Key Insights

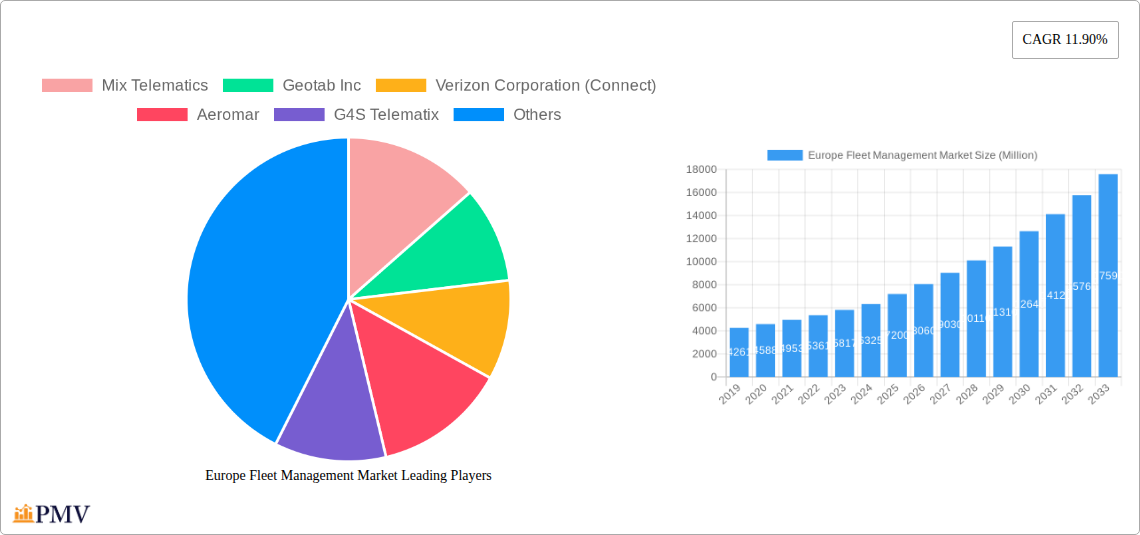

The Europe Fleet Management Market is poised for substantial growth, projected to reach \$7.20 million in 2025 and expand at an impressive Compound Annual Growth Rate (CAGR) of 11.90% through 2033. This robust expansion is fueled by a confluence of powerful drivers, including the increasing adoption of advanced telematics solutions, the growing demand for enhanced operational efficiency, and the stringent regulatory landscape mandating improved safety and compliance. Key applications such as asset management, information management, and driver management are witnessing significant uptake as businesses strive to gain greater control and visibility over their vehicle fleets. The ongoing digital transformation across industries like transportation, energy, and construction is further accelerating the deployment of sophisticated fleet management systems.

Europe Fleet Management Market Market Size (In Billion)

Emerging trends within the market point towards a greater emphasis on real-time data analytics, predictive maintenance, and the integration of IoT devices to optimize fleet performance and reduce operational costs. While the market exhibits strong momentum, certain restraints such as the initial implementation costs and the need for skilled personnel to manage these complex systems may present challenges. However, the undeniable benefits of improved fuel efficiency, enhanced driver safety, and streamlined logistics are outweighing these concerns. Geographically, Europe, with its strong focus on sustainability and technological advancement, is a pivotal region for fleet management solutions, with countries like the United Kingdom, Germany, and France leading the adoption curve. The market is characterized by a competitive landscape featuring established players like Mix Telematics, Geotab Inc., and Verizon Corporation, alongside emerging innovators, all vying to capture market share through product innovation and strategic partnerships.

Europe Fleet Management Market Company Market Share

Europe Fleet Management Market: Comprehensive Report Description

This in-depth report provides a detailed analysis of the Europe Fleet Management Market, a crucial sector for optimizing operational efficiency and driving sustainability across diverse industries. Leveraging sophisticated data analytics and extensive industry expertise, this report offers actionable insights for stakeholders seeking to understand and capitalize on market dynamics. The Europe Fleet Management Market is poised for significant expansion, driven by advancements in telematics, IoT, AI, and the increasing adoption of connected vehicle technology.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Our comprehensive research covers key market segments, including Deployment Type (On-demand, On-Premises) and Major Applications (Asset Management, Information Management, Driver Management, Safety and Compliance Management, Risk Management, Operations Management, Other Solutions), as well as End User Verticals (Transportation, Energy, Construction, Manufacturing, Other End-Users). The report identifies dominant markets, emerging trends, and competitive landscapes, providing a strategic outlook for the European fleet telematics solutions market.

Europe Fleet Management Market Market Structure & Competitive Dynamics

The Europe Fleet Management Market exhibits a moderately concentrated structure, with a mix of established global players and specialized regional providers. Innovation is a key differentiator, fueled by constant advancements in fleet tracking software, GPS fleet management, and vehicle diagnostics. The regulatory landscape, particularly concerning emissions standards and driver safety, significantly influences market strategies and product development. Product substitutes, while present, are increasingly being integrated into comprehensive fleet management solutions. End-user trends are shifting towards data-driven decision-making, predictive maintenance, and the integration of fleet management systems with broader enterprise resource planning (ERP) platforms. Mergers and acquisitions (M&A) activities are a strategic tool for market consolidation and expanding service portfolios. For instance, recent fleet management acquisitions highlight the competitive drive to offer end-to-end solutions. While specific market share figures are proprietary, leading companies are investing heavily in R&D to maintain their competitive edge in this evolving market.

Europe Fleet Management Market Industry Trends & Insights

The Europe Fleet Management Market is experiencing robust growth, projected to grow at a considerable Compound Annual Growth Rate (CAGR) over the forecast period. This expansion is propelled by several key industry trends. The increasing adoption of fleet optimization software and real-time fleet tracking is paramount, allowing businesses to enhance operational efficiency and reduce costs associated with fuel consumption, maintenance, and driver behavior. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) into fleet management solutions, are enabling predictive analytics for vehicle maintenance, route optimization, and enhanced safety protocols. The growing emphasis on sustainability and corporate social responsibility is driving demand for green fleet management solutions, focusing on reducing carbon emissions and improving fuel efficiency. Consumer preferences are leaning towards mobile fleet management applications for remote access and real-time monitoring. Competitive dynamics are characterized by strategic partnerships and collaborations aimed at broadening service offerings and geographical reach. For example, the increasing demand for integrated fleet management services that encompass telematics, maintenance scheduling, and compliance reporting is shaping market strategies. The penetration of IoT in fleet management is further accelerating the development of smart cities and autonomous vehicle technologies, creating new avenues for market growth.

Dominant Markets & Segments in Europe Fleet Management Market

The Transportation end-user vertical is the dominant market segment within the Europe Fleet Management Market, driven by the sheer volume of commercial vehicles and the critical need for efficient logistics and supply chain management. Within this segment, Asset Management and Operations Management are the most critical applications, directly impacting route planning, delivery schedules, and vehicle utilization. The On-demand deployment type is gaining significant traction, offering flexibility and scalability for businesses of all sizes, especially small and medium-sized enterprises (SMEs).

- Key Drivers for Transportation Dominance:

- Increasing e-commerce growth necessitating efficient last-mile delivery solutions.

- Stricter regulations on driver working hours and road safety in the European logistics sector.

- High fuel costs driving the adoption of fuel management systems for cost optimization.

- Technological advancements in fleet navigation systems and real-time tracking capabilities.

Geographically, Western European countries, particularly Germany, the UK, and France, represent the largest and most mature markets due to their established infrastructure, advanced technological adoption, and significant fleet sizes. However, Eastern European markets are showing considerable growth potential, driven by economic development and increasing investment in logistics.

The Safety and Compliance Management application segment is also experiencing substantial growth, driven by stringent regulatory frameworks across Europe mandating driver safety features, working hour compliance, and vehicle maintenance records. This is leading to increased adoption of driver behavior monitoring and electronic logging devices (ELDs).

Europe Fleet Management Market Product Innovations

Product innovation in the Europe Fleet Management Market is characterized by the integration of advanced technologies such as AI, IoT, and big data analytics. Companies are focusing on developing predictive fleet maintenance solutions that leverage sensor data to anticipate vehicle issues before they occur, reducing downtime and repair costs. The development of connected car technology is enabling seamless data exchange for enhanced fleet visibility. Innovations in driver safety technology, including fatigue detection and collision avoidance systems, are also prominent. Competitive advantages are being carved out through the development of user-friendly interfaces, comprehensive reporting dashboards, and mobile applications that offer real-time access to critical fleet information.

Report Segmentation & Scope

The Europe Fleet Management Market is segmented across various dimensions to provide granular insights.

Deployment Type:

- On-demand: Characterized by cloud-based solutions offering subscription models, high scalability, and accessibility from anywhere. This segment is projected for significant growth due to its flexibility.

- On-Premises: Involves software installed on the company's own servers, offering greater control but requiring significant upfront investment and maintenance.

Major Applications:

- Asset Management: Focuses on tracking and managing the lifecycle of vehicles and equipment.

- Information Management: Encompasses data collection, analysis, and reporting for operational insights.

- Driver Management: Includes monitoring driver behavior, performance, and compliance.

- Safety and Compliance Management: Addresses regulatory adherence and accident prevention.

- Risk Management: Identifies and mitigates potential risks associated with fleet operations.

- Operations Management: Optimizes daily fleet operations, including routing and scheduling.

- Other Solutions: Encompasses niche functionalities and emerging applications.

End User Vertical:

- Transportation: The largest segment, covering logistics, public transport, and delivery services.

- Energy: Includes utilities, oil, and gas companies with extensive field service fleets.

- Construction: For managing heavy equipment and mobile workforces.

- Manufacturing: For managing internal logistics and supply chain operations.

- Other End-Users: Includes sectors like retail, healthcare, and government agencies.

Key Drivers of Europe Fleet Management Market Growth

The growth of the Europe Fleet Management Market is propelled by a confluence of technological, economic, and regulatory factors.

- Technological Advancements: The proliferation of IoT devices, sophisticated telematics hardware, and AI-driven analytics is enabling more precise real-time tracking, predictive maintenance, and route optimization.

- Economic Imperatives: Rising fuel prices and operational costs are compelling businesses to adopt fleet management solutions for enhanced efficiency and cost reduction. The need for optimized resource allocation and improved productivity is a significant economic driver.

- Regulatory Push: Increasingly stringent environmental regulations regarding emissions and safety standards are mandating the adoption of advanced fleet compliance software and driver safety monitoring systems. This includes initiatives like the European Green Deal impacting fleet operations.

Challenges in the Europe Fleet Management Market Sector

Despite its strong growth trajectory, the Europe Fleet Management Market faces several challenges.

- High Initial Investment: The upfront cost of telematics hardware and fleet management software can be a barrier for some SMEs.

- Data Security and Privacy Concerns: Handling sensitive vehicle and driver data raises concerns about cybersecurity and compliance with data protection regulations like GDPR.

- Integration Complexity: Integrating new fleet management systems with existing legacy IT infrastructures can be complex and time-consuming.

- Skilled Workforce Shortage: A lack of trained professionals to manage and interpret the vast amounts of data generated by fleet tracking systems can hinder effective utilization.

Leading Players in the Europe Fleet Management Market Market

- Mix Telematics

- Geotab Inc

- Verizon Corporation (Connect)

- Aeromar

- G4S Telematix

- ABAX

- EcoFleet

- Trimble Navigation

- Viasaet Group

- Inseego Group

- ArealControl

- EasyFleet

Key Developments in Europe Fleet Management Market Sector

- March 2023: Wejo Group Limited, a leader in Smart Mobility software and cloud solutions for connected, autonomous, and electric vehicles, announced the availability of its Road Health solution, offered by NIRA Dynamics, across selected European markets. This transformative solution aggregates road data insights, enabling governments to shift to proactive road safety and informed infrastructure decisions.

- September 2022: Ford Pro's integrated service offering expanded with the launch of a new fleet management suite, marking a significant addition to its Ford Pro Intelligence platform. This move enhances accessibility for small businesses, offering scalable fleet software as an à la carte solution or a custom bundle.

Strategic Europe Fleet Management Market Market Outlook

The Europe Fleet Management Market is poised for continued strategic growth, driven by ongoing digital transformation and the increasing demand for sustainable and efficient operations. The expansion of electric vehicle (EV) fleet management solutions, coupled with advancements in autonomous driving technology, presents significant future potential. Strategic opportunities lie in developing integrated platforms that offer a holistic approach to fleet operations, encompassing everything from telematics and maintenance to driver wellness and environmental impact monitoring. Collaborations between telematics providers, automakers, and software developers will be crucial for capitalizing on emerging trends like smart city integration and the sharing economy, further solidifying the market's robust outlook.

Europe Fleet Management Market Segmentation

-

1. Deployment Type

- 1.1. On-demand

- 1.2. On-Premises

-

2. Major Applications

- 2.1. Asset Management

- 2.2. Information Management

- 2.3. Driver Management

- 2.4. Safety and Compliance Management

- 2.5. Risk Management

- 2.6. Operations Management

- 2.7. Other Solutions

-

3. End User Vertical

- 3.1. Transportation

- 3.2. Energy

- 3.3. Construction

- 3.4. Manufacturing

- 3.5. Other End-Users

Europe Fleet Management Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

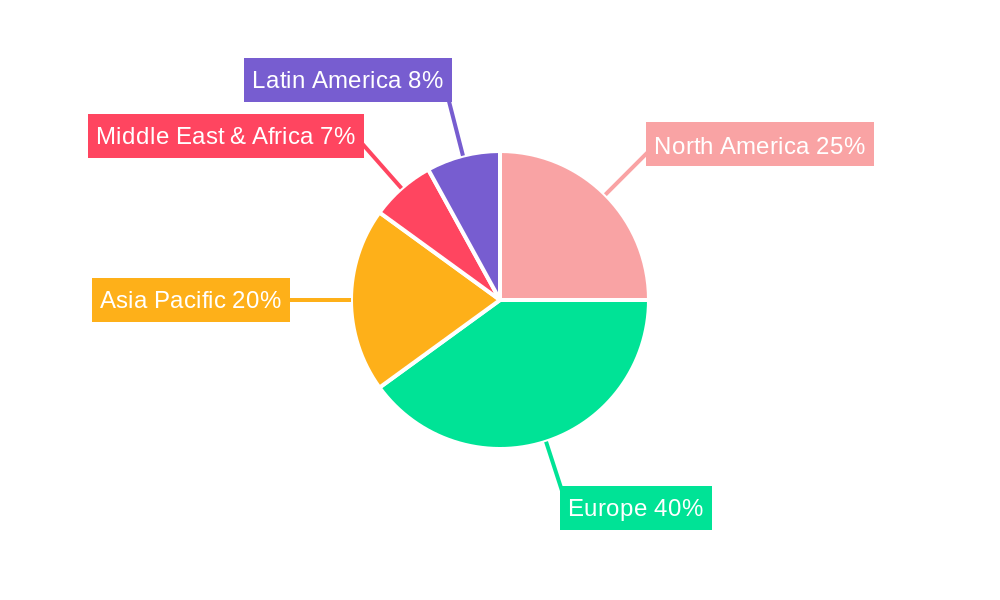

Europe Fleet Management Market Regional Market Share

Geographic Coverage of Europe Fleet Management Market

Europe Fleet Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Market Regulations Coupled with Growing Emphasis on Operational Efficiency; Collaborations between Aftermarket Providers and LCV Manufacturers; Evolving Pricing Models and Emergence of Internet of Transportation

- 3.3. Market Restrains

- 3.3.1. Threat of Data Breaches; High Costs Associated With Installations

- 3.4. Market Trends

- 3.4.1. Asset Management Application Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Fleet Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. On-demand

- 5.1.2. On-Premises

- 5.2. Market Analysis, Insights and Forecast - by Major Applications

- 5.2.1. Asset Management

- 5.2.2. Information Management

- 5.2.3. Driver Management

- 5.2.4. Safety and Compliance Management

- 5.2.5. Risk Management

- 5.2.6. Operations Management

- 5.2.7. Other Solutions

- 5.3. Market Analysis, Insights and Forecast - by End User Vertical

- 5.3.1. Transportation

- 5.3.2. Energy

- 5.3.3. Construction

- 5.3.4. Manufacturing

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mix Telematics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Geotab Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Verizon Corporation (Connect)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aeromar

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 G4S Telematix

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ABAX

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EcoFleet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trimble Navigation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Viasaet Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Inseego Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ArealControl

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 EasyFleet

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Mix Telematics

List of Figures

- Figure 1: Europe Fleet Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Fleet Management Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Fleet Management Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 2: Europe Fleet Management Market Revenue Million Forecast, by Major Applications 2020 & 2033

- Table 3: Europe Fleet Management Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 4: Europe Fleet Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Fleet Management Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 6: Europe Fleet Management Market Revenue Million Forecast, by Major Applications 2020 & 2033

- Table 7: Europe Fleet Management Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 8: Europe Fleet Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Fleet Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Fleet Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Fleet Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Fleet Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Fleet Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Fleet Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Fleet Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Fleet Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Fleet Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Fleet Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Fleet Management Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Fleet Management Market?

The projected CAGR is approximately 11.90%.

2. Which companies are prominent players in the Europe Fleet Management Market?

Key companies in the market include Mix Telematics, Geotab Inc, Verizon Corporation (Connect), Aeromar, G4S Telematix, ABAX, EcoFleet, Trimble Navigation, Viasaet Group, Inseego Group, ArealControl, EasyFleet.

3. What are the main segments of the Europe Fleet Management Market?

The market segments include Deployment Type, Major Applications, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Market Regulations Coupled with Growing Emphasis on Operational Efficiency; Collaborations between Aftermarket Providers and LCV Manufacturers; Evolving Pricing Models and Emergence of Internet of Transportation.

6. What are the notable trends driving market growth?

Asset Management Application Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Threat of Data Breaches; High Costs Associated With Installations.

8. Can you provide examples of recent developments in the market?

March 2023: Wejo Group Limited, one of the global leaders in Smart Mobility for software and cloud solutions for connected, autonomous, and electric vehicle data, announced the availability of its Road Health, offered by NIRA Dynamics, across selected European markets. Road Health is a transformative solution aggregating data insights across roads so governments can shift from reactive to proactive road safety and make informed infrastructure decisions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Fleet Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Fleet Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Fleet Management Market?

To stay informed about further developments, trends, and reports in the Europe Fleet Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence