Key Insights

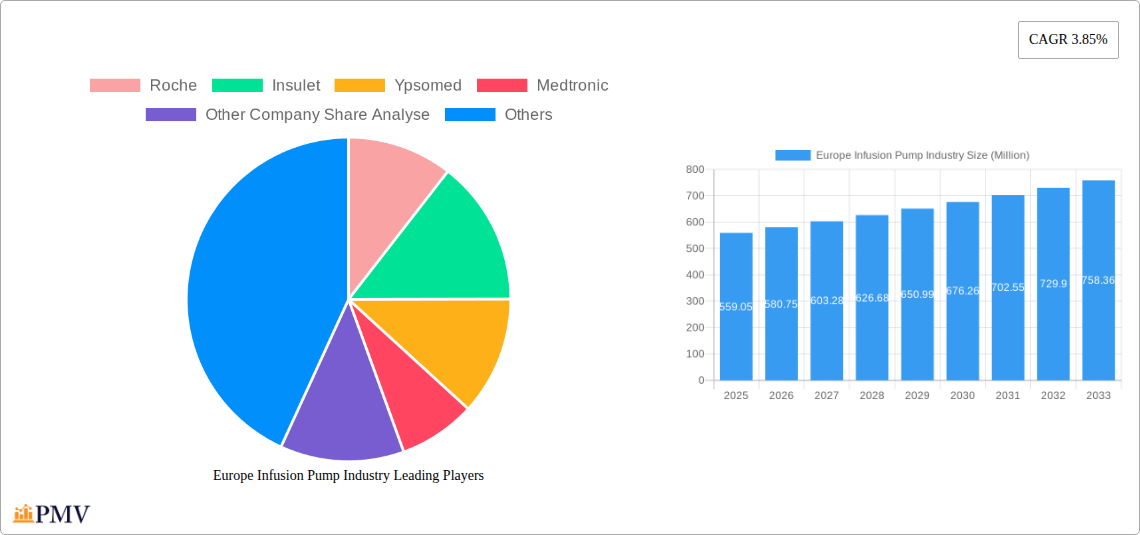

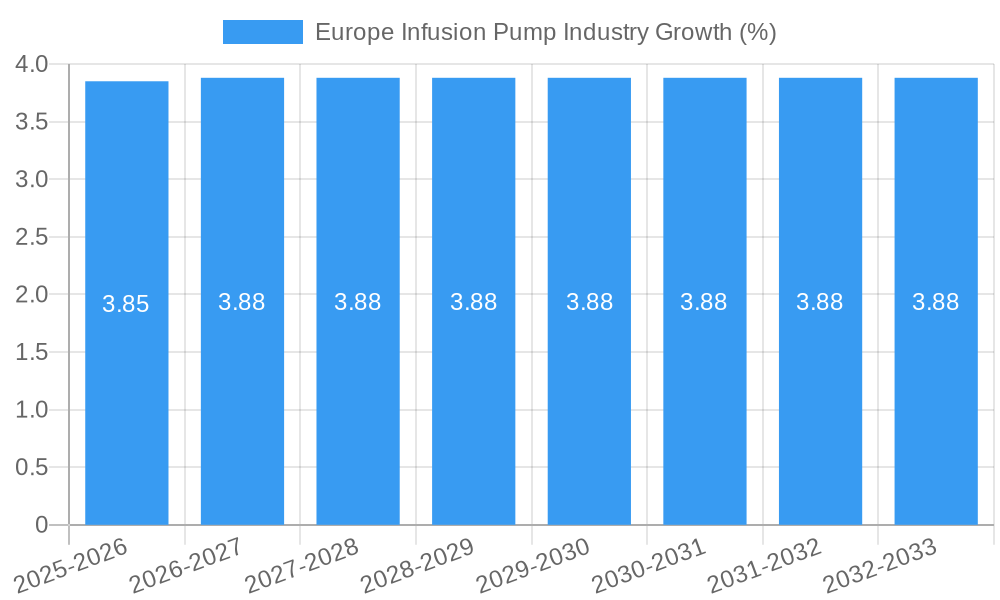

The European Infusion Pump Market is projected to reach a substantial value of €559.05 million by 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 3.85% through 2033. This growth is primarily fueled by the increasing prevalence of chronic diseases, particularly diabetes, which necessitates continuous insulin delivery. Technological advancements in infusion pump devices, such as the development of smart pumps with enhanced connectivity and user-friendly interfaces, are further driving market expansion. The rising adoption of insulin pumps among Type 1 diabetes patients, seeking better glycemic control and improved quality of life, is a significant catalyst. Additionally, the growing demand for home healthcare solutions and the aging European population, which often experiences a higher burden of chronic conditions, contribute to the positive market trajectory. Investments in research and development by key players to introduce innovative and more accessible infusion pump technologies are expected to sustain this upward trend.

Despite the positive outlook, the market faces certain restraints, including the high cost of advanced infusion pump devices, which can pose a barrier to widespread adoption, especially in budget-constrained healthcare systems. Stringent regulatory approval processes for new medical devices also present challenges for market players. However, the emergence of wearable and patch-based insulin pumps, alongside the integration of artificial intelligence for personalized diabetes management, presents significant future opportunities. The market is segmented into Insulin Pump Devices, Insulin Infusion Sets, and Reservoirs, with the Insulin Pump Devices segment anticipated to hold a dominant share due to ongoing innovation. Key players like Roche, Insulet, Ypsomed, and Medtronic are actively engaged in strategic collaborations and product launches to capture market share. Europe, with its well-established healthcare infrastructure and high disease burden, represents a critical market, with significant contributions expected from countries like Germany, France, and the United Kingdom.

Unlock critical insights into the dynamic European infusion pump market with our comprehensive report. Covering the period from 2019 to 2033, with a base year of 2025, this report delves deep into market structure, competitive dynamics, industry trends, product innovations, and future outlook. With a focus on the Insulin Infusion Pump segment, including Insulin Pump Devices, Insulin Infusion Sets, and Reservoirs, this analysis is essential for stakeholders seeking to navigate and capitalize on market opportunities.

Europe Infusion Pump Industry Market Structure & Competitive Dynamics

The Europe infusion pump market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, while a growing number of innovative companies are carving out niches. Roche, Insulet, Ypsomed, and Medtronic represent key established entities, commanding substantial portions of the market through their extensive product portfolios and robust distribution networks. The competitive landscape is characterized by a strong emphasis on technological innovation, particularly in the realm of automated insulin delivery systems and connected devices. Cellnovo and Animas (though Animas has transitioned its portfolio) also contribute to the competitive fray, with specialized offerings. Tandem Diabetes Care is another notable player in the insulin pump space.

- Market Concentration: Dominated by a few key global players, but with increasing fragmentation due to new entrants and niche product development.

- Innovation Ecosystems: Fueled by advancements in sensor technology, artificial intelligence for glycemic control, and data connectivity, driving the development of next-generation insulin pumps.

- Regulatory Frameworks: CE marking and national health authority approvals are crucial gating factors, impacting market entry and product lifecycle.

- Product Substitutes: While traditional injection methods persist, the efficacy and convenience of infusion pumps are steadily increasing their market penetration.

- End-User Trends: Growing patient demand for user-friendly, discreet, and automated solutions for diabetes management is a primary driver.

- Mergers & Acquisitions (M&A): Strategic M&A activities are anticipated to consolidate market share and acquire innovative technologies. The value of M&A deals in this sector is projected to increase, with specific figures dependent on emerging opportunities.

- Other Company Share Analysis: The report provides a detailed breakdown of the market share held by other significant companies beyond the key named players, offering a holistic view of the competitive intensity.

Europe Infusion Pump Industry Industry Trends & Insights

The European infusion pump industry is experiencing robust growth, propelled by a confluence of factors including increasing prevalence of chronic diseases like diabetes, advancements in medical device technology, and growing patient awareness regarding self-management of health conditions. The market is witnessing a significant shift towards connected infusion pumps and automated insulin delivery (AID) systems, often referred to as artificial pancreas systems. These innovations integrate glucose monitoring with insulin delivery, offering a more sophisticated and personalized approach to glycemic control. The CAGR for the Europe infusion pump market is projected to be in the range of 7-9% during the forecast period, indicating substantial expansion potential.

Technological disruptions are at the forefront, with miniaturization, improved connectivity (Bluetooth, Wi-Fi), and AI-driven algorithms enhancing pump functionality and user experience. The focus is on devices that reduce the burden of daily diabetes management, minimize hypoglycemia and hyperglycemia, and improve overall quality of life for patients. Consumer preferences are increasingly leaning towards discreet, wearable, and patch-based insulin pumps, which offer greater mobility and comfort compared to traditional tethered devices. The availability of user-friendly interfaces, smartphone integration for data tracking and pump control, and remote monitoring capabilities are also becoming critical purchasing considerations.

Competitive dynamics are intensifying, with established players investing heavily in R&D to launch next-generation products and smaller, agile companies focusing on disruptive technologies and specific market segments. Strategic partnerships between infusion pump manufacturers and continuous glucose monitoring (CGM) companies are becoming more common, fostering integrated solutions. The reimbursement landscape in various European countries also plays a crucial role, influencing market penetration and adoption rates. As a result of these trends, the market penetration of advanced infusion pump technologies is expected to witness significant growth across the European region.

Dominant Markets & Segments in Europe Infusion Pump Industry

The Insulin Infusion Pump segment is the undeniable leader within the broader European infusion pump market, driven by the escalating global and European burden of diabetes. Within this segment, Insulin Pump Devices hold the largest market share, accounting for an estimated 60-70% of the total insulin infusion pump market value. This dominance stems from the core functionality of these devices in delivering rapid-acting insulin continuously.

- Key Drivers for Dominance of Insulin Pumps:

- Rising Diabetes Prevalence: Type 1 and Type 2 diabetes diagnoses are increasing across Europe, creating a larger patient pool requiring advanced management solutions.

- Technological Advancements: Innovations in insulin pump technology, including AID systems and closed-loop solutions, are making them more effective and appealing.

- Improved Quality of Life: Patients are seeking better glycemic control and reduced burden of traditional injection methods.

- Reimbursement Policies: Favorable reimbursement policies in key European countries facilitate patient access to these devices.

- Patient & Physician Education: Increased awareness and understanding of the benefits of insulin pump therapy among patients and healthcare professionals.

Insulin Infusion Sets represent the second-largest segment, estimated to hold around 20-25% of the market. These are critical consumables, requiring regular replacement, thus ensuring a steady revenue stream. The demand for infusion sets is directly correlated with the adoption of insulin pump devices. Innovations in infusion set materials, insertion techniques, and comfort are also driving growth in this sub-segment.

The Reservoirs segment, typically comprising insulin cartridges or vials used within the pump, accounts for the remaining 5-10% of the market. While smaller in value, these are essential components that necessitate continuous supply. The market for reservoirs is influenced by the types of insulin pumps being used and the compatibility requirements.

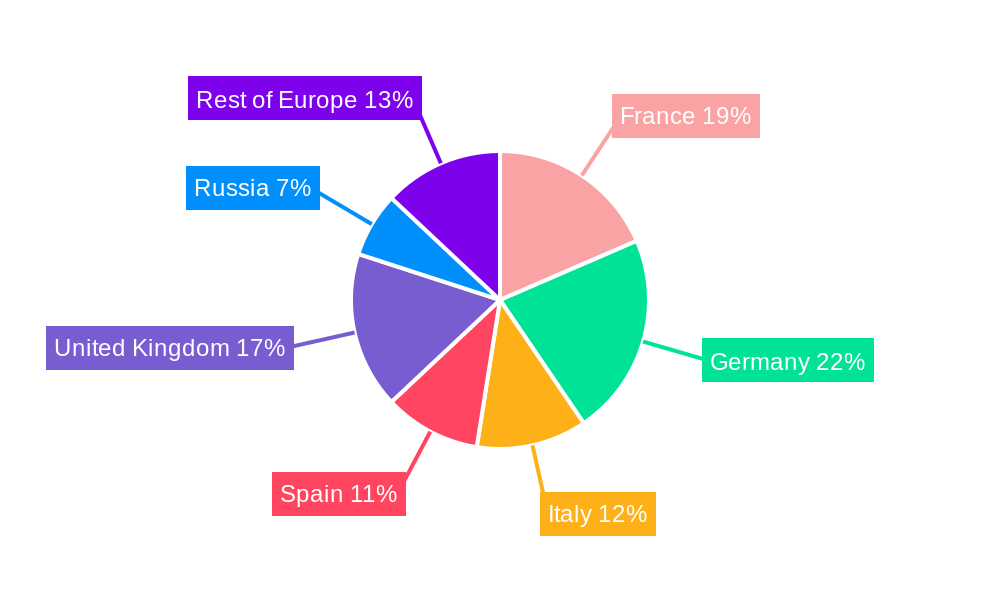

Geographically, Western European countries like Germany, the UK, France, and Italy currently represent the dominant markets due to their well-established healthcare infrastructures, higher disposable incomes, and greater adoption of advanced medical technologies. However, Eastern European markets are exhibiting faster growth rates, driven by improving healthcare access and increasing awareness of diabetes management options.

Europe Infusion Pump Industry Product Innovations

The Europe infusion pump industry is characterized by relentless innovation aimed at enhancing patient outcomes and user experience. Key product developments focus on creating smarter, more integrated, and user-friendly devices. The trend towards automated insulin delivery (AID) systems, often referred to as closed-loop or artificial pancreas systems, is a prime example. These systems utilize algorithms to automatically adjust insulin delivery based on continuous glucose monitoring (CGM) data, significantly reducing the risk of hypoglycemia and hyperglycemia. Miniaturization and discreet designs are also prominent, leading to wearable and patch-based pumps that offer greater mobility and comfort. Connectivity features, such as Bluetooth and Wi-Fi, enable seamless data sharing with smartphones and healthcare providers, facilitating better remote management and personalized therapy. Competitive advantages are being gained through improved algorithm accuracy, longer wear times for consumables, enhanced battery life, and intuitive user interfaces that simplify complex diabetes management tasks.

Report Segmentation & Scope

This report meticulously segments the Europe infusion pump market, offering granular insights into its various components. The primary focus is on the Insulin Infusion Pump market.

- Insulin Pump Devices: This segment encompasses the core electronic devices used to deliver insulin. It includes both traditional tethered pumps and newer tubeless or patch pumps. Growth projections for this segment are robust, driven by increasing adoption rates and technological advancements in AID systems. The market size is projected to reach approximately USD 3,500 Million by 2025.

- Insulin Infusion Sets: This segment covers the disposable components that connect the pump to the user's body, facilitating insulin delivery. It includes tubing, cannulas, and insertion devices. The steady replacement cycle of these consumables ensures consistent market demand. Growth in this segment is projected to be steady, aligning with the expansion of the insulin pump device market. The market size is estimated to be around USD 1,000 Million by 2025.

- Reservoirs: This segment includes the containers that hold the insulin, such as cartridges or vials, which are then placed within the insulin pump. While a smaller segment by value, these are essential for pump operation. The market size for reservoirs is projected to be approximately USD 300 Million by 2025.

Key Drivers of Europe Infusion Pump Industry Growth

The Europe infusion pump industry's growth is propelled by a multifaceted interplay of technological, economic, and regulatory factors.

- Technological Advancements: The continuous evolution of automated insulin delivery (AID) systems, improved CGM integration, and the development of user-friendly, connected devices are significantly enhancing treatment efficacy and patient convenience.

- Rising Diabetes Prevalence: The escalating incidence of Type 1 and Type 2 diabetes across Europe creates a continuously expanding patient demographic requiring sophisticated diabetes management solutions.

- Growing Patient Demand for Convenience and Quality of Life: Patients are increasingly seeking less burdensome and more effective methods for managing their diabetes, leading to a higher adoption rate of insulin pumps over traditional injection therapies.

- Favorable Reimbursement Policies: Expanding insurance coverage and government subsidies for advanced diabetes management technologies in key European nations are crucial in driving market access and adoption.

- Increased Awareness and Education: Enhanced awareness campaigns and educational initiatives by healthcare providers and patient advocacy groups are empowering individuals to opt for advanced infusion pump therapies.

Challenges in the Europe Infusion Pump Industry Sector

Despite its promising growth trajectory, the Europe infusion pump industry faces several significant challenges that could impede its expansion.

- High Cost of Devices and Consumables: The substantial upfront cost of advanced insulin pumps and the ongoing expense of disposable infusion sets and reservoirs can pose a barrier to widespread adoption, particularly in countries with limited reimbursement coverage or lower disposable incomes. The total market for consumables is estimated to be around USD 1,300 Million in 2025.

- Regulatory Hurdles and Approval Times: Navigating the complex regulatory landscape across different European countries, including CE marking and national health authority approvals, can be time-consuming and costly, potentially delaying market entry for new products.

- Integration and Interoperability Issues: Ensuring seamless integration and interoperability between different pump models, CGM systems, and digital health platforms remains a technical challenge, hindering the creation of truly comprehensive and unified diabetes management ecosystems.

- Technical Malfunctions and User Error: Despite advancements, the potential for device malfunctions, software glitches, or user errors can lead to adverse events, impacting patient confidence and potentially leading to product recalls.

- Competition from Emerging Technologies: While infusion pumps are advanced, the ongoing development of innovative drug delivery systems and alternative diabetes management approaches could present future competitive pressures.

Leading Players in the Europe Infusion Pump Industry Market

- Roche

- Insulet

- Ypsomed

- Medtronic

- Tandem

- Cellnovo

Key Developments in Europe Infusion Pump Industry Sector

- January 2024: Medtronic has obtained European approval to merge its most recent automated insulin pump with its latest glucose sensor, marking a significant milestone for the company. The MiniMed 780G pump and the Simplera Sync system, referred to as a disposable, comprehensive blood sugar sensor, are now covered by the CE mark. This innovative sensor can be effortlessly inserted under the skin in less than 10 seconds, eliminating the need for fingersticks.

- September 2022: Insulet announced that the Omnipod 5 system received CE mark clearance, making it available throughout the European Union. It's cleared for use by adults and children aged two and older with type-1 diabetes.

Strategic Europe Infusion Pump Industry Market Outlook

The strategic outlook for the Europe infusion pump market remains exceptionally positive, driven by an unyielding demand for advanced diabetes management solutions. Future growth will be significantly accelerated by the continued innovation in closed-loop systems and the increasing integration of artificial intelligence for personalized glycemic control. The expansion of telehealth and remote patient monitoring services will further bolster adoption by enabling more effective patient support and data-driven therapeutic adjustments. Strategic opportunities lie in developing more affordable and accessible pump technologies, forging stronger partnerships with CGM manufacturers, and expanding market reach into underserved Eastern European countries. The market is poised for substantial growth, with an estimated market size of USD 5,000 Million by 2025, and further expansion projected throughout the forecast period, driven by a commitment to improving the lives of individuals living with diabetes.

Europe Infusion Pump Industry Segmentation

-

1. Insulin Infusion Pump

- 1.1. Insulin Pump Devices

- 1.2. Insulin Infusion Sets

- 1.3. Reservoirs

Europe Infusion Pump Industry Segmentation By Geography

- 1. France

- 2. Germany

- 3. Italy

- 4. Spain

- 5. United Kingdom

- 6. Russia

- 7. Rest of Europe

Europe Infusion Pump Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques

- 3.3. Market Restrains

- 3.3.1. Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms

- 3.4. Market Trends

- 3.4.1. Insulin Pump Monitors Hold Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 5.1.1. Insulin Pump Devices

- 5.1.2. Insulin Infusion Sets

- 5.1.3. Reservoirs

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.2.2. Germany

- 5.2.3. Italy

- 5.2.4. Spain

- 5.2.5. United Kingdom

- 5.2.6. Russia

- 5.2.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 6. France Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 6.1.1. Insulin Pump Devices

- 6.1.2. Insulin Infusion Sets

- 6.1.3. Reservoirs

- 6.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 7. Germany Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 7.1.1. Insulin Pump Devices

- 7.1.2. Insulin Infusion Sets

- 7.1.3. Reservoirs

- 7.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 8. Italy Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 8.1.1. Insulin Pump Devices

- 8.1.2. Insulin Infusion Sets

- 8.1.3. Reservoirs

- 8.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 9. Spain Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 9.1.1. Insulin Pump Devices

- 9.1.2. Insulin Infusion Sets

- 9.1.3. Reservoirs

- 9.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 10. United Kingdom Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 10.1.1. Insulin Pump Devices

- 10.1.2. Insulin Infusion Sets

- 10.1.3. Reservoirs

- 10.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 11. Russia Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 11.1.1. Insulin Pump Devices

- 11.1.2. Insulin Infusion Sets

- 11.1.3. Reservoirs

- 11.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 12. Rest of Europe Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 12.1.1. Insulin Pump Devices

- 12.1.2. Insulin Infusion Sets

- 12.1.3. Reservoirs

- 12.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 13. Germany Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Infusion Pump Industry Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Roche

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Insulet

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Ypsomed

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Medtronic

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Other Company Share Analyse

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Cellnovo

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Animas

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Tandem

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.1 Roche

List of Figures

- Figure 1: Europe Infusion Pump Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Infusion Pump Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Infusion Pump Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Infusion Pump Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Infusion Pump Industry Revenue Million Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 4: Europe Infusion Pump Industry Volume K Unit Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 5: Europe Infusion Pump Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Infusion Pump Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Europe Infusion Pump Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Europe Infusion Pump Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Infusion Pump Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Europe Infusion Pump Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: France Europe Infusion Pump Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Europe Infusion Pump Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Italy Europe Infusion Pump Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Europe Infusion Pump Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Europe Infusion Pump Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Europe Infusion Pump Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Netherlands Europe Infusion Pump Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherlands Europe Infusion Pump Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Sweden Europe Infusion Pump Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Sweden Europe Infusion Pump Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe Infusion Pump Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Europe Infusion Pump Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Europe Infusion Pump Industry Revenue Million Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 24: Europe Infusion Pump Industry Volume K Unit Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 25: Europe Infusion Pump Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Infusion Pump Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: Europe Infusion Pump Industry Revenue Million Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 28: Europe Infusion Pump Industry Volume K Unit Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 29: Europe Infusion Pump Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Infusion Pump Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Europe Infusion Pump Industry Revenue Million Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 32: Europe Infusion Pump Industry Volume K Unit Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 33: Europe Infusion Pump Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Infusion Pump Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Europe Infusion Pump Industry Revenue Million Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 36: Europe Infusion Pump Industry Volume K Unit Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 37: Europe Infusion Pump Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Europe Infusion Pump Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Europe Infusion Pump Industry Revenue Million Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 40: Europe Infusion Pump Industry Volume K Unit Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 41: Europe Infusion Pump Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe Infusion Pump Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Europe Infusion Pump Industry Revenue Million Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 44: Europe Infusion Pump Industry Volume K Unit Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 45: Europe Infusion Pump Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Europe Infusion Pump Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: Europe Infusion Pump Industry Revenue Million Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 48: Europe Infusion Pump Industry Volume K Unit Forecast, by Insulin Infusion Pump 2019 & 2032

- Table 49: Europe Infusion Pump Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Europe Infusion Pump Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Infusion Pump Industry?

The projected CAGR is approximately 3.85%.

2. Which companies are prominent players in the Europe Infusion Pump Industry?

Key companies in the market include Roche, Insulet, Ypsomed, Medtronic, Other Company Share Analyse, Cellnovo, Animas, Tandem.

3. What are the main segments of the Europe Infusion Pump Industry?

The market segments include Insulin Infusion Pump.

4. Can you provide details about the market size?

The market size is estimated to be USD 559.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques.

6. What are the notable trends driving market growth?

Insulin Pump Monitors Hold Largest Market Share.

7. Are there any restraints impacting market growth?

Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms.

8. Can you provide examples of recent developments in the market?

January 2024: Medtronic has obtained European approval to merge its most recent automated insulin pump with its latest glucose sensor, marking a significant milestone for the company. The MiniMed 780G pump and the Simplera Sync system, referred to as a disposable, comprehensive blood sugar sensor, are now covered by the CE mark. This innovative sensor can be effortlessly inserted under the skin in less than 10 seconds, eliminating the need for fingersticks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Infusion Pump Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Infusion Pump Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Infusion Pump Industry?

To stay informed about further developments, trends, and reports in the Europe Infusion Pump Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence