Health, Merck KGaA, Johnson & Johnson (Depuy Synthes), Exactech, Stryker, DJO Global, Zimmer Biomet.

3. What are the main segments of the Global Bone Cement Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.17 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidence of Sports Injuries and Road Traffic Accidents; Rising Geriatric Population; Increasing Demand in the Field of Regenerative Medicine.

6. What are the notable trends driving market growth?

Polymethyl Methacrylate (PMMA) Cement is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Unfavourable Reimbursement Scenarios and High Cost Required for Launching New Products.

8. Can you provide examples of recent developments in the market?

In July 2022, GRAFTYS SA, a recognized specialist in resorbable bone cement for orthopedic surgery, completed an investment round of 2.0 Million Euro with its existing shareholders to accelerate the commercial development and new product launches

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Bone Cement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Bone Cement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Bone Cement Market?

To stay informed about further developments, trends, and reports in the Global Bone Cement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence