Key Insights

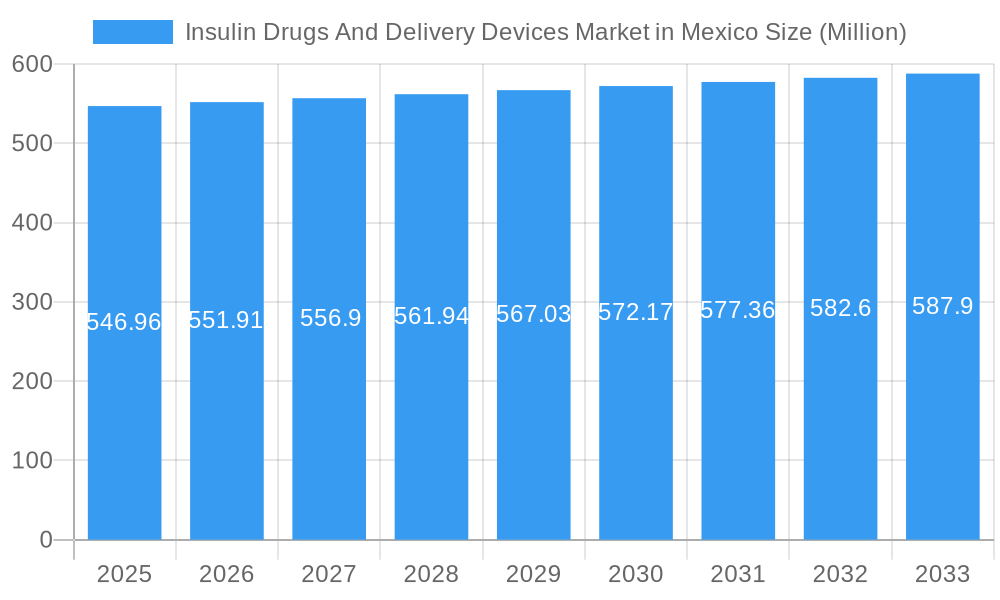

The Insulin Drugs and Delivery Devices Market in Mexico is poised for a modest but steady expansion, driven by an increasing prevalence of diabetes and a growing emphasis on effective diabetes management. With a projected market size of USD 546.96 million and a Compound Annual Growth Rate (CAGR) of 0.90% from 2019 to 2033, the market's expansion is attributed to a confluence of factors. Key drivers include the rising incidence of type 1 and type 2 diabetes in Mexico, necessitating continuous insulin therapy. Furthermore, advancements in insulin formulations, such as improved basal and bolus insulins, alongside the growing adoption of innovative delivery devices like insulin pens and pumps, are significantly contributing to market growth. These modern delivery systems offer enhanced convenience, accuracy, and patient compliance, thereby encouraging greater uptake among the diabetic population. The market also benefits from increased healthcare expenditure and a greater awareness among both healthcare professionals and patients regarding the importance of optimal glycemic control.

Insulin Drugs And Delivery Devices Market in Mexico Market Size (In Million)

Despite the overall positive outlook, certain restraints temper the market's growth trajectory. The high cost associated with advanced insulin delivery devices and next-generation insulin formulations can be a significant barrier for a segment of the Mexican population, particularly those with limited financial resources. Additionally, challenges related to the availability and affordability of biosimilar insulins, though increasingly important for cost-effective management, still present hurdles in widespread adoption. The competitive landscape is characterized by the presence of major global pharmaceutical and medical device companies, including Novo Nordisk, Eli Lilly, Sanofi, and Medtronic, alongside local players, fostering innovation but also intensifying price pressures. The market's segmentation highlights the demand for both traditional and advanced insulin drugs, and the growing preference for sophisticated delivery devices like insulin pens and pumps over traditional syringes, reflecting a global trend towards more user-friendly and efficient diabetes management solutions.

Insulin Drugs And Delivery Devices Market in Mexico Company Market Share

Mexico Insulin Drugs and Delivery Devices Market: Comprehensive Analysis and Growth Outlook (2019-2033)

This detailed report provides an in-depth analysis of the Mexico Insulin Drugs and Delivery Devices Market, offering critical insights into market dynamics, key trends, and future prospects. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study is an essential resource for stakeholders seeking to understand the Mexican diabetes management landscape. With a focus on insulin therapy, biosimilar insulins, insulin pens, and insulin pumps, this report offers actionable intelligence for pharmaceutical companies, medical device manufacturers, and healthcare providers.

Insulin Drugs And Delivery Devices Market in Mexico Market Structure & Competitive Dynamics

The Mexico Insulin Drugs and Delivery Devices Market exhibits a moderately concentrated structure, with key players like Novo Nordisk, Eli Lilly, and Sanofi holding significant market shares. The innovation ecosystem is characterized by increasing investments in research and development for novel insulin formulations and advanced insulin delivery devices, particularly smart insulin pens and continuous glucose monitoring (CGM) integrated insulin pumps. Mexico's regulatory framework, managed by COFEPRIS, is evolving to facilitate the approval of new diabetes treatments and medical technologies, though pathways for biosimilars and novel devices require ongoing attention. Potential product substitutes, such as oral anti-diabetic medications, continue to influence the market, but the growing prevalence of diabetes and the need for precise glycemic control drive demand for injectable insulin therapies and sophisticated delivery systems. End-user trends are shifting towards patient empowerment and personalized treatment approaches, favoring devices that offer greater convenience and data tracking capabilities. Merger and acquisition activities are anticipated to increase as companies seek to expand their product portfolios and gain a stronger foothold in this burgeoning market, with estimated M&A deal values in the tens of millions of US dollars.

Insulin Drugs And Delivery Devices Market in Mexico Industry Trends & Insights

The Mexico Insulin Drugs and Delivery Devices Market is poised for substantial growth, driven by a confluence of factors including the escalating prevalence of diabetes, a growing awareness of diabetes management, and advancements in insulin formulations and delivery technologies. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7-9% over the forecast period. This growth is further propelled by an expanding healthcare infrastructure and increasing government initiatives aimed at improving diabetes care. Biosimilar insulins are gaining traction due to their cost-effectiveness, presenting a significant opportunity for market penetration, particularly among the uninsured and underinsured populations. The adoption of insulin pens and insulin pumps is steadily rising, reflecting a shift towards more convenient and patient-friendly insulin delivery devices that enhance adherence and improve treatment outcomes. Technological disruptions, such as the integration of digital health solutions and connected insulin pens, are revolutionizing diabetes management by enabling real-time data monitoring and personalized therapy adjustments. Consumer preferences are increasingly leaning towards products that offer ease of use, portability, and improved glycemic control, fostering demand for innovative insulin drug and device combinations. The competitive landscape is dynamic, with established global players and emerging local manufacturers vying for market share through product innovation, strategic partnerships, and aggressive marketing strategies. The market penetration of advanced diabetes management solutions is still in its nascent stages, indicating significant untapped potential for growth and innovation.

Dominant Markets & Segments in Insulin Drugs And Delivery Devices Market in Mexico

Drug Segments:

- Basal or Long-acting Insulins: This segment holds a dominant position within the Mexico Insulin Drugs Market due to its crucial role in providing a consistent background insulin level, essential for managing type 1 and type 2 diabetes. Key drivers include the high incidence of individuals requiring around-the-clock glycemic control. The market penetration for these insulins is high, supported by established clinical guidelines and physician preference.

- Bolus or Fast-acting Insulins: This segment is experiencing robust growth, driven by the increasing need for mealtime insulin coverage and the rising adoption of sophisticated insulin regimens. Patients' preference for flexible meal schedules contributes to its expansion.

- Traditional Human Insulins: While still relevant due to their affordability, this segment is gradually being supplemented by analog insulins, especially in more advanced treatment protocols. Economic policies influencing drug pricing play a role in its continued presence.

- Combination Insulins: These formulations are gaining popularity for their convenience, offering both basal and bolus coverage in a single injection. The ease of use makes them attractive for patients seeking simplified treatment regimens.

- Biosimilar Insulins: This segment is a significant growth driver, offering a more accessible and cost-effective alternative to branded insulins. Favorable regulatory pathways and increasing acceptance by healthcare providers and patients are key factors. The market size for biosimilars is projected to expand significantly in the coming years.

Device Segments:

- Insulin Pens: This segment dominates the Insulin Delivery Devices Market in Mexico due to their user-friendliness, portability, and accuracy compared to traditional syringes. The development of smart insulin pens with connectivity features is further boosting their market share and appeal.

- Insulin Pumps: While having a smaller market share, insulin pumps represent a high-growth segment, offering advanced automated insulin delivery systems. Technological advancements and increasing awareness among endocrinologists and patients with type 1 diabetes are driving adoption. The market size is expected to grow substantially with improved affordability and accessibility.

- Insulin Syringes: These remain a fundamental delivery method, particularly in lower-income demographics or for individuals preferring traditional methods. Their market share is relatively stable but is expected to see a decline with the broader adoption of pens and pumps.

- Insulin Jet Injectors: This niche segment offers needle-free insulin delivery, catering to patients with needle phobia. While currently holding a small market share, innovation in this area could lead to increased adoption.

Insulin Drugs And Delivery Devices Market in Mexico Product Innovations

Product innovation in the Mexico Insulin Drugs and Delivery Devices Market is primarily focused on enhancing patient convenience, improving glycemic control, and integrating digital health technologies. Manufacturers are developing novel insulin formulations with improved pharmacokinetic profiles, alongside advancements in insulin delivery devices such as pre-filled insulin pens with enhanced features and more sophisticated insulin pumps that offer greater customization and data management capabilities. The integration of Near Field Communication (NFC) technology, as seen in the Becton Dickinson and Biocorp collaboration, for tracking injection adherence and connecting with pre-fillable syringes, signifies a major trend towards smarter diabetes management solutions. Furthermore, the development of oral insulin capsules, like Oramed's ORMD-0801, represents a significant potential breakthrough, promising a more convenient and less invasive method of insulin delivery that could revolutionize the market. These innovations aim to reduce the burden of diabetes management, improve patient outcomes, and differentiate products in a competitive landscape.

Report Segmentation & Scope

This report provides a comprehensive analysis of the Mexico Insulin Drugs and Delivery Devices Market, segmented by drug type and device type.

- Drug Segments: The insulin drugs covered include Basal or Long-acting Insulins, Bolus or Fast-acting Insulins, Traditional Human Insulins, Combination Insulins, and Biosimilar Insulins. Each segment's market size, growth projections, and competitive dynamics are analyzed to understand their individual contributions and potential.

- Device Segments: The insulin delivery devices segment comprises Insulin Pumps, Insulin Pens, Insulin Syringes, and Insulin Jet Injectors. The report details the market share, growth trends, and key players within each device category, offering insights into the evolving preferences for insulin administration methods.

Key Drivers of Insulin Drugs And Delivery Devices Market in Mexico Growth

Several key drivers are propelling the growth of the Mexico Insulin Drugs and Delivery Devices Market. The escalating prevalence of diabetes, fueled by sedentary lifestyles and changing dietary habits, directly increases the demand for insulin therapies. Advancements in medical technology are leading to the development of more sophisticated insulin delivery devices, such as smart insulin pens and insulin pumps, offering improved convenience and glycemic control for patients. Government initiatives and healthcare reforms aimed at enhancing diabetes management and access to treatments are also significant growth accelerators. Furthermore, the increasing availability and acceptance of biosimilar insulins are making diabetes management more affordable, thereby expanding market reach. Growing patient awareness regarding the importance of proactive diabetes management and the adoption of advanced treatment modalities also contribute to market expansion.

Challenges in the Insulin Drugs And Delivery Devices Market in Mexico Sector

Despite the promising growth trajectory, the Mexico Insulin Drugs and Delivery Devices Market faces several challenges. Regulatory hurdles for the approval and reimbursement of novel insulin drugs and advanced insulin delivery devices can slow down market entry and adoption. The high cost of some advanced insulin therapies and devices can pose a barrier for a significant portion of the population, impacting market penetration, particularly for insulin pumps and newer analog insulins. Supply chain disruptions and logistical complexities in ensuring consistent availability of these critical medications and devices across diverse geographical regions within Mexico can also present challenges. Intense competition among established players and emerging manufacturers further intensifies pricing pressures and necessitates continuous innovation. Additionally, a lack of widespread access to specialized diabetes education and healthcare infrastructure in certain regions can hinder optimal patient management and the adoption of advanced treatment solutions.

Leading Players in the Insulin Drugs And Delivery Devices Market in Mexico Market

- Ypsomed

- Medtronic

- Novo Nordisk

- Julphar

- Eli Lilly

- Sanofi

- Becton Dickinson

- Biocon

Key Developments in Insulin Drugs And Delivery Devices Market in Mexico Sector

- October 2022: Becton, Dickinson, and Company and Biocorp announced an agreement to integrate Biocorp's Injay technology with BD's UltraSafe Plus Passive Needle Guard for pre-fillable syringes. This collaboration aims to leverage connected technology to track adherence to self-administered drug therapies, enhancing outcomes for injectable drugs.

- March 2022: Oramed announced that its novel oral insulin capsule, ORMD-0801, is undergoing two pivotal Phase 3 trials. This potential first-in-class oral insulin therapy is anticipated to be a game-changer in the insulin and oral anti-diabetes drugs markets, offering a more convenient and safer delivery method for insulin.

Strategic Insulin Drugs And Delivery Devices Market in Mexico Market Outlook

The strategic outlook for the Mexico Insulin Drugs and Delivery Devices Market is exceptionally positive, driven by a clear need for improved diabetes management solutions. The increasing focus on patient-centric care, coupled with technological advancements, will continue to fuel demand for innovative insulin delivery devices and more effective insulin formulations. The growing penetration of biosimilar insulins presents a significant opportunity for expanding access and affordability. Strategic collaborations between pharmaceutical companies and device manufacturers, as evidenced by recent developments, are expected to accelerate the integration of smart technologies and enhance the overall patient experience. Investments in digital health platforms and remote monitoring solutions will play a crucial role in optimizing treatment outcomes and driving market growth. The market is poised for sustained expansion as Mexico continues to address the growing burden of diabetes.

Insulin Drugs And Delivery Devices Market in Mexico Segmentation

-

1. Drug

- 1.1. Basal or Long-acting Insulins

- 1.2. Bolus or Fast-acting Insulins

- 1.3. Traditional Human Insulins

- 1.4. Combination Insulins

- 1.5. Biosimilar Insulins

-

2. Device

- 2.1. Insulin Pumps

- 2.2. Insulin Pens

- 2.3. Insulin Syringes

- 2.4. Insulin Jet Injectors

Insulin Drugs And Delivery Devices Market in Mexico Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Insulin Drugs And Delivery Devices Market in Mexico Regional Market Share

Geographic Coverage of Insulin Drugs And Delivery Devices Market in Mexico

Insulin Drugs And Delivery Devices Market in Mexico REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Rising diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Insulin Drugs And Delivery Devices Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 5.1.1. Basal or Long-acting Insulins

- 5.1.2. Bolus or Fast-acting Insulins

- 5.1.3. Traditional Human Insulins

- 5.1.4. Combination Insulins

- 5.1.5. Biosimilar Insulins

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Insulin Pumps

- 5.2.2. Insulin Pens

- 5.2.3. Insulin Syringes

- 5.2.4. Insulin Jet Injectors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 6. North America Insulin Drugs And Delivery Devices Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 6.1.1. Basal or Long-acting Insulins

- 6.1.2. Bolus or Fast-acting Insulins

- 6.1.3. Traditional Human Insulins

- 6.1.4. Combination Insulins

- 6.1.5. Biosimilar Insulins

- 6.2. Market Analysis, Insights and Forecast - by Device

- 6.2.1. Insulin Pumps

- 6.2.2. Insulin Pens

- 6.2.3. Insulin Syringes

- 6.2.4. Insulin Jet Injectors

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 7. South America Insulin Drugs And Delivery Devices Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 7.1.1. Basal or Long-acting Insulins

- 7.1.2. Bolus or Fast-acting Insulins

- 7.1.3. Traditional Human Insulins

- 7.1.4. Combination Insulins

- 7.1.5. Biosimilar Insulins

- 7.2. Market Analysis, Insights and Forecast - by Device

- 7.2.1. Insulin Pumps

- 7.2.2. Insulin Pens

- 7.2.3. Insulin Syringes

- 7.2.4. Insulin Jet Injectors

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 8. Europe Insulin Drugs And Delivery Devices Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 8.1.1. Basal or Long-acting Insulins

- 8.1.2. Bolus or Fast-acting Insulins

- 8.1.3. Traditional Human Insulins

- 8.1.4. Combination Insulins

- 8.1.5. Biosimilar Insulins

- 8.2. Market Analysis, Insights and Forecast - by Device

- 8.2.1. Insulin Pumps

- 8.2.2. Insulin Pens

- 8.2.3. Insulin Syringes

- 8.2.4. Insulin Jet Injectors

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 9. Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug

- 9.1.1. Basal or Long-acting Insulins

- 9.1.2. Bolus or Fast-acting Insulins

- 9.1.3. Traditional Human Insulins

- 9.1.4. Combination Insulins

- 9.1.5. Biosimilar Insulins

- 9.2. Market Analysis, Insights and Forecast - by Device

- 9.2.1. Insulin Pumps

- 9.2.2. Insulin Pens

- 9.2.3. Insulin Syringes

- 9.2.4. Insulin Jet Injectors

- 9.1. Market Analysis, Insights and Forecast - by Drug

- 10. Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug

- 10.1.1. Basal or Long-acting Insulins

- 10.1.2. Bolus or Fast-acting Insulins

- 10.1.3. Traditional Human Insulins

- 10.1.4. Combination Insulins

- 10.1.5. Biosimilar Insulins

- 10.2. Market Analysis, Insights and Forecast - by Device

- 10.2.1. Insulin Pumps

- 10.2.2. Insulin Pens

- 10.2.3. Insulin Syringes

- 10.2.4. Insulin Jet Injectors

- 10.1. Market Analysis, Insights and Forecast - by Drug

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ypsomed

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 1 Medtronic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 1 Novo Nordisk

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Julphar

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eli Lilly

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sanofi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 2 Sanofi

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Becton Dickinson

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Medtronic

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 3 Becton Dickinso

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Insulin Delivery Devices

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 2 Ypsomed

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Biocon

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 3 Eli Lilly

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Novo Nordisk

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Insulin Drugs

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Ypsomed

List of Figures

- Figure 1: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Insulin Drugs And Delivery Devices Market in Mexico Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Drug 2025 & 2033

- Figure 4: North America Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Drug 2025 & 2033

- Figure 5: North America Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Drug 2025 & 2033

- Figure 6: North America Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Drug 2025 & 2033

- Figure 7: North America Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Device 2025 & 2033

- Figure 8: North America Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Device 2025 & 2033

- Figure 9: North America Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Device 2025 & 2033

- Figure 10: North America Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Device 2025 & 2033

- Figure 11: North America Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Drug 2025 & 2033

- Figure 16: South America Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Drug 2025 & 2033

- Figure 17: South America Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Drug 2025 & 2033

- Figure 18: South America Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Drug 2025 & 2033

- Figure 19: South America Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Device 2025 & 2033

- Figure 20: South America Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Device 2025 & 2033

- Figure 21: South America Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Device 2025 & 2033

- Figure 22: South America Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Device 2025 & 2033

- Figure 23: South America Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Country 2025 & 2033

- Figure 25: South America Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Drug 2025 & 2033

- Figure 28: Europe Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Drug 2025 & 2033

- Figure 29: Europe Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Drug 2025 & 2033

- Figure 30: Europe Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Drug 2025 & 2033

- Figure 31: Europe Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Device 2025 & 2033

- Figure 32: Europe Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Device 2025 & 2033

- Figure 33: Europe Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Device 2025 & 2033

- Figure 34: Europe Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Device 2025 & 2033

- Figure 35: Europe Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Country 2025 & 2033

- Figure 37: Europe Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Drug 2025 & 2033

- Figure 40: Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Drug 2025 & 2033

- Figure 41: Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Drug 2025 & 2033

- Figure 42: Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Drug 2025 & 2033

- Figure 43: Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Device 2025 & 2033

- Figure 44: Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Device 2025 & 2033

- Figure 45: Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Device 2025 & 2033

- Figure 46: Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Device 2025 & 2033

- Figure 47: Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Drug 2025 & 2033

- Figure 52: Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Drug 2025 & 2033

- Figure 53: Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Drug 2025 & 2033

- Figure 54: Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Drug 2025 & 2033

- Figure 55: Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Device 2025 & 2033

- Figure 56: Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Device 2025 & 2033

- Figure 57: Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Device 2025 & 2033

- Figure 58: Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Device 2025 & 2033

- Figure 59: Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Drug 2020 & 2033

- Table 2: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Drug 2020 & 2033

- Table 3: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Device 2020 & 2033

- Table 4: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Device 2020 & 2033

- Table 5: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Drug 2020 & 2033

- Table 8: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Drug 2020 & 2033

- Table 9: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Device 2020 & 2033

- Table 10: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Device 2020 & 2033

- Table 11: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Drug 2020 & 2033

- Table 20: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Drug 2020 & 2033

- Table 21: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Device 2020 & 2033

- Table 22: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Device 2020 & 2033

- Table 23: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Brazil Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Argentina Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Drug 2020 & 2033

- Table 32: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Drug 2020 & 2033

- Table 33: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Device 2020 & 2033

- Table 34: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Device 2020 & 2033

- Table 35: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Germany Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: France Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Italy Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Spain Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Russia Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Benelux Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Nordics Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Drug 2020 & 2033

- Table 56: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Drug 2020 & 2033

- Table 57: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Device 2020 & 2033

- Table 58: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Device 2020 & 2033

- Table 59: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Turkey Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Israel Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: GCC Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: North Africa Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: South Africa Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Drug 2020 & 2033

- Table 74: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Drug 2020 & 2033

- Table 75: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Device 2020 & 2033

- Table 76: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Device 2020 & 2033

- Table 77: Global Insulin Drugs And Delivery Devices Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Insulin Drugs And Delivery Devices Market in Mexico Volume K Unit Forecast, by Country 2020 & 2033

- Table 79: China Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: India Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Japan Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 85: South Korea Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Oceania Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Insulin Drugs And Delivery Devices Market in Mexico Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Insulin Drugs And Delivery Devices Market in Mexico?

The projected CAGR is approximately 0.90%.

2. Which companies are prominent players in the Insulin Drugs And Delivery Devices Market in Mexico?

Key companies in the market include Ypsomed, 1 Medtronic, 1 Novo Nordisk, Julphar, Eli Lilly, Sanofi, 2 Sanofi, Becton Dickinson, Medtronic, 3 Becton Dickinso, Insulin Delivery Devices, 2 Ypsomed, Biocon, 3 Eli Lilly, Novo Nordisk, Insulin Drugs.

3. What are the main segments of the Insulin Drugs And Delivery Devices Market in Mexico?

The market segments include Drug, Device.

4. Can you provide details about the market size?

The market size is estimated to be USD 546.96 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Rising diabetes prevalence.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

October 2022: Becton, Dickinson, and Company and Biocorp announced that they had signed an agreement to use connected technology to track adherence to self-administered drug therapies, like biologics. To support biopharmaceutical companies in their efforts to improve the adherence and outcomes of injectable drugs, the two companies will integrate Biocorp's Injay technology-a solution designed to capture and transmit injection events using Near Field Communication technology to the BD UltraSafe Plus Passive Needle Guard used with pre-fillable syringes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Insulin Drugs And Delivery Devices Market in Mexico," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Insulin Drugs And Delivery Devices Market in Mexico report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Insulin Drugs And Delivery Devices Market in Mexico?

To stay informed about further developments, trends, and reports in the Insulin Drugs And Delivery Devices Market in Mexico, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence