Key Insights

The Canadian cardiovascular devices market is poised for steady growth, driven by an aging population, increasing prevalence of cardiovascular diseases, and advancements in medical technology. The market is projected to reach a significant valuation in the coming years, fueled by a Compound Annual Growth Rate (CAGR) of 3.80%. This expansion will be primarily propelled by the increasing demand for both diagnostic and monitoring devices, such as advanced ECG machines and remote cardiac monitoring solutions, enabling earlier detection and better management of heart conditions. Furthermore, the therapeutic and surgical segment, encompassing innovative cardiac assist devices, sophisticated cardiac rhythm management solutions, and advanced surgical implants like heart valves and stents, will witness robust uptake as healthcare providers adopt cutting-edge treatments to improve patient outcomes. The focus on minimally invasive procedures and the continuous development of more effective and safer devices will also contribute to market expansion, aligning with Canada's commitment to enhancing its healthcare infrastructure and patient care.

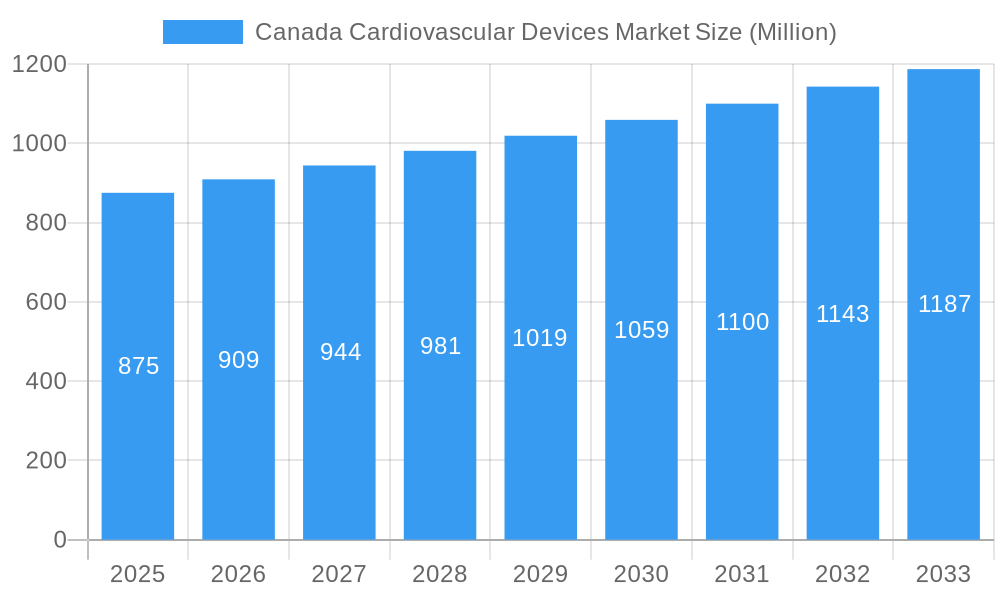

Canada Cardiovascular Devices Market Market Size (In Million)

The market's trajectory is further shaped by critical trends such as the growing adoption of wearable and connected cardiac monitoring devices, which offer continuous patient data and facilitate proactive healthcare interventions. Technological innovations, including the development of smart implants and AI-driven diagnostic tools, are expected to revolutionize cardiac care. However, the market is not without its restraints. High development and regulatory costs associated with novel cardiovascular devices, coupled with reimbursement challenges and the need for specialized training for healthcare professionals, could pose hurdles to widespread adoption. Despite these challenges, the strong underlying demand, supported by proactive government initiatives and an increasing awareness of cardiovascular health, positions the Canadian cardiovascular devices market for sustained and impactful growth, promising significant advancements in patient care and public health.

Canada Cardiovascular Devices Market Company Market Share

Here's the SEO-optimized, detailed report description for the Canada Cardiovascular Devices Market:

Canada Cardiovascular Devices Market: Comprehensive Analysis & Future Outlook (2019-2033)

Unlock the potential of the Canadian cardiovascular devices market with this in-depth report. Gain critical insights into market dynamics, growth drivers, competitive landscapes, and future opportunities. This report provides a detailed analysis of diagnostic, therapeutic, and surgical cardiovascular devices, crucial for healthcare providers, device manufacturers, investors, and policymakers navigating this dynamic sector. Our analysis covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, offering both historical context and forward-looking projections.

Canada Cardiovascular Devices Market Market Structure & Competitive Dynamics

The Canadian cardiovascular devices market exhibits a moderately concentrated structure, characterized by the presence of both global giants and specialized domestic players. Innovation ecosystems are robust, driven by significant R&D investments from leading companies aiming to address the growing burden of cardiovascular diseases in Canada. The regulatory framework, primarily overseen by Health Canada, plays a pivotal role in market access and product approval, ensuring stringent quality and safety standards. Product substitutes, while present in certain categories like traditional surgical procedures versus minimally invasive devices, are increasingly being outpaced by technological advancements. End-user trends are shifting towards minimally invasive procedures, remote monitoring solutions, and personalized treatment approaches, influencing product development and market demand. Mergers and acquisitions (M&A) activities, though not always publicly disclosed with specific deal values for the Canadian segment alone, are strategic moves by larger entities to consolidate market share and expand product portfolios. Key players continuously assess their market share through product launches and market penetration strategies, aiming for a larger slice of the growing Canadian cardiac care pie.

Canada Cardiovascular Devices Market Industry Trends & Insights

The Canada Cardiovascular Devices Market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. This expansion is fueled by several intersecting trends. An aging population in Canada, coupled with a rising prevalence of lifestyle-related cardiovascular diseases such as hypertension, diabetes, and obesity, significantly increases the demand for advanced cardiac care solutions. Technological disruptions are at the forefront, with continuous innovation in areas like artificial intelligence (AI) for diagnostics, implantable sensors for continuous monitoring, and advanced materials for cardiovascular implants. The integration of digital health technologies, including telemedicine platforms and wearable devices, is revolutionizing patient care by enabling remote monitoring, early detection, and proactive management of cardiac conditions. Consumer preferences are increasingly leaning towards less invasive procedures, faster recovery times, and personalized treatment plans, driving the adoption of innovative therapeutic and surgical devices. The competitive dynamics are intensifying, with companies focusing on product differentiation through enhanced features, improved patient outcomes, and cost-effectiveness. Increased healthcare expenditure in Canada, both public and private, further supports market growth by facilitating access to cutting-edge medical technologies. The penetration of advanced cardiovascular devices in Canadian hospitals and clinics is steadily rising, reflecting the healthcare system's commitment to adopting best-in-class solutions for managing cardiovascular health.

Dominant Markets & Segments in Canada Cardiovascular Devices Market

Within the Canada Cardiovascular Devices Market, Therapeutic and Surgical Devices emerge as the dominant segment, significantly outpacing the Diagnostic and Monitoring Devices. This dominance is driven by the critical need for interventional solutions to manage acute and chronic cardiovascular conditions.

Therapeutic and Surgical Devices:

- Cardiac Rhythm Management Devices (CRMDs): This sub-segment holds substantial market share due to the rising incidence of arrhythmias and the increasing adoption of pacemakers and implantable cardioverter-defibrillators (ICDs). The Canadian healthcare system’s focus on improving patient quality of life and reducing hospital readmissions for cardiac events further bolsters CRMD demand. Technological advancements in miniaturization, battery life, and remote monitoring capabilities for CRMDs are key drivers.

- Heart Valves: The aging demographic in Canada directly correlates with a higher prevalence of valvular heart disease. The increasing demand for transcatheter aortic valve replacement (TAVR) and other minimally invasive valve repair/replacement procedures contributes significantly to the growth of this sub-segment. Innovations in biomaterials and device design are improving patient outcomes and expanding treatment options.

- Stents: While the market for traditional drug-eluting stents remains strong, the development of bioresorbable scaffolds and advanced drug-coated balloons signifies a trend towards more sophisticated and potentially less permanent interventions. The prevalence of coronary artery disease in Canada necessitates a continuous supply of these life-saving devices.

- Cardiac Assist Devices: These devices, including ventricular assist devices (VADs), are crucial for patients with severe heart failure awaiting transplantation or as a bridge to recovery. Advancements in portability, efficacy, and reduction in complications are driving their increased use.

- Catheters and Grafts: These are fundamental tools for a wide range of cardiovascular interventions, from diagnostics to complex surgical procedures. The increasing number of interventional cardiology procedures directly fuels the demand for a diverse range of high-quality catheters and grafts.

Diagnostic and Monitoring Devices:

- Electrocardiogram (ECG) Devices: While foundational, the market for ECG devices is evolving with the integration of AI for enhanced analysis and the proliferation of portable and wearable ECG monitors, including Holter monitors and event recorders, catering to the growing demand for continuous and remote monitoring.

- Remote Cardiac Monitoring: This sub-segment is experiencing significant growth, propelled by the advancements in telemedicine and the need for continuous patient oversight. Wearable sensors and connected devices allow for real-time data collection, enabling proactive interventions and reducing the burden on healthcare facilities.

The dominance of therapeutic and surgical devices is primarily attributed to their direct impact on treating life-threatening cardiovascular conditions, coupled with ongoing technological advancements that enhance efficacy and patient safety.

Canada Cardiovascular Devices Market Product Innovations

The Canada Cardiovascular Devices Market is characterized by rapid product innovations aimed at enhancing patient outcomes and expanding treatment modalities. Leading companies are investing heavily in research and development to introduce next-generation devices. Key trends include the development of smaller, more sophisticated implantable devices like leadless pacemakers and miniaturized defibrillators, offering greater patient comfort and reduced invasiveness. Furthermore, advancements in materials science are leading to improved biocompatibility and durability for prosthetic heart valves and vascular grafts. The integration of artificial intelligence (AI) and machine learning into diagnostic and monitoring devices is enabling more accurate and earlier detection of cardiac abnormalities. Remote monitoring capabilities are becoming standard, with smart wearables and connected systems allowing for continuous patient data collection, facilitating personalized treatment plans and proactive interventions. These innovations are crucial for addressing the growing burden of cardiovascular diseases in Canada and improving the quality of life for patients.

Report Segmentation & Scope

This report segments the Canada Cardiovascular Devices Market into two primary categories: Device Type and Therapeutic Area.

Device Type:

- Diagnostic and Monitoring Devices: This segment encompasses technologies used for the identification, assessment, and continuous surveillance of cardiovascular health. It includes Electrocardiogram (ECG) Devices, crucial for detecting electrical activity of the heart, and Remote Cardiac Monitoring solutions, which leverage wearable technology and telemedicine for continuous patient oversight. The segment also includes Other Diagnostic and Monitoring Devices, such as echocardiography equipment and implantable loop recorders. The market size for this segment is projected to reach approximately $800 Million by 2025, with an estimated CAGR of 5.8% during the forecast period.

- Therapeutic and Surgical Devices: This segment comprises devices used for the treatment and surgical intervention of cardiovascular diseases. It includes Cardiac Assist Devices for supporting heart function, Cardiac Rhythm Management Devices like pacemakers and defibrillators, Catheters used in minimally invasive procedures, Grafts for vascular repair, Heart Valves for replacement or repair, and Stents for opening blocked arteries. The market size for this segment is estimated to be around $1.2 Billion in 2025, with an anticipated CAGR of 7.0% through 2033, driven by increasing procedural volumes and technological advancements.

Key Drivers of Canada Cardiovascular Devices Market Growth

The growth of the Canada Cardiovascular Devices Market is propelled by several interconnected factors. A significant driver is the rising prevalence of cardiovascular diseases (CVDs) in Canada, attributed to an aging population and increasing rates of lifestyle-related conditions like obesity and diabetes. Technological advancements are also playing a crucial role, with continuous innovation in minimally invasive devices, advanced diagnostics, and remote monitoring systems enhancing treatment efficacy and patient convenience. Supportive government initiatives and increasing healthcare expenditure in Canada contribute to better accessibility and adoption of these advanced medical technologies. Furthermore, a growing emphasis on preventative healthcare and early diagnosis fuels the demand for sophisticated diagnostic and monitoring equipment. The increasing patient preference for less invasive procedures over traditional open-heart surgeries also boosts the market for interventional devices.

Challenges in the Canada Cardiovascular Devices Market Sector

Despite the robust growth, the Canada Cardiovascular Devices Market faces several challenges. Stringent regulatory approval processes by Health Canada can lead to extended market entry timelines for new devices, impacting innovation speed. High costs associated with advanced cardiovascular devices and their implementation can pose a significant barrier to widespread adoption, particularly for public healthcare systems with budget constraints. The competitive landscape is intense, with pressure to demonstrate superior clinical outcomes and cost-effectiveness. Supply chain disruptions, as experienced globally, can impact the availability and cost of raw materials and finished products. Moreover, a shortage of skilled healthcare professionals trained in the use of specialized cardiovascular devices can hinder their effective deployment. The evolving reimbursement policies within the Canadian healthcare system also present a dynamic challenge for device manufacturers.

Leading Players in the Canada Cardiovascular Devices Market Market

- Siemens Healthcare GmbH

- Cardinal Health

- Biotronik

- Edwards Lifesciences

- General Electric (GE Healthcare)

- Medtronic

- Canon Medical Systems Corporation

- Boston Scientific Corporation

- Abbott Laboratories

- W L Gore & Associates Inc

Key Developments in Canada Cardiovascular Devices Market Sector

- December 2022: CardioComm Solutions Inc., a Canada-based company, confirmed a technology integration agreement with Utah-based CareXM LLC. Under the agreement, CareXM integrated ECG monitoring capabilities through the TouchPointCare telemedicine platform. This development signifies the growing importance of integrated telemedicine solutions for cardiac monitoring in Canada.

- November 2022: Abbott received Health Canada's approval for Aveir VR leadless pacemaker. The Aveir VR leadless pacemaker is implanted directly inside the heart's right ventricle via a minimally invasive procedure to treat slower-than-normal heart rates. This approval highlights the increasing adoption of advanced, minimally invasive technologies for cardiac rhythm management within Canada.

Strategic Canada Cardiovascular Devices Market Market Outlook

The strategic outlook for the Canada Cardiovascular Devices Market is exceptionally positive, driven by a confluence of demographic shifts, technological advancements, and an increasing focus on proactive cardiac care. The market is poised for sustained growth, with opportunities for companies focusing on innovative minimally invasive devices, sophisticated diagnostic tools, and integrated digital health solutions. Expansion in remote patient monitoring and AI-driven analytics will be critical for enhancing diagnostic accuracy and treatment personalization. Strategic partnerships and collaborations between device manufacturers, healthcare providers, and technology companies will be crucial for navigating the complex Canadian healthcare landscape and ensuring widespread adoption of cutting-edge cardiovascular technologies. Investing in product development that addresses unmet clinical needs and demonstrates clear economic value will be a key differentiator for success. The market's future lies in its ability to deliver improved patient outcomes, enhance system efficiencies, and adapt to the evolving demands of Canadian healthcare.

Canada Cardiovascular Devices Market Segmentation

-

1. Device Type

-

1.1. Diagnostic and Monitoring Devices

- 1.1.1. Electrocardiogram (ECG)

- 1.1.2. Remote Cardiac Monitoring

- 1.1.3. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic and Surgical Devices

- 1.2.1. Cardiac Assist Devices

- 1.2.2. Cardiac Rhythm Management Device

- 1.2.3. Catheter

- 1.2.4. Grafts

- 1.2.5. Heart Valves

- 1.2.6. Stents

- 1.2.7. Other Therapeutic and Surgical Devices

-

1.1. Diagnostic and Monitoring Devices

Canada Cardiovascular Devices Market Segmentation By Geography

- 1. Canada

Canada Cardiovascular Devices Market Regional Market Share

Geographic Coverage of Canada Cardiovascular Devices Market

Canada Cardiovascular Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Burden of Cardiovascular Diseases (CVD); High Prevalence of CVD Risk Factors

- 3.2.2 like Diabetes and Hypertension

- 3.2.3 and Increased Preference for Minimally Invasive Procedures

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies; High Cost of Instruments and Procedures

- 3.4. Market Trends

- 3.4.1. Electrocardiogram (ECG) Under Diagnostic and Monitoring Devices Segment is Expected to Record Significant Growth in the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Cardiovascular Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.1.1. Electrocardiogram (ECG)

- 5.1.1.2. Remote Cardiac Monitoring

- 5.1.1.3. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic and Surgical Devices

- 5.1.2.1. Cardiac Assist Devices

- 5.1.2.2. Cardiac Rhythm Management Device

- 5.1.2.3. Catheter

- 5.1.2.4. Grafts

- 5.1.2.5. Heart Valves

- 5.1.2.6. Stents

- 5.1.2.7. Other Therapeutic and Surgical Devices

- 5.1.1. Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Siemens Healthcare GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cardinal Health

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biotronik

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Edwards Lifesciences

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric (GE Healthcare)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Medtronic

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canon Medical Systems Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boston Scientific Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abbott Laboratories

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 W L Gore & Associates Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Siemens Healthcare GmbH

List of Figures

- Figure 1: Canada Cardiovascular Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Cardiovascular Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Cardiovascular Devices Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 2: Canada Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 3: Canada Cardiovascular Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Cardiovascular Devices Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Canada Cardiovascular Devices Market Revenue Million Forecast, by Device Type 2020 & 2033

- Table 6: Canada Cardiovascular Devices Market Volume K Units Forecast, by Device Type 2020 & 2033

- Table 7: Canada Cardiovascular Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Canada Cardiovascular Devices Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Cardiovascular Devices Market?

The projected CAGR is approximately 3.80%.

2. Which companies are prominent players in the Canada Cardiovascular Devices Market?

Key companies in the market include Siemens Healthcare GmbH, Cardinal Health, Biotronik, Edwards Lifesciences, General Electric (GE Healthcare), Medtronic, Canon Medical Systems Corporation, Boston Scientific Corporation, Abbott Laboratories, W L Gore & Associates Inc.

3. What are the main segments of the Canada Cardiovascular Devices Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Cardiovascular Diseases (CVD); High Prevalence of CVD Risk Factors. like Diabetes and Hypertension. and Increased Preference for Minimally Invasive Procedures.

6. What are the notable trends driving market growth?

Electrocardiogram (ECG) Under Diagnostic and Monitoring Devices Segment is Expected to Record Significant Growth in the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies; High Cost of Instruments and Procedures.

8. Can you provide examples of recent developments in the market?

In December 2022, CardioComm Solutions Inc., a Canada-based company, confirmed a technology integration agreement with Utah-based CareXM LLC. Under the agreement, CareXM integrated ECG monitoring capabilities through the TouchPointCare telemedicine platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Cardiovascular Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Cardiovascular Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Cardiovascular Devices Market?

To stay informed about further developments, trends, and reports in the Canada Cardiovascular Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence