Key Insights

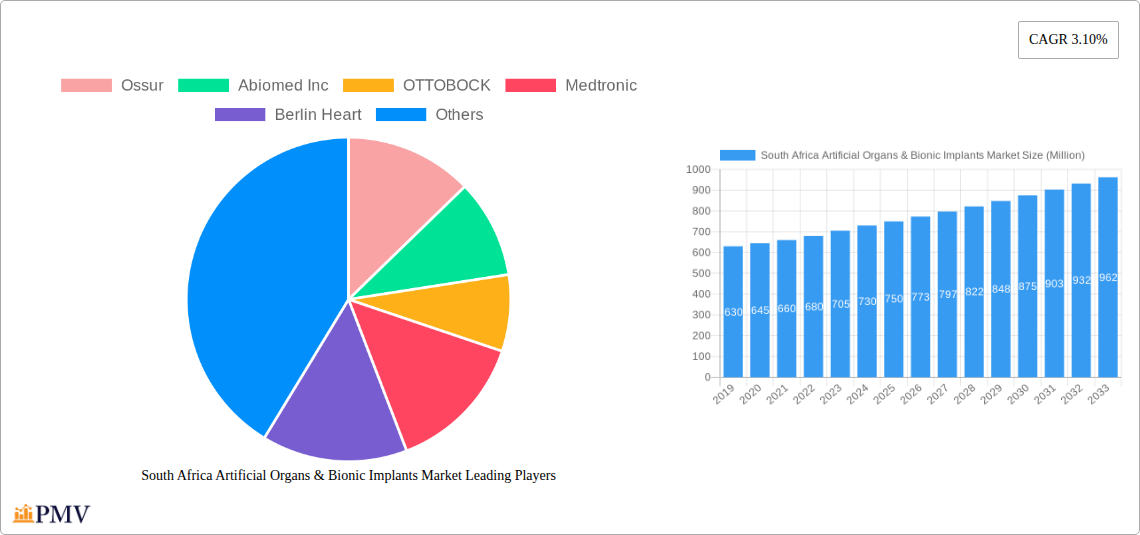

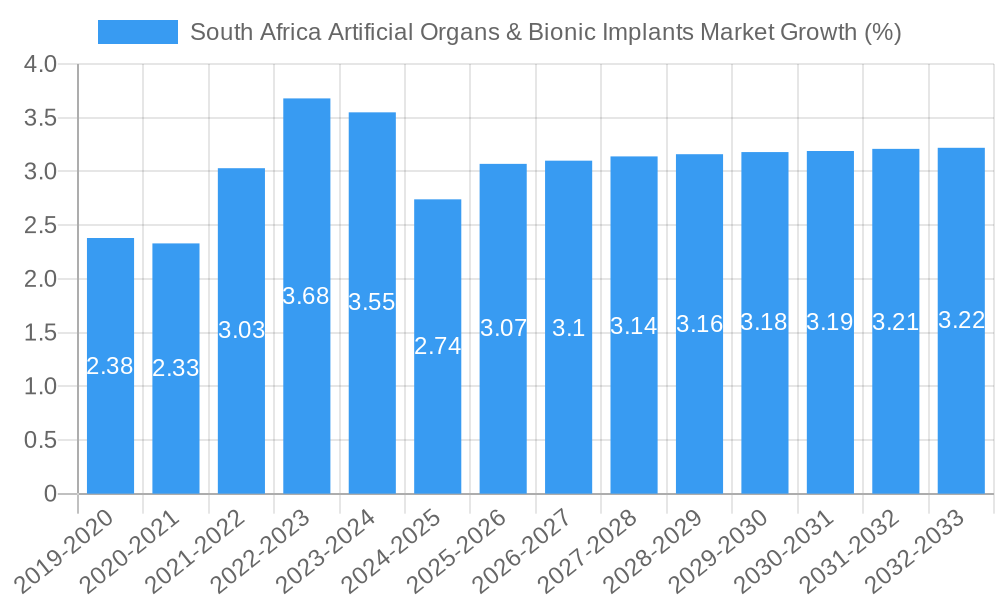

The South Africa Artificial Organs & Bionic Implants Market is poised for significant expansion, driven by a growing burden of chronic diseases, an aging population, and increasing advancements in medical technology. Estimated at approximately 750 million USD in 2025, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.10% through 2033. This growth is fueled by a rising incidence of organ failure, necessitating artificial replacements, and a burgeoning demand for bionic solutions that restore mobility and sensory functions. Key drivers include enhanced awareness of implantable technologies, improving healthcare infrastructure in South Africa, and a greater willingness among patients to adopt these life-altering medical devices. Furthermore, government initiatives focused on improving healthcare access and affordability are expected to contribute to market penetration and growth.

The market's segmentation reveals a dynamic landscape. Within Artificial Organs, Artificial Hearts and Artificial Kidneys are expected to see steady demand due to the high prevalence of cardiovascular and renal diseases. Cochlear implants are also a significant segment, addressing hearing loss which affects a considerable portion of the population. In the Bionics segment, orthopedic bionics, including advanced prosthetic limbs, are crucial for individuals with limb loss, a common issue stemming from accidents and chronic conditions. Cardiac bionics are also gaining traction, offering solutions for heart conditions. Despite the positive outlook, certain restraints may impede rapid growth, such as the high cost of advanced bionic implants and artificial organs, which can limit accessibility for a large segment of the South African population. Additionally, the need for specialized surgical expertise and post-operative care infrastructure presents a challenge. However, ongoing research and development focused on cost reduction and improved functionality, coupled with increasing health insurance coverage, are expected to mitigate these challenges and propel the market forward.

This in-depth market research report provides a detailed analysis of the South Africa Artificial Organs & Bionic Implants Market, covering the historical period from 2019 to 2024, the base year of 2025, and a comprehensive forecast from 2025 to 2033. We delve into key market segments, industry trends, competitive landscape, and strategic outlook, offering actionable insights for stakeholders in the South African healthcare and medtech industries. The report highlights critical developments, growth drivers, and challenges shaping the future of artificial organs and bionic implants in the region, including advancements in artificial heart technology, sophisticated cochlear implants, and cutting-edge orthopedic bionic solutions.

South Africa Artificial Organs & Bionic Implants Market Market Structure & Competitive Dynamics

The South Africa Artificial Organs & Bionic Implants Market exhibits a dynamic and evolving structure. While some segments are characterized by a moderate to high level of market concentration due to the presence of global leaders with established product portfolios and extensive R&D capabilities, the broader market fosters innovation through the entry of specialized players and the increasing adoption of advanced technologies. The innovation ecosystem is driven by collaborations between academic institutions, research centers, and leading medical device manufacturers, fostering the development of next-generation artificial organs and bionic solutions. Regulatory frameworks, overseen by bodies like the South African Health Products Regulatory Authority (SAHPRA), play a crucial role in ensuring product safety and efficacy, influencing market access and adoption rates. The threat of product substitutes, while present in some traditional medical device categories, is mitigated by the unique and often life-saving nature of artificial organs and bionic implants. End-user trends reveal a growing demand for less invasive procedures, personalized solutions, and enhanced quality of life following implantation. Mergers and acquisitions (M&A) activities are significant, signaling consolidation and strategic expansion. For instance, the acquisition of Intersect ENT by Medtronic PLC (May 2022) for an undisclosed value significantly bolstered Medtronic's ENT portfolio, demonstrating strategic moves to enhance comprehensive patient care. Similarly, Cochlear Limited's agreement to acquire Oticon Medical (April 2022) for an estimated value of several hundred million dollars underscores the consolidation within the hearing implant sector, aiming to leverage synergies and expand customer reach. These M&A activities are key to shaping market share and driving innovation.

South Africa Artificial Organs & Bionic Implants Market Industry Trends & Insights

The South Africa Artificial Organs & Bionic Implants Market is poised for significant expansion, driven by a confluence of technological advancements, increasing healthcare expenditure, and a growing awareness of the potential of restorative medical technologies. The market is experiencing a robust Compound Annual Growth Rate (CAGR) estimated to be in the XX%, reflecting sustained demand for innovative solutions to address a range of medical conditions. Key growth drivers include the rising prevalence of chronic diseases such as cardiovascular diseases, kidney failure, and hearing loss, which directly fuel the need for artificial organs and bionic implants. Technological disruptions are at the forefront of market evolution. Innovations in biomaterials, miniaturization of devices, and advancements in artificial intelligence are enabling the development of more sophisticated, durable, and user-friendly implants. For example, the development of advanced ventricular assist devices (VADs) and fully implantable artificial hearts is revolutionizing cardiac care. In the realm of bionics, progress in neural interface technologies is enhancing the functionality and intuitiveness of prosthetic limbs and cochlear implants. Consumer preferences are shifting towards personalized medicine and solutions that offer greater autonomy and an improved quality of life. Patients are actively seeking treatments that not only extend lifespan but also enhance daily functioning and well-being. This trend is particularly evident in the growing demand for advanced orthopedic bionic solutions that restore mobility and independence. The competitive dynamics are characterized by a blend of global medical device giants and emerging local innovators. Companies are investing heavily in research and development to gain a competitive edge, focusing on product differentiation, cost-effectiveness, and expanding their market penetration. The market penetration of advanced artificial organs and bionic implants is steadily increasing, though challenges related to affordability and accessibility in certain demographics persist. The integration of digital health technologies, such as remote monitoring and data analytics, is also becoming a critical differentiator, allowing for proactive patient management and personalized treatment adjustments. This holistic approach to patient care is shaping the future trajectory of the market, fostering a more connected and responsive healthcare ecosystem.

Dominant Markets & Segments in South Africa Artificial Organs & Bionic Implants Market

Within the South Africa Artificial Organs & Bionic Implants Market, the dominance is not uniform, with distinct segments and geographical areas exhibiting varied growth trajectories and market penetration. Artificial Organs, particularly Cochlear Implants, currently hold a significant market share and are expected to continue their dominance. This is driven by several factors, including a higher prevalence of hearing loss in the aging population and a greater awareness of the benefits of cochlear implantation for restoring hearing and improving communication abilities.

Cochlear Implants: The demand for cochlear implants is bolstered by government initiatives aimed at improving audiological care and increasing access to restorative technologies. Furthermore, the continuous innovation in implantable hearing devices, offering improved sound processing and speech intelligibility, makes them highly attractive to patients and clinicians. The presence of global leaders in this segment ensures a steady supply of advanced technologies.

Orthopedic Bionic: This segment is also experiencing robust growth, fueled by the rising incidence of musculoskeletal disorders, osteoarthritis, and sports-related injuries. The increasing adoption of bionic prosthetics and exoskeletons is significantly contributing to the market's expansion, offering enhanced mobility and functional recovery to amputees and individuals with mobility impairments. Economic policies that support rehabilitation services and the increasing focus on active aging also play a crucial role.

Artificial Heart: While representing a more complex and expensive segment, the artificial heart market is showing promising growth due to advancements in technology that improve durability and reduce the risk of complications. The increasing burden of cardiovascular diseases in South Africa necessitates such advanced life-support systems.

Other Organ Types (e.g., Artificial Kidney, Liver Assist Devices): These segments are still in nascent stages of development and adoption in South Africa. However, ongoing research and the potential to address critical organ shortages are driving future growth projections. The development of more accessible and efficient dialysis technologies and implantable artificial kidney prototypes will be key to their market penetration.

Ear Bionics (excluding Cochlear Implants): This category, which might include middle ear implants and other auditory assistive devices, complements the cochlear implant market by offering solutions for a broader spectrum of hearing impairments.

The dominance of specific segments is further influenced by South Africa's economic landscape, healthcare infrastructure development, and public health policies. Regions with better healthcare access and higher disposable incomes tend to see faster adoption rates of advanced bionic and artificial organ technologies. The government's commitment to improving healthcare outcomes and investing in medical technology infrastructure are critical enablers for the sustained growth and dominance of key market segments.

South Africa Artificial Organs & Bionic Implants Market Product Innovations

Product innovations in the South Africa Artificial Organs & Bionic Implants Market are primarily focused on enhancing functionality, improving patient outcomes, and increasing accessibility. Key advancements include the development of more sophisticated biomaterials that minimize rejection rates and promote tissue integration. In the realm of artificial hearts and other organ replacements, miniaturization and improved power sources are enabling longer-term use and greater patient mobility. For bionic implants, innovations are centered on more intuitive control systems, advanced sensory feedback, and lighter, more durable designs. For instance, the integration of AI in bionic limbs allows for more natural movement and adaptation to user intent. Cochlear implant technology continues to evolve with enhanced sound processing algorithms that mimic natural hearing more closely, offering clearer speech perception in challenging listening environments. These product innovations are crucial for providing competitive advantages, meeting evolving patient needs, and expanding the market reach of manufacturers.

Report Segmentation & Scope

This report segments the South Africa Artificial Organs & Bionic Implants Market by Type. The primary categories include Artificial Organs, encompassing Artificial Heart, Artificial Kidney, Cochlear Implants, and Other Organ Types. The second major category is Bionics, which further breaks down into Ear Bionics, Orthopedic Bionic, Cardiac Bionics, and Other Bionics. Each segment is analyzed for its current market size, projected growth, and the competitive dynamics at play. The scope extends to understanding the specific technological advancements, patient demographics, and reimbursement policies that influence the market penetration and adoption rates within each segment, providing a granular view of the market landscape.

Key Drivers of South Africa Artificial Organs & Bionic Implants Market Growth

Several key drivers are propelling the growth of the South Africa Artificial Organs & Bionic Implants Market. Technologically, continuous innovation in areas like biocompatible materials, miniaturization, and advanced power management systems for implants is enhancing device performance and patient quality of life. Economically, increasing per capita healthcare expenditure and greater access to private healthcare are making these advanced medical technologies more affordable and accessible. Regulatory frameworks, while stringent, are also evolving to facilitate the approval of novel devices. Furthermore, a rising awareness among the patient population regarding the benefits of these restorative solutions, coupled with an increasing prevalence of chronic diseases like cardiovascular ailments and hearing loss, directly fuels market demand.

Challenges in the South Africa Artificial Organs & Bionic Implants Market Sector

Despite its growth potential, the South Africa Artificial Organs & Bionic Implants Market faces significant challenges. High procurement and maintenance costs associated with advanced artificial organs and bionic implants pose a substantial barrier, particularly for a large segment of the population with limited disposable income. Reimbursement policies and insurance coverage for these specialized treatments are often inadequate, further exacerbating affordability issues. Regulatory hurdles, including lengthy approval processes for new devices and the need for specialized infrastructure and trained personnel for implantation and post-operative care, can slow down market penetration. Additionally, supply chain complexities and the availability of skilled healthcare professionals trained in implanting and managing these sophisticated devices can create regional disparities in access.

Leading Players in the South Africa Artificial Organs & Bionic Implants Market Market

- Ossur

- Abiomed Inc

- OTTOBOCK

- Medtronic

- Berlin Heart

- Ekso Bionics

- Abbott

- Sonova (Advanced Bionics AG)

- Cochlear Ltd

- Zimmer Biomet

Key Developments in South Africa Artificial Organs & Bionic Implants Market Sector

May 2022: Medtronic PLC acquired Intersect ENT, increasing the company's comprehensive ENT portfolio with cutting-edge technologies used in sinus surgeries to enhance post-operative results and cure nasal polyps. This strategic acquisition aims to strengthen Medtronic's position in the ENT market and expand its offerings in restorative ear, nose, and throat solutions.

April 2022: Cochlear Limited agreed to acquire Oticon Medical following Demant's decision to exit its hearing implant business activities. As part of the transaction, Cochlear committed to providing ongoing support for Oticon Medical's base of more than 75,000 hearing implant recipients, which includes cochlear and acoustic implants. This move consolidates Cochlear's market leadership in the hearing implant sector and expands its global reach.

May 2022: Medtronic PLC acquired Intersect ENT, increasing the company's comprehensive ENT portfolio with cutting-edge technologies used in sinus surgeries to enhance post-operative results and cure nasal polyps. This strategic acquisition aims to strengthen Medtronic's position in the ENT market and expand its offerings in restorative ear, nose, and throat solutions.

April 2022: Cochlear Limited agreed to acquire Oticon Medical following Demant's decision to exit its hearing implant business activities. As part of the transaction, Cochlear committed to providing ongoing support for Oticon Medical's base of more than 75,000 hearing implant recipients, which includes cochlear and acoustic implants. This move consolidates Cochlear's market leadership in the hearing implant sector and expands its global reach.

Strategic South Africa Artificial Organs & Bionic Implants Market Market Outlook

The strategic outlook for the South Africa Artificial Organs & Bionic Implants Market is one of sustained growth and increasing sophistication. The market is set to benefit from ongoing technological advancements, such as the development of more intelligent and integrated bionic systems and increasingly compact and efficient artificial organs. Strategic partnerships between technology providers, healthcare institutions, and governmental bodies will be crucial for addressing affordability and accessibility challenges. Increased focus on personalized medicine and patient-centric solutions will drive innovation in customized implants and rehabilitation programs. The market is also likely to witness a greater integration of digital health solutions for remote patient monitoring and management, further enhancing the value proposition of these medical devices. Companies that can effectively navigate the regulatory landscape, offer cost-effective solutions, and demonstrate superior patient outcomes will be best positioned for success in this evolving market.

South Africa Artificial Organs & Bionic Implants Market Segmentation

-

1. Type

-

1.1. Artificial Organ

- 1.1.1. Artificial Heart

- 1.1.2. Artificial Kidney

- 1.1.3. Cochlear Implants

- 1.1.4. Other Organ Types

-

1.2. Bionics

- 1.2.1. Ear Bionics

- 1.2.2. Orthopedic Bionic

- 1.2.3. Cardiac Bionics

- 1.2.4. Other Bionics

-

1.1. Artificial Organ

South Africa Artificial Organs & Bionic Implants Market Segmentation By Geography

- 1. South Africa

South Africa Artificial Organs & Bionic Implants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Incidence of Disabilities

- 3.2.2 Organ Failures

- 3.2.3 and Scarcity of Donor Organs; Technological Advancements in Artificial Organs and Bionics

- 3.3. Market Restrains

- 3.3.1. Expensive Procedures; Risk of Compatibility Issues and Malfunctions

- 3.4. Market Trends

- 3.4.1. Artificial Kidney Segment Expected to Garner a Large Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Artificial Organ

- 5.1.1.1. Artificial Heart

- 5.1.1.2. Artificial Kidney

- 5.1.1.3. Cochlear Implants

- 5.1.1.4. Other Organ Types

- 5.1.2. Bionics

- 5.1.2.1. Ear Bionics

- 5.1.2.2. Orthopedic Bionic

- 5.1.2.3. Cardiac Bionics

- 5.1.2.4. Other Bionics

- 5.1.1. Artificial Organ

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ossur

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abiomed Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OTTOBOCK

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Medtronic

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Berlin Heart

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ekso Bionics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abbott

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sonova (Advanced Bionics AG)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cochlear Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zimmer Biomet

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ossur

List of Figures

- Figure 1: South Africa Artificial Organs & Bionic Implants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Artificial Organs & Bionic Implants Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 11: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Artificial Organs & Bionic Implants Market?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the South Africa Artificial Organs & Bionic Implants Market?

Key companies in the market include Ossur, Abiomed Inc, OTTOBOCK, Medtronic, Berlin Heart, Ekso Bionics, Abbott, Sonova (Advanced Bionics AG), Cochlear Ltd, Zimmer Biomet.

3. What are the main segments of the South Africa Artificial Organs & Bionic Implants Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Incidence of Disabilities. Organ Failures. and Scarcity of Donor Organs; Technological Advancements in Artificial Organs and Bionics.

6. What are the notable trends driving market growth?

Artificial Kidney Segment Expected to Garner a Large Share of the Market.

7. Are there any restraints impacting market growth?

Expensive Procedures; Risk of Compatibility Issues and Malfunctions.

8. Can you provide examples of recent developments in the market?

May 2022: Medtronic PLC acquired Intersect ENT, increasing the company's comprehensive ENT portfolio with cutting-edge technologies used in sinus surgeries to enhance post-operative results and cure nasal polyps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Artificial Organs & Bionic Implants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Artificial Organs & Bionic Implants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Artificial Organs & Bionic Implants Market?

To stay informed about further developments, trends, and reports in the South Africa Artificial Organs & Bionic Implants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence