Key Insights

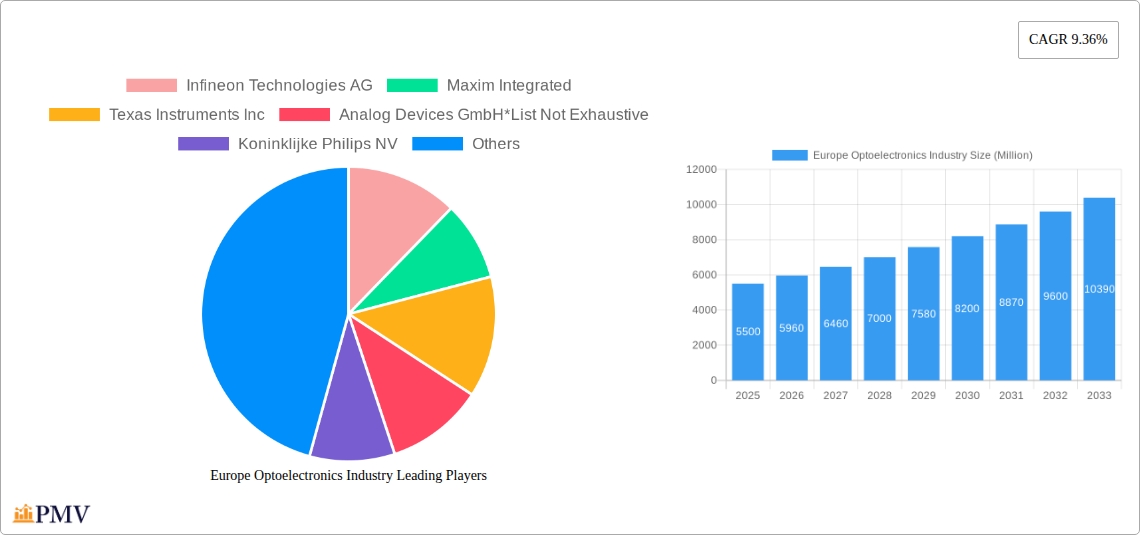

The European optoelectronics market is projected for substantial growth, reaching an estimated $5,500 million by 2025. With a Compound Annual Growth Rate (CAGR) of 9.36% through 2033, this expansion is driven by robust demand in automotive (ADAS, LED lighting, in-car displays), aerospace & defense (advanced sensing, communication), and consumer electronics (smartphones, wearables, high-resolution displays). The IT sector's reliance on optical components for high-speed data transmission further fuels market momentum. Key growth catalysts include innovations in LED efficiency and color rendering, alongside miniaturization and performance enhancements in image sensors, making optoelectronics essential across diverse applications.

Europe Optoelectronics Industry Market Size (In Billion)

Challenges to market expansion include the high cost of advanced components and complex manufacturing. Supply chain vulnerabilities also present a risk. However, ongoing optimization of manufacturing and logistics, coupled with cost-reducing technological advancements, are expected to mitigate these issues. Growing integration of optoelectronic solutions in residential and commercial sectors (smart home devices, advanced lighting) broadens adoption. Europe's optoelectronics leadership is reinforced by strong manufacturing and R&D in countries like Germany and the United Kingdom.

Europe Optoelectronics Industry Company Market Share

Europe Optoelectronics Industry Market Structure & Competitive Dynamics

The Europe optoelectronics industry exhibits a dynamic market structure characterized by a moderate to high concentration of key players, particularly in segments like LEDs and image sensors. Major optoelectronic component manufacturers such as Infineon Technologies AG, Texas Instruments Inc, and Osram Licht AG hold significant market share, driving innovation and setting industry standards. The optoelectronics market thrives on robust innovation ecosystems, fueled by substantial R&D investments and collaborations between established companies and research institutions. Regulatory frameworks, particularly those concerning energy efficiency (e.g., for LED lighting) and product safety, play a crucial role in shaping market entry and product development.

Substitute products, while present in some niches, often struggle to match the performance and efficiency gains offered by advanced optoelectronic solutions, especially in demanding applications like automotive sensors and healthcare imaging. End-user trends are strongly influenced by the burgeoning demand for advanced technologies across sectors like consumer electronics, information technology, and industrial automation. Mergers and acquisitions (M&A) are a significant aspect of the competitive landscape, with strategic deals aimed at consolidating market presence, acquiring new technologies, and expanding product portfolios. For instance, M&A deals in the optoelectronics market have historically ranged from tens to hundreds of Million Euros, underscoring the strategic importance of inorganic growth.

- Market Concentration: Moderate to High, with key players dominating specific segments.

- Innovation Ecosystems: Strong, driven by R&D and academic-industry collaborations.

- Regulatory Influence: Significant, impacting product compliance and market access.

- M&A Activity: Active, with deals valued in the tens to hundreds of Million Euros.

- Key Companies: Infineon Technologies AG, Texas Instruments Inc, Osram Licht AG.

Europe Optoelectronics Industry Industry Trends & Insights

The Europe optoelectronics industry is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and increasing adoption across diverse end-user industries. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033, a testament to the sector's robust expansion. This growth is underpinned by several key market growth drivers. Foremost among these is the escalating demand for energy-efficient lighting solutions, propelling the LED market forward. The transition to solid-state lighting is not only driven by environmental concerns but also by significant cost savings in electricity consumption, making LED adoption a strategic imperative for both residential and commercial sectors.

Technological disruptions are continuously reshaping the optoelectronics landscape. Advancements in laser diode technology are finding increasingly sophisticated applications in telecommunications, industrial processing, and medical devices. The development of higher resolution and more sensitive image sensors is fueling innovation in automotive driver assistance systems (ADAS), digital cameras, and medical imaging equipment, contributing to the overall market penetration of these sophisticated components. Furthermore, the increasing miniaturization and integration of optoelectronic components are enabling the development of smaller, more powerful, and feature-rich electronic devices, catering to evolving consumer preferences for portability and performance.

Competitive dynamics within the Europe optoelectronics industry are intensifying. Companies are investing heavily in R&D to differentiate their offerings and capture market share. Strategic partnerships and collaborations are becoming more prevalent as companies seek to leverage complementary expertise and accelerate product development cycles. The rise of customized optoelectronic solutions for niche applications, such as those in the aerospace and defense sector, further adds to the complexity and dynamism of the market. The integration of optoelectronics with artificial intelligence (AI) and machine learning (ML) is creating new avenues for innovation, enabling intelligent sensing and data processing capabilities that were previously unattainable.

The increasing adoption of smart technologies, including smart homes, smart cities, and the Internet of Things (IoT), is creating a pervasive demand for optoelectronic components across various applications. Photovoltaic cells continue to play a crucial role in the renewable energy sector, with ongoing improvements in efficiency and cost-effectiveness driving their market penetration. The healthcare industry's reliance on advanced diagnostic and therapeutic tools, many of which incorporate optoelectronic components, further solidifies the industry's growth trajectory. The forecast estimates the total market value to reach approximately 55,000 Million Euros by 2033.

Dominant Markets & Segments in Europe Optoelectronics Industry

The Europe optoelectronics industry's dominance is largely dictated by specific component types and end-user industries, with a few regions and countries leading the charge. Geographically, Germany emerges as a dominant market, driven by its strong automotive sector, advanced manufacturing capabilities, and significant R&D investment in optoelectronic technologies. The German optoelectronics market benefits from supportive economic policies and a robust industrial infrastructure that fosters innovation and adoption. Other significant markets include France, the United Kingdom, and Italy, each contributing to the overall European demand with their unique industrial strengths.

Component Type Dominance:

- LEDs (Light Emitting Diodes): This segment is a clear frontrunner, accounting for a substantial portion of the market. The widespread adoption of LEDs in general lighting, automotive lighting, display technologies, and signaling systems, driven by their energy efficiency and long lifespan, makes them a cornerstone of the optoelectronics industry. Economic policies promoting energy conservation and sustainable practices further bolster the demand for LED solutions.

- Image Sensors: The automotive sector's increasing reliance on advanced driver-assistance systems (ADAS) and autonomous driving technologies, coupled with the burgeoning demand for high-resolution cameras in consumer electronics and surveillance, propels the growth of the image sensor market. Technological advancements in pixel size, sensitivity, and frame rates are key drivers of dominance in this segment.

- Laser Diodes: This segment exhibits strong growth, fueled by applications in telecommunications (fiber optics), industrial manufacturing (cutting, welding), medical devices (surgery, diagnostics), and consumer electronics (optical storage, 3D sensing). Investments in high-speed communication infrastructure and advanced manufacturing processes contribute to its dominance.

- Photovoltaic Cells: While facing intense global competition, the growing imperative for renewable energy solutions in Europe continues to drive demand for photovoltaic cells, particularly in solar power generation for both residential and large-scale industrial applications. Supportive government incentives and ambitious climate targets are critical for sustained growth.

End-user Industry Dominance:

- Automotive: This sector is a paramount driver of the Europe optoelectronics industry. The integration of LEDs for headlights and taillights, image sensors for ADAS and autonomous driving, and laser diodes for lidar systems underscores its critical reliance on optoelectronic components. Stringent safety regulations and the ongoing shift towards electric and connected vehicles are significant market penetration accelerators. The automotive optoelectronics market is expected to reach approximately 20,000 Million Euros by 2033.

- Consumer Electronics: The relentless demand for smartphones, tablets, televisions, gaming consoles, and wearable devices ensures the continued dominance of this segment. High-performance displays, advanced camera modules, and efficient lighting solutions are all powered by optoelectronic components. Rapid product cycles and consumer appetite for new features fuel this dominance.

- Industrial: Automation, robotics, machine vision, and advanced manufacturing processes heavily rely on optoelectronic components such as sensors, laser scanners, and optical communication systems. The push for Industry 4.0 and increased efficiency in manufacturing operations are key drivers.

- Healthcare: The application of optoelectronics in medical imaging (MRI, CT scans), surgical lasers, diagnostic tools, and minimally invasive procedures highlights its vital role in modern healthcare. The aging population and increasing demand for advanced medical treatments contribute to this segment's significant market share.

Europe Optoelectronics Industry Product Innovations

The Europe optoelectronics industry is witnessing a surge in product innovations driven by the relentless pursuit of enhanced performance, miniaturization, and energy efficiency. Key developments include advanced LED technologies offering higher luminous efficacy and wider color spectrums for improved lighting quality and display vibrancy. Next-generation laser diodes are enabling higher data transmission rates in telecommunications and more precise control in industrial and medical applications. Furthermore, breakthroughs in image sensor technology are leading to higher resolutions, faster frame rates, and improved low-light performance, critical for automotive ADAS and advanced digital imaging. The integration of AI capabilities directly into optoelectronic components is also a significant trend, paving the way for smarter sensing and data processing.

Report Segmentation & Scope

This comprehensive report meticulously segments the Europe optoelectronics industry to provide granular insights into market dynamics and growth opportunities. The market is analyzed across various component types, including Light Emitting Diodes (LEDs), Laser Diodes, Image Sensors, Optocouplers, and Photovoltaic Cells, alongside "Other Component Types" encompassing photodetectors and optical sensors. The end-user industry segmentation delves into Automotive, Aerospace and Defense, Consumer Electronics, Information Technology, Healthcare, Residential and Commercial, and Industrial sectors, along with "Other End-user Industries." Each segment's market size, growth projections, and competitive landscape are thoroughly examined. For instance, the LED segment is projected to reach over 18,000 Million Euros by 2033, while the Automotive end-user industry segment is estimated to cross 20,000 Million Euros within the same period.

Key Drivers of Europe Optoelectronics Industry Growth

The Europe optoelectronics industry's growth is propelled by several interconnected factors. Technological advancements in areas like energy-efficient LEDs and sophisticated image sensors are creating new market opportunities. The widespread adoption of renewable energy solutions, particularly solar power, is a significant driver for photovoltaic cells. Stringent energy efficiency regulations across Europe mandate the use of power-saving technologies like LEDs. Furthermore, the increasing demand for advanced features in consumer electronics and the rapid evolution of the automotive sector towards autonomous and connected vehicles are substantial growth catalysts. Government initiatives supporting digital transformation and smart city development also play a crucial role.

Challenges in the Europe Optoelectronics Industry Sector

Despite robust growth, the Europe optoelectronics industry faces certain challenges. Intense global competition, particularly from Asian manufacturers, can exert downward pressure on pricing and profit margins. Supply chain disruptions, as evidenced by recent global events, can impact the availability of raw materials and components, leading to production delays and increased costs. Navigating complex and evolving regulatory hurdles, especially concerning environmental standards and product safety, can also pose challenges for market entry and compliance. Furthermore, the significant R&D investment required to stay at the forefront of technological innovation represents a substantial barrier for smaller players.

Leading Players in the Europe Optoelectronics Industry Market

- Infineon Technologies AG

- Maxim Integrated

- Texas Instruments Inc

- Analog Devices GmbH

- Koninklijke Philips NV

- On Semiconductor

- Stanley Electric Co

- Mitsubishi Electric

- Osram Licht AG

- Panasonic Corporation

Key Developments in Europe Optoelectronics Industry Sector

- 2023: Osram Licht AG announces significant investment in GaN-on-Si technology for enhanced LED performance.

- 2023: Infineon Technologies AG expands its portfolio of automotive image sensors to meet ADAS demands.

- 2022: Philips Lighting (now Signify) launches new smart LED solutions for smart city applications.

- 2022: Texas Instruments Inc introduces advanced optocouplers for industrial automation and power systems.

- 2021: Analog Devices GmbH acquires a company specializing in optical sensing technology for healthcare applications.

- 2020: On Semiconductor launches new low-power image sensors for battery-powered IoT devices.

Strategic Europe Optoelectronics Industry Market Outlook

The strategic outlook for the Europe optoelectronics industry is exceptionally promising, characterized by continued innovation and expanding application frontiers. Growth accelerators include the increasing integration of AI with optoelectronic components, enabling intelligent sensing and predictive analytics. The ongoing digitalization of industries and the expansion of 5G infrastructure will further boost demand for high-performance optoelectronic solutions in telecommunications and IT. The sustained focus on sustainability and energy efficiency will continue to drive the adoption of LED lighting and photovoltaic technologies. Strategic opportunities lie in developing bespoke solutions for niche markets like medical diagnostics and advanced aerospace applications, along with capitalizing on the growing demand for smart home and smart city technologies, with the market forecast to reach an impressive 55,000 Million Euros by 2033.

Europe Optoelectronics Industry Segmentation

-

1. Component type

- 1.1. LED

- 1.2. Laser Diode

- 1.3. Image Sensors

- 1.4. Optocouplers

- 1.5. Photovoltaic Cells

- 1.6. Other Component Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Aerospace and Defense

- 2.3. Consumer Electronics

- 2.4. Information Technology

- 2.5. Healthcare

- 2.6. Residential and Commercial

- 2.7. Industrial

- 2.8. Other End-user Industries

Europe Optoelectronics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

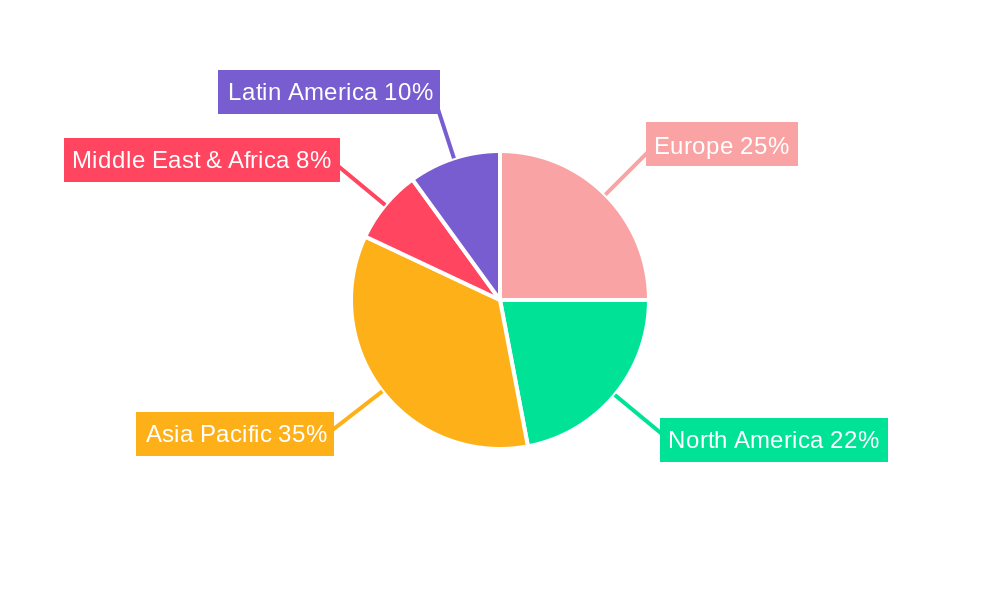

Europe Optoelectronics Industry Regional Market Share

Geographic Coverage of Europe Optoelectronics Industry

Europe Optoelectronics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Smart Consumer Electronics and Next-generation Technologies; Increasing Industrial Applications of the Technology

- 3.3. Market Restrains

- 3.3.1. ; High Manufacturing and Fabricating Costs

- 3.4. Market Trends

- 3.4.1. Automobile Industry to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Optoelectronics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component type

- 5.1.1. LED

- 5.1.2. Laser Diode

- 5.1.3. Image Sensors

- 5.1.4. Optocouplers

- 5.1.5. Photovoltaic Cells

- 5.1.6. Other Component Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace and Defense

- 5.2.3. Consumer Electronics

- 5.2.4. Information Technology

- 5.2.5. Healthcare

- 5.2.6. Residential and Commercial

- 5.2.7. Industrial

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Infineon Technologies AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maxim Integrated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Texas Instruments Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Analog Devices GmbH*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Koninklijke Philips NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 On Semiconductor

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stanley Electric Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi Electric

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Osram Licht AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Europe Optoelectronics Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Optoelectronics Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Optoelectronics Industry Revenue billion Forecast, by Component type 2020 & 2033

- Table 2: Europe Optoelectronics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Europe Optoelectronics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Optoelectronics Industry Revenue billion Forecast, by Component type 2020 & 2033

- Table 5: Europe Optoelectronics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Europe Optoelectronics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Optoelectronics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Optoelectronics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Optoelectronics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Optoelectronics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Optoelectronics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Optoelectronics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Optoelectronics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Optoelectronics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Optoelectronics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Optoelectronics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Optoelectronics Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Optoelectronics Industry?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Europe Optoelectronics Industry?

Key companies in the market include Infineon Technologies AG, Maxim Integrated, Texas Instruments Inc, Analog Devices GmbH*List Not Exhaustive, Koninklijke Philips NV, On Semiconductor, Stanley Electric Co, Mitsubishi Electric, Osram Licht AG, Panasonic Corporation.

3. What are the main segments of the Europe Optoelectronics Industry?

The market segments include Component type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.4 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Smart Consumer Electronics and Next-generation Technologies; Increasing Industrial Applications of the Technology.

6. What are the notable trends driving market growth?

Automobile Industry to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; High Manufacturing and Fabricating Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Optoelectronics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Optoelectronics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Optoelectronics Industry?

To stay informed about further developments, trends, and reports in the Europe Optoelectronics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence