Key Insights

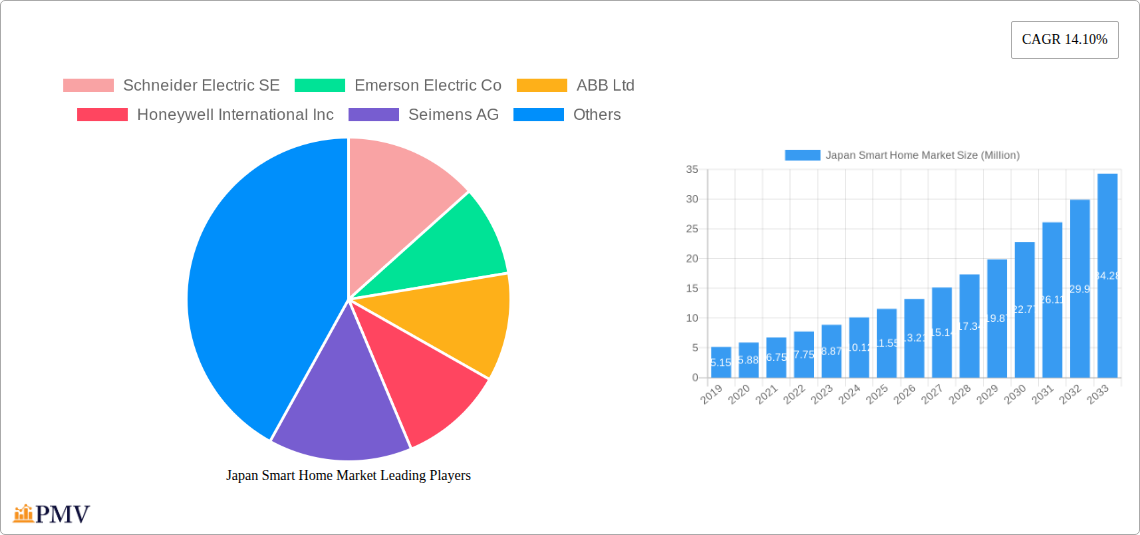

The Japan Smart Home Market is poised for substantial growth, projected to reach approximately $10.12 million by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 14.10% through 2033. This robust expansion is driven by a confluence of factors, including increasing consumer demand for convenience, enhanced security, and energy efficiency, all facilitated by rapid technological advancements and widespread internet penetration. The market is segmented across diverse product types, with Comfort and Lighting, Control and Connectivity, and Security emerging as key areas of innovation and adoption. The proliferation of smart appliances and sophisticated HVAC control systems further underscores the evolving needs and expectations of Japanese households. Underlying this growth are prevalent technologies such as Wi-Fi and Bluetooth, which provide the seamless connectivity essential for a truly integrated smart home experience. Leading companies like Schneider Electric SE, Emerson Electric Co, ABB Ltd, Honeywell International Inc, and Siemens AG are at the forefront, investing heavily in research and development to introduce cutting-edge solutions.

Japan Smart Home Market Market Size (In Million)

Further analysis of the Japan Smart Home Market reveals a strong inclination towards integrated systems that offer a holistic living experience. The emphasis on energy management, driven by both environmental consciousness and the desire to reduce utility costs, is a significant trend. Simultaneously, the growing concern for personal safety and property protection is fueling demand for advanced security solutions, including smart locks, surveillance cameras, and alarm systems. The "Home Entertainment" segment is also experiencing a surge, with consumers seeking immersive audio-visual experiences and seamless integration with other smart devices. While the market presents immense opportunities, potential restraints might include the initial cost of installation and the need for greater consumer education regarding the benefits and interoperability of various smart home systems. However, with continuous innovation and a focus on user-friendly interfaces, these challenges are expected to be overcome, solidifying Japan's position as a leading smart home market.

Japan Smart Home Market Company Market Share

This detailed report provides an in-depth analysis of the Japan Smart Home Market, offering actionable insights and future projections from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025–2033, this study is essential for stakeholders seeking to understand market dynamics, growth drivers, competitive landscapes, and emerging trends in Japan's rapidly evolving smart home ecosystem. We meticulously analyze product types, technologies, and industry developments, equipping you with the knowledge to navigate this lucrative market.

Japan Smart Home Market Market Structure & Competitive Dynamics

The Japan Smart Home Market exhibits a dynamic and evolving structure characterized by intense competition and a growing emphasis on interoperability and user experience. Market concentration is influenced by the presence of both established global technology giants and nimble domestic players, each vying for market share. Innovation ecosystems are robust, fueled by significant R&D investments in artificial intelligence, machine learning, and advanced connectivity solutions. Regulatory frameworks, while generally supportive of technological advancement, also focus on data privacy and security, shaping product development and deployment strategies.

Key aspects of market structure and competitive dynamics include:

- Market Concentration: The market is moderately concentrated, with a few leading players holding significant market share, particularly in the security and energy management segments. However, the increasing number of new entrants and niche product offerings contributes to a healthy level of competition.

- Innovation Ecosystems: Strong collaboration between technology developers, service providers, and telecommunications companies fosters a fertile ground for innovation. Research institutions and startups play a crucial role in introducing disruptive technologies and novel applications.

- Regulatory Frameworks: Government initiatives promoting digital transformation and energy efficiency positively impact the smart home market. However, evolving data protection regulations and cybersecurity standards necessitate continuous adaptation from manufacturers and service providers.

- Product Substitutes: While dedicated smart home devices offer advanced features, conventional home appliances and traditional security systems still represent a substitute. The value proposition of smart homes lies in their integrated functionality, convenience, and potential for energy savings.

- End-User Trends: Japanese consumers are increasingly embracing technology for convenience, security, and energy efficiency. A growing preference for seamless integration and user-friendly interfaces is driving demand for sophisticated smart home solutions.

- M&A Activities: Strategic mergers and acquisitions are instrumental in consolidating market presence, acquiring new technologies, and expanding product portfolios. While specific deal values are often confidential, these activities indicate a trend towards market consolidation and strategic growth among key players. For instance, the acquisition of smaller innovative startups by larger corporations aims to accelerate product development and market penetration.

Japan Smart Home Market Industry Trends & Insights

The Japan Smart Home Market is experiencing significant growth and transformation, driven by a confluence of technological advancements, evolving consumer expectations, and supportive government policies aimed at creating a more connected and sustainable future. The projected Compound Annual Growth Rate (CAGR) for the Japan smart home market is robust, reflecting increasing adoption across various product categories. Market penetration is steadily rising as consumers become more aware of the benefits and convenience offered by smart home technologies, ranging from enhanced security and energy savings to improved comfort and entertainment.

Technological disruptions are at the forefront of this expansion. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is enabling more sophisticated automation, personalized user experiences, and predictive capabilities within smart homes. Voice assistants, powered by advanced natural language processing, have become central to user interaction, making smart home control more intuitive and accessible. The proliferation of the Internet of Things (IoT) is facilitating seamless connectivity between a growing array of devices, creating a truly integrated living environment. Wi-Fi and Bluetooth continue to be the dominant connectivity technologies, offering widespread compatibility and ease of use, while emerging standards like Matter are poised to revolutionize interoperability, addressing a long-standing challenge in the smart home landscape by allowing devices from different manufacturers to communicate effortlessly. This interoperability is crucial for wider consumer adoption and for unlocking the full potential of a connected home.

Consumer preferences are increasingly shifting towards solutions that offer not only convenience but also tangible benefits such as energy efficiency and enhanced security. The aging population in Japan is also a significant demographic driver, with smart home technologies offering potential solutions for elderly care, remote monitoring, and assistance, thereby improving quality of life and enabling independent living. The demand for smart appliances that can be remotely controlled and monitored is growing, alongside a keen interest in smart lighting and comfort control systems that can adapt to individual routines and preferences, further contributing to energy savings and personalized living spaces. The increasing awareness and concern about environmental sustainability are also driving demand for energy management solutions that help households reduce their carbon footprint and utility bills.

Competitive dynamics are characterized by both global technology leaders and specialized Japanese companies. The market is seeing increased collaboration and partnerships to develop comprehensive smart home ecosystems. Companies are investing heavily in user interface design and customer support to ensure a positive and seamless experience, which is critical for retaining customers and fostering brand loyalty. The focus is shifting from standalone devices to integrated solutions that provide holistic home management. Furthermore, the growth of home automation services and subscription models is creating new revenue streams and enhancing customer engagement. The competitive edge is increasingly being defined by the ability to offer secure, reliable, and user-friendly platforms that can adapt to future technological advancements and evolving consumer needs. The ongoing development of AI-powered features, predictive analytics for energy usage, and proactive security alerts are key differentiators that will shape the future of the Japan smart home market.

Dominant Markets & Segments in Japan Smart Home Market

The Japan Smart Home Market is characterized by robust growth across several key segments, driven by distinct consumer needs and technological advancements. Analyzing the dominance of specific product types and technologies provides crucial insights into market potential and strategic focus areas.

Dominant Product Types:

- Security: The Security segment stands out as a dominant force within the Japan Smart Home Market.

- Key Drivers: High consumer concern for safety and property protection, coupled with a sophisticated aging population requiring remote monitoring solutions, significantly fuels demand for smart locks, surveillance cameras, alarm systems, and smart doorbells. The increasing adoption of IoT-enabled security devices that offer remote access and real-time alerts further solidifies its leadership. Economic policies promoting home safety and technological advancements in AI-powered threat detection contribute to this segment's prominence.

- Comfort and Lighting: This segment commands significant market share due to its direct impact on daily living and energy efficiency.

- Key Drivers: Growing consumer interest in creating personalized and comfortable living environments, coupled with a strong emphasis on energy conservation, drives the adoption of smart thermostats, smart lighting systems (e.g., Philips Hue), and automated blinds. The ability to remotely control and schedule lighting and temperature, leading to reduced energy consumption and enhanced convenience, is a major growth accelerator.

- Control and Connectivity: This foundational segment underpins the entire smart home ecosystem.

- Key Drivers: The increasing number of connected devices necessitates robust control and connectivity solutions. Smart hubs, intelligent speakers acting as central controllers (e.g., Amazon Echo, Google Home), and advanced networking equipment are essential for seamless integration and operation of various smart devices. The push for interoperability through standards like Matter further strengthens this segment.

- Energy Management: Driven by increasing energy costs and environmental consciousness, this segment is experiencing substantial growth.

- Key Drivers: Smart meters, energy monitoring devices, and intelligent power management systems enable consumers to track and optimize their energy consumption. Government incentives and initiatives promoting renewable energy adoption and energy efficiency play a vital role in this segment's expansion. The desire to reduce utility bills and contribute to sustainability are key consumer motivators.

- Smart Appliances: The integration of intelligence into everyday appliances is transforming home functionality.

- Key Drivers: Smart refrigerators, washing machines, ovens, and vacuum cleaners that offer remote control, diagnostic capabilities, and automated functions are gaining traction. Consumer demand for convenience, time-saving solutions, and enhanced appliance performance fuels adoption.

- Home Entertainment: While a mature market, smart home integration is enhancing its appeal.

- Key Drivers: Smart TVs, streaming devices, and multi-room audio systems that can be integrated with voice assistants and controlled through a single interface offer a more immersive and convenient entertainment experience.

- HVAC Control: Smart thermostats and integrated climate control systems are essential for comfort and energy savings.

- Key Drivers: The ability to remotely manage and optimize heating and cooling systems contributes significantly to reducing energy consumption and improving indoor comfort, aligning with both consumer desires and broader energy efficiency goals.

Dominant Technologies:

- Wi-Fi: Wi-Fi remains the most prevalent connectivity technology in the Japan Smart Home Market due to its widespread availability, high bandwidth, and compatibility with a vast array of devices. Its ability to support multiple devices simultaneously makes it ideal for complex smart home networks.

- Key Drivers: Existing infrastructure, ease of setup, and broad device support are key advantages. The continuous evolution of Wi-Fi standards (e.g., Wi-Fi 6/6E) offers improved speed, reliability, and capacity, further strengthening its dominance.

- Bluetooth: Bluetooth technology plays a crucial role, especially for low-power, short-range communication between devices.

- Key Drivers: Its energy efficiency and integration into many smaller smart devices, such as sensors and wearables, make it a popular choice for specific applications. Bluetooth Mesh capabilities are enhancing its utility in creating more extensive smart home networks.

- Other Technologies: This category includes emerging and specialized technologies that contribute to the smart home ecosystem.

- Key Drivers: Zigbee and Z-Wave are important for their low-power, mesh networking capabilities, often used in dedicated smart home devices. Cellular and Thread technologies are gaining traction for specific applications requiring greater range or enhanced security. The increasing emphasis on interoperability through standards like Matter will likely see these technologies play increasingly integrated roles.

The interplay between these product types and technologies, supported by economic policies promoting technological adoption and consumer demand for convenience and efficiency, defines the current and future landscape of the Japan Smart Home Market.

Japan Smart Home Market Product Innovations

The Japan Smart Home Market is experiencing a wave of innovative product developments focused on enhancing user experience, interoperability, and intelligence. Key trends include the integration of AI for predictive automation, enabling devices to learn user habits and proactively adjust settings for comfort and energy savings. Product innovations are also emphasizing seamless integration with popular voice assistants and expanding compatibility with open standards like Matter, ensuring a more unified and user-friendly smart home ecosystem. Advancements in sensor technology are leading to more discreet and accurate data collection for environmental monitoring and security. Furthermore, manufacturers are focusing on energy-efficient designs and sustainable materials, aligning with growing consumer and regulatory demands for eco-friendly solutions. These innovations are creating competitive advantages by offering greater convenience, improved safety, and tangible cost savings for Japanese households.

Report Segmentation & Scope

This report segment provides a detailed breakdown of the Japan Smart Home Market, encompassing key product types and underlying technologies. The scope covers the period from 2019 to 2033, with a focus on the base year 2025 and the forecast period 2025–2033.

- Comfort and Lighting: This segment includes smart thermostats, smart lighting systems, automated blinds, and other devices designed to enhance home ambiance and energy efficiency. Growth projections are strong, driven by consumer demand for personalized comfort and reduced energy bills.

- Control and Connectivity: Encompassing smart hubs, intelligent speakers, and advanced networking solutions, this segment is foundational to the smart home ecosystem. Its growth is directly tied to the increasing number of connected devices and the need for seamless integration and management.

- Energy Management: This segment focuses on smart meters, energy monitors, and intelligent power management systems that help households track and optimize energy consumption. Strong growth is anticipated due to rising energy costs and environmental consciousness.

- Home Entertainment: This includes smart TVs, streaming devices, and multi-room audio systems integrated into the smart home network. Continued growth is expected as these devices become more interconnected and controllable via voice and automation.

- Security: Featuring smart locks, surveillance cameras, alarm systems, and smart doorbells, this segment is driven by consumer concerns for safety and property protection. Robust growth is projected due to increasing adoption of IoT-enabled security solutions.

- Smart Appliances: This segment covers intelligent refrigerators, washing machines, ovens, and other appliances with advanced connectivity and automation features. Consumer demand for convenience and enhanced functionality fuels its expansion.

- HVAC Control: This segment focuses on smart thermostats and integrated climate control systems that optimize heating and cooling for comfort and energy savings. Steady growth is expected as consumers prioritize energy efficiency and convenience.

- Wi-Fi: As the dominant connectivity technology, Wi-Fi is integral to most smart home setups. Its continued growth is assured by its widespread availability and compatibility.

- Bluetooth: Essential for low-power, short-range communication, Bluetooth is crucial for many smaller smart devices. Its growth is linked to the expansion of the IoT device landscape.

- Other Technologies: This includes emerging and specialized connectivity solutions like Zigbee, Z-Wave, Thread, and cellular, which are vital for specific applications and increasing interoperability. Their growth will be influenced by the adoption of new standards and evolving network requirements.

Key Drivers of Japan Smart Home Market Growth

The Japan Smart Home Market is propelled by several interconnected growth drivers, shaping its trajectory towards widespread adoption. Technologically, the increasing sophistication of Artificial Intelligence (AI) and Machine Learning (ML) is enabling more intuitive and personalized user experiences, making smart home devices more proactive and responsive. The widespread availability and continuous improvement of high-speed internet infrastructure, including the expansion of 5G networks, are crucial for supporting the seamless operation of numerous connected devices. Economically, a rising disposable income among Japanese households, coupled with government incentives promoting energy efficiency and technological innovation, further stimulates consumer spending on smart home solutions. Regulatory factors also play a significant role, with supportive policies encouraging the development and deployment of smart technologies, alongside a growing emphasis on data privacy and cybersecurity standards that build consumer trust.

Challenges in the Japan Smart Home Market Sector

Despite its promising growth, the Japan Smart Home Market faces several challenges that can temper its expansion. A significant barrier is the concern around data privacy and cybersecurity, as consumers remain apprehensive about the security of their personal information and the potential for unauthorized access to their connected homes. The initial cost of smart home devices and installation can also be a deterrent for some consumers, particularly those on tighter budgets. Furthermore, interoperability issues, although improving with new standards like Matter, can still lead to fragmented ecosystems where devices from different manufacturers do not communicate effectively, frustrating users and limiting the overall smart home experience. The complexity of setting up and managing multiple devices can also be a hurdle for less tech-savvy individuals.

Leading Players in the Japan Smart Home Market Market

- Schneider Electric SE

- Emerson Electric Co

- ABB Ltd

- Honeywell International Inc

- Siemens AG

- Signify Holding

- Microsoft Corporation

- Google Inc

- Cisco Systems Inc

- General Electric Company

- Dahua Technology

- D-Link Electronics Co Lt

Key Developments in Japan Smart Home Market Sector

- March 2024: ABB announced the introduction of Matter connectivity standard compatibility and new partner add-ons that enhance interoperability, providing users with greater flexibility and the ability to choose from a broader range of smart home devices. With the Matter firmware, an emerging, open-source connectivity standard for smart homes, ABB-free home is expected to become part of other smart home ecosystems such as Apple Home, Google Home, Amazon Alexa, and Samsung.

- February 2024: Microsoft disclosed a new patent indicating that the company is developing a self-sufficient smart home system for Windows devices. This system, known as multi-device cross-experience, will be driven by AI. It allows connected devices to interact with each other through advertising without the need for user input. Devices within the system will continuously communicate with each other and perform actions when certain conditions are fulfilled.

Strategic Japan Smart Home Market Market Outlook

The strategic outlook for the Japan Smart Home Market remains exceptionally positive, driven by continuous innovation and a strong consumer appetite for enhanced convenience, security, and energy efficiency. The increasing focus on AI-driven personalization and predictive capabilities will unlock new levels of automation and user satisfaction. The widespread adoption of interoperability standards like Matter is set to significantly reduce fragmentation, paving the way for more integrated and seamless smart home experiences. Furthermore, demographic shifts, including an aging population seeking assistive technologies, and a growing environmental consciousness among consumers will continue to fuel demand for smart solutions that offer both quality of life improvements and sustainability benefits. Strategic opportunities lie in developing comprehensive ecosystem solutions, enhancing cybersecurity measures to build trust, and offering user-friendly interfaces that cater to a diverse range of consumers.

Japan Smart Home Market Segmentation

-

1. Product Type

- 1.1. Comfort and Lighting

- 1.2. Control and Connectivity

- 1.3. Energy Management

- 1.4. Home Entertainment

- 1.5. Security

- 1.6. Smart Appliances

- 1.7. HVAC Control

-

2. Technology

- 2.1. Wi-Fi

- 2.2. Bluetooth

- 2.3. Other Technologies

Japan Smart Home Market Segmentation By Geography

- 1. Japan

Japan Smart Home Market Regional Market Share

Geographic Coverage of Japan Smart Home Market

Japan Smart Home Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Concern about Home Security and Safety; Advances in Technology

- 3.2.2 such as IoT

- 3.2.3 Artificial Intelligence

- 3.2.4 and Voice Controlled Assistants

- 3.3. Market Restrains

- 3.3.1 Rising Concern about Home Security and Safety; Advances in Technology

- 3.3.2 such as IoT

- 3.3.3 Artificial Intelligence

- 3.3.4 and Voice Controlled Assistants

- 3.4. Market Trends

- 3.4.1. Rising Focus Toward Energy Efficiency is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Smart Home Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Comfort and Lighting

- 5.1.2. Control and Connectivity

- 5.1.3. Energy Management

- 5.1.4. Home Entertainment

- 5.1.5. Security

- 5.1.6. Smart Appliances

- 5.1.7. HVAC Control

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Wi-Fi

- 5.2.2. Bluetooth

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Schneider Electric SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Emerson Electric Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Seimens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Signify Holding

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Google Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cisco Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 General Electric Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dahua Technology

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 D-Link Electronics Co Lt

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Schneider Electric SE

List of Figures

- Figure 1: Japan Smart Home Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Smart Home Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Smart Home Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Japan Smart Home Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Japan Smart Home Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Japan Smart Home Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 5: Japan Smart Home Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Japan Smart Home Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Japan Smart Home Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Japan Smart Home Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Japan Smart Home Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Japan Smart Home Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 11: Japan Smart Home Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Japan Smart Home Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Smart Home Market?

The projected CAGR is approximately 14.10%.

2. Which companies are prominent players in the Japan Smart Home Market?

Key companies in the market include Schneider Electric SE, Emerson Electric Co, ABB Ltd, Honeywell International Inc, Seimens AG, Signify Holding, Microsoft Corporation, Google Inc, Cisco Systems Inc, General Electric Company, Dahua Technology, D-Link Electronics Co Lt.

3. What are the main segments of the Japan Smart Home Market?

The market segments include Product Type, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Concern about Home Security and Safety; Advances in Technology. such as IoT. Artificial Intelligence. and Voice Controlled Assistants.

6. What are the notable trends driving market growth?

Rising Focus Toward Energy Efficiency is Driving the Market.

7. Are there any restraints impacting market growth?

Rising Concern about Home Security and Safety; Advances in Technology. such as IoT. Artificial Intelligence. and Voice Controlled Assistants.

8. Can you provide examples of recent developments in the market?

March 2024: ABB announced the introduction of Matter connectivity standard compatibility and new partner add-ons that enhance interoperability, providing users with greater flexibility and the ability to choose from a broader range of smart home devices. With the Matter firmware, an emerging, open-source connectivity standard for smart homes, ABB-free home is expected to become part of other smart home ecosystems such as Apple Home, Google Home, Amazon Alexa, and Samsung.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Smart Home Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Smart Home Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Smart Home Market?

To stay informed about further developments, trends, and reports in the Japan Smart Home Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence