Key Insights

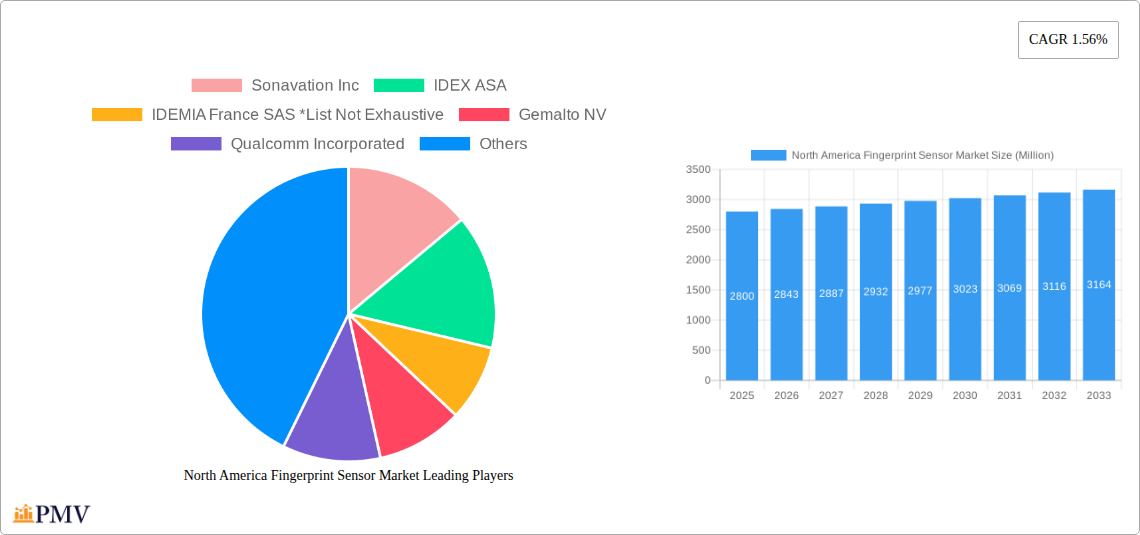

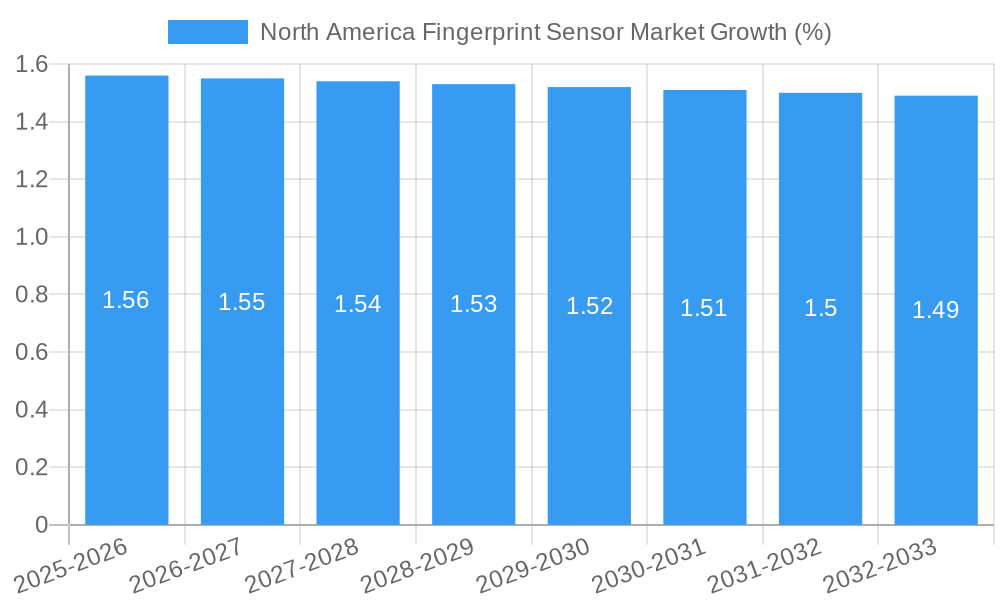

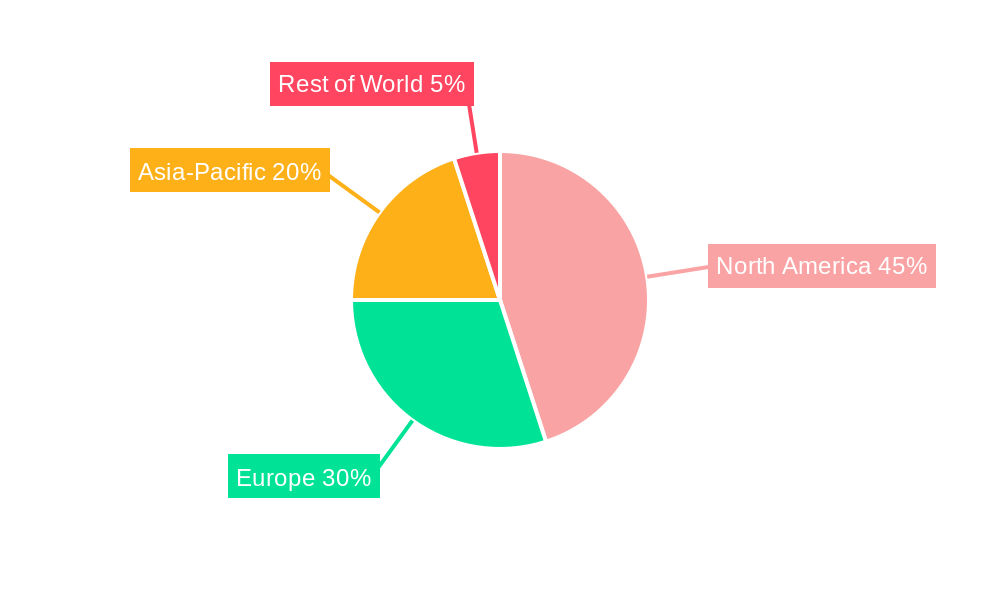

The North American fingerprint sensor market is poised for steady expansion, driven by the increasing integration of biometric authentication across a wide spectrum of consumer electronics and governmental applications. With an estimated market size of approximately USD 2,800 million in 2025, the sector is projected to experience a Compound Annual Growth Rate (CAGR) of 1.56% through 2033. This growth is primarily fueled by the escalating demand for enhanced security features in smartphones and tablets, alongside their adoption in smartcards, laptops, and the burgeoning Internet of Things (IoT) ecosystem. Governments and military organizations are also significant contributors, leveraging fingerprint technology for secure identification and access control. The widespread consumer acceptance of fingerprint scanners as a convenient and reliable security measure, coupled with continuous technological advancements in sensor types, including optical, capacitive, and ultrasonic, will further bolster market penetration.

While the market presents a positive outlook, certain restraints could influence its trajectory. The initial cost of implementing advanced fingerprint sensor technology in some devices, along with evolving data privacy regulations, may pose challenges. However, the ongoing innovation in sensor miniaturization, improved accuracy, and the development of cost-effective solutions are expected to mitigate these concerns. The expansion of the BFSI sector's adoption of biometric authentication for secure transactions and customer verification, and the growing presence of specialized companies like IDEX ASA and Fingerprint Cards AB, underscore the market's potential. The North American region, encompassing the United States, Canada, and Mexico, is a key player, benefiting from a strong technological infrastructure and high consumer adoption rates for advanced security features.

North America Fingerprint Sensor Market: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed examination of the North America Fingerprint Sensor Market, encompassing a comprehensive study period from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025. The forecast period extends from 2025 to 2033, building upon the historical analysis from 2019 to 2024. We delve into the intricate market structure, competitive dynamics, emerging industry trends, dominant market segments, groundbreaking product innovations, and strategic outlook. This analysis is crucial for stakeholders seeking to understand the growth trajectory and opportunities within the rapidly evolving North America fingerprint sensor market. The report leverages high-ranking keywords such as fingerprint sensor market North America, biometric security solutions, capacitive fingerprint sensors, optical fingerprint sensors, ultrasonic fingerprint sensors, smartphone biometrics, IoT security, consumer electronics authentication, and military and defense biometrics to enhance search visibility.

North America Fingerprint Sensor Market Market Structure & Competitive Dynamics

The North America fingerprint sensor market is characterized by a moderately concentrated structure, with key players like Qualcomm Incorporated, Fingerprint Cards AB, and Synaptics Inc. holding significant market share. Innovation ecosystems are vibrant, driven by continuous research and development in areas like under-display fingerprint sensors and advanced anti-spoofing technologies. Regulatory frameworks in North America, particularly concerning data privacy and security (e.g., CCPA, PIPEDA), indirectly influence the adoption and security standards of fingerprint sensor technology. Product substitutes, such as facial recognition and iris scanners, present a competitive landscape, yet fingerprint sensors maintain a strong foothold due to their cost-effectiveness and established user familiarity, especially in smartphones/tablets and laptops. End-user trends show a growing demand for enhanced security and convenience across various sectors. Merger and acquisition (M&A) activities, while not as frequent as in some other tech sectors, are strategic plays to acquire intellectual property or expand market reach. For instance, hypothetical M&A deals aimed at consolidating expertise in specialized ultrasonic fingerprint sensors could reshape competitive dynamics. The market penetration of fingerprint sensors in consumer electronics is estimated to be over 70% in 2025, driving significant market volume.

North America Fingerprint Sensor Market Industry Trends & Insights

The North America fingerprint sensor market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033. This expansion is fueled by the escalating demand for enhanced security and authentication solutions across a multitude of applications. The proliferation of connected devices, particularly in the IoT and Other Applications segment, is a major growth driver. As more devices become internet-enabled, the need for secure and user-friendly authentication mechanisms becomes paramount, with fingerprint sensors offering a convenient and reliable solution.

Technological disruptions are continuously reshaping the market. Advancements in capacitive fingerprint sensors, offering improved speed and accuracy, and the rise of more sophisticated optical fingerprint sensors, particularly under-display technologies, are enhancing user experience and expanding product applicability. Ultrasonic fingerprint sensors, known for their ability to read through screen contaminants and their 3D sensing capabilities, are gaining traction, especially in premium smartphones/tablets.

Consumer preferences are increasingly leaning towards devices that offer seamless and secure access. The convenience of unlocking devices with a touch, coupled with growing awareness about data breaches and privacy concerns, is accelerating the adoption of fingerprint technology. This trend is evident across the Consumer Electronics and BFSI (Banking, Financial Services, and Insurance) sectors, where secure transaction authentication is critical.

Competitive dynamics are intense, with established players investing heavily in R&D to maintain their market edge. Companies like Qualcomm Incorporated are integrating advanced fingerprint sensor technology into their chipsets, while specialists like Fingerprint Cards AB and Synaptics Inc. are focusing on innovating sensor designs and algorithms. The market penetration for fingerprint sensors in smartphones is expected to reach over 85% by 2033, signifying a mature yet still growing segment. The increasing demand for embedded security in emerging applications like smart homes, wearables, and access control systems is further bolstering market growth. The development of larger sensing areas and the integration of multiple biometric modalities are also key trends influencing the market's trajectory.

Dominant Markets & Segments in North America Fingerprint Sensor Market

The North America fingerprint sensor market exhibits distinct dominance across various segments, driven by specific technological advancements and end-user industry demands.

Type Dominance:

- Capacitive fingerprint sensors currently hold a significant market share due to their established presence in smartphones and laptops, offering a balance of performance and cost-effectiveness. Their widespread adoption in the Consumer Electronics segment has cemented their dominance.

- Optical fingerprint sensors, particularly under-display technologies, are rapidly gaining traction and are expected to challenge capacitive dominance in the coming years, especially in high-end smartphones/tablets.

- Ultrasonic fingerprint sensors are projected for substantial growth, driven by their superior accuracy and ability to authenticate through screen contaminants, finding increasing use in premium devices and emerging IoT and Other Applications.

- Thermal fingerprint sensors, while niche, have specific applications where their unique sensing capabilities are advantageous, though their market share remains smaller.

Application Dominance:

- Smartphones/Tablets represent the largest application segment. The sheer volume of these devices sold globally, coupled with the integrated nature of their security features, makes this the primary driver for fingerprint sensor demand. The trend towards larger display sizes and bezel-less designs further fuels the adoption of under-display and edge-mounted sensors.

- Laptops are a significant and growing segment, with manufacturers increasingly incorporating fingerprint readers for enhanced security and user convenience, especially in enterprise environments.

- IoT and Other Applications represent a rapidly expanding frontier, encompassing smart home devices, wearables, automotive systems, and access control solutions. The increasing need for secure device authentication in these connected environments is a key growth accelerator.

- Smartcards are a more niche but important application, particularly for secure financial transactions and identification.

End-user Industry Dominance:

- Consumer Electronics is undeniably the dominant end-user industry, primarily driven by the smartphones/tablets and laptops segments. The pervasive integration of fingerprint sensors in these devices for personal security and convenience makes this the largest market contributor.

- BFSI is a critical and growing sector, leveraging fingerprint sensors for secure mobile banking, transaction authentication, and identity verification. The increasing adoption of mobile payment solutions and the need for robust fraud prevention mechanisms are key drivers here.

- Government and Military and Defense sectors are significant consumers of fingerprint technology for access control, identification, and national security applications. The demand for high-security, tamper-proof biometric solutions in these areas is substantial.

- Other End-user Industries, including healthcare and retail, are also seeing increasing adoption of fingerprint sensors for patient identification, secure data access, and point-of-sale authentication.

Economic policies in North America that encourage technological innovation and digital transformation, coupled with robust infrastructure supporting the widespread adoption of connected devices, are foundational to the dominance of these segments.

North America Fingerprint Sensor Market Product Innovations

Product innovations in the North America fingerprint sensor market are centered on enhancing performance, integrating new form factors, and improving security features. The development of faster, more accurate, and more energy-efficient sensors is a constant pursuit. Under-display optical fingerprint sensors have gained significant traction, allowing for larger sensing areas and more aesthetically pleasing device designs in smartphones/tablets. Advancements in ultrasonic fingerprint sensors are enabling 3D fingerprint mapping, offering superior security against spoofing attempts and the ability to function even with wet or dirty fingers. The integration of sensors into flexible substrates and novel form factors is expanding their applicability beyond traditional devices into areas like wearables and smart cards. Competitive advantages are derived from proprietary algorithms for enhanced spoof detection, increased sensing speed, and lower power consumption.

Report Segmentation & Scope

This report segments the North America fingerprint sensor market across key categories for detailed analysis.

- Type: The market is segmented into Optical, Capacitive, Thermal, and Ultrasonic fingerprint sensors. Each type possesses distinct technological characteristics and adoption rates across various applications. Capacitive sensors currently lead in volume, while ultrasonic and advanced optical technologies are poised for significant growth. Market sizes for each type are projected to grow at varying CAGRs, reflecting their respective technological maturity and application scope.

- Application: Segments include Smartphones/Tablets, Laptops, Smartcards, IoT and Other Applications. The Smartphones/Tablets segment dominates due to high device penetration. The IoT and Other Applications segment is projected to exhibit the highest growth rate as more devices become connected and require secure authentication.

- End-user Industries: Key segments are Military and Defense, Consumer Electronics, BFSI, Government, and Other End-user Industries. Consumer Electronics is the largest contributor, followed by the steadily growing BFSI sector. Military and Defense and Government sectors represent significant markets for high-security biometric solutions.

Key Drivers of North America Fingerprint Sensor Market Growth

Several factors are propelling the North America fingerprint sensor market forward. The escalating demand for enhanced personal and data security is paramount, driven by rising cybersecurity threats and a growing awareness of privacy concerns. Technological advancements, such as the miniaturization and cost reduction of sensors, coupled with improved performance (speed, accuracy, and spoof detection), are crucial enablers. The ubiquitous adoption of smartphones, tablets, and the burgeoning Internet of Things (IoT) ecosystem creates a vast and expanding market for fingerprint authentication. Furthermore, government initiatives promoting digital identity and secure data management in sectors like BFSI and Government are significant growth accelerators. The increasing consumer preference for convenient and password-less authentication methods also plays a vital role.

Challenges in the North America Fingerprint Sensor Market Sector

Despite its robust growth, the North America fingerprint sensor market faces certain challenges. Stringent data privacy regulations, while driving the need for secure solutions, can also lead to complex compliance requirements for manufacturers and device makers. The competitive landscape is intense, with numerous players vying for market share, potentially leading to price pressures. The development and integration of advanced ultrasonic fingerprint sensors and under-display optical sensors still involve higher manufacturing costs, which can impact their adoption in budget-friendly devices. Supply chain disruptions, as witnessed in recent global events, can affect the availability and cost of essential components. Finally, the ongoing development of alternative biometric technologies like facial recognition and voice biometrics poses a continuous competitive threat, requiring fingerprint sensor manufacturers to constantly innovate.

Leading Players in the North America Fingerprint Sensor Market Market

- Sonavation Inc

- IDEX ASA

- IDEMIA France SAS

- Gemalto NV

- Qualcomm Incorporated

- Fingerprint Cards AB

- Synaptics Inc

- NEC Corporation

- TDK Corporation

- Egis Technology Inc

Key Developments in North America Fingerprint Sensor Market Sector

- 2023/Late 2022: Introduction of next-generation under-display optical sensors with larger sensing areas and faster authentication speeds for premium smartphones.

- 2023: Increased adoption of ultrasonic fingerprint sensors in laptops for enhanced security and device durability.

- 2022: Expansion of fingerprint sensor integration into wearable devices for seamless authentication and health monitoring access.

- 2022: Greater focus on developing advanced anti-spoofing algorithms to combat sophisticated biometric fraud.

- 2021: Strategic partnerships formed between semiconductor manufacturers and device makers to accelerate the integration of advanced fingerprint sensor technology.

- 2020: Emergence of enhanced security protocols for fingerprint data storage and processing in line with evolving privacy regulations.

Strategic North America Fingerprint Sensor Market Market Outlook

The strategic outlook for the North America fingerprint sensor market is highly promising, driven by continuous technological innovation and expanding application horizons. The increasing integration of fingerprint sensors into the burgeoning IoT and Other Applications segment presents a significant growth accelerator. Advancements in multimodal biometrics, combining fingerprint recognition with other authentication methods, will further enhance security and user experience. The ongoing refinement of ultrasonic and optical fingerprint sensors to achieve higher accuracy, faster speeds, and cost-effectiveness will drive their adoption across a broader range of consumer electronics and enterprise solutions. Strategic opportunities lie in developing solutions for emerging markets, such as smart cities, automotive biometrics, and advanced access control systems. The focus will remain on delivering secure, convenient, and integrated biometric solutions that meet the evolving demands of consumers and industries.

North America Fingerprint Sensor Market Segmentation

-

1. Type

- 1.1. Optical

- 1.2. Capacitive

- 1.3. Thermal

- 1.4. Ultrasonic

-

2. Application

- 2.1. Smartphones/Tablets

- 2.2. Laptops

- 2.3. Smartcards

- 2.4. IoT and Other Applications

-

3. End-user Industries

- 3.1. Military and Defense

- 3.2. Consumer Electronics

- 3.3. BFSI

- 3.4. Government

- 3.5. Other End-user Industries

North America Fingerprint Sensor Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Fingerprint Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Initiatives to Adopt Biometrics in Various Fields

- 3.3. Market Restrains

- 3.3.1 ; Increase in adoption of substitute technologies

- 3.3.2 such as face and iris scanning

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Industry to Augment the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fingerprint Sensor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Optical

- 5.1.2. Capacitive

- 5.1.3. Thermal

- 5.1.4. Ultrasonic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smartphones/Tablets

- 5.2.2. Laptops

- 5.2.3. Smartcards

- 5.2.4. IoT and Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industries

- 5.3.1. Military and Defense

- 5.3.2. Consumer Electronics

- 5.3.3. BFSI

- 5.3.4. Government

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Fingerprint Sensor Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Fingerprint Sensor Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Fingerprint Sensor Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Fingerprint Sensor Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Sonavation Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 IDEX ASA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IDEMIA France SAS *List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Gemalto NV

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Qualcomm Incorporated

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Fingerprint Cards AB

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Synaptics Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 NEC Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 TDK Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Egis Technology Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Sonavation Inc

List of Figures

- Figure 1: North America Fingerprint Sensor Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Fingerprint Sensor Market Share (%) by Company 2024

List of Tables

- Table 1: North America Fingerprint Sensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Fingerprint Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Fingerprint Sensor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Fingerprint Sensor Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 5: North America Fingerprint Sensor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Fingerprint Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Fingerprint Sensor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Fingerprint Sensor Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: North America Fingerprint Sensor Market Revenue Million Forecast, by End-user Industries 2019 & 2032

- Table 14: North America Fingerprint Sensor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Fingerprint Sensor Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fingerprint Sensor Market?

The projected CAGR is approximately 1.56%.

2. Which companies are prominent players in the North America Fingerprint Sensor Market?

Key companies in the market include Sonavation Inc, IDEX ASA, IDEMIA France SAS *List Not Exhaustive, Gemalto NV, Qualcomm Incorporated, Fingerprint Cards AB, Synaptics Inc, NEC Corporation, TDK Corporation, Egis Technology Inc.

3. What are the main segments of the North America Fingerprint Sensor Market?

The market segments include Type, Application, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Government Initiatives to Adopt Biometrics in Various Fields.

6. What are the notable trends driving market growth?

Consumer Electronics Industry to Augment the Market Growth.

7. Are there any restraints impacting market growth?

; Increase in adoption of substitute technologies. such as face and iris scanning.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fingerprint Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fingerprint Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fingerprint Sensor Market?

To stay informed about further developments, trends, and reports in the North America Fingerprint Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence