Key Insights

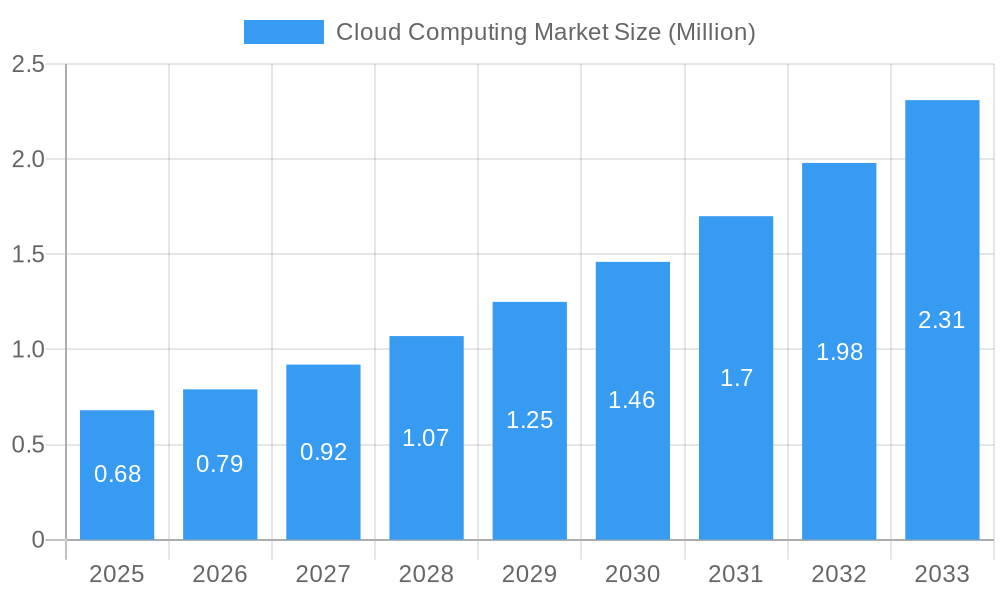

The global Cloud Computing Market is poised for robust expansion, projecting a significant surge from an estimated market size of $0.68 million in 2025. With a compelling Compound Annual Growth Rate (CAGR) of 16.40% anticipated throughout the forecast period of 2025-2033, the market is set to reach substantial value, driven by the increasing adoption of advanced computing paradigms like Infrastructure as a Service (IaaS), Software as a Service (SaaS), and Platform as a Service (PaaS). Key industries such as IT and Telecom, BFSI, Retail and Consumer Goods, Manufacturing, Healthcare, and Media and Entertainment are actively leveraging cloud solutions to enhance operational efficiency, scalability, and innovation. This widespread digital transformation is fueling demand for flexible and cost-effective cloud infrastructure and services.

Cloud Computing Market Market Size (In Million)

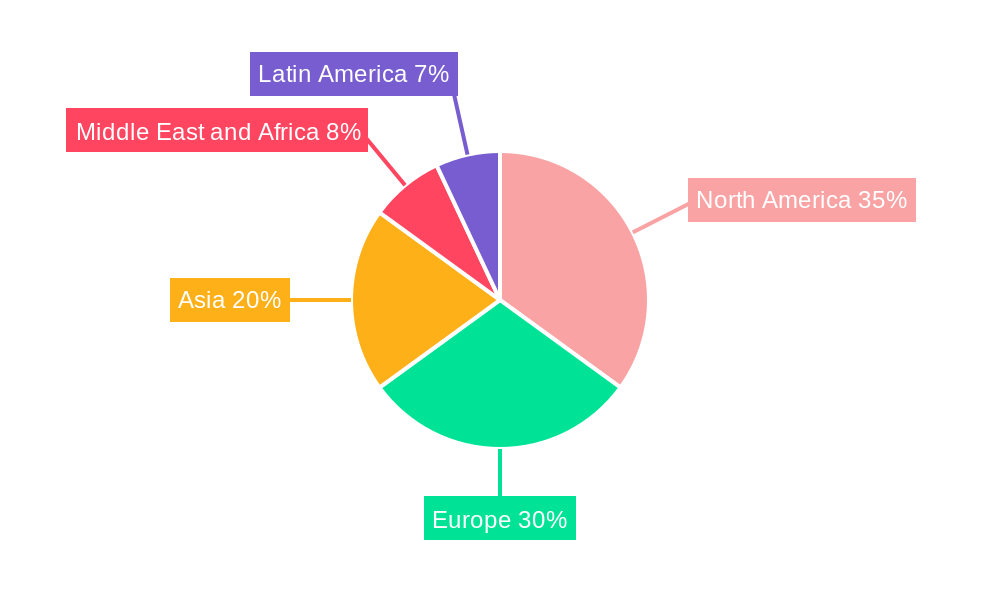

Several pivotal trends are shaping the cloud computing landscape. The escalating demand for hybrid and multi-cloud strategies, driven by the need for flexibility, vendor lock-in avoidance, and compliance, is a significant growth catalyst. Furthermore, the burgeoning adoption of edge computing, coupled with the rise of AI and Machine Learning workloads, necessitates advanced cloud capabilities, further stimulating market growth. While the market is characterized by intense competition among major players like Microsoft Corporation, Amazon com Inc (AWS), Google LLC, and IBM Corporation, certain restraints such as data security concerns and the complexity of cloud migration for legacy systems may pose challenges. Nevertheless, the overarching drive towards digital transformation and the inherent benefits of cloud computing are expected to propel the market's upward trajectory across all major regions, with North America and Europe currently leading in adoption, and Asia demonstrating substantial growth potential.

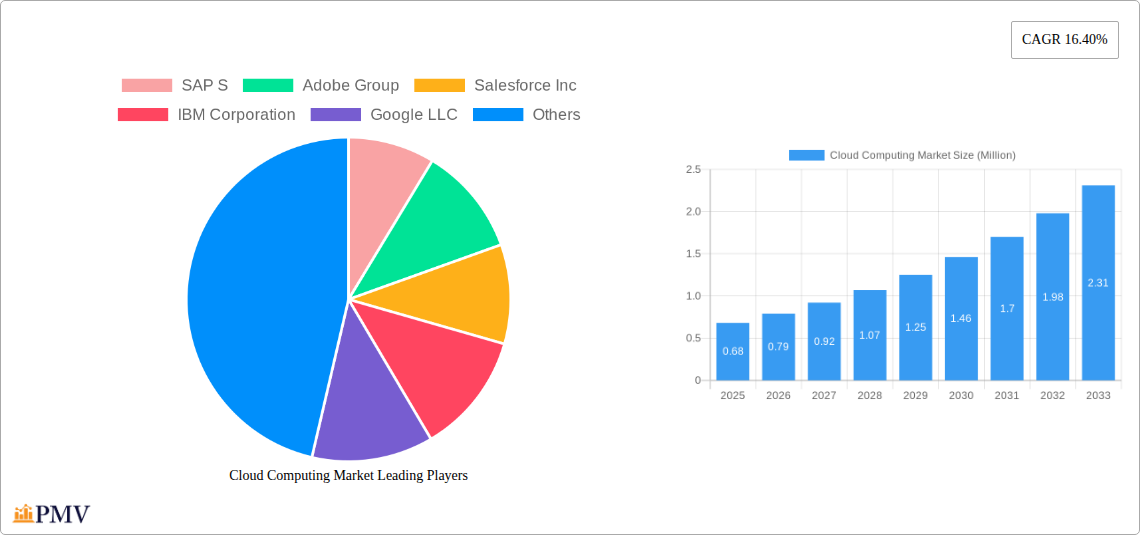

Cloud Computing Market Company Market Share

Comprehensive Cloud Computing Market Analysis: Forecasts, Trends, and Strategic Insights (2019-2033)

This in-depth report offers a definitive analysis of the global Cloud Computing Market, providing critical insights into its structure, competitive landscape, and future trajectory. Spanning the historical period of 2019–2024 and projecting growth through 2033, with a base and estimated year of 2025, this report is an indispensable resource for stakeholders seeking to navigate the dynamic cloud services market. We delve into key segments including Infrastructure as a Service (IaaS), Software as a Service (SaaS), and Platform as a Service (PaaS), alongside vital end-user verticals such as IT and Telecom, BFSI, Retail and Consumer Goods, Manufacturing, Healthcare, and Media and Entertainment. Leveraging high-ranking keywords such as cloud market size, cloud adoption trends, public cloud growth, private cloud solutions, hybrid cloud strategies, and cloud computing forecast, this report aims to significantly boost search visibility and engage industry professionals. Anticipated market value reaches several hundred million dollars by 2025, with substantial growth expected throughout the forecast period.

Cloud Computing Market Market Structure & Competitive Dynamics

The cloud computing market is characterized by a highly competitive and dynamic structure, dominated by a few key players alongside a growing number of specialized providers. Market concentration remains significant, with major technology giants like Amazon com Inc (AWS), Microsoft Corporation, and Google LLC holding substantial market share across IaaS, SaaS, and PaaS. These companies continuously invest in R&D, fostering robust innovation ecosystems that drive the rapid evolution of cloud solutions. Regulatory frameworks, while evolving, are largely supportive of cloud adoption, though data privacy and sovereignty remain key considerations. The threat of product substitutes is minimal due to the inherent advantages of cloud scalability and flexibility. End-user trends lean towards increased adoption of hybrid cloud and multi-cloud strategies to optimize costs and enhance resilience. Merger and acquisition (M&A) activities are prevalent, particularly among smaller players seeking to gain scale or specialize in niche cloud offerings. For example, the acquisition of DXC Group's healthcare analytics business by InterSystems in a deal valued in the hundreds of millions of dollars, highlights the ongoing consolidation and strategic partnerships shaping the competitive landscape.

- Market Concentration: Dominated by hyperscale cloud providers.

- Innovation Ecosystems: Driven by continuous R&D in AI, IoT, and edge computing integration.

- Regulatory Frameworks: Focus on data security, privacy, and compliance standards.

- Product Substitutes: Limited due to the inherent benefits of cloud infrastructure.

- End-User Trends: Strong adoption of hybrid and multi-cloud approaches.

- M&A Activities: Strategic acquisitions to enhance service portfolios and market reach.

Cloud Computing Market Industry Trends & Insights

The cloud computing industry is experiencing unprecedented growth, fueled by a confluence of technological advancements, evolving business needs, and increasing digital transformation initiatives across all sectors. The global market size is projected to reach hundreds of millions of dollars by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 15-20% expected from 2025 to 2033. Key growth drivers include the escalating demand for scalable and cost-effective IT infrastructure, the burgeoning adoption of big data analytics, artificial intelligence (AI), and machine learning (ML) solutions, and the imperative for remote work capabilities and enhanced business continuity. Technological disruptions, such as the rise of serverless computing, containerization, and edge computing, are further reshaping how applications are developed, deployed, and managed. Consumer preferences are increasingly shifting towards cloud-native applications and services that offer seamless user experiences and robust functionalities. Competitive dynamics are intense, with providers differentiating themselves through specialized services, pricing strategies, and regional expansion. The ongoing investment in cloud infrastructure by major players is a testament to the sustained demand. Cloud adoption trends are evident across all industries, with businesses recognizing the agility and efficiency that cloud-based operations provide. The market penetration of cloud services continues to expand, making it an integral part of modern enterprise IT strategies. The increasing reliance on digital platforms for commerce, communication, and operations ensures the continued upward trajectory of the cloud computing market.

Dominant Markets & Segments in Cloud Computing Market

The Cloud Computing Market demonstrates significant dominance in specific regions and segments, driven by robust economic policies, advanced digital infrastructure, and strong industry-specific adoption rates.

Leading Region: North America currently leads the cloud computing market due to early adoption, a mature technology ecosystem, and the presence of major cloud providers and technology-driven enterprises. The region's strong emphasis on innovation and significant investment in cloud services further solidify its position.

Dominant Computing Types:

- IaaS (Infrastructure as a Service): This segment is a foundational driver of cloud adoption. Its dominance stems from the ability of businesses to procure computing resources like servers, storage, and networking on a pay-as-you-go basis. This offers unparalleled scalability and cost-efficiency, particularly for IT and Telecom and BFSI sectors needing to manage fluctuating workloads. The projected market size for IaaS is in the hundreds of millions by 2025.

- SaaS (Software as a Service): SaaS continues to be a major revenue generator. Its popularity is driven by the ease of deployment, accessibility from any device, and subscription-based models that are attractive to a wide range of end-user verticals, including Retail and Consumer Goods and Healthcare. The availability of specialized cloud-based applications for customer relationship management, enterprise resource planning, and collaboration tools fuels its growth.

- PaaS (Platform as a Service): PaaS is experiencing rapid growth as it empowers developers with tools and services to build, deploy, and manage applications without the complexity of underlying infrastructure. This is particularly beneficial for the IT and Telecom sector and innovative Manufacturing firms looking to accelerate software development cycles and embrace agile methodologies.

Dominant End-User Verticals:

- IT and Telecom: This vertical is a primary adopter of all cloud services, leveraging cloud for network infrastructure, data management, and application hosting. The demand for high-bandwidth, low-latency cloud solutions is a key growth accelerator.

- BFSI (Banking, Financial Services, and Insurance): The BFSI sector increasingly relies on cloud for data analytics, fraud detection, customer-facing applications, and regulatory compliance. Enhanced security features and the ability to handle massive transaction volumes make cloud indispensable. The projected market size for cloud in BFSI is substantial, reaching hundreds of millions by 2025.

- Retail and Consumer Goods: This vertical utilizes cloud for e-commerce platforms, supply chain management, personalized marketing, and inventory optimization. The ability to scale during peak seasons and provide seamless online shopping experiences is crucial.

- Manufacturing: Cloud computing is transforming manufacturing through IoT integration, predictive maintenance, supply chain visibility, and smart factory initiatives. Industrial IoT (IIoT) and cloud-based analytics are driving efficiency gains.

- Healthcare: Cloud adoption in healthcare is accelerating for electronic health records (EHRs), telehealth services, medical imaging storage and analysis, and drug discovery. Data security and patient privacy are paramount, driving demand for specialized, compliant cloud solutions. The market size for cloud in healthcare is projected to reach hundreds of millions by 2025.

- Media and Entertainment: This sector leverages cloud for content creation, storage, distribution, and streaming services. The demand for scalable storage and high-performance computing for rendering and editing is a significant driver.

Cloud Computing Market Product Innovations

Product innovations in the cloud computing market are relentless, focusing on enhancing performance, security, and cost-efficiency. Key developments include advancements in AI and ML-powered cloud services, enabling sophisticated data analytics and automation. The rise of edge computing is bringing cloud capabilities closer to data sources, reducing latency for real-time applications. Furthermore, providers are innovating in serverless computing, simplifying application development by abstracting infrastructure management. Enhanced security features, including advanced encryption, threat detection, and identity management, are crucial competitive advantages. The continuous evolution of hybrid cloud and multi-cloud management platforms offers greater flexibility and control to enterprises.

Report Segmentation & Scope

This report comprehensively segments the Cloud Computing Market by Computing Type and End-user Verticals. The scope includes detailed analysis of Infrastructure as a Service (IaaS), Software as a Service (SaaS), and Platform as a Service (PaaS), along with IT and Telecom, BFSI, Retail and Consumer Goods, Manufacturing, Healthcare, and Media and Entertainment. Projections for each segment indicate robust growth, with market sizes estimated in the hundreds of millions by 2025. Competitive dynamics within each segment are explored, highlighting key players and emerging trends.

- IaaS: Focuses on fundamental cloud infrastructure resources.

- SaaS: Encompasses cloud-based software applications.

- PaaS: Provides platforms for application development and deployment.

- IT and Telecom: High adoption for core operations and service delivery.

- BFSI: Strong demand for secure data analytics and customer services.

- Retail and Consumer Goods: Driven by e-commerce and supply chain optimization.

- Manufacturing: Key for IIoT, smart factories, and operational efficiency.

- Healthcare: Essential for EHRs, telehealth, and data security.

- Media and Entertainment: Crucial for content delivery and digital workflows.

Key Drivers of Cloud Computing Market Growth

The cloud computing market is propelled by several key drivers. Technologically, the relentless advancements in AI, ML, IoT, and edge computing are creating new opportunities and demanding more robust cloud infrastructure. Economically, the scalability, cost-efficiency, and pay-as-you-go models offered by cloud services are compelling for businesses of all sizes, especially in an era of economic uncertainty. Regulatory frameworks that promote data security and compliance, such as GDPR and CCPA, paradoxically encourage cloud adoption as specialized providers offer robust solutions. Furthermore, the ongoing digital transformation initiatives across industries, coupled with the need for remote work capabilities and business continuity, are fundamentally reshaping IT strategies, making cloud computing an indispensable component.

Challenges in the Cloud Computing Market Sector

Despite its robust growth, the cloud computing market faces several challenges. Regulatory hurdles and compliance complexities, particularly concerning data sovereignty and privacy across different jurisdictions, can slow adoption. Supply chain issues for specialized hardware required for data centers can impact expansion plans. Intense competitive pressures among providers lead to pricing wars and necessitate continuous innovation, impacting profitability. Security concerns, though largely addressed by providers, remain a perceived barrier for some organizations, requiring substantial education and reassurance. Moreover, the shortage of skilled cloud professionals can hinder effective implementation and management of cloud services.

Leading Players in the Cloud Computing Market Market

- SAP S

- Adobe Group

- Salesforce Inc

- IBM Corporation

- Google LLC

- SAS

- Alibaba Cloud

- Microsoft Corporation

- DXC Group

- Oracle Corporation

- Amazon com Inc (AWS)

Key Developments in Cloud Computing Market Sector

- April 2023: Alibaba Cloud unveiled cheaper options for its Elastic Compute Service and Object Storage Service and a large language model to keep pace with the demand for cloud services. The new ECS Universal is claimed to offer the same stability as ECS while reducing costs by up to 40%, and is suited for running web applications and websites, enterprise office applications, and offline data analysis. The OSS Reserved Capacity (OSS-RC) would let its customers reserve storage capacity in a specific cloud region for one year, reducing capacity cost by up to 50%.

- November 2022: AWS opened India's Second Infrastructure Region. The second AWS Region enables Indian customers to have more alternatives to execute workloads with better resilience and availability, store data securely, and give end users even lower latency. By 2030, it is anticipated that the new AWS Asia Pacific (Hyderabad) region would provide more than 48,000 full-time employees annually, attributed to an investment of more than USD 4.4 billion in India.

Strategic Cloud Computing Market Market Outlook

The strategic outlook for the cloud computing market is exceptionally strong. Growth accelerators include the expanding integration of AI and ML into cloud services, enabling advanced analytics and automation for businesses. The increasing demand for specialized cloud solutions, such as those for cybersecurity, IoT, and edge computing, presents significant market opportunities. Furthermore, the ongoing digital transformation across industries and the continued evolution of remote work models will sustain and amplify cloud adoption. Hybrid and multi-cloud strategies will remain central, driving demand for interoperable and flexible cloud management platforms. Strategic partnerships and M&A activities will continue to shape the competitive landscape, leading to greater market consolidation and specialized offerings. The projected market size and sustained CAGR indicate a highly promising future for cloud services.

Cloud Computing Market Segmentation

-

1. Computing Type

- 1.1. IaaS

- 1.2. SaaS

- 1.3. PaaS

-

2. End-user Verticals

- 2.1. IT and Telecom

- 2.2. BFSI

- 2.3. Retail and Consumer Goods

- 2.4. Manufacturing

- 2.5. Healthcare

- 2.6. Media and Entertainment

Cloud Computing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Nordics

- 2.6. Benelux

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. GCC

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Cloud Computing Market Regional Market Share

Geographic Coverage of Cloud Computing Market

Cloud Computing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Shift Towards Digital Transformation Across the World; Post- Pandemic Remote Work-Related Policies Positively Impacting the Cloud Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Content Creation

- 3.4. Market Trends

- 3.4.1. Business Integration with Cloud Boosting Digitalization Across Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Computing Type

- 5.1.1. IaaS

- 5.1.2. SaaS

- 5.1.3. PaaS

- 5.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.2.1. IT and Telecom

- 5.2.2. BFSI

- 5.2.3. Retail and Consumer Goods

- 5.2.4. Manufacturing

- 5.2.5. Healthcare

- 5.2.6. Media and Entertainment

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Computing Type

- 6. North America Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Computing Type

- 6.1.1. IaaS

- 6.1.2. SaaS

- 6.1.3. PaaS

- 6.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 6.2.1. IT and Telecom

- 6.2.2. BFSI

- 6.2.3. Retail and Consumer Goods

- 6.2.4. Manufacturing

- 6.2.5. Healthcare

- 6.2.6. Media and Entertainment

- 6.1. Market Analysis, Insights and Forecast - by Computing Type

- 7. Europe Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Computing Type

- 7.1.1. IaaS

- 7.1.2. SaaS

- 7.1.3. PaaS

- 7.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 7.2.1. IT and Telecom

- 7.2.2. BFSI

- 7.2.3. Retail and Consumer Goods

- 7.2.4. Manufacturing

- 7.2.5. Healthcare

- 7.2.6. Media and Entertainment

- 7.1. Market Analysis, Insights and Forecast - by Computing Type

- 8. Asia Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Computing Type

- 8.1.1. IaaS

- 8.1.2. SaaS

- 8.1.3. PaaS

- 8.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 8.2.1. IT and Telecom

- 8.2.2. BFSI

- 8.2.3. Retail and Consumer Goods

- 8.2.4. Manufacturing

- 8.2.5. Healthcare

- 8.2.6. Media and Entertainment

- 8.1. Market Analysis, Insights and Forecast - by Computing Type

- 9. Latin America Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Computing Type

- 9.1.1. IaaS

- 9.1.2. SaaS

- 9.1.3. PaaS

- 9.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 9.2.1. IT and Telecom

- 9.2.2. BFSI

- 9.2.3. Retail and Consumer Goods

- 9.2.4. Manufacturing

- 9.2.5. Healthcare

- 9.2.6. Media and Entertainment

- 9.1. Market Analysis, Insights and Forecast - by Computing Type

- 10. Middle East and Africa Cloud Computing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Computing Type

- 10.1.1. IaaS

- 10.1.2. SaaS

- 10.1.3. PaaS

- 10.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 10.2.1. IT and Telecom

- 10.2.2. BFSI

- 10.2.3. Retail and Consumer Goods

- 10.2.4. Manufacturing

- 10.2.5. Healthcare

- 10.2.6. Media and Entertainment

- 10.1. Market Analysis, Insights and Forecast - by Computing Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SAP S

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Adobe Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Salesforce Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Google LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SAS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alibaba Cloud

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Microsoft Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DXC Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Oracle Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amazon com Inc (AWS)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 SAP S

List of Figures

- Figure 1: Global Cloud Computing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Cloud Computing Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Cloud Computing Market Revenue (Million), by Computing Type 2025 & 2033

- Figure 4: North America Cloud Computing Market Volume (K Unit), by Computing Type 2025 & 2033

- Figure 5: North America Cloud Computing Market Revenue Share (%), by Computing Type 2025 & 2033

- Figure 6: North America Cloud Computing Market Volume Share (%), by Computing Type 2025 & 2033

- Figure 7: North America Cloud Computing Market Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 8: North America Cloud Computing Market Volume (K Unit), by End-user Verticals 2025 & 2033

- Figure 9: North America Cloud Computing Market Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 10: North America Cloud Computing Market Volume Share (%), by End-user Verticals 2025 & 2033

- Figure 11: North America Cloud Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Cloud Computing Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Cloud Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Cloud Computing Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Cloud Computing Market Revenue (Million), by Computing Type 2025 & 2033

- Figure 16: Europe Cloud Computing Market Volume (K Unit), by Computing Type 2025 & 2033

- Figure 17: Europe Cloud Computing Market Revenue Share (%), by Computing Type 2025 & 2033

- Figure 18: Europe Cloud Computing Market Volume Share (%), by Computing Type 2025 & 2033

- Figure 19: Europe Cloud Computing Market Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 20: Europe Cloud Computing Market Volume (K Unit), by End-user Verticals 2025 & 2033

- Figure 21: Europe Cloud Computing Market Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 22: Europe Cloud Computing Market Volume Share (%), by End-user Verticals 2025 & 2033

- Figure 23: Europe Cloud Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Cloud Computing Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Cloud Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Cloud Computing Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Cloud Computing Market Revenue (Million), by Computing Type 2025 & 2033

- Figure 28: Asia Cloud Computing Market Volume (K Unit), by Computing Type 2025 & 2033

- Figure 29: Asia Cloud Computing Market Revenue Share (%), by Computing Type 2025 & 2033

- Figure 30: Asia Cloud Computing Market Volume Share (%), by Computing Type 2025 & 2033

- Figure 31: Asia Cloud Computing Market Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 32: Asia Cloud Computing Market Volume (K Unit), by End-user Verticals 2025 & 2033

- Figure 33: Asia Cloud Computing Market Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 34: Asia Cloud Computing Market Volume Share (%), by End-user Verticals 2025 & 2033

- Figure 35: Asia Cloud Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Cloud Computing Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Cloud Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Cloud Computing Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Cloud Computing Market Revenue (Million), by Computing Type 2025 & 2033

- Figure 40: Latin America Cloud Computing Market Volume (K Unit), by Computing Type 2025 & 2033

- Figure 41: Latin America Cloud Computing Market Revenue Share (%), by Computing Type 2025 & 2033

- Figure 42: Latin America Cloud Computing Market Volume Share (%), by Computing Type 2025 & 2033

- Figure 43: Latin America Cloud Computing Market Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 44: Latin America Cloud Computing Market Volume (K Unit), by End-user Verticals 2025 & 2033

- Figure 45: Latin America Cloud Computing Market Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 46: Latin America Cloud Computing Market Volume Share (%), by End-user Verticals 2025 & 2033

- Figure 47: Latin America Cloud Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Cloud Computing Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Latin America Cloud Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Cloud Computing Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Cloud Computing Market Revenue (Million), by Computing Type 2025 & 2033

- Figure 52: Middle East and Africa Cloud Computing Market Volume (K Unit), by Computing Type 2025 & 2033

- Figure 53: Middle East and Africa Cloud Computing Market Revenue Share (%), by Computing Type 2025 & 2033

- Figure 54: Middle East and Africa Cloud Computing Market Volume Share (%), by Computing Type 2025 & 2033

- Figure 55: Middle East and Africa Cloud Computing Market Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 56: Middle East and Africa Cloud Computing Market Volume (K Unit), by End-user Verticals 2025 & 2033

- Figure 57: Middle East and Africa Cloud Computing Market Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 58: Middle East and Africa Cloud Computing Market Volume Share (%), by End-user Verticals 2025 & 2033

- Figure 59: Middle East and Africa Cloud Computing Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Cloud Computing Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Middle East and Africa Cloud Computing Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Cloud Computing Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud Computing Market Revenue Million Forecast, by Computing Type 2020 & 2033

- Table 2: Global Cloud Computing Market Volume K Unit Forecast, by Computing Type 2020 & 2033

- Table 3: Global Cloud Computing Market Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 4: Global Cloud Computing Market Volume K Unit Forecast, by End-user Verticals 2020 & 2033

- Table 5: Global Cloud Computing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Cloud Computing Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Cloud Computing Market Revenue Million Forecast, by Computing Type 2020 & 2033

- Table 8: Global Cloud Computing Market Volume K Unit Forecast, by Computing Type 2020 & 2033

- Table 9: Global Cloud Computing Market Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 10: Global Cloud Computing Market Volume K Unit Forecast, by End-user Verticals 2020 & 2033

- Table 11: Global Cloud Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Cloud Computing Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Global Cloud Computing Market Revenue Million Forecast, by Computing Type 2020 & 2033

- Table 18: Global Cloud Computing Market Volume K Unit Forecast, by Computing Type 2020 & 2033

- Table 19: Global Cloud Computing Market Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 20: Global Cloud Computing Market Volume K Unit Forecast, by End-user Verticals 2020 & 2033

- Table 21: Global Cloud Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Cloud Computing Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Germany Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: France Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Spain Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Nordics Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Nordics Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Benelux Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Benelux Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Global Cloud Computing Market Revenue Million Forecast, by Computing Type 2020 & 2033

- Table 36: Global Cloud Computing Market Volume K Unit Forecast, by Computing Type 2020 & 2033

- Table 37: Global Cloud Computing Market Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 38: Global Cloud Computing Market Volume K Unit Forecast, by End-user Verticals 2020 & 2033

- Table 39: Global Cloud Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Cloud Computing Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: China Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: China Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: India Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: India Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: South Korea Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: South Korea Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Global Cloud Computing Market Revenue Million Forecast, by Computing Type 2020 & 2033

- Table 50: Global Cloud Computing Market Volume K Unit Forecast, by Computing Type 2020 & 2033

- Table 51: Global Cloud Computing Market Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 52: Global Cloud Computing Market Volume K Unit Forecast, by End-user Verticals 2020 & 2033

- Table 53: Global Cloud Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Cloud Computing Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 55: Brazil Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Brazil Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Argentina Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Argentina Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Rest of South America Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Rest of South America Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Global Cloud Computing Market Revenue Million Forecast, by Computing Type 2020 & 2033

- Table 62: Global Cloud Computing Market Volume K Unit Forecast, by Computing Type 2020 & 2033

- Table 63: Global Cloud Computing Market Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 64: Global Cloud Computing Market Volume K Unit Forecast, by End-user Verticals 2020 & 2033

- Table 65: Global Cloud Computing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global Cloud Computing Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 67: GCC Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: GCC Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: South Africa Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East and Africa Cloud Computing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East and Africa Cloud Computing Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Computing Market?

The projected CAGR is approximately 16.40%.

2. Which companies are prominent players in the Cloud Computing Market?

Key companies in the market include SAP S, Adobe Group, Salesforce Inc, IBM Corporation, Google LLC, SAS, Alibaba Cloud, Microsoft Corporation, DXC Group, Oracle Corporation, Amazon com Inc (AWS).

3. What are the main segments of the Cloud Computing Market?

The market segments include Computing Type, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Shift Towards Digital Transformation Across the World; Post- Pandemic Remote Work-Related Policies Positively Impacting the Cloud Market.

6. What are the notable trends driving market growth?

Business Integration with Cloud Boosting Digitalization Across Industries.

7. Are there any restraints impacting market growth?

High Cost of Content Creation.

8. Can you provide examples of recent developments in the market?

April 2023 - Alibaba Cloud unveiled cheaper options for its Elastic Compute Service and Object Storage Service and a large language model to keep pace with the demand for cloud services. The new ECS Universal is claimed to offer the same stability as ECS while reducing costs by up to 40%, and is suited for running web applications and websites, enterprise office applications, and offline data analysis. The OSS Reserved Capacity (OSS-RC) would let its customers reserve storage capacity in a specific cloud region for one year, reducing capacity cost by up to 50%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Computing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Computing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Computing Market?

To stay informed about further developments, trends, and reports in the Cloud Computing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence