Key Insights

The France Mobile POS Terminal Market is projected for substantial growth, with an anticipated market size of 3.63 million by 2025, driven by a strong Compound Annual Growth Rate (CAGR) of 13.80%. This expansion is largely attributed to the widespread adoption of mobile payment solutions across retail, hospitality, and healthcare sectors. French businesses are increasingly prioritizing flexible, cost-effective POS systems that enhance transaction efficiency, customer experience, and operational mobility. The ongoing shift to digital payments, combined with the rising demand for integrated business management tools, is fostering significant market development. Continuous advancements in hardware and software, offering more intuitive and feature-rich devices, further accelerate market penetration. Government digitalization initiatives and the proliferation of Small and Medium-sized Enterprises (SMEs) also contribute to this positive market trajectory.

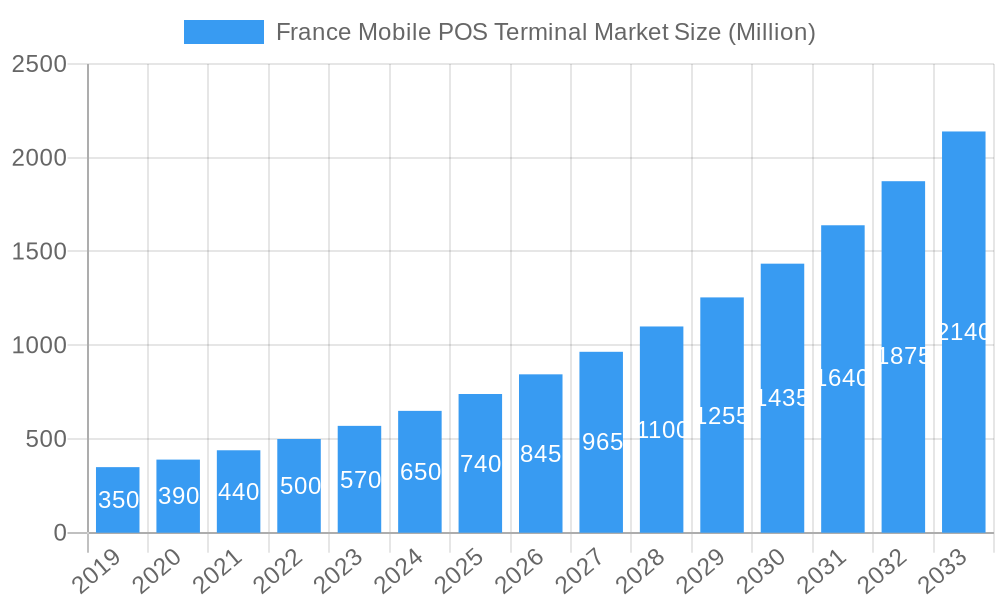

France Mobile POS Terminal Market Market Size (In Million)

Key market trends fueling this growth include the surge in contactless payments, the integration of customer loyalty programs, and the increasing preference for cloud-based POS solutions. Mobile POS terminals are proving invaluable for businesses seeking to accept payments flexibly, thereby broadening their customer reach and operational efficiency. While the market exhibits robust growth, potential challenges such as initial setup costs for advanced systems and the requirement for reliable internet connectivity in certain regions may present minor obstacles. However, the inherent benefits of mobility, scalability, and advanced data analytics provided by mobile POS solutions are expected to supersede these limitations, ensuring sustained market expansion. The competitive environment is marked by a mix of established market leaders and innovative new entrants, all actively pursuing market share through product differentiation and strategic alliances.

France Mobile POS Terminal Market Company Market Share

Gain comprehensive insights into the dynamic French Mobile Point-of-Sale (POS) Terminal Market. This report delivers in-depth analysis and expert forecasts for the period 2019-2033, with 2025 as the base year. Explore key market drivers, emerging trends, competitive strategies, and growth opportunities related to mobile POS solutions, contactless payments, and digital payment acceptance in France.

Study Period: 2019–2033 Base Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

France Mobile POS Terminal Market Market Structure & Competitive Dynamics

The France Mobile POS Terminal Market exhibits a moderate to high market concentration, driven by a mix of established global players and agile domestic innovators. The innovation ecosystem is robust, fueled by advancements in payment processing technology, mobile payment solutions, and the increasing demand for omnichannel retail experiences. Regulatory frameworks, primarily governed by the Banque de France and European Union directives, play a crucial role in shaping market entry and operational standards, particularly concerning data security and PCI DSS compliance. Product substitutes, while present in the form of traditional payment terminals, are increasingly challenged by the flexibility and cost-effectiveness of mobile POS devices. End-user trends are rapidly shifting towards seamless customer journeys, contactless payment adoption, and the need for integrated inventory and sales management. Merger and acquisition (M&A) activities are a key indicator of market consolidation and strategic expansion. For instance, major M&A deals within the broader payment processing sector, such as Worldline's acquisition activities, significantly influence the competitive landscape of mobile POS. Expected M&A deal values in this segment are in the hundreds of millions of Euros, indicating significant investment and strategic positioning by leading companies.

- Market Concentration: Moderate to High, with key players holding significant market share.

- Innovation Ecosystem: Driven by advancements in EMV chip technology, NFC capabilities, and cloud-based POS software.

- Regulatory Frameworks: Adherence to PSD2, GDPR, and other financial regulations is paramount.

- Product Substitutes: Traditional fixed POS systems, cash, and basic mobile payment apps.

- End-User Trends: Growing demand for convenience, speed, and integrated payment solutions.

- M&A Activities: Strategic acquisitions to expand product portfolios and market reach.

France Mobile POS Terminal Market Industry Trends & Insights

The France Mobile POS Terminal Market is poised for substantial growth, propelled by a confluence of accelerating factors. The CAGR for the forecast period is projected to be in the range of 12% to 15%, indicating a robust expansion trajectory. This growth is primarily fueled by the increasing penetration of smartphones and tablets among businesses of all sizes, enabling them to adopt mobile payment solutions and enhance customer service. Technological disruptions, particularly the widespread adoption of NFC (Near Field Communication) and EMV chip technology, have significantly improved the security and speed of transactions, fostering greater consumer confidence. Furthermore, the evolving consumer preferences for contactless payments and personalized shopping experiences are compelling businesses to invest in flexible and portable POS systems. The competitive dynamics are intensifying, with companies differentiating themselves through innovative software features, integrated loyalty programs, and competitive pricing models. The rise of SaaS-based POS platforms offers scalable solutions for small and medium-sized enterprises (SMEs), democratizing access to advanced payment technologies. The market penetration of mobile POS terminals is expected to reach over 70% by 2028, underscoring its dominance over traditional systems in various sectors. The increasing demand for bilingual POS interfaces and localized payment options further shapes the market.

- Growth Drivers: Increased smartphone penetration, growing e-commerce integration, demand for contactless payments, and government initiatives promoting digital transactions.

- Technological Disruptions: Advancements in NFC, EMV, QR code payments, and cloud-based POS software.

- Consumer Preferences: Demand for speed, convenience, security, and personalized shopping experiences.

- Competitive Dynamics: Intense competition focused on feature-rich software, ecosystem integration, and customer support.

- Market Penetration: Expected to exceed 70% for mobile POS terminals by 2028.

- CAGR: Projected between 12% and 15% during the forecast period.

Dominant Markets & Segments in France Mobile POS Terminal Market

Within the France Mobile POS Terminal Market, the Mobile/Portable Point-of-Sale Systems segment is demonstrably dominant, driven by unparalleled flexibility and cost-effectiveness. This segment is projected to account for approximately 65% of the total market revenue by 2025. The Retail end-user industry stands out as the leading sector, contributing an estimated 40% to the overall market size, owing to the sector's high transaction volumes and continuous need for efficient checkout processes. The Hospitality sector also represents a significant and growing segment, expected to capture around 25% of the market share, driven by the demand for table-side payments and streamlined order management.

Dominant Segment (By Type): Mobile/Portable Point-of-Sale Systems

- Key Drivers:

- Enhanced mobility for sales staff, enabling transactions anywhere on the premises.

- Lower upfront investment compared to traditional fixed POS systems, making it accessible for SMEs.

- Support for contactless payments, QR codes, and diverse payment methods.

- Integration capabilities with inventory management and CRM software.

- Detailed Dominance Analysis: Mobile POS systems offer unparalleled operational flexibility, allowing businesses to serve customers in queues, at outdoor events, or on the go. This adaptability is crucial for sectors like retail, where pop-up shops and mobile sales are common, and hospitality, where servers can process payments directly at tables. The growing trend of buy online, pick up in-store (BOPIS) further amplifies the need for mobile checkout solutions.

- Key Drivers:

Dominant End-User Industry: Retail

- Key Drivers:

- High frequency of transactions across diverse retail sub-segments (fashion, electronics, groceries).

- Increasing adoption of omnichannel strategies requiring seamless payment experiences.

- Demand for faster checkout to reduce customer wait times and improve satisfaction.

- Integration with loyalty programs and personalized marketing efforts.

- Detailed Dominance Analysis: The retail sector's inherent volume of transactions makes it a prime adopter of mobile POS technology. From small boutiques to large department stores, the ability to process payments efficiently and securely, often integrated with customer relationship management tools, is a key differentiator. The ongoing digital transformation within retail continues to propel the adoption of these advanced payment solutions.

- Key Drivers:

Significant Growing Segment: Hospitality

- Key Drivers:

- Demand for efficient table-side payment processing to enhance guest experience.

- Streamlined order taking and payment reconciliation for restaurants and bars.

- Integration with kitchen display systems (KDS) for improved operational flow.

- Support for splitting bills and various payment methods.

- Detailed Dominance Analysis: The hospitality industry leverages mobile POS for its ability to improve service speed and accuracy. Servers can take orders and process payments directly, reducing errors and freeing up staff for other guest interactions. The trend towards mobile ordering and payment within restaurants further solidifies the importance of mobile POS solutions in this sector.

- Key Drivers:

Other Segments: Healthcare and 'Others' (e.g., transportation, field services) are also contributing to market growth, albeit at a more nascent stage. Healthcare adoption is driven by patient payment collection at the point of care, while 'Others' leverage mobile POS for on-the-go service provision and delivery.

France Mobile POS Terminal Market Product Innovations

Product innovation in the France Mobile POS Terminal Market is primarily focused on enhancing user experience, expanding payment acceptance capabilities, and integrating advanced functionalities. Key developments include the integration of AI-powered analytics for sales forecasting and customer insights, the introduction of durable and ruggedized devices for demanding environments, and the development of compact, all-in-one solutions that combine payment processing with inventory management and customer loyalty features. The emphasis on secure payment solutions with robust encryption and tokenization remains a cornerstone of innovation. Furthermore, the increasing demand for biometric authentication and the seamless integration of diverse payment methods, including digital wallets and Buy Now, Pay Later (BNPL) options, are shaping new product offerings. These innovations aim to provide businesses with versatile, efficient, and secure tools to manage transactions and customer interactions effectively, driving competitive advantage and market adoption.

Report Segmentation & Scope

This report offers a granular analysis of the France Mobile POS Terminal Market, meticulously segmented to provide comprehensive market intelligence. The segmentation covers:

By Type:

- Fixed Point-of-sale Systems: This segment examines traditional POS hardware and software solutions designed for stationary use, often in traditional retail or banking environments. Its market size is estimated at xx Million Euros in 2025, with a projected CAGR of xx% during the forecast period. Competitive dynamics are characterized by established providers and a focus on integration with existing infrastructure.

- Mobile/Portable Point-of-sale Systems: This segment delves into the rapidly growing market for portable POS devices, including smartphones, tablets, and dedicated mobile terminals. It is estimated to reach xx Million Euros in 2025, with a strong CAGR of xx%. Growth drivers include increasing adoption by SMEs and the demand for on-the-go payment solutions.

End-User Industry:

- Retail: This segment analyzes the adoption and impact of mobile POS solutions across various retail sub-sectors, including apparel, electronics, grocery, and specialty stores. The retail market is projected to be worth xx Million Euros in 2025, with a CAGR of xx%.

- Hospitality: This segment focuses on the application of mobile POS in restaurants, cafes, hotels, and bars, addressing needs like table-side ordering and payment. The hospitality segment is estimated at xx Million Euros in 2025, with a projected CAGR of xx%.

- Healthcare: This segment explores the use of mobile POS in healthcare settings for patient billing and payment collection. This segment is valued at xx Million Euros in 2025 and is expected to grow at a CAGR of xx%.

- Others: This broad category includes diverse sectors such as transportation, field services, education, and government. The 'Others' segment is anticipated to reach xx Million Euros in 2025, with a CAGR of xx%.

Key Drivers of France Mobile POS Terminal Market Growth

The France Mobile POS Terminal Market is experiencing robust growth driven by several key factors:

- Technological Advancements: The widespread adoption of contactless payment technologies like NFC and EMV chip cards, along with the increasing prevalence of smartphones and tablets, directly fuels demand for mobile POS solutions.

- Evolving Consumer Behavior: Consumers increasingly prefer fast, convenient, and secure payment options, leading to a higher demand for mobile and contactless payment methods. This shift encourages businesses to invest in flexible POS systems.

- Small and Medium-sized Enterprise (SME) Adoption: Mobile POS offers a cost-effective and scalable solution for SMEs, enabling them to access advanced payment processing capabilities without significant upfront investment.

- Government Initiatives & Digitalization Push: Supportive government policies and a broader push towards digitalization across industries are encouraging businesses to adopt modern payment technologies, including mobile POS.

- Omnichannel Retail Strategies: The growing trend of integrating online and offline sales channels necessitates flexible payment solutions that can operate seamlessly across both environments, a key strength of mobile POS.

Challenges in the France Mobile POS Terminal Market Sector

Despite the promising growth trajectory, the France Mobile POS Terminal Market faces certain challenges:

- Security Concerns and Data Breach Risks: While mobile POS systems are secure, the increasing sophistication of cyber threats necessitates continuous investment in robust security measures and vigilance against data breaches, which can erode customer trust.

- Regulatory Compliance Complexity: Navigating the intricate web of financial regulations, including data privacy laws (GDPR) and payment processing standards (PCI DSS), can be a significant hurdle for both providers and users, especially for smaller businesses.

- Interoperability Issues: Ensuring seamless integration of mobile POS devices with existing business software, such as accounting, inventory management, and CRM systems, can sometimes be complex and require customized solutions.

- Dependence on Network Connectivity: The functionality of most mobile POS systems relies heavily on stable internet connectivity, which can be a challenge in certain remote or less developed areas, impacting transaction reliability.

- Competition and Price Sensitivity: The market is highly competitive, leading to potential price wars and pressure on profit margins for service providers. Businesses, particularly SMEs, are often price-sensitive when making technology investment decisions.

Leading Players in the France Mobile POS Terminal Market Market

- SumUp Limited

- dejamobile

- Zettle (PayPal)

- Innovorder SAS

- PayXpert LTD

- NEC Corporation

- myPOS World Ltd

- Smile&Pay

- AURES Group

- Ingenico Group (Worldline)

- PAX Technology

Key Developments in France Mobile POS Terminal Market Sector

- April 2022: Worldline has announced that it has been chosen by Monoprix to deploy its payment platform in all of its 700 stores in 250 cities in France, across its six banners: Monoprix, monop', monop'daily, monop'beauty, mono station, and Naturalia. This strategic partnership highlights the growing trend of large retailers adopting unified payment platforms.

- March 2022: PayXpert launched "PayXpress" and partnered with NetPay to sell android POS devices to merchants in France, Spain, and Taiwan. The PayXpress POS solution is ideal for travel, hospitality, and retail merchants, including hotels, restaurants, transport/taxi services, and luxury fashion brands. The solution enables merchants to accept Visa, MasterCard, American Express, Alipay, and WeChat on one single POS device, demonstrating a move towards comprehensive payment acceptance.

Strategic France Mobile POS Terminal Market Market Outlook

The strategic outlook for the France Mobile POS Terminal Market is exceptionally positive, driven by an accelerating demand for flexible, secure, and integrated payment solutions. Key growth accelerators include the continued proliferation of smartphones, the increasing consumer preference for contactless and mobile payments, and the ongoing digital transformation across all business sectors. Opportunities lie in the development of value-added services, such as integrated loyalty programs, advanced analytics, and tailored software solutions for specific industry verticals. The market is expected to witness further consolidation and innovation, with companies focusing on expanding their service offerings to become a one-stop-shop for business management tools. The growing adoption by SMEs and the increasing need for omnichannel capabilities will continue to fuel market expansion, making it a highly attractive landscape for investors and businesses alike. The forecast anticipates a sustained upward trend, with significant potential for market players to capture market share through strategic partnerships and a focus on customer-centric solutions.

France Mobile POS Terminal Market Segmentation

-

1. BY Type

- 1.1. Fixed Point-of-sale Systems

- 1.2. Mobile/Portable Point-of-sale Systems

-

2. End-User Industry

- 2.1. Retail

- 2.2. Hospitality

- 2.3. Healthcare

- 2.4. Others

France Mobile POS Terminal Market Segmentation By Geography

- 1. France

France Mobile POS Terminal Market Regional Market Share

Geographic Coverage of France Mobile POS Terminal Market

France Mobile POS Terminal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Payments from NFC-Compatible Smartphones and Smart Cards; Retail Sector Adopting the NFC POS Solutions Considerably; Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 3.3. Market Restrains

- 3.3.1. Data Security Concerns Due to the Usage of Critical Information; Lack of Digital Infrastructure in Rural Areas

- 3.4. Market Trends

- 3.4.1. Increased Payments from NFC-Compatible Smartphones and Smart Cards

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Mobile POS Terminal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 5.1.1. Fixed Point-of-sale Systems

- 5.1.2. Mobile/Portable Point-of-sale Systems

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Retail

- 5.2.2. Hospitality

- 5.2.3. Healthcare

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SumUp Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 dejamobile

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zettle (PayPal)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Innovorder SAS*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PayXpert LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NEC Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 myPOS World Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Smile&Pay

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AURES Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ingenico Group (Worldline)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PAX Technology

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 SumUp Limited

List of Figures

- Figure 1: France Mobile POS Terminal Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: France Mobile POS Terminal Market Share (%) by Company 2025

List of Tables

- Table 1: France Mobile POS Terminal Market Revenue million Forecast, by BY Type 2020 & 2033

- Table 2: France Mobile POS Terminal Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 3: France Mobile POS Terminal Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: France Mobile POS Terminal Market Revenue million Forecast, by BY Type 2020 & 2033

- Table 5: France Mobile POS Terminal Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 6: France Mobile POS Terminal Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Mobile POS Terminal Market?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the France Mobile POS Terminal Market?

Key companies in the market include SumUp Limited, dejamobile, Zettle (PayPal), Innovorder SAS*List Not Exhaustive, PayXpert LTD, NEC Corporation, myPOS World Ltd, Smile&Pay, AURES Group, Ingenico Group (Worldline), PAX Technology.

3. What are the main segments of the France Mobile POS Terminal Market?

The market segments include BY Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.63 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Payments from NFC-Compatible Smartphones and Smart Cards; Retail Sector Adopting the NFC POS Solutions Considerably; Significant Rise in the Demand for Contactless and Mobile POS Terminals.

6. What are the notable trends driving market growth?

Increased Payments from NFC-Compatible Smartphones and Smart Cards.

7. Are there any restraints impacting market growth?

Data Security Concerns Due to the Usage of Critical Information; Lack of Digital Infrastructure in Rural Areas.

8. Can you provide examples of recent developments in the market?

April 2022 - Worldline has announced that it has been chosen by Monoprix to deploy its payment platform in all of its 700 stores in 250 cities in France, across its six banners: Monoprix, monop', monop'daily, monop'beauty, mono station, and Naturalia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Mobile POS Terminal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Mobile POS Terminal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Mobile POS Terminal Market?

To stay informed about further developments, trends, and reports in the France Mobile POS Terminal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence