Key Insights

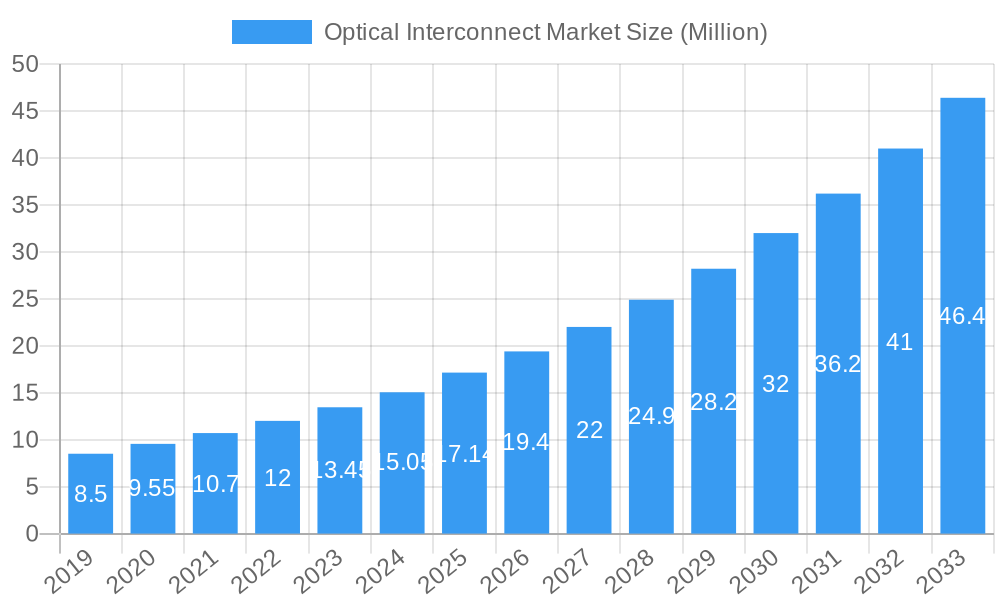

The global Optical Interconnect Market is poised for significant expansion, projected to reach $17.14 billion by 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 13.15% through 2033. This robust growth is fundamentally propelled by the insatiable demand for higher bandwidth and faster data transmission across telecommunication and data communication sectors. The proliferation of 5G networks, the exponential rise in cloud computing, and the increasing adoption of data-intensive applications like AI and IoT are creating an unprecedented need for advanced optical interconnect solutions. Companies are heavily investing in upgrading their network infrastructure to support these evolving demands, fueling the market for optical transceivers, active optical cables (AOCs), and embedded optical modules (EOMs). The relentless pursuit of speed, efficiency, and scalability in data transfer underscores the critical role of optical interconnects in shaping the future of digital communication.

Optical Interconnect Market Market Size (In Million)

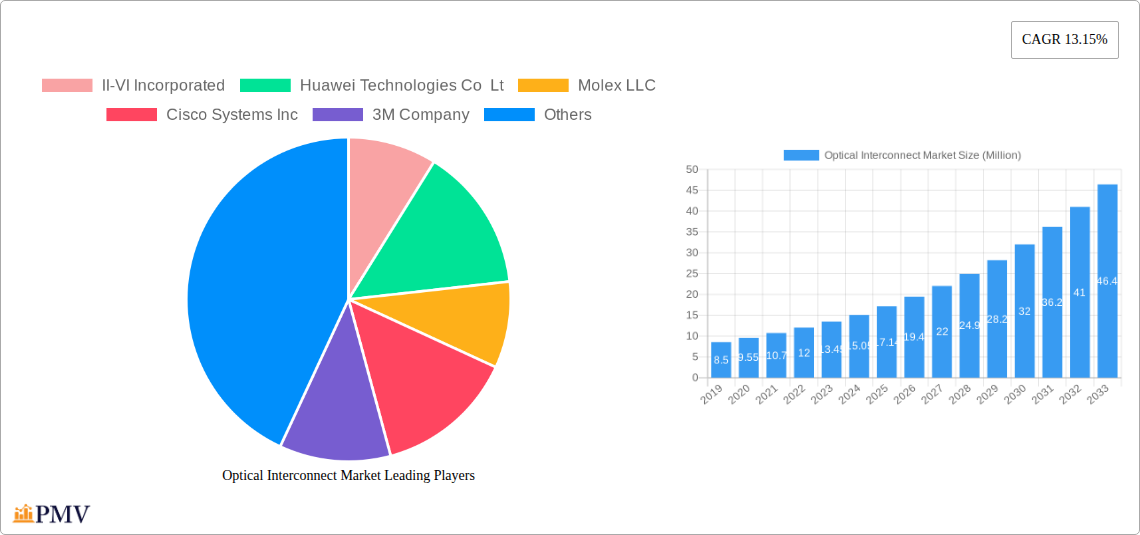

While the market is experiencing strong tailwinds, certain factors could present challenges. The significant upfront investment required for deploying advanced optical interconnect infrastructure can be a considerable barrier for some organizations. Furthermore, the rapid pace of technological evolution necessitates continuous innovation and adaptation, potentially leading to faster obsolescence of existing technologies. Supply chain disruptions and the availability of skilled labor for installation and maintenance also pose potential constraints. However, the overwhelming benefits in terms of performance, power efficiency, and future-proofing offered by optical interconnects are expected to outweigh these challenges, ensuring sustained market growth. Key players such as II-VI Incorporated, Huawei Technologies Co., Ltd., Molex LLC, and Cisco Systems Inc. are at the forefront of innovation, developing next-generation solutions to meet the escalating demands of this dynamic market. The Asia Pacific region, particularly China and India, is expected to be a major growth engine, alongside the mature markets of North America and Europe.

Optical Interconnect Market Company Market Share

Detailed Report Description: Optical Interconnect Market (2019–2033)

This comprehensive report provides an in-depth analysis of the global Optical Interconnect Market, offering critical insights into its structure, trends, and future trajectory. Leveraging extensive research and precise forecasting, this study covers the historical period from 2019 to 2024, the base year of 2025, the estimated year of 2025, and a detailed forecast period from 2025 to 2033. The report is meticulously crafted to assist stakeholders, including telecom operators, data center providers, equipment manufacturers, and investors, in navigating this dynamic and rapidly evolving sector. We explore the critical role of optical transceivers, active optical cables (AOCs), and embedded optical modules (EOMs) in enabling high-speed data transmission across diverse applications, from advanced telecommunications to sophisticated data communication networks.

Optical Interconnect Market Market Structure & Competitive Dynamics

The Optical Interconnect Market is characterized by a moderate to high level of market concentration, with key players investing heavily in research and development to maintain their competitive edge. The innovation ecosystem thrives on continuous advancements in optical technology, driving the demand for higher bandwidth and lower latency solutions. Regulatory frameworks, particularly concerning data privacy and network infrastructure deployment, play a significant role in shaping market dynamics. The threat of product substitutes, while present, is limited by the inherent performance advantages of optical interconnects for high-speed applications. End-user trends are predominantly driven by the insatiable demand for data, fueling the expansion of cloud computing, 5G networks, and AI. Mergers and acquisitions (M&A) activities are strategic maneuvers aimed at consolidating market share, acquiring new technologies, and expanding geographical reach. M&A deal values are anticipated to remain substantial as companies seek to secure their positions in this growth-oriented market. Analyzing market share distribution among leading vendors and understanding the strategic intent behind M&A transactions are crucial for comprehending the competitive landscape.

Optical Interconnect Market Industry Trends & Insights

The Optical Interconnect Market is experiencing robust growth, primarily driven by the escalating demand for higher bandwidth and faster data transfer speeds across various industries. The proliferation of data-intensive applications, including cloud computing, artificial intelligence (AI), the Internet of Things (IoT), and the widespread adoption of 5G technology, are key catalysts for this expansion. Technological disruptions, such as advancements in silicon photonics, co-packaged optics, and pluggable optical modules, are revolutionizing the capabilities and cost-effectiveness of optical interconnect solutions. Consumer preferences are increasingly leaning towards seamless, high-speed connectivity for enhanced digital experiences, further fueling market penetration. Competitive dynamics are intense, with a focus on product innovation, cost optimization, and strategic partnerships. The market is projected to witness a significant Compound Annual Growth Rate (CAGR), driven by the continuous need for network upgrades and the deployment of next-generation infrastructure. Market penetration is deepening as optical interconnects become indispensable for enabling the performance required by modern digital services. The ongoing digital transformation across sectors like healthcare, finance, and entertainment underscores the critical importance of efficient and scalable optical interconnect solutions to meet future demands. The development of energy-efficient optical modules is also a growing trend, aligning with global sustainability initiatives. The increasing complexity of data center architectures and the rise of edge computing further necessitate advanced optical interconnect solutions for efficient data flow and reduced latency. The market's growth is intrinsically linked to the expansion of global data traffic, which is predicted to grow exponentially in the coming years.

Dominant Markets & Segments in Optical Interconnect Market

The Optical Interconnect Market is currently dominated by regions that are at the forefront of technological adoption and network infrastructure development, with North America and Asia-Pacific leading the charge. In terms of applications, Data Communication is a primary driver, propelled by the exponential growth of data centers, cloud services, and enterprise networks. The burgeoning demand for higher bandwidth in these environments directly translates into a substantial market share for optical interconnect solutions. Within the Telecommunication sector, the ongoing rollout of 5G networks and the upgrade of existing fiber optic infrastructure are significantly contributing to market expansion. Countries with robust digital policies and substantial investments in telecommunications infrastructure, such as the United States, China, and countries within the European Union, represent key markets.

Dominant Segments:

- Type: Optical Transceivers: This segment holds a significant market share due to their pervasive use in connecting network equipment, facilitating high-speed data transmission across various distances. The continuous evolution of transceiver technology to meet higher data rates (e.g., 400GbE, 800GbE) is a key growth driver.

- Application: Data Communication: The relentless expansion of data centers to support cloud computing, big data analytics, and AI workloads is the primary engine for this segment. The need for efficient, high-bandwidth, and low-latency interconnects within data centers is paramount.

- Application: Telecommunication: The global deployment of 5G networks, requiring denser and faster optical infrastructure, and the continued expansion of broadband access are critical growth factors. The need for high-capacity optical links to backhaul mobile traffic and connect subscribers is immense.

Key Drivers for Dominance:

- Economic Policies: Government initiatives promoting digital infrastructure development and investment in advanced technologies directly impact market growth.

- Infrastructure Development: Extensive fiber optic network build-outs in both telecommunication and data communication sectors are fundamental.

- Technological Advancements: Continuous innovation in optical transceiver technology, including higher speeds and increased energy efficiency, drives adoption.

- Growing Data Consumption: The ever-increasing volume of data generated and consumed globally necessitates scalable and high-performance interconnect solutions.

The Embedded Optical Modules (EOMs) segment is also witnessing considerable growth, particularly in high-performance computing and specialized applications where integration and miniaturization are critical. The Active Optical Cables (AOCs) segment continues to be a strong performer, offering a cost-effective and plug-and-play solution for shorter-reach, high-speed interconnects within data centers and enterprise environments.

Optical Interconnect Market Product Innovations

The Optical Interconnect Market is characterized by rapid product innovation, driven by the relentless pursuit of higher bandwidth, lower power consumption, and improved integration. Key developments include the advancement of pluggable optical modules supporting ever-increasing data rates like 800 Gbps and beyond, the emergence of co-packaged optics for enhanced density and performance in next-generation servers and switches, and the development of specialized optical interconnects for harsh environments, such as space and industrial applications. These innovations offer competitive advantages by enabling faster data transfer, reducing system complexity, and lowering operational costs for end-users. Market fit is achieved by aligning these technological advancements with the evolving needs of data centers, telecommunication networks, and emerging high-performance computing applications.

Report Segmentation & Scope

This report segments the global Optical Interconnect Market by Type and Application.

- Type Segmentation: The market is analyzed across Optical Transceivers, Active Optical Cables (AOCs), and Embedded Optical Modules (EOMs). Optical transceivers are expected to continue dominating the market due to their widespread use in networking infrastructure, with growth projected at a significant CAGR. AOCs offer a competitive solution for shorter distances, experiencing steady growth driven by data center expansion. EOMs are anticipated to see strong growth in specialized, high-density applications.

- Application Segmentation: The market is further segmented into Telecommunication and Data Communication. The Data Communication segment, fueled by hyperscale data centers and cloud services, is projected to hold the largest market share, with robust growth driven by increasing data traffic. The Telecommunication segment is also experiencing substantial growth, propelled by the ongoing 5G network deployments and the demand for high-speed broadband access.

Key Drivers of Optical Interconnect Market Growth

The Optical Interconnect Market is propelled by a confluence of powerful drivers. The insatiable global demand for data, driven by the widespread adoption of cloud computing, big data analytics, and the Internet of Things (IoT), necessitates higher bandwidth and faster interconnectivity. The ongoing deployment and expansion of 5G mobile networks worldwide are a significant catalyst, requiring substantial upgrades to backhaul and fronthaul infrastructure. Technological advancements, such as the development of higher-speed optical transceivers (e.g., 400GbE, 800GbE) and innovations in silicon photonics, are enabling more efficient and cost-effective optical solutions. Furthermore, increasing investments in digital infrastructure by governments and enterprises across the globe are creating fertile ground for market expansion. The pursuit of lower latency in applications like real-time gaming, virtual reality, and autonomous systems also fuels the demand for advanced optical interconnects.

Challenges in the Optical Interconnect Market Sector

Despite its strong growth trajectory, the Optical Interconnect Market faces several challenges. High research and development costs associated with cutting-edge optical technologies can create barriers to entry for smaller players and impact profit margins for established ones. Supply chain disruptions, exacerbated by geopolitical factors and raw material shortages, can lead to production delays and increased costs. Intense price competition among vendors, particularly for standardized components, can squeeze profit margins. Furthermore, the evolving nature of technology requires continuous investment in upgrading manufacturing capabilities and skill sets, posing an ongoing challenge. Regulatory hurdles related to network standards and data security can also influence deployment timelines and strategies.

Leading Players in the Optical Interconnect Market Market

- II-VI Incorporated

- Huawei Technologies Co Lt

- Molex LLC

- Cisco Systems Inc

- 3M Company

- Amphenol Corporation

- TE Connectivity Ltd

- Go!Foton Inc

- Corning Incorporated

- Sumitomo Electric Industries Ltd

Key Developments in Optical Interconnect Market Sector

- March 2021: Canada-based Reflex Photonics was awarded a multimillion-dollar contract to deliver thousands of SpaceABLE 28 optical module devices. These modules are intended for high-throughput communication satellites (HTCS) potentially deployed in geostationary orbit. The SpaceABLE28 line is designed for radiation resistance and has been tested and qualified for harsh space environments, building on the inherent robustness of Reflex Photonics' optical modules. In 2019, Reflex Photonics launched its new LightCONEX active optical blind mate, which is compatible with the upcoming VITA 66.5 standard and supported by the Sensor Open System Architecture (SOSA) consortium.

- July 2020: Vodafone New Zealand collaborated with US-based Ciena Corporation to deploy an 800-Gbps data center interconnect between its facilities in Auckland. This fiber network upgrade is designed to help Vodafone manage network requirements supporting its recently launched 5G service. The deployment involves leveraging Ciena's WaveLogic 5 Extreme (WL5e) coherent optical engine online cards plugged into Vodafone New Zealand's existing Ciena 6500 packet-optical transport platforms. These new capabilities enable transmission rates from 200 to 800 Gbps and are expected to result in a 50% reduction in power consumption.

Strategic Optical Interconnect Market Market Outlook

The Optical Interconnect Market is poised for significant growth, driven by the accelerating digital transformation across all sectors. Strategic opportunities lie in the continued expansion of 5G infrastructure, the relentless demand for higher bandwidth in data centers to support AI and cloud computing, and the growing adoption of high-performance computing. The development of more compact, energy-efficient, and cost-effective optical interconnect solutions will be crucial for market players. Emerging applications in areas like autonomous driving, smart cities, and advanced medical imaging will also create new avenues for growth. Companies focusing on innovation in areas like co-packaged optics and advanced transceiver technologies are well-positioned to capitalize on future market demands. Strategic partnerships and acquisitions will remain vital for expanding market reach and technological capabilities.

Optical Interconnect Market Segmentation

-

1. Type

- 1.1. Optical Transceivers

- 1.2. Active Optical Cables (AOCs)

- 1.3. Embedded Optical Modules (EOMs)

-

2. Application

- 2.1. Telecommunication

- 2.2. Data Communication

Optical Interconnect Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Optical Interconnect Market Regional Market Share

Geographic Coverage of Optical Interconnect Market

Optical Interconnect Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Communication Bandwidth Owing to Demand for Cloud Computing

- 3.2.2 AI

- 3.2.3 and HPC; Increasing Investment in Data Centers Interconnect and Fiber Optic Communication

- 3.3. Market Restrains

- 3.3.1. Slow Commercialization of Optical Interconnection Related Technologies

- 3.4. Market Trends

- 3.4.1. Data Communication is Expected to Spur the Demand for Optical Interconnects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Optical Interconnect Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Optical Transceivers

- 5.1.2. Active Optical Cables (AOCs)

- 5.1.3. Embedded Optical Modules (EOMs)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Telecommunication

- 5.2.2. Data Communication

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Optical Interconnect Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Optical Transceivers

- 6.1.2. Active Optical Cables (AOCs)

- 6.1.3. Embedded Optical Modules (EOMs)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Telecommunication

- 6.2.2. Data Communication

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Optical Interconnect Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Optical Transceivers

- 7.1.2. Active Optical Cables (AOCs)

- 7.1.3. Embedded Optical Modules (EOMs)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Telecommunication

- 7.2.2. Data Communication

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Optical Interconnect Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Optical Transceivers

- 8.1.2. Active Optical Cables (AOCs)

- 8.1.3. Embedded Optical Modules (EOMs)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Telecommunication

- 8.2.2. Data Communication

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Optical Interconnect Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Optical Transceivers

- 9.1.2. Active Optical Cables (AOCs)

- 9.1.3. Embedded Optical Modules (EOMs)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Telecommunication

- 9.2.2. Data Communication

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Optical Interconnect Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Optical Transceivers

- 10.1.2. Active Optical Cables (AOCs)

- 10.1.3. Embedded Optical Modules (EOMs)

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Telecommunication

- 10.2.2. Data Communication

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 II-VI Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Huawei Technologies Co Lt

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Molex LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cisco Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Amphenol Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TE Connectivity Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Go!Foton Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Corning Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sumitomo Electric Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 II-VI Incorporated

List of Figures

- Figure 1: Global Optical Interconnect Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Optical Interconnect Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Optical Interconnect Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Optical Interconnect Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Optical Interconnect Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Optical Interconnect Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Optical Interconnect Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Optical Interconnect Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Optical Interconnect Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Optical Interconnect Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Optical Interconnect Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Optical Interconnect Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Optical Interconnect Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Optical Interconnect Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Optical Interconnect Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Optical Interconnect Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Optical Interconnect Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Optical Interconnect Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Optical Interconnect Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Optical Interconnect Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Optical Interconnect Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Optical Interconnect Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America Optical Interconnect Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Optical Interconnect Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Optical Interconnect Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Optical Interconnect Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Optical Interconnect Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Optical Interconnect Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Optical Interconnect Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Optical Interconnect Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Optical Interconnect Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Optical Interconnect Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Optical Interconnect Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Optical Interconnect Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Optical Interconnect Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Optical Interconnect Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Optical Interconnect Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Optical Interconnect Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Optical Interconnect Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Optical Interconnect Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Optical Interconnect Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Optical Interconnect Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Optical Interconnect Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Optical Interconnect Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Optical Interconnect Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Optical Interconnect Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Optical Interconnect Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Optical Interconnect Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Optical Interconnect Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: India Optical Interconnect Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: China Optical Interconnect Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Optical Interconnect Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Optical Interconnect Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Optical Interconnect Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Optical Interconnect Market Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Optical Interconnect Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Optical Interconnect Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Optical Interconnect Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Optical Interconnect Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Optical Interconnect Market?

The projected CAGR is approximately 13.15%.

2. Which companies are prominent players in the Optical Interconnect Market?

Key companies in the market include II-VI Incorporated, Huawei Technologies Co Lt, Molex LLC, Cisco Systems Inc, 3M Company, Amphenol Corporation, TE Connectivity Ltd, Go!Foton Inc, Corning Incorporated, Sumitomo Electric Industries Ltd.

3. What are the main segments of the Optical Interconnect Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Communication Bandwidth Owing to Demand for Cloud Computing. AI. and HPC; Increasing Investment in Data Centers Interconnect and Fiber Optic Communication.

6. What are the notable trends driving market growth?

Data Communication is Expected to Spur the Demand for Optical Interconnects.

7. Are there any restraints impacting market growth?

Slow Commercialization of Optical Interconnection Related Technologies.

8. Can you provide examples of recent developments in the market?

March 2021 - Canada-based Reflex Photonics was awarded a multimillion-dollar contract to deliver thousands of SpaceABLE 28 optical module devices to be used in high-throughput communication satellites (HTCS) that may be deployed in geostationary orbit. Building on the recognized robustness inherent in the design of Reflex Photonics' optical modules, the SpaceABLE28 line may provide radiation-resistant optical interconnect modules tested and qualified for use in harsh space environment. In 2019, the company launched new LightCONEX active optical blind mate that interconnects compatible with the upcoming VITA 66.5 standard and supported by the Sensor Open System Architecture (SOSA) consortium.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Optical Interconnect Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Optical Interconnect Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Optical Interconnect Market?

To stay informed about further developments, trends, and reports in the Optical Interconnect Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence