Key Insights

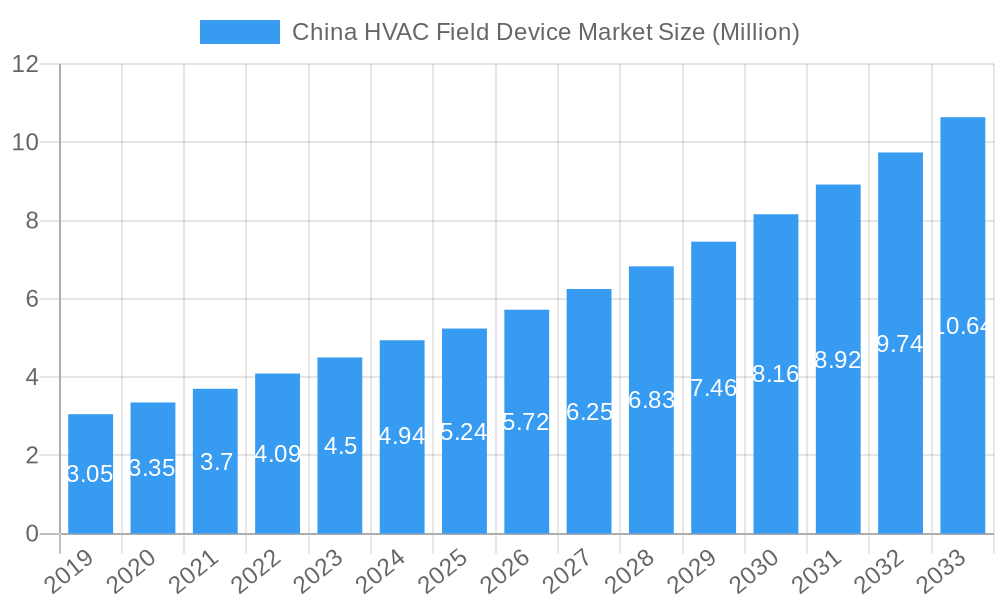

The China HVAC Field Device Market is poised for substantial growth, projected to reach an estimated 5.24 million value units by 2025. Driven by an impressive Compound Annual Growth Rate (CAGR) of 9.10% throughout the forecast period of 2025-2033, this expansion signifies a robust demand for advanced and efficient HVAC solutions within the region. Key market drivers include the increasing focus on energy efficiency regulations and government initiatives promoting sustainable building practices. Furthermore, the escalating adoption of smart building technologies, coupled with a growing awareness of indoor air quality and occupant comfort, are propelling the demand for sophisticated field devices. The market's segmentation reflects this dynamic, with Control Valves, Balancing Valves, and PICVs leading the way in terms of adoption, driven by their ability to optimize system performance and reduce energy consumption. Simultaneously, Damper HVAC units and Damper Actuators are experiencing significant traction, essential for precise airflow management in both commercial and residential settings.

China HVAC Field Device Market Market Size (In Million)

The sensors segment is also a crucial contributor to market expansion, with Environmental Sensors, Multi Sensors, and Air Quality Sensors becoming indispensable for intelligent building management. The growing need for real-time data on occupancy and lighting further fuels the demand for integrated sensor solutions. The end-user landscape is dominated by the commercial sector, owing to the widespread implementation of Building Management Systems (BMS) in offices, retail spaces, and hospitality establishments. Residential and industrial sectors are also demonstrating increasing interest, driven by the desire for enhanced comfort, operational efficiency, and regulatory compliance. Major industry players such as Honeywell International Inc., Johnson Controls International PLC, Siemens AG, and Danfoss A/S are actively investing in research and development to introduce innovative products and expand their market presence in China, further stimulating market competition and technological advancement.

China HVAC Field Device Market Company Market Share

Unlocking the Future of Building Efficiency: China HVAC Field Device Market Report 2019-2033

This comprehensive report offers an in-depth analysis of the China HVAC Field Device Market, a critical sector driving energy efficiency and occupant comfort in one of the world's largest economies. Covering the Study Period 2019–2033, with the Base Year and Estimated Year at 2025, and a Forecast Period from 2025–2033, this analysis leverages Historical Period data from 2019–2024 to provide unparalleled market intelligence. Explore the intricate landscape of HVAC control valves, balancing valves, PICVs, damper actuators HVAC, and advanced environmental sensors, including multi-sensors, air quality sensors, and occupancy and lighting controls. Delve into the significant impact of these devices across Commercial, Residential, and Industrial end-user segments. With a projected market size of billions of US dollars, this report is an indispensable resource for manufacturers, suppliers, investors, and policymakers seeking to navigate the dynamic Chinese building automation systems market and capitalize on emerging opportunities in smart buildings and green building technology.

China HVAC Field Device Market Market Structure & Competitive Dynamics

The China HVAC Field Device Market exhibits a moderately concentrated structure, characterized by the presence of both global giants and a growing number of domestic innovators. Key players such as Honeywell International Inc, Johnson Controls International PLC, Siemens AG, and Danfoss A/S command significant market share through established product portfolios and extensive distribution networks. However, specialized players like Rotork Plc, Dwyer Instruments Inc, Belimo Holding AG, and Robert Bosch GmbH contribute unique technological advancements. Advanced Flow Control Group Co Ltd (AFC) is also an emerging force in this competitive arena. The innovation ecosystem is vibrant, driven by the increasing demand for energy-efficient HVAC solutions and stringent government regulations promoting sustainable construction. Product substitutes include simpler mechanical components, but the trend towards smart, connected devices with advanced control capabilities is a significant differentiator. End-user trends are heavily influenced by the rapid urbanization and the growing emphasis on indoor air quality (IAQ) and building energy management systems. Mergers and acquisitions (M&A) activities, while not at a frenzied pace, play a role in market consolidation and technology acquisition. For instance, strategic acquisitions of smaller technology firms by larger players aim to bolster their offerings in areas like IoT-enabled sensors and intelligent actuators. The overall market value for M&A activities in this sector is estimated to be in the hundreds of millions of US dollars annually, reflecting a strategic approach to growth. The regulatory framework, particularly government initiatives supporting green buildings and energy efficiency, acts as both a driver and a constraint, shaping product development and market entry strategies.

China HVAC Field Device Market Industry Trends & Insights

The China HVAC Field Device Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This expansion is fueled by several interconnected industry trends and insights. A primary growth driver is the escalating demand for energy-efficient building solutions. China's commitment to reducing carbon emissions and improving air quality has led to stricter building codes and incentives for adopting advanced HVAC technologies that minimize energy consumption. The penetration of smart building technology is rapidly increasing, with a growing adoption of integrated systems that allow for remote monitoring, control, and optimization of HVAC operations. This trend is particularly pronounced in commercial and industrial sectors, where energy savings translate directly into operational cost reductions.

Technological disruptions are also reshaping the market. The proliferation of the Internet of Things (IoT) is enabling HVAC field devices to become more intelligent and interconnected. Wireless sensor networks, cloud-based analytics, and artificial intelligence (AI) are being integrated into devices to provide predictive maintenance, optimize performance based on occupancy and environmental conditions, and enhance user experience. Indoor air quality (IAQ) has emerged as a paramount concern, especially in the wake of global health events. This has significantly boosted the demand for sophisticated air quality sensors, multi-sensors capable of monitoring parameters like CO2, VOCs, particulate matter, and humidity, and ventilation systems designed to ensure a healthy indoor environment.

Consumer preferences are evolving towards greater comfort, convenience, and health consciousness. Homeowners are increasingly seeking smart home solutions that offer automated climate control, energy savings, and improved IAQ. In the commercial sector, building owners and facility managers are prioritizing occupant well-being and seeking to create healthier, more productive work environments. This shift in demand is driving the adoption of advanced control valves, PICVs, and intelligent damper actuators that offer precise temperature regulation and efficient air distribution.

The competitive landscape is characterized by intense innovation and strategic partnerships. Global players are investing heavily in research and development to introduce cutting-edge products, while local manufacturers are rapidly gaining traction by offering cost-effective solutions tailored to the Chinese market. The market penetration for advanced HVAC field devices is still evolving, with significant room for growth, particularly in lower-tier cities and the residential sector. The overall market value is estimated to reach over $20,000 Million by 2033, up from an estimated $10,000 Million in the base year of 2025, highlighting the immense growth potential.

Dominant Markets & Segments in China HVAC Field Device Market

The China HVAC Field Device Market demonstrates significant dominance across various segments, driven by distinct economic policies, infrastructure development, and evolving consumer demands.

Dominant Region/Country: While the report focuses on China, within China, the Eastern and Southern coastal regions, including major metropolises like Shanghai, Beijing, and Guangzhou, represent the most dominant markets. These areas boast higher concentrations of commercial and industrial development, larger disposable incomes, and greater adoption of advanced technologies due to robust economic growth and proactive implementation of smart city and green building initiatives.

Dominant Segments by Type:

- Control Valves: This segment holds a substantial market share due to their fundamental role in regulating the flow of heating and cooling media in HVAC systems. The increasing deployment of sophisticated building management systems (BMS) and the need for precise temperature control in commercial buildings are key drivers. Market dominance is fueled by the demand for energy efficiency and occupant comfort.

- Damper Actuators HVAC: With the growing emphasis on ventilation and air quality management, damper actuators are crucial for controlling airflow in ducts. Their integration into intelligent ventilation systems for both commercial and residential applications solidifies their dominant position. The rise of demand for smart ventilation solutions is a major contributor.

- Balancing Valves: Essential for ensuring efficient distribution of heating and cooling fluids throughout a building's HVAC system, balancing valves play a critical role in energy conservation and system performance. Their consistent demand across all end-user segments contributes to their market dominance.

- PICV (Pressure Independent Control Valves): While a more advanced technology, PICVs are rapidly gaining traction, especially in larger commercial and industrial projects where precise flow control and system efficiency are paramount. Their ability to maintain a constant flow rate regardless of pressure fluctuations makes them indispensable for modern HVAC designs.

Dominant Segments by End User:

- Commercial: This is the leading end-user segment, encompassing office buildings, retail spaces, hotels, hospitals, and educational institutions. The stringent energy efficiency regulations, the need for optimal occupant comfort, and the growing adoption of smart building technologies in this sector drive the demand for a wide range of HVAC field devices. The market size for commercial HVAC field devices is projected to exceed $8,000 Million in 2025.

- Industrial: The industrial sector, including manufacturing plants, data centers, and warehouses, also represents a significant market. These applications often require robust and specialized HVAC solutions to maintain precise environmental conditions for processes and equipment. Energy efficiency and reliability are key considerations.

- Residential: While historically lagging behind commercial and industrial sectors, the residential segment is witnessing rapid growth. Increasing disposable incomes, rising awareness about indoor air quality and energy savings, and the growing popularity of smart home technologies are propelling the demand for HVAC field devices in new construction and retrofits. The residential market is expected to grow at a CAGR of over 9% during the forecast period.

Dominant Segments by Sensor Type:

- Environmental Sensors: These are foundational for any HVAC system, measuring parameters like temperature and humidity. Their widespread application in all end-user segments ensures their dominant market position.

- Air Quality Sensors: With heightened awareness of IAQ, these sensors, including CO2, VOC, and particulate matter monitors, are experiencing exponential growth, particularly in commercial and residential spaces.

- Occupancy and Lighting: Integration with occupancy sensors and lighting controls allows for intelligent HVAC operation, leading to significant energy savings and enhanced comfort, driving their increasing adoption.

China HVAC Field Device Market Product Innovations

Product innovations in the China HVAC Field Device Market are sharply focused on enhancing energy efficiency, improving indoor air quality, and enabling smarter building management. Manufacturers are developing advanced control valves and PICVs with finer control capabilities and lower leakage rates, reducing energy waste. Smart damper actuators are integrating wireless connectivity and self-diagnostic features for easier installation and maintenance. The development of sophisticated multi-sensors that combine environmental monitoring (temperature, humidity, CO2, VOCs) with occupancy detection is a key trend, enabling HVAC systems to dynamically adapt to real-time conditions. These innovations offer significant competitive advantages by reducing operational costs, improving occupant comfort, and contributing to a healthier building environment. The market is seeing a surge in IoT-enabled devices that seamlessly integrate with Building Management Systems (BMS) and cloud platforms.

Report Segmentation & Scope

This report provides a granular segmentation of the China HVAC Field Device Market, offering detailed insights into each sub-sector. The market is analyzed across key product categories: Control Valve, Balancing Valve, PICV, Damper HVAC, and Damper Actuator HVAC. Furthermore, the sensor segment is meticulously broken down into Environmental Sensors, Multi Sensors, Air Quality Sensors, and Occupancy and Lighting sensors. The analysis also covers the distinct applications within the Commercial, Residential, and Industrial end-user segments. Each segment's current market size, projected growth rates, and competitive dynamics are thoroughly examined. For example, the Commercial segment, valued at an estimated $8,000 Million in 2025, is projected to grow at a CAGR of 8.8%. The Air Quality Sensors segment is expected to experience the highest growth rate, exceeding 12% CAGR, driven by increasing health consciousness.

Key Drivers of China HVAC Field Device Market Growth

Several pivotal factors are propelling the China HVAC Field Device Market forward. Government mandates promoting green building standards and energy efficiency are a primary driver, incentivizing the adoption of advanced HVAC technologies. The rapid pace of urbanization and infrastructure development across China necessitates efficient and reliable HVAC systems for new constructions. Furthermore, rising awareness regarding indoor air quality (IAQ) and occupant comfort, amplified by public health concerns, is boosting demand for sophisticated sensors and control devices. The burgeoning adoption of smart building technologies and the Internet of Things (IoT) is integrating HVAC field devices into connected ecosystems, enabling intelligent automation and remote management, thus unlocking significant growth potential.

Challenges in the China HVAC Field Device Market Sector

Despite robust growth, the China HVAC Field Device Market faces several challenges. Stringent regulatory hurdles and evolving compliance standards can pose difficulties for manufacturers, particularly smaller ones. Supply chain disruptions, as witnessed in recent years, can impact the availability of components and lead to price volatility. Intense competitive pressures, especially from cost-effective domestic players, can squeeze profit margins for established international brands. Furthermore, the lack of skilled technicians for installation and maintenance of advanced systems in some regions can hinder widespread adoption. Quantifiable impacts include potential delays in project completion and increased operational costs for end-users, estimated to be in the range of 5-10% for projects affected by supply chain issues.

Leading Players in the China HVAC Field Device Market Market

- Honeywell International Inc

- Johnson Controls International PLC

- Siemens AG

- Rotork Plc

- Dwyer Instruments Inc

- Belimo Holding AG

- Robert Bosch GmbH

- Electrolux AB

- Danfoss A/S

- Advanced Flow Control Group Co Ltd (AFC)

Key Developments in China HVAC Field Device Market Sector

- June 2023 - Rotork extended the CK range of modular electric valve actuators to include a new part-turn variant, the CKQ. The entire range has a modular design that provides high degrees of configurability and flexibility while enabling quick delivery. This development enhances their offering in actuators, catering to diverse industrial and commercial HVAC applications requiring precise and reliable valve operation.

- March 2023 - Attune launched its latest product for outdoor air quality monitoring. The Outdoor Air Quality Monitoring (OAQ) Kit repackages Attune's UL-2905-certified indoor air quality monitoring sensors for outdoor usage, delivering data on air quality around any given site. This innovation signifies a growing trend towards comprehensive environmental monitoring, impacting the demand for advanced sensor solutions in smart building management.

Strategic China HVAC Field Device Market Market Outlook

The strategic outlook for the China HVAC Field Device Market is overwhelmingly positive, driven by the sustained push for energy efficiency, the ubiquitous adoption of smart building technologies, and the increasing prioritization of indoor air quality. Future growth will be accelerated by further integration of AI and machine learning into HVAC control systems, enabling predictive maintenance and hyper-personalized climate control. The continued expansion of smart city initiatives and government support for green construction will create significant market opportunities. Strategic focus on developing cost-effective, IoT-enabled solutions tailored for the Chinese market, alongside high-performance products for industrial applications, will be crucial for market leadership. The market is poised for substantial expansion, with a strong emphasis on digital transformation and sustainability.

China HVAC Field Device Market Segmentation

-

1. Type

- 1.1. Control Valve

- 1.2. Balancing Valve

- 1.3. PICV

- 1.4. Damper HVAC

- 1.5. Damper Actuator HVAC

-

2. Sensors

- 2.1. Environmental Sensors

- 2.2. Multi Sensors

- 2.3. Air Quality Sensors

- 2.4. Occupancy and Lighting

-

3. End User

- 3.1. Commercial

- 3.2. Residential

- 3.3. Industrial

China HVAC Field Device Market Segmentation By Geography

- 1. China

China HVAC Field Device Market Regional Market Share

Geographic Coverage of China HVAC Field Device Market

China HVAC Field Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High Usage of Heating

- 3.2.2 Ventilation

- 3.2.3 and Air Conditioning Systems; Increase in Commercial Construction Activities

- 3.3. Market Restrains

- 3.3.1. Dependence on Macro-economic Conditions; High Initial Cost of Energy Efficient Systems

- 3.4. Market Trends

- 3.4.1. Control Valve Holding Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China HVAC Field Device Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Control Valve

- 5.1.2. Balancing Valve

- 5.1.3. PICV

- 5.1.4. Damper HVAC

- 5.1.5. Damper Actuator HVAC

- 5.2. Market Analysis, Insights and Forecast - by Sensors

- 5.2.1. Environmental Sensors

- 5.2.2. Multi Sensors

- 5.2.3. Air Quality Sensors

- 5.2.4. Occupancy and Lighting

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Advanced Flow Control Group Co Ltd (AFC)*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson Controls International PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rotork Plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dwyer Instruments Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Belimo Holding AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Robert Bosch GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Electrolux AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Danfoss A/S

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: China HVAC Field Device Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China HVAC Field Device Market Share (%) by Company 2025

List of Tables

- Table 1: China HVAC Field Device Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: China HVAC Field Device Market Revenue Million Forecast, by Sensors 2020 & 2033

- Table 3: China HVAC Field Device Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: China HVAC Field Device Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: China HVAC Field Device Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: China HVAC Field Device Market Revenue Million Forecast, by Sensors 2020 & 2033

- Table 7: China HVAC Field Device Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: China HVAC Field Device Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China HVAC Field Device Market?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the China HVAC Field Device Market?

Key companies in the market include Honeywell International Inc, Advanced Flow Control Group Co Ltd (AFC)*List Not Exhaustive, Johnson Controls International PLC, Rotork Plc, Siemens AG, Dwyer Instruments Inc, Belimo Holding AG, Robert Bosch GmbH, Electrolux AB, Danfoss A/S.

3. What are the main segments of the China HVAC Field Device Market?

The market segments include Type, Sensors, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.24 Million as of 2022.

5. What are some drivers contributing to market growth?

High Usage of Heating. Ventilation. and Air Conditioning Systems; Increase in Commercial Construction Activities.

6. What are the notable trends driving market growth?

Control Valve Holding Significant Market Share.

7. Are there any restraints impacting market growth?

Dependence on Macro-economic Conditions; High Initial Cost of Energy Efficient Systems.

8. Can you provide examples of recent developments in the market?

June 2023 - Rotork extended the CK range of modular electric valve actuators to include a new part-turn variant, the CKQ. The entire range has a modular design that provides high degrees of configurability and flexibility while enabling quick delivery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China HVAC Field Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China HVAC Field Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China HVAC Field Device Market?

To stay informed about further developments, trends, and reports in the China HVAC Field Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence