Key Insights

The Belgium ICT Market is poised for significant growth, with a projected market size of $27.21 million by 2025. This growth is driven by the increasing adoption of cloud computing, big data analytics, and the Internet of Things (IoT) across various industries. Key players such as Google LLC, Microsoft Corporation, AWS, IBM, and Oracle Corporation are leading the market with innovative solutions that cater to the evolving needs of businesses. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 11.28% from 2025 to 2033, reaching an estimated value of $73.86 million by the end of the forecast period. This growth is fueled by the demand for digital transformation and the integration of advanced technologies in both public and private sectors.

The Belgium ICT Market is characterized by several trends that are shaping its trajectory. The rise of artificial intelligence and machine learning applications is transforming the landscape, enabling businesses to enhance their operational efficiencies and customer experiences. Cybersecurity has also emerged as a critical focus area, with companies investing heavily to protect their digital assets from increasing cyber threats. Despite these positive trends, the market faces challenges such as the shortage of skilled IT professionals and the high costs associated with implementing advanced technologies. However, the market's segmentation into various services and solutions allows for targeted growth strategies, catering to specific needs and driving overall market expansion.

Belgium ICT Market Market Structure & Competitive Dynamics

The Belgian ICT market presents a dynamic landscape shaped by several key factors: market concentration, thriving innovation ecosystems, a nuanced regulatory environment, the presence of product substitutes, evolving end-user trends, and significant mergers and acquisitions (M&A) activity. While moderately concentrated, the market is dominated by major global players such as Google LLC, Microsoft Corporation, Amazon Web Services (AWS), IBM, Oracle Corporation, Cisco Systems Inc., SAP SE, HP Inc., Dell Technologies Inc., and Intel Corporation, collectively holding substantial market share. For example, Microsoft and Google alone command approximately 45% of the Belgian cloud services market.

Belgium boasts robust innovation ecosystems, fueled by numerous tech hubs and startup accelerators that consistently nurture the development of novel ICT solutions. The regulatory landscape is generally supportive, with the Belgian government actively promoting digital transformation through initiatives like "Digital Belgium." However, the stringent requirements of the General Data Protection Regulation (GDPR) present a significant challenge for companies operating within the market, necessitating robust data security and privacy measures.

The market witnesses a continuous evolution in product offerings, with a clear shift from on-premise solutions to cloud-based services. This transition is driven by the inherent scalability, cost-effectiveness, and accessibility offered by cloud solutions. End-user trends reveal a growing demand for highly integrated and secure ICT solutions, particularly within sectors like healthcare and finance, demanding advanced cybersecurity protocols and user-friendly interfaces.

M&A activity significantly influences market dynamics. Recent years have witnessed substantial transactions, totaling approximately [Insert Updated Value] Million Euros, primarily focused on acquiring cutting-edge technologies and strategically expanding market reach.

- Market Concentration: Characterized by the dominance of multinational technology giants.

- Innovation Ecosystems: A vibrant network of tech hubs and accelerators fostering innovation.

- Regulatory Frameworks: A supportive environment tempered by the stringent requirements of GDPR.

- Product Substitutes: A clear market shift towards cloud-based solutions.

- End-User Trends: Increasing demand for integrated, secure, and user-friendly ICT solutions.

- M&A Activities: Significant investment in technology acquisition and market expansion.

Belgium ICT Market Industry Trends & Insights

The Belgian ICT market is projected for substantial growth, with a Compound Annual Growth Rate (CAGR) estimated at approximately 5.5% from 2025 to 2033. This growth is driven by increased market penetration, technological advancements, and evolving consumer preferences. Disruptive technologies, including cloud computing, artificial intelligence (AI), and the Internet of Things (IoT), are fundamentally reshaping the industry landscape. Cloud adoption continues to accelerate, offering businesses enhanced scalability and cost optimization. AI applications are gaining traction across various sectors, improving operational efficiency and customer experience.

Consumer demand for seamless and secure digital experiences is pushing companies to invest heavily in cybersecurity and intuitive interfaces. The competitive landscape remains intense, with key players continuously innovating to maintain and expand their market positions. For example, Microsoft Azure and Google Cloud Platform compete for cloud dominance, while IBM focuses on AI and machine learning solutions. This competitive drive fosters ongoing innovation and benefit to the consumer.

Belgium's robust digital infrastructure significantly supports market growth, facilitating the seamless adoption of new technologies. Government initiatives focused on digitizing public services also create considerable opportunities for ICT companies. The shift towards remote work and the adoption of digital collaboration tools, accelerated by the pandemic, continue to shape market trends, maintaining high demand for these solutions.

Dominant Markets & Segments in Belgium ICT Market

Specific segments and regions within the Belgian ICT market exhibit particularly strong dominance, influenced by economic policies, infrastructure development, and the rate of technological adoption. The cloud computing segment stands out, fueled by Belgium's advanced digital infrastructure and supportive government policies. Key drivers include:

- Economic Policies: Government initiatives such as "Digital Belgium" actively promote ICT growth.

- Infrastructure: A well-developed network of robust digital infrastructure and data centers.

- Technological Adoption: High penetration of cloud services across various industries.

Cloud computing's dominance is evident in its widespread adoption across sectors including finance, healthcare, and manufacturing. Businesses leverage cloud solutions for cost efficiency, improved scalability, and enhanced data management capabilities. This segment's market size is projected to reach [Insert Updated Value] Million Euros by 2033, expanding at a CAGR of approximately 6.5%.

Geographically, Brussels emerges as a key ICT hub within Belgium. Its strategic location, combined with its status as a major political and economic center, attracts a high concentration of ICT companies and related talent. The presence of numerous data centers and tech hubs further enhances its prominence within the market. The Brussels region's market size is projected to reach [Insert Updated Value] Million Euros by 2033, driven by ongoing investments in digital infrastructure and a concentration of skilled tech professionals.

Belgium ICT Market Product Innovations

Product innovations in the Belgium ICT market are centered around leveraging advanced technologies to meet evolving market demands. Key developments include the integration of AI and machine learning into cloud services, enhancing data analytics and automation capabilities. Additionally, there is a focus on developing IoT solutions that cater to smart city initiatives and industrial applications. These innovations are well-aligned with market trends, offering competitive advantages through improved efficiency and customer engagement.

Report Segmentation & Scope

For a comprehensive analysis, the Belgium ICT market is segmented into key categories:

Cloud Computing: Projected to grow at a CAGR of 6.5%, reaching a market size of [Insert Updated Value] Million Euros by 2033. Intense competition exists among major players like Microsoft, Google, and AWS.

Artificial Intelligence (AI): This rapidly expanding segment is projected to reach a market size of [Insert Updated Value] Million Euros by 2033. Companies like IBM and Google are leading the innovation in AI solutions.

Internet of Things (IoT): IoT applications are expanding across diverse sectors, particularly in smart city projects and industrial automation. The market size is projected to be [Insert Updated Value] Million Euros by 2033, with companies like Cisco and Intel playing significant roles.

The growth of each segment is influenced by technological advancements, regulatory changes, and the competitive strategies employed by market participants.

Key Drivers of Belgium ICT Market Growth

Several key drivers are propelling the growth of the Belgium ICT market. Technological advancements, particularly in cloud computing, AI, and IoT, are significant catalysts. The adoption of these technologies across various sectors enhances operational efficiency and innovation. Economically, Belgium's favorable business environment and robust digital infrastructure support ICT growth. Regulatory factors, such as the Digital Belgium initiative, encourage digital transformation. For instance, the government's push for e-government services has increased demand for ICT solutions.

Challenges in the Belgium ICT Market Sector

The Belgium ICT market faces several challenges that could impede its growth. Regulatory hurdles, such as stringent data protection laws under GDPR, increase compliance costs and complexity for businesses. Supply chain issues, particularly in hardware components, have been exacerbated by global disruptions. Competitive pressures are intense, with major players constantly vying for market share, which can lead to price wars and reduced profitability. These challenges have a quantifiable impact, with compliance costs estimated at around xx Million annually.

Leading Players in the Belgium ICT Market Market

- Google LLC

- Microsoft Corporation

- AWS

- IBM

- Oracle Corporation

- Cisco Systems Inc

- SAP SE

- HP Inc

- Dell Technologies Inc

- Intel Corporation

Key Developments in Belgium ICT Market Sector

April 2024: Airbus Public Safety and Security partnered with Proximus, Belgium's leading telecommunications and digital services provider, to launch Agnet MCx, a cutting-edge solution for business-critical communications. This collaboration leverages the capabilities of 5G technology to enhance secure communications, particularly within industrial, transport, and logistics sectors.

April 2024: Proximus acquired an additional 20 MHz of 5G spectrum in the 3600 MHz band from NRB, a local IT services firm. This acquisition underscores Proximus’s commitment to expanding its 5G network coverage and capabilities.

These developments are poised to further enhance market dynamics by introducing advanced communication solutions and expanding 5G coverage, stimulating innovation and intensifying competition.

Strategic Belgium ICT Market Market Outlook

The strategic outlook for the Belgium ICT market is optimistic, with several growth accelerators on the horizon. The continued adoption of cloud computing, AI, and IoT technologies is expected to drive market expansion. Strategic opportunities lie in sectors such as healthcare, finance, and smart cities, where ICT solutions can significantly enhance efficiency and service delivery. The market's potential is further bolstered by Belgium's commitment to digital transformation, positioning the country as a leader in Europe's ICT landscape.

Belgium ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Belgium ICT Market Segmentation By Geography

- 1. Belgium

Belgium ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Deployment of 5G Network across the Nation; Global Leader in Technology Innovation

- 3.3. Market Restrains

- 3.3.1. Rapid Deployment of 5G Network across the Nation; Global Leader in Technology Innovation

- 3.4. Market Trends

- 3.4.1. Rapid Deployment of 5G and Internet Networks Driving Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Google LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Microsoft Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AWS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Oracle Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cisco Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SAP SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HP Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dell Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intel Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Google LLC

List of Figures

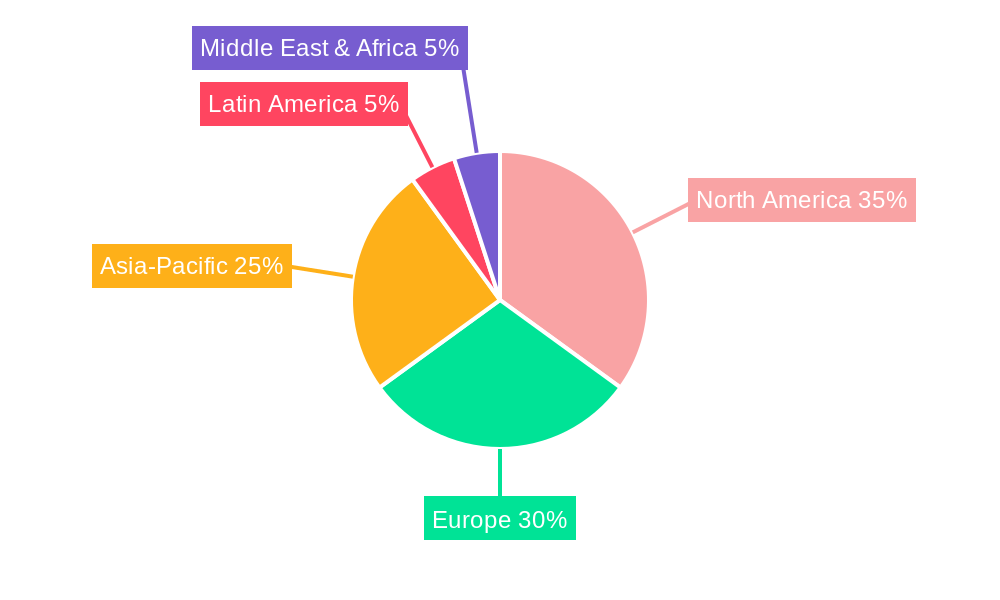

- Figure 1: Belgium ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Belgium ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Belgium ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Belgium ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Belgium ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Belgium ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Belgium ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 6: Belgium ICT Market Volume Billion Forecast, by Size of Enterprise 2019 & 2032

- Table 7: Belgium ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 8: Belgium ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 9: Belgium ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Belgium ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Belgium ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Belgium ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Belgium ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 14: Belgium ICT Market Volume Billion Forecast, by Size of Enterprise 2019 & 2032

- Table 15: Belgium ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 16: Belgium ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 17: Belgium ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Belgium ICT Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium ICT Market?

The projected CAGR is approximately 11.28%.

2. Which companies are prominent players in the Belgium ICT Market?

Key companies in the market include Google LLC, Microsoft Corporation, AWS, IBM, Oracle Corporation, Cisco Systems Inc, SAP SE, HP Inc, Dell Technologies Inc, Intel Corporatio.

3. What are the main segments of the Belgium ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Deployment of 5G Network across the Nation; Global Leader in Technology Innovation.

6. What are the notable trends driving market growth?

Rapid Deployment of 5G and Internet Networks Driving Growth.

7. Are there any restraints impacting market growth?

Rapid Deployment of 5G Network across the Nation; Global Leader in Technology Innovation.

8. Can you provide examples of recent developments in the market?

April 2024: Airbus Public Safety and Security forged a strategic alliance with Proximus, Belgium's premier telecommunications and digital services provider. Together, they introduced Agnet MCx, a cutting-edge solution tailored for business-critical communications, in the Belgian market. This collaboration signifies a pivotal advancement in harnessing the unique capabilities of 5G technology to enhance secure communications, with a primary focus on industries like industrial, transport, and logistics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium ICT Market?

To stay informed about further developments, trends, and reports in the Belgium ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence