Key Insights

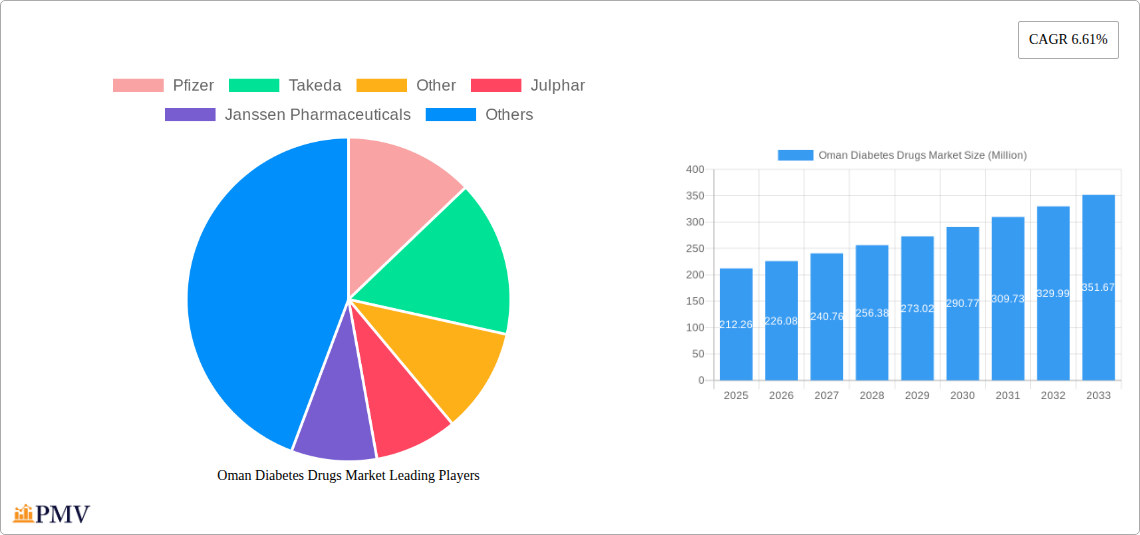

The Oman Diabetes Drugs Market is poised for substantial growth, projected to reach a market size of USD 212.26 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.61% anticipated throughout the forecast period. This expansion is primarily driven by the increasing prevalence of diabetes, both Type 1 and Type 2, in Oman, attributed to lifestyle changes, including sedentary habits and dietary shifts. The growing awareness among the population and healthcare professionals regarding diabetes management further bolsters market demand. Key product segments contributing to this growth include Insulins, Oral Anti-diabetic Drugs, and GLP-1 Receptor Agonists, as these offer diverse therapeutic options to manage blood glucose levels effectively. The self-administered route of administration is expected to dominate, reflecting patient preference for convenience and home-based care.

Oman Diabetes Drugs Market Market Size (In Million)

The market's upward trajectory is further supported by the expanding healthcare infrastructure in Oman, with hospitals, clinics, and pharmacies playing crucial roles in drug distribution and patient care. The rise of home healthcare services is also creating new avenues for market penetration, enabling patients to manage their condition effectively in familiar surroundings. While the market is experiencing strong demand, potential restraints such as the cost of newer, advanced therapies and the availability of affordable generic alternatives need to be carefully navigated by market players. Nonetheless, the overall outlook for the Oman Diabetes Drugs Market remains highly positive, driven by a confluence of rising diabetes incidence, technological advancements in drug development, and enhanced healthcare accessibility.

Oman Diabetes Drugs Market Company Market Share

This in-depth report provides a meticulous analysis of the Oman Diabetes Drugs Market, covering the historical period from 2019 to 2024, the base year of 2025, and a detailed forecast extending to 2033. Designed for industry stakeholders, pharmaceutical manufacturers, healthcare providers, and investors, this report offers actionable insights into market dynamics, competitive landscapes, and emerging opportunities within Oman's rapidly evolving diabetes treatment sector. Leverage critical data and expert analysis to navigate the complexities of this vital market, from insulins and oral anti-diabetic drugs to innovative GLP-1 receptor agonists and non-insulin injectable drugs.

Oman Diabetes Drugs Market Market Structure & Competitive Dynamics

The Oman diabetes drugs market exhibits a moderately concentrated structure, with Novo Nordisk A/S and Sanofi Aventis holding significant market shares due to their established portfolios of insulins and other anti-diabetic medications. Innovation ecosystems are driven by ongoing research and development in novel drug classes like GLP-1 receptor agonists and SGLT-2 inhibitors. Regulatory frameworks, overseen by the Ministry of Health, ensure the safety and efficacy of approved diabetes treatments. Product substitutes are emerging, particularly biosimilar insulins, which are beginning to influence pricing strategies. End-user trends are shifting towards a greater demand for convenient, self-administered therapies and treatments that offer improved glycemic control and reduced cardiovascular risks. Merger and acquisition (M&A) activities, while less prevalent in recent years, remain a strategic avenue for market expansion, with potential deal values in the tens of millions of US dollars. Key players are continuously assessing opportunities for strategic alliances and product pipeline acquisitions to bolster their market presence. The market penetration of advanced diabetes therapies is projected to increase, driven by growing awareness and the availability of innovative treatment options.

Oman Diabetes Drugs Market Industry Trends & Insights

The Oman diabetes drugs market is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025–2033). This expansion is primarily fueled by a rising prevalence of diabetes, driven by sedentary lifestyles, dietary changes, and an aging population. Technological disruptions are playing a crucial role, with the development of more effective and patient-friendly drug formulations, including long-acting insulins and oral medications with fewer side effects. Consumer preferences are increasingly leaning towards personalized treatment approaches, demanding drugs that not only manage blood glucose levels but also address co-morbidities such as cardiovascular disease and obesity. Pharmaceutical companies are responding by investing heavily in research and development for next-generation therapies, including combination drugs and incretin-based treatments. Competitive dynamics are intensifying, with both global pharmaceutical giants and local manufacturers vying for market share. The increasing awareness of diabetes complications and the growing emphasis on preventative healthcare are further accelerating market penetration. The Omani government's initiatives to improve healthcare infrastructure and accessibility also contribute to the positive market outlook. Market penetration for advanced diabetes treatments, such as GLP-1 receptor agonists, is expected to rise significantly as awareness and affordability improve. The market size is estimated to be around USD 150 Million in 2025, with significant growth anticipated in the coming years.

Dominant Markets & Segments in Oman Diabetes Drugs Market

Product Type: Insulins currently dominate the Oman diabetes drugs market, driven by their long-standing efficacy and widespread prescription for both Type 1 and Type 2 diabetes. The projected market size for insulins is estimated to be around USD 70 Million in 2025. The growing number of diabetes patients necessitates a continuous supply of insulin, making it a foundational segment. However, Oral Anti-diabetic Drugs are experiencing rapid growth, projected to capture a market share of approximately 25% by 2033, valued at around USD 40 Million in 2025. This growth is attributed to their convenience and the introduction of novel drug classes like SGLT-2 inhibitors and DPP-4 inhibitors, which offer additional cardiovascular and renal benefits. GLP-1 Receptor Agonists are emerging as a high-growth segment, with an anticipated market size of USD 25 Million in 2025, driven by their effectiveness in weight management and glycemic control, appealing to a growing obese diabetic population. Non-Insulin Injectable Drugs, while currently a smaller segment (estimated USD 15 Million in 2025), are poised for significant expansion due to advancements in drug delivery and the development of novel therapeutic agents.

- Key Drivers for Insulins Dominance:

- High prevalence of Type 1 and Type 2 diabetes requiring insulin therapy.

- Established clinical evidence and physician trust in insulin efficacy.

- Availability of both rapid-acting and long-acting insulin formulations.

- Key Drivers for Oral Anti-diabetic Drugs Growth:

- Patient preference for oral administration over injections.

- Introduction of novel classes with improved efficacy and safety profiles.

- Focus on managing co-morbidities alongside glycemic control.

- Key Drivers for GLP-1 Receptor Agonists Growth:

- Significant weight loss benefits, addressing the obesity epidemic in diabetes.

- Cardiovascular protective effects, a critical unmet need.

- Advancements in injectable formulations offering less frequent dosing.

Route of Administration: Self-administered drugs are the dominant route, representing approximately 75% of the market, valued at around USD 112.5 Million in 2025. This is largely due to the widespread use of oral anti-diabetic medications and pre-filled insulin pens, offering convenience and empowering patients in their daily management. Healthcare-administered drugs, primarily intravenous insulins in hospital settings and certain injectable therapies, constitute the remaining 25%, estimated at USD 37.5 Million in 2025.

Application: Type 2 Diabetes is the largest application segment, accounting for over 85% of the market share due to its significantly higher prevalence compared to Type 1 Diabetes. The market size for Type 2 Diabetes treatments is estimated at USD 127.5 Million in 2025. Type 1 Diabetes remains a critical segment, driving the demand for insulin and related therapies, with an estimated market size of USD 15 Million in 2025. Gestational Diabetes treatments are a niche but growing segment, with an estimated market size of USD 7.5 Million in 2025, reflecting increased awareness and management of diabetes during pregnancy.

End-User: Pharmacies are the primary end-user segment, accounting for over 50% of the market, estimated at USD 75 Million in 2025, serving as the main channel for dispensing both prescription and over-the-counter diabetes medications. Hospitals represent a significant segment, valued at approximately USD 40 Million in 2025, particularly for inpatient care, management of acute complications, and administration of complex injectable therapies. Clinics and home healthcare services are also growing segments, with combined market shares around USD 35 Million in 2025, reflecting the trend towards outpatient management and personalized care delivery.

Oman Diabetes Drugs Market Product Innovations

Product innovation in the Oman diabetes drugs market is centered on enhancing efficacy, improving patient convenience, and addressing unmet needs. Key developments include the introduction of ultra-long-acting insulins offering once-weekly dosing, significantly improving patient adherence. Furthermore, research is yielding novel oral anti-diabetic drugs with dual mechanisms of action, providing synergistic glycemic control and mitigating side effects. The emergence of combination therapies, such as fixed-dose oral medications and insulin-GLP-1 receptor agonist combinations, offers simplified treatment regimens. These innovations are driven by a competitive landscape that demands superior therapeutic profiles and patient-centric solutions. The market fit for these innovations is strong, given the rising prevalence of diabetes and the increasing patient demand for effective, convenient, and safe treatment options that can also manage associated complications like obesity and cardiovascular disease.

Report Segmentation & Scope

This report meticulously segments the Oman Diabetes Drugs Market, offering granular insights into its diverse components. The Product Type segmentation includes Insulins, Oral Anti-diabetic Drugs, GLP-1 Receptor Agonists, and Non-Insulin Injectable Drugs, providing detailed market sizes and growth projections for each category. The Route of Administration segment differentiates between Self-administered and Healthcare-administered drugs, highlighting user preferences and accessibility. The Application segment focuses on Type 1 Diabetes, Type 2 Diabetes, and Gestational Diabetes, reflecting the disease burden and treatment focus. Finally, the End-User segmentation examines Hospitals, Clinics, Pharmacies, and Home Healthcare, detailing the distribution channels and points of care. Each segment is analyzed for its current market share, projected growth trajectory, and competitive dynamics, offering a comprehensive view of the market's structure and potential.

Key Drivers of Oman Diabetes Drugs Market Growth

The Oman diabetes drugs market growth is propelled by several key factors. Firstly, a rising prevalence of diabetes, exacerbated by lifestyle changes, constitutes a primary driver. Secondly, increasing healthcare expenditure and government initiatives aimed at improving diabetes management and patient care are significant accelerators. Thirdly, advancements in pharmaceutical research and development leading to the introduction of innovative and more effective diabetes therapies, including GLP-1 receptor agonists and novel oral anti-diabetic drugs, are fueling market expansion. Fourthly, growing patient awareness and demand for better glycemic control and disease management are pushing the adoption of advanced treatments. Finally, the availability of biosimilar insulins is contributing to market accessibility and affordability, thereby driving volume growth.

Challenges in the Oman Diabetes Drugs Market Sector

Despite robust growth, the Oman diabetes drugs market faces several challenges. High drug costs, particularly for newer biologics and innovative therapies, can limit accessibility for a segment of the population and strain healthcare budgets. Regulatory hurdles and lengthy approval processes for new drugs can slow down market entry and the adoption of cutting-edge treatments. Supply chain disruptions, as seen globally, can impact the consistent availability of essential diabetes medications. Intense competition among global and local players, coupled with the emergence of biosimil alternatives, puts pressure on pricing and profit margins. Furthermore, limited patient adherence to complex treatment regimens and a lack of widespread awareness regarding certain advanced therapies can hinder market penetration. Quantifiable impacts include potential delays in treatment initiation and a slower adoption rate for novel therapeutics.

Leading Players in the Oman Diabetes Drugs Market Market

- Novo Nordisk A/S

- Sanofi Aventis

- Pfizer

- Merck and Co

- Eli Lilly

- AstraZeneca

- Boehringer Ingelheim

- Takeda

- Janssen Pharmaceuticals

- Bristol Myers Squibb

- Novartis

- Julphar

- Astellas

Key Developments in Oman Diabetes Drugs Market Sector

- November 2023: Novo Nordisk's initiation of a Phase III comparative trial for their pipeline drug CagriSema against the recently approved Zepbound suggests the potential for direct competition between the two drugs upon Novo Nordisk's candidate entering the market, indicating a highly competitive future for weight-management focused diabetes therapies.

- October 2022: The Ministry of Industry and Advanced Technology announced the signing of a pair of memoranda of understanding worth AED 260 million (USD 70.8 million) between major pharmaceutical and medical device companies in the UAE. The partnerships align with the National Strategy for Industry and Advanced Technology and the ICV Program, aiming to attract investors and manufacturers to the UAE's pharmaceutical and medical equipment sectors. Under a separate MoU, PureHealth and Gulf Pharmaceutical Industries Company will establish the first factory in the Middle East to produce Glargine to treat diabetes, signifying regional investment in local manufacturing of essential diabetes drugs.

Strategic Oman Diabetes Drugs Market Market Outlook

The strategic outlook for the Oman diabetes drugs market remains highly promising, driven by persistent demand and ongoing innovation. The market is poised for sustained growth, with opportunities emerging from the increasing adoption of GLP-1 receptor agonists and novel oral anti-diabetic drugs that offer comprehensive benefits beyond glycemic control. Government support for local pharmaceutical manufacturing, as evidenced by recent MOUs, will likely enhance the availability and affordability of key medications. Furthermore, the focus on preventative healthcare and early diagnosis will expand the patient pool seeking effective treatment solutions. Pharmaceutical companies that invest in patient education, robust supply chains, and a diversified product portfolio encompassing both established and cutting-edge therapies will be well-positioned to capitalize on this dynamic market. The strategic imperative for market players lies in fostering patient adherence, collaborating with healthcare providers, and aligning with national health objectives to achieve long-term success.

Oman Diabetes Drugs Market Segmentation

-

1. Product Type

- 1.1. Insulins

- 1.2. Oral Anti-diabetic Drugs

- 1.3. GLP-1 Receptor Agonists

- 1.4. Non-Insulin Injectable Drugs

-

2. Route of Administration

- 2.1. Self-administered

- 2.2. Healthcare-administered

-

3. Application

- 3.1. Type 1 Diabetes

- 3.2. Type 2 Diabetes

- 3.3. Gestational Diabetes

-

4. End-User

- 4.1. Hospitals

- 4.2. Clinics

- 4.3. Pharmacies

- 4.4. Home Healthcare

Oman Diabetes Drugs Market Segmentation By Geography

- 1. Oman

Oman Diabetes Drugs Market Regional Market Share

Geographic Coverage of Oman Diabetes Drugs Market

Oman Diabetes Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. The oral anti-diabetic drugs segment holds the highest market share in the Oman Diabetes Drugs Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Diabetes Drugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Insulins

- 5.1.2. Oral Anti-diabetic Drugs

- 5.1.3. GLP-1 Receptor Agonists

- 5.1.4. Non-Insulin Injectable Drugs

- 5.2. Market Analysis, Insights and Forecast - by Route of Administration

- 5.2.1. Self-administered

- 5.2.2. Healthcare-administered

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Type 1 Diabetes

- 5.3.2. Type 2 Diabetes

- 5.3.3. Gestational Diabetes

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Hospitals

- 5.4.2. Clinics

- 5.4.3. Pharmacies

- 5.4.4. Home Healthcare

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pfizer

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Takeda

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Other

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Julphar

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Janssen Pharmaceuticals

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eli Lilly

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novartis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Merck and Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AstraZeneca

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sanofi Aventis

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bristol Myers Squibb

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Novo Nordisk A/S

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Boehringer Ingelheim

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sanofi Aventis

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Astellas

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Pfizer

List of Figures

- Figure 1: Oman Diabetes Drugs Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Oman Diabetes Drugs Market Share (%) by Company 2025

List of Tables

- Table 1: Oman Diabetes Drugs Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Oman Diabetes Drugs Market Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 3: Oman Diabetes Drugs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Oman Diabetes Drugs Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 5: Oman Diabetes Drugs Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Oman Diabetes Drugs Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Oman Diabetes Drugs Market Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 8: Oman Diabetes Drugs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Oman Diabetes Drugs Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Oman Diabetes Drugs Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Diabetes Drugs Market?

The projected CAGR is approximately 6.61%.

2. Which companies are prominent players in the Oman Diabetes Drugs Market?

Key companies in the market include Pfizer, Takeda, Other, Julphar, Janssen Pharmaceuticals, Eli Lilly, Novartis, Merck and Co, AstraZeneca, Sanofi Aventis, Bristol Myers Squibb, Novo Nordisk A/S, Boehringer Ingelheim, Sanofi Aventis, Astellas.

3. What are the main segments of the Oman Diabetes Drugs Market?

The market segments include Product Type, Route of Administration, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 212.26 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

The oral anti-diabetic drugs segment holds the highest market share in the Oman Diabetes Drugs Market in the current year.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

November 2023: Novo Nordisk's initiation of a Phase III comparative trial for their pipeline drug CagriSema against the recently approved Zepbound suggests the potential for direct competition between the two drugs upon Novo Nordisk's candidate entering the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Diabetes Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Diabetes Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Diabetes Drugs Market?

To stay informed about further developments, trends, and reports in the Oman Diabetes Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence