Key Insights

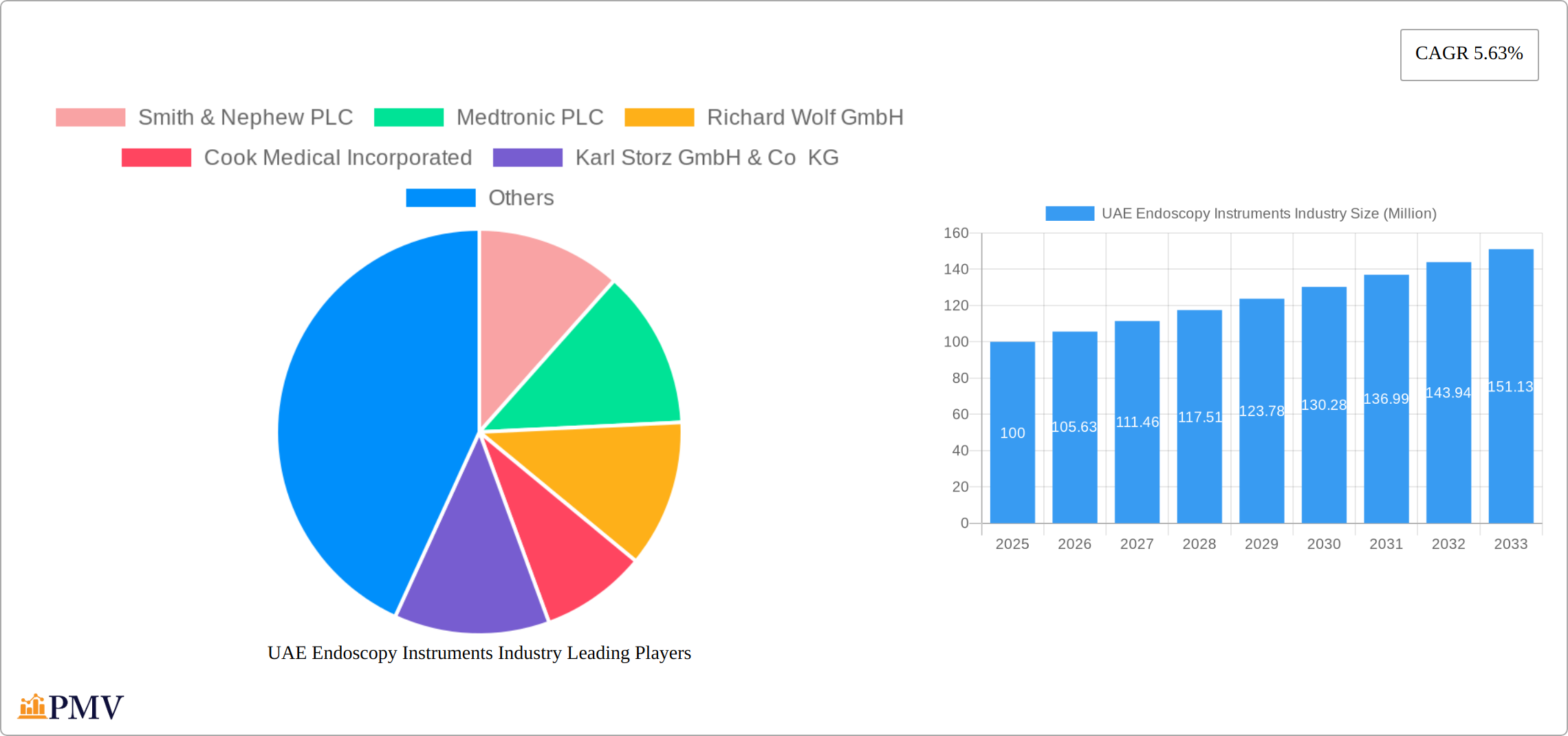

The UAE endoscopy instruments market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a rising prevalence of chronic diseases requiring endoscopic procedures, increasing demand for minimally invasive surgeries, and a growing geriatric population. The market's 5.63% CAGR from 2019-2033 indicates a significant expansion over the forecast period (2025-2033). Key segments within the market include endoscopes (including specialized operative devices and visualization equipment) and various applications across gastroenterology, pulmonology, urology, cardiology, and gynecology. The market is highly competitive, with prominent players like Smith & Nephew PLC, Medtronic PLC, and others vying for market share through technological advancements, strategic partnerships, and expansions. The rising adoption of advanced endoscopy techniques, such as robotic-assisted procedures and single-use endoscopes, further fuels market expansion. While challenges such as high costs associated with advanced equipment and potential procedural risks exist, the overall positive outlook driven by healthcare infrastructure improvements and increasing public awareness of minimally invasive procedures points towards sustained market growth throughout the forecast period. This growth is also fueled by increased government investments in healthcare infrastructure and technological advancements in the medical devices sector.

The UAE's strategic location and commitment to advanced healthcare infrastructure position it favorably for further market growth. The government's emphasis on improving healthcare accessibility and quality is a significant driver. Furthermore, the increasing influx of medical tourists seeking advanced endoscopic procedures in the UAE contributes to market expansion. Growth will be influenced by technological innovations leading to enhanced image quality, precision, and minimally invasive capabilities. Competitive dynamics, including mergers and acquisitions, new product launches, and strategic alliances, will continue to shape the market landscape. The increasing focus on training and development of endoscopy specialists also ensures that the market demand is adequately met.

UAE Endoscopy Instruments Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UAE endoscopy instruments market, offering invaluable insights for stakeholders across the medical device industry. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report projects robust growth, fueled by technological advancements, rising prevalence of chronic diseases, and increasing healthcare expenditure in the UAE. The market is segmented by device type (Endoscopes, Endoscopic Operative Devices, Visualization Equipment) and application (Gastroenterology, Pulmonology, Urology, Cardiology, Gynecology, and Other Applications). Key players like Smith & Nephew PLC, Medtronic PLC, Richard Wolf GmbH, and others are analyzed for their market share, strategic initiatives, and competitive positioning.

UAE Endoscopy Instruments Industry Market Structure & Competitive Dynamics

The UAE endoscopy instruments market exhibits a moderately consolidated structure, with a few multinational corporations holding significant market share. The industry is characterized by a dynamic innovation ecosystem, driven by continuous technological advancements and a supportive regulatory framework. While the market faces competition from substitute products, including minimally invasive surgical techniques, the overall demand for endoscopy instruments remains strong due to their efficacy and versatility. The presence of several prominent players results in intense competition, characterized by strategic partnerships, product launches, and technological innovations. Recent M&A activities have been limited, with reported deal values in the range of xx Million during the historical period (2019-2024). Market concentration is measured by the Herfindahl-Hirschman Index (HHI) at xx, indicating a (moderately concentrated/oligopolistic/ etc.) market. End-user trends show increasing preference for advanced, technologically superior endoscopy instruments with enhanced visualization capabilities and minimally invasive surgical options.

UAE Endoscopy Instruments Industry Industry Trends & Insights

The UAE endoscopy instruments market is experiencing robust growth, fueled by a confluence of factors. The rising prevalence of chronic diseases like gastrointestinal cancers, colorectal disorders, and respiratory illnesses is driving increased demand for minimally invasive diagnostic and therapeutic procedures. This trend is further amplified by the growing adoption of advanced endoscopy techniques, including robotic-assisted endoscopy and capsule endoscopy, offering improved precision, visualization, and patient outcomes. Significant investments in the UAE's healthcare infrastructure, coupled with government initiatives promoting advanced medical technologies and specialized healthcare services, are creating a fertile ground for market expansion. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of [Insert Projected CAGR]% during the forecast period (2025-2033). Competitive dynamics are shaped by continuous technological innovation, strategic partnerships, and a focus on product differentiation, with market players emphasizing ease of use, superior visualization capabilities, and reduced recovery times for patients.

Dominant Markets & Segments in UAE Endoscopy Instruments Industry

The UAE endoscopy instruments market is geographically concentrated in major urban areas with well-established healthcare infrastructure. The gastroenterology segment holds the largest market share, driven by the high prevalence of gastrointestinal disorders.

Key Drivers for Gastroenterology Segment Dominance:

- High prevalence of gastrointestinal diseases.

- Increased adoption of advanced endoscopic procedures.

- Growing number of specialized gastroenterology clinics.

Key Drivers for Other Segments:

- Increasing prevalence of respiratory diseases (Pulmonology).

- Growing demand for minimally invasive urological procedures (Urology).

- Rising incidence of cardiovascular diseases (Cardiology).

- Increased awareness regarding women's health (Gynecology).

Within the device type segment, endoscopes constitute the largest share, followed by endoscopic operative devices and visualization equipment. The high demand for sophisticated visualization equipment is a significant growth driver. Economic policies promoting healthcare investments and the robust infrastructure supporting advanced medical technologies further contribute to the market's dominance.

UAE Endoscopy Instruments Industry Product Innovations

Recent years have witnessed significant product innovations in the UAE endoscopy instruments market, with a focus on enhanced visualization capabilities, miniaturization of devices, and integration of advanced technologies like artificial intelligence. Manufacturers are launching endoscopes with improved image quality, greater flexibility, and functionalities such as narrow-band imaging (NBI) and chromoendoscopy. The market is seeing an increased adoption of single-use endoscopes, improving infection control and reducing sterilization costs. These innovations enhance the accuracy, safety, and efficiency of endoscopic procedures, aligning with the market's demand for improved patient outcomes and cost-effectiveness.

Report Segmentation & Scope

This report segments the UAE endoscopy instruments market by device type and application, providing a granular analysis of market dynamics within each segment.

By Type of Device:

Endoscopes: This segment is a major growth driver, with increasing demand for high-definition endoscopes featuring advanced functionalities such as improved image quality, enhanced maneuverability, and integrated therapeutic capabilities. Competition in this segment is fierce, with established players and emerging innovators vying for market share.

Endoscopic Operative Devices: This category encompasses a range of instruments used during endoscopic procedures, including graspers, dissectors, and other specialized tools. The growth of this segment is closely tied to the rising adoption of minimally invasive surgical techniques across various specialties.

Visualization Equipment: High-resolution monitors, video processors, and related equipment are crucial components of endoscopic procedures. The demand for superior visualization capabilities is driving innovation in this segment, with manufacturers focusing on features like 4K resolution, improved image processing, and advanced connectivity.

By Application:

Gastroenterology: This remains the largest application segment, driven by the high prevalence of gastrointestinal disorders and the widespread use of endoscopy for diagnosis and treatment. The segment is anticipated to maintain its dominant position throughout the forecast period.

Pulmonology, Urology, Cardiology, Gynecology, Other Applications: Minimally invasive procedures are gaining traction across various specialties, driving growth in these application segments. The competitive landscape is dynamic, with companies tailoring their offerings to meet the specific needs of each specialty.

Key Drivers of UAE Endoscopy Instruments Industry Growth

The expansion of the UAE endoscopy instruments market is driven by several interconnected factors. The escalating prevalence of chronic diseases necessitates minimally invasive procedures, creating a strong foundation for market growth. Technological advancements, including the development of single-use endoscopes, AI-powered diagnostic tools, and robotic-assisted systems, are enhancing procedure efficiency, safety, and patient outcomes. Government support, through investments in healthcare infrastructure and initiatives promoting advanced medical technologies, is fostering market expansion. Finally, the increasing number of specialized medical centers and hospitals across the UAE is contributing significantly to market growth.

Challenges in the UAE Endoscopy Instruments Industry Sector

The UAE endoscopy instruments market faces certain challenges. Stringent regulatory requirements and lengthy approval processes can hamper product launches and market entry. Supply chain disruptions, particularly during global crises, can affect instrument availability and pricing. High import duties and competition from established international players present significant challenges for local and smaller market participants. These factors can influence overall market dynamics and growth trajectories.

Leading Players in the UAE Endoscopy Instruments Industry Market

- Smith & Nephew PLC

- Medtronic PLC

- Richard Wolf GmbH

- Cook Medical Incorporated

- Karl Storz GmbH & Co KG

- Fujifilm Holdings

- Johnson & Johnson

- C R Bard Inc

- Stryker Corporation

- Boston Scientific Corporation

- Aesculap Inc

Key Developments in UAE Endoscopy Instruments Industry Sector

December 2022: Sharjah University Hospital's launch of a state-of-the-art center for endoscopic orthopedic surgeries, utilizing the latest technologies, underscores the growing adoption of minimally invasive techniques in orthopedics and boosts the demand for related instruments.

August 2022: The successful completion of final-stage testing of Hisense's 55-inch endoscopic monitor in UAE hospitals highlights the growing demand for high-resolution visualization equipment with advanced features, driving growth in this segment.

[Add another recent key development here]

Strategic UAE Endoscopy Instruments Industry Market Outlook

The UAE endoscopy instruments market presents significant growth opportunities for companies that embrace innovation and strategic partnerships. The continued rise in healthcare expenditure, coupled with a growing, aging population and increased awareness of preventative healthcare, creates a favorable environment for market expansion. Strategic focus areas for market players include the development of single-use endoscopes to reduce infection risk, AI-powered diagnostic tools to improve accuracy and efficiency, and robotic-assisted endoscopy systems to enhance precision and minimally invasiveness. Collaboration with local healthcare providers and a deep understanding of the regulatory landscape are crucial for success in this dynamic market. The long-term outlook for the UAE endoscopy instruments market remains positive, with substantial growth potential across various segments and applications.

UAE Endoscopy Instruments Industry Segmentation

-

1. Type of Device

-

1.1. Endoscopes

- 1.1.1. Rigid Endoscope

- 1.1.2. Flexible Endoscope

- 1.1.3. Other Endoscopes

-

1.2. Endoscopic Operative Device

- 1.2.1. Irrigation/Suction System

- 1.2.2. Access Device

- 1.2.3. Wound Protector

- 1.2.4. Other Endoscopic Operative Devices

- 1.3. Visualization Equipment

-

1.1. Endoscopes

-

2. Application

- 2.1. Gastroenterology

- 2.2. Pulmonology

- 2.3. Urology

- 2.4. Cardiology

- 2.5. Gynecology

- 2.6. Other Applications

UAE Endoscopy Instruments Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Endoscopy Instruments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Preference for Minimally Invasive Surgeries; Technological Advancements Leading to Enhanced Applications

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Technicians; Infections Caused by Few Endoscopes

- 3.4. Market Trends

- 3.4.1. The Urology Segment is Expected to Hold the Largest Share in the UAE Endoscopy Equipment Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Endoscopy Instruments Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Endoscopes

- 5.1.1.1. Rigid Endoscope

- 5.1.1.2. Flexible Endoscope

- 5.1.1.3. Other Endoscopes

- 5.1.2. Endoscopic Operative Device

- 5.1.2.1. Irrigation/Suction System

- 5.1.2.2. Access Device

- 5.1.2.3. Wound Protector

- 5.1.2.4. Other Endoscopic Operative Devices

- 5.1.3. Visualization Equipment

- 5.1.1. Endoscopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gastroenterology

- 5.2.2. Pulmonology

- 5.2.3. Urology

- 5.2.4. Cardiology

- 5.2.5. Gynecology

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. North America UAE Endoscopy Instruments Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 6.1.1. Endoscopes

- 6.1.1.1. Rigid Endoscope

- 6.1.1.2. Flexible Endoscope

- 6.1.1.3. Other Endoscopes

- 6.1.2. Endoscopic Operative Device

- 6.1.2.1. Irrigation/Suction System

- 6.1.2.2. Access Device

- 6.1.2.3. Wound Protector

- 6.1.2.4. Other Endoscopic Operative Devices

- 6.1.3. Visualization Equipment

- 6.1.1. Endoscopes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Gastroenterology

- 6.2.2. Pulmonology

- 6.2.3. Urology

- 6.2.4. Cardiology

- 6.2.5. Gynecology

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 7. South America UAE Endoscopy Instruments Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 7.1.1. Endoscopes

- 7.1.1.1. Rigid Endoscope

- 7.1.1.2. Flexible Endoscope

- 7.1.1.3. Other Endoscopes

- 7.1.2. Endoscopic Operative Device

- 7.1.2.1. Irrigation/Suction System

- 7.1.2.2. Access Device

- 7.1.2.3. Wound Protector

- 7.1.2.4. Other Endoscopic Operative Devices

- 7.1.3. Visualization Equipment

- 7.1.1. Endoscopes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Gastroenterology

- 7.2.2. Pulmonology

- 7.2.3. Urology

- 7.2.4. Cardiology

- 7.2.5. Gynecology

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 8. Europe UAE Endoscopy Instruments Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 8.1.1. Endoscopes

- 8.1.1.1. Rigid Endoscope

- 8.1.1.2. Flexible Endoscope

- 8.1.1.3. Other Endoscopes

- 8.1.2. Endoscopic Operative Device

- 8.1.2.1. Irrigation/Suction System

- 8.1.2.2. Access Device

- 8.1.2.3. Wound Protector

- 8.1.2.4. Other Endoscopic Operative Devices

- 8.1.3. Visualization Equipment

- 8.1.1. Endoscopes

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Gastroenterology

- 8.2.2. Pulmonology

- 8.2.3. Urology

- 8.2.4. Cardiology

- 8.2.5. Gynecology

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 9. Middle East & Africa UAE Endoscopy Instruments Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 9.1.1. Endoscopes

- 9.1.1.1. Rigid Endoscope

- 9.1.1.2. Flexible Endoscope

- 9.1.1.3. Other Endoscopes

- 9.1.2. Endoscopic Operative Device

- 9.1.2.1. Irrigation/Suction System

- 9.1.2.2. Access Device

- 9.1.2.3. Wound Protector

- 9.1.2.4. Other Endoscopic Operative Devices

- 9.1.3. Visualization Equipment

- 9.1.1. Endoscopes

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Gastroenterology

- 9.2.2. Pulmonology

- 9.2.3. Urology

- 9.2.4. Cardiology

- 9.2.5. Gynecology

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 10. Asia Pacific UAE Endoscopy Instruments Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 10.1.1. Endoscopes

- 10.1.1.1. Rigid Endoscope

- 10.1.1.2. Flexible Endoscope

- 10.1.1.3. Other Endoscopes

- 10.1.2. Endoscopic Operative Device

- 10.1.2.1. Irrigation/Suction System

- 10.1.2.2. Access Device

- 10.1.2.3. Wound Protector

- 10.1.2.4. Other Endoscopic Operative Devices

- 10.1.3. Visualization Equipment

- 10.1.1. Endoscopes

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Gastroenterology

- 10.2.2. Pulmonology

- 10.2.3. Urology

- 10.2.4. Cardiology

- 10.2.5. Gynecology

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Smith & Nephew PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medtronic PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Richard Wolf GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cook Medical Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Karl Storz GmbH & Co KG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fujifilm Holdings

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson & Johnson

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 C R Bard Inc*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Stryker Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Boston Scientific Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aesculap Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Smith & Nephew PLC

List of Figures

- Figure 1: Global UAE Endoscopy Instruments Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: UAE UAE Endoscopy Instruments Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: UAE UAE Endoscopy Instruments Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UAE Endoscopy Instruments Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 5: North America UAE Endoscopy Instruments Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 6: North America UAE Endoscopy Instruments Industry Revenue (Million), by Application 2024 & 2032

- Figure 7: North America UAE Endoscopy Instruments Industry Revenue Share (%), by Application 2024 & 2032

- Figure 8: North America UAE Endoscopy Instruments Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America UAE Endoscopy Instruments Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America UAE Endoscopy Instruments Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 11: South America UAE Endoscopy Instruments Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 12: South America UAE Endoscopy Instruments Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: South America UAE Endoscopy Instruments Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: South America UAE Endoscopy Instruments Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: South America UAE Endoscopy Instruments Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe UAE Endoscopy Instruments Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 17: Europe UAE Endoscopy Instruments Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 18: Europe UAE Endoscopy Instruments Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe UAE Endoscopy Instruments Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe UAE Endoscopy Instruments Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe UAE Endoscopy Instruments Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa UAE Endoscopy Instruments Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 23: Middle East & Africa UAE Endoscopy Instruments Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 24: Middle East & Africa UAE Endoscopy Instruments Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Middle East & Africa UAE Endoscopy Instruments Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Middle East & Africa UAE Endoscopy Instruments Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa UAE Endoscopy Instruments Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific UAE Endoscopy Instruments Industry Revenue (Million), by Type of Device 2024 & 2032

- Figure 29: Asia Pacific UAE Endoscopy Instruments Industry Revenue Share (%), by Type of Device 2024 & 2032

- Figure 30: Asia Pacific UAE Endoscopy Instruments Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific UAE Endoscopy Instruments Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific UAE Endoscopy Instruments Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific UAE Endoscopy Instruments Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 3: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 7: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 13: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 19: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 31: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 40: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global UAE Endoscopy Instruments Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific UAE Endoscopy Instruments Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Endoscopy Instruments Industry?

The projected CAGR is approximately 5.63%.

2. Which companies are prominent players in the UAE Endoscopy Instruments Industry?

Key companies in the market include Smith & Nephew PLC, Medtronic PLC, Richard Wolf GmbH, Cook Medical Incorporated, Karl Storz GmbH & Co KG, Fujifilm Holdings, Johnson & Johnson, C R Bard Inc*List Not Exhaustive, Stryker Corporation, Boston Scientific Corporation, Aesculap Inc.

3. What are the main segments of the UAE Endoscopy Instruments Industry?

The market segments include Type of Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Preference for Minimally Invasive Surgeries; Technological Advancements Leading to Enhanced Applications.

6. What are the notable trends driving market growth?

The Urology Segment is Expected to Hold the Largest Share in the UAE Endoscopy Equipment Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled Technicians; Infections Caused by Few Endoscopes.

8. Can you provide examples of recent developments in the market?

December 2022: Sharjah University Hospital launched the latest technology in endoscopic orthopedic surgeries using advanced technologies. This includes a center of excellence for sports medicine and sports injuries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Endoscopy Instruments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Endoscopy Instruments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Endoscopy Instruments Industry?

To stay informed about further developments, trends, and reports in the UAE Endoscopy Instruments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence