Key Insights

The Commercial Satellite Imaging Market is experiencing robust expansion, projected to reach an estimated USD 5.04 billion in 2025, with an impressive Compound Annual Growth Rate (CAGR) of 11.84% through 2033. This significant growth is propelled by a confluence of powerful drivers, including the escalating demand for high-resolution geospatial data across diverse sectors. Key applications such as Natural Resource Management, Surveillance and Security, and Disaster Management are pivotal in fueling this expansion. The increasing adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML) for data analysis further enhances the value proposition of commercial satellite imagery, enabling more sophisticated insights and actionable intelligence. Furthermore, the growing deployment of small satellite constellations is democratizing access to space-based data, fostering innovation and expanding market reach.

Commercial Satellite Imaging Market Market Size (In Billion)

The market's trajectory is also shaped by emerging trends that underscore its dynamism. The burgeoning adoption of cloud-based platforms for data processing and dissemination is streamlining workflows and improving accessibility for end-users. Furthermore, the integration of satellite imagery with other data sources, such as IoT sensors and ground-based surveys, is creating comprehensive geospatial solutions. While the market presents immense opportunities, certain restraints, such as the high initial investment costs for satellite development and launch, and evolving regulatory landscapes, pose challenges. However, strategic partnerships, technological advancements in sensor technology, and the increasing awareness of the benefits of geospatial intelligence are expected to outweigh these limitations, ensuring sustained market growth across segments like Government, Construction, Military and Defense, and Energy.

Commercial Satellite Imaging Market Company Market Share

This in-depth report provides a detailed analysis of the global Commercial Satellite Imaging Market, encompassing market structure, industry trends, dominant segments, product innovations, growth drivers, challenges, leading players, and future outlook. With a study period from 2019 to 2033, and a base year of 2025, this report offers actionable insights for stakeholders seeking to understand and capitalize on the rapidly evolving commercial satellite imagery market. Our analysis leverages high-ranking keywords such as satellite data analytics, geospatial intelligence, earth observation satellites, remote sensing technology, and commercial remote sensing.

Commercial Satellite Imaging Market Market Structure & Competitive Dynamics

The commercial satellite imaging market exhibits a moderately concentrated structure, with a blend of established players and emerging innovators driving competition. Key companies like DigitalGlobe Inc, L3Harris Corporation Inc, and Planet Labs Inc hold significant market share, leveraging extensive satellite constellations and advanced processing capabilities. The innovation ecosystem is vibrant, fueled by advancements in sensor technology, data analytics, and artificial intelligence, enabling higher resolution imagery and more sophisticated geospatial data acquisition and mapping. Regulatory frameworks, though evolving, primarily focus on data security, privacy, and export controls, influencing market access and operational strategies. Product substitutes are limited, with ground-based sensors and aerial imagery offering different resolutions and coverage. End-user trends indicate a growing demand for real-time data and integrated analytical solutions across various verticals. Mergers and acquisitions (M&A) activities are notable, with strategic deals aimed at consolidating capabilities, expanding market reach, and acquiring specialized technologies. For instance, recent M&A deals in the past three years have collectively valued at approximately $500 Million to $1 Billion, indicating significant investment and consolidation efforts within the commercial satellite imagery sector.

Commercial Satellite Imaging Market Industry Trends & Insights

The commercial satellite imaging market is experiencing robust growth, propelled by increasing demand for actionable intelligence across diverse industries. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033. Key growth drivers include the escalating need for accurate geospatial data acquisition and mapping, driven by urbanization and infrastructure development. Technological disruptions are continuously reshaping the market, with the advent of high-resolution optical and synthetic-aperture radar (SAR) satellites, miniaturization of satellite technology, and the proliferation of AI-powered analytics platforms for satellite data processing. Consumer preferences are shifting towards subscription-based models, cloud-based platforms, and end-to-end solutions that integrate raw imagery with value-added analytics for applications like natural resource management and surveillance and security. Competitive dynamics are intensifying, characterized by strategic partnerships, technological advancements, and the expansion of service offerings by leading players. The commercial remote sensing market is witnessing a significant increase in data accessibility and affordability, democratizing the use of satellite imagery beyond traditional government and defense sectors. The integration of machine learning algorithms for automated feature extraction and change detection is a critical trend, enhancing the efficiency and accuracy of earth observation analysis. Furthermore, the development of constellations with higher revisit rates is crucial for applications requiring near real-time monitoring, such as disaster management and defense and intelligence. The market penetration of geospatial intelligence solutions is expanding as more businesses recognize the strategic value of satellite-derived insights for operational efficiency and strategic decision-making.

Dominant Markets & Segments in Commercial Satellite Imaging Market

The Commercial Satellite Imaging Market is experiencing significant dominance in specific regions and application segments.

Leading Region: North America currently holds the largest market share, driven by substantial investments in defense, intelligence, and technological innovation. The United States, in particular, is a major consumer and producer of commercial satellite imagery, supported by government initiatives like the aforementioned Luno program.

- Key Drivers in North America:

- Strong government demand for defense and intelligence applications.

- Robust technological infrastructure and a high concentration of leading satellite data analytics companies.

- Significant investments in infrastructure development and natural resource management.

- Key Drivers in North America:

Dominant Application Segment: Geospatial Data Acquisition and Mapping consistently leads the market. This segment is fundamental to a wide array of other applications, providing the foundational data for analysis and decision-making. The increasing demand for high-resolution imagery for urban planning, environmental monitoring, and infrastructure development fuels its dominance.

Dominant End-user Vertical: The Government and Military and Defense verticals are the largest consumers of commercial satellite imagery. Their consistent need for surveillance and security, intelligence gathering, and disaster management operations drives significant market demand. The National Geospatial-Intelligence Agency's (NGA) increased reliance on commercial sources underscores this trend.

Detailed Dominance Analysis - Application Segments:

- Geospatial Data Acquisition and Mapping: This segment's growth is propelled by the need for accurate, up-to-date maps for urban planning, agricultural analysis, and infrastructure monitoring. The ability of earth observation satellites to provide comprehensive coverage makes this a cornerstone of the market.

- Surveillance and Security: The global rise in security concerns and border monitoring requirements significantly boosts this segment. Commercial satellite imagery offers cost-effective and scalable solutions for monitoring critical infrastructure and identifying potential threats.

- Defense and Intelligence: This segment is a perpetual high-value market. Satellite data analytics are critical for strategic planning, battlefield awareness, and threat assessment, driving substantial procurement from commercial providers.

- Natural Resource Management: With growing concerns about climate change and resource depletion, this segment is witnessing accelerated adoption. Satellite imagery aids in monitoring forests, water bodies, and agricultural land, supporting sustainable practices.

- Disaster Management: The increasing frequency and intensity of natural disasters worldwide have made commercial satellite imagery an indispensable tool for early warning, damage assessment, and response coordination.

- Construction and Development: Accurate site analysis, progress monitoring, and environmental impact assessments for large-scale projects are increasingly reliant on satellite data.

- Conservation and Research: Environmental scientists and conservationists utilize satellite imagery for monitoring biodiversity, tracking deforestation, and studying climate change impacts.

Detailed Dominance Analysis - End-user Verticals:

- Government: Beyond defense, government agencies use satellite data for urban planning, environmental regulation, emergency management, and public safety initiatives.

- Military and Defense: This sector consistently represents a significant portion of the market, utilizing imagery for reconnaissance, targeting, and situational awareness.

- Energy: The energy sector uses satellite imagery for exploration, pipeline monitoring, site assessment for renewable energy projects, and environmental impact studies.

- Forestry and Agriculture: Precision agriculture and sustainable forestry practices are heavily reliant on satellite data for crop health monitoring, yield prediction, and forest fire detection.

- Transportation and Logistics: Satellite imagery supports route planning, infrastructure monitoring (roads, railways), and logistics optimization.

Commercial Satellite Imaging Market Product Innovations

Innovations in the commercial satellite imaging market are characterized by advancements in resolution, spectral capabilities, and data processing. Companies are developing next-generation constellations offering higher revisit rates and improved accuracy, enabling near real-time monitoring. The integration of artificial intelligence and machine learning into satellite data analytics platforms is a key trend, allowing for automated feature extraction, anomaly detection, and predictive modeling. These innovations enhance the value proposition of earth observation satellites by transforming raw imagery into actionable intelligence for diverse applications, from surveillance and security to natural resource management. The development of synthetic aperture radar (SAR) satellites with enhanced all-weather imaging capabilities further expands the market's utility.

Report Segmentation & Scope

This report segments the Commercial Satellite Imaging Market based on Application and End-user Vertical.

Application Segments:

- Geospatial Data Acquisition and Mapping: This segment, projected to reach approximately $15 Billion by 2033, involves capturing and processing satellite imagery for creating detailed maps and spatial datasets.

- Natural Resource Management: Valued at around $8 Billion by 2033, this segment focuses on monitoring and managing earth's resources like forests, water, and agriculture.

- Surveillance and Security: Estimated at $12 Billion by 2033, this segment utilizes imagery for monitoring borders, critical infrastructure, and public safety.

- Conservation and Research: Expected to reach $4 Billion by 2033, this segment supports environmental studies and biodiversity monitoring.

- Construction and Development: Projected to be $6 Billion by 2033, this segment is vital for site assessment and progress tracking in infrastructure projects.

- Disaster Management: Valued at $7 Billion by 2033, this segment aids in response and recovery efforts for natural and man-made disasters.

- Defense and Intelligence: A substantial segment estimated at $20 Billion by 2033, crucial for national security and strategic analysis.

End-user Vertical Segments:

- Government: A leading segment with projected market size of $25 Billion by 2033, encompassing various civilian agencies.

- Construction: Expected to reach $6 Billion by 2033, serving infrastructure and building projects.

- Transportation and Logistics: Projected at $5 Billion by 2033, supporting infrastructure and operational efficiency.

- Military and Defense: A dominant segment valued at $20 Billion by 2033, crucial for defense operations.

- Energy: Estimated at $7 Billion by 2033, supporting exploration and monitoring.

- Forestry and Agriculture: Projected to grow to $9 Billion by 2033, facilitating precision farming and sustainable forestry.

- Other End-user Verticals: Including insurance, telecommunications, and media, projected to reach $4 Billion by 2033.

Key Drivers of Commercial Satellite Imaging Market Growth

The Commercial Satellite Imaging Market is propelled by several critical drivers. Technological advancements, including the deployment of higher resolution sensors and more sophisticated earth observation satellites, are fundamental. The increasing demand for actionable insights from geospatial intelligence across various sectors, particularly defense and intelligence and natural resource management, is a significant economic factor. Regulatory shifts favoring the increased utilization of commercial remote sensing technology by government agencies, such as the NGA's Luno program, are creating new market opportunities. Furthermore, the growing need for precise data in areas like urban planning, precision agriculture, and disaster response, driven by global challenges, further fuels market expansion. The decreasing cost of satellite imagery and data processing services also democratizes access, expanding its adoption by smaller enterprises and research institutions.

Challenges in the Commercial Satellite Imaging Market Sector

Despite its robust growth, the Commercial Satellite Imaging Market faces several challenges. Regulatory hurdles and data privacy concerns can limit market access and data utilization, particularly for sensitive applications. The high initial investment and operational costs associated with launching and maintaining satellite constellations remain a barrier, though diminishing with technological advancements. Supply chain issues in the manufacturing of satellite components and ground infrastructure can lead to project delays. Intense competition among providers, especially in saturated market segments, can put pressure on pricing and profit margins. Furthermore, the need for specialized expertise in satellite data analytics and interpretation can limit the adoption of these solutions by less technically advanced organizations. Cybersecurity threats to satellite systems and data transmission also pose a growing concern.

Leading Players in the Commercial Satellite Imaging Market Market

- L3Harris Corporation Inc

- BlackSky Global LLC

- Skylab Analytics

- DigitalGlobe Inc

- SpaceKnow Inc

- ImageSat International NV

- Galileo Group Inc

- European Space Imaging (EUSI) GmbH

- Planet Labs Inc

- UrtheCast Corp

Key Developments in Commercial Satellite Imaging Market Sector

- February 2024 - The National Geospatial-Intelligence Agency is supercharging its use of commercial satellite imagery and analytics with a procurement program, “Luno.” The Luno program seeks to leverage commercial satellite imagery and data analytics to enhance NGA’s global monitoring capabilities. This development signifies a strong governmental endorsement and increased demand for commercial geospatial intelligence and satellite data analytics.

Strategic Commercial Satellite Imaging Market Market Outlook

The strategic outlook for the Commercial Satellite Imaging Market is exceptionally positive, driven by sustained innovation and expanding applications. The increasing reliance of governments and industries on geospatial intelligence for critical decision-making, coupled with advancements in earth observation satellites and satellite data analytics, will continue to accelerate market growth. The trend towards integrated solutions, offering not just imagery but comprehensive analytical services, presents significant strategic opportunities. Furthermore, the expanding capabilities of companies like Planet Labs Inc and BlackSky Global LLC in providing frequent and high-resolution data will unlock new use cases, particularly in real-time monitoring for disaster management and surveillance and security. The growing integration of AI and machine learning will further enhance the value proposition, making satellite data more accessible and insightful, solidifying its position as an indispensable tool across diverse sectors.

Commercial Satellite Imaging Market Segmentation

-

1. Application

- 1.1. Geospatial Data Acquisition and Mapping

- 1.2. Natural Resource Management

- 1.3. Surveillance and Security

- 1.4. Conservation and Research

- 1.5. Construction and Development

- 1.6. Disaster Management

- 1.7. Defense and Intelligence

-

2. End-user Vertical

- 2.1. Government

- 2.2. Construction

- 2.3. Transportation and Logistics

- 2.4. Military and Defense

- 2.5. Energy

- 2.6. Forestry and Agriculture

- 2.7. Other End-user Verticals

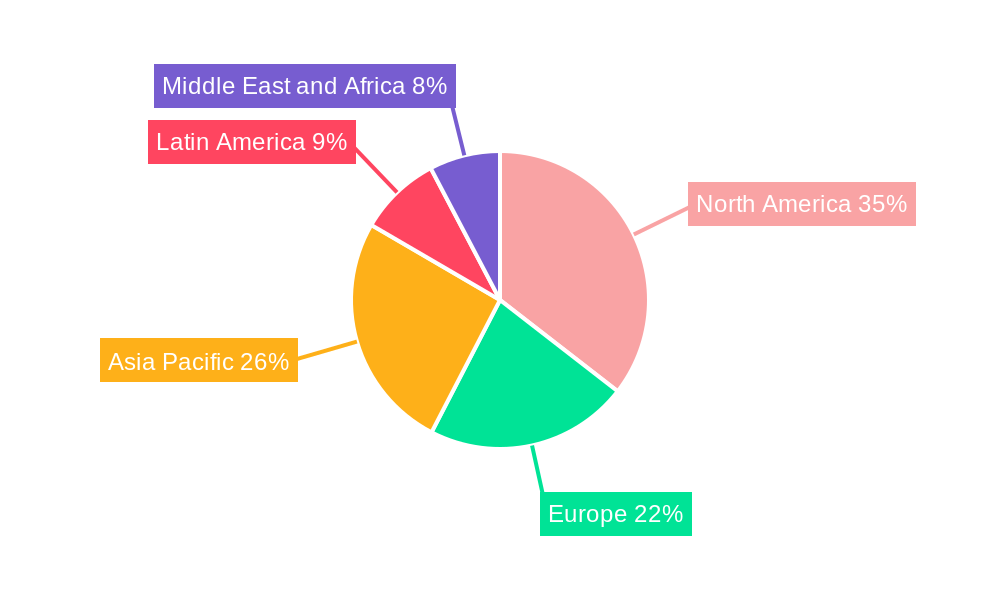

Commercial Satellite Imaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Commercial Satellite Imaging Market Regional Market Share

Geographic Coverage of Commercial Satellite Imaging Market

Commercial Satellite Imaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Requirement for Efficient Monitoring of Vast Land Areas; Rising Smart City Initiatives; Big Data and Imagery Analytics

- 3.3. Market Restrains

- 3.3.1. High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. Military and Defense is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Geospatial Data Acquisition and Mapping

- 5.1.2. Natural Resource Management

- 5.1.3. Surveillance and Security

- 5.1.4. Conservation and Research

- 5.1.5. Construction and Development

- 5.1.6. Disaster Management

- 5.1.7. Defense and Intelligence

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Government

- 5.2.2. Construction

- 5.2.3. Transportation and Logistics

- 5.2.4. Military and Defense

- 5.2.5. Energy

- 5.2.6. Forestry and Agriculture

- 5.2.7. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Geospatial Data Acquisition and Mapping

- 6.1.2. Natural Resource Management

- 6.1.3. Surveillance and Security

- 6.1.4. Conservation and Research

- 6.1.5. Construction and Development

- 6.1.6. Disaster Management

- 6.1.7. Defense and Intelligence

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Government

- 6.2.2. Construction

- 6.2.3. Transportation and Logistics

- 6.2.4. Military and Defense

- 6.2.5. Energy

- 6.2.6. Forestry and Agriculture

- 6.2.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Geospatial Data Acquisition and Mapping

- 7.1.2. Natural Resource Management

- 7.1.3. Surveillance and Security

- 7.1.4. Conservation and Research

- 7.1.5. Construction and Development

- 7.1.6. Disaster Management

- 7.1.7. Defense and Intelligence

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Government

- 7.2.2. Construction

- 7.2.3. Transportation and Logistics

- 7.2.4. Military and Defense

- 7.2.5. Energy

- 7.2.6. Forestry and Agriculture

- 7.2.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Geospatial Data Acquisition and Mapping

- 8.1.2. Natural Resource Management

- 8.1.3. Surveillance and Security

- 8.1.4. Conservation and Research

- 8.1.5. Construction and Development

- 8.1.6. Disaster Management

- 8.1.7. Defense and Intelligence

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Government

- 8.2.2. Construction

- 8.2.3. Transportation and Logistics

- 8.2.4. Military and Defense

- 8.2.5. Energy

- 8.2.6. Forestry and Agriculture

- 8.2.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Geospatial Data Acquisition and Mapping

- 9.1.2. Natural Resource Management

- 9.1.3. Surveillance and Security

- 9.1.4. Conservation and Research

- 9.1.5. Construction and Development

- 9.1.6. Disaster Management

- 9.1.7. Defense and Intelligence

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Government

- 9.2.2. Construction

- 9.2.3. Transportation and Logistics

- 9.2.4. Military and Defense

- 9.2.5. Energy

- 9.2.6. Forestry and Agriculture

- 9.2.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Geospatial Data Acquisition and Mapping

- 10.1.2. Natural Resource Management

- 10.1.3. Surveillance and Security

- 10.1.4. Conservation and Research

- 10.1.5. Construction and Development

- 10.1.6. Disaster Management

- 10.1.7. Defense and Intelligence

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Government

- 10.2.2. Construction

- 10.2.3. Transportation and Logistics

- 10.2.4. Military and Defense

- 10.2.5. Energy

- 10.2.6. Forestry and Agriculture

- 10.2.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Corporation Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BlackSky Global LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Skylab Analytics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DigitalGlobe Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SpaceKnow Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ImageSat International NV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Galileo Group Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 European Space Imaging (EUSI) GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Planet Labs Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 UrtheCast Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 L3Harris Corporation Inc

List of Figures

- Figure 1: Global Commercial Satellite Imaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Satellite Imaging Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Commercial Satellite Imaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 5: North America Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 6: North America Commercial Satellite Imaging Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Commercial Satellite Imaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Commercial Satellite Imaging Market Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Commercial Satellite Imaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: Europe Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Europe Commercial Satellite Imaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Commercial Satellite Imaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Commercial Satellite Imaging Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Commercial Satellite Imaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 17: Asia Pacific Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: Asia Pacific Commercial Satellite Imaging Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Commercial Satellite Imaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Commercial Satellite Imaging Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Latin America Commercial Satellite Imaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Latin America Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Latin America Commercial Satellite Imaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Commercial Satellite Imaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Commercial Satellite Imaging Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Commercial Satellite Imaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 29: Middle East and Africa Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 30: Middle East and Africa Commercial Satellite Imaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Commercial Satellite Imaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 9: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 15: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Satellite Imaging Market?

The projected CAGR is approximately 11.84%.

2. Which companies are prominent players in the Commercial Satellite Imaging Market?

Key companies in the market include L3Harris Corporation Inc, BlackSky Global LLC, Skylab Analytics, DigitalGlobe Inc, SpaceKnow Inc, ImageSat International NV, Galileo Group Inc, European Space Imaging (EUSI) GmbH, Planet Labs Inc, UrtheCast Corp.

3. What are the main segments of the Commercial Satellite Imaging Market?

The market segments include Application, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Requirement for Efficient Monitoring of Vast Land Areas; Rising Smart City Initiatives; Big Data and Imagery Analytics.

6. What are the notable trends driving market growth?

Military and Defense is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

February 2024 - The National Geospatial-Intelligence Agency is supercharging its use of commercial satellite imagery and analytics with a procurement program, “Luno.” The Luno program seeks to leverage commercial satellite imagery and data analytics to enhance NGA’s global monitoring capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Satellite Imaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Satellite Imaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Satellite Imaging Market?

To stay informed about further developments, trends, and reports in the Commercial Satellite Imaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence