Key Insights

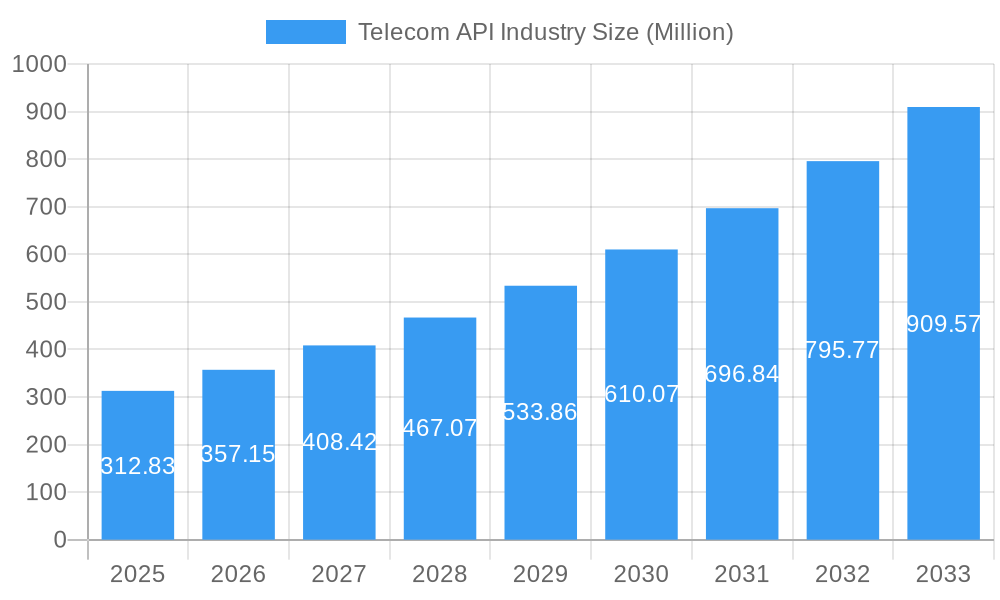

The Telecom API market is experiencing robust growth, projected to reach $312.83 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of 14.05%. This expansion is fueled by the increasing demand for seamless integration of telecommunication functionalities into diverse applications and services. Key drivers include the proliferation of digital transformation initiatives across enterprises, the growing adoption of cloud-based solutions, and the need for enhanced customer engagement through rich communication services. The Messaging API segment is anticipated to lead the market, followed by IVR/Voice Store and Voice Control API, as businesses leverage these for critical customer interactions, notifications, and support. Furthermore, the rise of WebRTC (Real-Time Connection) APIs is enabling more immersive and interactive communication experiences, from video conferencing to real-time collaboration.

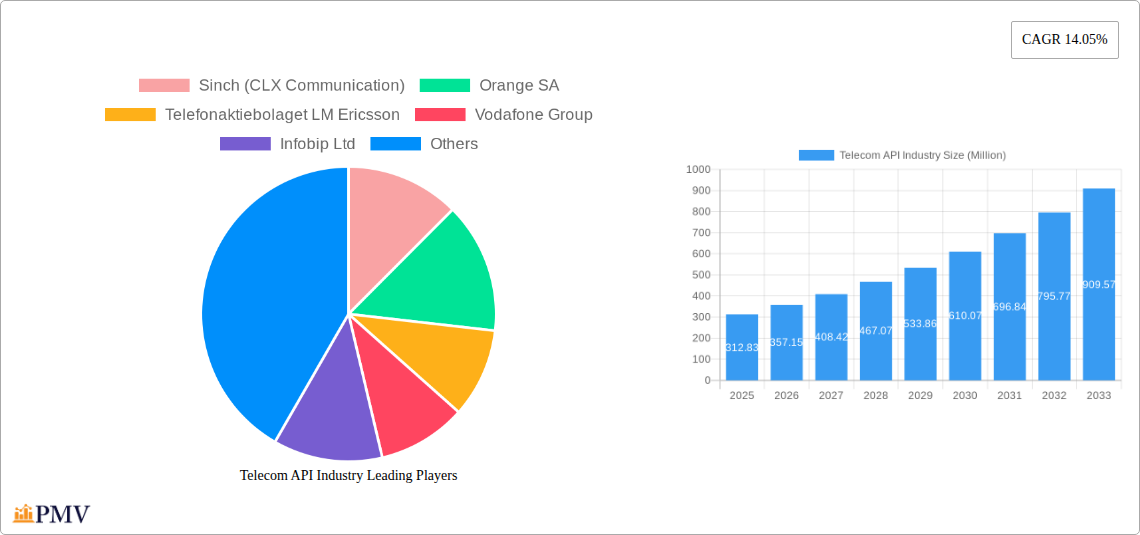

Telecom API Industry Market Size (In Million)

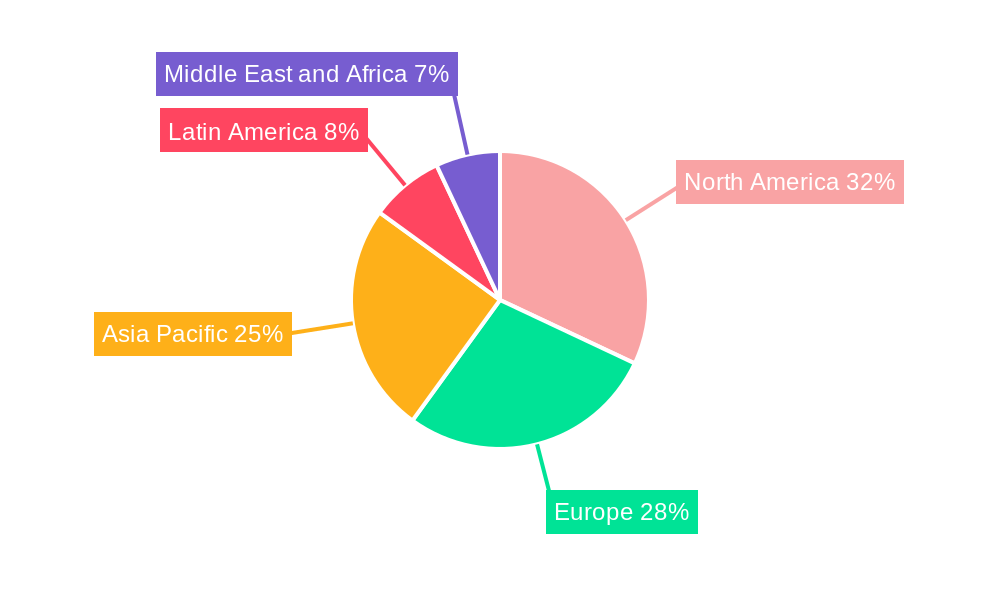

The market's dynamic nature is further shaped by strategic investments from major players like Sinch, Infobip, and Twilio, who are continuously innovating and expanding their offerings. The deployment landscape is tilting towards Hybrid and Multi-cloud strategies, offering flexibility and scalability to developers. Enterprise Developers and Internal Telecom Developers represent key end-user segments, driving adoption for both external customer-facing applications and internal operational efficiencies. While the market presents immense opportunities, potential restraints could include data privacy concerns and the evolving regulatory landscape surrounding telecommunications. Geographically, North America and Europe are expected to dominate, with Asia Pacific showing substantial growth potential due to its rapidly expanding digital infrastructure and increasing smartphone penetration. Latin America and the Middle East & Africa are emerging markets with considerable untapped potential for telecom API solutions.

Telecom API Industry Company Market Share

Unlocking the Future: Telecom API Industry Market Analysis Report (2019-2033)

Unlock the immense potential of the global Telecom API market with this comprehensive, data-driven report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis dives deep into the evolving landscape of telecommunications application programming interfaces. Discover critical insights into market structure, competitive dynamics, emerging trends, and future outlooks. This report is an essential resource for telecom operators, API providers, developers, investors, and strategists seeking to leverage the power of 5G, IoT, and digital transformation. Gain a competitive edge with actionable intelligence on market segmentation, key growth drivers, product innovations, and strategic opportunities. Explore how leading players like Sinch (CLX Communication), Orange SA, Infobip Ltd, Twilio Inc., and Google LLC (Apigee Corporation) are shaping the future of communication services through robust API strategies.

Telecom API Industry Market Structure & Competitive Dynamics

The Telecom API market is characterized by a moderately concentrated structure, with a few dominant players like Twilio, Sinch, and Infobip holding significant market share, estimated to be over 60% collectively. This concentration is driven by the high capital investment required for network infrastructure, R&D, and global reach. The innovation ecosystem thrives on partnerships between telecom operators and technology providers, fostering the development of new use cases. Regulatory frameworks, while evolving, are increasingly focused on data privacy and security, influencing API design and deployment. Product substitutes, such as direct integration solutions, exist but are less agile and scalable than API-driven approaches. End-user trends clearly favor self-service developer portals and easily consumable APIs, driving demand for Messaging APIs and WebRTC (Real-Time Connection) APIs. Mergers and acquisitions (M&A) are a key feature, with deal values projected to reach several hundred million for strategic acquisitions aimed at expanding service portfolios or geographic reach. For instance, past M&A activities in the sector have seen valuations of up to $1,000 million for companies with strong customer bases in CPaaS (Communications Platform as a Service).

- Market Concentration: Dominated by a few key players, but with emerging competition.

- Innovation Ecosystem: Driven by collaborations and open innovation initiatives.

- Regulatory Impact: Increasing focus on data privacy, security, and interoperability standards.

- End-User Demand: Prioritizing ease of integration, scalability, and developer experience.

- M&A Activity: Strategic acquisitions to consolidate market share and expand service offerings.

Telecom API Industry Industry Trends & Insights

The Telecom API industry is experiencing robust growth, propelled by the relentless digital transformation across all sectors and the pervasive rollout of 5G networks. This era witnesses a paradigm shift from traditional communication services to dynamic, programmable interactions. The CAGR for the Telecom API market is projected to be a significant 18.5% during the forecast period (2025-2033), reaching an estimated market value of over $50,000 million by 2033. This surge is fueled by the increasing demand for rich communication services, including Messaging APIs, IVR/Voice Store and Voice Control APIs, and WebRTC (Real-Time Connection) APIs, enabling businesses to connect with their customers in more engaging ways. The expansion of the Internet of Things (IoT) ecosystem further amplifies the need for standardized APIs to manage device communication and data exchange. Consumer preferences are leaning towards seamless, omnichannel experiences, pushing telecom providers to offer sophisticated API solutions that integrate various communication channels. Technological disruptions, such as advancements in AI and machine learning integrated into APIs, are enabling intelligent automation of customer interactions and personalized service delivery. Competitive dynamics are intensifying as established telecom giants collaborate with agile tech companies, fostering an environment of rapid innovation. The penetration of API-enabled services is expected to exceed 70% among enterprises by 2030, underscoring the indispensable role of APIs in modern business operations. The shift towards cloud-native architectures and multi-cloud deployments is also a significant trend, allowing for greater flexibility and scalability in API service delivery.

Dominant Markets & Segments in Telecom API Industry

The global Telecom API market's dominance is a multifaceted phenomenon, influenced by regional economic strengths, technological adoption rates, and the specific needs of diverse end-user segments. North America and Europe currently lead in market penetration, driven by advanced digital infrastructure, high disposable incomes, and a mature enterprise developer ecosystem. However, the Asia Pacific region is exhibiting the fastest growth, fueled by rapid 5G deployment and a burgeoning digital economy.

Type of Service Dominance:

- Messaging API: This segment commands the largest market share, projected to exceed $15,000 million by 2033. Its dominance stems from the universal need for customer communication, SMS marketing, notifications, and two-factor authentication. Key drivers include the rise of e-commerce, digital banking, and the demand for instant customer engagement. Economic policies supporting digital adoption and robust mobile penetration are critical factors.

- IVR/Voice Store and Voice Control API: Valued at over $10,000 million in the forecast period, this segment is crucial for customer service automation, interactive voice response systems, and voice-activated applications. The increasing adoption of AI-powered voice assistants and the need for scalable call center solutions contribute to its growth.

- WebRTC (Real-Time Connection) API: This segment, expected to reach over $8,000 million, is a significant growth area, enabling real-time video, voice, and data communication directly within web browsers and mobile applications. Its application in telehealth, online education, and collaborative tools makes it vital.

- Payment API: Essential for enabling secure in-app and online transactions, this segment is projected to grow substantially, reaching over $7,000 million. It plays a pivotal role in the fintech revolution and the growth of digital commerce.

- Location and Map API: Critical for logistics, ride-sharing, and location-based services, this segment is estimated to reach over $4,000 million. The expansion of IoT devices and the demand for real-time tracking drive its market penetration.

- Subscriber Identity Management and SSO API: Vital for secure user authentication and access management, this segment is projected to be valued at over $3,000 million. Its importance grows with the increasing cyber threats and the need for robust security solutions.

Deployment Type Dominance:

- Hybrid Deployment: Currently holds the largest market share, offering a balance between on-premises control and cloud flexibility. This is driven by organizations that require both security and scalability.

- Multi-cloud Deployment: Emerging as a strong contender, driven by the desire to avoid vendor lock-in and leverage specialized cloud services. Its market share is expected to grow significantly.

End User Dominance:

- Enterprise Developer: This segment accounts for the largest share, as large enterprises integrate APIs for customer engagement, internal operations, and digital transformation initiatives. Their substantial IT budgets and complex integration needs drive demand.

- Partner Developer: Developers from third-party software companies and system integrators represent a significant user base, building applications on top of telecom APIs for a wide range of industries.

- Internal Telecom Developer: Primarily focused on enhancing their own network capabilities and offering value-added services to their subscribers.

- Long Tail Developer: While individually smaller, this segment represents a vast number of independent developers and startups contributing to niche applications and driving innovation.

Telecom API Industry Product Innovations

The Telecom API industry is witnessing a rapid evolution of product innovations, largely driven by the capabilities unlocked by 5G and the increasing demand for seamless digital experiences. Key developments include the creation of programmable network APIs that expose network functions for direct use by applications, such as location, quality of service (QoS), and identity verification. Advancements in AI and machine learning are being integrated into APIs to enable intelligent chatbots, automated customer service, and personalized communication workflows. Low-code/no-code API platforms are democratizing access, allowing non-developers to build sophisticated communication applications. Furthermore, the focus on enhanced security features, including advanced authentication and encryption protocols, is a critical area of innovation. The competitive advantage lies in offering APIs that are not only functional but also easy to integrate, highly scalable, secure, and provide rich contextual information for more intelligent application development.

Report Segmentation & Scope

This report provides an in-depth segmentation of the Telecom API market, offering granular insights into various facets of its growth and dynamics. The segmentation covers:

- Type of Service: This includes Messaging APIs (SMS, MMS, WhatsApp, RCS), IVR/Voice Store and Voice Control APIs (outbound/inbound calling, IVR flows, voice assistants), Payment APIs (billing, in-app payments), WebRTC (Real-Time Connection) APIs (video, audio, data streaming), Location and Map APIs (geofencing, route optimization), and Subscriber Identity Management and SSO APIs (authentication, authorization). Each segment is analyzed for market size, growth projections, and competitive landscape.

- Deployment Type: We analyze the market across Hybrid, Multi-cloud, and Other Deployment Types (on-premises, single-cloud), assessing their adoption rates, benefits, and market share projections.

- End User: The report segments the market by Enterprise Developer, Internal Telecom Developer, Partner Developer, and Long Tail Developer, examining their specific needs, investment patterns, and influence on market trends.

Key Drivers of Telecom API Industry Growth

The Telecom API industry's significant growth trajectory is propelled by a confluence of technological, economic, and regulatory factors.

- 5G Network Expansion: The deployment of 5G networks is a primary catalyst, enabling higher speeds, lower latency, and greater capacity, which are crucial for supporting advanced API-driven services like real-time video and IoT.

- Digital Transformation Imperative: Businesses across all sectors are increasingly reliant on digital channels for customer engagement, operational efficiency, and product delivery, driving the demand for flexible and scalable API solutions.

- Growth of the Gig Economy and Remote Work: The surge in freelance work and the widespread adoption of remote work models necessitate robust communication and collaboration tools, often facilitated by APIs.

- Rise of CPaaS and Developer-Centric Platforms: The accessibility and ease of integration offered by Communications Platform as a Service (CPaaS) providers, coupled with a focus on developer experience, are lowering barriers to entry and accelerating API adoption.

- Increased Demand for Personalization and Omnichannel Experiences: Consumers expect seamless and personalized interactions across multiple touchpoints, driving the need for APIs that can integrate various communication channels and data sources.

Challenges in the Telecom API Industry Sector

Despite its rapid growth, the Telecom API industry faces several challenges that can temper its expansion.

- Regulatory Compliance and Data Privacy: Evolving regulations around data privacy (e.g., GDPR, CCPA) and security require constant adaptation and investment in compliance measures, which can be costly and complex.

- Interoperability and Standardization: The lack of universal standards across different API providers and telecom networks can lead to integration challenges and fragmentation, hindering seamless communication.

- Security Threats and Vulnerabilities: As APIs become more prevalent, they also become more attractive targets for cyberattacks, necessitating robust security protocols and continuous monitoring.

- Talent Gap and Skill Shortage: A shortage of skilled developers with expertise in API design, integration, and security can slow down adoption and innovation.

- Competition from Over-the-Top (OTT) Players: While APIs enable integration with OTT services, direct competition from these platforms can also pressure traditional telecom service revenue models.

Leading Players in the Telecom API Industry Market

- Sinch (CLX Communication)

- Orange SA

- Telefonaktiebolaget LM Ericsson

- Vodafone Group

- Infobip Ltd

- Cisco Systems Inc

- Verizon Communications Inc

- Twilio Inc

- Ribbon Communications

- Nokia

- Deutsche Telekom AG

- Google LLC (Apigee Corporation)

- Huawei Technologies Co Ltd

- AT&T Inc

- Telefonica SA

Key Developments in Telecom API Industry Sector

- March 2024: Comviva, a provider of operations support systems (OSS) and business support systems (BSS), contributed to the expansion of application programming interfaces (APIs) driven by 5G, which is likely to help telecom operators monetize their fifth-generation networks.

- February 2024: The GSMA outlined the mobile industry and technology partners' substantial advancement in unlocking the full potential of 5G networks and commercializing network APIs through the GSMA Open Gateway initiative. A year since GSMA Open Gateway was unveiled at MWC 2023, 47 mobile operator groups, representing 239 mobile networks and 65% of connections worldwide, have signed up for the initiative.

Strategic Telecom API Industry Market Outlook

The strategic outlook for the Telecom API industry is exceptionally bright, fueled by accelerating digital transformation and the widespread adoption of advanced technologies. The increasing demand for programmable network capabilities, coupled with the ongoing rollout of 5G, presents a significant growth runway. Opportunities lie in developing more sophisticated APIs for emerging use cases such as AI-powered customer service, enhanced IoT device management, and immersive real-time communication experiences. Strategic collaborations between telecom operators, cloud providers, and application developers will be crucial for unlocking new revenue streams and fostering innovation. The focus on security, interoperability, and developer experience will remain paramount. Companies that can offer comprehensive API portfolios, robust developer support, and a clear path to monetization will be well-positioned for substantial growth in the coming years, with market projections indicating a continued expansion into new verticals and geographic regions.

Telecom API Industry Segmentation

-

1. Type of Service

- 1.1. Messaging API

- 1.2. IVR/Voice Store and Voice Control API

- 1.3. Payment API

- 1.4. WebRTC (Real-Time Connection) API

- 1.5. Location and Map API

- 1.6. Subscriber Identity Management and SSO API

- 1.7. Other Types of Service

-

2. Deployment Type

- 2.1. Hybrid

- 2.2. Multi-cloud

- 2.3. Other Deployment Types

-

3. End User

- 3.1. Enterprise Developer

- 3.2. Internal Telecom Developer

- 3.3. Partner Developer

- 3.4. Long Tail Developer

Telecom API Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. South Korea

- 3.3. Australia

- 3.4. New Zealand

- 3.5. India

- 3.6. Thailand

- 3.7. Singapore

- 3.8. Malaysia

- 3.9. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. South Africa

- 5.3. Saudi Arabia

- 5.4. Rest Of MEA

Telecom API Industry Regional Market Share

Geographic Coverage of Telecom API Industry

Telecom API Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Mobile Data and the Rise of Digital Communication; Advent of 5G technology

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness of Security Services is Discouraging the Market Expansion

- 3.4. Market Trends

- 3.4.1. Hybrid Segment to Hold Considerable Market Shares

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecom API Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Service

- 5.1.1. Messaging API

- 5.1.2. IVR/Voice Store and Voice Control API

- 5.1.3. Payment API

- 5.1.4. WebRTC (Real-Time Connection) API

- 5.1.5. Location and Map API

- 5.1.6. Subscriber Identity Management and SSO API

- 5.1.7. Other Types of Service

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. Hybrid

- 5.2.2. Multi-cloud

- 5.2.3. Other Deployment Types

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Enterprise Developer

- 5.3.2. Internal Telecom Developer

- 5.3.3. Partner Developer

- 5.3.4. Long Tail Developer

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Service

- 6. North America Telecom API Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Service

- 6.1.1. Messaging API

- 6.1.2. IVR/Voice Store and Voice Control API

- 6.1.3. Payment API

- 6.1.4. WebRTC (Real-Time Connection) API

- 6.1.5. Location and Map API

- 6.1.6. Subscriber Identity Management and SSO API

- 6.1.7. Other Types of Service

- 6.2. Market Analysis, Insights and Forecast - by Deployment Type

- 6.2.1. Hybrid

- 6.2.2. Multi-cloud

- 6.2.3. Other Deployment Types

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Enterprise Developer

- 6.3.2. Internal Telecom Developer

- 6.3.3. Partner Developer

- 6.3.4. Long Tail Developer

- 6.1. Market Analysis, Insights and Forecast - by Type of Service

- 7. Europe Telecom API Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Service

- 7.1.1. Messaging API

- 7.1.2. IVR/Voice Store and Voice Control API

- 7.1.3. Payment API

- 7.1.4. WebRTC (Real-Time Connection) API

- 7.1.5. Location and Map API

- 7.1.6. Subscriber Identity Management and SSO API

- 7.1.7. Other Types of Service

- 7.2. Market Analysis, Insights and Forecast - by Deployment Type

- 7.2.1. Hybrid

- 7.2.2. Multi-cloud

- 7.2.3. Other Deployment Types

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Enterprise Developer

- 7.3.2. Internal Telecom Developer

- 7.3.3. Partner Developer

- 7.3.4. Long Tail Developer

- 7.1. Market Analysis, Insights and Forecast - by Type of Service

- 8. Asia Pacific Telecom API Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Service

- 8.1.1. Messaging API

- 8.1.2. IVR/Voice Store and Voice Control API

- 8.1.3. Payment API

- 8.1.4. WebRTC (Real-Time Connection) API

- 8.1.5. Location and Map API

- 8.1.6. Subscriber Identity Management and SSO API

- 8.1.7. Other Types of Service

- 8.2. Market Analysis, Insights and Forecast - by Deployment Type

- 8.2.1. Hybrid

- 8.2.2. Multi-cloud

- 8.2.3. Other Deployment Types

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Enterprise Developer

- 8.3.2. Internal Telecom Developer

- 8.3.3. Partner Developer

- 8.3.4. Long Tail Developer

- 8.1. Market Analysis, Insights and Forecast - by Type of Service

- 9. Latin America Telecom API Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Service

- 9.1.1. Messaging API

- 9.1.2. IVR/Voice Store and Voice Control API

- 9.1.3. Payment API

- 9.1.4. WebRTC (Real-Time Connection) API

- 9.1.5. Location and Map API

- 9.1.6. Subscriber Identity Management and SSO API

- 9.1.7. Other Types of Service

- 9.2. Market Analysis, Insights and Forecast - by Deployment Type

- 9.2.1. Hybrid

- 9.2.2. Multi-cloud

- 9.2.3. Other Deployment Types

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Enterprise Developer

- 9.3.2. Internal Telecom Developer

- 9.3.3. Partner Developer

- 9.3.4. Long Tail Developer

- 9.1. Market Analysis, Insights and Forecast - by Type of Service

- 10. Middle East and Africa Telecom API Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Service

- 10.1.1. Messaging API

- 10.1.2. IVR/Voice Store and Voice Control API

- 10.1.3. Payment API

- 10.1.4. WebRTC (Real-Time Connection) API

- 10.1.5. Location and Map API

- 10.1.6. Subscriber Identity Management and SSO API

- 10.1.7. Other Types of Service

- 10.2. Market Analysis, Insights and Forecast - by Deployment Type

- 10.2.1. Hybrid

- 10.2.2. Multi-cloud

- 10.2.3. Other Deployment Types

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Enterprise Developer

- 10.3.2. Internal Telecom Developer

- 10.3.3. Partner Developer

- 10.3.4. Long Tail Developer

- 10.1. Market Analysis, Insights and Forecast - by Type of Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sinch (CLX Communication)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Orange SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Telefonaktiebolaget LM Ericsson

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vodafone Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Infobip Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cisco Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Verizon Communications Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Twilio Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ribbon Communications

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Noki

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Deutsche Telekom AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Google LLC (Apigee Corporation)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Huawei Technologies Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 AT&T Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Telefonica SA

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Sinch (CLX Communication)

List of Figures

- Figure 1: Global Telecom API Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Telecom API Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Telecom API Industry Revenue (Million), by Type of Service 2025 & 2033

- Figure 4: North America Telecom API Industry Volume (K Unit), by Type of Service 2025 & 2033

- Figure 5: North America Telecom API Industry Revenue Share (%), by Type of Service 2025 & 2033

- Figure 6: North America Telecom API Industry Volume Share (%), by Type of Service 2025 & 2033

- Figure 7: North America Telecom API Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 8: North America Telecom API Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 9: North America Telecom API Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 10: North America Telecom API Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 11: North America Telecom API Industry Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Telecom API Industry Volume (K Unit), by End User 2025 & 2033

- Figure 13: North America Telecom API Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Telecom API Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Telecom API Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Telecom API Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Telecom API Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Telecom API Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Telecom API Industry Revenue (Million), by Type of Service 2025 & 2033

- Figure 20: Europe Telecom API Industry Volume (K Unit), by Type of Service 2025 & 2033

- Figure 21: Europe Telecom API Industry Revenue Share (%), by Type of Service 2025 & 2033

- Figure 22: Europe Telecom API Industry Volume Share (%), by Type of Service 2025 & 2033

- Figure 23: Europe Telecom API Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 24: Europe Telecom API Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 25: Europe Telecom API Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 26: Europe Telecom API Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 27: Europe Telecom API Industry Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Telecom API Industry Volume (K Unit), by End User 2025 & 2033

- Figure 29: Europe Telecom API Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Telecom API Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Telecom API Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Telecom API Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Telecom API Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Telecom API Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Telecom API Industry Revenue (Million), by Type of Service 2025 & 2033

- Figure 36: Asia Pacific Telecom API Industry Volume (K Unit), by Type of Service 2025 & 2033

- Figure 37: Asia Pacific Telecom API Industry Revenue Share (%), by Type of Service 2025 & 2033

- Figure 38: Asia Pacific Telecom API Industry Volume Share (%), by Type of Service 2025 & 2033

- Figure 39: Asia Pacific Telecom API Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 40: Asia Pacific Telecom API Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 41: Asia Pacific Telecom API Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 42: Asia Pacific Telecom API Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 43: Asia Pacific Telecom API Industry Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific Telecom API Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Asia Pacific Telecom API Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Telecom API Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Telecom API Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Telecom API Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Telecom API Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Telecom API Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Telecom API Industry Revenue (Million), by Type of Service 2025 & 2033

- Figure 52: Latin America Telecom API Industry Volume (K Unit), by Type of Service 2025 & 2033

- Figure 53: Latin America Telecom API Industry Revenue Share (%), by Type of Service 2025 & 2033

- Figure 54: Latin America Telecom API Industry Volume Share (%), by Type of Service 2025 & 2033

- Figure 55: Latin America Telecom API Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 56: Latin America Telecom API Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 57: Latin America Telecom API Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 58: Latin America Telecom API Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 59: Latin America Telecom API Industry Revenue (Million), by End User 2025 & 2033

- Figure 60: Latin America Telecom API Industry Volume (K Unit), by End User 2025 & 2033

- Figure 61: Latin America Telecom API Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Latin America Telecom API Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Latin America Telecom API Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Latin America Telecom API Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Latin America Telecom API Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Latin America Telecom API Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Telecom API Industry Revenue (Million), by Type of Service 2025 & 2033

- Figure 68: Middle East and Africa Telecom API Industry Volume (K Unit), by Type of Service 2025 & 2033

- Figure 69: Middle East and Africa Telecom API Industry Revenue Share (%), by Type of Service 2025 & 2033

- Figure 70: Middle East and Africa Telecom API Industry Volume Share (%), by Type of Service 2025 & 2033

- Figure 71: Middle East and Africa Telecom API Industry Revenue (Million), by Deployment Type 2025 & 2033

- Figure 72: Middle East and Africa Telecom API Industry Volume (K Unit), by Deployment Type 2025 & 2033

- Figure 73: Middle East and Africa Telecom API Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 74: Middle East and Africa Telecom API Industry Volume Share (%), by Deployment Type 2025 & 2033

- Figure 75: Middle East and Africa Telecom API Industry Revenue (Million), by End User 2025 & 2033

- Figure 76: Middle East and Africa Telecom API Industry Volume (K Unit), by End User 2025 & 2033

- Figure 77: Middle East and Africa Telecom API Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: Middle East and Africa Telecom API Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: Middle East and Africa Telecom API Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Telecom API Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Telecom API Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Telecom API Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Telecom API Industry Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 2: Global Telecom API Industry Volume K Unit Forecast, by Type of Service 2020 & 2033

- Table 3: Global Telecom API Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 4: Global Telecom API Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 5: Global Telecom API Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Telecom API Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Telecom API Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Telecom API Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Telecom API Industry Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 10: Global Telecom API Industry Volume K Unit Forecast, by Type of Service 2020 & 2033

- Table 11: Global Telecom API Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 12: Global Telecom API Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 13: Global Telecom API Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Telecom API Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Global Telecom API Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Telecom API Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Telecom API Industry Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 24: Global Telecom API Industry Volume K Unit Forecast, by Type of Service 2020 & 2033

- Table 25: Global Telecom API Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 26: Global Telecom API Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 27: Global Telecom API Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Telecom API Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Telecom API Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Telecom API Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Telecom API Industry Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 44: Global Telecom API Industry Volume K Unit Forecast, by Type of Service 2020 & 2033

- Table 45: Global Telecom API Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 46: Global Telecom API Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 47: Global Telecom API Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 48: Global Telecom API Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 49: Global Telecom API Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Telecom API Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: South Korea Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: South Korea Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Australia Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Australia Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: New Zealand Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: New Zealand Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: India Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: India Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Thailand Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Thailand Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Singapore Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Singapore Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Malaysia Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Malaysia Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Rest of Asia Pacific Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of Asia Pacific Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: Global Telecom API Industry Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 70: Global Telecom API Industry Volume K Unit Forecast, by Type of Service 2020 & 2033

- Table 71: Global Telecom API Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 72: Global Telecom API Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 73: Global Telecom API Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 74: Global Telecom API Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 75: Global Telecom API Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 76: Global Telecom API Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 77: Brazil Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Brazil Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: Argentina Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Argentina Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest of South America Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of South America Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Global Telecom API Industry Revenue Million Forecast, by Type of Service 2020 & 2033

- Table 84: Global Telecom API Industry Volume K Unit Forecast, by Type of Service 2020 & 2033

- Table 85: Global Telecom API Industry Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 86: Global Telecom API Industry Volume K Unit Forecast, by Deployment Type 2020 & 2033

- Table 87: Global Telecom API Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 88: Global Telecom API Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 89: Global Telecom API Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global Telecom API Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 91: UAE Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: UAE Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: South Africa Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: South Africa Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 95: Saudi Arabia Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Saudi Arabia Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 97: Rest Of MEA Telecom API Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: Rest Of MEA Telecom API Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom API Industry?

The projected CAGR is approximately 14.05%.

2. Which companies are prominent players in the Telecom API Industry?

Key companies in the market include Sinch (CLX Communication), Orange SA, Telefonaktiebolaget LM Ericsson, Vodafone Group, Infobip Ltd, Cisco Systems Inc, Verizon Communications Inc, Twilio Inc, Ribbon Communications, Noki, Deutsche Telekom AG, Google LLC (Apigee Corporation), Huawei Technologies Co Ltd, AT&T Inc, Telefonica SA.

3. What are the main segments of the Telecom API Industry?

The market segments include Type of Service, Deployment Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 312.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Mobile Data and the Rise of Digital Communication; Advent of 5G technology.

6. What are the notable trends driving market growth?

Hybrid Segment to Hold Considerable Market Shares.

7. Are there any restraints impacting market growth?

Lack of Awareness of Security Services is Discouraging the Market Expansion.

8. Can you provide examples of recent developments in the market?

March 2024: Comviva, a provider of operations support systems (OSS) and business support systems (BSS), contributed to the expansion of application programming interfaces (APIs) driven by 5G, which is likely to help telecom operators monetize their fifth-generation networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecom API Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecom API Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecom API Industry?

To stay informed about further developments, trends, and reports in the Telecom API Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence