Key Insights

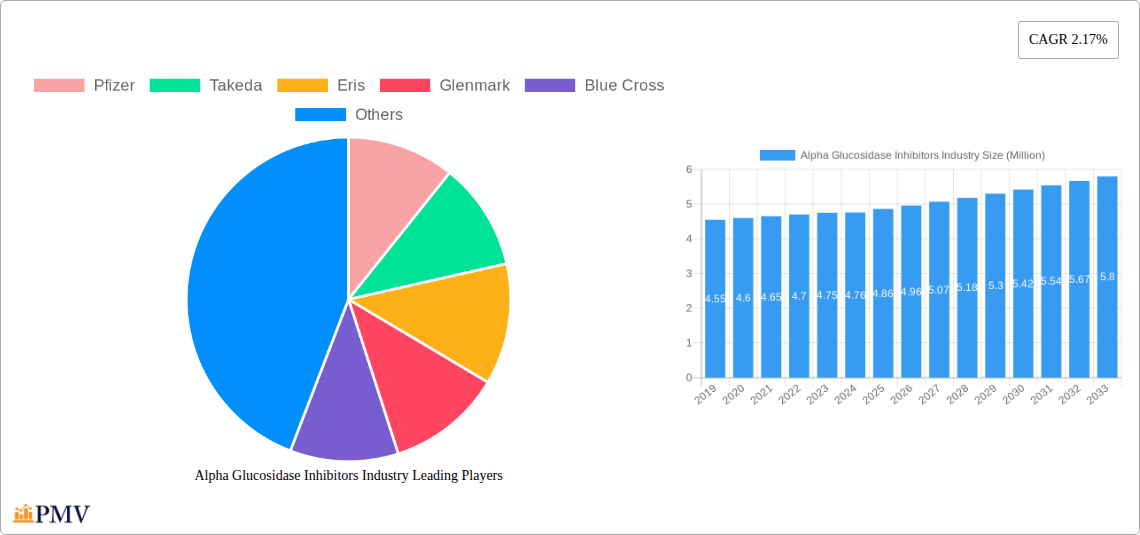

The global Alpha-Glucosidase Inhibitors market is poised for steady growth, with a current market size of approximately USD 4.76 million and a projected Compound Annual Growth Rate (CAGR) of 2.17% between 2025 and 2033. This sustained expansion is primarily driven by the increasing global prevalence of Type 2 diabetes, a chronic condition that necessitates effective management strategies. Factors such as an aging population, sedentary lifestyles, and rising obesity rates worldwide are contributing to a growing patient pool actively seeking treatment options. Alpha-glucosidase inhibitors play a crucial role in managing postprandial hyperglycemia by delaying carbohydrate absorption in the digestive tract, making them a valuable therapeutic intervention for diabetic patients. Furthermore, advancements in drug formulation and ongoing research into novel applications are expected to further bolster market demand.

Alpha Glucosidase Inhibitors Industry Market Size (In Million)

The market is characterized by a competitive landscape featuring major pharmaceutical players like Pfizer, Takeda, Bayer, and Sun Pharma, alongside several regional and specialized companies. These companies are actively engaged in research and development to enhance existing products and explore new therapeutic avenues, which is a significant trend shaping the market. While the market presents opportunities, it also faces certain restraints. These include the potential for gastrointestinal side effects associated with alpha-glucosidase inhibitors, the availability of alternative diabetes treatments such as metformin and newer classes of antidiabetics (e.g., SGLT2 inhibitors and GLP-1 receptor agonists), and evolving regulatory landscapes in different regions. However, the established efficacy and generally favorable safety profile of alpha-glucosidase inhibitors, particularly for specific patient demographics, ensure their continued relevance and a consistent demand. The Asia Pacific region, driven by large populations and increasing healthcare expenditure, is anticipated to be a key growth engine for the market.

Alpha Glucosidase Inhibitors Industry Company Market Share

Alpha Glucosidase Inhibitors Market Research Report: Forecast 2024-2033

This comprehensive report provides an in-depth analysis of the global Alpha Glucosidase Inhibitors market, offering a detailed examination of market structure, competitive dynamics, industry trends, dominant regions, product innovations, segmentation, growth drivers, challenges, and key player strategies. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period extending from 2025 to 2033, this report equips stakeholders with actionable insights and data-driven forecasts to navigate the evolving landscape of diabetes management drugs.

Alpha Glucosidase Inhibitors Industry Market Structure & Competitive Dynamics

The Alpha Glucosidase Inhibitors market exhibits a moderately concentrated structure, with a few key players holding significant market share, alongside a growing number of generic manufacturers. Innovation plays a crucial role, driven by research into novel formulations and combination therapies for enhanced glycemic control. The regulatory landscape, particularly stringent approvals from bodies like the US FDA and the Indian NPPA, significantly influences market entry and product development. Potential product substitutes include other classes of anti-diabetic medications such as SGLT2 inhibitors, DPP-4 inhibitors, and GLP-1 receptor agonists, all of which are experiencing their own innovation cycles and market penetration. End-user trends are increasingly focused on combination therapies offering improved efficacy and patient compliance. Mergers and acquisitions (M&A) activities are expected to be strategic, aimed at consolidating market presence, expanding product portfolios, and gaining access to new geographical markets. For instance, strategic partnerships and acquisitions in the pharmaceutical sector aiming to strengthen diabetes drug portfolios are anticipated. The market share of leading players is estimated to be significant, with M&A deal values potentially reaching several hundred million dollars as companies seek to bolster their presence in this lucrative segment of the anti-diabetic drugs market.

Alpha Glucosidase Inhibitors Industry Industry Trends & Insights

The Alpha Glucosidase Inhibitors market is poised for substantial growth, driven by the escalating global prevalence of type 2 diabetes mellitus and the growing demand for effective oral anti-diabetic agents. The increasing awareness among patients and healthcare professionals regarding the benefits of alpha-glucosidase inhibitors in postprandial glucose management is a significant market penetrator. Technological disruptions, such as advancements in drug delivery systems and the development of more targeted therapies, are expected to further enhance the efficacy and patient acceptance of these drugs. Consumer preferences are shifting towards combination therapies that offer a synergistic effect and reduce the risk of monotherapy-related side effects. The competitive dynamics are characterized by intense R&D efforts aimed at improving drug profiles, reducing gastrointestinal side effects, and developing novel combinations with other anti-diabetic classes. The projected Compound Annual Growth Rate (CAGR) for the oral anti-diabetic drugs market, which includes alpha-glucosidase inhibitors, is robust. Market penetration is expected to deepen in emerging economies due to the rising incidence of lifestyle diseases and increasing access to healthcare. The focus on personalized medicine and combination therapies will continue to shape product development strategies. Emerging research into gut microbiome modulation and its impact on glucose metabolism could also present future opportunities and challenges for the existing alpha-glucosidase inhibitor landscape. Furthermore, the shift towards value-based healthcare models is encouraging the development of drugs that demonstrate clear clinical and economic benefits, a trend that alpha-glucosidase inhibitors are well-positioned to capitalize on by managing postprandial hyperglycemia effectively. The overall trend indicates a sustained upward trajectory for alpha-glucosidase inhibitors within the broader diabetes therapeutics market.

Dominant Markets & Segments in Alpha Glucosidase Inhibitors Industry

The Alpha Glucosidase Inhibitors market is currently dominated by the Asia-Pacific region, particularly countries like India and China, due to their large and growing populations, rising incidence of type 2 diabetes, increasing disposable incomes, and expanding healthcare infrastructure. Government initiatives promoting diabetes awareness and accessible healthcare further bolster this dominance. Economic policies that encourage the manufacturing and export of generic pharmaceuticals also contribute to the region's leading position. The infrastructure development in these nations, including improved distribution networks for pharmaceuticals, ensures wider availability of these essential medications.

- Key Drivers of Dominance in Asia-Pacific:

- High diabetes prevalence and incidence rates.

- Growing middle-class population with increased purchasing power.

- Government focus on public health and diabetes management programs.

- Strong presence of generic drug manufacturers leading to cost-effectiveness.

- Favorable regulatory environments for pharmaceutical production and approval.

Within the broader Alpha Glucosidase Inhibitors market, the segment of Acarbose represents a significant portion of the market share, owing to its established efficacy and widespread availability. However, Voglibose is gaining traction, especially in Asian markets, due to its favorable tolerability profile and potent inhibition of alpha-glucosidase enzymes. The segment of combination drugs, which often include alpha-glucosidase inhibitors like Voglibose or Acarbose combined with Metformin or Glimepiride, is experiencing rapid growth. This is driven by the need for more comprehensive glycemic control in patients with advanced diabetes. The demand for extended-release formulations within this segment is also on the rise, offering convenience and improved patient adherence.

Alpha Glucosidase Inhibitors Industry Product Innovations

Product innovations in the Alpha Glucosidase Inhibitors industry are primarily focused on enhancing efficacy, improving tolerability, and developing novel combination therapies. Research is exploring ways to mitigate common gastrointestinal side effects like bloating and diarrhea, thereby increasing patient compliance. The development of fixed-dose combination tablets that integrate alpha-glucosidase inhibitors with other anti-diabetic drugs, such as metformin or sulfonylureas, offers a convenient and synergistic approach to glycemic control. These innovations aim to provide more effective and patient-friendly treatment options for managing type 2 diabetes, solidifying the competitive advantage of advanced formulations.

Report Segmentation & Scope

This report segments the Alpha Glucosidase Inhibitors market based on various criteria to provide a granular view of market dynamics. The primary segmentation includes:

- By Drug Type: This segment categorizes the market into Acarbose, Miglitol, Voglibose, and others. Each drug type has unique therapeutic profiles and market penetration. Projections indicate steady growth for established drugs like Acarbose, while Voglibose is expected to see significant expansion, particularly in Asia.

- By Formulation: This segment considers different dosage forms such as tablets, capsules, and oral solutions. The dominance of oral tablets is expected to continue, with a growing interest in extended-release formulations for improved patient convenience and adherence.

- By Application: This segment focuses on the primary application, which is the treatment of Type 2 Diabetes Mellitus. The increasing prevalence of this chronic disease globally is a key growth driver.

- By Distribution Channel: This includes hospital pharmacies, retail pharmacies, and online pharmacies. The retail pharmacy segment is projected to hold a substantial market share due to direct patient accessibility.

- By Region: This encompasses North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The Asia-Pacific region is expected to lead the market in terms of revenue and growth.

Key Drivers of Alpha Glucosidase Inhibitors Industry Growth

The Alpha Glucosidase Inhibitors industry is propelled by several key growth drivers. The escalating global incidence of type 2 diabetes mellitus, a direct consequence of aging populations, sedentary lifestyles, and rising obesity rates, forms the primary impetus. Increased awareness and diagnosis of diabetes, coupled with greater access to healthcare in emerging economies, further fuel market expansion. Furthermore, the established efficacy of alpha-glucosidase inhibitors in managing postprandial hyperglycemia and their role in combination therapy regimens contribute significantly to their demand. Regulatory support for generic drug production in various countries also lowers treatment costs, making these medications more accessible.

Challenges in the Alpha Glucosidase Inhibitors Industry Sector

Despite robust growth prospects, the Alpha Glucosidase Inhibitors industry faces several challenges. The primary restraint stems from the gastrointestinal side effects, such as flatulence, bloating, and diarrhea, associated with these drugs, which can impact patient compliance. Intense competition from alternative anti-diabetic drug classes, including newer and potentially more effective therapies like SGLT2 inhibitors and GLP-1 receptor agonists, poses a significant threat. Stringent regulatory approval processes and the need for extensive clinical trials to demonstrate safety and efficacy add to the development costs and timelines. Price pressures from healthcare payers and the generic market also challenge profitability for manufacturers.

Leading Players in the Alpha Glucosidase Inhibitors Industry Market

- Pfizer

- Takeda

- Eris

- Glenmark

- Blue Cross

- Sun Pharma

- Unichem

- Hexalag

- Bayer

- Torrent

Key Developments in Alpha Glucosidase Inhibitors Industry Sector

- January 2023: The Indian Drug pricing regulator National Pharmaceutical Pricing Authority (NPPA) fixed the retail price of 12 scheduled formulations under the Drugs (Prices Control) Order, 2013 (NLEM 2022). The retail price of one tablet of anti-diabetes combination drug Glimepiride, Voglibose & Metformin (extended-release) is fixed at INR 13.83 (USD 0.17). This move aims to ensure affordability and accessibility of essential diabetes medications in India.

- May 2022: The US FDA issued a revised draft guidance for the industry on generic acarbose, recommending in vitro comparative dissolution studies or one in vivo pilot bioequivalence study and one in vivo pivotal bioequivalence study with pharmacodynamic endpoints studies. This guidance provides a clearer pathway for generic manufacturers seeking approval, potentially leading to increased market competition.

Strategic Alpha Glucosidase Inhibitors Industry Market Outlook

The strategic outlook for the Alpha Glucosidase Inhibitors market is characterized by continued growth driven by the unmet needs in diabetes management. Key strategies for market players will involve focusing on developing improved formulations with reduced side effects, investing in combination therapies that offer enhanced glycemic control, and expanding market reach in emerging economies with high diabetes prevalence. Strategic collaborations and partnerships will be crucial for product development, market access, and navigating the complex regulatory landscape. The increasing emphasis on patient-centric care and the demand for cost-effective treatments will shape future market opportunities. Pharmaceutical companies are expected to leverage their R&D capabilities to innovate within this space, ensuring alpha-glucosidase inhibitors remain a vital component of comprehensive diabetes management strategies.

Alpha Glucosidase Inhibitors Industry Segmentation

- 1. Alpha-glucosidase Inhibitors

Alpha Glucosidase Inhibitors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. France

- 2.2. Germany

- 2.3. Italy

- 2.4. Spain

- 2.5. United Kingdom

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Latin America

- 3.1. Mexico

- 3.2. Brazil

- 3.3. Rest of Latin America

-

4. Asia Pacific

- 4.1. Japan

- 4.2. South Korea

- 4.3. China

- 4.4. India

- 4.5. Australia

- 4.6. Vietnam

- 4.7. Malaysia

- 4.8. Indonesia

- 4.9. Philippines

- 4.10. Thailand

- 4.11. Rest of Asia Pacific

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Iran

- 5.3. Egypt

- 5.4. Oman

- 5.5. South Africa

- 5.6. Rest of Middle East and Africa

Alpha Glucosidase Inhibitors Industry Regional Market Share

Geographic Coverage of Alpha Glucosidase Inhibitors Industry

Alpha Glucosidase Inhibitors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Number of Kidney Cancer Cases; Increased R&D Expenditure of Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. ; High Cost Associated with Treatment; Preference for Generic Drugs

- 3.4. Market Trends

- 3.4.1. Rising diabetes prevalence globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Alpha Glucosidase Inhibitors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Latin America

- 5.2.4. Asia Pacific

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 6. North America Alpha Glucosidase Inhibitors Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 6.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 7. Europe Alpha Glucosidase Inhibitors Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 7.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 8. Latin America Alpha Glucosidase Inhibitors Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 8.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 9. Asia Pacific Alpha Glucosidase Inhibitors Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 9.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 10. Middle East and Africa Alpha Glucosidase Inhibitors Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 10.1. Market Analysis, Insights and Forecast - by Alpha-glucosidase Inhibitors

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Pfizer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Takeda

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eris

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Glenmark

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Blue Cross

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sun Pharma

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Unichem

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hexalag

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bayer

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Torrent

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Pfizer

List of Figures

- Figure 1: Global Alpha Glucosidase Inhibitors Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Alpha Glucosidase Inhibitors Industry Revenue (Million), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 3: North America Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 4: North America Alpha Glucosidase Inhibitors Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Alpha Glucosidase Inhibitors Industry Revenue (Million), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 7: Europe Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 8: Europe Alpha Glucosidase Inhibitors Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Latin America Alpha Glucosidase Inhibitors Industry Revenue (Million), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 11: Latin America Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 12: Latin America Alpha Glucosidase Inhibitors Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Latin America Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Alpha Glucosidase Inhibitors Industry Revenue (Million), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 15: Asia Pacific Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 16: Asia Pacific Alpha Glucosidase Inhibitors Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Asia Pacific Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Alpha Glucosidase Inhibitors Industry Revenue (Million), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 19: Middle East and Africa Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Alpha-glucosidase Inhibitors 2025 & 2033

- Figure 20: Middle East and Africa Alpha Glucosidase Inhibitors Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Alpha Glucosidase Inhibitors Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Alpha-glucosidase Inhibitors 2020 & 2033

- Table 2: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Alpha-glucosidase Inhibitors 2020 & 2033

- Table 4: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Alpha-glucosidase Inhibitors 2020 & 2033

- Table 9: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: France Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Germany Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Alpha-glucosidase Inhibitors 2020 & 2033

- Table 18: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Mexico Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Brazil Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Latin America Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Alpha-glucosidase Inhibitors 2020 & 2033

- Table 23: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Japan Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: South Korea Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: China Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Vietnam Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Malaysia Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Indonesia Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Philippines Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Thailand Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Asia Pacific Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Alpha-glucosidase Inhibitors 2020 & 2033

- Table 36: Global Alpha Glucosidase Inhibitors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Saudi Arabia Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Iran Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Egypt Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Oman Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: South Africa Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Alpha Glucosidase Inhibitors Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Alpha Glucosidase Inhibitors Industry?

The projected CAGR is approximately 2.17%.

2. Which companies are prominent players in the Alpha Glucosidase Inhibitors Industry?

Key companies in the market include Pfizer, Takeda, Eris, Glenmark, Blue Cross, Sun Pharma, Unichem, Hexalag, Bayer, Torrent.

3. What are the main segments of the Alpha Glucosidase Inhibitors Industry?

The market segments include Alpha-glucosidase Inhibitors.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.76 Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Number of Kidney Cancer Cases; Increased R&D Expenditure of Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Rising diabetes prevalence globally.

7. Are there any restraints impacting market growth?

; High Cost Associated with Treatment; Preference for Generic Drugs.

8. Can you provide examples of recent developments in the market?

January 2023: The Indian Drug pricing regulator National Pharmaceutical Pricing Authority (NPPA) fixed the retail price of 12 scheduled formulations under the Drugs (Prices Control) Order, 2013 (NLEM 2022). The retail price of one tablet of anti-diabetes combination drug Glimepiride, Voglibose & Metformin (extended-release) is fixed at INR 13.83 (USD 0.17).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Alpha Glucosidase Inhibitors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Alpha Glucosidase Inhibitors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Alpha Glucosidase Inhibitors Industry?

To stay informed about further developments, trends, and reports in the Alpha Glucosidase Inhibitors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence