Key Insights

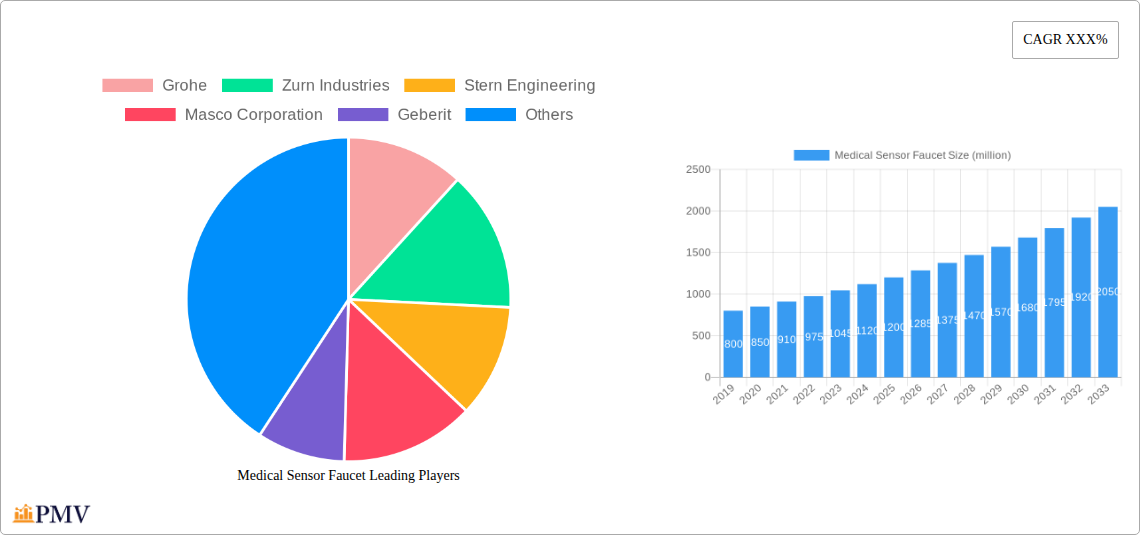

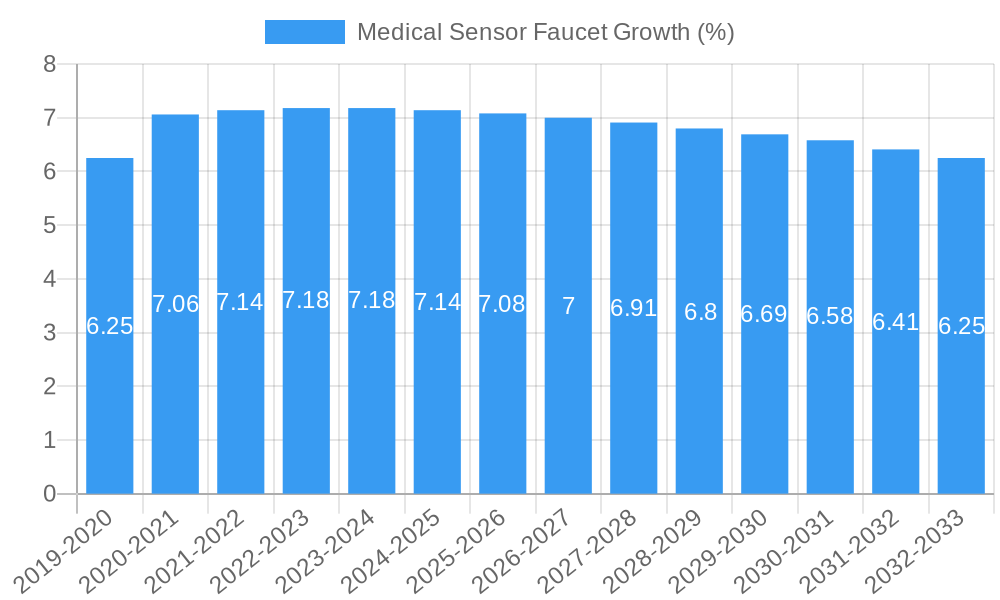

The global Medical Sensor Faucet market is poised for substantial growth, projected to reach approximately \$1,250 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7.5% anticipated throughout the forecast period of 2025-2033. This expansion is primarily driven by the increasing adoption of advanced technologies in healthcare facilities to enhance hygiene and infection control. The inherent benefits of sensor faucets, such as hands-free operation, reduced water wastage, and minimized cross-contamination, are becoming critical considerations for hospitals, clinics, and laboratories. The medical application segment is expected to dominate the market, fueled by stringent regulatory requirements for sanitation and the growing awareness of healthcare-associated infections. Furthermore, the rising investment in modernizing healthcare infrastructure, particularly in developed economies and rapidly developing regions like Asia Pacific, will continue to propel market demand. The availability of a wide range of innovative products, including both countertop and wall-mounted models designed for specialized medical environments, further supports this upward trajectory.

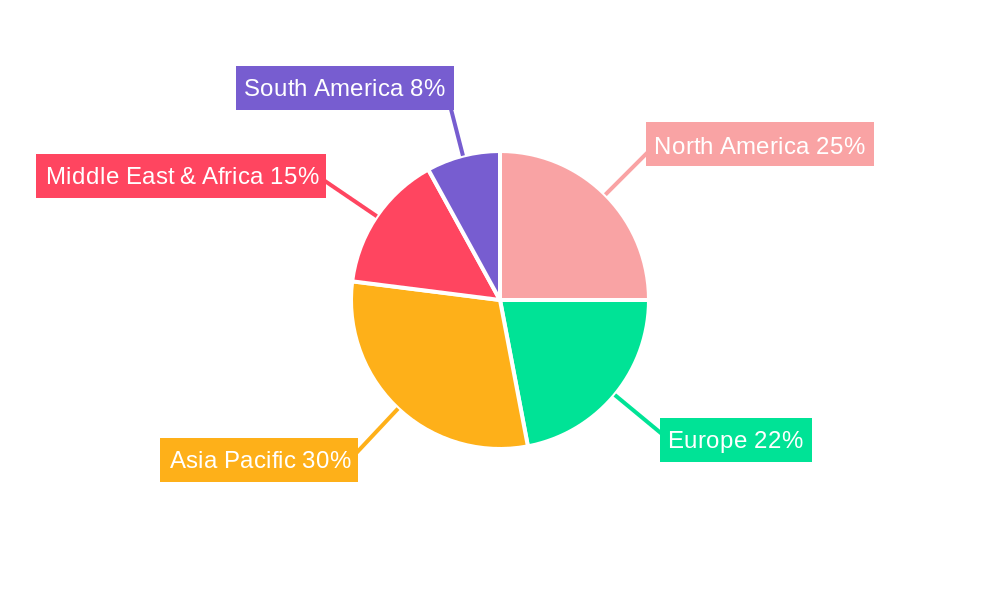

The market's growth is also influenced by advancements in sensor technology, leading to more precise and reliable faucet operations. While the market enjoys strong drivers, certain restraints, such as the initial installation costs and the need for regular maintenance, might pose minor challenges. However, the long-term benefits in terms of hygiene, operational efficiency, and reduced water consumption are expected to outweigh these concerns. Key players like Grohe, Zurn Industries, and Geberit are actively investing in research and development to introduce cutting-edge solutions and expand their market reach globally. The Asia Pacific region, particularly China and India, is anticipated to witness significant growth due to rapid healthcare infrastructure development and increasing disposable incomes. North America and Europe are expected to maintain their dominance due to established healthcare systems and a higher adoption rate of advanced technologies. The food industry also presents a growing segment, driven by increasing demand for hygienic food processing environments.

Here's an SEO-optimized, detailed report description for the Medical Sensor Faucet market, designed for immediate use without modification:

This in-depth market research report provides a detailed analysis of the global Medical Sensor Faucet market, offering critical insights into its structure, competitive landscape, trends, and future outlook. Spanning from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for manufacturers, suppliers, investors, and industry stakeholders seeking to understand and capitalize on the evolving opportunities within the medical sensor faucet sector. We delve into market segmentation by application and faucet type, analyze key growth drivers and challenges, and highlight product innovations and strategic developments. The study meticulously covers the historical period (2019–2024), base year (2025), and forecast period (2025–2033), ensuring a comprehensive understanding of market dynamics.

Medical Sensor Faucet Market Structure & Competitive Dynamics

The Medical Sensor Faucet market is characterized by a moderate to high level of concentration, with a significant presence of established global players and emerging regional manufacturers. Innovation ecosystems are rapidly developing, driven by advancements in sensor technology, contactless operation, and antimicrobial materials. Regulatory frameworks, particularly in healthcare applications, play a crucial role in shaping product development and market entry. While direct product substitutes are limited for specialized medical applications, basic manual faucets represent an indirect alternative in some segments. End-user trends are increasingly focused on hygiene, water efficiency, and infection control, directly impacting demand for sensor-operated faucets. Merger and Acquisition (M&A) activities are anticipated to increase as companies seek to expand their product portfolios, gain market share, and enhance their technological capabilities. For instance, strategic acquisitions valued in the hundreds of millions are expected to reshape the competitive landscape in the coming years. Key market share figures are detailed within the full report, providing a quantitative overview of leading companies' positions.

Medical Sensor Faucet Industry Trends & Insights

The global Medical Sensor Faucet market is experiencing robust growth, fueled by a confluence of factors that are reshaping the plumbing and sanitation industry. The increasing global emphasis on hygiene and infection control, particularly in healthcare facilities, educational institutions, and public spaces, is a primary growth driver. Sensor faucets offer a contactless solution, significantly reducing the risk of cross-contamination, a critical concern post-pandemic. Technological advancements, including the integration of more sophisticated sensors, enhanced water flow control, and energy-efficient designs, are further propelling market adoption. The growing demand for smart and automated bathroom solutions, aligning with the broader smart home and building trends, also contributes to market expansion. Consumer preferences are shifting towards products that offer convenience, hygiene, and water conservation. This is driving innovation in faucet design, materials, and functionality. Competitive dynamics are intensifying, with companies investing heavily in research and development to differentiate their offerings. The projected Compound Annual Growth Rate (CAGR) for the medical sensor faucet market is estimated to be robust, with market penetration expected to rise significantly across various applications. The market penetration for advanced sensor faucets in medical and high-traffic public restrooms is forecast to reach substantial levels, indicating a strong upward trajectory.

Dominant Markets & Segments in Medical Sensor Faucet

The Medical Sensor Faucet market exhibits distinct regional and segment-specific dominance, driven by varied economic policies, infrastructure development, and healthcare spending.

Leading Region Analysis: North America and Europe currently lead the market due to advanced healthcare infrastructure, stringent hygiene regulations, and a high propensity for adopting innovative technologies. The presence of major healthcare providers and a strong focus on patient safety are key drivers.

Emerging Markets: Asia Pacific is projected to be the fastest-growing region, spurred by rapid urbanization, increasing healthcare investments, and a rising awareness of hygiene standards in developing economies. Government initiatives promoting smart city development and public health infrastructure upgrades are also significant contributors.

Dominant Application Segment: The Medical application segment holds the largest market share, driven by the critical need for infection control in hospitals, clinics, and laboratories. Strict regulatory requirements for sterile environments further solidify its dominance. The "Food" segment also shows significant growth due to food safety regulations in commercial kitchens and food processing facilities.

Dominant Faucet Type: Wall Mounted Faucets are increasingly preferred in medical and food service applications for ease of cleaning and space optimization. Their seamless integration into countertops and splashbacks minimizes crevices where bacteria can accumulate. Countertop faucets remain popular in other commercial and domestic settings.

Key drivers for dominance in these segments include government mandates for hygiene, increased healthcare expenditure, and a growing consumer preference for touchless technologies in public and private spaces.

Medical Sensor Faucet Product Innovations

Product innovations in the Medical Sensor Faucet market are primarily focused on enhancing user experience, improving hygiene, and optimizing water efficiency. Developments include the integration of advanced infrared or microwave sensors for faster and more reliable activation, as well as features like adjustable water flow rates and temperature control. Antimicrobial coatings and materials are being widely adopted to further inhibit bacterial growth. Some manufacturers are introducing smart functionalities, allowing for remote monitoring, usage tracking, and predictive maintenance, particularly beneficial in large healthcare facilities. These innovations provide a significant competitive advantage by addressing evolving end-user needs for safety, convenience, and sustainability.

Report Segmentation & Scope

This report segments the Medical Sensor Faucet market based on key criteria to provide granular insights into each sub-segment.

Application: The market is segmented into Medical, Food, and Others. The Medical segment, crucial for infection control in healthcare settings, is expected to witness substantial growth. The Food segment is driven by food safety regulations in commercial kitchens and processing plants. The 'Others' category encompasses various commercial and public spaces prioritizing hygiene and convenience.

Type: Further segmentation is based on faucet type, including Countertop Faucet and Wall Mounted Faucet. Wall-mounted variants are gaining traction in hygiene-critical environments due to their ease of cleaning and space-saving design. Countertop faucets continue to be a popular choice across a broader range of applications.

Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed within the report.

Key Drivers of Medical Sensor Faucet Growth

Several pivotal factors are propelling the expansion of the Medical Sensor Faucet market. Firstly, the unwavering global focus on hygiene and infection control, amplified by recent public health events, is a primary catalyst. Secondly, technological advancements in sensor technology, water efficiency, and material science are making these faucets more accessible, reliable, and appealing. Thirdly, increasing government regulations mandating higher hygiene standards in healthcare and food service industries are creating a consistent demand. Finally, a growing consumer preference for contactless, convenient, and aesthetically pleasing bathroom solutions in both commercial and residential settings is a significant growth accelerator.

Challenges in the Medical Sensor Faucet Sector

Despite robust growth, the Medical Sensor Faucet sector faces several challenges. High initial investment costs associated with advanced sensor technology and installation can be a barrier, particularly for smaller establishments. Regulatory compliance for specific medical applications can be complex and time-consuming. Supply chain disruptions and the availability of specialized components can impact production and lead times. Furthermore, intense competition among manufacturers necessitates continuous innovation and cost optimization, putting pressure on profit margins. The need for regular maintenance and potential for sensor malfunction, though decreasing with technological improvements, also presents a consideration for end-users.

Leading Players in the Medical Sensor Faucet Market

- Grohe

- Zurn Industries

- Stern Engineering

- Masco Corporation

- Geberit

- GESSI

- Ningbo Zhanying Intelligent Kitchen and Bathroom Technology

- Shanghai DOSON Automatic Control Equipment

Key Developments in Medical Sensor Faucet Sector

- 2024: Launch of next-generation, ultra-low flow sensor faucets designed for enhanced water conservation and longer battery life.

- 2023: Introduction of advanced antimicrobial materials in faucet bodies to further reduce microbial contamination.

- 2023: Strategic partnership formed between a leading sensor technology provider and a major faucet manufacturer to accelerate innovation.

- 2022: Increased focus on smart faucet features, including IoT connectivity for facility management and usage analytics.

- 2021: Merger activity aimed at consolidating market share and expanding product portfolios in the high-growth medical segment.

Strategic Medical Sensor Faucet Market Outlook

The strategic outlook for the Medical Sensor Faucet market is exceptionally positive, driven by sustained demand for hygiene-focused solutions across critical sectors. Growth accelerators include the continued integration of smart technologies for enhanced efficiency and user experience, particularly in the healthcare and hospitality industries. The expanding middle class in emerging economies, coupled with increasing government investment in public health infrastructure, presents significant untapped market potential. Companies that can offer innovative, reliable, and cost-effective solutions, while adhering to evolving regulatory landscapes, are poised for substantial growth and market leadership in the coming years. Strategic partnerships and a focus on sustainability will be key to navigating future market dynamics.

Medical Sensor Faucet Segmentation

-

1. Application

- 1.1. Medical

- 1.2. Food

- 1.3. Others

-

2. Type

- 2.1. Countertop Faucet

- 2.2. Wall Mounted Faucet

Medical Sensor Faucet Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Sensor Faucet REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Sensor Faucet Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. Food

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Countertop Faucet

- 5.2.2. Wall Mounted Faucet

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Sensor Faucet Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical

- 6.1.2. Food

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Countertop Faucet

- 6.2.2. Wall Mounted Faucet

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Sensor Faucet Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical

- 7.1.2. Food

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Countertop Faucet

- 7.2.2. Wall Mounted Faucet

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Sensor Faucet Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical

- 8.1.2. Food

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Countertop Faucet

- 8.2.2. Wall Mounted Faucet

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Sensor Faucet Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical

- 9.1.2. Food

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Countertop Faucet

- 9.2.2. Wall Mounted Faucet

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Sensor Faucet Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical

- 10.1.2. Food

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Countertop Faucet

- 10.2.2. Wall Mounted Faucet

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Grohe

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zurn Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Stern Engineering

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Masco Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Geberit

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GESSI

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ningbo Zhanying Intelligent Kitchen and Bathroom Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shanghai DOSON Automatic Control Equipment

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Grohe

List of Figures

- Figure 1: Global Medical Sensor Faucet Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Medical Sensor Faucet Revenue (million), by Application 2024 & 2032

- Figure 3: North America Medical Sensor Faucet Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Medical Sensor Faucet Revenue (million), by Type 2024 & 2032

- Figure 5: North America Medical Sensor Faucet Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Medical Sensor Faucet Revenue (million), by Country 2024 & 2032

- Figure 7: North America Medical Sensor Faucet Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Medical Sensor Faucet Revenue (million), by Application 2024 & 2032

- Figure 9: South America Medical Sensor Faucet Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Medical Sensor Faucet Revenue (million), by Type 2024 & 2032

- Figure 11: South America Medical Sensor Faucet Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Medical Sensor Faucet Revenue (million), by Country 2024 & 2032

- Figure 13: South America Medical Sensor Faucet Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Medical Sensor Faucet Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Medical Sensor Faucet Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Medical Sensor Faucet Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Medical Sensor Faucet Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Medical Sensor Faucet Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Medical Sensor Faucet Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Medical Sensor Faucet Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Medical Sensor Faucet Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Medical Sensor Faucet Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Medical Sensor Faucet Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Medical Sensor Faucet Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Medical Sensor Faucet Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Medical Sensor Faucet Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Medical Sensor Faucet Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Medical Sensor Faucet Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Medical Sensor Faucet Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Medical Sensor Faucet Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Medical Sensor Faucet Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Sensor Faucet Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Sensor Faucet Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Medical Sensor Faucet Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Medical Sensor Faucet Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Medical Sensor Faucet Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Medical Sensor Faucet Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Medical Sensor Faucet Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Medical Sensor Faucet Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Medical Sensor Faucet Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Medical Sensor Faucet Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Medical Sensor Faucet Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Medical Sensor Faucet Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Medical Sensor Faucet Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Medical Sensor Faucet Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Medical Sensor Faucet Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Medical Sensor Faucet Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Medical Sensor Faucet Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Medical Sensor Faucet Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Medical Sensor Faucet Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Medical Sensor Faucet Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Sensor Faucet?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Medical Sensor Faucet?

Key companies in the market include Grohe, Zurn Industries, Stern Engineering, Masco Corporation, Geberit, GESSI, Ningbo Zhanying Intelligent Kitchen and Bathroom Technology, Shanghai DOSON Automatic Control Equipment.

3. What are the main segments of the Medical Sensor Faucet?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Sensor Faucet," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Sensor Faucet report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Sensor Faucet?

To stay informed about further developments, trends, and reports in the Medical Sensor Faucet, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence