Key Insights

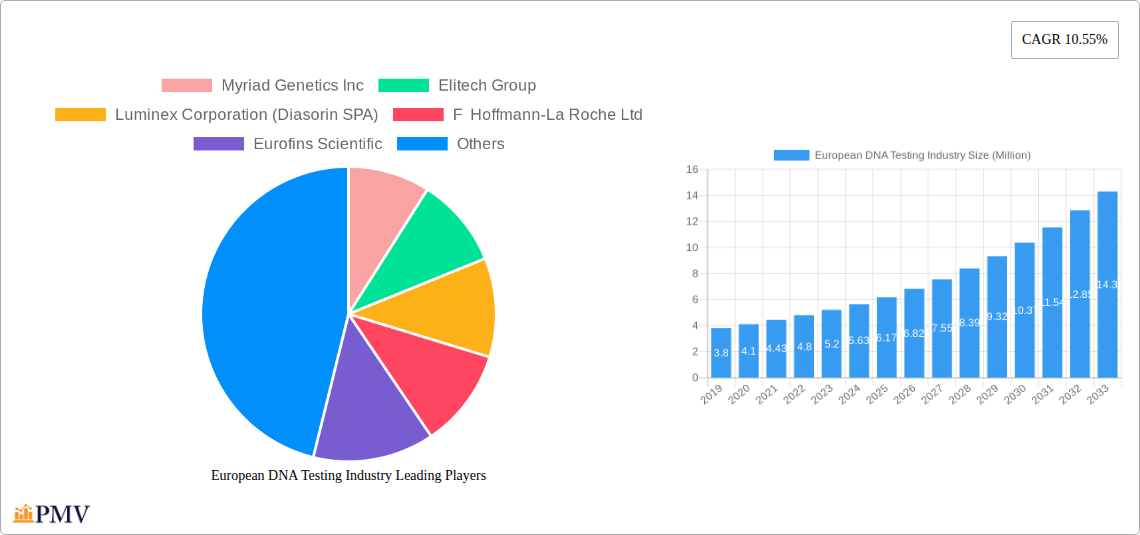

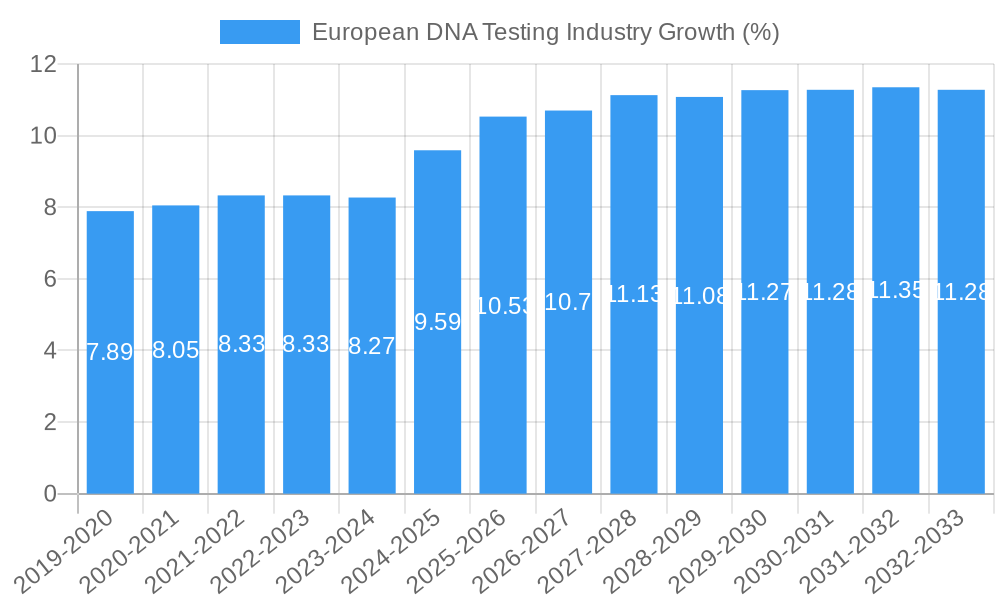

The European DNA testing market is experiencing robust growth, projected to reach approximately USD 6.17 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 10.55% through 2033. This significant expansion is fueled by increasing consumer awareness regarding genetic predispositions to diseases, a rising demand for personalized medicine, and advancements in molecular and cytogenetic testing technologies. The diagnostic testing segment, particularly for conditions like cancer and inherited disorders such as Cystic Fibrosis and Sickle Cell Anemia, is a primary driver. Furthermore, the growing adoption of prenatal testing for genetic abnormalities and newborn screening programs to detect congenital diseases early are contributing to market momentum. The European market benefits from a well-established healthcare infrastructure and a growing emphasis on preventive healthcare measures, pushing demand for sophisticated genetic analysis.

The market's dynamism is further shaped by key trends including the increasing integration of DNA testing into routine healthcare diagnostics, the proliferation of direct-to-consumer (DTC) genetic testing services for ancestry and wellness, and the development of more accurate and cost-effective testing methodologies. While the market enjoys strong growth, potential restraints include stringent data privacy regulations and ethical concerns surrounding genetic information. However, ongoing innovation in technologies like next-generation sequencing (NGS) and the expansion of testing capabilities for complex conditions like Alzheimer's Disease and Huntington's Disease are expected to overcome these challenges. Major players like F Hoffmann-La Roche Ltd, Thermo Fisher Scientific, and Illumina Inc. are actively investing in research and development, strategic partnerships, and market expansion within Europe, catering to the diverse needs across various segments and countries like Germany, the UK, and France.

This comprehensive report provides an in-depth analysis of the European DNA Testing Industry, offering critical insights into market dynamics, growth drivers, segmentation, and competitive strategies. Covering the historical period from 2019-2024, the base year of 2025, and an extensive forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the rapidly evolving European genetic testing market.

European DNA Testing Industry Market Structure & Competitive Dynamics

The European DNA Testing Industry is characterized by a moderately concentrated market structure, with key players investing heavily in research and development to drive innovation. The genetic testing market Europe sees significant collaboration between academic institutions and private companies, fostering robust innovation ecosystems. Regulatory frameworks, while evolving, play a crucial role in shaping market access and product development. Substitutes for direct genetic testing, such as traditional diagnostic methods, are gradually being displaced by the precision and efficiency of DNA testing in Europe. End-user trends indicate a growing demand for personalized medicine, preventative healthcare, and advanced diagnostic solutions. Mergers and acquisitions (M&A) activities are prevalent, with an estimated European DNA testing market M&A deal value in the hundreds of Million Euros annually, as companies strategically consolidate to gain market share and expand technological capabilities. The overall market share for leading companies like Myriad Genetics Inc and Eurofins Scientific is substantial, reflecting their established presence and diversified portfolios in the European genetics market.

European DNA Testing Industry Industry Trends & Insights

The European DNA Testing Industry is experiencing robust growth, driven by increasing awareness of genetic predispositions and the rising prevalence of chronic diseases. The European genetic testing market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 15-20% during the forecast period. Technological advancements, particularly in molecular testing and next-generation sequencing (NGS), are revolutionizing diagnostic capabilities, making DNA diagnostics Europe more accessible and accurate. Consumer preferences are shifting towards proactive health management, with a significant uptake in carrier testing, prenatal testing, and predictive and presymptomatic testing. The competitive landscape is dynamic, with established giants and agile startups vying for market dominance. The penetration of genetic testing for diseases in Europe, including Alzheimer's disease, cancer, and cystic fibrosis, is steadily increasing due to improved diagnostic accuracy and cost-effectiveness. Factors such as favorable reimbursement policies and government initiatives supporting genetic research are further accelerating market expansion.

Dominant Markets & Segments in European DNA Testing Industry

The European DNA Testing Industry is seeing significant traction across various segments. Diagnostic Testing currently holds the largest market share, fueled by the increasing diagnosis of cancer and rare genetic diseases such as Cystic Fibrosis and Thalassemia. Prenatal Testing is also a major contributor, with a rising trend in non-invasive prenatal testing (NIPT) due to its safety and accuracy. Newborn Screening programs are expanding across European nations, aiming to detect and treat genetic disorders early.

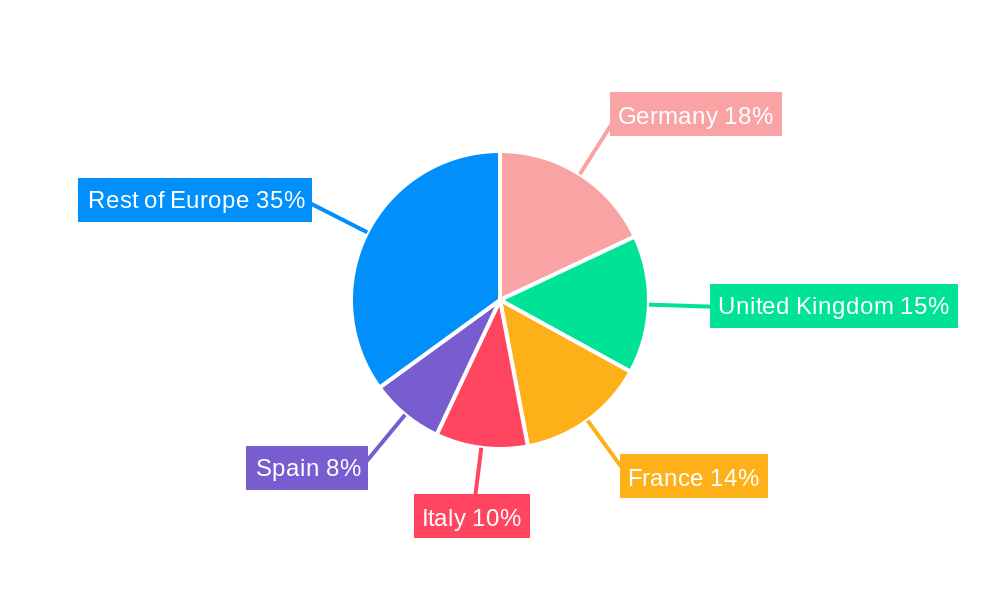

- Leading Region: Western Europe, particularly Germany, the United Kingdom, and France, dominates the European DNA testing market due to advanced healthcare infrastructure, high disposable incomes, and strong government support for genetic research.

- Dominant Segments by Type:

- Diagnostic Testing: Driven by the need for precise identification of genetic disorders and the growing burden of diseases like cancer.

- Prenatal Testing: Fueled by a desire for early detection of fetal genetic abnormalities and advancements in NIPT.

- Dominant Segments by Disease:

- Cancer: Comprehensive cancer genetic testing is in high demand for diagnosis, prognosis, and treatment selection.

- Alzheimer's Disease: Increasing research and interest in genetic markers for Alzheimer's Disease predict a significant market growth.

- Dominant Segments by Technology:

- Molecular Testing: This segment leads due to its versatility in analyzing DNA and RNA for a wide range of genetic conditions, including Huntington's Disease and Sickle Cell Anemia.

- Cytogenetic Testing: Remains crucial for diagnosing chromosomal abnormalities.

Economic policies supporting healthcare innovation and infrastructure development are key drivers of this dominance.

European DNA Testing Industry Product Innovations

Product innovation in the European DNA Testing Industry is largely focused on enhancing accuracy, speed, and accessibility. Developments include more sensitive molecular testing platforms for early disease detection and advanced algorithms for interpreting complex genomic data. Companies are also innovating in the field of prenatal testing, offering non-invasive solutions that reduce risk. The integration of artificial intelligence (AI) in analyzing genetic data is a significant trend, enabling faster and more precise diagnoses for conditions like Duchenne Muscular Dystrophy. These advancements provide a competitive edge by addressing unmet clinical needs and expanding the application of genetic testing in Europe.

Report Segmentation & Scope

This report segments the European DNA Testing Industry by testing type, disease, and technology.

- Type: The analysis covers Carrier Testing, Diagnostic Testing, Newborn Screening, Predictive and Presymptomatic Testing, Prenatal Testing, and Other Types. Each segment's growth projections and market sizes are detailed.

- Disease: The report delves into Alzheimer's Disease, Cancer, Cystic Fibrosis, Sickle Cell Anemia, Duchenne Muscular Dystrophy, Thalassemia, Huntington's Disease, and Other Diseases. Competitive dynamics within each disease-specific testing market are explored.

- Technology: Key technologies examined include Cytogenetic Testing, Biochemical Testing, and Molecular Testing. Growth in the molecular testing segment is particularly emphasized.

Key Drivers of European DNA Testing Industry Growth

Several factors are propelling the European DNA Testing Industry.

- Technological Advancements: Continuous innovation in molecular testing and NGS technologies, leading to greater accuracy and cost-effectiveness.

- Growing Awareness: Increasing public and medical awareness regarding the benefits of genetic testing for early disease detection and personalized medicine.

- Rising Incidence of Chronic Diseases: A higher prevalence of cancer, Alzheimer's disease, and other genetic disorders necessitates advanced diagnostic tools.

- Favorable Regulatory Environment: Supportive government policies and initiatives promoting genetic research and healthcare innovation.

- Increased Investment: Growing R&D expenditure by both public and private entities in the European genetics market.

Challenges in the European DNA Testing Industry Sector

Despite robust growth, the European DNA Testing Industry faces several challenges.

- Regulatory Hurdles: Navigating diverse and evolving regulatory landscapes across different European countries can be complex and time-consuming, impacting market entry for new DNA testing services Europe.

- Reimbursement Policies: Inconsistent reimbursement policies for genetic testing across national health systems can limit patient access and market penetration.

- Data Privacy and Security Concerns: Handling sensitive genetic information requires stringent data protection measures, posing ongoing challenges.

- High Cost of Advanced Technologies: While decreasing, the cost of some advanced molecular testing technologies can still be a barrier for widespread adoption.

- Skilled Workforce Shortage: A demand for highly trained geneticists, bioinformaticians, and laboratory technicians can impact operational scalability.

Leading Players in the European DNA Testing Industry Market

- Myriad Genetics Inc

- Elitech Group

- Luminex Corporation (Diasorin SPA)

- F Hoffmann-La Roche Ltd

- Eurofins Scientific

- 23andMe Inc

- Abbott Laboratories

- Blueprint Genetics Oy

- Danaher Corporation

- Qiagen

- Illumina Inc

- Centogene AG

- Thermo Fisher Scientific

Key Developments in European DNA Testing Industry Sector

- October 2022: NHS England launched a national genetic testing service to deliver rapid life-saving checks for children and babies. As a result of the launch, patients can undergo simple blood tests. Once they are processed, the service is likely to give medical teams from across the country results within days, meaning they can kick-start lifesaving treatment plans for more than 6,000 genetic diseases. This development significantly boosts the newborn screening and diagnostic testing segments.

- August 2022: Myriad Genetics partnered with Institut für Hämopathologie Hamburg and Centre Georges-Francois LeClerc to expand access to genetic testing in Europe. Collaboration brings MyChoice CDx Plus Testing to Hamburg, Germany, and Dijon, France. This partnership enhances the availability of predictive and presymptomatic testing and cancer genetic testing in key European markets.

Strategic European DNA Testing Industry Market Outlook

- October 2022: NHS England launched a national genetic testing service to deliver rapid life-saving checks for children and babies. As a result of the launch, patients can undergo simple blood tests. Once they are processed, the service is likely to give medical teams from across the country results within days, meaning they can kick-start lifesaving treatment plans for more than 6,000 genetic diseases. This development significantly boosts the newborn screening and diagnostic testing segments.

- August 2022: Myriad Genetics partnered with Institut für Hämopathologie Hamburg and Centre Georges-Francois LeClerc to expand access to genetic testing in Europe. Collaboration brings MyChoice CDx Plus Testing to Hamburg, Germany, and Dijon, France. This partnership enhances the availability of predictive and presymptomatic testing and cancer genetic testing in key European markets.

Strategic European DNA Testing Industry Market Outlook

The European DNA Testing Industry is poised for sustained, high-impact growth, driven by an increasing demand for personalized medicine and preventative healthcare solutions. Strategic opportunities lie in expanding access to advanced molecular testing for rare genetic diseases and chronic conditions, as well as leveraging AI for more efficient data analysis. Collaborations with healthcare providers and government bodies to establish standardized reimbursement frameworks will be crucial. The growing focus on genomics in healthcare Europe presents a fertile ground for innovation in carrier testing, prenatal testing, and diagnostics for conditions like Alzheimer's disease and cancer. The market's trajectory points towards a future where DNA testing is an integral part of routine healthcare across the continent.

European DNA Testing Industry Segmentation

-

1. Type

- 1.1. Carrier Testing

- 1.2. Diagnostic Testing

- 1.3. Newborn Screening

- 1.4. Predictive and Presymptomatic Testing

- 1.5. Prenatal Testing

- 1.6. Other Types

-

2. Disease

- 2.1. Alzheimer's Disease

- 2.2. Cancer

- 2.3. Cystic Fibrosis

- 2.4. Sickle Cell Anemia

- 2.5. Duchenne Muscular Dystrophy

- 2.6. Thalassemia

- 2.7. Huntington's Disease

- 2.8. Other Diseases

-

3. Technology

- 3.1. Cytogenetic Testing

- 3.2. Biochemical Testing

- 3.3. Molecular Testing

European DNA Testing Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

European DNA Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Emphasis on Early Disease Detection and Prevention; Increasing Demand for Personalized Medicine; Increasing Application of Genetic Testing in Oncology

- 3.3. Market Restrains

- 3.3.1. High Costs of Genetic Testing; Social and Ethical Implications of Genetic Testing

- 3.4. Market Trends

- 3.4.1. The Diagnostic Testing Segment is Expected to Hold a Significant Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carrier Testing

- 5.1.2. Diagnostic Testing

- 5.1.3. Newborn Screening

- 5.1.4. Predictive and Presymptomatic Testing

- 5.1.5. Prenatal Testing

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Disease

- 5.2.1. Alzheimer's Disease

- 5.2.2. Cancer

- 5.2.3. Cystic Fibrosis

- 5.2.4. Sickle Cell Anemia

- 5.2.5. Duchenne Muscular Dystrophy

- 5.2.6. Thalassemia

- 5.2.7. Huntington's Disease

- 5.2.8. Other Diseases

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Cytogenetic Testing

- 5.3.2. Biochemical Testing

- 5.3.3. Molecular Testing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Carrier Testing

- 6.1.2. Diagnostic Testing

- 6.1.3. Newborn Screening

- 6.1.4. Predictive and Presymptomatic Testing

- 6.1.5. Prenatal Testing

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Disease

- 6.2.1. Alzheimer's Disease

- 6.2.2. Cancer

- 6.2.3. Cystic Fibrosis

- 6.2.4. Sickle Cell Anemia

- 6.2.5. Duchenne Muscular Dystrophy

- 6.2.6. Thalassemia

- 6.2.7. Huntington's Disease

- 6.2.8. Other Diseases

- 6.3. Market Analysis, Insights and Forecast - by Technology

- 6.3.1. Cytogenetic Testing

- 6.3.2. Biochemical Testing

- 6.3.3. Molecular Testing

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Carrier Testing

- 7.1.2. Diagnostic Testing

- 7.1.3. Newborn Screening

- 7.1.4. Predictive and Presymptomatic Testing

- 7.1.5. Prenatal Testing

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Disease

- 7.2.1. Alzheimer's Disease

- 7.2.2. Cancer

- 7.2.3. Cystic Fibrosis

- 7.2.4. Sickle Cell Anemia

- 7.2.5. Duchenne Muscular Dystrophy

- 7.2.6. Thalassemia

- 7.2.7. Huntington's Disease

- 7.2.8. Other Diseases

- 7.3. Market Analysis, Insights and Forecast - by Technology

- 7.3.1. Cytogenetic Testing

- 7.3.2. Biochemical Testing

- 7.3.3. Molecular Testing

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Carrier Testing

- 8.1.2. Diagnostic Testing

- 8.1.3. Newborn Screening

- 8.1.4. Predictive and Presymptomatic Testing

- 8.1.5. Prenatal Testing

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Disease

- 8.2.1. Alzheimer's Disease

- 8.2.2. Cancer

- 8.2.3. Cystic Fibrosis

- 8.2.4. Sickle Cell Anemia

- 8.2.5. Duchenne Muscular Dystrophy

- 8.2.6. Thalassemia

- 8.2.7. Huntington's Disease

- 8.2.8. Other Diseases

- 8.3. Market Analysis, Insights and Forecast - by Technology

- 8.3.1. Cytogenetic Testing

- 8.3.2. Biochemical Testing

- 8.3.3. Molecular Testing

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Carrier Testing

- 9.1.2. Diagnostic Testing

- 9.1.3. Newborn Screening

- 9.1.4. Predictive and Presymptomatic Testing

- 9.1.5. Prenatal Testing

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Disease

- 9.2.1. Alzheimer's Disease

- 9.2.2. Cancer

- 9.2.3. Cystic Fibrosis

- 9.2.4. Sickle Cell Anemia

- 9.2.5. Duchenne Muscular Dystrophy

- 9.2.6. Thalassemia

- 9.2.7. Huntington's Disease

- 9.2.8. Other Diseases

- 9.3. Market Analysis, Insights and Forecast - by Technology

- 9.3.1. Cytogenetic Testing

- 9.3.2. Biochemical Testing

- 9.3.3. Molecular Testing

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Carrier Testing

- 10.1.2. Diagnostic Testing

- 10.1.3. Newborn Screening

- 10.1.4. Predictive and Presymptomatic Testing

- 10.1.5. Prenatal Testing

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Disease

- 10.2.1. Alzheimer's Disease

- 10.2.2. Cancer

- 10.2.3. Cystic Fibrosis

- 10.2.4. Sickle Cell Anemia

- 10.2.5. Duchenne Muscular Dystrophy

- 10.2.6. Thalassemia

- 10.2.7. Huntington's Disease

- 10.2.8. Other Diseases

- 10.3. Market Analysis, Insights and Forecast - by Technology

- 10.3.1. Cytogenetic Testing

- 10.3.2. Biochemical Testing

- 10.3.3. Molecular Testing

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Europe European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Carrier Testing

- 11.1.2. Diagnostic Testing

- 11.1.3. Newborn Screening

- 11.1.4. Predictive and Presymptomatic Testing

- 11.1.5. Prenatal Testing

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Disease

- 11.2.1. Alzheimer's Disease

- 11.2.2. Cancer

- 11.2.3. Cystic Fibrosis

- 11.2.4. Sickle Cell Anemia

- 11.2.5. Duchenne Muscular Dystrophy

- 11.2.6. Thalassemia

- 11.2.7. Huntington's Disease

- 11.2.8. Other Diseases

- 11.3. Market Analysis, Insights and Forecast - by Technology

- 11.3.1. Cytogenetic Testing

- 11.3.2. Biochemical Testing

- 11.3.3. Molecular Testing

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Germany European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 13. France European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe European DNA Testing Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Myriad Genetics Inc

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Elitech Group

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Luminex Corporation (Diasorin SPA)

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 F Hoffmann-La Roche Ltd

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Eurofins Scientific

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 F Hoffmann-La Roche Ltd*List Not Exhaustive

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 23andMe Inc

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Abbott Laboratories

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Blueprint Genetics Oy

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Danaher Corporation

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Qiagen

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 Illumina Inc

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.13 Centogene AG

- 19.2.13.1. Overview

- 19.2.13.2. Products

- 19.2.13.3. SWOT Analysis

- 19.2.13.4. Recent Developments

- 19.2.13.5. Financials (Based on Availability)

- 19.2.14 Thermo Fisher Scientific

- 19.2.14.1. Overview

- 19.2.14.2. Products

- 19.2.14.3. SWOT Analysis

- 19.2.14.4. Recent Developments

- 19.2.14.5. Financials (Based on Availability)

- 19.2.1 Myriad Genetics Inc

List of Figures

- Figure 1: European DNA Testing Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European DNA Testing Industry Share (%) by Company 2024

List of Tables

- Table 1: European DNA Testing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 4: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 5: European DNA Testing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe European DNA Testing Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 16: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 17: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 20: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 21: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 24: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 25: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 27: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 28: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 29: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 32: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 33: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: European DNA Testing Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 35: European DNA Testing Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 36: European DNA Testing Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 37: European DNA Testing Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European DNA Testing Industry?

The projected CAGR is approximately 10.55%.

2. Which companies are prominent players in the European DNA Testing Industry?

Key companies in the market include Myriad Genetics Inc, Elitech Group, Luminex Corporation (Diasorin SPA), F Hoffmann-La Roche Ltd, Eurofins Scientific, F Hoffmann-La Roche Ltd*List Not Exhaustive, 23andMe Inc, Abbott Laboratories, Blueprint Genetics Oy, Danaher Corporation, Qiagen, Illumina Inc, Centogene AG, Thermo Fisher Scientific.

3. What are the main segments of the European DNA Testing Industry?

The market segments include Type, Disease, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Emphasis on Early Disease Detection and Prevention; Increasing Demand for Personalized Medicine; Increasing Application of Genetic Testing in Oncology.

6. What are the notable trends driving market growth?

The Diagnostic Testing Segment is Expected to Hold a Significant Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs of Genetic Testing; Social and Ethical Implications of Genetic Testing.

8. Can you provide examples of recent developments in the market?

October 2022: NHS England launched a national genetic testing service to deliver rapid life-saving checks for children and babies. As a result of the launch, patients can undergo simple blood tests. Once they are processed, the service is likely to give medical teams from across the country results within days, meaning they can kick-start lifesaving treatment plans for more than 6,000 genetic diseases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European DNA Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European DNA Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European DNA Testing Industry?

To stay informed about further developments, trends, and reports in the European DNA Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence