Key Insights

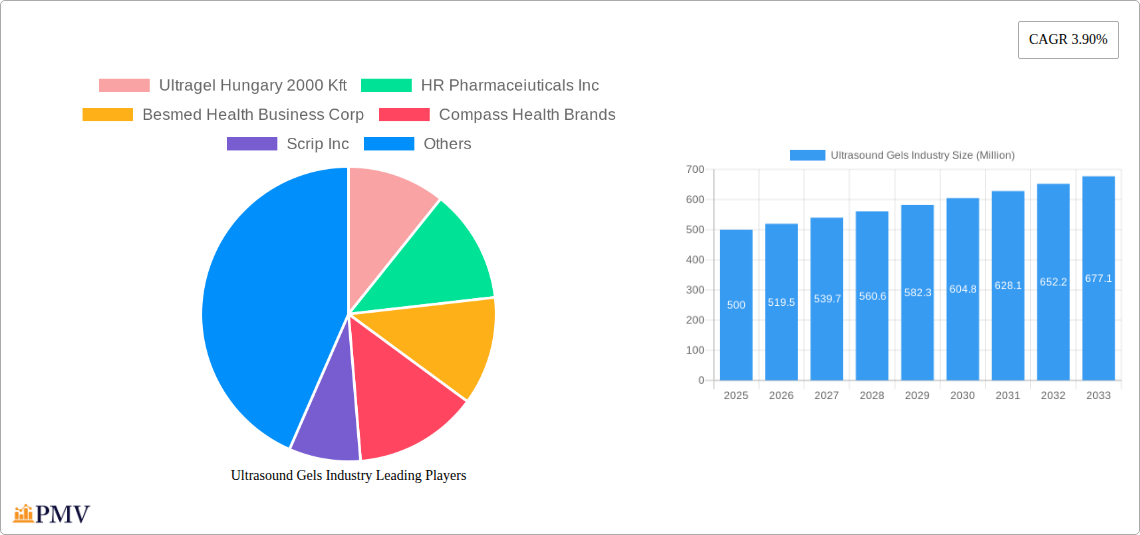

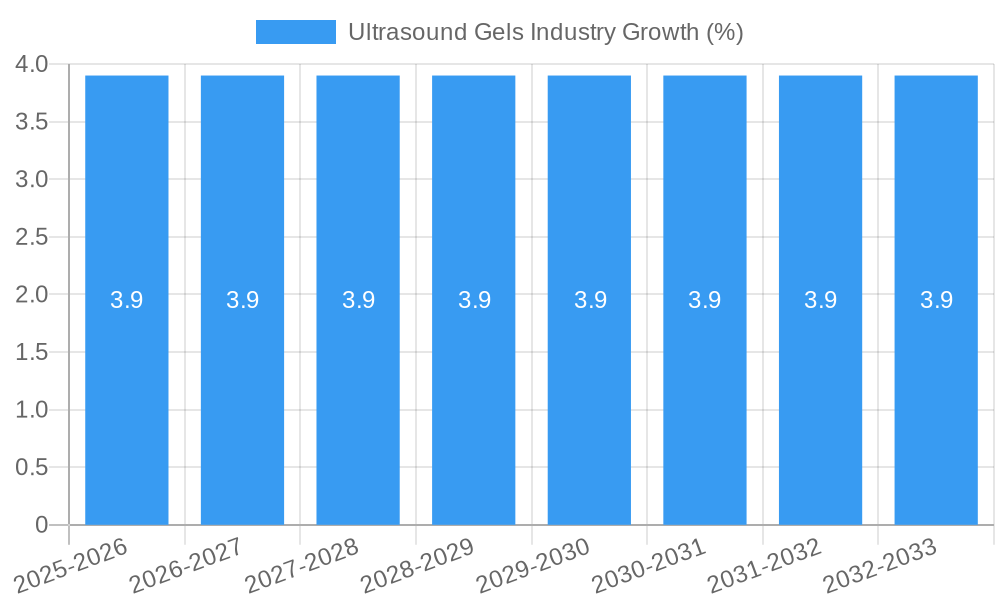

The global Ultrasound Gels market is poised for steady growth, projected to reach a significant market size of approximately $XX million by 2033. This expansion is fueled by a Compound Annual Growth Rate (CAGR) of 3.90% from 2025 to 2033. The increasing adoption of diagnostic imaging techniques across healthcare settings, driven by an aging global population and the rising prevalence of chronic diseases, forms the bedrock of this market's ascent. Technological advancements in ultrasound equipment, leading to enhanced diagnostic accuracy and patient comfort, further stimulate demand for high-quality ultrasound gels. The growing emphasis on preventative healthcare and early disease detection is also a key contributor, as ultrasound remains a non-invasive and widely accessible imaging modality. Furthermore, the expanding healthcare infrastructure in emerging economies, coupled with increasing disposable incomes, is opening up new avenues for market penetration and growth.

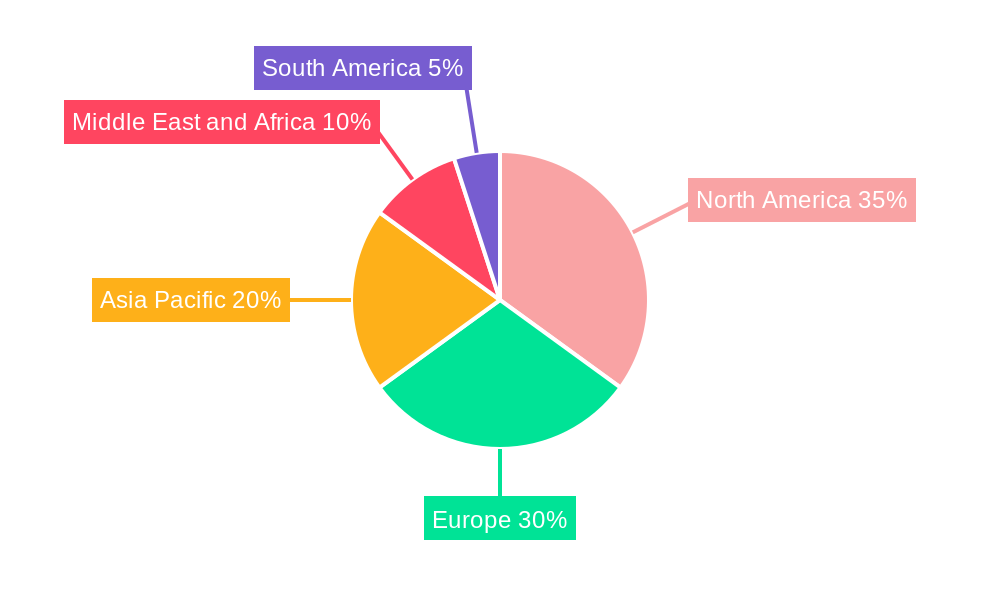

The market segmentation reveals distinct dynamics. The "Sterile" product type segment is anticipated to witness robust demand, owing to stringent hygiene protocols in clinical environments and the growing preference for single-use sterile products. Hospitals and clinics represent the largest end-user segment, driven by their high volume of diagnostic procedures and therapeutic applications. Diagnostic centers are also emerging as significant consumers, reflecting the trend towards specialized imaging facilities. Geographically, North America and Europe are expected to dominate the market, owing to their well-established healthcare systems and high utilization of advanced medical technologies. However, the Asia Pacific region is projected to exhibit the fastest growth, propelled by rapid healthcare infrastructure development, increasing medical tourism, and a large patient pool. Key players in the market are focusing on product innovation, strategic partnerships, and expanding their distribution networks to capture market share.

This in-depth report delivers a comprehensive analysis of the global Ultrasound Gels Industry, offering critical insights into market dynamics, growth drivers, challenges, and future prospects. Spanning a study period from 2019 to 2033, with a base year of 2025 and a detailed forecast for 2025-2033, this report provides actionable intelligence for stakeholders. We cover key segments including non-sterile ultrasound gel and sterile ultrasound gel, and analyze end-user markets such as hospitals/clinics, diagnostic centers, and other end users. Leverage our expert analysis to navigate the competitive landscape, identify emerging opportunities, and make informed strategic decisions in this vital medical consumables market.

Ultrasound Gels Industry Market Structure & Competitive Dynamics

The Ultrasound Gels Industry exhibits a moderately fragmented market structure characterized by a blend of established global players and emerging regional manufacturers. Market concentration is influenced by factors such as product innovation, brand reputation, and established distribution networks. The ultrasound gel market is driven by an innovation ecosystem focused on enhancing patient comfort, improving image quality, and ensuring sterility. Regulatory frameworks, particularly those governing medical device consumables, play a crucial role in market entry and product development, demanding adherence to stringent quality and safety standards. While direct product substitutes are limited, advancements in imaging technologies that require less couplant or alternative diagnostic methods can indirectly influence demand. End-user trends are largely dictated by the growth of diagnostic imaging procedures, an aging global population, and increasing healthcare expenditure. Mergers and acquisitions (M&A) activities, though not always high-profile in this sector, are observed as companies seek to expand their product portfolios, gain market share, and achieve economies of scale. For instance, strategic acquisitions of smaller, specialized manufacturers can bolster a larger company's presence in niche segments like sterile ultrasound gel. The global ultrasound gel market size is estimated to reach several hundred million dollars in the base year, with projected growth driven by these dynamics.

Ultrasound Gels Industry Industry Trends & Insights

The Ultrasound Gels Industry is poised for sustained growth, driven by an increasing global demand for diagnostic imaging services. A significant market growth driver is the rising prevalence of chronic diseases and the subsequent need for accurate and timely diagnostic procedures, with ultrasound imaging playing a pivotal role. Technological advancements are also reshaping the landscape. For example, the development of smart ultrasound gel dispensers like the one launched by YUSO technology in February 2022, incorporating features like automated dispensing and gel warming, signifies a trend towards enhanced user experience and improved sonographer efficiency. This innovation not only addresses practical challenges faced by healthcare professionals but also contributes to improved patient comfort by eliminating the discomfort of cold gel. Furthermore, the growing emphasis on infection control in healthcare settings is fueling the demand for sterile ultrasound gel, a key segment within the market. The CAGR for the ultrasound gel market is projected to be in the healthy single digits over the forecast period, reflecting a stable and consistent expansion. Market penetration is expected to deepen, particularly in emerging economies with rapidly developing healthcare infrastructures and increasing access to advanced medical equipment. Competitive dynamics are characterized by a focus on product differentiation through features such as hypoallergenic formulations, enhanced conductivity, and eco-friendly packaging. The ongoing efforts by leading players to secure strategic partnerships and distribution agreements further solidify their market positions. The ultrasound coupling gel market continues to be a cornerstone in facilitating effective ultrasound examinations.

Dominant Markets & Segments in Ultrasound Gels Industry

The Ultrasound Gels Industry is witnessing dominance in specific geographical regions and product segments, driven by a confluence of economic, demographic, and healthcare infrastructure factors. North America and Europe currently represent the largest markets due to their mature healthcare systems, high adoption rates of advanced diagnostic technologies, and significant investment in medical research and development. Within these regions, the demand for sterile ultrasound gel is particularly pronounced, driven by stringent hygiene protocols in hospitals/clinics and diagnostic centers.

- Product Type Dominance: The sterile ultrasound gel segment is experiencing robust growth. This is primarily attributed to its critical role in invasive procedures and its necessity in environments where infection control is paramount. The increasing number of surgical interventions and diagnostic procedures requiring a sterile field directly fuels the demand for sterile couplants. Conversely, non-sterile ultrasound gel continues to hold a significant share due to its widespread use in routine diagnostic imaging where the sterility requirement is less stringent, offering a more cost-effective solution for high-volume applications in general diagnostic imaging.

- End-User Dominance: Hospitals/Clinics constitute the largest end-user segment for ultrasound gels. This is a direct consequence of the high volume of ultrasound procedures conducted within these facilities for a wide range of diagnostic and therapeutic applications, from prenatal scans to abdominal imaging and cardiology. Diagnostic Centers represent another substantial segment, characterized by a specialized focus on imaging services, leading to consistent and high demand for ultrasound couplants. Economic policies that favor healthcare infrastructure development and increased patient access to diagnostic services are key drivers of growth in these segments. Furthermore, the ongoing global push to expand diagnostic capabilities, particularly in underserved regions, will further solidify the dominance of these end-user segments. The expanding scope of ultrasound applications in areas like point-of-care diagnostics also contributes to the growth within the Other End Users category, which includes specialized imaging facilities and mobile diagnostic units. The market size for ultrasound gels in the base year is projected to be in the hundreds of millions, with the hospitals/clinics segment contributing the largest share.

Ultrasound Gels Industry Product Innovations

The Ultrasound Gels Industry is marked by a consistent stream of product innovations aimed at enhancing user experience and diagnostic accuracy. Key developments include the introduction of hypoallergenic and latex-free formulations to cater to sensitive patients, reducing the risk of allergic reactions. Manufacturers are also focusing on developing gels with optimal viscosity and acoustic properties to ensure superior image clarity and signal transmission. Innovations in packaging, such as ergonomic dispensers and single-use sachets, are gaining traction to improve convenience and hygiene. Furthermore, the trend towards warming ultrasound gel, as exemplified by the YUSO Smart Ultrasound Gel Dispenser, addresses patient comfort, a critical factor in repeated or lengthy examinations. These advancements not only differentiate products but also provide competitive advantages by meeting evolving clinical needs and patient expectations, contributing to the overall ultrasound coupling gel market expansion.

Report Segmentation & Scope

This report meticulously segments the Ultrasound Gels Industry across key dimensions to provide granular market insights. The segmentation encompasses:

- Product Type:

- Non-sterile Ultrasound Gel: This segment focuses on gels used in applications where sterility is not a primary concern, often for routine diagnostic imaging. Projections indicate steady growth, driven by cost-effectiveness and widespread adoption in general imaging practices.

- Sterile Ultrasound Gel: This segment covers gels manufactured under sterile conditions for use in invasive procedures, surgery, and sensitive patient populations. Significant growth is anticipated due to increasing healthcare standards and the rising volume of interventional ultrasound procedures.

- End User:

- Hospitals/Clinics: This is the largest segment, encompassing a broad spectrum of ultrasound applications performed in inpatient and outpatient settings. Robust growth is expected, fueled by expanding healthcare access and increasing reliance on ultrasound diagnostics.

- Diagnostic Centers: This segment includes specialized imaging facilities. Consistent demand and steady growth are projected, driven by their dedicated focus on diagnostic imaging services.

- Other End Users: This category comprises niche applications, research institutions, and mobile imaging units. This segment, while smaller, is poised for growth as ultrasound technology finds new applications.

The total ultrasound gel market size is analyzed for each segment, with projections for market share and competitive dynamics throughout the forecast period.

Key Drivers of Ultrasound Gels Industry Growth

The Ultrasound Gels Industry is propelled by several key growth drivers. The expanding global demand for diagnostic imaging services, largely due to an aging population and the increasing prevalence of chronic diseases, is a primary catalyst. Technological advancements in ultrasound equipment, leading to higher resolution and more diverse applications, directly correlate with the need for compatible and high-performance couplants. Government initiatives promoting healthcare infrastructure development and increased healthcare spending in emerging economies are also significant contributors. Furthermore, a growing awareness among healthcare professionals and patients regarding the importance of proper ultrasound couplants for accurate diagnoses and improved patient comfort is driving demand for specialized and high-quality ultrasound gels. The ultrasound coupling gel market is set to benefit from these synergistic factors.

Challenges in the Ultrasound Gels Industry Sector

Despite the positive growth trajectory, the Ultrasound Gels Industry faces several challenges. Stringent regulatory requirements for medical device consumables can pose barriers to entry for new players and increase product development costs. Fluctuations in raw material prices, particularly for key ingredients like glycerin and propylene glycol, can impact profit margins. Intense competition among manufacturers, leading to price pressures, is another significant restraint. Moreover, the development of alternative imaging modalities or advancements in ultrasound technology that might reduce the reliance on traditional gel couplants could pose a long-term challenge. Supply chain disruptions, as experienced globally in recent years, can also affect product availability and lead times, impacting the ultrasound gel market.

Leading Players in the Ultrasound Gels Industry Market

- Ultragel Hungary 2000 Kft

- HR Pharmaceiuticals Inc

- Besmed Health Business Corp

- Compass Health Brands

- Scrip Inc

- Medline Industries LP

- OJI Group (TELE-PAPER (M) SDN BHD)

- Parker Laboratories Inc

- Sonogel Vertriebs GmbH

- National Therapy Products Inc

Key Developments in Ultrasound Gels Industry Sector

- November 2022: Parker Laboratories Inc. showcased its wide range of ultrasound and electromedical contact media and leading lines of institutional cleaners and disinfectants at MEDICA 2022.

- February 2022: YUSO technology launched a Smart Ultrasound Gel Dispenser, which is used to assist the sonographer in squeezing the ultrasound gel instead of the hand, and there's a heating function to warm the gel as well.

- November 2022: Parker Laboratories Inc. showcased its wide range of ultrasound and electromedical contact media and leading lines of institutional cleaners and disinfectants at MEDICA 2022.

- February 2022: YUSO technology launched a Smart Ultrasound Gel Dispenser, which is used to assist the sonographer in squeezing the ultrasound gel instead of the hand, and there's a heating function to warm the gel as well.

These developments highlight the industry's focus on product diversification, technological integration, and participation in major global medical exhibitions to enhance market visibility and drive innovation within the ultrasound coupling gel market.

Strategic Ultrasound Gels Industry Market Outlook

The strategic outlook for the Ultrasound Gels Industry is highly positive, driven by continued advancements in medical imaging and an expanding global healthcare landscape. Growth accelerators include the increasing adoption of ultrasound technology in point-of-care diagnostics and emerging markets with a growing need for accessible and affordable imaging solutions. Manufacturers that focus on product differentiation through features like enhanced conductivity, superior acoustic transmission, and improved patient comfort are well-positioned for success. Strategic opportunities lie in developing eco-friendly product lines, investing in advanced manufacturing technologies to optimize costs, and forging strong distribution partnerships to reach a wider customer base. The emphasis on sterile ultrasound gels for an increasing number of interventional procedures will also present significant growth avenues, ensuring the sustained expansion of the ultrasound gel market.

Ultrasound Gels Industry Segmentation

-

1. Product Type

- 1.1. Non-sterile

- 1.2. Sterile

-

2. End User

- 2.1. Hospitals/Clinics

- 2.2. Diagnostic Centers

- 2.3. Other End Users

Ultrasound Gels Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Ultrasound Gels Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Number of Ultrasound Procedures; Advancements in Ultrasound Gels Preparations

- 3.3. Market Restrains

- 3.3.1. Use of Other Alternative Products

- 3.4. Market Trends

- 3.4.1. Sterile Ultrasound Gels Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultrasound Gels Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Non-sterile

- 5.1.2. Sterile

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals/Clinics

- 5.2.2. Diagnostic Centers

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Ultrasound Gels Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Non-sterile

- 6.1.2. Sterile

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals/Clinics

- 6.2.2. Diagnostic Centers

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Ultrasound Gels Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Non-sterile

- 7.1.2. Sterile

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals/Clinics

- 7.2.2. Diagnostic Centers

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Ultrasound Gels Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Non-sterile

- 8.1.2. Sterile

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals/Clinics

- 8.2.2. Diagnostic Centers

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Ultrasound Gels Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Non-sterile

- 9.1.2. Sterile

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals/Clinics

- 9.2.2. Diagnostic Centers

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Ultrasound Gels Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Non-sterile

- 10.1.2. Sterile

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals/Clinics

- 10.2.2. Diagnostic Centers

- 10.2.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Ultrasound Gels Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Ultrasound Gels Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Ultrasound Gels Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Ultrasound Gels Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Ultrasound Gels Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Ultragel Hungary 2000 Kft

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 HR Pharmaceiuticals Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Besmed Health Business Corp

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Compass Health Brands

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Scrip Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Medline Industries LP

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 OJI Group (TELE-PAPER (M) SDN BHD)

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Parker Laboratories Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Sonogel Vertriebs GmbH

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 National Therapy Products Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Ultragel Hungary 2000 Kft

List of Figures

- Figure 1: Global Ultrasound Gels Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Ultrasound Gels Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Ultrasound Gels Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Ultrasound Gels Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Ultrasound Gels Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Ultrasound Gels Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Ultrasound Gels Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Ultrasound Gels Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Ultrasound Gels Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Ultrasound Gels Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Ultrasound Gels Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Ultrasound Gels Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Ultrasound Gels Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Ultrasound Gels Industry Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Ultrasound Gels Industry Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Ultrasound Gels Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Ultrasound Gels Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Ultrasound Gels Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Ultrasound Gels Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Ultrasound Gels Industry Revenue (Million), by End User 2024 & 2032

- Figure 21: Europe Ultrasound Gels Industry Revenue Share (%), by End User 2024 & 2032

- Figure 22: Europe Ultrasound Gels Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Ultrasound Gels Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Ultrasound Gels Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia Pacific Ultrasound Gels Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia Pacific Ultrasound Gels Industry Revenue (Million), by End User 2024 & 2032

- Figure 27: Asia Pacific Ultrasound Gels Industry Revenue Share (%), by End User 2024 & 2032

- Figure 28: Asia Pacific Ultrasound Gels Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Ultrasound Gels Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Ultrasound Gels Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Middle East and Africa Ultrasound Gels Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Middle East and Africa Ultrasound Gels Industry Revenue (Million), by End User 2024 & 2032

- Figure 33: Middle East and Africa Ultrasound Gels Industry Revenue Share (%), by End User 2024 & 2032

- Figure 34: Middle East and Africa Ultrasound Gels Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Ultrasound Gels Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Ultrasound Gels Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: South America Ultrasound Gels Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: South America Ultrasound Gels Industry Revenue (Million), by End User 2024 & 2032

- Figure 39: South America Ultrasound Gels Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: South America Ultrasound Gels Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Ultrasound Gels Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ultrasound Gels Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Ultrasound Gels Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Ultrasound Gels Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Ultrasound Gels Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Ultrasound Gels Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Ultrasound Gels Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Ultrasound Gels Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Ultrasound Gels Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Ultrasound Gels Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Ultrasound Gels Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: Global Ultrasound Gels Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 33: Global Ultrasound Gels Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Ultrasound Gels Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: Global Ultrasound Gels Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 39: Global Ultrasound Gels Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Ultrasound Gels Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 47: Global Ultrasound Gels Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 48: Global Ultrasound Gels Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Ultrasound Gels Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 56: Global Ultrasound Gels Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 57: Global Ultrasound Gels Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Ultrasound Gels Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 62: Global Ultrasound Gels Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 63: Global Ultrasound Gels Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Ultrasound Gels Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultrasound Gels Industry?

The projected CAGR is approximately 3.90%.

2. Which companies are prominent players in the Ultrasound Gels Industry?

Key companies in the market include Ultragel Hungary 2000 Kft, HR Pharmaceiuticals Inc, Besmed Health Business Corp, Compass Health Brands, Scrip Inc, Medline Industries LP, OJI Group (TELE-PAPER (M) SDN BHD), Parker Laboratories Inc, Sonogel Vertriebs GmbH, National Therapy Products Inc.

3. What are the main segments of the Ultrasound Gels Industry?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Number of Ultrasound Procedures; Advancements in Ultrasound Gels Preparations.

6. What are the notable trends driving market growth?

Sterile Ultrasound Gels Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Use of Other Alternative Products.

8. Can you provide examples of recent developments in the market?

November 2022: Parker Laboratories Inc. showcased its wide range of ultrasound and electromedical contact media and leading lines of institutional cleaners and disinfectants at MEDICA 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultrasound Gels Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultrasound Gels Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultrasound Gels Industry?

To stay informed about further developments, trends, and reports in the Ultrasound Gels Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence