Key Insights

The Global Intraoperative Radiation Therapy (IORT) Market is poised for significant expansion, propelled by its increasing integration in oncology and technological advancements. The market, valued at $251.77 million in the base year 2025, is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 12.1%. This growth is attributed to the rising incidence of cancers such as breast and brain tumors, where IORT offers a precise, targeted treatment, minimizing harm to surrounding healthy tissue. Innovations in IORT systems, including advanced applicators and planning software, are enhancing treatment efficacy and patient experience, driving market adoption. Furthermore, the growing emphasis on personalized medicine and minimally invasive surgical techniques supports the broader integration of IORT into cancer care protocols.

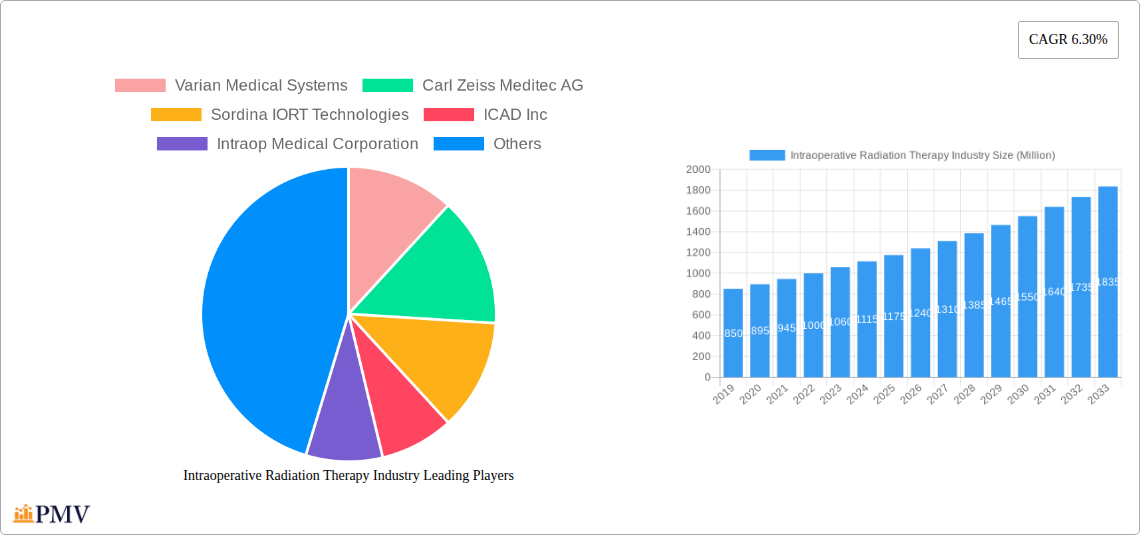

Intraoperative Radiation Therapy Industry Market Size (In Million)

Market segmentation by modality and product type highlights varied growth opportunities. Electron IORT and Intraoperative Brachytherapy remain key modalities, with ongoing developments focused on enhanced accuracy and safety. Demand is expected to be strong for "Systems/Accelerators" and "Applicators and Afterloaders" as healthcare facilities invest in IORT infrastructure. Geographically, North America leads due to early adoption of medical technologies and a high cancer prevalence. The Asia Pacific region presents substantial growth potential, driven by increased healthcare investment, a rising cancer burden, and government initiatives to strengthen cancer care. Challenges to widespread adoption may include the initial capital investment for IORT equipment and the requirement for specialized professional training, particularly in resource-constrained environments.

Intraoperative Radiation Therapy Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Intraoperative Radiation Therapy (IORT) market, detailing its structure, key trends, dominant segments, and competitive landscape. Spanning a study period from 2019 to 2033 with 2025 as the base year, this report offers actionable intelligence for stakeholders in the evolving oncology radiation therapy sector. The global IORT market is set for substantial growth, fueled by technological innovations, increasing cancer diagnoses, and a growing preference for minimally invasive treatments. We examine key market players, product advancements, and the strategic outlook within this vital segment of the cancer treatment market.

Intraoperative Radiation Therapy Industry Market Structure & Competitive Dynamics

The Intraoperative Radiation Therapy market exhibits a moderate to high concentration, with key players like Varian Medical Systems, Elekta AB, and Carl Zeiss Meditec AG holding significant market share. The innovation ecosystem is robust, characterized by continuous product development and technological integration to enhance treatment efficacy and patient outcomes. Regulatory frameworks, while stringent, are evolving to accommodate new IORT modalities and applications. Product substitutes, such as external beam radiation therapy and conventional brachytherapy, exist, but IORT offers distinct advantages in terms of precision and reduced treatment time. End-user trends point towards an increasing preference for localized and targeted cancer treatments, especially for early-stage and recurrent cancers. Mergers and acquisitions (M&A) activities are a key feature, with strategic acquisitions aimed at expanding product portfolios and market reach. Recent M&A deal values indicate a growing investor confidence in the IORT sector. For instance, the acquisition of smaller IORT technology providers by larger medical device manufacturers reflects this consolidation trend. The market share distribution underscores the competitive intensity, with leading companies vying for dominance through technological superiority and expanded clinical applications.

Intraoperative Radiation Therapy Industry Industry Trends & Insights

The Intraoperative Radiation Therapy industry is poised for substantial growth, driven by a confluence of technological advancements, increasing cancer prevalence, and a shift towards personalized medicine. The market is experiencing a CAGR of approximately 7.5% during the forecast period. Market penetration of IORT is steadily increasing as oncologists and surgical teams recognize its efficacy in delivering high doses of radiation directly to tumor sites during surgery, minimizing damage to surrounding healthy tissues. This precision in cancer treatment translates to improved patient outcomes, reduced side effects, and shorter recovery times, thereby fueling demand.

Technological disruptions are at the forefront of market evolution. Innovations in miniaturization of accelerators, development of advanced applicators, and sophisticated treatment planning systems are making IORT more accessible and adaptable to a wider range of cancers and surgical procedures. The integration of artificial intelligence (AI) and machine learning in treatment planning is further enhancing the accuracy and efficiency of IORT delivery.

Consumer preferences are increasingly leaning towards less invasive and more targeted therapies. Patients, armed with more information, are seeking treatment options that offer better quality of life and faster return to normalcy. IORT perfectly aligns with these preferences, making it a highly sought-after modality.

Competitive dynamics within the market are characterized by intense innovation and strategic collaborations. Companies are investing heavily in R&D to develop next-generation IORT devices and expand their clinical applications. Strategic partnerships between device manufacturers, research institutions, and healthcare providers are crucial for clinical validation and wider adoption of IORT technologies. The growing emphasis on oncology solutions and radiotherapy equipment by a broad spectrum of healthcare providers is a testament to the expanding market.

The increasing incidence of various cancers, including breast cancer, brain tumors, and gastrointestinal cancers, directly translates into a larger patient pool eligible for IORT. Furthermore, the effectiveness of IORT in treating recurrent tumors and in situations where conventional radiotherapy is challenging makes it an indispensable tool in the oncologist's arsenal. The global expansion of healthcare infrastructure and increased expenditure on advanced medical technologies in emerging economies also contribute significantly to market growth. The IORT market value is projected to reach over $5,000 million by 2033.

Dominant Markets & Segments in Intraoperative Radiation Therapy Industry

The Intraoperative Radiation Therapy market demonstrates significant dominance across several key segments, driven by specific medical needs and technological advancements.

Dominant Method:

- Electron IORT stands out as the most prevalent method. This is attributed to its proven efficacy, versatility, and the availability of sophisticated delivery systems.

- Key Drivers:

- Established clinical evidence and wide acceptance in surgical oncology.

- Technological maturity and robust infrastructure supporting electron beam delivery.

- Suitability for treating a broad spectrum of superficial and moderately deep-seated tumors.

- Key Drivers:

Dominant Product & Service:

- Systems/Accelerators represent the largest segment. The core IORT devices, which include compact linear accelerators designed for intraoperative use, are critical for treatment delivery.

- Key Drivers:

- Essential component for any IORT procedure; demand is directly linked to IORT adoption.

- Continuous innovation in miniaturization and beam control enhances their applicability.

- High capital investment associated with these systems drives their market value.

- Key Drivers:

Dominant Application:

- Breast Cancer application dominates the IORT market. The success of single-fraction IORT in early-stage breast cancer treatment has made it a standard of care in many regions.

- Key Drivers:

- High incidence of breast cancer globally.

- Demonstrated effectiveness of IORT in reducing local recurrence rates and preserving breast aesthetics.

- Patient preference for less invasive and shorter treatment durations.

- Key Drivers:

Geographic Dominance:

- North America and Europe currently lead the IORT market, owing to high healthcare expenditure, advanced medical infrastructure, and early adoption of innovative cancer treatments. However, the Asia-Pacific region is emerging as a high-growth market, driven by increasing cancer rates, expanding healthcare access, and government initiatives to promote advanced medical technologies.

Segmentation Analysis:

- Intraoperative Brachytherapy: While not as dominant as Electron IORT, this segment is growing, particularly for specific tumor types where interstitial or intracavitary application is beneficial. Its growth is fueled by advancements in miniaturized radioactive sources and remote afterloading systems, projected to reach approximately $800 million by 2033.

- Other Methods: This category includes emerging IORT techniques and specialized applications, which are expected to see steady growth as research and development continue, potentially reaching $400 million by 2033.

- Applicators and Afterloaders: As the core of IORT delivery, this segment is directly tied to the growth of the accelerators market, with advancements in applicator design enhancing precision and treatment options, projected to reach over $1,200 million by 2033.

- Treatment Planning Systems: Sophisticated TPS are crucial for accurate IORT dose calculation and delivery. Their market is expanding with the integration of AI and advanced imaging, estimated to reach $600 million by 2033.

- Accessories: This segment, encompassing items like shielding, positioning devices, and disposables, sees consistent demand mirroring the overall IORT market growth, projected to be around $300 million by 2033.

- Brain Tumor: IORT for brain tumors is a significant niche application, driven by the need for precise radiation delivery in a critical anatomical region. Projected market value is approximately $700 million by 2033.

- Gastrointestinal Cancer: With advancements in IORT techniques for abdominal and pelvic cancers, this segment is experiencing a notable upward trend, with a projected market value of $500 million by 2033.

- Head and Neck Cancer: IORT offers benefits in treating complex head and neck tumors, minimizing damage to vital structures. This segment is expected to grow to $450 million by 2033.

- Other Applications: This encompasses a range of less common but growing applications, contributing to overall market diversification and reaching an estimated $350 million by 2033.

Intraoperative Radiation Therapy Industry Product Innovations

Product innovations in the IORT industry are primarily focused on enhancing precision, portability, and ease of use. Miniaturized linear accelerators capable of delivering high-energy X-rays or electrons directly at the surgical site are a key development. Advanced applicator designs are enabling more targeted radiation delivery for diverse tumor shapes and locations, such as the INTRABEAM 600 device, which offers a minimally disruptive treatment for early-stage breast cancer. Treatment planning systems are becoming more sophisticated, incorporating AI for real-time dose optimization and adaptive planning, leading to improved clinical outcomes and reduced treatment times. These innovations cater to the growing demand for precise, localized cancer therapies, providing a competitive edge for companies investing in cutting-edge oncology radiation technology.

Report Segmentation & Scope

This report segments the Intraoperative Radiation Therapy market based on critical parameters to provide a granular understanding of its dynamics. The segmentation includes:

- Method: Covering Electron IORT, Intraoperative Brachytherapy, and Other Methods. Each segment's growth is influenced by its specific applications and technological advancements. For instance, Electron IORT is expected to maintain its lead, while Intraoperative Brachytherapy is poised for steady growth.

- Products and Services: This encompasses Systems/Accelerators, Applicators and Afterloaders, Treatment Planning Systems, and Accessories. The Systems/Accelerators segment is the largest, with significant growth projected for Treatment Planning Systems due to AI integration.

- Application: The report analyzes key applications including Breast Cancer, Brain Tumor, Gastrointestinal Cancer, Head and Neck Cancer, and Other Applications. Breast Cancer is the dominant application, with Brain Tumor and Gastrointestinal Cancer showing strong growth potential.

The scope of this report covers the global market, providing detailed insights into market size, growth projections, and competitive landscapes for each segment.

Key Drivers of Intraoperative Radiation Therapy Industry Growth

The Intraoperative Radiation Therapy industry is propelled by several key drivers. The escalating global incidence of cancer, particularly breast, brain, and gastrointestinal cancers, creates a continuously expanding patient pool eligible for IORT. Technological advancements are a significant catalyst; miniaturized accelerators, sophisticated applicators, and intelligent treatment planning systems are making IORT more accessible and effective. The growing preference for minimally invasive procedures and faster recovery times among patients further fuels demand. Regulatory bodies are increasingly recognizing and approving IORT for various oncological indications, facilitating broader adoption. Furthermore, increased healthcare expenditure and government initiatives aimed at improving cancer care infrastructure worldwide are contributing to market expansion.

Challenges in the Intraoperative Radiation Therapy Industry Sector

Despite its promising growth, the Intraoperative Radiation Therapy sector faces certain challenges. High upfront costs associated with IORT equipment can be a barrier to adoption, particularly for smaller healthcare facilities or in emerging economies. The need for specialized training for surgical and radiation oncology teams to effectively operate IORT systems can also pose a hurdle. Regulatory complexities and the time required for clinical validation of new IORT applications can slow down market penetration. Additionally, while IORT offers precision, potential risks of complications, though low, necessitate careful patient selection and treatment planning. Intense competition from established radiation therapy modalities and the constant need for technological innovation to stay ahead of the curve also present ongoing challenges.

Leading Players in the Intraoperative Radiation Therapy Industry Market

- Varian Medical Systems

- Carl Zeiss Meditec AG

- Sordina IORT Technologies

- ICAD Inc

- Intraop Medical Corporation

- Varian Medical Systems Inc

- Elekta AB

- GMV Innovating Solutions

- Ariane Medical Systems Ltd

- Isoray Inc

- Eckert & Ziegler

- Sensus Healthcare Inc

Key Developments in Intraoperative Radiation Therapy Industry Sector

- March 2022: Zeiss Medical Technology introduced the INTRABEAM 600 device to provide Intraoperative Radiation Therapy (IORT) in India. This device offers a minimally disruptive treatment method for patients diagnosed with early-stage breast cancer.

- February 2022: Fortis Cancer Institute announced the installation of Karnataka's first Intraoperative radiotherapy (IORT) system for the treatment of breast cancer.

Strategic Intraoperative Radiation Therapy Industry Market Outlook

The strategic market outlook for the Intraoperative Radiation Therapy industry is exceptionally positive, driven by ongoing innovation and a widening acceptance of its therapeutic benefits. The focus on precision oncology and minimally invasive techniques will continue to be a major growth accelerator. Expansion into new geographical markets, particularly in Asia and Latin America, presents significant opportunities. Strategic collaborations between technology providers, hospitals, and research institutions will foster further development of advanced IORT applications and treatment protocols. Investments in AI-driven treatment planning and robotic-assisted IORT systems are expected to shape the future landscape, enhancing efficiency and patient outcomes. The IORT market is poised for sustained growth, solidifying its position as a critical component of modern cancer care.

Intraoperative Radiation Therapy Industry Segmentation

-

1. Method

- 1.1. Electron IORT

- 1.2. Intraoperative Brachytherapy

- 1.3. Other Methods

-

2. Products and Services

- 2.1. Systems/Accelerators

- 2.2. Applicators and Afterloaders

- 2.3. Treatment Planning Systems

- 2.4. Accessories

-

3. Application

- 3.1. Breast Cancer

- 3.2. Brain Tumor

- 3.3. Gastrointestinal Cancer

- 3.4. Head and Neck Cancer

- 3.5. Other Applications

Intraoperative Radiation Therapy Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Intraoperative Radiation Therapy Industry Regional Market Share

Geographic Coverage of Intraoperative Radiation Therapy Industry

Intraoperative Radiation Therapy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Global Prevalence of Cancer; Advancements in Cancer Therapy Technologies; Advantages of IORT Over External Beam Radiotherapy

- 3.3. Market Restrains

- 3.3.1. Limitations of IORT and Shortage of Trained Personnel; Preference for Conventional Radiotherapy Over Intraoperative Radiation Therapy

- 3.4. Market Trends

- 3.4.1. Electron IORT Segment is Expected to Hold Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Intraoperative Radiation Therapy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Method

- 5.1.1. Electron IORT

- 5.1.2. Intraoperative Brachytherapy

- 5.1.3. Other Methods

- 5.2. Market Analysis, Insights and Forecast - by Products and Services

- 5.2.1. Systems/Accelerators

- 5.2.2. Applicators and Afterloaders

- 5.2.3. Treatment Planning Systems

- 5.2.4. Accessories

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Breast Cancer

- 5.3.2. Brain Tumor

- 5.3.3. Gastrointestinal Cancer

- 5.3.4. Head and Neck Cancer

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Method

- 6. North America Intraoperative Radiation Therapy Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Method

- 6.1.1. Electron IORT

- 6.1.2. Intraoperative Brachytherapy

- 6.1.3. Other Methods

- 6.2. Market Analysis, Insights and Forecast - by Products and Services

- 6.2.1. Systems/Accelerators

- 6.2.2. Applicators and Afterloaders

- 6.2.3. Treatment Planning Systems

- 6.2.4. Accessories

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Breast Cancer

- 6.3.2. Brain Tumor

- 6.3.3. Gastrointestinal Cancer

- 6.3.4. Head and Neck Cancer

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Method

- 7. Europe Intraoperative Radiation Therapy Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Method

- 7.1.1. Electron IORT

- 7.1.2. Intraoperative Brachytherapy

- 7.1.3. Other Methods

- 7.2. Market Analysis, Insights and Forecast - by Products and Services

- 7.2.1. Systems/Accelerators

- 7.2.2. Applicators and Afterloaders

- 7.2.3. Treatment Planning Systems

- 7.2.4. Accessories

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Breast Cancer

- 7.3.2. Brain Tumor

- 7.3.3. Gastrointestinal Cancer

- 7.3.4. Head and Neck Cancer

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Method

- 8. Asia Pacific Intraoperative Radiation Therapy Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Method

- 8.1.1. Electron IORT

- 8.1.2. Intraoperative Brachytherapy

- 8.1.3. Other Methods

- 8.2. Market Analysis, Insights and Forecast - by Products and Services

- 8.2.1. Systems/Accelerators

- 8.2.2. Applicators and Afterloaders

- 8.2.3. Treatment Planning Systems

- 8.2.4. Accessories

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Breast Cancer

- 8.3.2. Brain Tumor

- 8.3.3. Gastrointestinal Cancer

- 8.3.4. Head and Neck Cancer

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Method

- 9. Middle East and Africa Intraoperative Radiation Therapy Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Method

- 9.1.1. Electron IORT

- 9.1.2. Intraoperative Brachytherapy

- 9.1.3. Other Methods

- 9.2. Market Analysis, Insights and Forecast - by Products and Services

- 9.2.1. Systems/Accelerators

- 9.2.2. Applicators and Afterloaders

- 9.2.3. Treatment Planning Systems

- 9.2.4. Accessories

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Breast Cancer

- 9.3.2. Brain Tumor

- 9.3.3. Gastrointestinal Cancer

- 9.3.4. Head and Neck Cancer

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Method

- 10. South America Intraoperative Radiation Therapy Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Method

- 10.1.1. Electron IORT

- 10.1.2. Intraoperative Brachytherapy

- 10.1.3. Other Methods

- 10.2. Market Analysis, Insights and Forecast - by Products and Services

- 10.2.1. Systems/Accelerators

- 10.2.2. Applicators and Afterloaders

- 10.2.3. Treatment Planning Systems

- 10.2.4. Accessories

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Breast Cancer

- 10.3.2. Brain Tumor

- 10.3.3. Gastrointestinal Cancer

- 10.3.4. Head and Neck Cancer

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Method

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Varian Medical Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carl Zeiss Meditec AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sordina IORT Technologies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ICAD Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Intraop Medical Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Varian Medical Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Elekta AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GMV Innovating Solutions

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ariane Medical Systems Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Isoray Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Eckert & Ziegler

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sensus Healthcare Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Varian Medical Systems

List of Figures

- Figure 1: Global Intraoperative Radiation Therapy Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Intraoperative Radiation Therapy Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Intraoperative Radiation Therapy Industry Revenue (million), by Method 2025 & 2033

- Figure 4: North America Intraoperative Radiation Therapy Industry Volume (K Unit), by Method 2025 & 2033

- Figure 5: North America Intraoperative Radiation Therapy Industry Revenue Share (%), by Method 2025 & 2033

- Figure 6: North America Intraoperative Radiation Therapy Industry Volume Share (%), by Method 2025 & 2033

- Figure 7: North America Intraoperative Radiation Therapy Industry Revenue (million), by Products and Services 2025 & 2033

- Figure 8: North America Intraoperative Radiation Therapy Industry Volume (K Unit), by Products and Services 2025 & 2033

- Figure 9: North America Intraoperative Radiation Therapy Industry Revenue Share (%), by Products and Services 2025 & 2033

- Figure 10: North America Intraoperative Radiation Therapy Industry Volume Share (%), by Products and Services 2025 & 2033

- Figure 11: North America Intraoperative Radiation Therapy Industry Revenue (million), by Application 2025 & 2033

- Figure 12: North America Intraoperative Radiation Therapy Industry Volume (K Unit), by Application 2025 & 2033

- Figure 13: North America Intraoperative Radiation Therapy Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Intraoperative Radiation Therapy Industry Volume Share (%), by Application 2025 & 2033

- Figure 15: North America Intraoperative Radiation Therapy Industry Revenue (million), by Country 2025 & 2033

- Figure 16: North America Intraoperative Radiation Therapy Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Intraoperative Radiation Therapy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Intraoperative Radiation Therapy Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Intraoperative Radiation Therapy Industry Revenue (million), by Method 2025 & 2033

- Figure 20: Europe Intraoperative Radiation Therapy Industry Volume (K Unit), by Method 2025 & 2033

- Figure 21: Europe Intraoperative Radiation Therapy Industry Revenue Share (%), by Method 2025 & 2033

- Figure 22: Europe Intraoperative Radiation Therapy Industry Volume Share (%), by Method 2025 & 2033

- Figure 23: Europe Intraoperative Radiation Therapy Industry Revenue (million), by Products and Services 2025 & 2033

- Figure 24: Europe Intraoperative Radiation Therapy Industry Volume (K Unit), by Products and Services 2025 & 2033

- Figure 25: Europe Intraoperative Radiation Therapy Industry Revenue Share (%), by Products and Services 2025 & 2033

- Figure 26: Europe Intraoperative Radiation Therapy Industry Volume Share (%), by Products and Services 2025 & 2033

- Figure 27: Europe Intraoperative Radiation Therapy Industry Revenue (million), by Application 2025 & 2033

- Figure 28: Europe Intraoperative Radiation Therapy Industry Volume (K Unit), by Application 2025 & 2033

- Figure 29: Europe Intraoperative Radiation Therapy Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Intraoperative Radiation Therapy Industry Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Intraoperative Radiation Therapy Industry Revenue (million), by Country 2025 & 2033

- Figure 32: Europe Intraoperative Radiation Therapy Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Intraoperative Radiation Therapy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Intraoperative Radiation Therapy Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Intraoperative Radiation Therapy Industry Revenue (million), by Method 2025 & 2033

- Figure 36: Asia Pacific Intraoperative Radiation Therapy Industry Volume (K Unit), by Method 2025 & 2033

- Figure 37: Asia Pacific Intraoperative Radiation Therapy Industry Revenue Share (%), by Method 2025 & 2033

- Figure 38: Asia Pacific Intraoperative Radiation Therapy Industry Volume Share (%), by Method 2025 & 2033

- Figure 39: Asia Pacific Intraoperative Radiation Therapy Industry Revenue (million), by Products and Services 2025 & 2033

- Figure 40: Asia Pacific Intraoperative Radiation Therapy Industry Volume (K Unit), by Products and Services 2025 & 2033

- Figure 41: Asia Pacific Intraoperative Radiation Therapy Industry Revenue Share (%), by Products and Services 2025 & 2033

- Figure 42: Asia Pacific Intraoperative Radiation Therapy Industry Volume Share (%), by Products and Services 2025 & 2033

- Figure 43: Asia Pacific Intraoperative Radiation Therapy Industry Revenue (million), by Application 2025 & 2033

- Figure 44: Asia Pacific Intraoperative Radiation Therapy Industry Volume (K Unit), by Application 2025 & 2033

- Figure 45: Asia Pacific Intraoperative Radiation Therapy Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Asia Pacific Intraoperative Radiation Therapy Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Asia Pacific Intraoperative Radiation Therapy Industry Revenue (million), by Country 2025 & 2033

- Figure 48: Asia Pacific Intraoperative Radiation Therapy Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Intraoperative Radiation Therapy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Intraoperative Radiation Therapy Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Intraoperative Radiation Therapy Industry Revenue (million), by Method 2025 & 2033

- Figure 52: Middle East and Africa Intraoperative Radiation Therapy Industry Volume (K Unit), by Method 2025 & 2033

- Figure 53: Middle East and Africa Intraoperative Radiation Therapy Industry Revenue Share (%), by Method 2025 & 2033

- Figure 54: Middle East and Africa Intraoperative Radiation Therapy Industry Volume Share (%), by Method 2025 & 2033

- Figure 55: Middle East and Africa Intraoperative Radiation Therapy Industry Revenue (million), by Products and Services 2025 & 2033

- Figure 56: Middle East and Africa Intraoperative Radiation Therapy Industry Volume (K Unit), by Products and Services 2025 & 2033

- Figure 57: Middle East and Africa Intraoperative Radiation Therapy Industry Revenue Share (%), by Products and Services 2025 & 2033

- Figure 58: Middle East and Africa Intraoperative Radiation Therapy Industry Volume Share (%), by Products and Services 2025 & 2033

- Figure 59: Middle East and Africa Intraoperative Radiation Therapy Industry Revenue (million), by Application 2025 & 2033

- Figure 60: Middle East and Africa Intraoperative Radiation Therapy Industry Volume (K Unit), by Application 2025 & 2033

- Figure 61: Middle East and Africa Intraoperative Radiation Therapy Industry Revenue Share (%), by Application 2025 & 2033

- Figure 62: Middle East and Africa Intraoperative Radiation Therapy Industry Volume Share (%), by Application 2025 & 2033

- Figure 63: Middle East and Africa Intraoperative Radiation Therapy Industry Revenue (million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Intraoperative Radiation Therapy Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Intraoperative Radiation Therapy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Intraoperative Radiation Therapy Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Intraoperative Radiation Therapy Industry Revenue (million), by Method 2025 & 2033

- Figure 68: South America Intraoperative Radiation Therapy Industry Volume (K Unit), by Method 2025 & 2033

- Figure 69: South America Intraoperative Radiation Therapy Industry Revenue Share (%), by Method 2025 & 2033

- Figure 70: South America Intraoperative Radiation Therapy Industry Volume Share (%), by Method 2025 & 2033

- Figure 71: South America Intraoperative Radiation Therapy Industry Revenue (million), by Products and Services 2025 & 2033

- Figure 72: South America Intraoperative Radiation Therapy Industry Volume (K Unit), by Products and Services 2025 & 2033

- Figure 73: South America Intraoperative Radiation Therapy Industry Revenue Share (%), by Products and Services 2025 & 2033

- Figure 74: South America Intraoperative Radiation Therapy Industry Volume Share (%), by Products and Services 2025 & 2033

- Figure 75: South America Intraoperative Radiation Therapy Industry Revenue (million), by Application 2025 & 2033

- Figure 76: South America Intraoperative Radiation Therapy Industry Volume (K Unit), by Application 2025 & 2033

- Figure 77: South America Intraoperative Radiation Therapy Industry Revenue Share (%), by Application 2025 & 2033

- Figure 78: South America Intraoperative Radiation Therapy Industry Volume Share (%), by Application 2025 & 2033

- Figure 79: South America Intraoperative Radiation Therapy Industry Revenue (million), by Country 2025 & 2033

- Figure 80: South America Intraoperative Radiation Therapy Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Intraoperative Radiation Therapy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Intraoperative Radiation Therapy Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Method 2020 & 2033

- Table 2: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 3: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Products and Services 2020 & 2033

- Table 4: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 5: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Region 2020 & 2033

- Table 8: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Method 2020 & 2033

- Table 10: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 11: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Products and Services 2020 & 2033

- Table 12: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 13: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Application 2020 & 2033

- Table 14: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: United States Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Canada Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Method 2020 & 2033

- Table 24: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 25: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Products and Services 2020 & 2033

- Table 26: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 27: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Application 2020 & 2033

- Table 28: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Country 2020 & 2033

- Table 30: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Germany Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: France Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Italy Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Spain Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Method 2020 & 2033

- Table 44: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 45: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Products and Services 2020 & 2033

- Table 46: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 47: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Application 2020 & 2033

- Table 48: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 49: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Country 2020 & 2033

- Table 50: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: China Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Japan Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 56: India Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 58: Australia Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Method 2020 & 2033

- Table 64: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 65: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Products and Services 2020 & 2033

- Table 66: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 67: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Application 2020 & 2033

- Table 68: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 69: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Country 2020 & 2033

- Table 70: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 72: GCC Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Method 2020 & 2033

- Table 78: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Method 2020 & 2033

- Table 79: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Products and Services 2020 & 2033

- Table 80: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Products and Services 2020 & 2033

- Table 81: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Application 2020 & 2033

- Table 82: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 83: Global Intraoperative Radiation Therapy Industry Revenue million Forecast, by Country 2020 & 2033

- Table 84: Global Intraoperative Radiation Therapy Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Intraoperative Radiation Therapy Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Intraoperative Radiation Therapy Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Intraoperative Radiation Therapy Industry?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the Intraoperative Radiation Therapy Industry?

Key companies in the market include Varian Medical Systems, Carl Zeiss Meditec AG, Sordina IORT Technologies, ICAD Inc, Intraop Medical Corporation, Varian Medical Systems Inc, Elekta AB, GMV Innovating Solutions, Ariane Medical Systems Ltd, Isoray Inc, Eckert & Ziegler, Sensus Healthcare Inc.

3. What are the main segments of the Intraoperative Radiation Therapy Industry?

The market segments include Method, Products and Services, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 251.77 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Global Prevalence of Cancer; Advancements in Cancer Therapy Technologies; Advantages of IORT Over External Beam Radiotherapy.

6. What are the notable trends driving market growth?

Electron IORT Segment is Expected to Hold Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Limitations of IORT and Shortage of Trained Personnel; Preference for Conventional Radiotherapy Over Intraoperative Radiation Therapy.

8. Can you provide examples of recent developments in the market?

In March 2022, Zeiss Medical Technology introduced INTRABEAM 600 device to provide Intraoperative Radiation Therapy (IORT) in India. INTRABEAM 600, Zeiss Meditec's IORT device, offers the least disruptive treatment method available to patients diagnosed with early-stage breast cancer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Intraoperative Radiation Therapy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Intraoperative Radiation Therapy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Intraoperative Radiation Therapy Industry?

To stay informed about further developments, trends, and reports in the Intraoperative Radiation Therapy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence