Key Insights

The global Wireless Flow Sensors Market is poised for substantial expansion, projected to reach a significant market size by 2033, fueled by an impressive Compound Annual Growth Rate (CAGR) of 27.07%. This robust growth trajectory is primarily driven by the increasing demand for real-time monitoring and automation across various industries, coupled with the inherent advantages of wireless technology, such as reduced installation costs, enhanced flexibility, and improved data accessibility. The market is witnessing a significant shift towards smart manufacturing and the Industrial Internet of Things (IIoT), where wireless flow sensors play a pivotal role in optimizing operational efficiency, ensuring precise process control, and enabling predictive maintenance. Furthermore, the growing emphasis on water conservation, stringent environmental regulations, and the need for enhanced safety in hazardous industrial environments are further propelling the adoption of these advanced sensing solutions. The market's expansion is also supported by continuous innovation in sensor technology, leading to more accurate, reliable, and cost-effective wireless flow measurement devices.

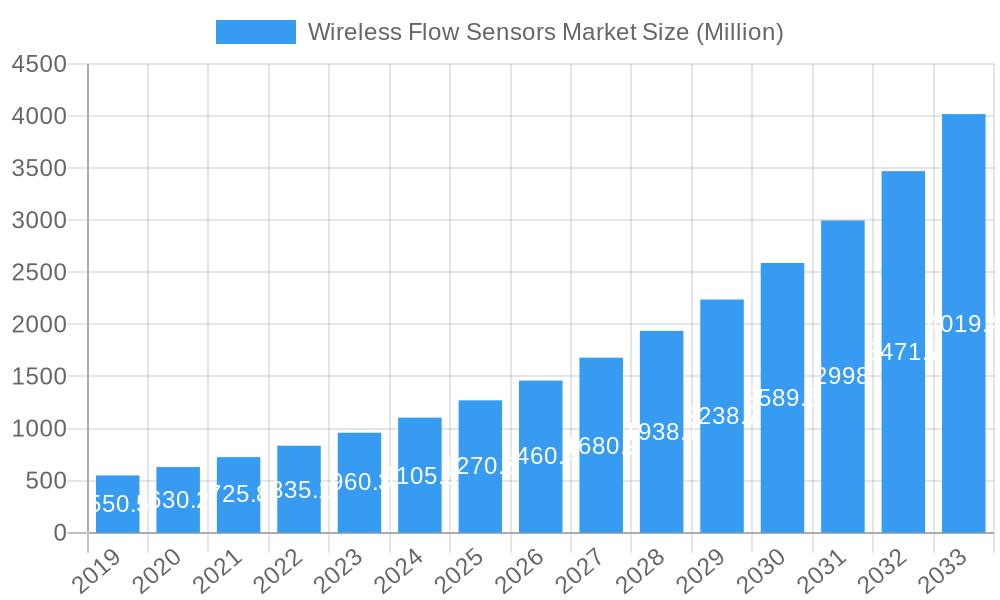

Wireless Flow Sensors Market Market Size (In Million)

The market segmentation reveals a diverse application landscape, with the Water and Wastewater sector expected to be a major consumer of wireless flow sensors, driven by the critical need for efficient resource management and pollution control. The Chemicals and Petrochemicals and Power Generation industries also represent significant growth areas, owing to the demanding requirements for precise fluid handling, safety compliance, and operational optimization in these sectors. Technologically, while Bluetooth and Wi-Fi are established players, emerging technologies like ZigBee and RFID are gaining traction for their specific benefits in industrial settings. Leading companies such as Honeywell International Inc., ABB Ltd., Siemens AG, and Emerson Electric Co. are at the forefront of this market, investing heavily in research and development to introduce innovative products and expand their global footprint. Regional analysis indicates a strong market presence and growth potential across North America, Europe, and Asia Pacific, driven by industrialization, technological adoption, and government initiatives promoting smart infrastructure.

Wireless Flow Sensors Market Company Market Share

Wireless Flow Sensors Market: Comprehensive Analysis and Future Outlook (2019–2033)

This detailed market research report provides an in-depth analysis of the global Wireless Flow Sensors Market, covering the historical period of 2019–2024, the base and estimated year of 2025, and a comprehensive forecast period from 2025 to 2033. We delve into market dynamics, technological advancements, key applications, dominant segments, and the competitive landscape, offering actionable insights for industry stakeholders. The report emphasizes the growing adoption of IoT in industrial processes, driving the demand for smart, connected flow measurement solutions.

Wireless Flow Sensors Market Market Structure & Competitive Dynamics

The Wireless Flow Sensors Market is characterized by a moderately consolidated structure, with a mix of large multinational corporations and specialized technology providers. Innovation is a key competitive differentiator, fostering an ecosystem where companies invest heavily in research and development for enhanced accuracy, connectivity, and data analytics capabilities. Regulatory frameworks, particularly concerning industrial safety and data security, play a crucial role in shaping market entry and product development. The presence of readily available product substitutes, such as wired flow sensors and manual monitoring systems, necessitates continuous innovation to demonstrate the superior value proposition of wireless solutions. End-user trends lean towards the adoption of Industry 4.0 principles, demanding real-time data, remote monitoring, and predictive maintenance. Mergers and acquisition (M&A) activities, while not extensively documented with specific deal values publicly, are observed as strategic moves by larger players to acquire advanced technologies or expand their market reach. Key players are actively pursuing partnerships and collaborations to accelerate the integration of wireless flow sensors with broader automation and digital transformation initiatives. The market share distribution is influenced by factors such as technological expertise, product portfolio breadth, and established customer relationships across diverse industries.

Wireless Flow Sensors Market Industry Trends & Insights

The global Wireless Flow Sensors Market is experiencing robust growth, driven by the accelerating adoption of Industrial Internet of Things (IIoT) and the increasing demand for real-time, accurate flow measurement across various industrial sectors. The inherent advantages of wireless flow sensors, including reduced installation costs, enhanced flexibility, simplified maintenance, and improved data accessibility for remote monitoring and control, are significant growth drivers. Technological advancements in wireless communication protocols such as Bluetooth, ZigBee, Wi-Fi, and cellular technologies are enabling seamless integration with existing plant infrastructure and cloud-based platforms. The increasing need for operational efficiency, reduced downtime, and optimized resource utilization in industries like water and wastewater management, chemicals and petrochemicals, and power generation further fuels market expansion.

Consumer preferences are shifting towards intelligent field devices that offer not only accurate measurement but also diagnostic capabilities and predictive maintenance insights. This trend is spurring innovation in sensor design and software development. The competitive dynamics are intensifying, with established players like Honeywell International Inc., ABB Ltd., Siemens AG, and Emerson Electric Co. investing in R&D and strategic partnerships to maintain their market leadership. Emerging players are focusing on niche applications and specialized wireless technologies. The market penetration of wireless flow sensors is steadily increasing, particularly in greenfield projects and in retrofitting older facilities where the cost and complexity of wired installations are prohibitive. The projected Compound Annual Growth Rate (CAGR) for this market is substantial, reflecting the ongoing digital transformation across industries. The development of advanced algorithms for data analysis and the integration of artificial intelligence (AI) and machine learning (ML) into wireless flow sensor systems are poised to unlock new levels of operational intelligence and efficiency, further solidifying the market's upward trajectory. The increasing focus on environmental monitoring and compliance also necessitates accurate and readily available flow data, contributing to the sustained demand for these advanced sensing solutions.

Dominant Markets & Segments in Wireless Flow Sensors Market

The Wireless Flow Sensors Market exhibits distinct dominance across various geographical regions and technological as well as application segments. North America and Europe currently represent the leading regional markets, driven by early adoption of Industry 4.0 technologies, stringent environmental regulations, and the presence of major industrial players. Within these regions, countries like the United States, Germany, and the United Kingdom showcase high market penetration due to significant investments in smart grid infrastructure, advanced manufacturing, and water management systems.

Technology Dominance:

- Wi-Fi/WLAN: This technology segment is witnessing significant growth due to its established infrastructure, high bandwidth, and ability to support complex data transfer. Its dominance is further amplified by applications requiring continuous, real-time data streams and integration with enterprise-level systems. The ease of deployment in existing industrial networks makes Wi-Fi a preferred choice for many smart factory initiatives.

- Bluetooth: Bluetooth technology is gaining traction for its low power consumption, cost-effectiveness, and suitability for localized monitoring and configuration. Its integration with mobile devices and apps facilitates on-site diagnostics and maintenance, making it a popular choice for smaller-scale deployments and specific application needs.

- ZigBee: While less prevalent than Wi-Fi, ZigBee is a strong contender in applications requiring robust mesh networking capabilities and energy efficiency, particularly in large-scale sensor networks where power management is critical.

- RFID: Radio-Frequency Identification (RFID) is carving out a niche in asset tracking and inventory management aspects related to flow systems, rather than primary flow measurement itself, but its integration offers added value in certain industrial contexts.

- EnOcean: This wireless technology, focusing on energy harvesting, is emerging for self-powered sensors in remote or hard-to-reach locations, reducing the need for battery replacements and associated maintenance costs.

Application Dominance:

- Water and Wastewater: This segment is a primary driver of the Wireless Flow Sensors Market. Growing concerns about water scarcity, aging infrastructure, and the need for efficient water management and wastewater treatment are leading to widespread adoption of wireless flow monitoring. Economic policies promoting water conservation and smart city initiatives further bolster this segment.

- Chemicals and Petrochemicals: The stringent safety requirements and the need for precise process control in this industry make wireless flow sensors indispensable. Real-time monitoring of flow rates for reactants, products, and utilities ensures operational safety, optimizes production yields, and minimizes environmental risks. Infrastructure upgrades and a focus on predictive maintenance in chemical plants are key drivers.

- Power Generation: Accurate flow measurement is critical for efficiency and safety in power plants, whether for fuel input, cooling systems, or steam generation. Wireless solutions offer flexibility in installing sensors in challenging environments and facilitate remote monitoring of critical parameters. The transition towards renewable energy sources and the modernization of existing power infrastructure also contribute to demand.

- Other Applications: This broad category includes sectors like food and beverage, pharmaceuticals, and manufacturing, where precise flow control is crucial for product quality, process efficiency, and compliance. The increasing automation in these diverse industries is a significant growth enabler.

Wireless Flow Sensors Market Product Innovations

Product innovation in the Wireless Flow Sensors Market is centered on enhancing data accuracy, connectivity, and user-friendliness. Key developments include the integration of advanced communication modules like Wi-Fi for seamless configuration and diagnostics, as well as Bluetooth for mobile app accessibility. These innovations enable remote monitoring, predictive maintenance, and integration with cloud-based platforms, offering significant competitive advantages. For instance, Emerson Electric Co.'s Micro Motion Model 5700 Coriolis Transmitter with Wi-Fi connectivity exemplifies this trend by providing total flow measurement confidence and valuable process insights, all configurable via a Wi-Fi connection that turns the transmitter into an access point. Endress+Hauser Group Services AG's Proline 10 series, combinable with Promag and Promassflow sensors and operable via Bluetooth with the SmartBlue app, further highlights the trend towards user-friendly, app-enabled devices for various industrial applications. These advancements are crucial for meeting the evolving demands of smart manufacturing and Industry 4.0.

Report Segmentation & Scope

This report meticulously segments the Wireless Flow Sensors Market across key dimensions to provide granular insights. The segmentation is structured to cover the diverse technological underpinnings and the varied industrial applications driving market growth.

- Technology Segmentation: The report analyzes the market share and growth projections for technologies including Bluetooth, ZigBee, RFID, Wi-Fi, WLAN, and EnOcean. Each technology segment is evaluated based on its adoption rates, technical capabilities, and suitability for different industrial environments, highlighting the competitive dynamics and market trends within each.

- Application Segmentation: The market is further segmented by application, focusing on critical sectors such as Water and Wastewater, Chemicals and Petrochemicals, Power Generation, and Other Applications. For each application, the report details market size, growth drivers, key use cases, and the specific challenges and opportunities presented by wireless flow sensor technology.

Key Drivers of Wireless Flow Sensors Market Growth

The growth of the Wireless Flow Sensors Market is propelled by several interconnected factors. The pervasive adoption of Industry 4.0 and the Industrial Internet of Things (IIoT) is a primary catalyst, demanding connected, intelligent devices for real-time data acquisition and remote monitoring. Technological advancements in wireless communication protocols (Wi-Fi, Bluetooth, ZigBee) are enhancing data transmission speed, reliability, and energy efficiency, making wireless solutions more practical and cost-effective. The increasing need for operational efficiency, predictive maintenance, and reduced downtime across industries like water and wastewater, chemicals, and power generation directly translates into higher demand for accurate and accessible flow measurement. Furthermore, stringent regulatory compliance regarding environmental monitoring and industrial safety mandates the deployment of robust sensing technologies. The decreasing cost of wireless hardware and the availability of specialized software platforms for data analytics further contribute to market expansion, making these advanced solutions accessible to a broader range of businesses.

Challenges in the Wireless Flow Sensors Market Sector

Despite the robust growth, the Wireless Flow Sensors Market faces several challenges. Connectivity issues, especially in harsh industrial environments with potential signal interference, can impact data reliability and require careful deployment strategies. Security concerns regarding data transmission and unauthorized access are paramount, necessitating robust cybersecurity measures and protocols. The initial investment in wireless infrastructure and compatible systems, although often offset by long-term savings, can be a barrier for some small and medium-sized enterprises. The availability of skilled personnel for installation, maintenance, and data interpretation of these advanced systems also poses a challenge. Furthermore, standardization across different wireless protocols and communication platforms is still evolving, which can create integration complexities. Finally, the need for rigorous calibration and certification processes to ensure accuracy and compliance in critical applications adds to the overall implementation effort and cost.

Leading Players in the Wireless Flow Sensors Market Market

The Wireless Flow Sensors Market is home to a number of prominent companies driving innovation and market growth. These leading players are instrumental in shaping the technology landscape and expanding the application reach of wireless flow measurement solutions. The list of key companies includes:

- Honeywell International Inc

- ABB Ltd

- Microchip Technology Inc

- Sensata Technologies Inc

- Endress+Hauser Group Services AG

- Emerson Electric Co

- NXP Semiconductors

- Siemens AG

- Texas Instruments Incorporated

- Panasonic Corporation

- AW-Lake

Key Developments in Wireless Flow Sensors Market Sector

- September 2022: Wireless technology enabled intelligent field device configuration and diagnostics options for process automation-related mobile applications. Emerson Electric Co.'s Micro Motion Model 5700 Advanced, Field-Mount, or Truck-Mount Coriolis Transmitter with Wi-Fi connectivity ensures total flow measurement confidence, valuable process insight, and greater operational efficiency. It now has an option for configuration via a Wi-Fi connection. The Wi-Fi option turns the 5700 transmitters into an access point, enabling easy connections with an SSID and WPA2 password.

- July 2021: Endress+Hauser Group Services AG launched its new Proline 10. Promag and Promassflow sensors can be combined with four different Proline 10 transmitters as a compact version. With two status LEDs, these flow sensors can be operated with the SmartBlue app via Bluetooth. These flowmeters cover several basic applications in various industries. The Proline Promag electromagnetic flowmeters are suited for conductive liquids and volume measurement of water and corrosive liquids.

Strategic Wireless Flow Sensors Market Market Outlook

The strategic outlook for the Wireless Flow Sensors Market is highly positive, driven by the continuous evolution of digital industrial technologies and the increasing imperative for data-driven decision-making. The ongoing advancements in wireless communication, edge computing, and AI are set to unlock new functionalities, including more sophisticated predictive analytics and autonomous process optimization. Market growth will be further accelerated by the expansion of wireless flow sensor adoption in emerging economies and underserved application areas. Strategic opportunities lie in developing integrated solutions that combine flow sensing with other IIoT devices, offering comprehensive plant monitoring and control capabilities. Companies that focus on enhancing cybersecurity, ensuring interoperability, and providing robust data analytics platforms will be well-positioned to capitalize on the future potential of this dynamic market. The trend towards remote operations and the need for resilient supply chains will continue to fuel the demand for flexible and intelligent flow measurement solutions.

Wireless Flow Sensors Market Segmentation

-

1. Technology

- 1.1. Bluetooth

- 1.2. ZigBee

- 1.3. RFID

- 1.4. Wi-Fi

- 1.5. WLAN

- 1.6. EnOcean

-

2. Application

- 2.1. Water and Wastewater

- 2.2. Chemicals and Petrochemicals

- 2.3. Power Generation

- 2.4. Other Applications

Wireless Flow Sensors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Wireless Flow Sensors Market Regional Market Share

Geographic Coverage of Wireless Flow Sensors Market

Wireless Flow Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Application of Temperature Sensors in Industries; Increasing Demand for Temperature Sensors in Consumer Electronics

- 3.3. Market Restrains

- 3.3.1. Shorter Operating Range of WiGig Products

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Wireless Technologies to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless Flow Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Bluetooth

- 5.1.2. ZigBee

- 5.1.3. RFID

- 5.1.4. Wi-Fi

- 5.1.5. WLAN

- 5.1.6. EnOcean

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Water and Wastewater

- 5.2.2. Chemicals and Petrochemicals

- 5.2.3. Power Generation

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Wireless Flow Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Bluetooth

- 6.1.2. ZigBee

- 6.1.3. RFID

- 6.1.4. Wi-Fi

- 6.1.5. WLAN

- 6.1.6. EnOcean

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Water and Wastewater

- 6.2.2. Chemicals and Petrochemicals

- 6.2.3. Power Generation

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Wireless Flow Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Bluetooth

- 7.1.2. ZigBee

- 7.1.3. RFID

- 7.1.4. Wi-Fi

- 7.1.5. WLAN

- 7.1.6. EnOcean

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Water and Wastewater

- 7.2.2. Chemicals and Petrochemicals

- 7.2.3. Power Generation

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Wireless Flow Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Bluetooth

- 8.1.2. ZigBee

- 8.1.3. RFID

- 8.1.4. Wi-Fi

- 8.1.5. WLAN

- 8.1.6. EnOcean

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Water and Wastewater

- 8.2.2. Chemicals and Petrochemicals

- 8.2.3. Power Generation

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Wireless Flow Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Bluetooth

- 9.1.2. ZigBee

- 9.1.3. RFID

- 9.1.4. Wi-Fi

- 9.1.5. WLAN

- 9.1.6. EnOcean

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Water and Wastewater

- 9.2.2. Chemicals and Petrochemicals

- 9.2.3. Power Generation

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Wireless Flow Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Bluetooth

- 10.1.2. ZigBee

- 10.1.3. RFID

- 10.1.4. Wi-Fi

- 10.1.5. WLAN

- 10.1.6. EnOcean

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Water and Wastewater

- 10.2.2. Chemicals and Petrochemicals

- 10.2.3. Power Generation

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Microchip Technology Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sensata Technologies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Endress+Hauser Group Services AG*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Emerson Electric Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NXP Semiconductors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Texas Instruments Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panasonic Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AW-Lake

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Wireless Flow Sensors Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Wireless Flow Sensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 3: North America Wireless Flow Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Wireless Flow Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America Wireless Flow Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Wireless Flow Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Wireless Flow Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wireless Flow Sensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 9: Europe Wireless Flow Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Wireless Flow Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: Europe Wireless Flow Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Wireless Flow Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Wireless Flow Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Wireless Flow Sensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 15: Asia Pacific Wireless Flow Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Wireless Flow Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Asia Pacific Wireless Flow Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Wireless Flow Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Wireless Flow Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Wireless Flow Sensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 21: Latin America Wireless Flow Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Latin America Wireless Flow Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Latin America Wireless Flow Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Wireless Flow Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Wireless Flow Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Wireless Flow Sensors Market Revenue (undefined), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Wireless Flow Sensors Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Wireless Flow Sensors Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Wireless Flow Sensors Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Wireless Flow Sensors Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Wireless Flow Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 5: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 8: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 11: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 14: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 17: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Wireless Flow Sensors Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless Flow Sensors Market?

The projected CAGR is approximately 20.6%.

2. Which companies are prominent players in the Wireless Flow Sensors Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Microchip Technology Inc, Sensata Technologies Inc, Endress+Hauser Group Services AG*List Not Exhaustive, Emerson Electric Co, NXP Semiconductors, Siemens AG, Texas Instruments Incorporated, Panasonic Corporation, AW-Lake.

3. What are the main segments of the Wireless Flow Sensors Market?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Application of Temperature Sensors in Industries; Increasing Demand for Temperature Sensors in Consumer Electronics.

6. What are the notable trends driving market growth?

Increasing Adoption of Wireless Technologies to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Shorter Operating Range of WiGig Products.

8. Can you provide examples of recent developments in the market?

September 2022: Wireless technology enabled intelligent field device configuration and diagnostics options for process automation-related mobile applications. Emerson Electric Co's Micro Motion Model 5700 Advanced, Field-Mount, or Truck-Mount Coriolis Transmitter with Wi-Fi connectivity ensures total flow measurement confidence, valuable process insight, and greater operational efficiency. It now has an option for configuration via a Wi-Fi connection. The Wi-Fi option turns the 5700 transmitters into an access point, enabling easy connections with an SSID and WPA2 password.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wireless Flow Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wireless Flow Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wireless Flow Sensors Market?

To stay informed about further developments, trends, and reports in the Wireless Flow Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence