Key Insights

The global Pregabalin market is projected to expand significantly, reaching an estimated 859.13 million by 2024, at a Compound Annual Growth Rate (CAGR) of 3.69%. This growth is driven by the rising prevalence of neurological disorders such as epilepsy and neuropathic pain, alongside an increasing incidence of anxiety disorders. The growing demand for effective pain management and improved treatments for these conditions are key market accelerators. Furthermore, advancements in drug formulations, including more convenient dosage forms, and the widespread availability of generic pregabalin are contributing to market expansion and affordability.

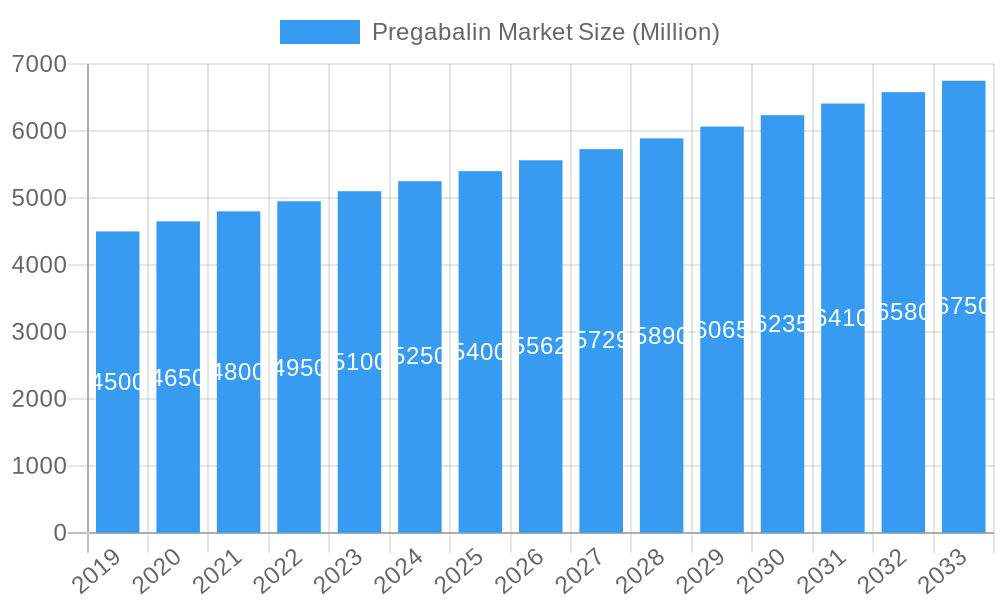

Pregabalin Market Market Size (In Million)

Key restraints include stringent regulatory approvals for new drug applications and the potential for adverse drug reactions, necessitating vigilant monitoring and development. The emergence of alternative therapies also presents a competitive challenge. Geographically, North America is anticipated to dominate, supported by high healthcare expenditure and a robust pharmaceutical infrastructure. The Asia Pacific region is expected to experience the fastest growth, driven by a growing patient base, increased healthcare awareness, and supportive government initiatives. The market is segmented by product type (Capsules, Oral Solutions, Other) and application (Epilepsy, Neuropathic Pain, Anxiety Disorder, Other), with neuropathic pain and epilepsy currently holding substantial market shares.

Pregabalin Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Pregabalin market, covering its structure, competitive landscape, industry trends, dominant segments, product innovations, growth drivers, challenges, and strategic outlook. Analyzing the period from 2024 to 2033, this report provides actionable intelligence for stakeholders navigating the dynamic pregabalin market.

Pregabalin Market Market Structure & Competitive Dynamics

The global Pregabalin market exhibits a moderately concentrated structure, with a mix of large pharmaceutical giants and specialized generic manufacturers vying for market share. Innovation plays a crucial role, driven by continuous research into novel drug delivery systems and improved therapeutic efficacy for conditions like neuropathic pain and epilepsy. Regulatory frameworks, particularly those set by the FDA and EMA, significantly influence market entry and product approval processes, fostering a demand for high-quality, compliant products. The presence of readily available generic alternatives and the potential for therapeutic substitutes in some applications present ongoing competitive pressures. End-user trends, such as the increasing prevalence of chronic pain conditions and neurological disorders, coupled with an aging global population, are significant growth accelerators. Mergers and acquisitions (M&A) remain a strategic tool for companies to expand their product portfolios and geographical reach. For instance, the acquisition of a product portfolio by AGP Limited from Viatris Inc. highlights ongoing consolidation activities. Market share is closely tied to manufacturing capabilities, distribution networks, and the ability to secure regulatory approvals for both branded and generic pregabalin formulations. The competitive dynamics are further shaped by pricing strategies and the development of extended-release formulations to enhance patient compliance and treatment outcomes.

Pregabalin Market Industry Trends & Insights

The Pregabalin market is characterized by a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025–2033), driven by a confluence of factors. The escalating incidence of neurological disorders, including epilepsy and neuropathic pain, is a primary growth engine. As the global population ages, the prevalence of conditions such as diabetic peripheral neuropathy and postherpetic neuralgia, for which pregabalin is a widely prescribed treatment, continues to rise. Technological disruptions are primarily focused on enhancing drug delivery mechanisms, leading to the development of extended-release formulations that offer improved patient convenience and adherence, thereby expanding market penetration. For example, the FDA approval of SinoT's ANDA for extended-release pregabalin tablets signifies a key advancement in this area. Consumer preferences are shifting towards treatments that offer better symptom management with fewer side effects, pushing manufacturers to invest in research and development for more refined pregabalin products. The competitive landscape is dynamic, with intense rivalry between branded and generic manufacturers. The increasing availability of cost-effective generic pregabalin is expanding access to treatment, particularly in emerging economies, thus contributing to overall market growth. Furthermore, advancements in diagnostic techniques are leading to earlier and more accurate identification of conditions treatable with pregabalin, thereby boosting demand. The integration of digital health technologies, such as remote patient monitoring and adherence apps, is also beginning to influence prescription patterns and patient outcomes, creating new avenues for market expansion. Intellectual property rights and patent expirations play a pivotal role in shaping the competitive dynamics, with generic manufacturers actively seeking to introduce their versions of pregabalin upon patent expiry. The global healthcare expenditure, particularly in pain management and neurological therapeutics, is on an upward trajectory, further underpinning the sustained growth of the pregabalin market.

Dominant Markets & Segments in Pregabalin Market

The global Pregabalin market is witnessing significant dominance from specific regions and product/application segments, driven by varying epidemiological profiles and healthcare infrastructure.

Dominant Regions:

- North America currently holds the largest market share, attributed to high healthcare spending, widespread availability of advanced treatment facilities, and a high prevalence of neurological disorders and chronic pain conditions. The United States, in particular, benefits from a well-established pharmaceutical market and robust regulatory approvals.

- Europe follows closely, with countries like Germany, the UK, and France demonstrating strong demand due to an aging population and advanced healthcare systems. Favorable reimbursement policies for pain management therapies also contribute to its dominance.

- Asia Pacific is emerging as the fastest-growing region, fueled by increasing healthcare awareness, a growing middle-class population, rising disposable incomes, and a significant unmet medical need in many developing economies. Countries like China and India are key contributors to this growth.

Dominant Product Segments:

- Capsules: This segment commands the largest market share due to its ease of administration, established efficacy, and widespread physician preference. The development of various dosage strengths within the capsule form caters to a broad spectrum of patient needs.

- Key Drivers: Patient convenience, established therapeutic profile, wide availability of strengths, manufacturing efficiency for large-scale production.

- Oral Solutions: While smaller in market share compared to capsules, oral solutions are crucial for pediatric patients, elderly individuals with swallowing difficulties, and patients requiring precise titration of dosage.

- Key Drivers: Pediatric and geriatric patient accessibility, dose titration flexibility, patient preference for liquid formulations.

- Other Products: This category includes extended-release formulations and potentially novel delivery systems being developed. The growth in this segment is driven by innovation aimed at improving patient compliance and therapeutic outcomes.

- Key Drivers: Enhanced patient compliance (extended-release), improved pharmacokinetic profiles, potential for reduced dosing frequency.

Dominant Application Segments:

- Neuropathic Pain: This segment is the primary driver of pregabalin market growth. The increasing global burden of conditions like diabetic peripheral neuropathy, postherpetic neuralgia, and fibromyalgia directly translates into a substantial demand for pregabalin.

- Key Drivers: High and growing prevalence of diabetic neuropathy, postherpetic neuralgia, and fibromyalgia; pregabalin's efficacy in managing neuropathic pain.

- Epilepsy: As a well-established adjunctive therapy for partial-onset seizures, epilepsy remains a significant application area for pregabalin.

- Key Drivers: Long-standing efficacy in seizure control, integration into treatment guidelines for epilepsy, growing number of epilepsy patients globally.

- Anxiety Disorder: Pregabalin is increasingly prescribed for Generalized Anxiety Disorder (GAD) and other anxiety-related conditions, contributing to its market expansion.

- Key Drivers: Growing recognition of pregabalin's anxiolytic properties, off-label use and increasing physician confidence, demand for effective anxiety treatments.

- Other Applications: This segment includes conditions such as fibromyalgia and restless legs syndrome, where pregabalin also finds therapeutic use, contributing to its overall market demand.

- Key Drivers: Expanding therapeutic indications, ongoing research into new applications, off-label prescription growth.

Pregabalin Market Product Innovations

Product innovation in the pregabalin market is primarily focused on enhancing patient convenience and therapeutic outcomes. The development of extended-release (ER) formulations, such as those approved by the FDA for SinoT, represents a significant advancement, offering reduced dosing frequency and improved patient adherence, particularly crucial for chronic pain management. These innovations aim to provide sustained therapeutic levels, minimizing peaks and troughs associated with immediate-release forms, and thereby potentially reducing side effects. Competitive advantages are being gained through novel drug delivery systems that optimize absorption and bioavailability. Manufacturers are also exploring combination therapies and the development of pregabalin with improved safety profiles. The market fit for these innovations is strong, driven by physician demand for more patient-friendly treatment options and the ongoing need for effective management of neurological disorders and chronic pain.

Report Segmentation & Scope

This report segments the global Pregabalin market across key areas to provide a granular understanding of its dynamics.

Product Segmentation:

- Capsules: This segment, projected to hold a significant market share throughout the forecast period, encompasses immediate-release and extended-release capsule formulations. Growth is driven by established efficacy and ease of administration, with an estimated market size of approximately $4,500 Million by 2025.

- Oral Solutions: Valued at an estimated $500 Million in 2025, this segment caters to specific patient populations, including pediatrics and geriatrics, offering flexibility in dosage titration.

- Other Products: This category, including novel delivery systems and combination products, is expected to witness robust growth driven by innovation, with an estimated market size of $300 Million in 2025.

Application Segmentation:

- Epilepsy: This established application segment is projected to reach approximately $2,000 Million by 2025, driven by its role as an adjunctive therapy.

- Neuropathic Pain: As the largest and fastest-growing application, this segment is estimated at $2,500 Million in 2025, fueled by the rising incidence of conditions like diabetic peripheral neuropathy.

- Anxiety Disorder: This segment is projected to grow substantially, reaching an estimated $1,000 Million by 2025, due to increasing diagnosis and treatment of anxiety disorders.

- Other Applications: Including conditions like fibromyalgia, this segment is expected to contribute an estimated $200 Million to the market by 2025.

Key Drivers of Pregabalin Market Growth

The global Pregabalin market is propelled by several key drivers. The escalating global burden of chronic pain conditions, particularly neuropathic pain stemming from diabetes and shingles, significantly fuels demand. Furthermore, the increasing prevalence of neurological disorders like epilepsy and anxiety disorders contributes to sustained market growth. Technological advancements in drug delivery systems, leading to the development of extended-release formulations, enhance patient compliance and therapeutic efficacy, thus boosting market penetration. Growing healthcare expenditure and improved access to healthcare services, especially in emerging economies, are also pivotal in expanding the market. Regulatory approvals for new indications or improved formulations provide further impetus.

Challenges in the Pregabalin Market Sector

Despite robust growth, the Pregabalin market faces several challenges. The intense competition from generic manufacturers, leading to price erosion, poses a significant threat to profit margins. Stringent regulatory hurdles for new drug approvals and the high cost of research and development can impede innovation. Supply chain disruptions, geopolitical instability, and raw material price fluctuations can impact production and availability. Moreover, concerns regarding the potential for misuse and addiction associated with pregabalin necessitate careful monitoring and prescription practices, potentially impacting future market expansion.

Leading Players in the Pregabalin Market Market

- Sciegen Pharmaceuticals Inc

- Novartis AG

- Viatris Inc

- SINOTHERAPEUTICS

- Rising Pharmaceuticals Inc

- MSN Laboratories Ltd

- Lupin

- Medley Pharmaceuticals Ltd

- Teva Pharmaceutical Industries Ltd

- Cipla Limited

- Amneal Pharmaceuticals LLC

- Zydus Group

Key Developments in Pregabalin Market Sector

- June 2023: Food and Drug Administration (FDA) approved SinoT's ANDA application for PREGABALIN EXTENDED-RELEASE TABLETS 82.5 mg, 165 mg, and 330 mg for the treatment of neuropathic pain associated with diabetic peripheral neuropathy (DPN), and Postherpetic neuralgia (PHN).

- April 2023: Pakistani pharmaceutical firm AGP Limited acquired a selected portfolio of products from American firm Viatris Inc. The portfolio includes many anti-depressants, including pregabalin, anti-hypertensive, and ophthalmology products.

Strategic Pregabalin Market Market Outlook

The strategic outlook for the Pregabalin market remains highly positive, driven by the persistent unmet medical needs in pain management and neurological disorders. Key growth accelerators include the expanding applications of pregabalin, ongoing product innovations focusing on patient-centric drug delivery systems, and increasing healthcare investments globally. The growing emphasis on generic pregabalin availability in emerging markets presents substantial opportunities. Companies that can effectively navigate regulatory landscapes, leverage their manufacturing capabilities for cost-efficient production, and invest in R&D for novel formulations are well-positioned for sustained growth. Strategic partnerships and M&A activities will continue to shape the competitive terrain, offering pathways for market expansion and portfolio diversification in this dynamic sector.

Pregabalin Market Segmentation

-

1. Product

- 1.1. Capsules

- 1.2. Oral Solutions

- 1.3. Other Products

-

2. Application

- 2.1. Epilepsy

- 2.2. Neuropathic Pain

- 2.3. Anxiety Disorder

- 2.4. Other Applications

Pregabalin Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Pregabalin Market Regional Market Share

Geographic Coverage of Pregabalin Market

Pregabalin Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Prevalence of Epilepsy and Related Disorders; Rising Geriatric Population with Neuropathic Pain

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies; Availability of Alternatives and Adverse Effects Related to Pregabalin

- 3.4. Market Trends

- 3.4.1. Neuropathic Pain Application Segment is Expected to Occupy Significant Share in the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pregabalin Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Capsules

- 5.1.2. Oral Solutions

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Epilepsy

- 5.2.2. Neuropathic Pain

- 5.2.3. Anxiety Disorder

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Pregabalin Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Capsules

- 6.1.2. Oral Solutions

- 6.1.3. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Epilepsy

- 6.2.2. Neuropathic Pain

- 6.2.3. Anxiety Disorder

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Pregabalin Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Capsules

- 7.1.2. Oral Solutions

- 7.1.3. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Epilepsy

- 7.2.2. Neuropathic Pain

- 7.2.3. Anxiety Disorder

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Pregabalin Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Capsules

- 8.1.2. Oral Solutions

- 8.1.3. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Epilepsy

- 8.2.2. Neuropathic Pain

- 8.2.3. Anxiety Disorder

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of the World Pregabalin Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Capsules

- 9.1.2. Oral Solutions

- 9.1.3. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Epilepsy

- 9.2.2. Neuropathic Pain

- 9.2.3. Anxiety Disorder

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Sciegen Pharmaceuticals Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Novartis AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Viatris Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SINOTHERAPEUTICS

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Rising Pharmaceuticals Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 MSN Laboratories Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Lupin

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Medley Pharmaceuticals Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Teva Pharmaceutical Industries Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Cipla Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Amneal Pharmaceuticals LLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Zydus Group

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Sciegen Pharmaceuticals Inc

List of Figures

- Figure 1: Global Pregabalin Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Pregabalin Market Revenue (million), by Product 2025 & 2033

- Figure 3: North America Pregabalin Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Pregabalin Market Revenue (million), by Application 2025 & 2033

- Figure 5: North America Pregabalin Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Pregabalin Market Revenue (million), by Country 2025 & 2033

- Figure 7: North America Pregabalin Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pregabalin Market Revenue (million), by Product 2025 & 2033

- Figure 9: Europe Pregabalin Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Pregabalin Market Revenue (million), by Application 2025 & 2033

- Figure 11: Europe Pregabalin Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Pregabalin Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Pregabalin Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Pregabalin Market Revenue (million), by Product 2025 & 2033

- Figure 15: Asia Pacific Pregabalin Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Pregabalin Market Revenue (million), by Application 2025 & 2033

- Figure 17: Asia Pacific Pregabalin Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Pregabalin Market Revenue (million), by Country 2025 & 2033

- Figure 19: Asia Pacific Pregabalin Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Pregabalin Market Revenue (million), by Product 2025 & 2033

- Figure 21: Rest of the World Pregabalin Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Rest of the World Pregabalin Market Revenue (million), by Application 2025 & 2033

- Figure 23: Rest of the World Pregabalin Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Pregabalin Market Revenue (million), by Country 2025 & 2033

- Figure 25: Rest of the World Pregabalin Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pregabalin Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Global Pregabalin Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Pregabalin Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Pregabalin Market Revenue million Forecast, by Product 2020 & 2033

- Table 5: Global Pregabalin Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Pregabalin Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Pregabalin Market Revenue million Forecast, by Product 2020 & 2033

- Table 11: Global Pregabalin Market Revenue million Forecast, by Application 2020 & 2033

- Table 12: Global Pregabalin Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Germany Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: France Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Italy Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Spain Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Pregabalin Market Revenue million Forecast, by Product 2020 & 2033

- Table 20: Global Pregabalin Market Revenue million Forecast, by Application 2020 & 2033

- Table 21: Global Pregabalin Market Revenue million Forecast, by Country 2020 & 2033

- Table 22: China Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Japan Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: India Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Pregabalin Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Global Pregabalin Market Revenue million Forecast, by Product 2020 & 2033

- Table 27: Global Pregabalin Market Revenue million Forecast, by Application 2020 & 2033

- Table 28: Global Pregabalin Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pregabalin Market?

The projected CAGR is approximately 3.69%.

2. Which companies are prominent players in the Pregabalin Market?

Key companies in the market include Sciegen Pharmaceuticals Inc, Novartis AG, Viatris Inc, SINOTHERAPEUTICS, Rising Pharmaceuticals Inc, MSN Laboratories Ltd, Lupin, Medley Pharmaceuticals Ltd, Teva Pharmaceutical Industries Ltd, Cipla Limited, Amneal Pharmaceuticals LLC, Zydus Group.

3. What are the main segments of the Pregabalin Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 859.13 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Prevalence of Epilepsy and Related Disorders; Rising Geriatric Population with Neuropathic Pain.

6. What are the notable trends driving market growth?

Neuropathic Pain Application Segment is Expected to Occupy Significant Share in the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies; Availability of Alternatives and Adverse Effects Related to Pregabalin.

8. Can you provide examples of recent developments in the market?

June 2023: Food and Drug Administration (FDA) approved SinoT's ANDA application for PREGABALIN EXTENDED-RELEASE TABLETS 82.5 mg, 165 mg, and 330 mg for the treatment of neuropathic pain associated with diabetic peripheral neuropathy (DPN), and Postherpetic neuralgia (PHN).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pregabalin Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pregabalin Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pregabalin Market?

To stay informed about further developments, trends, and reports in the Pregabalin Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence