Key Insights

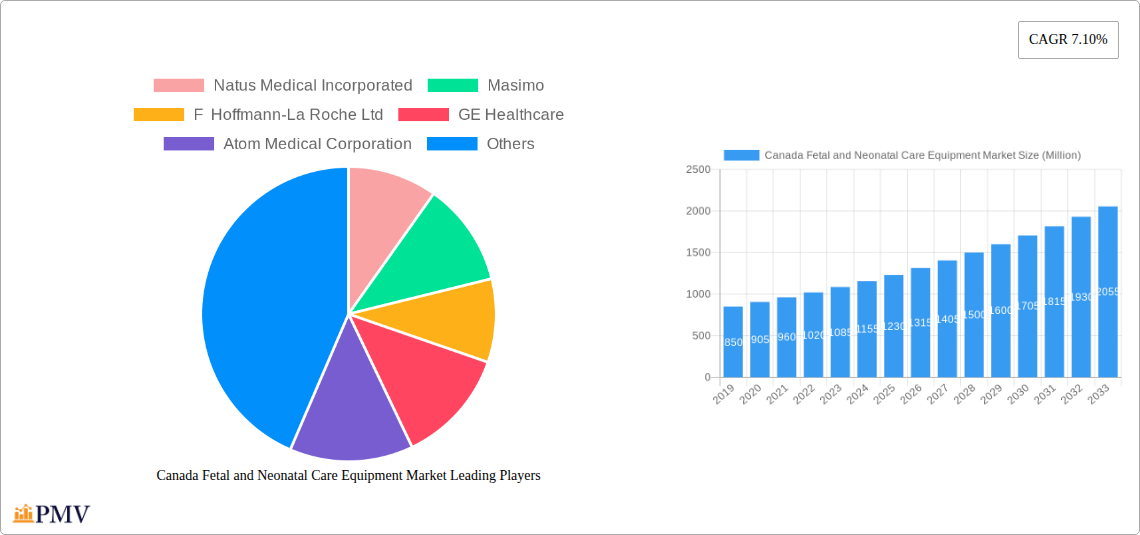

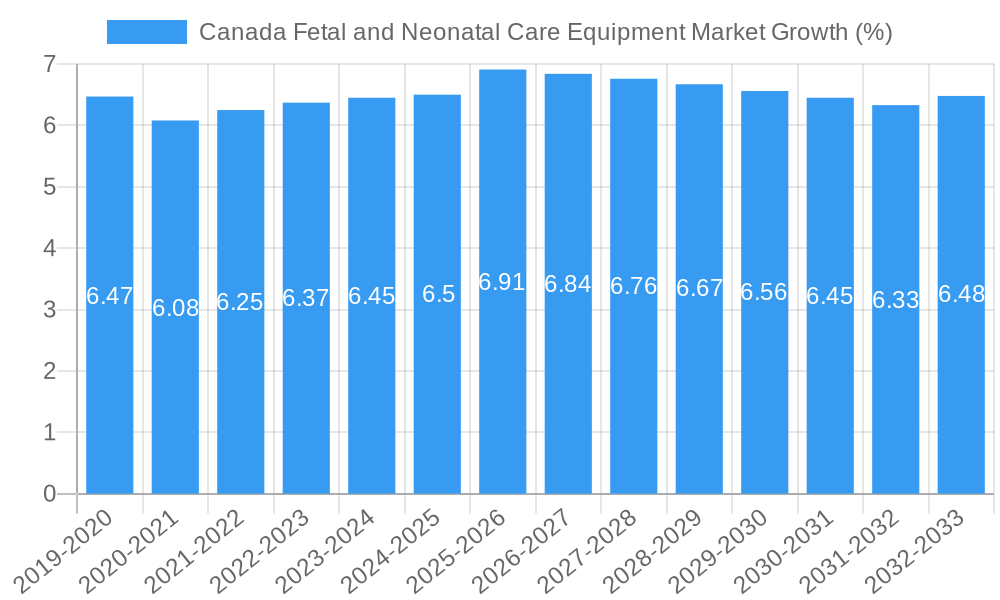

The Canadian fetal and neonatal care equipment market is poised for robust growth, projected to reach an estimated XX Million by 2025, expanding at a compound annual growth rate (CAGR) of 7.10% through 2033. This significant expansion is primarily driven by increasing awareness of fetal and neonatal health, coupled with advancements in medical technology. Key drivers include a rising number of high-risk pregnancies, a growing premature birth rate, and enhanced government initiatives focused on improving maternal and child healthcare infrastructure across Canada. The market benefits from the continuous introduction of sophisticated diagnostic and therapeutic devices, offering improved outcomes for both fetuses and newborns. Furthermore, the increasing adoption of advanced monitoring systems and therapeutic equipment in hospitals and specialized clinics is fueling market demand.

The market is broadly segmented into Fetal Care Equipment and Neonatal Care Equipment. Within fetal care, ultrasound devices and fetal dopplers are experiencing substantial demand due to their critical role in early detection and monitoring of fetal well-being. In the neonatal segment, incubators and respiratory assistance devices are paramount, driven by the need for intensive care for premature and critically ill newborns. Restraints, such as the high cost of advanced medical equipment and the need for specialized training for healthcare professionals, are being mitigated by technological innovations that offer greater affordability and ease of use. Key players like GE Healthcare, Siemens Healthineers AG, and Koninklijke Philips N.V. are actively investing in research and development to introduce innovative solutions, thereby shaping the competitive landscape and catering to the evolving needs of Canadian healthcare providers. The forecast period (2025-2033) is expected to witness sustained innovation and market penetration of these advanced care solutions.

Here's the detailed SEO-optimized report description for the Canada Fetal and Neonatal Care Equipment Market:

Canada Fetal and Neonatal Care Equipment Market: Growth, Trends, and Innovations (2019-2033)

This comprehensive market research report provides an in-depth analysis of the Canada Fetal and Neonatal Care Equipment Market, offering critical insights into its current state and future trajectory. Covering the study period of 2019–2033, with a base year of 2025 and an estimated year also of 2025, this report delves into the forecast period of 2025–2033 and the historical period of 2019–2024. Explore key market dynamics, dominant segments, product innovations, and strategic opportunities within this vital healthcare sector. This report is indispensable for stakeholders seeking to understand and capitalize on the evolving landscape of fetal monitoring devices, neonatal intensive care units (NICU) equipment, and related technologies in Canada.

Canada Fetal and Neonatal Care Equipment Market Market Structure & Competitive Dynamics

The Canada Fetal and Neonatal Care Equipment Market exhibits a moderately consolidated structure, with key players like GE Healthcare, Siemens Healthineers AG, and Koninklijke Philips N.V. holding significant market share. Innovation is a critical differentiator, driven by ongoing research and development in areas like remote patient monitoring and AI-driven diagnostics for fetal and neonatal health. The regulatory framework, governed by Health Canada, plays a crucial role in ensuring product safety and efficacy, influencing market entry and product lifecycle. While direct product substitutes are limited, advancements in less invasive monitoring techniques or alternative care pathways can represent indirect competitive threats. End-user trends are shifting towards minimally invasive, connected, and data-rich solutions, enabling better patient outcomes and operational efficiency in hospitals and clinics. Mergers and acquisitions (M&A) have been strategic, aimed at expanding product portfolios and geographical reach. Recent M&A activities have focused on consolidating capabilities in advanced neonatal respiratory support and fetal surveillance technologies, with deal values estimated to range from $10 Million to $50 Million. The market's competitive intensity is expected to remain high due to these factors.

Canada Fetal and Neonatal Care Equipment Market Industry Trends & Insights

The Canada Fetal and Neonatal Care Equipment Market is poised for significant growth, driven by an increasing number of births, a rise in high-risk pregnancies, and a growing awareness of the importance of early detection and intervention for fetal and neonatal health. Technological advancements are at the forefront of market expansion, with a strong emphasis on developing non-invasive fetal monitoring devices, advanced neonatal incubators, and sophisticated neonatal respiratory assistance and monitoring devices. The adoption of telehealth and remote monitoring solutions is a major trend, allowing healthcare providers to extend their reach and provide continuous care for vulnerable newborns and expectant mothers, especially in remote areas of Canada. Furthermore, the increasing prevalence of chronic conditions in pregnant women, such as diabetes and hypertension, contributes to a higher demand for advanced fetal monitoring equipment. The Canadian government's increasing focus on improving maternal and child health outcomes, coupled with favorable reimbursement policies for advanced medical devices, further fuels market growth. The competitive landscape is characterized by continuous innovation, with companies investing heavily in R&D to introduce next-generation products that offer enhanced accuracy, portability, and user-friendliness. The CAGR for the fetal and neonatal care equipment market in Canada is projected to be approximately 7.5% during the forecast period. Market penetration of advanced diagnostic imaging for prenatal care is expected to reach over 85% by 2030, underscoring the growing reliance on technology for improved perinatal care. The market penetration of advanced neonatal monitoring devices is estimated at 70% currently, with significant room for growth.

Dominant Markets & Segments in Canada Fetal and Neonatal Care Equipment Market

Within the Canada Fetal and Neonatal Care Equipment Market, Neonatal Care Equipment emerges as the dominant segment, accounting for an estimated 60% of the total market share in 2025. This dominance is propelled by the critical need for specialized equipment to manage the complexities of premature birth, congenital anomalies, and other critical conditions in newborns.

- Neonatal Monitoring Devices: This sub-segment is particularly strong due to the increasing adoption of advanced technologies that provide real-time physiological data, enabling timely interventions. Key drivers include the rising incidence of prematurity and low birth weight, and the demand for continuous, non-invasive monitoring solutions to reduce the risk of complications. Economic policies that prioritize healthcare infrastructure development and technological adoption in NICUs contribute significantly.

- Respiratory Assistance and Monitoring Devices: These devices, including ventilators and CPAP machines, are crucial for supporting the fragile respiratory systems of neonates. The growing number of NICU beds across Canada and the focus on reducing infant mortality rates are key growth catalysts. Government funding for critical care infrastructure and training programs for neonatal respiratory therapists further bolster this segment's dominance.

- Incubators: While a foundational element of neonatal care, the demand for advanced incubators with integrated monitoring and treatment capabilities continues to drive growth. Innovations focusing on temperature regulation, humidity control, and infection prevention are key to their sustained market presence.

Conversely, Fetal Care Equipment also represents a substantial and growing market, driven by the proactive identification and management of fetal well-being.

- Ultrasound Devices: These are indispensable for prenatal diagnostics, including anatomical surveys, growth monitoring, and anomaly detection. The increasing number of prenatal screenings and the demand for high-resolution, portable ultrasound machines are key growth drivers. Technological advancements in 3D/4D imaging and AI-assisted interpretation are enhancing their utility and market penetration.

- Fetal Dopplers: Essential for monitoring fetal heart rate during pregnancy and labor, fetal dopplers remain a staple. Their affordability and ease of use ensure continued demand, especially in primary care settings and for home monitoring applications.

The robust performance of both fetal and neonatal care equipment segments is supported by Canada's well-established healthcare system, significant investment in medical technology, and a growing focus on preventive and proactive perinatal care.

Canada Fetal and Neonatal Care Equipment Market Product Innovations

Product innovations in the Canada Fetal and Neonatal Care Equipment Market are primarily focused on enhancing diagnostic accuracy, improving patient comfort, and increasing connectivity. Leading companies are developing smart incubators with integrated sensors for real-time physiological monitoring, AI-powered fetal ECG analysis for improved risk stratification, and non-invasive respiratory support devices that minimize patient distress. Wearable fetal monitoring patches are gaining traction for their ability to provide continuous, untethered surveillance, offering greater mobility for expectant mothers. Furthermore, advancements in phototherapy equipment are leading to more efficient and targeted light delivery for neonatal jaundice treatment, reducing treatment duration and potential side effects. These innovations address the growing demand for portable, user-friendly, and data-driven solutions that contribute to better clinical outcomes and operational efficiency in healthcare settings.

Report Segmentation & Scope

This report meticulously segments the Canada Fetal and Neonatal Care Equipment Market to provide granular insights. The primary segmentation is based on Product Type, encompassing two major categories: Fetal Care Equipment and Neonatal Care Equipment.

Under Fetal Care Equipment, the report analyzes sub-segments including Fetal Dopplers, Fetal Magnetic Resonance Imaging (MRI) Devices, Ultrasound Devices, Fetal Pulse Oximeters, and Other Fetal Care Equipment. Each of these sub-segments is examined for its market size, growth projections, and competitive dynamics, with ultrasound devices and fetal dopplers expected to exhibit strong growth.

The Neonatal Care Equipment segment is further divided into Incubators, Neonatal Monitoring Devices, Phototherapy Equipment, Respiratory Assistance and Monitoring Devices, and Other Neonatal Care Equipment. This segment is projected to continue its dominance, driven by the critical needs of NICU care, with neonatal monitoring devices and respiratory support systems showing particularly robust growth trajectories.

Key Drivers of Canada Fetal and Neonatal Care Equipment Market Growth

Several key drivers are propelling the Canada Fetal and Neonatal Care Equipment Market. A significant factor is the rising number of preterm births and pregnancies with high-risk complications, necessitating advanced monitoring and intervention technologies. Technological advancements, particularly in non-invasive monitoring, AI-driven diagnostics, and smart connected devices, are creating new opportunities for enhanced patient care and operational efficiency. Government initiatives aimed at improving maternal and child health outcomes, coupled with increased healthcare expenditure, also contribute to market expansion. Furthermore, a growing awareness among healthcare providers and the public about the benefits of early detection and intervention for fetal and neonatal health is fostering a higher demand for sophisticated equipment. The increasing adoption of telehealth and remote patient monitoring solutions, especially post-pandemic, is also a crucial growth acceleratore.

Challenges in the Canada Fetal and Neonatal Care Equipment Market Sector

Despite the positive growth outlook, the Canada Fetal and Neonatal Care Equipment Market faces several challenges. High upfront costs associated with advanced fetal and neonatal care equipment can be a significant barrier for some healthcare facilities, particularly smaller clinics or those in underserved regions. Stringent regulatory approval processes, though essential for patient safety, can prolong the time-to-market for new products, impacting innovation timelines. The need for specialized training for healthcare professionals to effectively operate and interpret data from complex equipment can also pose a challenge. Furthermore, the competitive pressure among existing players and the potential for rapid technological obsolescence necessitate continuous investment in R&D, which can strain resources for smaller companies. Supply chain disruptions and geopolitical uncertainties can also impact the availability and cost of components and finished products.

Leading Players in the Canada Fetal and Neonatal Care Equipment Market Market

- Natus Medical Incorporated

- Masimo

- F Hoffmann-La Roche Ltd

- GE Healthcare

- Atom Medical Corporation

- Koninklijke Philips N V

- Medtronic PLC

- Siemens Healthineers AG

- Becton Dickinson and Company

- Dragerwerk AG & Co KGaA

Key Developments in Canada Fetal and Neonatal Care Equipment Market Sector

- 2023: GE Healthcare launched its new generation of neonatal ventilators, offering enhanced patient-ventilator synchrony and improved outcomes for critically ill newborns.

- 2022: Masimo introduced an advanced fetal pulse oximetry system, providing real-time oxygen saturation monitoring during labor to better assess fetal well-being.

- 2022: Koninklijke Philips N.V. expanded its IntelliVue patient monitoring portfolio with new solutions tailored for neonatal intensive care, emphasizing data integration and workflow efficiency.

- 2021: Siemens Healthineers AG announced the development of AI-powered ultrasound technology for prenatal diagnostics, aimed at improving detection rates of fetal abnormalities.

- 2020: Dragerwerk AG & Co KGaA released an innovative incubator with advanced temperature and humidity control, designed to create an optimal microenvironment for vulnerable neonates.

Strategic Canada Fetal and Neonatal Care Equipment Market Market Outlook

The strategic outlook for the Canada Fetal and Neonatal Care Equipment Market is highly optimistic, driven by sustained demand for advanced healthcare solutions and ongoing technological innovation. Growth accelerators include the increasing focus on preventative healthcare, the expanding role of telemedicine in perinatal care, and government investments in upgrading healthcare infrastructure. Opportunities lie in the development of user-friendly, AI-integrated devices that can support healthcare professionals in delivering more personalized and efficient care. The market is also likely to witness further consolidation and strategic partnerships as companies aim to broaden their product portfolios and enhance their market reach. The growing demand for portable and connected devices that facilitate continuous monitoring, both in hospital settings and potentially in home-care scenarios, presents a significant avenue for future growth. Continued emphasis on improving neonatal outcomes and reducing infant mortality rates will remain a central theme, guiding product development and market strategies.

Canada Fetal and Neonatal Care Equipment Market Segmentation

-

1. Product Type

-

1.1. Fetal Care Equipment

- 1.1.1. Fetal Dopplers

- 1.1.2. Fetal Magnetic Resonance Imaging (MRI) Devices

- 1.1.3. Ultrasound Devices

- 1.1.4. Fetal Pulse Oximeters

- 1.1.5. Other Fetal Care Equipment

-

1.2. Neonatal Care Equipment

- 1.2.1. Incubators

- 1.2.2. Neonatal Monitoring Devices

- 1.2.3. Phototherapy Equipment

- 1.2.4. Respiratory Assistance and Monitoring Devices

- 1.2.5. Other Neonatal Care Equipment

-

1.1. Fetal Care Equipment

Canada Fetal and Neonatal Care Equipment Market Segmentation By Geography

- 1. Canada

Canada Fetal and Neonatal Care Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number of Preterm and Low-weight Births; Increasing Technological Advancement in Infant and Maternal Care Products

- 3.3. Market Restrains

- 3.3.1. ; High Cost Associated with Neonatal Care

- 3.4. Market Trends

- 3.4.1. Neonatal Care Equipment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Fetal and Neonatal Care Equipment Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fetal Care Equipment

- 5.1.1.1. Fetal Dopplers

- 5.1.1.2. Fetal Magnetic Resonance Imaging (MRI) Devices

- 5.1.1.3. Ultrasound Devices

- 5.1.1.4. Fetal Pulse Oximeters

- 5.1.1.5. Other Fetal Care Equipment

- 5.1.2. Neonatal Care Equipment

- 5.1.2.1. Incubators

- 5.1.2.2. Neonatal Monitoring Devices

- 5.1.2.3. Phototherapy Equipment

- 5.1.2.4. Respiratory Assistance and Monitoring Devices

- 5.1.2.5. Other Neonatal Care Equipment

- 5.1.1. Fetal Care Equipment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Eastern Canada Canada Fetal and Neonatal Care Equipment Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Fetal and Neonatal Care Equipment Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Fetal and Neonatal Care Equipment Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Natus Medical Incorporated

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Masimo

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 F Hoffmann-La Roche Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 GE Healthcare

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Atom Medical Corporation

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Koninklijke Philips N V

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Medtronic PLC

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Siemens Healthineers AG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Becton Dickinson and Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Dragerwerk AG & Co KGaA

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Natus Medical Incorporated

List of Figures

- Figure 1: Canada Fetal and Neonatal Care Equipment Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Fetal and Neonatal Care Equipment Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Fetal and Neonatal Care Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Fetal and Neonatal Care Equipment Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Canada Fetal and Neonatal Care Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Canada Fetal and Neonatal Care Equipment Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: Canada Fetal and Neonatal Care Equipment Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Fetal and Neonatal Care Equipment Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Canada Fetal and Neonatal Care Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Canada Fetal and Neonatal Care Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Eastern Canada Canada Fetal and Neonatal Care Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Eastern Canada Canada Fetal and Neonatal Care Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: Western Canada Canada Fetal and Neonatal Care Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Western Canada Canada Fetal and Neonatal Care Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Central Canada Canada Fetal and Neonatal Care Equipment Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Central Canada Canada Fetal and Neonatal Care Equipment Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada Fetal and Neonatal Care Equipment Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Canada Fetal and Neonatal Care Equipment Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 17: Canada Fetal and Neonatal Care Equipment Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Canada Fetal and Neonatal Care Equipment Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Fetal and Neonatal Care Equipment Market?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Canada Fetal and Neonatal Care Equipment Market?

Key companies in the market include Natus Medical Incorporated, Masimo, F Hoffmann-La Roche Ltd, GE Healthcare, Atom Medical Corporation, Koninklijke Philips N V, Medtronic PLC, Siemens Healthineers AG, Becton Dickinson and Company, Dragerwerk AG & Co KGaA.

3. What are the main segments of the Canada Fetal and Neonatal Care Equipment Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number of Preterm and Low-weight Births; Increasing Technological Advancement in Infant and Maternal Care Products.

6. What are the notable trends driving market growth?

Neonatal Care Equipment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

; High Cost Associated with Neonatal Care.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Fetal and Neonatal Care Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Fetal and Neonatal Care Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Fetal and Neonatal Care Equipment Market?

To stay informed about further developments, trends, and reports in the Canada Fetal and Neonatal Care Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence