Key Insights

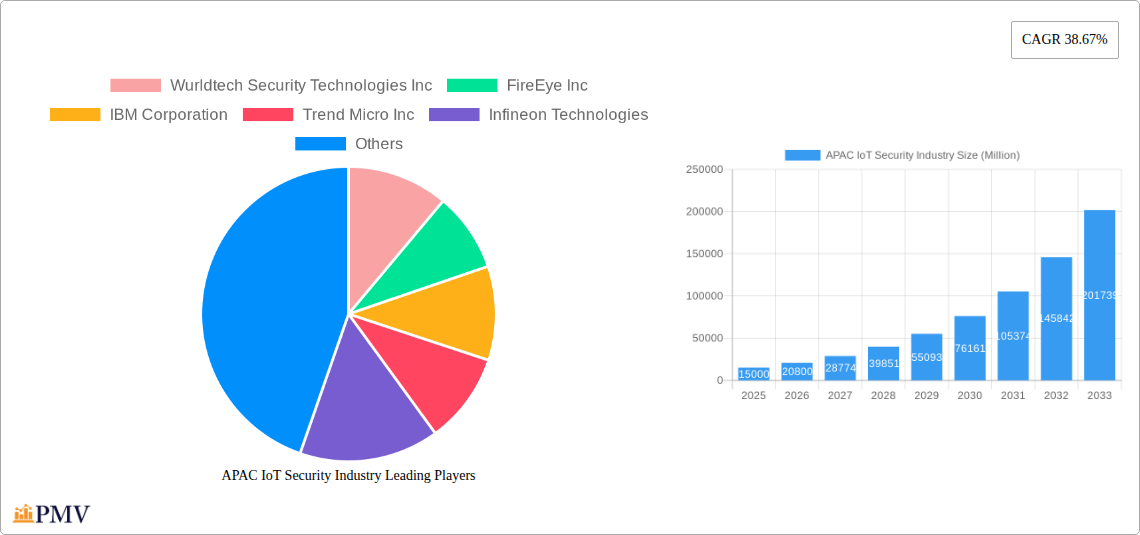

The APAC IoT Security market is poised for explosive growth, driven by the burgeoning adoption of Internet of Things (IoT) devices across diverse sectors and an escalating need to safeguard sensitive data from increasingly sophisticated cyber threats. With an estimated market size of approximately USD 15,000 million in 2025 and a remarkable Compound Annual Growth Rate (CAGR) of 38.67%, this sector is set to witness substantial expansion over the forecast period of 2025-2033. Key drivers fueling this surge include the rapid digital transformation initiatives in countries like China and India, the increasing demand for enhanced patient data security in healthcare, and the critical need for robust manufacturing process management to prevent operational disruptions and intellectual property theft. The proliferation of smart home devices, wearable technology, and the industrial internet of things (IIoT) further amplifies the attack surface, making robust security solutions indispensable.

APAC IoT Security Industry Market Size (In Billion)

The market's trajectory is further shaped by critical trends such as the growing adoption of cloud security solutions to manage and protect distributed IoT ecosystems, and the rising importance of identity and access management (IAM) to control device authentication and user permissions. Unified Threat Management (UTM) systems are gaining traction as organizations seek consolidated approaches to network security. However, the market is not without its challenges. Restraints such as the high cost of implementing comprehensive security frameworks and the persistent shortage of skilled cybersecurity professionals in the region can impede rapid deployment. Despite these hurdles, the strategic investments by major players like IBM Corporation, Trend Micro Inc., and Symantec Corporation (NortonLifeLock Inc.) in developing advanced security technologies, including Intrusion Prevention Systems (IPS) and Data Loss Protection (DLP), underscore the immense potential and the competitive landscape of the APAC IoT Security industry.

APAC IoT Security Industry Company Market Share

This in-depth report provides a detailed analysis of the APAC IoT Security Industry, offering crucial insights for stakeholders navigating this rapidly evolving landscape. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this research delves into market dynamics, key trends, dominant segments, and future outlooks. Our comprehensive analysis will empower businesses to make informed strategic decisions and capitalize on emerging opportunities within the Asia-Pacific Internet of Things security market.

APAC IoT Security Industry Market Structure & Competitive Dynamics

The APAC IoT Security Industry exhibits a dynamic and evolving market structure. While the market is characterized by a growing number of innovative startups, key players like Wurldtech Security Technologies Inc, FireEye Inc, IBM Corporation, Trend Micro Inc, Infineon Technologies, Gemalto NV, Symantec Corporation (NortonLifeLock Inc), ARM Holdings PLC, Sophos Group PLC, and Intel Corporation are establishing significant market presence. Market concentration is moderate, with a trend towards consolidation through strategic mergers and acquisitions (M&A) to enhance product portfolios and expand geographical reach. The estimated total value of M&A deals in the region has reached over 500 Million. Innovation ecosystems are thriving, driven by increasing investment in research and development for advanced IoT security solutions. Regulatory frameworks are gradually maturing across various APAC nations, with a growing emphasis on data privacy and device security standards. Product substitutes are emerging, but specialized IoT security solutions continue to dominate due to their tailored capabilities. End-user trends indicate a strong demand for robust security across all application areas, particularly in Healthcare, Manufacturing, and BFSI.

- Market Concentration: Moderate, with a growing number of specialized players and increasing M&A activity.

- Innovation Ecosystems: Vibrant, driven by R&D in areas like AI-powered threat detection and blockchain for secure IoT.

- Regulatory Frameworks: Developing, with a focus on data protection and device security mandates.

- Product Substitutes: Emerging, but specialized IoT security remains critical.

- End-User Trends: High demand for comprehensive security across diverse applications.

- M&A Activities: Significant, with over 500 Million in deal values to strengthen market position.

APAC IoT Security Industry Industry Trends & Insights

The APAC IoT Security Industry is poised for substantial growth, projected to experience a Compound Annual Growth Rate (CAGR) of over 18% during the forecast period. This robust expansion is fueled by the exponential proliferation of connected devices across various sectors, including Home Automation, Manufacturing Process Management, and Healthcare. The increasing sophistication of cyber threats targeting IoT ecosystems necessitates enhanced security measures, driving demand for advanced Network Security, Endpoint Security, and Cloud Security solutions. Technological disruptions, such as the widespread adoption of 5G technology, are further accelerating IoT deployment and, consequently, the demand for scalable and resilient IoT security. Consumer preferences are shifting towards greater awareness of data privacy and security, compelling businesses to prioritize secure IoT implementations. Competitive dynamics are intensifying, with established cybersecurity firms and agile startups vying for market share. The market penetration of comprehensive IoT security solutions is expected to reach over 65% by 2033. Furthermore, the growing adoption of AI and machine learning in threat intelligence and anomaly detection is a significant trend, enabling more proactive and intelligent security responses. The integration of security at the device level, through hardware-based security modules and secure boot processes, is also gaining traction. The need for end-to-end security, encompassing device, network, cloud, and application layers, is becoming paramount for organizations to mitigate the expanding attack surface. The increasing adoption of smart city initiatives and the industrial internet of things (IIoT) are also major catalysts for growth. The report will delve into the specific impact of these trends on various security types and solutions. The market is expected to reach a valuation of over 50 Billion by the end of the forecast period.

Dominant Markets & Segments in APAC IoT Security Industry

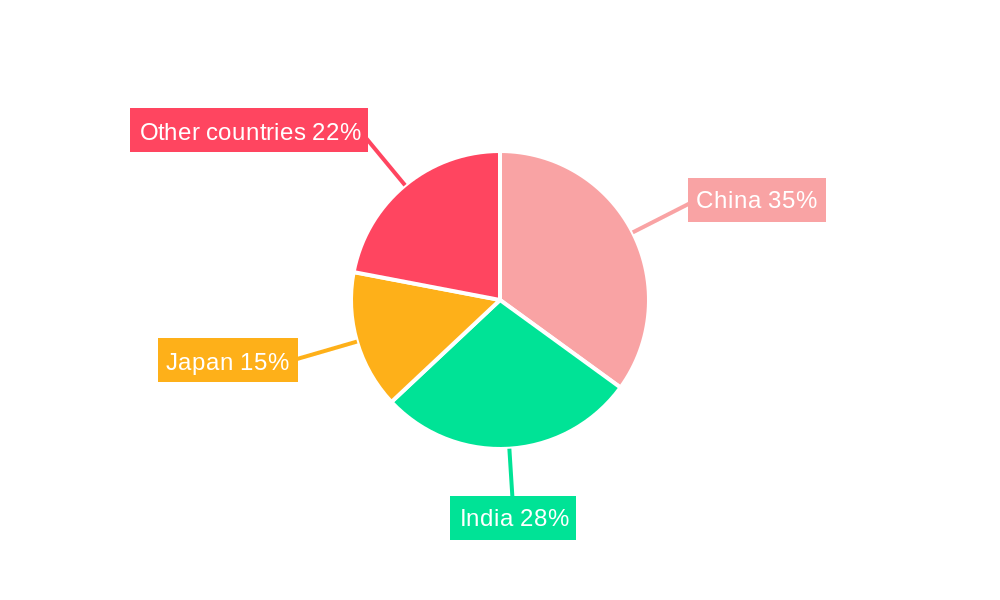

The APAC IoT Security Industry is characterized by distinct regional and sectoral dominance.

Dominant Geography: China is expected to lead the market, driven by its extensive manufacturing base, rapid adoption of smart technologies, and significant government investments in digital infrastructure. India and Japan follow closely, with their burgeoning IoT markets and increasing focus on cybersecurity.

- Key Drivers in China: Government initiatives for smart cities, large-scale IIoT adoption in manufacturing, and a massive consumer electronics market.

- Key Drivers in India: Rapid digitalization, growth in the smart home sector, and increasing government focus on cybersecurity for critical infrastructure.

- Key Drivers in Japan: Advanced robotics and automation in manufacturing, a mature consumer electronics market, and a strong emphasis on data security.

Dominant Type of Security: Network Security is projected to maintain its leadership position, essential for protecting the communication channels of vast numbers of interconnected IoT devices. Endpoint Security follows closely, focusing on securing individual devices from compromise. Cloud Security is also experiencing rapid growth due to the increasing reliance on cloud platforms for IoT data management and processing.

- Network Security: Critical for securing data transmission and preventing unauthorized access to IoT networks.

- Endpoint Security: Vital for safeguarding individual IoT devices from malware and exploits.

- Cloud Security: Essential for protecting data stored and processed in cloud environments for IoT applications.

Dominant Solutions: Identity and Access Management (IAM) will be a cornerstone, ensuring only authorized entities can access IoT devices and data. Security & Vulnerability Management (SVM) is crucial for identifying and mitigating potential weaknesses in the IoT ecosystem. Intrusion Prevention Systems (IPS) and Data Loss Protection (DLP) are also vital for real-time threat detection and preventing sensitive data exfiltration.

- Identity and Access Management (IAM): Central to controlling device and user access.

- Security & Vulnerability Management (SVM): Proactive identification and remediation of risks.

- Intrusion Prevention System (IPS): Real-time detection and blocking of malicious network activity.

Dominant Applications: Manufacturing Process Management is a leading application, driven by the industrial IoT revolution and the need for secure operational technology. Home Automation and Wearables are also significant, fueled by consumer adoption and the increasing interconnectedness of daily life.

- Manufacturing Process Management: Securing critical industrial operations and data.

- Home Automation: Protecting smart home devices and user data.

- Wearables: Ensuring the security and privacy of personal health and activity data.

Dominant End-User Verticals: Manufacturing will lead, followed by Healthcare and BFSI, each facing unique security challenges and regulatory requirements for their extensive IoT deployments.

- Manufacturing: Securing IIoT devices and sensitive production data.

- Healthcare: Protecting patient data (PHI) and medical devices.

- BFSI: Ensuring the security of financial transactions and customer data in an increasingly digitalized sector.

APAC IoT Security Industry Product Innovations

The APAC IoT Security Industry is witnessing a surge in product innovations aimed at addressing the unique challenges of securing interconnected devices. Companies are developing AI-driven anomaly detection systems capable of identifying subtle deviations in IoT device behavior, offering proactive threat mitigation. Advances in hardware-based security, such as secure elements and Trusted Platform Modules (TPMs), are enhancing device integrity and enabling secure boot processes. Blockchain technology is being explored and implemented for secure data logging, device authentication, and decentralized IoT management, promising enhanced transparency and tamper-proof security. Furthermore, advancements in lightweight cryptographic algorithms are enabling robust security for resource-constrained IoT devices without compromising performance. These innovations focus on providing scalable, efficient, and end-to-end security solutions that cater to the diverse needs of various applications and verticals within the APAC region.

Report Segmentation & Scope

This report segments the APAC IoT Security Industry comprehensively. The market is analyzed by Type of Security, including Network Security, Endpoint Security, Application Security, Cloud Security, and Other types of security. We also examine Solutions such as Identity Access Management (IAM), Intrusion Prevention System (IPS), Data Loss Protection (DLP), Unified Threat Management (UTM), Security & Vulnerability Management (SVM), Network Security Forensics (NSF), and Other solutions. The analysis extends to Applications like Home Automation, Wearables, Manufacturing Process Management, Patient Information Management, Supply Chain Operation, Customer Information Security, and Other applications. Furthermore, the report covers End-User Verticals including Healthcare, Manufacturing, Utilities, BFSI, Retail, Government, and Other end-user verticals. Geographically, the report provides detailed insights into China, India, Japan, and Other countries within the APAC region. Growth projections and market sizes are estimated for each segment, providing a granular understanding of the competitive dynamics and future potential.

Key Drivers of APAC IoT Security Industry Growth

The rapid expansion of the APAC IoT Security Industry is propelled by several key drivers. The escalating adoption of IoT devices across all sectors, driven by digital transformation initiatives and the pursuit of operational efficiency, forms the primary impetus. The increasing sophistication and frequency of cyber threats targeting IoT ecosystems necessitate robust security measures. Government initiatives and regulatory mandates promoting data privacy and device security also play a crucial role in driving market growth. Furthermore, the widespread deployment of 5G technology is enabling faster and more efficient IoT connectivity, further accelerating IoT adoption and the demand for enhanced security solutions. The growing awareness among businesses and consumers regarding the risks associated with unsecured IoT devices is also a significant contributing factor.

Challenges in the APAC IoT Security Industry Sector

Despite its robust growth, the APAC IoT Security Industry faces several challenges. The sheer scale and diversity of IoT devices create a complex and vast attack surface that is difficult to secure comprehensively. Interoperability issues between different IoT platforms and security solutions can hinder seamless integration and create vulnerabilities. The lack of standardized security protocols and regulations across the diverse APAC region presents a significant hurdle. Furthermore, the cost associated with implementing and maintaining advanced IoT security solutions can be a barrier for small and medium-sized enterprises. The shortage of skilled cybersecurity professionals capable of managing and securing complex IoT environments also poses a challenge. Supply chain vulnerabilities, where compromised components can introduce security risks, remain a concern.

Leading Players in the APAC IoT Security Industry Market

- Wurldtech Security Technologies Inc

- FireEye Inc

- IBM Corporation

- Trend Micro Inc

- Infineon Technologies

- Gemalto NV

- Symantec Corporation (NortonLifeLock Inc)

- ARM Holdings PLC

- Sophos Group PLC

- Intel Corporation

Key Developments in APAC IoT Security Industry Sector

- August 2022: Truvisor announced its partnership with One Identity, a unified identity security provider. The partnership would allow Truvisor to deliver One Identity solutions through their resellers' channels in Singapore, the Philippines, and Indonesia. This development enhances the availability of integrated identity security for IoT deployments.

- April 2022: Swimlane, a low-code security automation provider, announced the launch of Swimlane Cloud in the Asia-Pacific Japan (APJ) region. Swimlane's interactive dashboards and automated, easily customizable workflows reduce the mean time to respond and ultimately help organizations ensure continuous compliance and prevent breaches, bolstering the region's incident response capabilities for IoT threats.

Strategic APAC IoT Security Industry Market Outlook

The APAC IoT Security Industry presents a highly promising strategic outlook, characterized by sustained high growth and continuous innovation. The increasing digitization of economies across the region, coupled with government support for smart technologies and cybersecurity, will continue to be major growth accelerators. The rising adoption of advanced technologies like AI, machine learning, and blockchain will further enhance the capabilities of IoT security solutions, offering more proactive and intelligent threat defense. Strategic opportunities lie in developing comprehensive, end-to-end security platforms that address the entire IoT ecosystem, from device to cloud. Partnerships and collaborations between hardware manufacturers, software providers, and cybersecurity firms will be crucial for delivering integrated and robust security offerings. The growing demand for specialized security solutions in sectors like healthcare and critical infrastructure presents significant market potential for innovative and compliant offerings. The focus on data privacy and regulatory compliance will also drive the adoption of advanced data protection and access management solutions.

APAC IoT Security Industry Segmentation

-

1. Type of Security

- 1.1. Network Security

- 1.2. Endpoint Security

- 1.3. Application Security

- 1.4. Cloud Security

- 1.5. Other types of security

-

2. Solutions

- 2.1. Identity Access Management (IAM)

- 2.2. Intrusion Prevention System (IPS)

- 2.3. Data Loss Protection (DLP)

- 2.4. Unified Threat Management (UTM)

- 2.5. Security & Vulnerability Management (SVM)

- 2.6. Network Security Forensics (NSF)

- 2.7. Other solutions

-

3. Applications

- 3.1. Home Automation

- 3.2. Wearables

- 3.3. Manufacturing Process Management

- 3.4. Patient Information Management

- 3.5. Supply Chain Operation

- 3.6. Customer Information Security

- 3.7. Other applications

-

4. End-User Verticals

- 4.1. Healthcare

- 4.2. Manufacturing

- 4.3. Utilities

- 4.4. BFSI

- 4.5. Retail

- 4.6. Government

- 4.7. Other end-user verticals

-

5. Geography

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. Other countries

APAC IoT Security Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Other countries

APAC IoT Security Industry Regional Market Share

Geographic Coverage of APAC IoT Security Industry

APAC IoT Security Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Data Breaches; Emergence of Smart Cities

- 3.3. Market Restrains

- 3.3.1 Growing Complexity among Devices

- 3.3.2 coupled with the Lack of Ubiquitous Legislation

- 3.4. Market Trends

- 3.4.1. Emergence of Smart City and Smart Home Developments to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC IoT Security Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Security

- 5.1.1. Network Security

- 5.1.2. Endpoint Security

- 5.1.3. Application Security

- 5.1.4. Cloud Security

- 5.1.5. Other types of security

- 5.2. Market Analysis, Insights and Forecast - by Solutions

- 5.2.1. Identity Access Management (IAM)

- 5.2.2. Intrusion Prevention System (IPS)

- 5.2.3. Data Loss Protection (DLP)

- 5.2.4. Unified Threat Management (UTM)

- 5.2.5. Security & Vulnerability Management (SVM)

- 5.2.6. Network Security Forensics (NSF)

- 5.2.7. Other solutions

- 5.3. Market Analysis, Insights and Forecast - by Applications

- 5.3.1. Home Automation

- 5.3.2. Wearables

- 5.3.3. Manufacturing Process Management

- 5.3.4. Patient Information Management

- 5.3.5. Supply Chain Operation

- 5.3.6. Customer Information Security

- 5.3.7. Other applications

- 5.4. Market Analysis, Insights and Forecast - by End-User Verticals

- 5.4.1. Healthcare

- 5.4.2. Manufacturing

- 5.4.3. Utilities

- 5.4.4. BFSI

- 5.4.5. Retail

- 5.4.6. Government

- 5.4.7. Other end-user verticals

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Other countries

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.6.2. India

- 5.6.3. Japan

- 5.6.4. Other countries

- 5.1. Market Analysis, Insights and Forecast - by Type of Security

- 6. China APAC IoT Security Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Security

- 6.1.1. Network Security

- 6.1.2. Endpoint Security

- 6.1.3. Application Security

- 6.1.4. Cloud Security

- 6.1.5. Other types of security

- 6.2. Market Analysis, Insights and Forecast - by Solutions

- 6.2.1. Identity Access Management (IAM)

- 6.2.2. Intrusion Prevention System (IPS)

- 6.2.3. Data Loss Protection (DLP)

- 6.2.4. Unified Threat Management (UTM)

- 6.2.5. Security & Vulnerability Management (SVM)

- 6.2.6. Network Security Forensics (NSF)

- 6.2.7. Other solutions

- 6.3. Market Analysis, Insights and Forecast - by Applications

- 6.3.1. Home Automation

- 6.3.2. Wearables

- 6.3.3. Manufacturing Process Management

- 6.3.4. Patient Information Management

- 6.3.5. Supply Chain Operation

- 6.3.6. Customer Information Security

- 6.3.7. Other applications

- 6.4. Market Analysis, Insights and Forecast - by End-User Verticals

- 6.4.1. Healthcare

- 6.4.2. Manufacturing

- 6.4.3. Utilities

- 6.4.4. BFSI

- 6.4.5. Retail

- 6.4.6. Government

- 6.4.7. Other end-user verticals

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. China

- 6.5.2. India

- 6.5.3. Japan

- 6.5.4. Other countries

- 6.1. Market Analysis, Insights and Forecast - by Type of Security

- 7. India APAC IoT Security Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Security

- 7.1.1. Network Security

- 7.1.2. Endpoint Security

- 7.1.3. Application Security

- 7.1.4. Cloud Security

- 7.1.5. Other types of security

- 7.2. Market Analysis, Insights and Forecast - by Solutions

- 7.2.1. Identity Access Management (IAM)

- 7.2.2. Intrusion Prevention System (IPS)

- 7.2.3. Data Loss Protection (DLP)

- 7.2.4. Unified Threat Management (UTM)

- 7.2.5. Security & Vulnerability Management (SVM)

- 7.2.6. Network Security Forensics (NSF)

- 7.2.7. Other solutions

- 7.3. Market Analysis, Insights and Forecast - by Applications

- 7.3.1. Home Automation

- 7.3.2. Wearables

- 7.3.3. Manufacturing Process Management

- 7.3.4. Patient Information Management

- 7.3.5. Supply Chain Operation

- 7.3.6. Customer Information Security

- 7.3.7. Other applications

- 7.4. Market Analysis, Insights and Forecast - by End-User Verticals

- 7.4.1. Healthcare

- 7.4.2. Manufacturing

- 7.4.3. Utilities

- 7.4.4. BFSI

- 7.4.5. Retail

- 7.4.6. Government

- 7.4.7. Other end-user verticals

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. China

- 7.5.2. India

- 7.5.3. Japan

- 7.5.4. Other countries

- 7.1. Market Analysis, Insights and Forecast - by Type of Security

- 8. Japan APAC IoT Security Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Security

- 8.1.1. Network Security

- 8.1.2. Endpoint Security

- 8.1.3. Application Security

- 8.1.4. Cloud Security

- 8.1.5. Other types of security

- 8.2. Market Analysis, Insights and Forecast - by Solutions

- 8.2.1. Identity Access Management (IAM)

- 8.2.2. Intrusion Prevention System (IPS)

- 8.2.3. Data Loss Protection (DLP)

- 8.2.4. Unified Threat Management (UTM)

- 8.2.5. Security & Vulnerability Management (SVM)

- 8.2.6. Network Security Forensics (NSF)

- 8.2.7. Other solutions

- 8.3. Market Analysis, Insights and Forecast - by Applications

- 8.3.1. Home Automation

- 8.3.2. Wearables

- 8.3.3. Manufacturing Process Management

- 8.3.4. Patient Information Management

- 8.3.5. Supply Chain Operation

- 8.3.6. Customer Information Security

- 8.3.7. Other applications

- 8.4. Market Analysis, Insights and Forecast - by End-User Verticals

- 8.4.1. Healthcare

- 8.4.2. Manufacturing

- 8.4.3. Utilities

- 8.4.4. BFSI

- 8.4.5. Retail

- 8.4.6. Government

- 8.4.7. Other end-user verticals

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. China

- 8.5.2. India

- 8.5.3. Japan

- 8.5.4. Other countries

- 8.1. Market Analysis, Insights and Forecast - by Type of Security

- 9. Other countries APAC IoT Security Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Security

- 9.1.1. Network Security

- 9.1.2. Endpoint Security

- 9.1.3. Application Security

- 9.1.4. Cloud Security

- 9.1.5. Other types of security

- 9.2. Market Analysis, Insights and Forecast - by Solutions

- 9.2.1. Identity Access Management (IAM)

- 9.2.2. Intrusion Prevention System (IPS)

- 9.2.3. Data Loss Protection (DLP)

- 9.2.4. Unified Threat Management (UTM)

- 9.2.5. Security & Vulnerability Management (SVM)

- 9.2.6. Network Security Forensics (NSF)

- 9.2.7. Other solutions

- 9.3. Market Analysis, Insights and Forecast - by Applications

- 9.3.1. Home Automation

- 9.3.2. Wearables

- 9.3.3. Manufacturing Process Management

- 9.3.4. Patient Information Management

- 9.3.5. Supply Chain Operation

- 9.3.6. Customer Information Security

- 9.3.7. Other applications

- 9.4. Market Analysis, Insights and Forecast - by End-User Verticals

- 9.4.1. Healthcare

- 9.4.2. Manufacturing

- 9.4.3. Utilities

- 9.4.4. BFSI

- 9.4.5. Retail

- 9.4.6. Government

- 9.4.7. Other end-user verticals

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. Other countries

- 9.1. Market Analysis, Insights and Forecast - by Type of Security

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Wurldtech Security Technologies Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 FireEye Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IBM Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Trend Micro Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Infineon Technologies

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Gemalto NV*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Symantec Corporation (NortonLifeLock Inc)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ARM Holdings PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sophos Group PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Intel Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Wurldtech Security Technologies Inc

List of Figures

- Figure 1: APAC IoT Security Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: APAC IoT Security Industry Share (%) by Company 2025

List of Tables

- Table 1: APAC IoT Security Industry Revenue undefined Forecast, by Type of Security 2020 & 2033

- Table 2: APAC IoT Security Industry Revenue undefined Forecast, by Solutions 2020 & 2033

- Table 3: APAC IoT Security Industry Revenue undefined Forecast, by Applications 2020 & 2033

- Table 4: APAC IoT Security Industry Revenue undefined Forecast, by End-User Verticals 2020 & 2033

- Table 5: APAC IoT Security Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: APAC IoT Security Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: APAC IoT Security Industry Revenue undefined Forecast, by Type of Security 2020 & 2033

- Table 8: APAC IoT Security Industry Revenue undefined Forecast, by Solutions 2020 & 2033

- Table 9: APAC IoT Security Industry Revenue undefined Forecast, by Applications 2020 & 2033

- Table 10: APAC IoT Security Industry Revenue undefined Forecast, by End-User Verticals 2020 & 2033

- Table 11: APAC IoT Security Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: APAC IoT Security Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: APAC IoT Security Industry Revenue undefined Forecast, by Type of Security 2020 & 2033

- Table 14: APAC IoT Security Industry Revenue undefined Forecast, by Solutions 2020 & 2033

- Table 15: APAC IoT Security Industry Revenue undefined Forecast, by Applications 2020 & 2033

- Table 16: APAC IoT Security Industry Revenue undefined Forecast, by End-User Verticals 2020 & 2033

- Table 17: APAC IoT Security Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: APAC IoT Security Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: APAC IoT Security Industry Revenue undefined Forecast, by Type of Security 2020 & 2033

- Table 20: APAC IoT Security Industry Revenue undefined Forecast, by Solutions 2020 & 2033

- Table 21: APAC IoT Security Industry Revenue undefined Forecast, by Applications 2020 & 2033

- Table 22: APAC IoT Security Industry Revenue undefined Forecast, by End-User Verticals 2020 & 2033

- Table 23: APAC IoT Security Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: APAC IoT Security Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: APAC IoT Security Industry Revenue undefined Forecast, by Type of Security 2020 & 2033

- Table 26: APAC IoT Security Industry Revenue undefined Forecast, by Solutions 2020 & 2033

- Table 27: APAC IoT Security Industry Revenue undefined Forecast, by Applications 2020 & 2033

- Table 28: APAC IoT Security Industry Revenue undefined Forecast, by End-User Verticals 2020 & 2033

- Table 29: APAC IoT Security Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: APAC IoT Security Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC IoT Security Industry?

The projected CAGR is approximately 19%.

2. Which companies are prominent players in the APAC IoT Security Industry?

Key companies in the market include Wurldtech Security Technologies Inc, FireEye Inc, IBM Corporation, Trend Micro Inc, Infineon Technologies, Gemalto NV*List Not Exhaustive, Symantec Corporation (NortonLifeLock Inc), ARM Holdings PLC, Sophos Group PLC, Intel Corporation.

3. What are the main segments of the APAC IoT Security Industry?

The market segments include Type of Security, Solutions, Applications, End-User Verticals, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Data Breaches; Emergence of Smart Cities.

6. What are the notable trends driving market growth?

Emergence of Smart City and Smart Home Developments to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Growing Complexity among Devices. coupled with the Lack of Ubiquitous Legislation.

8. Can you provide examples of recent developments in the market?

August 2022 : Truvisor announced its partnership with One Identity, a unified identity security provider. The partnership would allow Truvisor to deliver One Identity solutions through their resellers' channels in Singapore, the Philippines, and Indonesia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC IoT Security Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC IoT Security Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC IoT Security Industry?

To stay informed about further developments, trends, and reports in the APAC IoT Security Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence