Key Insights

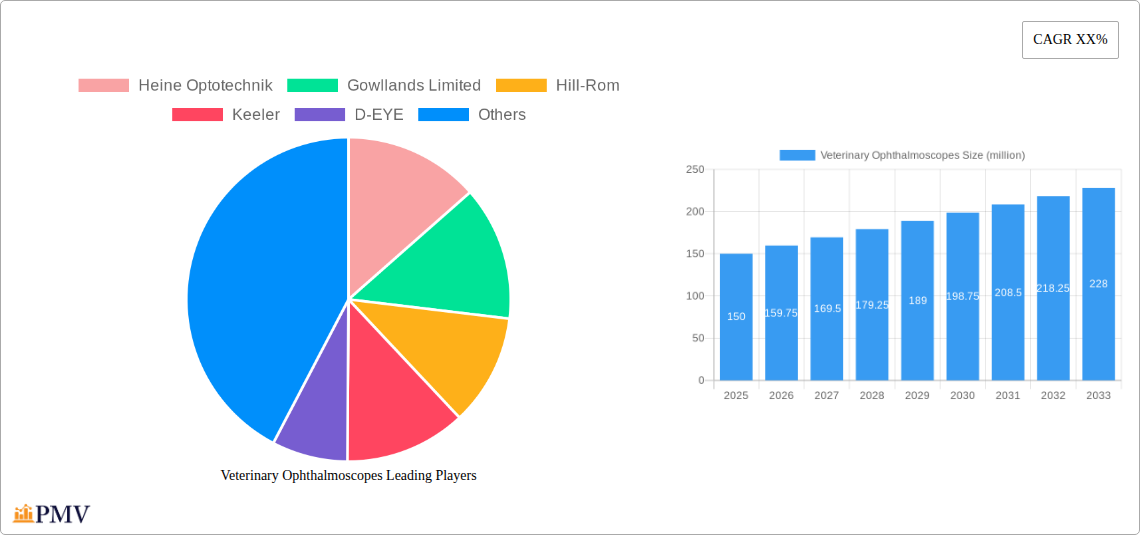

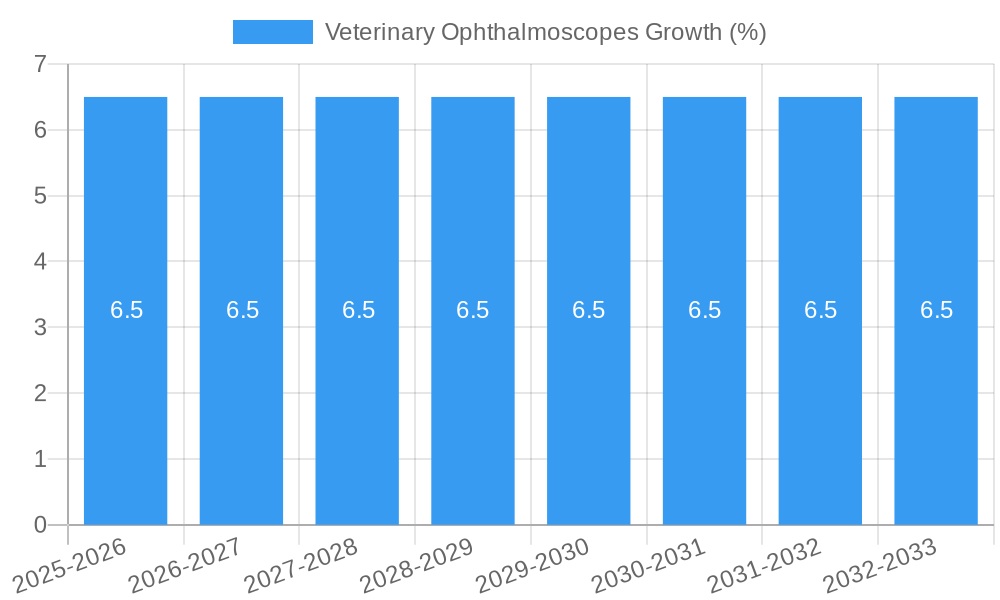

The global veterinary ophthalmoscopes market is poised for substantial growth, projected to reach an estimated market size of approximately $150 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 6.5% anticipated through 2033. This expansion is primarily fueled by the increasing prevalence of ocular diseases in companion animals like dogs and cats, coupled with a rising trend in pet humanization. Owners are increasingly willing to invest in advanced diagnostic tools and specialized veterinary care for their pets, driving demand for sophisticated ophthalmoscopes that enable accurate diagnosis and treatment of conditions such as cataracts, glaucoma, and retinal disorders. Advancements in technology, including the development of digital and portable ophthalmoscopes offering enhanced imaging capabilities and remote diagnostic potential, are also significant market drivers. Furthermore, the growing number of veterinary clinics and hospitals adopting state-of-the-art equipment to improve patient outcomes is a key factor contributing to market expansion.

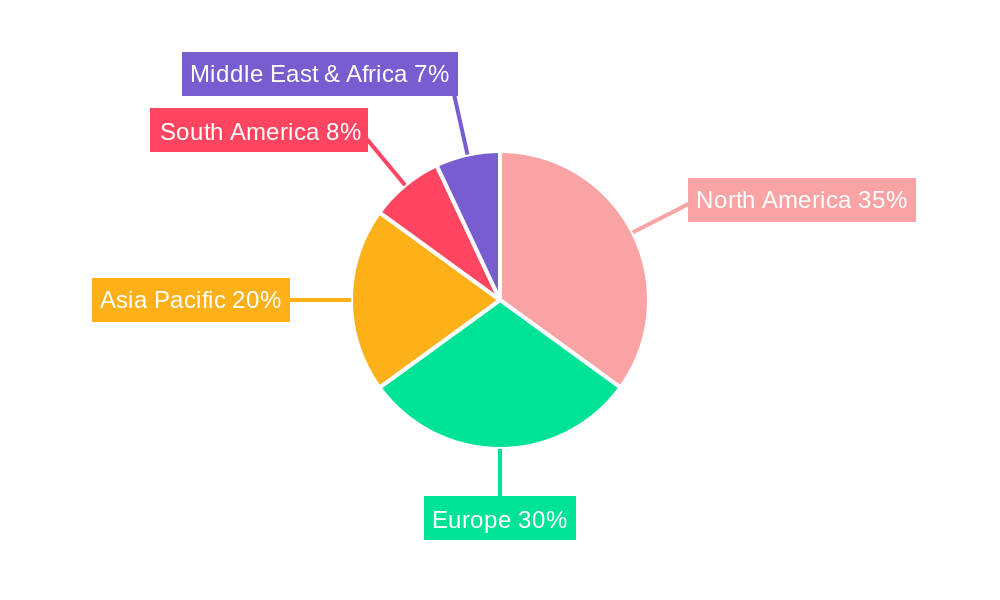

The market segmentation reveals a strong preference for feline and canine applications, reflecting the dominant pet population. The 3.5V ophthalmoscopes are expected to lead in terms of adoption due to their superior illumination and magnification, crucial for detailed ocular examinations. Geographically, North America and Europe are anticipated to hold the largest market shares, driven by well-established veterinary healthcare infrastructure, higher disposable incomes, and a strong culture of pet ownership. However, the Asia Pacific region is expected to witness the fastest growth, propelled by rapid urbanization, increasing pet ownership, and a burgeoning veterinary workforce. Restraints, such as the initial high cost of advanced ophthalmoscopes and limited awareness in some emerging markets, may temper growth to some extent, but are likely to be overcome by the overarching trends of increasing pet healthcare expenditure and technological innovation.

This comprehensive veterinary ophthalmoscopes market report provides an exhaustive analysis of the global veterinary ophthalmology diagnostic tools landscape. Delving deep into market dynamics, key players, and future trends, this report is an indispensable resource for veterinarians, animal health companies, researchers, and investors seeking to understand the veterinary ophthalmoscope market size, veterinary slit lamp technology, and veterinary diagnostic imaging opportunities. Covering the study period from 2019–2033, with a base year of 2025 and an estimated year of 2025, this report offers a robust forecast period of 2025–2033, building upon insights from the historical period of 2019–2024. With a focus on canine ophthalmoscopes, feline ophthalmoscopes, and equine ophthalmoscopes, alongside an examination of 2.5V ophthalmoscopes and 3.5V ophthalmoscopes, this research navigates the evolving needs of animal eye care.

Veterinary Ophthalmoscopes Market Structure & Competitive Dynamics

The veterinary ophthalmoscopes market exhibits a moderately concentrated structure, with a few key players dominating significant market share in veterinary diagnostic equipment. Innovation ecosystems are robust, driven by the continuous pursuit of improved diagnostic accuracy and ease of use in animal ophthalmology. Regulatory frameworks, primarily focused on veterinary medical device standards, play a crucial role in market entry and product development. Product substitutes, while limited in direct comparison, include advanced imaging techniques like OCT and ultrasound, which complement ophthalmoscopic examination. End-user trends are strongly influenced by the growing pet humanization movement, increased disposable income for pet care, and the rising number of veterinary clinics and specialists. Merger and acquisition (M&A) activities, while not as frequent as in broader medical device markets, are strategic for companies seeking to expand their product portfolios or geographic reach. Estimated M&A deal values are projected to reach several million annually, reinforcing market consolidation. Market share for leading veterinary ophthalmoscope manufacturers is continuously shifting with product innovations.

Veterinary Ophthalmoscopes Industry Trends & Insights

The global veterinary ophthalmoscopes market is poised for substantial growth, driven by an escalating demand for advanced animal healthcare solutions. A significant market growth driver is the increasing prevalence of ocular diseases in companion animals, such as cataracts, glaucoma, and retinal degenerations, necessitating more frequent and sophisticated diagnostic examinations. The burgeoning pet humanization trend, where pets are increasingly viewed as integral family members, fuels expenditure on their well-being, including specialized veterinary services. Technological disruptions are reshaping the industry, with the integration of digital imaging capabilities, Wi-Fi connectivity for remote consultations, and improved illumination technologies enhancing diagnostic precision. Consumer preferences are leaning towards portable, user-friendly, and high-resolution ophthalmoscopes that enable veterinarians to provide accurate diagnoses and treatment plans efficiently. The compound annual growth rate (CAGR) for the veterinary ophthalmoscopes market is estimated to be around XX% during the forecast period. Market penetration of advanced ophthalmoscopes in emerging economies is also a key trend, driven by rising awareness and accessibility of veterinary care. Competitive dynamics are characterized by ongoing product innovation, strategic partnerships, and a focus on differentiating through specialized features and affordability. The market penetration of digital veterinary ophthalmoscopes is projected to increase by approximately XX% over the next decade.

Dominant Markets & Segments in Veterinary Ophthalmoscopes

The canine ophthalmoscopes segment is currently the dominant market within veterinary ophthalmology diagnostics. This dominance is fueled by the sheer volume of canine ownership globally and the high incidence of breed-specific ocular conditions that require regular monitoring and early intervention. Key drivers for this segment's leadership include the economic policies that support pet ownership and pet insurance, leading to increased willingness and ability to invest in advanced veterinary care. The infrastructure of veterinary clinics and specialized animal hospitals is well-developed to support the use of ophthalmoscopes for canine eye examinations.

The feline ophthalmoscopes segment is experiencing rapid growth, driven by an increasing understanding of feline ocular health and the rising popularity of cats as companion animals. While historically less studied, feline ophthalmology is gaining traction, leading to greater demand for specialized diagnostic tools. Economic factors supporting the growth of this segment include the rise of cat-specific veterinary practices and the development of targeted diagnostic solutions.

The horses ophthalmoscopes segment represents a niche but significant market. Horses, particularly performance and breeding animals, often require detailed ophthalmic evaluations for conditions affecting vision and eye health, which can impact their value and performance. Infrastructure supporting this segment includes equine veterinary hospitals and mobile veterinary services equipped for on-site examinations.

Regarding types, the 3.5V ophthalmoscopes segment is leading due to its superior illumination and magnification capabilities, which are crucial for detailed examination of the posterior eye structures. This type of ophthalmoscope offers enhanced diagnostic accuracy, appealing to veterinarians prioritizing comprehensive eye health assessments. The 2.5V ophthalmoscopes segment, while still relevant for basic examinations and in resource-limited settings, is gradually being overshadowed by the advanced features of 3.5V models.

Veterinary Ophthalmoscopes Product Innovations

Recent veterinary ophthalmoscope product innovations focus on enhancing portability, diagnostic accuracy, and connectivity. Developments include the integration of high-definition digital cameras for image capture and telemedicine, enabling remote expert consultations and enhanced client communication. The incorporation of advanced LED illumination provides consistent, bright light with reduced heat, improving patient comfort and examiner visibility. Competitive advantages are being gained through features like superior magnification, wider field of view, and ergonomic designs that facilitate prolonged use. Market fit is being optimized by tailoring features to specific animal species and common ocular pathologies, driving the demand for specialized veterinary diagnostic tools.

Report Segmentation & Scope

This report meticulously segments the veterinary ophthalmoscopes market across key applications and device types. The Canine segment is expected to capture a substantial market share, driven by the extensive global canine population and a growing emphasis on preventative eye care and treatment of prevalent canine ocular diseases. Projections indicate a significant increase in market size due to rising veterinary expenditure. The Feline segment is a rapidly expanding area, fueled by increased awareness of feline-specific eye conditions and the growing popularity of feline companionship. Market sizes are set to grow considerably as more specialized diagnostic tools become available. The Horses segment represents a vital market for specialized equine ophthalmology, particularly for performance animals. Growth is anticipated in this segment due to the economic importance of healthy vision in horses.

Within device types, the 2.5V ophthalmoscopes segment will continue to serve essential diagnostic needs, especially in certain regions and for fundamental examinations. However, the 3.5V ophthalmoscopes segment is projected to dominate, offering superior illumination and magnification essential for detailed diagnostics and specialist veterinary ophthalmology. Competitive dynamics show a trend towards higher voltage and advanced features in this segment.

Key Drivers of Veterinary Ophthalmoscopes Growth

Several factors are propelling the growth of the veterinary ophthalmoscopes market. The increasing prevalence of ocular diseases in pets is a primary driver, demanding more sophisticated diagnostic tools. The humanization of pets is leading to higher spending on animal healthcare, including specialized ophthalmology. Technological advancements in illumination, optics, and digital imaging are enhancing diagnostic capabilities and creating new market opportunities. Furthermore, growing awareness among pet owners about animal eye health and the availability of advanced veterinary services contribute to market expansion. The increasing number of veterinary clinics and specialists globally ensures a broader reach for these diagnostic instruments.

Challenges in the Veterinary Ophthalmoscopes Sector

Despite robust growth prospects, the veterinary ophthalmoscopes sector faces several challenges. High initial investment costs for advanced ophthalmoscopes can be a barrier for smaller veterinary practices. Limited availability of specialized veterinary ophthalmologists in certain regions can constrain the adoption of advanced diagnostic equipment. Stringent regulatory requirements for medical devices, though necessary for quality and safety, can increase product development timelines and costs. Competition from alternative diagnostic technologies, while complementary, can also influence market dynamics. Supply chain disruptions and economic downturns can temporarily impact market expansion. The cost of specialized training for veterinary staff on advanced ophthalmoscope usage also presents a challenge.

Leading Players in the Veterinary Ophthalmoscopes Market

- Heine Optotechnik

- Gowllands Limited

- Hill-Rom

- Keeler

- D-EYE

- Jorgensen Laboratories

- Riester

Key Developments in Veterinary Ophthalmoscopes Sector

- Q4 2023: Launch of new veterinary ophthalmoscope models with enhanced LED illumination and improved optical clarity.

- Q1 2024: Introduction of digital connectivity features enabling image sharing and remote diagnostics for veterinary ophthalmoscopes.

- Q2 2024: Strategic partnerships formed between ophthalmoscope manufacturers and veterinary telemedicine platforms to expand market reach.

- Q3 2024: Acquisition of a niche veterinary diagnostic imaging company by a major player to strengthen its ophthalmic portfolio.

- Q4 2024: Rollout of training programs for veterinary professionals on the effective use of advanced ophthalmoscopes.

- 2025: Anticipated launch of AI-powered diagnostic assistance features integrated into veterinary ophthalmoscopes.

- 2025: Expansion of distribution networks into emerging markets for veterinary ophthalmic diagnostic tools.

- 2026: Development of more compact and portable ophthalmoscope designs for field veterinary use.

- 2027: Introduction of multi-functional diagnostic devices combining ophthalmoscopy with other eye examination capabilities.

- 2028: Increased adoption of subscription-based models for ophthalmoscope software and updates.

- 2029: Further integration with electronic health records (EHR) systems for seamless patient data management.

- 2030: Advancements in battery technology leading to longer operational life for portable veterinary ophthalmoscopes.

- 2031: Focus on sustainable manufacturing practices and eco-friendly materials for veterinary diagnostic devices.

- 2032: Emergence of specialized ophthalmoscopes tailored for exotic animal ophthalmology.

- 2033: Continued evolution towards fully integrated digital diagnostic suites for comprehensive veterinary eye care.

Strategic Veterinary Ophthalmoscopes Market Outlook

- Q4 2023: Launch of new veterinary ophthalmoscope models with enhanced LED illumination and improved optical clarity.

- Q1 2024: Introduction of digital connectivity features enabling image sharing and remote diagnostics for veterinary ophthalmoscopes.

- Q2 2024: Strategic partnerships formed between ophthalmoscope manufacturers and veterinary telemedicine platforms to expand market reach.

- Q3 2024: Acquisition of a niche veterinary diagnostic imaging company by a major player to strengthen its ophthalmic portfolio.

- Q4 2024: Rollout of training programs for veterinary professionals on the effective use of advanced ophthalmoscopes.

- 2025: Anticipated launch of AI-powered diagnostic assistance features integrated into veterinary ophthalmoscopes.

- 2025: Expansion of distribution networks into emerging markets for veterinary ophthalmic diagnostic tools.

- 2026: Development of more compact and portable ophthalmoscope designs for field veterinary use.

- 2027: Introduction of multi-functional diagnostic devices combining ophthalmoscopy with other eye examination capabilities.

- 2028: Increased adoption of subscription-based models for ophthalmoscope software and updates.

- 2029: Further integration with electronic health records (EHR) systems for seamless patient data management.

- 2030: Advancements in battery technology leading to longer operational life for portable veterinary ophthalmoscopes.

- 2031: Focus on sustainable manufacturing practices and eco-friendly materials for veterinary diagnostic devices.

- 2032: Emergence of specialized ophthalmoscopes tailored for exotic animal ophthalmology.

- 2033: Continued evolution towards fully integrated digital diagnostic suites for comprehensive veterinary eye care.

Strategic Veterinary Ophthalmoscopes Market Outlook

The strategic outlook for the veterinary ophthalmoscopes market is exceptionally promising, driven by sustained growth accelerators and evolving industry demands. The increasing professionalization of veterinary care, coupled with advancements in diagnostic technology, will continue to fuel demand for high-performance ophthalmoscopes. Future market potential lies in the integration of artificial intelligence for diagnostic support and the development of more affordable yet sophisticated devices for a wider range of veterinary practices. Strategic opportunities abound for companies focusing on user-centric design, digital integration, and expanding their reach into underserved geographical markets. The ongoing commitment to animal welfare and the financial capacity of pet owners to invest in their pets' health position the veterinary ophthalmoscopes market for continued expansion and innovation.

Veterinary Ophthalmoscopes Segmentation

-

1. Application

- 1.1. Canine

- 1.2. Feline

- 1.3. Horses

-

2. Types

- 2.1. 2.5V

- 2.2. 3.5V

Veterinary Ophthalmoscopes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Veterinary Ophthalmoscopes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Ophthalmoscopes Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Canine

- 5.1.2. Feline

- 5.1.3. Horses

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 2.5V

- 5.2.2. 3.5V

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Veterinary Ophthalmoscopes Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Canine

- 6.1.2. Feline

- 6.1.3. Horses

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 2.5V

- 6.2.2. 3.5V

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Veterinary Ophthalmoscopes Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Canine

- 7.1.2. Feline

- 7.1.3. Horses

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 2.5V

- 7.2.2. 3.5V

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Veterinary Ophthalmoscopes Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Canine

- 8.1.2. Feline

- 8.1.3. Horses

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 2.5V

- 8.2.2. 3.5V

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Veterinary Ophthalmoscopes Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Canine

- 9.1.2. Feline

- 9.1.3. Horses

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 2.5V

- 9.2.2. 3.5V

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Veterinary Ophthalmoscopes Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Canine

- 10.1.2. Feline

- 10.1.3. Horses

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 2.5V

- 10.2.2. 3.5V

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Heine Optotechnik

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Gowllands Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hill-Rom

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Keeler

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 D-EYE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jorgensen Laboratories

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Riester

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Heine Optotechnik

List of Figures

- Figure 1: Global Veterinary Ophthalmoscopes Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Veterinary Ophthalmoscopes Revenue (million), by Application 2024 & 2032

- Figure 3: North America Veterinary Ophthalmoscopes Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Veterinary Ophthalmoscopes Revenue (million), by Types 2024 & 2032

- Figure 5: North America Veterinary Ophthalmoscopes Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Veterinary Ophthalmoscopes Revenue (million), by Country 2024 & 2032

- Figure 7: North America Veterinary Ophthalmoscopes Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Veterinary Ophthalmoscopes Revenue (million), by Application 2024 & 2032

- Figure 9: South America Veterinary Ophthalmoscopes Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Veterinary Ophthalmoscopes Revenue (million), by Types 2024 & 2032

- Figure 11: South America Veterinary Ophthalmoscopes Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Veterinary Ophthalmoscopes Revenue (million), by Country 2024 & 2032

- Figure 13: South America Veterinary Ophthalmoscopes Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Veterinary Ophthalmoscopes Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Veterinary Ophthalmoscopes Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Veterinary Ophthalmoscopes Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Veterinary Ophthalmoscopes Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Veterinary Ophthalmoscopes Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Veterinary Ophthalmoscopes Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Veterinary Ophthalmoscopes Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Veterinary Ophthalmoscopes Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Veterinary Ophthalmoscopes Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Veterinary Ophthalmoscopes Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Veterinary Ophthalmoscopes Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Veterinary Ophthalmoscopes Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Veterinary Ophthalmoscopes Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Veterinary Ophthalmoscopes Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Veterinary Ophthalmoscopes Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Veterinary Ophthalmoscopes Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Veterinary Ophthalmoscopes Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Veterinary Ophthalmoscopes Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Veterinary Ophthalmoscopes Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Veterinary Ophthalmoscopes Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Ophthalmoscopes?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Veterinary Ophthalmoscopes?

Key companies in the market include Heine Optotechnik, Gowllands Limited, Hill-Rom, Keeler, D-EYE, Jorgensen Laboratories, Riester.

3. What are the main segments of the Veterinary Ophthalmoscopes?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Ophthalmoscopes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Ophthalmoscopes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Ophthalmoscopes?

To stay informed about further developments, trends, and reports in the Veterinary Ophthalmoscopes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence