Key Insights

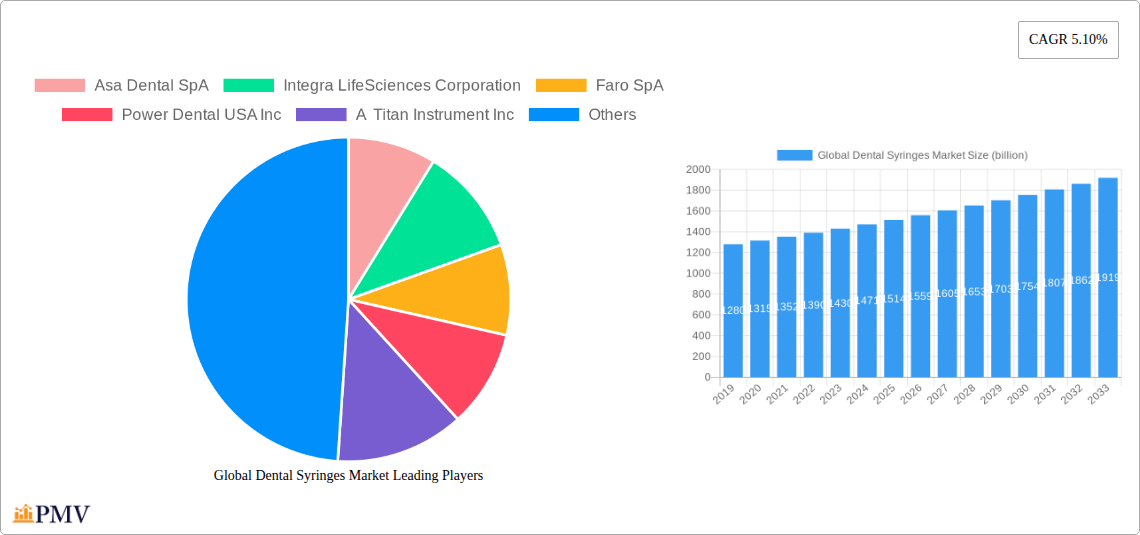

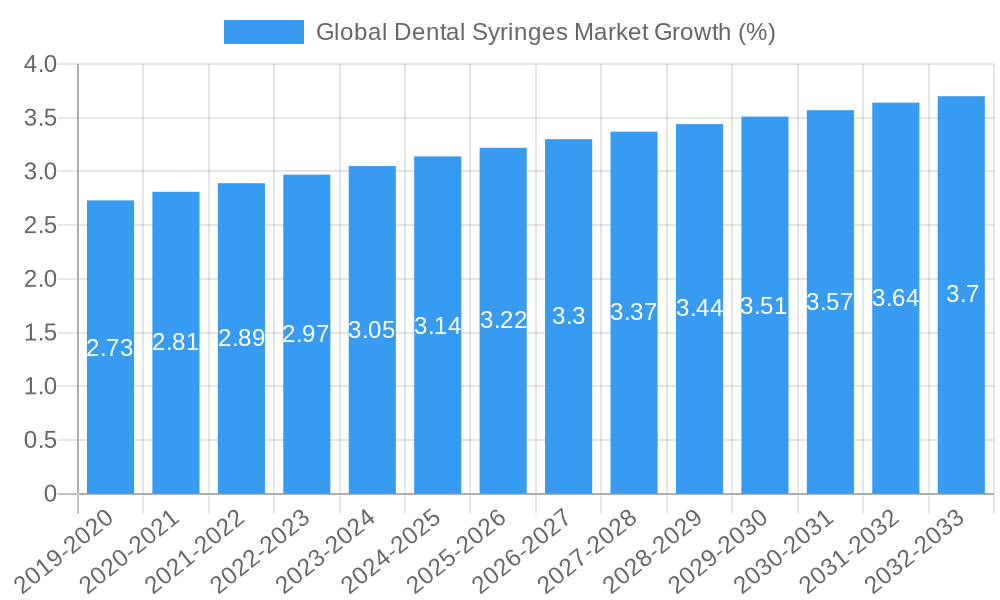

The global dental syringes market is poised for steady expansion, projected to reach a substantial valuation of approximately USD 1.5 billion in 2025 and grow at a Compound Annual Growth Rate (CAGR) of 5.10% through 2033. This growth is primarily fueled by the increasing global prevalence of dental conditions such as caries and periodontal diseases, necessitating more frequent and advanced dental treatments. The rising disposable incomes in emerging economies, coupled with a growing awareness of oral hygiene and the availability of innovative dental products, are significant drivers. Furthermore, the expanding dental tourism sector in various regions, attracting patients seeking cost-effective and high-quality dental care, also contributes to the demand for dental syringes. The market’s expansion is also supported by technological advancements leading to the development of more efficient and user-friendly syringe designs, enhancing procedural outcomes and patient comfort.

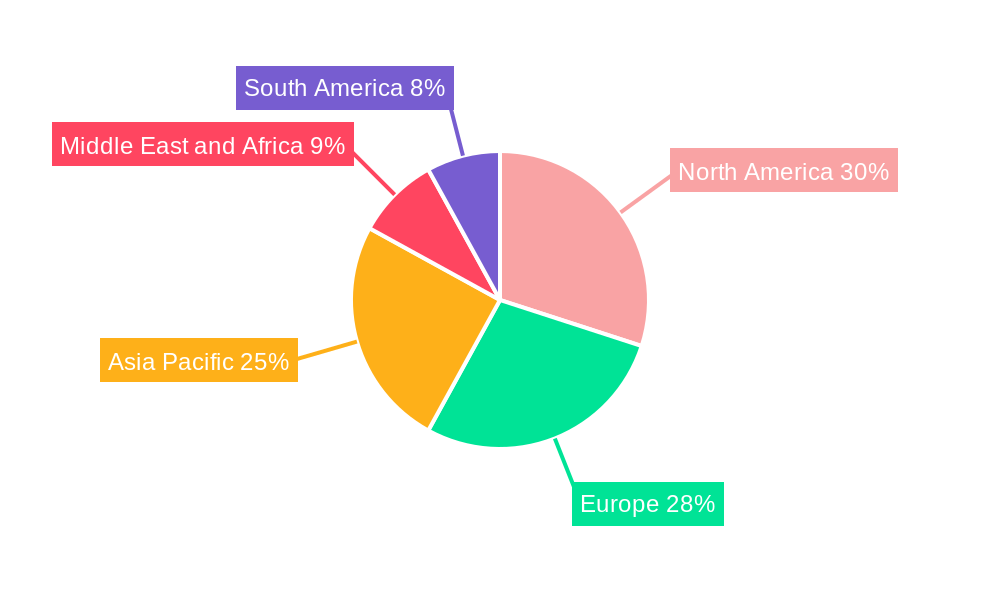

The market segmentation reveals a dynamic landscape. Disposable dental syringes are expected to dominate, driven by their convenience, sterility, and cost-effectiveness in preventing cross-contamination, a crucial aspect in modern dental practices. Reusable dental syringes, while offering long-term cost benefits, face stringent sterilization requirements which can impact adoption rates. By type, aspirating dental syringes are likely to see higher demand due to their precision in managing fluid aspiration during procedures. In terms of material, both metallic and plastic dental syringes hold significant market share, with plastic variants gaining traction due to their lightweight nature, disposability, and reduced manufacturing costs. Geographically, North America and Europe are anticipated to lead the market owing to well-established healthcare infrastructure, high patient expenditure on dental care, and early adoption of advanced dental technologies. However, the Asia Pacific region is projected to exhibit the fastest growth, propelled by increasing dental healthcare investments, a burgeoning population, and a rising middle class with greater access to dental services.

This comprehensive report provides an exhaustive analysis of the global dental syringes market, offering crucial insights into market dynamics, growth trajectories, and competitive landscapes. Covering a study period from 2019 to 2033, with a base year of 2025, this report delves deep into the factors shaping the future of dental syringe usage worldwide. We estimate the global dental syringes market to reach $XX billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Global Dental Syringes Market Market Structure & Competitive Dynamics

The global dental syringes market is characterized by a moderately concentrated structure, with a blend of established global players and specialized regional manufacturers. Innovation ecosystems are driven by the continuous need for enhanced patient safety, infection control, and user convenience. Regulatory frameworks, particularly concerning medical device manufacturing and biocompatibility, play a pivotal role in shaping market entry and product development. The presence of product substitutes, such as alternative drug delivery systems, necessitates ongoing innovation in dental syringe technology to maintain market relevance. End-user trends are heavily influenced by the rising global demand for dental procedures, advancements in restorative dentistry, and increasing awareness of oral hygiene. Mergers and acquisition (M&A) activities, while present, are often focused on expanding product portfolios or geographical reach rather than consolidating market share among the top players. The market share of leading companies is expected to see gradual shifts based on their investment in R&D and strategic partnerships. M&A deal values are anticipated to range from $XX million to $XX billion, reflecting strategic acquisitions aimed at inorganic growth.

- Market Concentration: Moderately concentrated with a mix of large multinational corporations and niche players.

- Innovation Ecosystem: Driven by advancements in materials, safety features, and ergonomic designs.

- Regulatory Frameworks: Strict adherence to global medical device standards (e.g., ISO 13485, FDA approvals) is critical.

- Product Substitutes: Alternative drug delivery methods and specialized dental tools.

- End-User Trends: Growing demand for minimally invasive procedures, aesthetic dentistry, and preventive care.

- M&A Activities: Strategic acquisitions focused on technology integration and market expansion.

Global Dental Syringes Market Industry Trends & Insights

The global dental syringes market is experiencing significant growth, propelled by an increasing global population and a rising prevalence of dental caries and periodontal diseases, necessitating a greater volume of dental treatments. Technological advancements are at the forefront of market expansion, with the introduction of syringes featuring enhanced precision, improved ergonomics for dental professionals, and advanced safety mechanisms to prevent needlestick injuries. The shift towards disposable dental syringes continues to dominate due to superior infection control capabilities and convenience, although reusable syringes maintain a niche in specific applications where sterilization protocols are robust. Consumer preferences are increasingly leaning towards pain-free and efficient dental procedures, which directly influences the demand for innovative and user-friendly dental syringes. The competitive landscape is marked by intense R&D efforts aimed at developing biodegradable materials and syringes with integrated functionalities, such as precise dose delivery systems. The market penetration of advanced dental syringe technologies is expected to rise as dental practitioners embrace digital dentistry and seek solutions that streamline workflows and improve patient outcomes. The projected market size for dental syringes in 2025 stands at $XX billion, with a projected CAGR of XX% from 2025 to 2033, indicating a robust and sustained growth trajectory. The focus on preventive dentistry and the increasing affordability of dental care in emerging economies are also significant growth drivers. Furthermore, the growing awareness of oral health's impact on overall well-being is encouraging more individuals to seek regular dental check-ups and treatments, thereby boosting the demand for essential dental supplies like syringes.

Dominant Markets & Segments in Global Dental Syringes Market

The global dental syringes market is currently dominated by North America and Europe, driven by high healthcare expenditure, well-established dental infrastructure, and a strong emphasis on advanced dental care. Within these regions, the United States and Germany represent key markets due to the high density of dental practitioners and the widespread adoption of sophisticated dental technologies.

Product Segmentation Dominance:

Disposable Dental Syringes: This segment holds the largest market share and is expected to continue its dominance throughout the forecast period.

- Key Drivers: Superior infection control, elimination of sterilization costs and time, convenience for dental professionals, and patient preference for single-use devices.

- Market Penetration: High market penetration due to widespread adoption in routine dental procedures.

- Growth Factors: Increasing incidence of dental procedures, rising awareness of hygiene protocols, and cost-effectiveness in the long run.

Reusable Dental Syringes: While a smaller segment, reusable syringes are crucial for specific applications and where cost-effectiveness and material sustainability are prioritized.

- Key Drivers: Durability, potential cost savings in high-volume settings with efficient sterilization, and environmental considerations.

- Market Penetration: Moderate, primarily in specialized clinics or dental schools with robust sterilization facilities.

- Growth Factors: Limited growth potential compared to disposables, but a steady demand for certain applications.

Type Segmentation Dominance:

Aspirating Dental Syringes: These are essential for precise anesthesia delivery, allowing dentists to confirm needle placement before injecting.

- Key Drivers: Critical for safe and effective administration of local anesthetics, reducing the risk of intravascular injection.

- Market Penetration: High adoption across all dental practices offering local anesthesia.

- Growth Factors: Continued reliance on local anesthesia for pain management in dental procedures.

Non-aspirating Dental Syringes: Used for various applications including irrigation, medication delivery, and other non-anesthetic purposes.

- Key Drivers: Versatility and ease of use for a range of dental tasks.

- Market Penetration: Significant, often used in conjunction with aspirating syringes.

- Growth Factors: Broad application in dental hygiene, restorative dentistry, and orthodontics.

Material Segmentation Dominance:

Plastic Dental Syringes: This segment dominates the market, offering a combination of affordability, disposability, and design flexibility.

- Key Drivers: Cost-effectiveness, lightweight, sterile packaging, and ease of manufacturing.

- Market Penetration: Nearly universal for disposable syringes.

- Growth Factors: Continued innovation in polymer technology for enhanced strength and safety.

Metallic Dental Syringes: Primarily used for reusable syringes, offering durability and longevity.

- Key Drivers: Robustness, longevity, and suitability for repeated sterilization cycles.

- Market Penetration: Niche, mainly for specific types of reusable syringes.

- Growth Factors: Stable demand from institutions with existing infrastructure for reusable instruments.

The dominance of plastic disposable aspirating dental syringes is a testament to the industry's focus on safety, efficiency, and infection control in modern dental practice.

Global Dental Syringes Market Product Innovations

Product innovations in the global dental syringes market are primarily focused on enhancing safety, precision, and user experience. Key developments include syringes with integrated safety features like retractable needles and passive shielding mechanisms to prevent needlestick injuries, a critical concern for dental professionals. Advancements in materials science are leading to the development of lighter, more durable, and biocompatible plastic syringes. Furthermore, innovations in dose control technology are enabling more accurate and consistent delivery of local anesthetics and other medications, improving patient comfort and treatment efficacy. Competitive advantages are being gained through ergonomic designs that reduce hand fatigue for dentists and improved plunger mechanisms for smoother aspiration and injection.

Report Segmentation & Scope

This report meticulously segments the global dental syringes market based on critical parameters to provide a granular understanding of market dynamics and growth opportunities. The scope encompasses:

Product:

- Reusable Dental Syringes: This segment, while smaller, caters to specific clinical needs for durability and cost-effectiveness in high-volume settings with stringent sterilization protocols. Projections indicate a steady but limited market share.

- Disposable Dental Syringes: This segment is expected to continue its dominance, driven by paramount concerns for infection control and convenience. Growth projections are robust, with significant market size anticipated.

- Other Products: This category includes specialized syringes not fitting the primary classifications, contributing a niche but growing market share.

Type:

- Aspirating Dental Syringes: Crucial for safe anesthetic delivery, this segment is expected to maintain a strong market presence due to its essential role in pain management.

- Non-aspirating Dental Syringes: These versatile syringes are projected to experience consistent growth due to their broad applicability in various dental procedures.

Material:

- Metallic Dental Syringes: This segment, primarily linked to reusable syringes, is expected to maintain a stable market share, catering to specific clinical requirements.

- Plastic Dental Syringes: This segment is projected to dominate the market due to the widespread preference for disposable, cost-effective, and easily manufacturable solutions.

Key Drivers of Global Dental Syringes Market Growth

The global dental syringes market is propelled by several key factors: the escalating global prevalence of dental diseases like caries and periodontitis, driving demand for dental treatments; continuous technological advancements in syringe design, leading to safer and more efficient products; increasing patient awareness regarding oral hygiene and preventive dental care, encouraging more frequent dental visits; and the rising disposable incomes in emerging economies, making dental procedures more accessible. The growing trend of aesthetic dentistry and restorative procedures also significantly contributes to the market's expansion.

Challenges in the Global Dental Syringes Market Sector

Despite robust growth, the global dental syringes market faces several challenges. Stringent regulatory approvals for new medical devices can lead to extended product launch timelines and increased development costs. Fluctuations in raw material prices, particularly for plastics and specialized metals, can impact manufacturing costs and profitability. Intense price competition among manufacturers, especially in the disposable syringes segment, can affect profit margins. Furthermore, the increasing adoption of digital dentistry and alternative treatment modalities might pose long-term competitive pressures. Supply chain disruptions, as evidenced by recent global events, can also impact product availability and delivery schedules.

Leading Players in the Global Dental Syringes Market Market

- Asa Dental SpA

- Integra LifeSciences Corporation

- Faro SpA

- Power Dental USA Inc

- A Titan Instrument Inc

- Septodont

- Ultradent Products

- Dentsply Sirona

- Carl Martin GmbH

- Anthogyr SAS

- 3M Company

- Vista Dental Products

- Delmarks Surgico

- Diadent Group International

- Accesia

Key Developments in Global Dental Syringes Market Sector

- March 2022: IMI (International Medical Industries, Inc.) bolsters expertise in secure drug delivery products with the release of the new Prep-Lock Tamper Evident Cap for ENFit and Oral Syringes with incorporated Radio Frequency Identification (RFID) technology. This innovation enhances drug traceability and security.

- February 2021: No Borders, Inc. launched of MediDent supplies needles and syringes, with millions of needles and syringes delivered to clients across the United States. This development signifies expansion in product distribution and increased market presence.

Strategic Global Dental Syringes Market Market Outlook

- March 2022: IMI (International Medical Industries, Inc.) bolsters expertise in secure drug delivery products with the release of the new Prep-Lock Tamper Evident Cap for ENFit and Oral Syringes with incorporated Radio Frequency Identification (RFID) technology. This innovation enhances drug traceability and security.

- February 2021: No Borders, Inc. launched of MediDent supplies needles and syringes, with millions of needles and syringes delivered to clients across the United States. This development signifies expansion in product distribution and increased market presence.

Strategic Global Dental Syringes Market Market Outlook

The strategic outlook for the global dental syringes market is exceptionally positive, driven by sustained demand for dental treatments and ongoing innovation. Key growth accelerators include the increasing integration of smart technologies for enhanced precision and patient safety, the development of biodegradable materials to address environmental concerns, and the expansion of dental services in underserved regions. Strategic opportunities lie in forming partnerships with dental distributors and educational institutions to promote advanced syringe technologies, investing in R&D for novel drug delivery systems within syringes, and focusing on emerging markets with a growing middle class and rising healthcare expenditure. The market is poised for significant expansion as dental professionals prioritize efficiency, patient comfort, and infection control.

Global Dental Syringes Market Segmentation

-

1. Product

- 1.1. Reusable Dental Syringes

- 1.2. Disposable Dental Syringes

- 1.3. Other Products

-

2. Type

- 2.1. Aspirating Dental Syringes

- 2.2. Non-aspirating Dental Syringes

-

3. Material

- 3.1. Metallic Dental Syringes

- 3.2. Plastic Dental Syringes

Global Dental Syringes Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Dental Syringes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Innovations in syringe technology

- 3.2.2 such as the development of self-aspirating syringes

- 3.2.3 disposable syringes

- 3.2.4 and safety-engineered syringes

- 3.2.5 are enhancing the efficiency and safety of dental procedures

- 3.3. Market Restrains

- 3.3.1 The development of alternative methods for pain management

- 3.3.2 such as computer-controlled local anesthesia delivery systems

- 3.3.3 may pose challenges for traditional dental syringes

- 3.4. Market Trends

- 3.4.1 The dental industry is becoming more focused on sustainability

- 3.4.2 prompting manufacturers to develop eco-friendly syringes and packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Syringes Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Reusable Dental Syringes

- 5.1.2. Disposable Dental Syringes

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Aspirating Dental Syringes

- 5.2.2. Non-aspirating Dental Syringes

- 5.3. Market Analysis, Insights and Forecast - by Material

- 5.3.1. Metallic Dental Syringes

- 5.3.2. Plastic Dental Syringes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Global Dental Syringes Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Reusable Dental Syringes

- 6.1.2. Disposable Dental Syringes

- 6.1.3. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Aspirating Dental Syringes

- 6.2.2. Non-aspirating Dental Syringes

- 6.3. Market Analysis, Insights and Forecast - by Material

- 6.3.1. Metallic Dental Syringes

- 6.3.2. Plastic Dental Syringes

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Global Dental Syringes Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Reusable Dental Syringes

- 7.1.2. Disposable Dental Syringes

- 7.1.3. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Aspirating Dental Syringes

- 7.2.2. Non-aspirating Dental Syringes

- 7.3. Market Analysis, Insights and Forecast - by Material

- 7.3.1. Metallic Dental Syringes

- 7.3.2. Plastic Dental Syringes

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Global Dental Syringes Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Reusable Dental Syringes

- 8.1.2. Disposable Dental Syringes

- 8.1.3. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Aspirating Dental Syringes

- 8.2.2. Non-aspirating Dental Syringes

- 8.3. Market Analysis, Insights and Forecast - by Material

- 8.3.1. Metallic Dental Syringes

- 8.3.2. Plastic Dental Syringes

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Global Dental Syringes Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Reusable Dental Syringes

- 9.1.2. Disposable Dental Syringes

- 9.1.3. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Aspirating Dental Syringes

- 9.2.2. Non-aspirating Dental Syringes

- 9.3. Market Analysis, Insights and Forecast - by Material

- 9.3.1. Metallic Dental Syringes

- 9.3.2. Plastic Dental Syringes

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Global Dental Syringes Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Reusable Dental Syringes

- 10.1.2. Disposable Dental Syringes

- 10.1.3. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Aspirating Dental Syringes

- 10.2.2. Non-aspirating Dental Syringes

- 10.3. Market Analysis, Insights and Forecast - by Material

- 10.3.1. Metallic Dental Syringes

- 10.3.2. Plastic Dental Syringes

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North Americ Global Dental Syringes Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. South America Global Dental Syringes Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Brazil

- 12.1.2 Mexico

- 12.1.3 Rest of South America

- 13. Europe Global Dental Syringes Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Italy

- 13.1.5 Spain

- 13.1.6 Rest of Europe

- 14. Asia Pacific Global Dental Syringes Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Taiwan

- 14.1.6 Australia

- 14.1.7 Rest of Asia-Pacific

- 15. MEA Global Dental Syringes Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Middle East

- 15.1.2 Africa

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Asa Dental SpA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Integra LifeSciences Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Faro SpA

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Power Dental USA Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 A Titan Instrument Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Septodont

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Ultradent Products

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Dentsply Sirona

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Carl Martin GmbH

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Anthogyr SAS

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 3M Company

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Vista Dental Products

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Delmarks Surgico

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Diadent Group International

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Accesia

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 Asa Dental SpA

List of Figures

- Figure 1: Global Global Dental Syringes Market Revenue Breakdown (billion, %) by Region 2024 & 2032

- Figure 2: North Americ Global Dental Syringes Market Revenue (billion), by Country 2024 & 2032

- Figure 3: North Americ Global Dental Syringes Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: South America Global Dental Syringes Market Revenue (billion), by Country 2024 & 2032

- Figure 5: South America Global Dental Syringes Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Global Dental Syringes Market Revenue (billion), by Country 2024 & 2032

- Figure 7: Europe Global Dental Syringes Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Asia Pacific Global Dental Syringes Market Revenue (billion), by Country 2024 & 2032

- Figure 9: Asia Pacific Global Dental Syringes Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Global Dental Syringes Market Revenue (billion), by Country 2024 & 2032

- Figure 11: MEA Global Dental Syringes Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Global Dental Syringes Market Revenue (billion), by Product 2024 & 2032

- Figure 13: North America Global Dental Syringes Market Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Global Dental Syringes Market Revenue (billion), by Type 2024 & 2032

- Figure 15: North America Global Dental Syringes Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Global Dental Syringes Market Revenue (billion), by Material 2024 & 2032

- Figure 17: North America Global Dental Syringes Market Revenue Share (%), by Material 2024 & 2032

- Figure 18: North America Global Dental Syringes Market Revenue (billion), by Country 2024 & 2032

- Figure 19: North America Global Dental Syringes Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Global Dental Syringes Market Revenue (billion), by Product 2024 & 2032

- Figure 21: Europe Global Dental Syringes Market Revenue Share (%), by Product 2024 & 2032

- Figure 22: Europe Global Dental Syringes Market Revenue (billion), by Type 2024 & 2032

- Figure 23: Europe Global Dental Syringes Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Global Dental Syringes Market Revenue (billion), by Material 2024 & 2032

- Figure 25: Europe Global Dental Syringes Market Revenue Share (%), by Material 2024 & 2032

- Figure 26: Europe Global Dental Syringes Market Revenue (billion), by Country 2024 & 2032

- Figure 27: Europe Global Dental Syringes Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Global Dental Syringes Market Revenue (billion), by Product 2024 & 2032

- Figure 29: Asia Pacific Global Dental Syringes Market Revenue Share (%), by Product 2024 & 2032

- Figure 30: Asia Pacific Global Dental Syringes Market Revenue (billion), by Type 2024 & 2032

- Figure 31: Asia Pacific Global Dental Syringes Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Global Dental Syringes Market Revenue (billion), by Material 2024 & 2032

- Figure 33: Asia Pacific Global Dental Syringes Market Revenue Share (%), by Material 2024 & 2032

- Figure 34: Asia Pacific Global Dental Syringes Market Revenue (billion), by Country 2024 & 2032

- Figure 35: Asia Pacific Global Dental Syringes Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Global Dental Syringes Market Revenue (billion), by Product 2024 & 2032

- Figure 37: Middle East and Africa Global Dental Syringes Market Revenue Share (%), by Product 2024 & 2032

- Figure 38: Middle East and Africa Global Dental Syringes Market Revenue (billion), by Type 2024 & 2032

- Figure 39: Middle East and Africa Global Dental Syringes Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Middle East and Africa Global Dental Syringes Market Revenue (billion), by Material 2024 & 2032

- Figure 41: Middle East and Africa Global Dental Syringes Market Revenue Share (%), by Material 2024 & 2032

- Figure 42: Middle East and Africa Global Dental Syringes Market Revenue (billion), by Country 2024 & 2032

- Figure 43: Middle East and Africa Global Dental Syringes Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Global Dental Syringes Market Revenue (billion), by Product 2024 & 2032

- Figure 45: South America Global Dental Syringes Market Revenue Share (%), by Product 2024 & 2032

- Figure 46: South America Global Dental Syringes Market Revenue (billion), by Type 2024 & 2032

- Figure 47: South America Global Dental Syringes Market Revenue Share (%), by Type 2024 & 2032

- Figure 48: South America Global Dental Syringes Market Revenue (billion), by Material 2024 & 2032

- Figure 49: South America Global Dental Syringes Market Revenue Share (%), by Material 2024 & 2032

- Figure 50: South America Global Dental Syringes Market Revenue (billion), by Country 2024 & 2032

- Figure 51: South America Global Dental Syringes Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dental Syringes Market Revenue billion Forecast, by Region 2019 & 2032

- Table 2: Global Dental Syringes Market Revenue billion Forecast, by Product 2019 & 2032

- Table 3: Global Dental Syringes Market Revenue billion Forecast, by Type 2019 & 2032

- Table 4: Global Dental Syringes Market Revenue billion Forecast, by Material 2019 & 2032

- Table 5: Global Dental Syringes Market Revenue billion Forecast, by Region 2019 & 2032

- Table 6: Global Dental Syringes Market Revenue billion Forecast, by Country 2019 & 2032

- Table 7: United States Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 8: Canada Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 9: Mexico Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 10: Global Dental Syringes Market Revenue billion Forecast, by Country 2019 & 2032

- Table 11: Brazil Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 12: Mexico Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 14: Global Dental Syringes Market Revenue billion Forecast, by Country 2019 & 2032

- Table 15: Germany Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 17: France Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 18: Italy Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 19: Spain Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 21: Global Dental Syringes Market Revenue billion Forecast, by Country 2019 & 2032

- Table 22: China Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 23: Japan Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 24: India Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 25: South Korea Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 26: Taiwan Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 27: Australia Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 28: Rest of Asia-Pacific Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 29: Global Dental Syringes Market Revenue billion Forecast, by Country 2019 & 2032

- Table 30: Middle East Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 31: Africa Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 32: Global Dental Syringes Market Revenue billion Forecast, by Product 2019 & 2032

- Table 33: Global Dental Syringes Market Revenue billion Forecast, by Type 2019 & 2032

- Table 34: Global Dental Syringes Market Revenue billion Forecast, by Material 2019 & 2032

- Table 35: Global Dental Syringes Market Revenue billion Forecast, by Country 2019 & 2032

- Table 36: United States Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 37: Canada Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 38: Mexico Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 39: Global Dental Syringes Market Revenue billion Forecast, by Product 2019 & 2032

- Table 40: Global Dental Syringes Market Revenue billion Forecast, by Type 2019 & 2032

- Table 41: Global Dental Syringes Market Revenue billion Forecast, by Material 2019 & 2032

- Table 42: Global Dental Syringes Market Revenue billion Forecast, by Country 2019 & 2032

- Table 43: Germany Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 45: France Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 46: Italy Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 47: Spain Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 49: Global Dental Syringes Market Revenue billion Forecast, by Product 2019 & 2032

- Table 50: Global Dental Syringes Market Revenue billion Forecast, by Type 2019 & 2032

- Table 51: Global Dental Syringes Market Revenue billion Forecast, by Material 2019 & 2032

- Table 52: Global Dental Syringes Market Revenue billion Forecast, by Country 2019 & 2032

- Table 53: China Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 54: Japan Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 55: India Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 56: Australia Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 57: South Korea Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 59: Global Dental Syringes Market Revenue billion Forecast, by Product 2019 & 2032

- Table 60: Global Dental Syringes Market Revenue billion Forecast, by Type 2019 & 2032

- Table 61: Global Dental Syringes Market Revenue billion Forecast, by Material 2019 & 2032

- Table 62: Global Dental Syringes Market Revenue billion Forecast, by Country 2019 & 2032

- Table 63: GCC Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 64: South Africa Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 66: Global Dental Syringes Market Revenue billion Forecast, by Product 2019 & 2032

- Table 67: Global Dental Syringes Market Revenue billion Forecast, by Type 2019 & 2032

- Table 68: Global Dental Syringes Market Revenue billion Forecast, by Material 2019 & 2032

- Table 69: Global Dental Syringes Market Revenue billion Forecast, by Country 2019 & 2032

- Table 70: Brazil Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 71: Argentina Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Global Dental Syringes Market Revenue (billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Dental Syringes Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Global Dental Syringes Market?

Key companies in the market include Asa Dental SpA, Integra LifeSciences Corporation, Faro SpA, Power Dental USA Inc, A Titan Instrument Inc, Septodont, Ultradent Products, Dentsply Sirona, Carl Martin GmbH, Anthogyr SAS, 3M Company, Vista Dental Products, Delmarks Surgico, Diadent Group International, Accesia.

3. What are the main segments of the Global Dental Syringes Market?

The market segments include Product, Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD XX billion as of 2022.

5. What are some drivers contributing to market growth?

Innovations in syringe technology. such as the development of self-aspirating syringes. disposable syringes. and safety-engineered syringes. are enhancing the efficiency and safety of dental procedures.

6. What are the notable trends driving market growth?

The dental industry is becoming more focused on sustainability. prompting manufacturers to develop eco-friendly syringes and packaging.

7. Are there any restraints impacting market growth?

The development of alternative methods for pain management. such as computer-controlled local anesthesia delivery systems. may pose challenges for traditional dental syringes.

8. Can you provide examples of recent developments in the market?

In March 2022, IMI (International Medical Industries, Inc.) bolsters expertise in secure drug delivery products with the release of the new Prep-Lock Tamper Evident Cap for ENFit and Oral Syringes with incorporated Radio Frequency Identification (RFID) technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Dental Syringes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Dental Syringes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Dental Syringes Market?

To stay informed about further developments, trends, and reports in the Global Dental Syringes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence