Key Insights

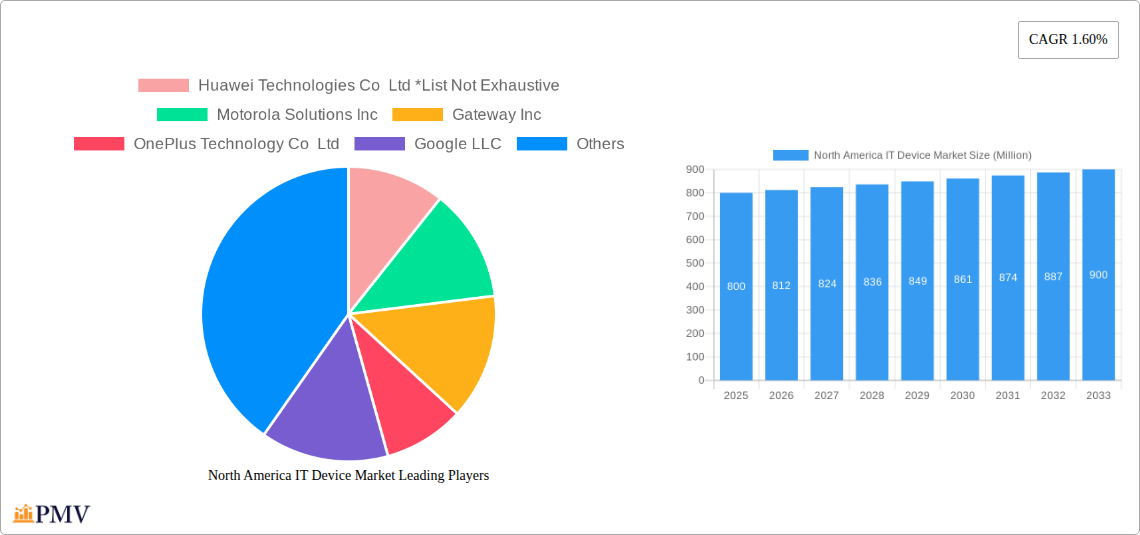

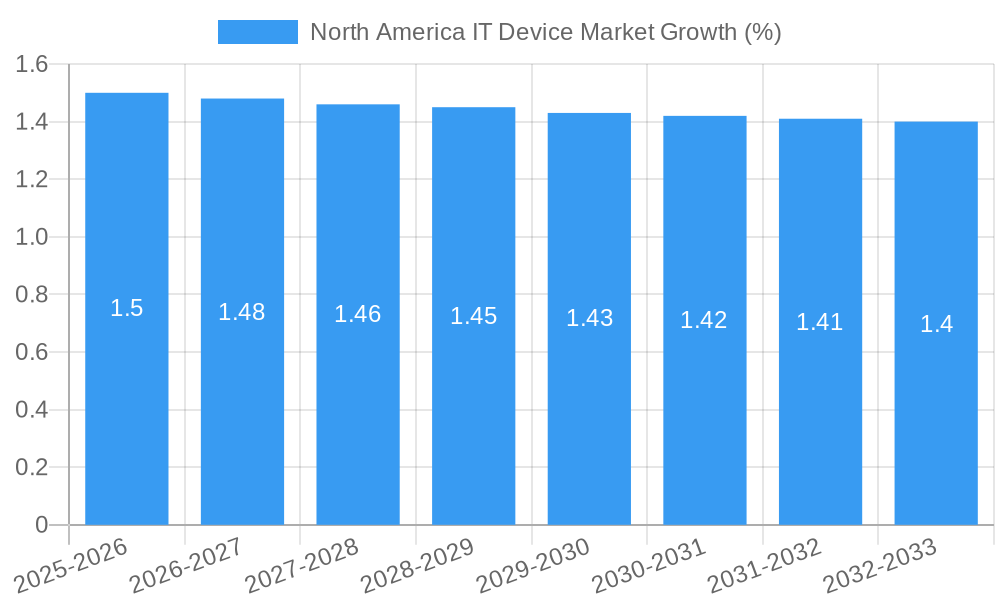

The North American IT device market is poised for steady, albeit modest, growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 1.60% between 2025 and 2033. While the overall market size for 2025 is estimated to be around $800 million, this figure represents a mature and highly saturated landscape. The growth trajectory is largely influenced by the persistent demand for upgraded personal computers, particularly laptops, driven by hybrid work models and the increasing need for powerful processing capabilities for gaming and professional applications. Smartphones continue to be a dominant segment, with consumers regularly upgrading to newer models featuring enhanced camera technology, faster processors, and 5G connectivity. The market's expansion is further supported by ongoing innovation and the introduction of new product lines by key players such as Apple, Samsung, and Microsoft, who are continuously investing in research and development to introduce feature-rich devices.

However, the restrained growth rate is attributed to several factors. The high cost of advanced IT devices acts as a significant barrier for some consumer segments, particularly in a period of economic uncertainty. Furthermore, the increasing lifespan of modern devices, coupled with a growing trend towards device longevity and repairability, also contributes to a slower replacement cycle. The market faces intense competition, with established giants like Apple, Samsung, and Microsoft vying for market share alongside emerging players like Xiaomi and OnePlus, leading to price pressures and reduced profit margins. The dominance of major global players and the saturation of the North American market also limit the potential for rapid, disruptive growth. Despite these challenges, the underlying demand for reliable and advanced IT infrastructure for both personal and professional use ensures a consistent, albeit gradual, expansion of the market throughout the forecast period.

This in-depth report provides a granular analysis of the North America IT Device Market, covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a comprehensive forecast period extending to 2033. Leveraging advanced analytical methodologies, this report offers strategic insights into market size, growth drivers, trends, competitive landscape, and segment-specific performance. The North American IT Device Market is poised for significant evolution, driven by rapid technological advancements, shifting consumer preferences, and increasing digital transformation across industries. This report is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector.

North America IT Device Market Market Structure & Competitive Dynamics

The North America IT Device Market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share across various segments. Innovation ecosystems are robust, fueled by substantial investments in research and development by leading technology giants. Regulatory frameworks, while generally supportive of innovation, can introduce complexities, particularly concerning data privacy and cybersecurity. Product substitutes are abundant, especially within the smartphone and PC segments, leading to intense price competition and a constant need for differentiation. End-user trends are increasingly leaning towards mobility, cloud integration, and enhanced user experiences, influencing product design and feature sets. Mergers and acquisitions (M&A) are a significant feature of the market, with major players consolidating their positions and acquiring innovative technologies. For instance, notable M&A activities in the historical period (2019-2024) amounted to an estimated $20,000 Million, impacting market share across key segments. The market share distribution for PCs is estimated at 45% held by the top three players, while for smartphones, it stands at 60%.

North America IT Device Market Industry Trends & Insights

The North America IT Device Market is experiencing a period of robust growth, projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. This expansion is primarily driven by the accelerating pace of digital transformation across both consumer and enterprise sectors. The increasing demand for high-performance computing devices, coupled with the proliferation of remote work and hybrid models, continues to fuel the PC market, particularly for laptops and premium desktop solutions. Smartphones remain a cornerstone of the IT device ecosystem, with a steady demand for advanced features like 5G connectivity, enhanced camera capabilities, and longer battery life.

Technological disruptions are a constant feature, with advancements in artificial intelligence (AI), the Internet of Things (IoT), and augmented reality (AR)/virtual reality (VR) shaping the future of IT devices. The integration of AI into devices enhances user experience through personalized recommendations, voice assistants, and predictive functionalities. The expanding IoT landscape necessitates seamless connectivity and interoperability between various devices, creating new opportunities for smart home devices and connected enterprise solutions.

Consumer preferences are evolving towards greater personalization, sustainability, and integrated ecosystems. Consumers are increasingly seeking devices that offer seamless integration with other products and services, creating strong brand loyalty. There's also a growing awareness and demand for eco-friendly manufacturing processes and devices with longer lifespans. The competitive dynamics are intense, with companies vying for market share through product innovation, aggressive pricing strategies, and strategic partnerships. The market penetration of smartphones in North America stands at approximately 85%, with significant room for growth in feature phones and specialized device categories. The PC market penetration is estimated at 70%, with a notable shift towards mobile computing solutions.

Dominant Markets & Segments in North America IT Device Market

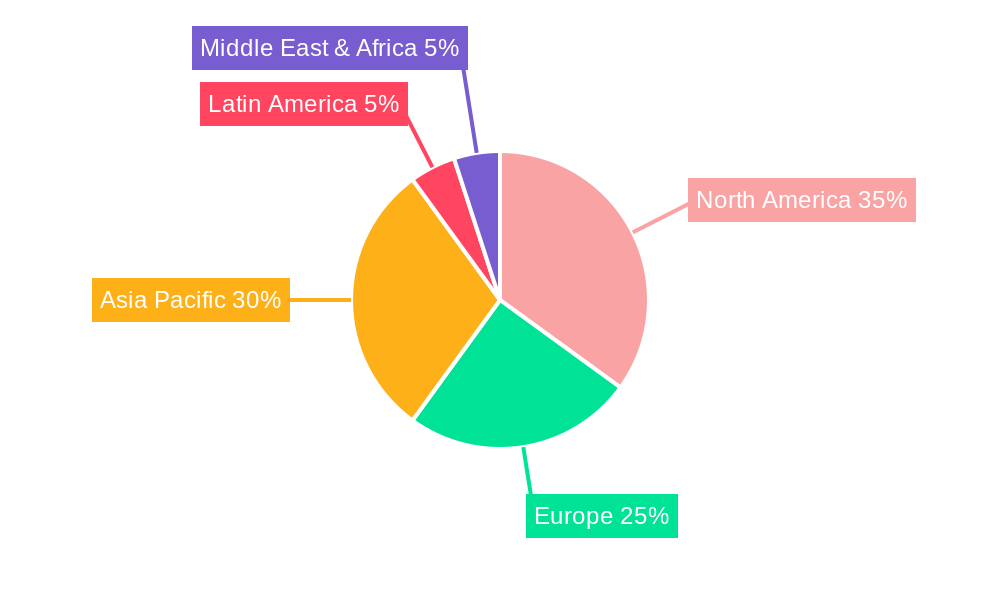

The United States stands as the dominant market within North America for IT devices, driven by its large consumer base, advanced technological infrastructure, and high disposable income. The country's robust economic policies and significant investments in digital innovation create a fertile ground for the IT device market's growth. Consequently, the United States accounts for an estimated 80% of the total North America IT Device Market revenue.

Within the PC segment, laptops represent the most dominant sub-segment. This is largely attributable to the sustained demand from both the professional and educational sectors, amplified by the widespread adoption of remote and hybrid work models. The convenience, portability, and increasing power of modern laptops make them indispensable for a vast array of tasks. The market share for laptops within the PC segment is estimated at 65%, with a projected market size of $90,000 Million by 2033. Desktop PCs, while still relevant for specialized high-performance computing and gaming, are experiencing a more moderate growth trajectory. Tablets are also witnessing steady demand, particularly for educational purposes and as secondary consumer devices.

In the Phones segment, smartphones are unequivocally the dominant category, commanding an overwhelming market share. The continuous innovation in mobile technology, including the rollout of 5G networks, advanced camera systems, and powerful processors, fuels sustained consumer upgrades. The ubiquitous nature of smartphones makes them central to daily life for communication, entertainment, productivity, and accessing a vast array of digital services. The smartphone market share within the Phones segment is estimated at 90%, with a projected market size of $120,000 Million by 2033. Landline phones are in a state of decline, relegated to niche business applications and specific demographic needs. Feature phones, while experiencing a resurgence in certain emerging markets globally, hold a minimal market share within the technologically advanced North American region.

North America IT Device Market Product Innovations

Product innovations in the North America IT Device Market are centered around enhanced performance, seamless connectivity, and intelligent functionalities. Laptops are increasingly featuring more powerful processors, longer battery life, and innovative form factors like 2-in-1 convertibles. Smartphones are pushing boundaries with foldable displays, advanced camera technologies leveraging AI for superior image processing, and robust 5G capabilities enabling faster data transfer and lower latency. The integration of AI across devices offers personalized user experiences, predictive capabilities, and more intuitive interactions. Competitive advantages are derived from superior processing power, sophisticated camera systems, advanced display technologies, and robust ecosystem integration. The focus on sustainability through the use of recycled materials and energy-efficient designs is also a growing area of innovation.

Report Segmentation & Scope

This report meticulously segments the North America IT Device Market across key categories to provide a comprehensive view. The Type segmentation includes PCs, encompassing Laptops, Desktop PCs, and Tablets, and Phones, which are further divided into Landline Phones, Smartphones, and Feature Phones. The Geography segmentation is focused on North America, specifically the United States and Canada. Within the PC segment, Laptops are projected to hold a significant market share, driven by remote work trends, with an estimated market size of $90,000 Million by 2033. Smartphones dominate the Phones segment, with a projected market size of $120,000 Million by 2033, owing to continuous technological advancements and consumer demand. The United States is expected to maintain its leading position within the North American region.

Key Drivers of North America IT Device Market Growth

Several key factors are propelling the growth of the North America IT Device Market. Technological advancements, including the widespread adoption of 5G networks, the integration of AI and machine learning, and the increasing demand for IoT-enabled devices, are primary drivers. Economically, factors such as rising disposable incomes and strong enterprise IT spending are crucial. The ongoing digital transformation initiatives across various industries, coupled with the sustained demand for remote work and hybrid learning solutions, further bolster the market. Regulatory support for innovation and data security also plays a vital role in fostering a conducive environment for growth.

Challenges in the North America IT Device Market Sector

Despite its robust growth, the North America IT Device Market faces several challenges. Intense competition leads to price wars and squeezed profit margins for manufacturers. Supply chain disruptions, exacerbated by geopolitical factors and component shortages, can impact production and lead times. Evolving regulatory landscapes, particularly concerning data privacy and cybersecurity, require constant adaptation and compliance, adding to operational complexities. The rapid pace of technological obsolescence necessitates continuous investment in R&D to remain competitive, presenting a significant financial hurdle. Furthermore, the increasing demand for sustainable manufacturing practices and responsible e-waste management adds another layer of complexity to the market.

Leading Players in the North America IT Device Market Market

- Huawei Technologies Co Ltd

- Motorola Solutions Inc

- Gateway Inc

- OnePlus Technology Co Ltd

- Google LLC

- Lenovo Group Limited

- Samsung Electronics Co Ltd

- Microsoft Corporation

- Xiaomi Corporation

- Dell Inc

- The International Business Machines Corporation(IBM)

- Intel Corp

- Oracle Corp

- Apple Inc

- LG Corporation

Key Developments in North America IT Device Market Sector

- November 2022: Apple, the leading telephone brand in the world, introduced a satellite-enabled SOS service in the United States and Canada. Only iPhone 14 owners may utilize the service, which enables the device to transmit SOS signals in an emergency from a distance even if cellular networks are not accessible.

- April 2022: Microsoft Corp. announced an expansion of its strategic collaboration with MediaKind to open new possibilities for video content owners, broadcasters, operators, and businesses to speed up their transition to digital video. This new partnership is intended to improve the integration and optimization of both businesses' products, platforms, and cloud capabilities, enabling their respective clients in the media and entertainment sector and beyond to achieve new heights of success.

Strategic North America IT Device Market Market Outlook

- November 2022: Apple, the leading telephone brand in the world, introduced a satellite-enabled SOS service in the United States and Canada. Only iPhone 14 owners may utilize the service, which enables the device to transmit SOS signals in an emergency from a distance even if cellular networks are not accessible.

- April 2022: Microsoft Corp. announced an expansion of its strategic collaboration with MediaKind to open new possibilities for video content owners, broadcasters, operators, and businesses to speed up their transition to digital video. This new partnership is intended to improve the integration and optimization of both businesses' products, platforms, and cloud capabilities, enabling their respective clients in the media and entertainment sector and beyond to achieve new heights of success.

Strategic North America IT Device Market Market Outlook

The strategic outlook for the North America IT Device Market remains highly positive, driven by continuous technological innovation and evolving consumer and enterprise needs. The growing adoption of AI, 5G, and IoT will create new avenues for device manufacturers to develop smarter, more connected, and personalized solutions. The ongoing shift towards hybrid work and digital-first business models will sustain the demand for high-performance laptops and versatile computing devices. Furthermore, the increasing focus on sustainability and eco-friendly products presents a significant opportunity for companies to differentiate themselves and capture market share among environmentally conscious consumers. Strategic partnerships and acquisitions are expected to continue shaping the competitive landscape, with companies focusing on acquiring cutting-edge technologies and expanding their market reach. The market is poised for sustained growth, offering lucrative opportunities for players who can effectively navigate technological advancements and shifting consumer preferences.

North America IT Device Market Segmentation

-

1. Type

-

1.1. PC's

- 1.1.1. Laptops

- 1.1.2. Desktop PCs

- 1.1.3. Tablets

-

1.2. Phones

- 1.2.1. Landline Phones

- 1.2.2. Smartphones

- 1.2.3. Feature Phones

-

1.1. PC's

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

-

2.1. North America

North America IT Device Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

North America IT Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Demand for Smartphones; Signidicant 5G Coverage in the Region

- 3.3. Market Restrains

- 3.3.1. Shortage of Semiconductor (Chip)

- 3.4. Market Trends

- 3.4.1. Stellar Smart Phone Penetration

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. PC's

- 5.1.1.1. Laptops

- 5.1.1.2. Desktop PCs

- 5.1.1.3. Tablets

- 5.1.2. Phones

- 5.1.2.1. Landline Phones

- 5.1.2.2. Smartphones

- 5.1.2.3. Feature Phones

- 5.1.1. PC's

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America IT Device Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Huawei Technologies Co Ltd *List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Motorola Solutions Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Gateway Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 OnePlus Technology Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Google LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Lenovo Group Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Samsung Electronics Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Microsoft Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Xiaomi Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dell Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 The International Business Machines Corporation(IBM)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Intel Corp

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Oracle Corp

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Apple Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 LG Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Huawei Technologies Co Ltd *List Not Exhaustive

List of Figures

- Figure 1: North America IT Device Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America IT Device Market Share (%) by Company 2024

List of Tables

- Table 1: North America IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: North America IT Device Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America IT Device Market?

The projected CAGR is approximately 1.60%.

2. Which companies are prominent players in the North America IT Device Market?

Key companies in the market include Huawei Technologies Co Ltd *List Not Exhaustive, Motorola Solutions Inc, Gateway Inc, OnePlus Technology Co Ltd, Google LLC, Lenovo Group Limited, Samsung Electronics Co Ltd, Microsoft Corporation, Xiaomi Corporation, Dell Inc, The International Business Machines Corporation(IBM), Intel Corp, Oracle Corp, Apple Inc, LG Corporation.

3. What are the main segments of the North America IT Device Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Demand for Smartphones; Signidicant 5G Coverage in the Region.

6. What are the notable trends driving market growth?

Stellar Smart Phone Penetration.

7. Are there any restraints impacting market growth?

Shortage of Semiconductor (Chip).

8. Can you provide examples of recent developments in the market?

November 2022: Apple, the leading telephone brand in the world, introduced a satellite-enabled SOS service in the United States and Canada. Only iPhone 14 owners may utilize the service, which enables the device to transmit SOS signals in an emergency from a distance even if cellular networks are not accessible.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America IT Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America IT Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America IT Device Market?

To stay informed about further developments, trends, and reports in the North America IT Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence