Key Insights

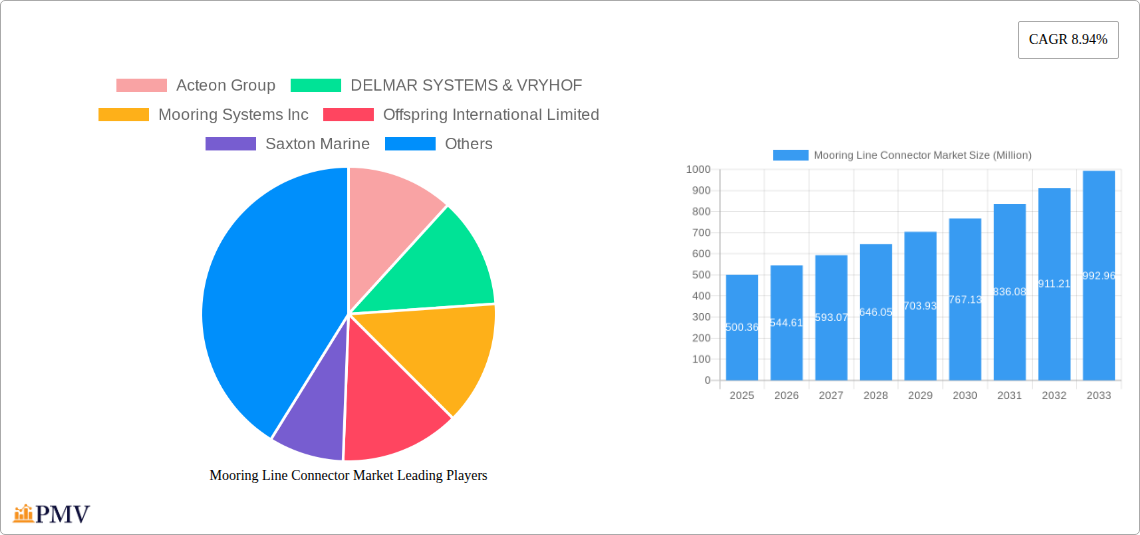

The global Mooring Line Connector Market is projected to witness robust expansion, reaching a substantial USD 500.36 million in value. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 8.94%, indicating a dynamic and evolving industry landscape. The primary impetus for this expansion stems from the burgeoning activities within the Oil and Gas Industry, particularly in offshore exploration and production, which necessitates advanced and reliable mooring solutions. Furthermore, the increasing investment in Marine Industry infrastructure, including ports, offshore wind farms, and aquaculture, is significantly contributing to market demand. Emerging applications in specialized maritime operations also present lucrative avenues for market participants.

The market is characterized by diverse product offerings, with H-Link, Y-Link, and M-Link connectors leading the segment due to their widespread adoption in various offshore applications. However, the "Others" category, encompassing innovative and specialized connectors, is anticipated to grow at a notable pace as technological advancements cater to niche requirements. Restraints are primarily linked to the high capital expenditure associated with offshore projects and the potential for stringent regulatory environments in certain regions. Despite these challenges, the overarching demand for enhanced safety, operational efficiency, and the increasing complexity of offshore installations are expected to drive sustained market growth and innovation in mooring line connector technologies.

This in-depth report provides a detailed examination of the global Mooring Line Connector Market, offering strategic insights and actionable intelligence for stakeholders. Covering the historical period from 2019 to 2024 and projecting growth through 2033, this analysis delves into market structure, key trends, segment dominance, product innovations, and competitive landscapes. With a focus on the Oil and Gas Industry, Marine Industry, and emerging offshore renewable sectors, the report identifies critical growth drivers, challenges, and the strategic moves of leading industry players. This research leverages advanced analytics to present a clear and concise outlook for the Mooring Line Connector market.

Mooring Line Connector Market Market Structure & Competitive Dynamics

The Mooring Line Connector Market is characterized by a moderately concentrated structure, with several key players vying for market share. Innovation ecosystems are robust, driven by the increasing demand for enhanced safety, efficiency, and sustainability in offshore operations. Regulatory frameworks, particularly those governing offshore safety and environmental protection, significantly influence market dynamics. The advent of stricter maritime regulations, such as the SOLAS amendments adopted in November 2023, is a critical factor shaping product development and market entry.

Key aspects influencing the competitive landscape include:

- Market Share: Leading companies are consolidating their positions through technological advancements and strategic partnerships. The global market share for mooring line connectors is projected to reach approximately $350 Million by 2025, with significant growth anticipated in the forecast period.

- Innovation Ecosystems: Continuous R&D investment fuels the development of advanced connector designs, improved materials, and integrated systems for faster and safer mooring operations.

- Regulatory Frameworks: Evolving international and regional maritime safety standards necessitate ongoing compliance and product upgrades, creating both opportunities and challenges for manufacturers.

- Product Substitutes: While traditional mooring methods exist, the inherent advantages of specialized connectors in terms of speed, safety, and reliability limit direct substitution in critical offshore applications.

- End-User Trends: Growing investments in offshore wind, floating solar, aquaculture, and the continued importance of the oil and gas sector are primary demand drivers. The shift towards more sustainable energy sources is particularly boosting the market for connectors used in renewable energy infrastructure.

- M&A Activities: Mergers and acquisitions are anticipated to play a role in market consolidation, with estimated M&A deal values potentially reaching several million dollars as companies seek to expand their product portfolios and geographical reach. The market size for mooring line connectors is projected to reach over $500 Million by 2030.

Mooring Line Connector Market Industry Trends & Insights

The Mooring Line Connector Market is experiencing dynamic growth, propelled by a confluence of technological advancements, increasing offshore energy exploration, and a paramount focus on operational safety and efficiency. The estimated market size in the base year 2025 stands at approximately $350 Million, with a projected Compound Annual Growth Rate (CAGR) of around 5.5% through the forecast period of 2025-2033. This growth trajectory is underpinned by several key trends shaping the industry.

The escalating development of offshore renewable energy projects, including offshore wind farms and floating solar installations, is a significant market expansion driver. These projects require robust and reliable mooring systems capable of withstanding harsh marine environments. Consequently, there is a heightened demand for innovative mooring line connectors that facilitate quicker installation, reduce deployment times, and ensure the long-term integrity of mooring lines. The oil and gas industry, though undergoing a transition, continues to be a substantial consumer of mooring line connectors for platforms, FPSOs (Floating Production Storage and Offloading units), and subsea infrastructure, further bolstering market demand.

Technological disruptions are revolutionizing connector designs. Manufacturers are increasingly focusing on developing connectors that are lighter, stronger, more corrosion-resistant, and incorporate smart features for real-time monitoring and diagnostics. The integration of advanced materials and manufacturing techniques, such as high-strength steel alloys and precision engineering, is crucial for meeting the stringent performance requirements of offshore applications.

Consumer preferences are evolving towards solutions that offer not only enhanced safety and reliability but also cost-effectiveness and reduced environmental impact. The ability of connectors to minimize downtime, simplify maintenance, and extend the lifespan of mooring assets is becoming a key purchasing criterion. Competitive dynamics are characterized by intense innovation, with companies actively investing in R&D to differentiate their offerings and capture market share. The market penetration of advanced mooring line connectors is expected to rise significantly as industries prioritize operational resilience and sustainability. The total market value is estimated to reach over $600 Million by 2033.

Dominant Markets & Segments in Mooring Line Connector Market

The Mooring Line Connector Market is segmented by Type and End Use Industry, with certain segments exhibiting pronounced dominance due to specific economic, technological, and regulatory factors.

By Type:

- H-Link: This type of connector holds a significant market share due to its robust design and widespread application in various offshore settings. Its dominance is driven by established use in traditional offshore structures and its reliability in high-tension environments. The Oil and Gas Industry is a primary consumer.

- Y-Link: Exhibiting strong growth, Y-links are gaining traction due to their efficiency in load distribution and versatility. Their suitability for complex mooring configurations in offshore wind and renewable energy projects contributes to their increasing market penetration.

- M-Link: While a niche segment, M-links are crucial for specialized applications requiring quick connect/disconnect capabilities. Their growth is tied to projects demanding rapid deployment and retrieval.

- K-Link: K-links are essential for specific offshore operations where a secure and reliable connection is paramount, often found in deep-water applications.

- Others: This category encompasses custom-designed and emerging connector types that cater to evolving industry needs and niche applications.

By End Use Industry:

- Oil and Gas Industry: This sector remains a dominant force in the Mooring Line Connector Market.

- Key Drivers: Continued global demand for oil and gas, exploration in challenging offshore environments, and the need for secure mooring of production facilities (FPSOs, semi-submersibles) and subsea infrastructure.

- Dominance Analysis: The Oil and Gas Industry's extensive offshore footprint, coupled with its long-standing reliance on established mooring technologies, positions it as a consistent and significant consumer of mooring line connectors. The value of connectors used in this sector is projected to be in the hundreds of millions of dollars annually.

- Marine Industry: Encompassing commercial shipping, naval operations, and port infrastructure, this segment contributes steadily to the market.

- Key Drivers: Growth in global trade, increasing fleet sizes, and the need for reliable mooring solutions in ports and for various marine vessels.

- Others: This rapidly expanding segment includes:

- Offshore Renewable Energy (Wind, Solar, Tidal, Wave): This is the fastest-growing segment.

- Key Drivers: Ambitious global targets for renewable energy adoption, significant investments in offshore wind farms, and the development of innovative floating offshore energy technologies. The need for efficient and robust mooring solutions for floating platforms and turbines is driving substantial demand. The market for connectors in this sector is expected to grow at a CAGR exceeding 7% in the forecast period, reaching hundreds of millions of dollars.

- Aquaculture: The expansion of offshore aquaculture operations also contributes to the demand for specialized mooring solutions.

- Offshore Renewable Energy (Wind, Solar, Tidal, Wave): This is the fastest-growing segment.

The dominance of the Oil and Gas Industry is expected to persist through the forecast period, albeit with a proportionally increasing share captured by the burgeoning offshore renewable energy sector. Regions with extensive offshore oil and gas reserves and those actively investing in renewable energy infrastructure will lead market growth.

Mooring Line Connector Market Product Innovations

Product innovations in the Mooring Line Connector Market are primarily driven by the pursuit of enhanced safety, efficiency, and sustainability in offshore operations. Recent developments focus on materials science, intelligent design, and integrated functionality. For instance, the introduction of quick-connect systems like Bardex's BarMoor Quick Connector aims to reduce installation durations and prolong asset lifespan. Similarly, Blackfish Engineering's C-Dart system addresses the critical need to minimize direct handling of heavy mooring lines by operational personnel, thereby improving safety and speed across diverse floating structures. These innovations provide a competitive edge by offering faster deployment, reduced risk, and improved operational interfaces, aligning with the stringent demands of the evolving marine and energy sectors. The market is witnessing a trend towards connectors that are not only structurally robust but also incorporate features that reduce maintenance requirements and increase overall system reliability.

Report Segmentation & Scope

This report segments the Mooring Line Connector Market based on Type and End Use Industry, providing detailed analysis for each category.

Type Segmentation:

- H-Link: Characterized by its robust, link-based design, this segment is projected to maintain a significant market share due to its established reliability in the Oil and Gas Industry. Projected market size for H-links is expected to be in the range of $150-180 Million by 2025.

- Y-Link: With growing adoption in renewable energy applications, Y-links are anticipated to experience robust growth. Projected market size is estimated at $80-100 Million by 2025, with a CAGR of over 6%.

- M-Link: This segment caters to specialized, quick-release applications and is expected to see steady growth driven by specific project requirements. Projected market size around $30-40 Million by 2025.

- K-Link: Essential for high-tension, critical deep-water applications, this segment will see consistent demand. Projected market size in the range of $40-50 Million by 2025.

- Others: This segment includes emerging connector designs and custom solutions, with projected market size of $20-30 Million by 2025.

End Use Industry Segmentation:

- Oil and Gas Industry: This remains the largest segment, with projected market size exceeding $200 Million by 2025.

- Marine Industry: A stable segment with projected market size around $50-70 Million by 2025.

- Others (Renewable Energy, Aquaculture): This segment is the fastest-growing, with projected market size of $70-90 Million by 2025 and a CAGR above 7%.

The scope of this report encompasses the global Mooring Line Connector Market, providing a comprehensive overview of market dynamics, key players, and future outlook.

Key Drivers of Mooring Line Connector Market Growth

The Mooring Line Connector Market is propelled by several interconnected drivers that underscore its increasing importance in offshore operations. The relentless expansion of the offshore oil and gas sector, particularly in frontier regions, necessitates highly reliable and robust mooring solutions. Simultaneously, the global surge in investment towards renewable energy infrastructure, especially offshore wind farms, is creating substantial demand for innovative and efficient mooring systems. Technological advancements in connector design, focusing on enhanced safety, speed of deployment, and durability in harsh marine environments, are also key growth catalysts. Furthermore, evolving international maritime safety regulations, such as the recent SOLAS amendments, are mandating the use of more sophisticated and certified mooring equipment, directly stimulating market growth. The drive towards operational efficiency and cost reduction in offshore projects also favors advanced connector solutions that minimize downtime and simplify maintenance.

Challenges in the Mooring Line Connector Market Sector

Despite robust growth prospects, the Mooring Line Connector Market faces several significant challenges that can impede its trajectory. Stringent and evolving regulatory compliance requirements across different jurisdictions can be complex and costly for manufacturers to navigate, potentially slowing down product approvals and market entry. The specialized nature of mooring connectors and the high capital investment required for R&D and manufacturing can lead to supply chain vulnerabilities, particularly during periods of high demand or geopolitical instability. Intense competition among established players and emerging entrants can exert downward pressure on pricing, impacting profit margins. Furthermore, the relatively long lifecycle of offshore assets means that the replacement cycle for mooring connectors can be extended, influencing the pace of new technology adoption. Finally, the inherent risks associated with offshore operations and the critical nature of mooring systems mean that any perceived unreliability or failure can lead to significant financial and reputational damage, creating a barrier for less proven technologies.

Leading Players in the Mooring Line Connector Market Market

- Acteon Group

- DELMAR SYSTEMS & VRYHOF

- Mooring Systems Inc

- Offspring International Limited

- Saxton Marine

- VICINAY MOORING CONNECTORS

- Blackfish Engineering

- Balltec Engineered Solutions

- First Subsea Ltd

- Flintstone Technology Ltd

- InterMoo

Key Developments in Mooring Line Connector Market Sector

- July 2024: Blackfish Engineering (UK) introduced the C-Dart mooring system, designed for swift connections across floating structures like wave and tidal energy converters, offshore wind platforms, floating solar, and aquaculture. This system eliminates the need for personnel to directly handle heavy mooring lines.

- March 2024: Bardex (USA) launched the BarMoor Quick Connector, a mooring solution for offshore wind and oil & gas sectors. It enhances operational interfaces, prolongs system and line lifespan, minimizes project risks, shortens installation durations, and offers scalable production.

- November 2023: At MSC 102, amendments to SOLAS II-1/Reg.3-8 ("Towing and Mooring Equipment") were adopted, effective January 1, 2024. These amendments introduce enhanced safety requirements for the design, selection, inspection, maintenance, and replacement of mooring and towing arrangements, aligning with MSC.1/Circ.1175/Rev.1, MSC.1/Circ.1619, and MSC.1/Circ.1620.

Strategic Mooring Line Connector Market Market Outlook

- July 2024: Blackfish Engineering (UK) introduced the C-Dart mooring system, designed for swift connections across floating structures like wave and tidal energy converters, offshore wind platforms, floating solar, and aquaculture. This system eliminates the need for personnel to directly handle heavy mooring lines.

- March 2024: Bardex (USA) launched the BarMoor Quick Connector, a mooring solution for offshore wind and oil & gas sectors. It enhances operational interfaces, prolongs system and line lifespan, minimizes project risks, shortens installation durations, and offers scalable production.

- November 2023: At MSC 102, amendments to SOLAS II-1/Reg.3-8 ("Towing and Mooring Equipment") were adopted, effective January 1, 2024. These amendments introduce enhanced safety requirements for the design, selection, inspection, maintenance, and replacement of mooring and towing arrangements, aligning with MSC.1/Circ.1175/Rev.1, MSC.1/Circ.1619, and MSC.1/Circ.1620.

Strategic Mooring Line Connector Market Market Outlook

The strategic outlook for the Mooring Line Connector Market is highly positive, driven by sustained global investments in offshore energy infrastructure and an increasing emphasis on operational safety and efficiency. The burgeoning offshore renewable energy sector, particularly offshore wind, represents a significant growth accelerator, demanding innovative and robust mooring solutions for floating platforms. Continued exploration and production in the oil and gas industry, alongside advancements in subsea technologies, will also sustain demand. Strategic opportunities lie in developing advanced, high-performance connectors with integrated monitoring capabilities, focusing on eco-friendly materials, and expanding market reach into emerging geographical regions and niche applications like offshore aquaculture. Collaborations between connector manufacturers and offshore engineering firms are crucial for co-developing solutions that address evolving industry challenges, ensuring the market's continued expansion and technological advancement.

Mooring Line Connector Market Segmentation

-

1. Type

- 1.1. H-Link

- 1.2. Y-Link

- 1.3. M-Link

- 1.4. K-Link

- 1.5. Others

-

2. End Use Industry

- 2.1. Oil and Gas Industry

- 2.2. Marine Industry

- 2.3. Others

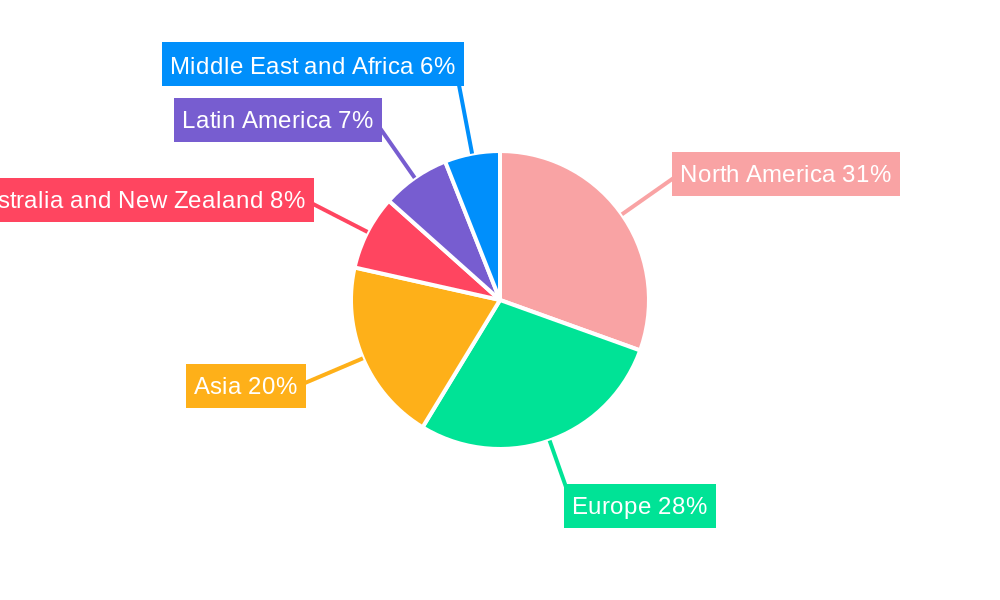

Mooring Line Connector Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Mooring Line Connector Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

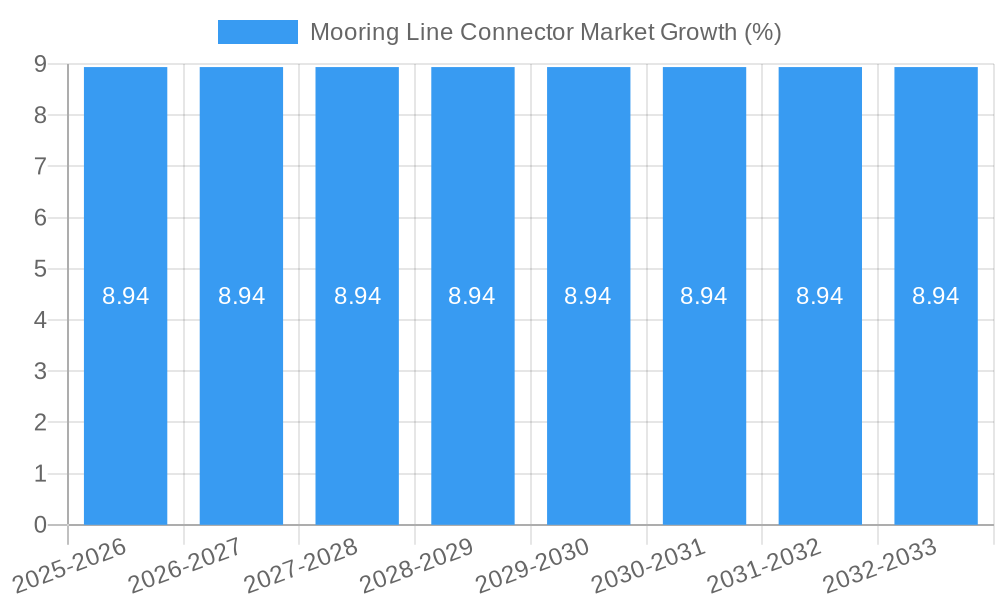

| Growth Rate | CAGR of 8.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Offshore Oil and Gas Industry as well as growing number of renewable projects; Rising Marine Transportation Owing to Growing Trade Among Nations

- 3.3. Market Restrains

- 3.3.1. Rising Offshore Oil and Gas Industry as well as growing number of renewable projects; Rising Marine Transportation Owing to Growing Trade Among Nations

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry Expected to Share Wide Traction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mooring Line Connector Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. H-Link

- 5.1.2. Y-Link

- 5.1.3. M-Link

- 5.1.4. K-Link

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End Use Industry

- 5.2.1. Oil and Gas Industry

- 5.2.2. Marine Industry

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Mooring Line Connector Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. H-Link

- 6.1.2. Y-Link

- 6.1.3. M-Link

- 6.1.4. K-Link

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End Use Industry

- 6.2.1. Oil and Gas Industry

- 6.2.2. Marine Industry

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Mooring Line Connector Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. H-Link

- 7.1.2. Y-Link

- 7.1.3. M-Link

- 7.1.4. K-Link

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End Use Industry

- 7.2.1. Oil and Gas Industry

- 7.2.2. Marine Industry

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Mooring Line Connector Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. H-Link

- 8.1.2. Y-Link

- 8.1.3. M-Link

- 8.1.4. K-Link

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End Use Industry

- 8.2.1. Oil and Gas Industry

- 8.2.2. Marine Industry

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Mooring Line Connector Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. H-Link

- 9.1.2. Y-Link

- 9.1.3. M-Link

- 9.1.4. K-Link

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End Use Industry

- 9.2.1. Oil and Gas Industry

- 9.2.2. Marine Industry

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Mooring Line Connector Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. H-Link

- 10.1.2. Y-Link

- 10.1.3. M-Link

- 10.1.4. K-Link

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by End Use Industry

- 10.2.1. Oil and Gas Industry

- 10.2.2. Marine Industry

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Mooring Line Connector Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. H-Link

- 11.1.2. Y-Link

- 11.1.3. M-Link

- 11.1.4. K-Link

- 11.1.5. Others

- 11.2. Market Analysis, Insights and Forecast - by End Use Industry

- 11.2.1. Oil and Gas Industry

- 11.2.2. Marine Industry

- 11.2.3. Others

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Acteon Group

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 DELMAR SYSTEMS & VRYHOF

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Mooring Systems Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Offspring International Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Saxton Marine

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 VICINAY MOORING CONNECTORS

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Offspring International Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Blackfish Engineering

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Balltec Engineered Solutions

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 First Subsea Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Flintstone Technology Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 InterMoo

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Acteon Group

List of Figures

- Figure 1: Global Mooring Line Connector Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Mooring Line Connector Market Volume Breakdown (Million, %) by Region 2024 & 2032

- Figure 3: North America Mooring Line Connector Market Revenue (Million), by Type 2024 & 2032

- Figure 4: North America Mooring Line Connector Market Volume (Million), by Type 2024 & 2032

- Figure 5: North America Mooring Line Connector Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Mooring Line Connector Market Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Mooring Line Connector Market Revenue (Million), by End Use Industry 2024 & 2032

- Figure 8: North America Mooring Line Connector Market Volume (Million), by End Use Industry 2024 & 2032

- Figure 9: North America Mooring Line Connector Market Revenue Share (%), by End Use Industry 2024 & 2032

- Figure 10: North America Mooring Line Connector Market Volume Share (%), by End Use Industry 2024 & 2032

- Figure 11: North America Mooring Line Connector Market Revenue (Million), by Country 2024 & 2032

- Figure 12: North America Mooring Line Connector Market Volume (Million), by Country 2024 & 2032

- Figure 13: North America Mooring Line Connector Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Mooring Line Connector Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Europe Mooring Line Connector Market Revenue (Million), by Type 2024 & 2032

- Figure 16: Europe Mooring Line Connector Market Volume (Million), by Type 2024 & 2032

- Figure 17: Europe Mooring Line Connector Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Mooring Line Connector Market Volume Share (%), by Type 2024 & 2032

- Figure 19: Europe Mooring Line Connector Market Revenue (Million), by End Use Industry 2024 & 2032

- Figure 20: Europe Mooring Line Connector Market Volume (Million), by End Use Industry 2024 & 2032

- Figure 21: Europe Mooring Line Connector Market Revenue Share (%), by End Use Industry 2024 & 2032

- Figure 22: Europe Mooring Line Connector Market Volume Share (%), by End Use Industry 2024 & 2032

- Figure 23: Europe Mooring Line Connector Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Europe Mooring Line Connector Market Volume (Million), by Country 2024 & 2032

- Figure 25: Europe Mooring Line Connector Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Mooring Line Connector Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Asia Mooring Line Connector Market Revenue (Million), by Type 2024 & 2032

- Figure 28: Asia Mooring Line Connector Market Volume (Million), by Type 2024 & 2032

- Figure 29: Asia Mooring Line Connector Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Mooring Line Connector Market Volume Share (%), by Type 2024 & 2032

- Figure 31: Asia Mooring Line Connector Market Revenue (Million), by End Use Industry 2024 & 2032

- Figure 32: Asia Mooring Line Connector Market Volume (Million), by End Use Industry 2024 & 2032

- Figure 33: Asia Mooring Line Connector Market Revenue Share (%), by End Use Industry 2024 & 2032

- Figure 34: Asia Mooring Line Connector Market Volume Share (%), by End Use Industry 2024 & 2032

- Figure 35: Asia Mooring Line Connector Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Asia Mooring Line Connector Market Volume (Million), by Country 2024 & 2032

- Figure 37: Asia Mooring Line Connector Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Mooring Line Connector Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Australia and New Zealand Mooring Line Connector Market Revenue (Million), by Type 2024 & 2032

- Figure 40: Australia and New Zealand Mooring Line Connector Market Volume (Million), by Type 2024 & 2032

- Figure 41: Australia and New Zealand Mooring Line Connector Market Revenue Share (%), by Type 2024 & 2032

- Figure 42: Australia and New Zealand Mooring Line Connector Market Volume Share (%), by Type 2024 & 2032

- Figure 43: Australia and New Zealand Mooring Line Connector Market Revenue (Million), by End Use Industry 2024 & 2032

- Figure 44: Australia and New Zealand Mooring Line Connector Market Volume (Million), by End Use Industry 2024 & 2032

- Figure 45: Australia and New Zealand Mooring Line Connector Market Revenue Share (%), by End Use Industry 2024 & 2032

- Figure 46: Australia and New Zealand Mooring Line Connector Market Volume Share (%), by End Use Industry 2024 & 2032

- Figure 47: Australia and New Zealand Mooring Line Connector Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Australia and New Zealand Mooring Line Connector Market Volume (Million), by Country 2024 & 2032

- Figure 49: Australia and New Zealand Mooring Line Connector Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Australia and New Zealand Mooring Line Connector Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Latin America Mooring Line Connector Market Revenue (Million), by Type 2024 & 2032

- Figure 52: Latin America Mooring Line Connector Market Volume (Million), by Type 2024 & 2032

- Figure 53: Latin America Mooring Line Connector Market Revenue Share (%), by Type 2024 & 2032

- Figure 54: Latin America Mooring Line Connector Market Volume Share (%), by Type 2024 & 2032

- Figure 55: Latin America Mooring Line Connector Market Revenue (Million), by End Use Industry 2024 & 2032

- Figure 56: Latin America Mooring Line Connector Market Volume (Million), by End Use Industry 2024 & 2032

- Figure 57: Latin America Mooring Line Connector Market Revenue Share (%), by End Use Industry 2024 & 2032

- Figure 58: Latin America Mooring Line Connector Market Volume Share (%), by End Use Industry 2024 & 2032

- Figure 59: Latin America Mooring Line Connector Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Latin America Mooring Line Connector Market Volume (Million), by Country 2024 & 2032

- Figure 61: Latin America Mooring Line Connector Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Latin America Mooring Line Connector Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Middle East and Africa Mooring Line Connector Market Revenue (Million), by Type 2024 & 2032

- Figure 64: Middle East and Africa Mooring Line Connector Market Volume (Million), by Type 2024 & 2032

- Figure 65: Middle East and Africa Mooring Line Connector Market Revenue Share (%), by Type 2024 & 2032

- Figure 66: Middle East and Africa Mooring Line Connector Market Volume Share (%), by Type 2024 & 2032

- Figure 67: Middle East and Africa Mooring Line Connector Market Revenue (Million), by End Use Industry 2024 & 2032

- Figure 68: Middle East and Africa Mooring Line Connector Market Volume (Million), by End Use Industry 2024 & 2032

- Figure 69: Middle East and Africa Mooring Line Connector Market Revenue Share (%), by End Use Industry 2024 & 2032

- Figure 70: Middle East and Africa Mooring Line Connector Market Volume Share (%), by End Use Industry 2024 & 2032

- Figure 71: Middle East and Africa Mooring Line Connector Market Revenue (Million), by Country 2024 & 2032

- Figure 72: Middle East and Africa Mooring Line Connector Market Volume (Million), by Country 2024 & 2032

- Figure 73: Middle East and Africa Mooring Line Connector Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Middle East and Africa Mooring Line Connector Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mooring Line Connector Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Mooring Line Connector Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Global Mooring Line Connector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Mooring Line Connector Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: Global Mooring Line Connector Market Revenue Million Forecast, by End Use Industry 2019 & 2032

- Table 6: Global Mooring Line Connector Market Volume Million Forecast, by End Use Industry 2019 & 2032

- Table 7: Global Mooring Line Connector Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Mooring Line Connector Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Global Mooring Line Connector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Global Mooring Line Connector Market Volume Million Forecast, by Type 2019 & 2032

- Table 11: Global Mooring Line Connector Market Revenue Million Forecast, by End Use Industry 2019 & 2032

- Table 12: Global Mooring Line Connector Market Volume Million Forecast, by End Use Industry 2019 & 2032

- Table 13: Global Mooring Line Connector Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Mooring Line Connector Market Volume Million Forecast, by Country 2019 & 2032

- Table 15: Global Mooring Line Connector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Mooring Line Connector Market Volume Million Forecast, by Type 2019 & 2032

- Table 17: Global Mooring Line Connector Market Revenue Million Forecast, by End Use Industry 2019 & 2032

- Table 18: Global Mooring Line Connector Market Volume Million Forecast, by End Use Industry 2019 & 2032

- Table 19: Global Mooring Line Connector Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Mooring Line Connector Market Volume Million Forecast, by Country 2019 & 2032

- Table 21: Global Mooring Line Connector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Mooring Line Connector Market Volume Million Forecast, by Type 2019 & 2032

- Table 23: Global Mooring Line Connector Market Revenue Million Forecast, by End Use Industry 2019 & 2032

- Table 24: Global Mooring Line Connector Market Volume Million Forecast, by End Use Industry 2019 & 2032

- Table 25: Global Mooring Line Connector Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Mooring Line Connector Market Volume Million Forecast, by Country 2019 & 2032

- Table 27: Global Mooring Line Connector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Mooring Line Connector Market Volume Million Forecast, by Type 2019 & 2032

- Table 29: Global Mooring Line Connector Market Revenue Million Forecast, by End Use Industry 2019 & 2032

- Table 30: Global Mooring Line Connector Market Volume Million Forecast, by End Use Industry 2019 & 2032

- Table 31: Global Mooring Line Connector Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Mooring Line Connector Market Volume Million Forecast, by Country 2019 & 2032

- Table 33: Global Mooring Line Connector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global Mooring Line Connector Market Volume Million Forecast, by Type 2019 & 2032

- Table 35: Global Mooring Line Connector Market Revenue Million Forecast, by End Use Industry 2019 & 2032

- Table 36: Global Mooring Line Connector Market Volume Million Forecast, by End Use Industry 2019 & 2032

- Table 37: Global Mooring Line Connector Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Mooring Line Connector Market Volume Million Forecast, by Country 2019 & 2032

- Table 39: Global Mooring Line Connector Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Mooring Line Connector Market Volume Million Forecast, by Type 2019 & 2032

- Table 41: Global Mooring Line Connector Market Revenue Million Forecast, by End Use Industry 2019 & 2032

- Table 42: Global Mooring Line Connector Market Volume Million Forecast, by End Use Industry 2019 & 2032

- Table 43: Global Mooring Line Connector Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Mooring Line Connector Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mooring Line Connector Market?

The projected CAGR is approximately 8.94%.

2. Which companies are prominent players in the Mooring Line Connector Market?

Key companies in the market include Acteon Group, DELMAR SYSTEMS & VRYHOF, Mooring Systems Inc, Offspring International Limited, Saxton Marine, VICINAY MOORING CONNECTORS, Offspring International Limited, Blackfish Engineering, Balltec Engineered Solutions, First Subsea Ltd, Flintstone Technology Ltd, InterMoo.

3. What are the main segments of the Mooring Line Connector Market?

The market segments include Type, End Use Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 500.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Offshore Oil and Gas Industry as well as growing number of renewable projects; Rising Marine Transportation Owing to Growing Trade Among Nations.

6. What are the notable trends driving market growth?

Oil and Gas Industry Expected to Share Wide Traction.

7. Are there any restraints impacting market growth?

Rising Offshore Oil and Gas Industry as well as growing number of renewable projects; Rising Marine Transportation Owing to Growing Trade Among Nations.

8. Can you provide examples of recent developments in the market?

July 2024 - Blackfish Engineering, hailing from the UK, has introduced the C-Dart mooring system. This innovative system removes the need for operational personnel to directly handle heavy mooring lines. As per the company's announcement, C-Dart is engineered for swift connections across a range of floating structures and assets. These include wave and tidal energy converters, offshore wind platforms, floating solar installations, aquaculture setups, and beyond.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mooring Line Connector Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mooring Line Connector Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mooring Line Connector Market?

To stay informed about further developments, trends, and reports in the Mooring Line Connector Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence