Key Insights

The UK artificial organs and bionic implants market is poised for steady growth, driven by an increasing prevalence of chronic diseases, a rapidly aging population, and significant advancements in medical technology. While the global market size is substantial, the UK segment benefits from a robust healthcare infrastructure and a proactive approach to adopting innovative medical solutions. The demand for artificial organs such as artificial hearts and kidneys is expected to rise as organ donation shortfalls persist, making bioengineered alternatives and advanced implantable devices a critical necessity. Similarly, the bionic implants sector, encompassing everything from cochlear implants for hearing restoration to sophisticated orthopedic and cardiac bionic devices, is experiencing a surge fueled by improved functionality, greater patient acceptance, and a growing awareness of the quality of life improvements these technologies offer. The UK's National Health Service (NHS) plays a pivotal role in this market, both as a major procurer of these advanced medical technologies and as a facilitator of research and development, encouraging innovation and accessibility.

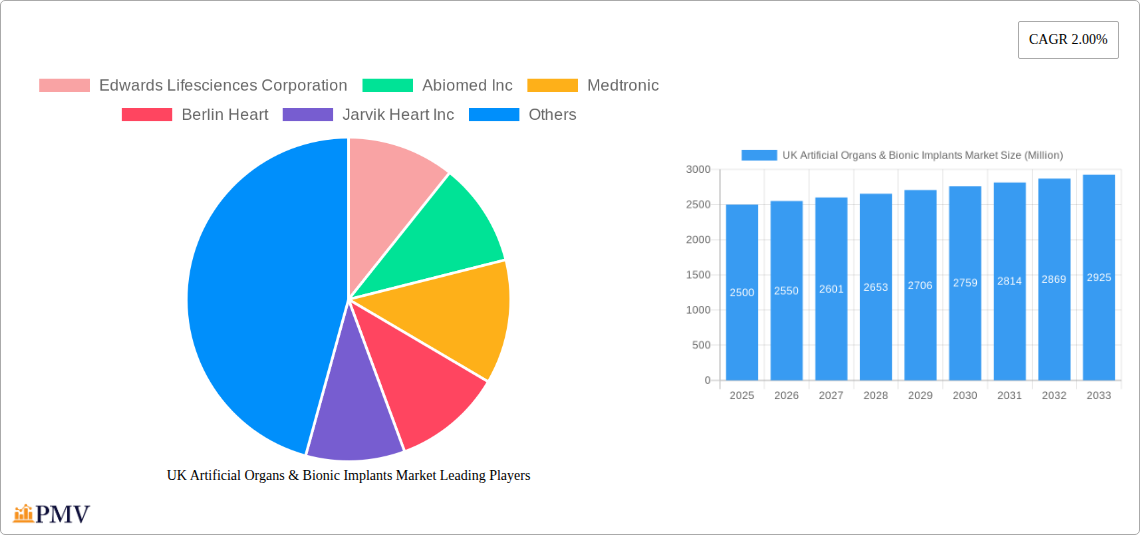

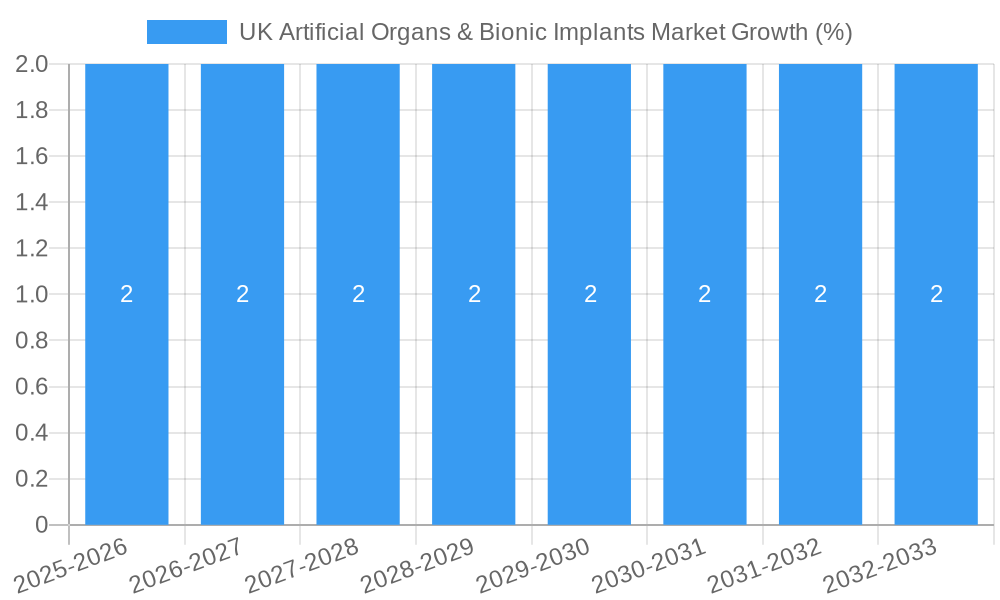

The market's growth trajectory, projected at a Compound Annual Growth Rate (CAGR) of 2.00%, indicates a healthy expansion over the forecast period of 2025-2033. This growth is underpinned by several key drivers, including escalating healthcare expenditure, a rising incidence of conditions like diabetes and cardiovascular diseases that often necessitate artificial organ support, and the continuous innovation in miniaturization, biocompatibility, and integration of bionic devices with the human nervous system. Restraints, such as the high cost of these advanced technologies and the need for specialized surgical expertise and post-operative care, are being addressed through ongoing research aimed at cost reduction and improved training programs. The competitive landscape features established global players alongside emerging UK-based innovators, all vying to capture market share through product differentiation, strategic partnerships, and expanding distribution networks within the UK's healthcare ecosystem.

This in-depth market research report provides a detailed analysis of the UK Artificial Organs & Bionic Implants Market for the Study Period: 2019–2033, with a Base Year: 2025, Estimated Year: 2025, and Forecast Period: 2025–2033. The report covers the Historical Period: 2019–2024, offering unparalleled insights into this rapidly evolving sector.

Keywords: UK Artificial Organs Market, Bionic Implants UK, Artificial Heart UK, Artificial Kidney UK, Cochlear Implants UK, Orthopedic Bionics UK, Cardiac Bionics UK, Medical Technology UK, Healthcare Innovation UK, NHS Bionics, Advanced Prosthetics UK, Regenerative Medicine UK, Biocompatible Materials UK, Medical Device Market UK, Limb Replacement UK, Hearing Aids UK, Neuroprosthetics UK, Cardiovascular Devices UK, Renal Replacement Therapy UK, Market Analysis UK, Market Forecast UK, Industry Report UK, Medtech Market UK.

UK Artificial Organs & Bionic Implants Market Market Structure & Competitive Dynamics

The UK Artificial Organs & Bionic Implants Market is characterized by a moderate to high market concentration, driven by a mix of established global players and emerging specialized companies. Innovation ecosystems are flourishing, fueled by significant investments in research and development, particularly in areas like advanced materials, AI integration, and miniaturization of devices. The regulatory framework, overseen by bodies like the MHRA, is stringent yet adaptive, ensuring patient safety while promoting technological advancement. Potential product substitutes exist in traditional treatments and therapies, but the unique benefits of artificial organs and bionic implants in restoring function and improving quality of life are increasingly recognized. End-user trends indicate a growing demand for minimally invasive procedures, personalized solutions, and long-term implant efficacy. Mergers and Acquisitions (M&A) activities are strategically shaping the market landscape, with companies seeking to expand their product portfolios and geographical reach. For instance, recent M&A deal values in the broader European medtech sector have ranged from tens to hundreds of millions of pounds, indicative of the strategic importance of acquiring innovative technologies. Key players are continuously vying for market share through product differentiation and strategic partnerships.

UK Artificial Organs & Bionic Implants Market Industry Trends & Insights

The UK Artificial Organs & Bionic Implants Market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period. This expansion is primarily propelled by an increasing prevalence of chronic diseases, a growing aging population, and advancements in medical technology. Key market growth drivers include the rising incidence of cardiovascular diseases, diabetes-related complications leading to renal failure, and hearing impairments, all of which necessitate advanced treatment modalities like artificial organs and bionic implants. Technological disruptions are at the forefront, with innovations such as 3D bioprinting for organ regeneration, advanced neural interfaces for bionic limbs, and sophisticated implantable devices for cardiac support playing a crucial role. Consumer preferences are shifting towards solutions that offer improved quality of life, greater autonomy, and longer-term health benefits. The competitive dynamics are intensifying as companies invest heavily in R&D to develop next-generation products with enhanced functionality and reduced invasiveness. The market penetration of these advanced medical devices is steadily increasing, driven by greater clinical acceptance, improved reimbursement policies, and rising healthcare expenditure in the UK. The integration of AI and machine learning in implantable devices is a significant trend, enabling predictive maintenance, personalized therapy, and improved patient outcomes. Furthermore, the growing emphasis on patient-centric care and the development of connected health ecosystems are creating new opportunities for market players. The successful adoption of these technologies is also supported by a growing understanding and acceptance among healthcare professionals and the general public.

Dominant Markets & Segments in UK Artificial Organs & Bionic Implants Market

The Artificial Organ segment, specifically Cochlear Implants, currently exhibits significant dominance within the UK market, driven by the high prevalence of hearing loss and the long-standing effectiveness and widespread adoption of cochlear implant technology. The Bionics segment, particularly Orthopedic Bionic implants, is rapidly gaining traction, fueled by advancements in robotic prosthetics and the increasing demand for enhanced mobility solutions.

Artificial Organs:

- Cochlear Implants: Dominance is attributed to established clinical protocols, a strong patient advocacy base, and continuous technological refinements by leading manufacturers. Government-led public health initiatives and accessible healthcare infrastructure contribute significantly to their market penetration. The economic policies supporting long-term healthcare solutions and the robust research infrastructure in the UK further bolster this segment.

- Artificial Heart: While a more complex and resource-intensive segment, advancements in ventricular assist devices (VADs) and total artificial hearts are driving growth, particularly for end-stage heart failure patients. Investment in advanced cardiovascular research and the presence of specialized cardiac centers in the UK are key drivers.

- Artificial Kidney: Ongoing research into artificial kidney technologies, including wearable dialyzers and bio-artificial kidneys, shows immense potential. However, widespread clinical adoption is still in its nascent stages, facing challenges related to cost and long-term viability.

- Other Organ Types: This includes nascent but promising research in areas like artificial lungs and livers, which are currently in pre-clinical or early clinical trial phases but hold significant future market potential.

Bionics:

- Orthopedic Bionic: This segment is witnessing rapid expansion due to breakthroughs in prosthetic limb technology, neuro-muscular interfaces, and AI-powered control systems. The UK's commitment to veteran care and rehabilitation programs, alongside advancements in biomechanics research, is a significant growth catalyst.

- Ear Bionics: Beyond cochlear implants, this segment includes other auditory prosthetic devices addressing various types of hearing loss and middle ear disorders, with ongoing innovation in signal processing and miniaturization.

- Cardiac Bionics: This segment largely overlaps with artificial hearts and VADs, focusing on devices that assist or replace the pumping function of the heart.

- Other Bionics: This encompasses a broad range of emerging technologies, including neuroprosthetics for spinal cord injuries, advanced exoskeletons for mobility assistance, and sensory substitution devices.

UK Artificial Organs & Bionic Implants Market Product Innovations

The UK Artificial Organs & Bionic Implants Market is defined by relentless product innovation, focusing on enhanced biocompatibility, improved functionality, and reduced invasiveness. Key technological trends include the integration of AI for adaptive device performance, miniaturization for less intrusive implants, and the use of advanced materials for greater durability and patient comfort. Developments in 3D printing are revolutionizing the creation of customized artificial organs and implant components, offering bespoke solutions for individual patient anatomies. These innovations aim to bridge the gap between existing treatment limitations and patient needs, providing more effective, safer, and patient-friendly alternatives. For example, advancements in neuro-prosthetics are enabling individuals with paralysis to regain limb control through direct brain-computer interfaces, showcasing the transformative potential of these technologies. The competitive advantage lies in developing devices that offer superior clinical outcomes, reduce recovery times, and integrate seamlessly into patients' lives.

Report Segmentation & Scope

This report segments the UK Artificial Organs & Bionic Implants Market into two primary categories: Artificial Organs and Bionics.

The Artificial Organ segment is further broken down into:

- Artificial Heart: Covering devices like ventricular assist devices (VADs) and total artificial hearts used for end-stage heart failure. Growth projections for this segment are moderate, with market sizes influenced by the availability of advanced cardiac surgery and transplant programs.

- Artificial Kidney: Encompassing current dialysis technologies and emerging bio-artificial kidney solutions, with significant future growth potential contingent on technological breakthroughs and cost-effectiveness.

- Cochlear Implants: Addressing profound hearing loss through implantable hearing devices. This segment is projected to maintain strong growth due to its established efficacy and increasing awareness.

- Other Organ Types: Including research and early-stage development of artificial lungs, livers, and other vital organs. This segment is expected to see substantial growth in the long term as technology matures.

The Bionics segment is segmented into:

- Ear Bionics: Beyond cochlear implants, this includes other implantable auditory prosthetics.

- Orthopedic Bionic: Focusing on advanced prosthetic limbs, robotic exoskeletons, and assistive devices for mobility. This segment is anticipated to experience rapid growth driven by technological advancements and rehabilitation needs.

- Cardiac Bionics: Devices that assist or replace cardiac function, often overlapping with artificial heart technologies.

- Other Bionics: This broad category includes neuroprosthetics, sensory substitution devices, and other emerging bio-integrated technologies.

Key Drivers of UK Artificial Organs & Bionic Implants Market Growth

The UK Artificial Organs & Bionic Implants Market growth is propelled by several interconnected factors. Technological advancements in fields like biomaterials, nanotechnology, AI, and robotics are leading to the development of more sophisticated and effective devices. The increasing prevalence of chronic diseases, such as cardiovascular conditions, kidney failure, and degenerative neurological disorders, creates a sustained demand for advanced therapeutic solutions. Demographic shifts, including an aging population, further contribute to this demand as age-related health issues become more common. Growing healthcare expenditure in the UK, coupled with supportive government initiatives and policies aimed at improving patient outcomes and access to innovative treatments, also plays a crucial role. Furthermore, rising patient awareness and acceptance of implantable technologies, driven by successful clinical outcomes and patient advocacy groups, are key accelerators.

Challenges in the UK Artificial Organs & Bionic Implants Market Sector

Despite the promising growth trajectory, the UK Artificial Organs & Bionic Implants Market faces several challenges. High research and development costs coupled with the lengthy and rigorous regulatory approval processes for novel medical devices pose significant barriers. Reimbursement policies can sometimes be complex and inconsistent, impacting the accessibility and affordability of these advanced technologies for some patient populations. Supply chain complexities and the need for highly specialized manufacturing processes can also lead to production bottlenecks. Competition from established traditional treatments and the need for extensive patient and clinician training for the effective use of complex bionic devices present further hurdles. The ethical considerations surrounding artificial life support and advanced prosthetics also require careful navigation.

Leading Players in the UK Artificial Organs & Bionic Implants Market Market

- Edwards Lifesciences Corporation

- Abiomed Inc

- Medtronic

- Berlin Heart

- Jarvik Heart Inc

- Ekso Bionics

- Abbott

- Cochlear Ltd

Key Developments in UK Artificial Organs & Bionic Implants Market Sector

- November 2022: NHS announced that brain-controlled bionic arms that mimic real hand movements will be offered to amputees on the NHS. The newly available bionic arms controlled by electrical brain signals have multi-grip capabilities, enabling a greater range of movements to make day-to-day tasks easier. This development signifies a major step forward in the accessibility and sophistication of bionic limb technology within the public healthcare system.

- April 2022: Oticon Medical's parent company, Demant, decided to discontinue its hearing implants business and, therefore, has negotiated an agreement with the intention to sell Oticon Medical to Cochlear. This strategic move by Cochlear is expected to consolidate its market position and potentially drive further innovation and integration within the cochlear implant sector.

Strategic UK Artificial Organs & Bionic Implants Market Market Outlook

- November 2022: NHS announced that brain-controlled bionic arms that mimic real hand movements will be offered to amputees on the NHS. The newly available bionic arms controlled by electrical brain signals have multi-grip capabilities, enabling a greater range of movements to make day-to-day tasks easier. This development signifies a major step forward in the accessibility and sophistication of bionic limb technology within the public healthcare system.

- April 2022: Oticon Medical's parent company, Demant, decided to discontinue its hearing implants business and, therefore, has negotiated an agreement with the intention to sell Oticon Medical to Cochlear. This strategic move by Cochlear is expected to consolidate its market position and potentially drive further innovation and integration within the cochlear implant sector.

Strategic UK Artificial Organs & Bionic Implants Market Market Outlook

The strategic outlook for the UK Artificial Organs & Bionic Implants Market is exceptionally strong, driven by continuous innovation and increasing demand. Growth accelerators include the ongoing miniaturization and enhanced intelligence of implantable devices, leading to improved patient outcomes and reduced invasiveness. The expansion of the bionics sector, particularly in orthopedic and neuroprosthetics, presents significant opportunities for restoring mobility and function. Strategic collaborations between medical device manufacturers, research institutions, and healthcare providers will be crucial for market penetration and adoption. Furthermore, the growing focus on personalized medicine and the potential of regenerative medicine techniques offer long-term avenues for growth. Investments in R&D for advanced materials and AI integration will further solidify the UK's position as a leader in this transformative medical technology landscape, unlocking substantial market potential and creating new avenues for strategic expansion.

UK Artificial Organs & Bionic Implants Market Segmentation

-

1. Type

-

1.1. Artificial Organ

- 1.1.1. Artificial Heart

- 1.1.2. Artificial Kidney

- 1.1.3. Cochlear Implants

- 1.1.4. Other Organ Types

-

1.2. Bionics

- 1.2.1. Ear Bionics

- 1.2.2. Orthopedic Bionic

- 1.2.3. Cardiac Bionics

- 1.2.4. Other Bionics

-

1.1. Artificial Organ

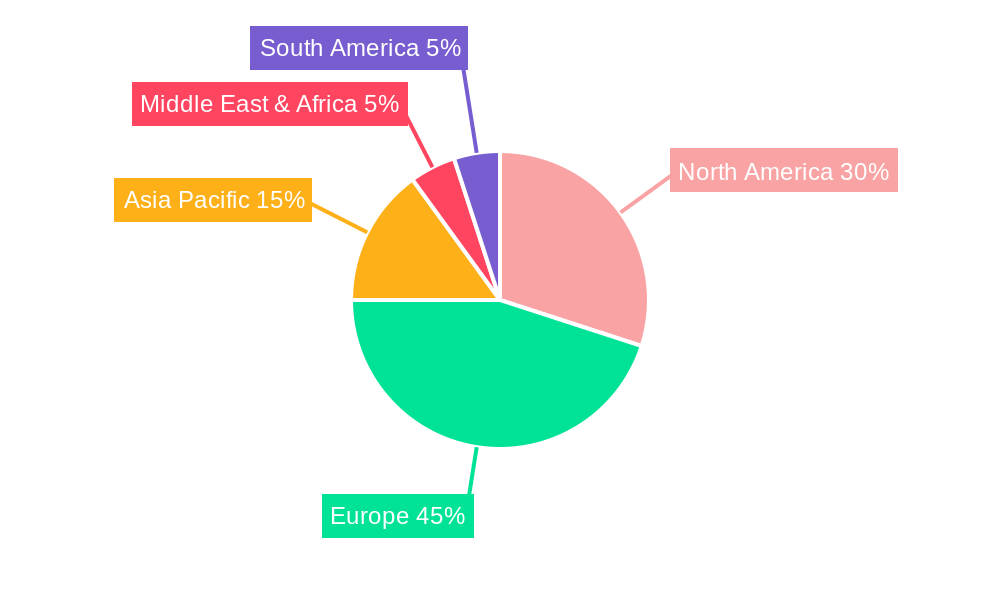

UK Artificial Organs & Bionic Implants Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Artificial Organs & Bionic Implants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Incidence of Disabilities

- 3.2.2 Organ Failures and Scarcity of Donor Organs; Technological Advancements in the Artificial Organ and Bionics

- 3.3. Market Restrains

- 3.3.1. Expensive Procedures; Risk of Compatibility Issues and Malfunctions

- 3.4. Market Trends

- 3.4.1. Artificial Heart Segment is Estimated to Witness a Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Artificial Organ

- 5.1.1.1. Artificial Heart

- 5.1.1.2. Artificial Kidney

- 5.1.1.3. Cochlear Implants

- 5.1.1.4. Other Organ Types

- 5.1.2. Bionics

- 5.1.2.1. Ear Bionics

- 5.1.2.2. Orthopedic Bionic

- 5.1.2.3. Cardiac Bionics

- 5.1.2.4. Other Bionics

- 5.1.1. Artificial Organ

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Artificial Organ

- 6.1.1.1. Artificial Heart

- 6.1.1.2. Artificial Kidney

- 6.1.1.3. Cochlear Implants

- 6.1.1.4. Other Organ Types

- 6.1.2. Bionics

- 6.1.2.1. Ear Bionics

- 6.1.2.2. Orthopedic Bionic

- 6.1.2.3. Cardiac Bionics

- 6.1.2.4. Other Bionics

- 6.1.1. Artificial Organ

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Artificial Organ

- 7.1.1.1. Artificial Heart

- 7.1.1.2. Artificial Kidney

- 7.1.1.3. Cochlear Implants

- 7.1.1.4. Other Organ Types

- 7.1.2. Bionics

- 7.1.2.1. Ear Bionics

- 7.1.2.2. Orthopedic Bionic

- 7.1.2.3. Cardiac Bionics

- 7.1.2.4. Other Bionics

- 7.1.1. Artificial Organ

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Artificial Organ

- 8.1.1.1. Artificial Heart

- 8.1.1.2. Artificial Kidney

- 8.1.1.3. Cochlear Implants

- 8.1.1.4. Other Organ Types

- 8.1.2. Bionics

- 8.1.2.1. Ear Bionics

- 8.1.2.2. Orthopedic Bionic

- 8.1.2.3. Cardiac Bionics

- 8.1.2.4. Other Bionics

- 8.1.1. Artificial Organ

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Artificial Organ

- 9.1.1.1. Artificial Heart

- 9.1.1.2. Artificial Kidney

- 9.1.1.3. Cochlear Implants

- 9.1.1.4. Other Organ Types

- 9.1.2. Bionics

- 9.1.2.1. Ear Bionics

- 9.1.2.2. Orthopedic Bionic

- 9.1.2.3. Cardiac Bionics

- 9.1.2.4. Other Bionics

- 9.1.1. Artificial Organ

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Artificial Organ

- 10.1.1.1. Artificial Heart

- 10.1.1.2. Artificial Kidney

- 10.1.1.3. Cochlear Implants

- 10.1.1.4. Other Organ Types

- 10.1.2. Bionics

- 10.1.2.1. Ear Bionics

- 10.1.2.2. Orthopedic Bionic

- 10.1.2.3. Cardiac Bionics

- 10.1.2.4. Other Bionics

- 10.1.1. Artificial Organ

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. England UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Edwards Lifesciences Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Abiomed Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Medtronic

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Berlin Heart

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Jarvik Heart Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Ekso Bionics*List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Abbott

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Cochlear Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Edwards Lifesciences Corporation

List of Figures

- Figure 1: Global UK Artificial Organs & Bionic Implants Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Artificial Organs & Bionic Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Artificial Organs & Bionic Implants Market Revenue (Million), by Type 2024 & 2032

- Figure 5: North America UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America UK Artificial Organs & Bionic Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America UK Artificial Organs & Bionic Implants Market Revenue (Million), by Type 2024 & 2032

- Figure 9: South America UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America UK Artificial Organs & Bionic Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe UK Artificial Organs & Bionic Implants Market Revenue (Million), by Type 2024 & 2032

- Figure 13: Europe UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: Europe UK Artificial Organs & Bionic Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa UK Artificial Organs & Bionic Implants Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Middle East & Africa UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Middle East & Africa UK Artificial Organs & Bionic Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific UK Artificial Organs & Bionic Implants Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Asia Pacific UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Asia Pacific UK Artificial Organs & Bionic Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific UK Artificial Organs & Bionic Implants Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: England UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Wales UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Scotland UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Ireland UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Russia UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Benelux UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Nordics UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global UK Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific UK Artificial Organs & Bionic Implants Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Artificial Organs & Bionic Implants Market?

The projected CAGR is approximately 2.00%.

2. Which companies are prominent players in the UK Artificial Organs & Bionic Implants Market?

Key companies in the market include Edwards Lifesciences Corporation, Abiomed Inc, Medtronic, Berlin Heart, Jarvik Heart Inc, Ekso Bionics*List Not Exhaustive, Abbott, Cochlear Ltd.

3. What are the main segments of the UK Artificial Organs & Bionic Implants Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Incidence of Disabilities. Organ Failures and Scarcity of Donor Organs; Technological Advancements in the Artificial Organ and Bionics.

6. What are the notable trends driving market growth?

Artificial Heart Segment is Estimated to Witness a Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Expensive Procedures; Risk of Compatibility Issues and Malfunctions.

8. Can you provide examples of recent developments in the market?

November 2022: NHS announced that brain-controlled bionic arms that mimic real hand movements will be offered to amputees on the NHS. The newly available bionic arms controlled by electrical brain signals have multi-grip capabilities, enabling a greater range of movements to make day-to-day tasks easier.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Artificial Organs & Bionic Implants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Artificial Organs & Bionic Implants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Artificial Organs & Bionic Implants Market?

To stay informed about further developments, trends, and reports in the UK Artificial Organs & Bionic Implants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence