Key Insights

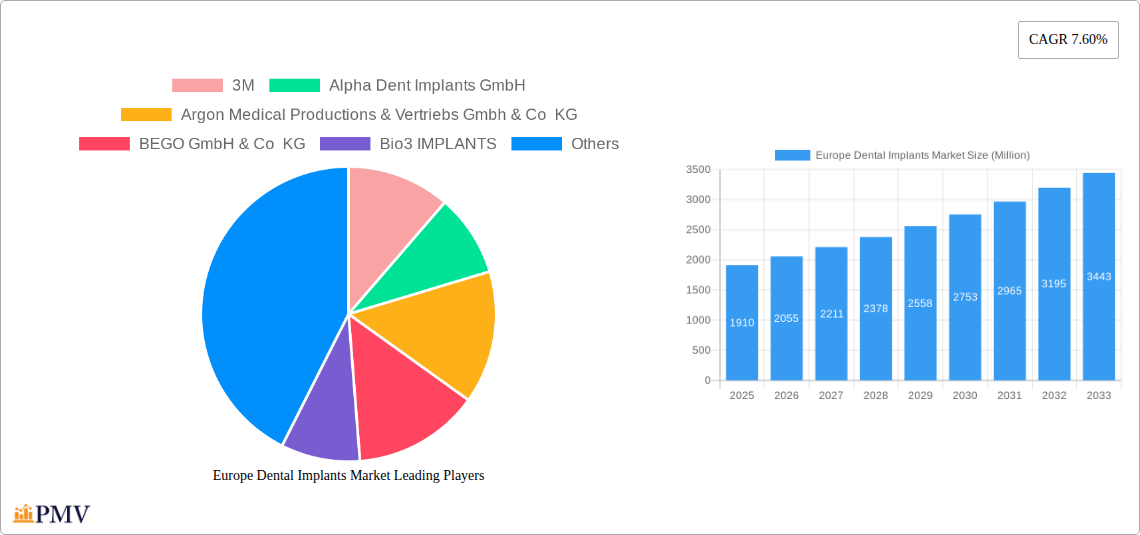

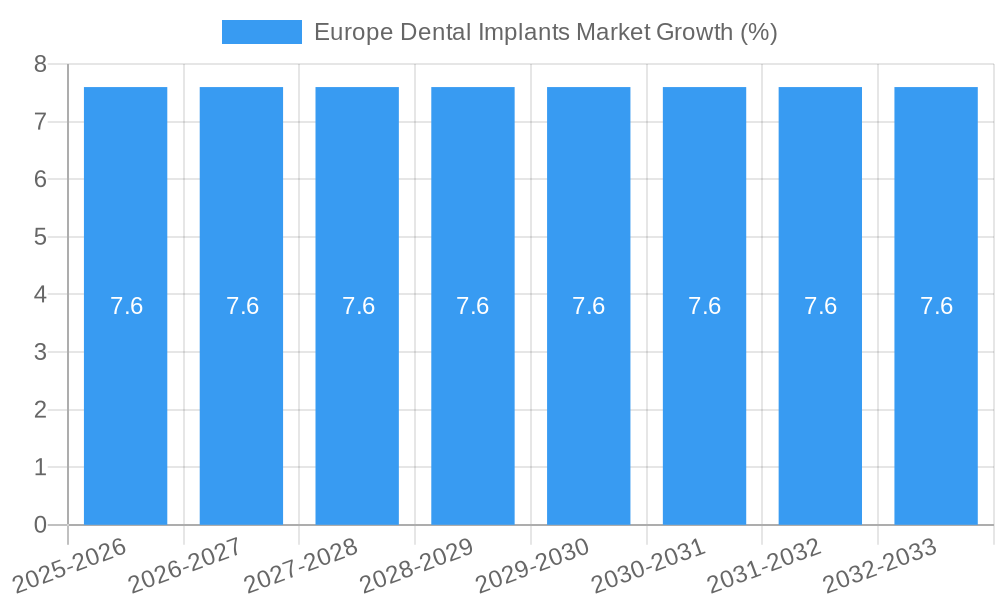

The Europe dental implants market is poised for robust expansion, projected to reach an impressive USD 1.91 billion by 2025. This growth is fueled by a substantial Compound Annual Growth Rate (CAGR) of 7.60% over the forecast period of 2025-2033. A primary driver for this upward trajectory is the increasing prevalence of dental conditions such as periodontitis and tooth loss, exacerbated by an aging population and evolving lifestyle habits across the continent. Furthermore, growing aesthetic consciousness and a desire for improved oral health and appearance are compelling more individuals to opt for dental implant procedures. Advancements in implant materials, including the widespread adoption of biocompatible options like titanium and zirconium, are enhancing implant longevity and patient satisfaction, thereby stimulating market demand. The continuous innovation in surgical techniques, such as minimally invasive procedures and digital dentistry, is also contributing significantly to market growth by improving patient outcomes and reducing recovery times.

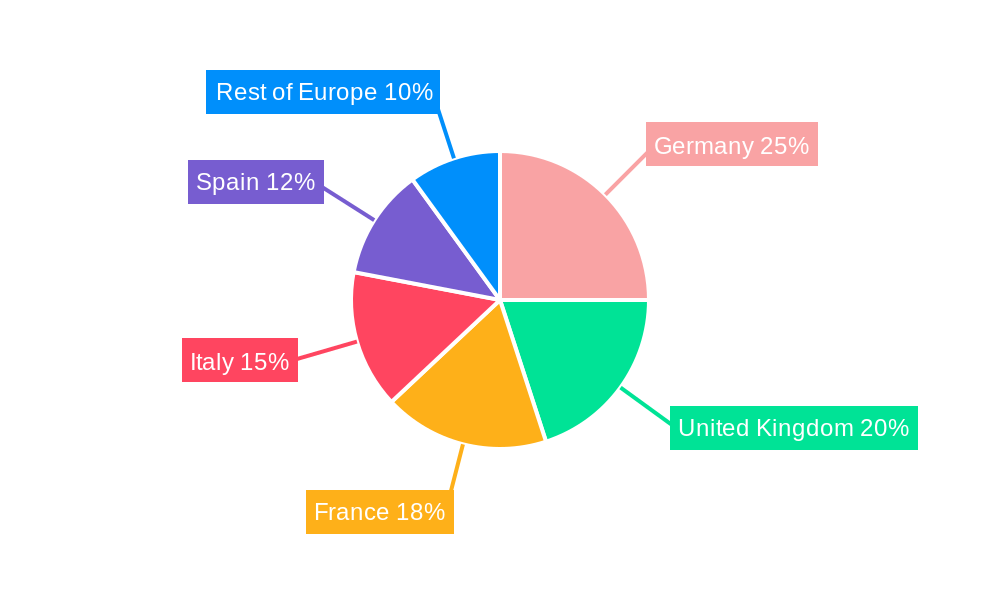

The market segmentation reveals a dynamic landscape. Within implant fixtures, endosteal implants are expected to dominate due to their widespread use and proven efficacy. However, subperiosteal and transosteal implants will also see steady demand, catering to specific patient needs. The increasing preference for aesthetically pleasing and durable solutions is driving the demand for both titanium and zirconium implants, with zirconium gaining traction due to its metal-free properties and biocompatibility. Key market players like Institut Straumann AG, Dentsply Sirona, and Nobel Biocare Services AG are actively engaged in research and development, introducing innovative products and expanding their market reach. The European region, particularly Germany, the United Kingdom, France, Italy, and Spain, represents a significant share of the global dental implants market, driven by high healthcare expenditure, advanced dental infrastructure, and a strong emphasis on patient care. The "Rest of Europe" segment also holds considerable potential for growth as dental tourism and access to advanced treatments expand.

This in-depth market report provides a detailed analysis of the Europe Dental Implants Market, offering actionable insights and strategic recommendations for stakeholders. Leveraging extensive historical data from 2019-2024 and robust forecasting for 2025-2033, with a base and estimated year of 2025, this report illuminates market dynamics, key trends, and competitive landscapes. We delve into crucial segments, including dental implant parts (Fixture: Endosteal Implants, Subperiosteal Implants, Transosteal Implants, Abutment) and materials (Titanium Implants, Zirconium Implants), and examine significant industry developments. The Europe dental implants market is projected to reach approximately $4,500 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period.

Europe Dental Implants Market Market Structure & Competitive Dynamics

The Europe Dental Implants Market exhibits a moderately concentrated structure, characterized by the presence of established global players alongside emerging regional manufacturers. Innovation ecosystems are thriving, driven by significant R&D investments from leading companies and a growing emphasis on digital dentistry and personalized treatment solutions. Regulatory frameworks, primarily governed by the EU Medical Device Regulation (MDR), are stringent, demanding robust quality management systems and clinical evidence for market entry, thereby influencing product development and market access. Product substitutes, such as traditional dentures and bridges, continue to pose a competitive threat, although dental implants offer superior long-term efficacy and patient satisfaction. End-user trends indicate a growing preference for minimally invasive procedures, aesthetic outcomes, and long-term oral health solutions, fueled by increasing disposable incomes and a greater awareness of dental care. Mergers and acquisitions (M&A) are a key feature of market consolidation and strategic expansion. For instance, recent M&A activities, such as Institut Straumann AG's acquisition of GalvoSurge, underscore the drive for portfolio enhancement and market leadership. While specific deal values are proprietary, the strategic rationale behind these transactions points towards a significant investment in technologies that address critical market needs like peri-implantitis. The overall market share distribution reflects the dominance of key players, with the top five companies accounting for an estimated 60-70% of the total market value.

Europe Dental Implants Market Industry Trends & Insights

The Europe dental implants market is experiencing robust growth, propelled by a confluence of technological advancements, shifting consumer preferences, and favorable demographic trends. A significant driver is the increasing prevalence of tooth loss among the aging European population, a demographic segment that also exhibits higher disposable incomes and a greater propensity to invest in advanced dental solutions. Technological disruptions are revolutionizing the field, with the advent of CAD/CAM technology, 3D printing, and AI-powered diagnostics enabling more precise implant placement, faster treatment times, and improved patient outcomes. The digital dentistry revolution, exemplified by Straumann's March 2023 launch of digital solutions for implantology at the International Dental Show (IDS), is streamlining the entire implant workflow from planning to execution. Consumer preferences are increasingly leaning towards aesthetic and functionally superior solutions, driving demand for high-quality, biocompatible implants and restorative components. The emphasis on personalized medicine is also growing, with patient-specific implant designs becoming more commonplace. Competitive dynamics are intense, with companies vying for market share through product innovation, strategic partnerships, and expanding distribution networks. The CAGR of the Europe dental implants market is estimated at 7.2% for the forecast period (2025-2033), indicating a healthy and expanding market. Market penetration for dental implants, while already significant in some Western European nations, continues to rise across the continent, offering substantial untapped potential. The growing demand for immediate loading protocols and minimally invasive surgery is also shaping product development and clinical practices, further fueling market expansion.

Dominant Markets & Segments in Europe Dental Implants Market

The Europe dental implants market is characterized by distinct regional and segmental dominance, driven by a combination of economic prosperity, advanced healthcare infrastructure, and proactive dental care initiatives. Within the Part: Fixture segment, Endosteal Implants consistently hold the largest market share, accounting for approximately 85% of the fixture market. This dominance stems from their widespread applicability, proven long-term success rates, and adaptability to various bone densities. Subperiosteal Implants and Transosteal Implants, while serving specific niche applications, represent a much smaller fraction of the market due to their more complex surgical procedures and limited indications.

In terms of Material, Titanium Implants remain the gold standard, commanding an estimated market share of 90%. Their excellent biocompatibility, corrosion resistance, and osseointegration properties have made them the material of choice for decades. Zirconium Implants are gaining traction, particularly for patients with titanium allergies or those seeking all-ceramic restorations, but their market share is currently around 10%, albeit with strong growth potential.

Geographically, Germany is a dominant market within Europe, contributing approximately 20% to the overall market revenue. This leadership is attributed to its advanced dental education system, high per capita healthcare spending, a large aging population, and robust reimbursement policies. The UK and France follow closely, with significant contributions stemming from their well-developed healthcare systems and increasing adoption of advanced dental technologies.

Key drivers for the dominance of these regions and segments include:

- Economic Policies: Favorable economic conditions and high disposable incomes in countries like Germany, Switzerland, and the Nordic nations directly translate to higher healthcare expenditure, including dental treatments.

- Infrastructure: Well-established healthcare and dental infrastructure, including a high density of dental clinics and specialized implantology centers, facilitates market growth.

- Technological Adoption: Early and widespread adoption of digital dentistry tools, such as intraoral scanners and CBCT imaging, streamlines implant procedures and improves patient outcomes, driving demand.

- Awareness and Education: High levels of public awareness regarding oral health and the benefits of dental implants, coupled with comprehensive dental education for practitioners, foster market expansion.

- Regulatory Environment: While stringent, the clear regulatory pathways in major European countries, once met, provide a stable environment for manufacturers and clinicians.

The Abutment segment, while intrinsically linked to fixture placement, also exhibits strong growth, driven by advancements in prosthetic design and materials to achieve superior aesthetic and functional results. The demand for customized abutments is on the rise, further stimulating innovation within this sub-segment.

Europe Dental Implants Market Product Innovations

Product innovations in the Europe dental implants market are primarily focused on enhancing osseointegration, improving surgical precision, and achieving superior aesthetic outcomes. Advancements in surface treatments for titanium implants, such as nanostructured coatings, accelerate bone healing and reduce healing times. The development of digital workflows, integrating intraoral scanning, 3D planning software, and guided surgery systems, offers unparalleled precision and predictability in implant placement. Furthermore, the emergence of one-piece implant designs and novel abutment materials like zirconia-based composites aims to reduce complications and improve esthetics. These innovations provide a competitive advantage by offering dentists more predictable, efficient, and patient-friendly treatment options, meeting the growing demand for durable and aesthetically pleasing restorations.

Report Segmentation & Scope

This report segments the Europe Dental Implants Market by Part: Fixture (including Endosteal Implants, Subperiosteal Implants, and Transosteal Implants), and Abutment. It further segments the market by Material, encompassing Titanium Implants and Zirconium Implants. The forecast period for this report is 2025–2033, with a base year of 2025. Endosteal implants are projected to dominate the fixture segment, with an estimated market size of $3,000 Million by 2033, driven by their versatility. Zirconium implants, while a smaller segment, are expected to witness a CAGR of 9.5% during the forecast period, reaching an estimated $450 Million by 2033, indicating increasing adoption due to patient demand for metal-free options. The abutment segment is anticipated to grow at a CAGR of 6.8%, reflecting the demand for advanced prosthetic solutions. The competitive dynamics within each segment are influenced by material innovation, surgical technique advancements, and product-specific regulatory approvals.

Key Drivers of Europe Dental Implants Market Growth

Several key drivers are propelling the Europe Dental Implants Market. Technological advancements in implant design, surface treatments, and digital dentistry (e.g., CAD/CAM, 3D printing) are enhancing precision and patient outcomes. The aging population in Europe, coupled with increasing awareness of oral hygiene and the benefits of dental implants, is a significant demographic driver. Rising disposable incomes and a growing emphasis on aesthetic appeal are leading more individuals to seek permanent tooth replacement solutions. Furthermore, supportive reimbursement policies in some European countries and the increasing willingness of dental professionals to adopt innovative implantology techniques contribute to market expansion. The drive for improved patient quality of life and reduced long-term healthcare costs associated with untreated tooth loss also plays a crucial role.

Challenges in the Europe Dental Implants Market Sector

Despite robust growth, the Europe Dental Implants Market faces several challenges. Stringent regulatory requirements, particularly the EU MDR, necessitate extensive clinical data and compliance costs, posing a barrier for smaller manufacturers. The high cost of dental implant procedures remains a significant restraint, limiting accessibility for a portion of the population. Reimbursement inconsistencies across different European countries create market fragmentation and can hinder widespread adoption. Supply chain disruptions and raw material price volatility, especially for titanium, can impact manufacturing costs and availability. Furthermore, the limited availability of trained implantologists in certain regions and the need for continuous professional development pose workforce challenges. Competition from alternative restorative solutions like dentures and bridges, though less durable, also presents an ongoing challenge.

Leading Players in the Europe Dental Implants Market Market

- 3M

- Alpha Dent Implants GmbH

- Argon Medical Productions & Vertriebs Gmbh & Co KG

- BEGO GmbH & Co KG

- Bio3 IMPLANTS

- Institut Straumann AG

- Dentsply Sirona

- Nobel Biocare Services AG

- CAMLOG Biotechnologies GmbH

- Champions-Implants GmbH

Key Developments in Europe Dental Implants Market Sector

- May 2023: Straumann acquired GalvoSurge, a Swiss medical device manufacturer specializing in implant care and maintenance solutions. This acquisition aims to address the increasing demand for peri-implantitis treatments and mitigate implant loss.

- March 2023: Straumann launched advanced digital solutions for implantology and introduced new features from its orthodontic brand, ClearCorrect, at the International Dental Show (IDS) in Cologne, Germany, underscoring a commitment to digital innovation.

Strategic Europe Dental Implants Market Market Outlook

- May 2023: Straumann acquired GalvoSurge, a Swiss medical device manufacturer specializing in implant care and maintenance solutions. This acquisition aims to address the increasing demand for peri-implantitis treatments and mitigate implant loss.

- March 2023: Straumann launched advanced digital solutions for implantology and introduced new features from its orthodontic brand, ClearCorrect, at the International Dental Show (IDS) in Cologne, Germany, underscoring a commitment to digital innovation.

Strategic Europe Dental Implants Market Market Outlook

The strategic outlook for the Europe Dental Implants Market remains highly positive, driven by continuous innovation and a growing unmet need for advanced restorative solutions. Key growth accelerators include the increasing adoption of digital dentistry, which enhances precision and efficiency, and the development of biomaterials that promote faster osseointegration and improved long-term outcomes. Strategic opportunities lie in expanding market access through partnerships with dental associations and exploring novel financing models to address cost barriers. The rising demand for personalized treatments and minimally invasive procedures presents avenues for further product differentiation. Companies focusing on developing comprehensive implant solutions, from surgical planning to prosthetic restoration and long-term maintenance, are well-positioned for sustained growth. The market's trajectory is also influenced by proactive engagement with regulatory bodies to ensure streamlined product approvals and continued investment in research and development to address emerging clinical challenges.

Europe Dental Implants Market Segmentation

-

1. Part

-

1.1. Fixture

- 1.1.1. Endosteal Implants

- 1.1.2. Subperiosteal Implants

- 1.1.3. Transosteal Implants

- 1.2. Abutment

-

1.1. Fixture

-

2. Material

- 2.1. Titanium Implants

- 2.2. Zirconium Implants

Europe Dental Implants Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Dental Implants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Geriatric Population and Burden of Dental Diseases; Increasing Demand for Cosmetic Dentistry; Increasing Application of CAD/CAM Technologies

- 3.3. Market Restrains

- 3.3.1. Rising Geriatric Population and Burden of Dental Diseases; Increasing Demand for Cosmetic Dentistry; Increasing Application of CAD/CAM Technologies

- 3.4. Market Trends

- 3.4.1. The Zirconium Implants Segment is Expected to Witness a Positive Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Part

- 5.1.1. Fixture

- 5.1.1.1. Endosteal Implants

- 5.1.1.2. Subperiosteal Implants

- 5.1.1.3. Transosteal Implants

- 5.1.2. Abutment

- 5.1.1. Fixture

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Titanium Implants

- 5.2.2. Zirconium Implants

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Part

- 6. Germany Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Part

- 6.1.1. Fixture

- 6.1.1.1. Endosteal Implants

- 6.1.1.2. Subperiosteal Implants

- 6.1.1.3. Transosteal Implants

- 6.1.2. Abutment

- 6.1.1. Fixture

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Titanium Implants

- 6.2.2. Zirconium Implants

- 6.1. Market Analysis, Insights and Forecast - by Part

- 7. United Kingdom Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Part

- 7.1.1. Fixture

- 7.1.1.1. Endosteal Implants

- 7.1.1.2. Subperiosteal Implants

- 7.1.1.3. Transosteal Implants

- 7.1.2. Abutment

- 7.1.1. Fixture

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Titanium Implants

- 7.2.2. Zirconium Implants

- 7.1. Market Analysis, Insights and Forecast - by Part

- 8. France Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Part

- 8.1.1. Fixture

- 8.1.1.1. Endosteal Implants

- 8.1.1.2. Subperiosteal Implants

- 8.1.1.3. Transosteal Implants

- 8.1.2. Abutment

- 8.1.1. Fixture

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Titanium Implants

- 8.2.2. Zirconium Implants

- 8.1. Market Analysis, Insights and Forecast - by Part

- 9. Italy Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Part

- 9.1.1. Fixture

- 9.1.1.1. Endosteal Implants

- 9.1.1.2. Subperiosteal Implants

- 9.1.1.3. Transosteal Implants

- 9.1.2. Abutment

- 9.1.1. Fixture

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Titanium Implants

- 9.2.2. Zirconium Implants

- 9.1. Market Analysis, Insights and Forecast - by Part

- 10. Spain Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Part

- 10.1.1. Fixture

- 10.1.1.1. Endosteal Implants

- 10.1.1.2. Subperiosteal Implants

- 10.1.1.3. Transosteal Implants

- 10.1.2. Abutment

- 10.1.1. Fixture

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Titanium Implants

- 10.2.2. Zirconium Implants

- 10.1. Market Analysis, Insights and Forecast - by Part

- 11. Rest of Europe Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Part

- 11.1.1. Fixture

- 11.1.1.1. Endosteal Implants

- 11.1.1.2. Subperiosteal Implants

- 11.1.1.3. Transosteal Implants

- 11.1.2. Abutment

- 11.1.1. Fixture

- 11.2. Market Analysis, Insights and Forecast - by Material

- 11.2.1. Titanium Implants

- 11.2.2. Zirconium Implants

- 11.1. Market Analysis, Insights and Forecast - by Part

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 3M

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Alpha Dent Implants GmbH

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Argon Medical Productions & Vertriebs Gmbh & Co KG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 BEGO GmbH & Co KG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bio3 IMPLANTS

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Institut Straumann AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dentsply Sirona

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nobel Biocare Services AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 CAMLOG Biotechnologies GmbH

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Champions-Implants GmbH*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 3M

List of Figures

- Figure 1: Global Europe Dental Implants Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Europe Dental Implants Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: Germany Europe Dental Implants Market Revenue (Million), by Part 2024 & 2032

- Figure 4: Germany Europe Dental Implants Market Volume (Billion), by Part 2024 & 2032

- Figure 5: Germany Europe Dental Implants Market Revenue Share (%), by Part 2024 & 2032

- Figure 6: Germany Europe Dental Implants Market Volume Share (%), by Part 2024 & 2032

- Figure 7: Germany Europe Dental Implants Market Revenue (Million), by Material 2024 & 2032

- Figure 8: Germany Europe Dental Implants Market Volume (Billion), by Material 2024 & 2032

- Figure 9: Germany Europe Dental Implants Market Revenue Share (%), by Material 2024 & 2032

- Figure 10: Germany Europe Dental Implants Market Volume Share (%), by Material 2024 & 2032

- Figure 11: Germany Europe Dental Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 12: Germany Europe Dental Implants Market Volume (Billion), by Country 2024 & 2032

- Figure 13: Germany Europe Dental Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Germany Europe Dental Implants Market Volume Share (%), by Country 2024 & 2032

- Figure 15: United Kingdom Europe Dental Implants Market Revenue (Million), by Part 2024 & 2032

- Figure 16: United Kingdom Europe Dental Implants Market Volume (Billion), by Part 2024 & 2032

- Figure 17: United Kingdom Europe Dental Implants Market Revenue Share (%), by Part 2024 & 2032

- Figure 18: United Kingdom Europe Dental Implants Market Volume Share (%), by Part 2024 & 2032

- Figure 19: United Kingdom Europe Dental Implants Market Revenue (Million), by Material 2024 & 2032

- Figure 20: United Kingdom Europe Dental Implants Market Volume (Billion), by Material 2024 & 2032

- Figure 21: United Kingdom Europe Dental Implants Market Revenue Share (%), by Material 2024 & 2032

- Figure 22: United Kingdom Europe Dental Implants Market Volume Share (%), by Material 2024 & 2032

- Figure 23: United Kingdom Europe Dental Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 24: United Kingdom Europe Dental Implants Market Volume (Billion), by Country 2024 & 2032

- Figure 25: United Kingdom Europe Dental Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: United Kingdom Europe Dental Implants Market Volume Share (%), by Country 2024 & 2032

- Figure 27: France Europe Dental Implants Market Revenue (Million), by Part 2024 & 2032

- Figure 28: France Europe Dental Implants Market Volume (Billion), by Part 2024 & 2032

- Figure 29: France Europe Dental Implants Market Revenue Share (%), by Part 2024 & 2032

- Figure 30: France Europe Dental Implants Market Volume Share (%), by Part 2024 & 2032

- Figure 31: France Europe Dental Implants Market Revenue (Million), by Material 2024 & 2032

- Figure 32: France Europe Dental Implants Market Volume (Billion), by Material 2024 & 2032

- Figure 33: France Europe Dental Implants Market Revenue Share (%), by Material 2024 & 2032

- Figure 34: France Europe Dental Implants Market Volume Share (%), by Material 2024 & 2032

- Figure 35: France Europe Dental Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 36: France Europe Dental Implants Market Volume (Billion), by Country 2024 & 2032

- Figure 37: France Europe Dental Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: France Europe Dental Implants Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Italy Europe Dental Implants Market Revenue (Million), by Part 2024 & 2032

- Figure 40: Italy Europe Dental Implants Market Volume (Billion), by Part 2024 & 2032

- Figure 41: Italy Europe Dental Implants Market Revenue Share (%), by Part 2024 & 2032

- Figure 42: Italy Europe Dental Implants Market Volume Share (%), by Part 2024 & 2032

- Figure 43: Italy Europe Dental Implants Market Revenue (Million), by Material 2024 & 2032

- Figure 44: Italy Europe Dental Implants Market Volume (Billion), by Material 2024 & 2032

- Figure 45: Italy Europe Dental Implants Market Revenue Share (%), by Material 2024 & 2032

- Figure 46: Italy Europe Dental Implants Market Volume Share (%), by Material 2024 & 2032

- Figure 47: Italy Europe Dental Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Italy Europe Dental Implants Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Italy Europe Dental Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Italy Europe Dental Implants Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Spain Europe Dental Implants Market Revenue (Million), by Part 2024 & 2032

- Figure 52: Spain Europe Dental Implants Market Volume (Billion), by Part 2024 & 2032

- Figure 53: Spain Europe Dental Implants Market Revenue Share (%), by Part 2024 & 2032

- Figure 54: Spain Europe Dental Implants Market Volume Share (%), by Part 2024 & 2032

- Figure 55: Spain Europe Dental Implants Market Revenue (Million), by Material 2024 & 2032

- Figure 56: Spain Europe Dental Implants Market Volume (Billion), by Material 2024 & 2032

- Figure 57: Spain Europe Dental Implants Market Revenue Share (%), by Material 2024 & 2032

- Figure 58: Spain Europe Dental Implants Market Volume Share (%), by Material 2024 & 2032

- Figure 59: Spain Europe Dental Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Spain Europe Dental Implants Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Spain Europe Dental Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Spain Europe Dental Implants Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Rest of Europe Europe Dental Implants Market Revenue (Million), by Part 2024 & 2032

- Figure 64: Rest of Europe Europe Dental Implants Market Volume (Billion), by Part 2024 & 2032

- Figure 65: Rest of Europe Europe Dental Implants Market Revenue Share (%), by Part 2024 & 2032

- Figure 66: Rest of Europe Europe Dental Implants Market Volume Share (%), by Part 2024 & 2032

- Figure 67: Rest of Europe Europe Dental Implants Market Revenue (Million), by Material 2024 & 2032

- Figure 68: Rest of Europe Europe Dental Implants Market Volume (Billion), by Material 2024 & 2032

- Figure 69: Rest of Europe Europe Dental Implants Market Revenue Share (%), by Material 2024 & 2032

- Figure 70: Rest of Europe Europe Dental Implants Market Volume Share (%), by Material 2024 & 2032

- Figure 71: Rest of Europe Europe Dental Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 72: Rest of Europe Europe Dental Implants Market Volume (Billion), by Country 2024 & 2032

- Figure 73: Rest of Europe Europe Dental Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Rest of Europe Europe Dental Implants Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Europe Dental Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Europe Dental Implants Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 4: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 5: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 6: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 7: Global Europe Dental Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Europe Dental Implants Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 10: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 11: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 13: Global Europe Dental Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Europe Dental Implants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 16: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 17: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 18: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 19: Global Europe Dental Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Europe Dental Implants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 21: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 22: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 23: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 24: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 25: Global Europe Dental Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Europe Dental Implants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 28: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 29: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 30: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 31: Global Europe Dental Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Europe Dental Implants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 34: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 35: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 36: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 37: Global Europe Dental Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Europe Dental Implants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 39: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 40: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 41: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 42: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 43: Global Europe Dental Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Europe Dental Implants Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Dental Implants Market?

The projected CAGR is approximately 7.60%.

2. Which companies are prominent players in the Europe Dental Implants Market?

Key companies in the market include 3M, Alpha Dent Implants GmbH, Argon Medical Productions & Vertriebs Gmbh & Co KG, BEGO GmbH & Co KG, Bio3 IMPLANTS, Institut Straumann AG, Dentsply Sirona, Nobel Biocare Services AG, CAMLOG Biotechnologies GmbH, Champions-Implants GmbH*List Not Exhaustive.

3. What are the main segments of the Europe Dental Implants Market?

The market segments include Part, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Geriatric Population and Burden of Dental Diseases; Increasing Demand for Cosmetic Dentistry; Increasing Application of CAD/CAM Technologies.

6. What are the notable trends driving market growth?

The Zirconium Implants Segment is Expected to Witness a Positive Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Rising Geriatric Population and Burden of Dental Diseases; Increasing Demand for Cosmetic Dentistry; Increasing Application of CAD/CAM Technologies.

8. Can you provide examples of recent developments in the market?

May 2023: Straumann acquired GalvoSurge, a Swiss medical device manufacturer in the dental field. GalvoSurge specializes in implant care and maintenance solutions, and with the acquisition, Straumann is expected to meet the increasing demand for peri-implantitis treatments and protect patients from implant loss.March 2023: Straumann launched digital solutions for implantology and new features from the group’s orthodontic brand, ClearCorrect, during the International Dental Show (IDS) in Cologne, Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Dental Implants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Dental Implants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Dental Implants Market?

To stay informed about further developments, trends, and reports in the Europe Dental Implants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence