Key Insights

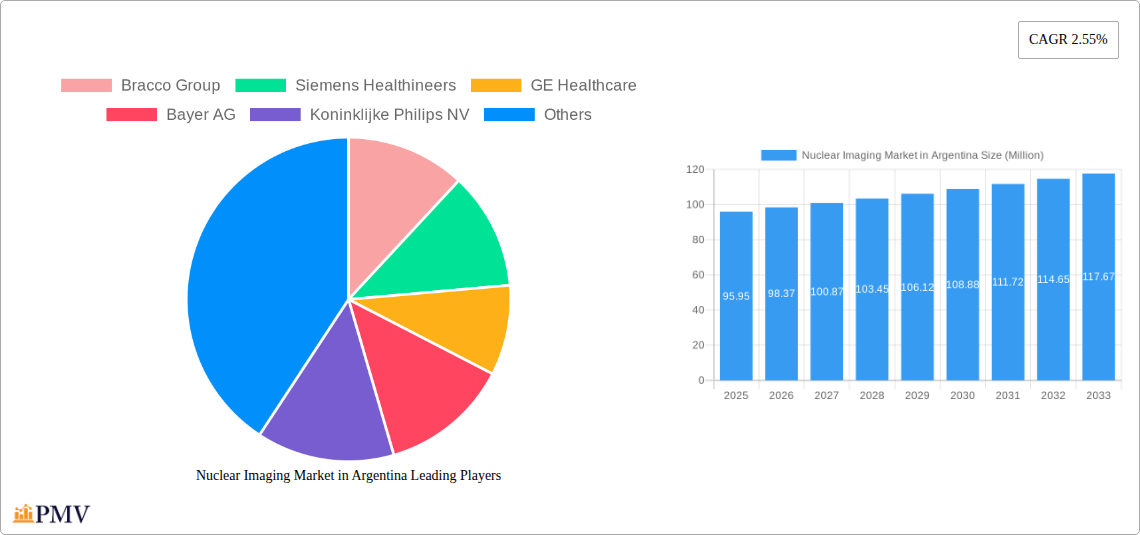

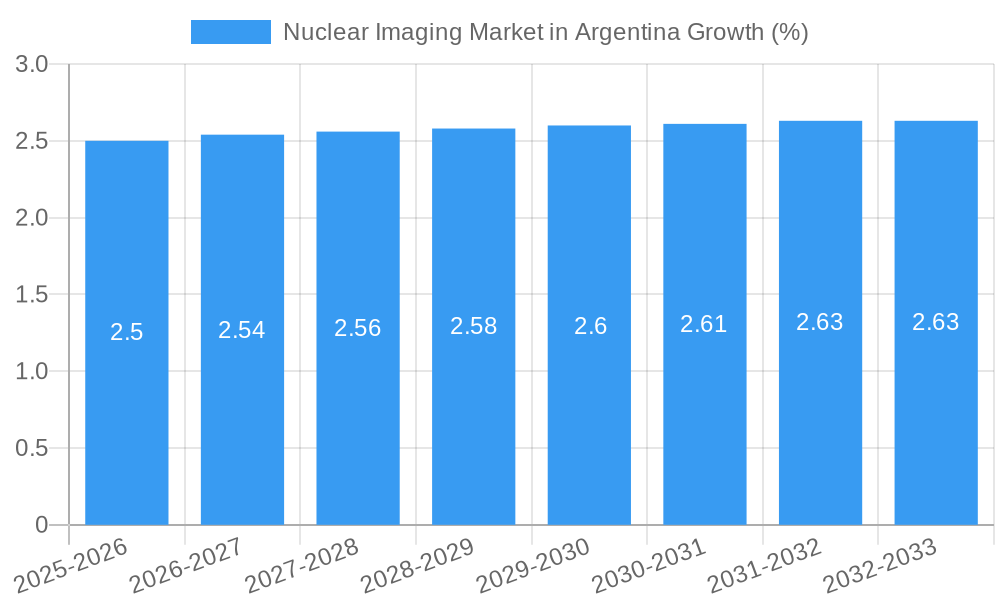

The Nuclear Imaging Market in Argentina, valued at an estimated USD 95.95 million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 2.55% through 2033. This expansion is primarily fueled by an increasing prevalence of chronic diseases, particularly in cardiology and oncology, driving the demand for advanced diagnostic tools. Nuclear imaging techniques like SPECT and PET offer unparalleled functional and metabolic insights into these conditions, enabling earlier and more accurate diagnoses, personalized treatment planning, and improved patient outcomes. The growing adoption of SPECT radioisotopes for routine cardiac assessments and PET radioisotopes for sophisticated oncological staging and treatment response monitoring are key drivers. Furthermore, the continuous technological advancements in imaging equipment, leading to higher resolution, faster scan times, and improved patient comfort, are also contributing significantly to market expansion.

Argentina's healthcare infrastructure, while facing certain resource constraints, is increasingly prioritizing specialized diagnostic imaging. Government initiatives aimed at enhancing public health services and a growing private healthcare sector with a focus on cutting-edge medical technology are creating a more favorable environment for nuclear imaging adoption. However, challenges such as the high cost of advanced equipment and radiopharmaceuticals, coupled with the need for specialized trained personnel, may present some restraints to rapid market penetration. Despite these hurdles, the inherent diagnostic value and the ongoing efforts by key market players to introduce innovative solutions and expand access are expected to propel the nuclear imaging market forward in Argentina, making it a crucial segment within the broader Latin American healthcare landscape.

Unveiling the Nuclear Imaging Market in Argentina: A Comprehensive Growth Trajectory Report (2019–2033)

This in-depth report provides an exhaustive analysis of the Nuclear Imaging Market in Argentina, a dynamic sector crucial for advanced diagnostics and therapeutic interventions. Delve into market size, CAGR, segmentation, trends, drivers, challenges, and competitive landscapes, from its historical performance (2019–2024) through to robust future projections (2025–2033). Discover the strategic implications of technological advancements, regulatory shifts, and key player activities, empowering stakeholders with actionable insights for informed decision-making in Argentina's medical imaging sector.

Nuclear Imaging Market in Argentina Market Structure & Competitive Dynamics

The Argentinian nuclear medicine market exhibits a moderate to high level of concentration, with global leaders like Siemens Healthineers, GE Healthcare, and Philips NV holding significant market shares. However, a growing number of regional and specialized players are contributing to a vibrant innovation ecosystem. Regulatory frameworks, primarily overseen by national health authorities, play a crucial role in dictating market access and product approval. Product substitutes, though limited in direct replacement of nuclear imaging's unique diagnostic capabilities, can include advanced conventional imaging modalities in certain diagnostic pathways. End-user trends are increasingly driven by demand for minimally invasive diagnostics, personalized medicine, and improved patient outcomes, fostering the adoption of advanced PET and SPECT imaging technologies. Mergers and acquisitions (M&A) activities, while not as frequent as in more mature markets, are strategic for consolidating market presence and acquiring specialized expertise. For instance, the acquisition of Argentinian nuclear medicine specialist Tecnonuclear S.A. by Eckert & Ziegler in January 2022 signals consolidation and expansion in the diagnostic radioisotope market. Future M&A will likely focus on enhancing technological portfolios and expanding geographical reach within the Argentinian healthcare industry. The market's growth is further influenced by government initiatives aimed at bolstering healthcare infrastructure and accessibility to advanced diagnostic tools.

Nuclear Imaging Market in Argentina Industry Trends & Insights

The nuclear imaging market in Argentina is poised for significant expansion, driven by an escalating demand for advanced diagnostic solutions and a growing awareness of nuclear medicine's therapeutic potential. The estimated market size in 2025 is projected to reach approximately $XXX Million, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This robust growth is propelled by several key factors. Firstly, the increasing prevalence of chronic diseases, including oncology, cardiology, and neurology, necessitates sophisticated imaging techniques for early detection, precise staging, and effective treatment monitoring. PET scans and SPECT scans offer unparalleled functional and metabolic insights that are indispensable in managing these complex conditions.

Secondly, technological advancements are revolutionizing the field. Innovations in diagnostic radioisotope production, such as the potential for enhanced molybdenum-99 and other radioisotope generation in Argentina, alongside the development of more sensitive and higher resolution imaging equipment (including SPECT equipment and PET equipment), are enhancing diagnostic accuracy and patient comfort. The integration of artificial intelligence (AI) and machine learning (ML) in image analysis promises to further improve interpretation efficiency and diagnostic confidence.

Thirdly, a growing emphasis on preventative healthcare and personalized medicine is driving demand for non-invasive diagnostic tools like those offered by nuclear imaging. Patients and healthcare providers are increasingly seeking methods that can detect disease at its earliest, most treatable stages and tailor treatment plans based on individual patient characteristics. This trend directly benefits the nuclear imaging market.

Furthermore, the competitive landscape is evolving, with both global players and emerging local entities vying for market share. Strategic collaborations, product launches, and expanding service offerings are key strategies employed by companies to gain a competitive edge. Government initiatives aimed at modernizing healthcare infrastructure and increasing access to advanced medical technologies also play a pivotal role. The market penetration of nuclear imaging modalities is expected to deepen as awareness and affordability improve. The report will delve into the nuances of these trends, offering a granular understanding of the forces shaping the Argentinian nuclear medicine market.

Dominant Markets & Segments in Nuclear Imaging Market in Argentina

The nuclear imaging market in Argentina is characterized by distinct dominant segments, each driven by specific needs and advancements within the healthcare ecosystem.

Product Segmentation Dominance

Equipment: The nuclear imaging equipment segment is a primary driver of the market. This includes sophisticated SPECT scanners and PET scanners. The dominance here is fueled by ongoing technological upgrades and the increasing need for higher resolution and faster scan times to improve diagnostic accuracy and patient throughput. Investment in new installations and replacement of older equipment in hospitals and diagnostic centers contributes significantly to this segment's growth. Key drivers include the rising demand for advanced diagnostic capabilities, government investments in healthcare infrastructure, and the competitive push by manufacturers like GE Healthcare, Siemens Healthineers, and Philips NV to offer cutting-edge technology.

Diagnostic Radioisotope: Within this segment, both SPECT Radioisotopes and PET Radioisotopes are critical.

- SPECT Radioisotopes: Technetium-99m remains a cornerstone of SPECT imaging due to its favorable physical properties and widespread availability. The stability and accessibility of these isotopes are paramount for routine diagnostics. Developments in on-site generator technology and local production capabilities are crucial for maintaining a consistent supply and reducing logistical challenges. The acquisition of Tecnonuclear S.A. by Eckert & Ziegler highlights the strategic importance of Technetium-99 generators in the Argentinian market.

- PET Radioisotopes: Fluorodeoxyglucose (FDG) is the most prevalent PET radioisotope, especially for oncology applications. The expanding use of PET in oncology for staging, treatment response assessment, and recurrence detection directly drives the demand for FDG. Other PET radioisotopes are gaining traction for specific neurological and cardiac applications, further bolstering this sub-segment. The global trend of increased PET utilization directly translates to growing importance in Argentina.

Application Segmentation Dominance

SPECT Applications:

- Cardiology: This remains a leading application for SPECT imaging in Argentina. Myocardial perfusion imaging is routinely used for diagnosing and managing coronary artery disease, a significant health concern in the region. The ability of SPECT to assess blood flow and heart muscle function makes it indispensable for cardiac assessment.

- Neurology: SPECT plays a vital role in the diagnosis of neurological disorders such as Alzheimer's disease, Parkinson's disease, and epilepsy by assessing brain perfusion and neurotransmitter activity.

- Thyroid: While often assessed with other modalities, SPECT imaging remains important for evaluating thyroid function and detecting nodules.

- Other SPECT Applications: This includes applications in infection imaging, inflammatory conditions, and pre-surgical planning, which collectively contribute to the segment's overall demand.

PET Applications:

- Oncology: This is the most dominant and fastest-growing application for PET imaging in Argentina. The use of FDG-PET for cancer detection, staging, and monitoring treatment response is well-established and continues to expand. The precision offered by PET in identifying metabolically active tumors is invaluable.

- Other PET Applications: This category encompasses the expanding use of PET in neurology (e.g., dementia evaluation) and cardiology (e.g., viability assessment), as well as emerging research applications, all of which are contributing to market growth.

Equipment: The nuclear imaging equipment segment is a primary driver of the market. This includes sophisticated SPECT scanners and PET scanners. The dominance here is fueled by ongoing technological upgrades and the increasing need for higher resolution and faster scan times to improve diagnostic accuracy and patient throughput. Investment in new installations and replacement of older equipment in hospitals and diagnostic centers contributes significantly to this segment's growth. Key drivers include the rising demand for advanced diagnostic capabilities, government investments in healthcare infrastructure, and the competitive push by manufacturers like GE Healthcare, Siemens Healthineers, and Philips NV to offer cutting-edge technology.

Diagnostic Radioisotope: Within this segment, both SPECT Radioisotopes and PET Radioisotopes are critical.

- SPECT Radioisotopes: Technetium-99m remains a cornerstone of SPECT imaging due to its favorable physical properties and widespread availability. The stability and accessibility of these isotopes are paramount for routine diagnostics. Developments in on-site generator technology and local production capabilities are crucial for maintaining a consistent supply and reducing logistical challenges. The acquisition of Tecnonuclear S.A. by Eckert & Ziegler highlights the strategic importance of Technetium-99 generators in the Argentinian market.

- PET Radioisotopes: Fluorodeoxyglucose (FDG) is the most prevalent PET radioisotope, especially for oncology applications. The expanding use of PET in oncology for staging, treatment response assessment, and recurrence detection directly drives the demand for FDG. Other PET radioisotopes are gaining traction for specific neurological and cardiac applications, further bolstering this sub-segment. The global trend of increased PET utilization directly translates to growing importance in Argentina.

SPECT Applications:

- Cardiology: This remains a leading application for SPECT imaging in Argentina. Myocardial perfusion imaging is routinely used for diagnosing and managing coronary artery disease, a significant health concern in the region. The ability of SPECT to assess blood flow and heart muscle function makes it indispensable for cardiac assessment.

- Neurology: SPECT plays a vital role in the diagnosis of neurological disorders such as Alzheimer's disease, Parkinson's disease, and epilepsy by assessing brain perfusion and neurotransmitter activity.

- Thyroid: While often assessed with other modalities, SPECT imaging remains important for evaluating thyroid function and detecting nodules.

- Other SPECT Applications: This includes applications in infection imaging, inflammatory conditions, and pre-surgical planning, which collectively contribute to the segment's overall demand.

PET Applications:

- Oncology: This is the most dominant and fastest-growing application for PET imaging in Argentina. The use of FDG-PET for cancer detection, staging, and monitoring treatment response is well-established and continues to expand. The precision offered by PET in identifying metabolically active tumors is invaluable.

- Other PET Applications: This category encompasses the expanding use of PET in neurology (e.g., dementia evaluation) and cardiology (e.g., viability assessment), as well as emerging research applications, all of which are contributing to market growth.

The interplay between advanced equipment, reliable radioisotope supply chains, and diverse clinical applications dictates the market's trajectory. The increasing focus on precision medicine and early disease detection will continue to propel the growth of dominant segments within the nuclear imaging market in Argentina.

Nuclear Imaging Market in Argentina Product Innovations

Product innovations in the nuclear imaging market in Argentina are focused on enhancing diagnostic accuracy, improving patient experience, and expanding therapeutic applications. Manufacturers are developing SPECT and PET scanners with higher sensitivity, better spatial resolution, and reduced scan times, leading to more precise diagnoses and reduced patient exposure to radiation. Innovations in diagnostic radioisotopes, including the development of novel radiotracers for specific molecular targets in oncology, neurology, and cardiology, are expanding the scope of nuclear imaging. Furthermore, advancements in integrated imaging platforms, combining PET/CT or PET/MRI, offer fused anatomical and functional information, providing comprehensive insights for complex diseases. These technological advancements, coupled with an increasing emphasis on software solutions for image analysis and workflow optimization, are crucial for maintaining competitive advantages in the Argentinian market.

Report Segmentation & Scope

This report meticulously segments the Nuclear Imaging Market in Argentina to provide a granular understanding of its various facets. The scope covers key product categories, including Equipment (encompassing advanced SPECT and PET scanners) and Diagnostic Radioisotopes (further divided into SPECT Radioisotopes and PET Radioisotopes). On the application front, the report details SPECT Applications, with specific attention to Cardiology, Neurology, and Thyroid, along with other niche SPECT uses. Similarly, PET Applications are explored, with a focus on Oncology and other emerging PET applications. Growth projections, estimated market sizes for each segment, and the competitive dynamics within these segments are analyzed for the study period of 2019–2033, with a base year of 2025.

Key Drivers of Nuclear Imaging Market in Argentina Growth

The nuclear imaging market in Argentina is propelled by several critical growth drivers. A primary factor is the escalating burden of chronic diseases, particularly oncology, cardiology, and neurology, necessitating advanced diagnostic tools for early detection and precise management. Technological advancements in SPECT and PET imaging equipment, leading to improved resolution and functionality, are also crucial. The increasing availability and diversity of diagnostic radioisotopes, including potential domestic production initiatives, reduce supply chain dependencies and costs. Furthermore, government initiatives aimed at enhancing healthcare infrastructure, increasing access to advanced medical technologies, and promoting medical tourism are significant accelerators. Growing awareness among healthcare professionals and patients about the benefits of nuclear imaging for personalized medicine and effective treatment monitoring further fuels market expansion. The Argentinian healthcare system's increasing investment in specialized diagnostic centers also plays a pivotal role.

Challenges in the Nuclear Imaging Market in Argentina Sector

Despite its growth potential, the nuclear imaging market in Argentina faces several challenges. High acquisition and maintenance costs of sophisticated nuclear imaging equipment can be a barrier for smaller healthcare facilities. The availability and reliable supply of diagnostic radioisotopes, especially those with short half-lives, remain a logistical and cost challenge, although local production efforts are aimed at mitigating this. Stringent regulatory requirements for radiation safety and product approvals can sometimes slow down market entry for new technologies. A shortage of skilled nuclear medicine technologists and radiologists can also limit the widespread adoption and optimal utilization of these advanced diagnostic tools. Additionally, reimbursement policies and insurance coverage for nuclear imaging procedures can impact patient access and provider adoption. Intense competition from established global players and the potential for evolving conventional imaging techniques in specific applications present ongoing competitive pressures within the Argentinian medical imaging sector.

Leading Players in the Nuclear Imaging Market in Argentina Market

- Bracco Group

- Siemens Healthineers

- GE Healthcare

- Bayer AG

- Koninklijke Philips NV

- Canon Medical Systems Corporation

- DDD Diagnostics A/S

- Curium

- Shanghai United Imaging Medical Technology Co Ltd

- Fujifilm Holdings Corporation

Key Developments in Nuclear Imaging Market in Argentina Sector

- February 2022: China announced a national plan to produce molybdenum-99 and other radioisotopes for medical use, the vast majority of which are currently imported from Argentina. The use of Argentina technology has gained significant attention in the Chinese market, indicating potential for export growth and technology transfer.

- January 2022: Eckert & Ziegler acquired 100% shares of Argentinian nuclear medicine specialist Tecnonuclear S. A., a manufacturer of Technetium-99 generators and related biomolecules. This acquisition signifies consolidation within the diagnostic radioisotope supply chain and potentially enhances the local production capabilities for crucial SPECT radioisotopes.

Strategic Nuclear Imaging Market in Argentina Market Outlook

The strategic outlook for the Nuclear Imaging Market in Argentina is exceptionally promising, driven by a confluence of factors poised to accelerate growth. The increasing focus on early disease detection, particularly in oncology, cardiology, and neurology, will continue to be a primary growth accelerator. Advancements in PET and SPECT technology, offering enhanced diagnostic precision and expanded applications, will further solidify market penetration. The development and potential localized production of diagnostic radioisotopes will be crucial for ensuring supply chain resilience and cost-effectiveness. Government support for healthcare infrastructure development and the integration of digital health solutions, including AI in image analysis, are expected to create new opportunities. Strategic partnerships between global manufacturers and local distributors, along with potential mergers and acquisitions focusing on specialized technologies or regional reach, will shape the competitive landscape. The growing demand for personalized medicine and minimally invasive diagnostic procedures positions nuclear imaging as a cornerstone of future healthcare delivery in Argentina, presenting significant avenues for investment and expansion.

Nuclear Imaging Market in Argentina Segmentation

-

1. Product

- 1.1. Equipment

-

1.2. Diagnostic Radioisotope

- 1.2.1. SPECT Radioisotopes

- 1.2.2. PET Radioisotopes

-

2. Application

-

2.1. SPECT Applications

- 2.1.1. Cardiology

- 2.1.2. Neurology

- 2.1.3. Thyroid

- 2.1.4. Other SPECT Applications

-

2.2. PET Applications

- 2.2.1. Oncology

- 2.2.2. Other PET Applications

-

2.1. SPECT Applications

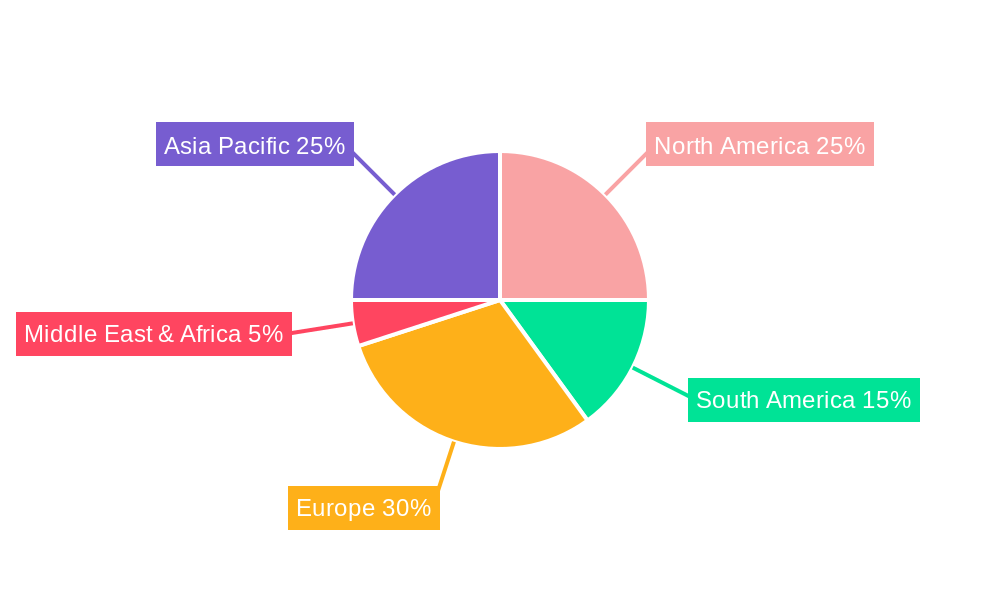

Nuclear Imaging Market in Argentina Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nuclear Imaging Market in Argentina REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Cancer and Cardiac Disorders; Technological Advancements in Nuclear Imaging

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations

- 3.4. Market Trends

- 3.4.1. PET Radioisotopes are Expected to Witness Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nuclear Imaging Market in Argentina Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Equipment

- 5.1.2. Diagnostic Radioisotope

- 5.1.2.1. SPECT Radioisotopes

- 5.1.2.2. PET Radioisotopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. SPECT Applications

- 5.2.1.1. Cardiology

- 5.2.1.2. Neurology

- 5.2.1.3. Thyroid

- 5.2.1.4. Other SPECT Applications

- 5.2.2. PET Applications

- 5.2.2.1. Oncology

- 5.2.2.2. Other PET Applications

- 5.2.1. SPECT Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Nuclear Imaging Market in Argentina Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Equipment

- 6.1.2. Diagnostic Radioisotope

- 6.1.2.1. SPECT Radioisotopes

- 6.1.2.2. PET Radioisotopes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. SPECT Applications

- 6.2.1.1. Cardiology

- 6.2.1.2. Neurology

- 6.2.1.3. Thyroid

- 6.2.1.4. Other SPECT Applications

- 6.2.2. PET Applications

- 6.2.2.1. Oncology

- 6.2.2.2. Other PET Applications

- 6.2.1. SPECT Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Nuclear Imaging Market in Argentina Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Equipment

- 7.1.2. Diagnostic Radioisotope

- 7.1.2.1. SPECT Radioisotopes

- 7.1.2.2. PET Radioisotopes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. SPECT Applications

- 7.2.1.1. Cardiology

- 7.2.1.2. Neurology

- 7.2.1.3. Thyroid

- 7.2.1.4. Other SPECT Applications

- 7.2.2. PET Applications

- 7.2.2.1. Oncology

- 7.2.2.2. Other PET Applications

- 7.2.1. SPECT Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Nuclear Imaging Market in Argentina Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Equipment

- 8.1.2. Diagnostic Radioisotope

- 8.1.2.1. SPECT Radioisotopes

- 8.1.2.2. PET Radioisotopes

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. SPECT Applications

- 8.2.1.1. Cardiology

- 8.2.1.2. Neurology

- 8.2.1.3. Thyroid

- 8.2.1.4. Other SPECT Applications

- 8.2.2. PET Applications

- 8.2.2.1. Oncology

- 8.2.2.2. Other PET Applications

- 8.2.1. SPECT Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Nuclear Imaging Market in Argentina Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Equipment

- 9.1.2. Diagnostic Radioisotope

- 9.1.2.1. SPECT Radioisotopes

- 9.1.2.2. PET Radioisotopes

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. SPECT Applications

- 9.2.1.1. Cardiology

- 9.2.1.2. Neurology

- 9.2.1.3. Thyroid

- 9.2.1.4. Other SPECT Applications

- 9.2.2. PET Applications

- 9.2.2.1. Oncology

- 9.2.2.2. Other PET Applications

- 9.2.1. SPECT Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Nuclear Imaging Market in Argentina Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Equipment

- 10.1.2. Diagnostic Radioisotope

- 10.1.2.1. SPECT Radioisotopes

- 10.1.2.2. PET Radioisotopes

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. SPECT Applications

- 10.2.1.1. Cardiology

- 10.2.1.2. Neurology

- 10.2.1.3. Thyroid

- 10.2.1.4. Other SPECT Applications

- 10.2.2. PET Applications

- 10.2.2.1. Oncology

- 10.2.2.2. Other PET Applications

- 10.2.1. SPECT Applications

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bracco Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Siemens Healthineers

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bayer AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Koninklijke Philips NV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Canon Medical Systems Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DDD Diagnostics A/S

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Curium

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shanghai United Imaging Medical Technology Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fujifilm Holdings Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bracco Group

List of Figures

- Figure 1: Global Nuclear Imaging Market in Argentina Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Argentina Nuclear Imaging Market in Argentina Revenue (Million), by Country 2024 & 2032

- Figure 3: Argentina Nuclear Imaging Market in Argentina Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Nuclear Imaging Market in Argentina Revenue (Million), by Product 2024 & 2032

- Figure 5: North America Nuclear Imaging Market in Argentina Revenue Share (%), by Product 2024 & 2032

- Figure 6: North America Nuclear Imaging Market in Argentina Revenue (Million), by Application 2024 & 2032

- Figure 7: North America Nuclear Imaging Market in Argentina Revenue Share (%), by Application 2024 & 2032

- Figure 8: North America Nuclear Imaging Market in Argentina Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Nuclear Imaging Market in Argentina Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Nuclear Imaging Market in Argentina Revenue (Million), by Product 2024 & 2032

- Figure 11: South America Nuclear Imaging Market in Argentina Revenue Share (%), by Product 2024 & 2032

- Figure 12: South America Nuclear Imaging Market in Argentina Revenue (Million), by Application 2024 & 2032

- Figure 13: South America Nuclear Imaging Market in Argentina Revenue Share (%), by Application 2024 & 2032

- Figure 14: South America Nuclear Imaging Market in Argentina Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Nuclear Imaging Market in Argentina Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Nuclear Imaging Market in Argentina Revenue (Million), by Product 2024 & 2032

- Figure 17: Europe Nuclear Imaging Market in Argentina Revenue Share (%), by Product 2024 & 2032

- Figure 18: Europe Nuclear Imaging Market in Argentina Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Nuclear Imaging Market in Argentina Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Nuclear Imaging Market in Argentina Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Nuclear Imaging Market in Argentina Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Nuclear Imaging Market in Argentina Revenue (Million), by Product 2024 & 2032

- Figure 23: Middle East & Africa Nuclear Imaging Market in Argentina Revenue Share (%), by Product 2024 & 2032

- Figure 24: Middle East & Africa Nuclear Imaging Market in Argentina Revenue (Million), by Application 2024 & 2032

- Figure 25: Middle East & Africa Nuclear Imaging Market in Argentina Revenue Share (%), by Application 2024 & 2032

- Figure 26: Middle East & Africa Nuclear Imaging Market in Argentina Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Nuclear Imaging Market in Argentina Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Nuclear Imaging Market in Argentina Revenue (Million), by Product 2024 & 2032

- Figure 29: Asia Pacific Nuclear Imaging Market in Argentina Revenue Share (%), by Product 2024 & 2032

- Figure 30: Asia Pacific Nuclear Imaging Market in Argentina Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific Nuclear Imaging Market in Argentina Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific Nuclear Imaging Market in Argentina Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Nuclear Imaging Market in Argentina Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Product 2019 & 2032

- Table 7: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Product 2019 & 2032

- Table 13: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Product 2019 & 2032

- Table 19: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Product 2019 & 2032

- Table 31: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Nuclear Imaging Market in Argentina Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Nuclear Imaging Market in Argentina Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nuclear Imaging Market in Argentina?

The projected CAGR is approximately 2.55%.

2. Which companies are prominent players in the Nuclear Imaging Market in Argentina?

Key companies in the market include Bracco Group, Siemens Healthineers, GE Healthcare, Bayer AG, Koninklijke Philips NV, Canon Medical Systems Corporation, DDD Diagnostics A/S, Curium, Shanghai United Imaging Medical Technology Co Ltd, Fujifilm Holdings Corporation.

3. What are the main segments of the Nuclear Imaging Market in Argentina?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 95.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Cancer and Cardiac Disorders; Technological Advancements in Nuclear Imaging.

6. What are the notable trends driving market growth?

PET Radioisotopes are Expected to Witness Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulations.

8. Can you provide examples of recent developments in the market?

In February 2022, China announced a national plan to produce molybdenum-99 and other radioisotopes for medical use, the vast majority of which are currently imported from Argentina. The use of Argentina technology has gained significant attention in Chinese market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nuclear Imaging Market in Argentina," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nuclear Imaging Market in Argentina report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nuclear Imaging Market in Argentina?

To stay informed about further developments, trends, and reports in the Nuclear Imaging Market in Argentina, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence