Key Insights

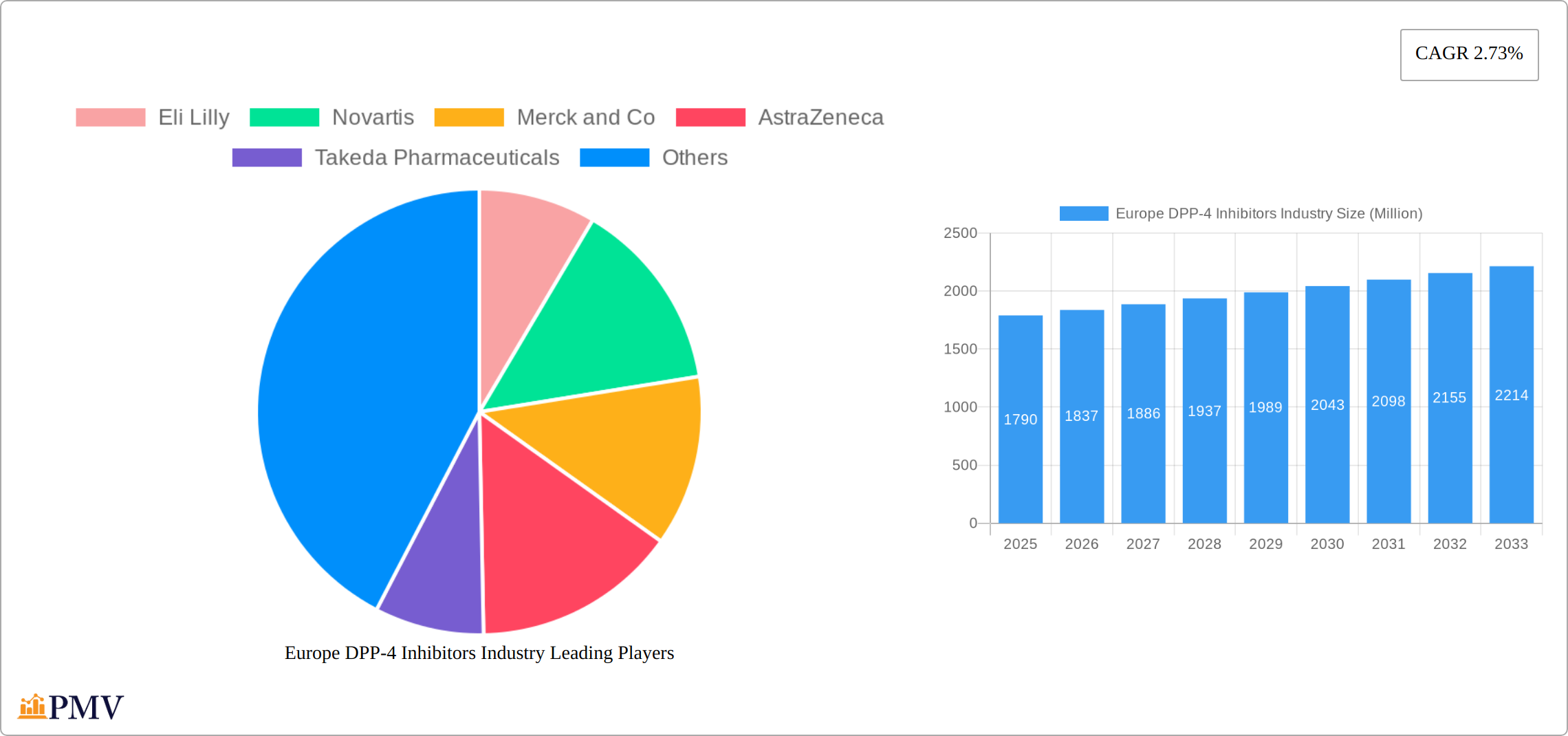

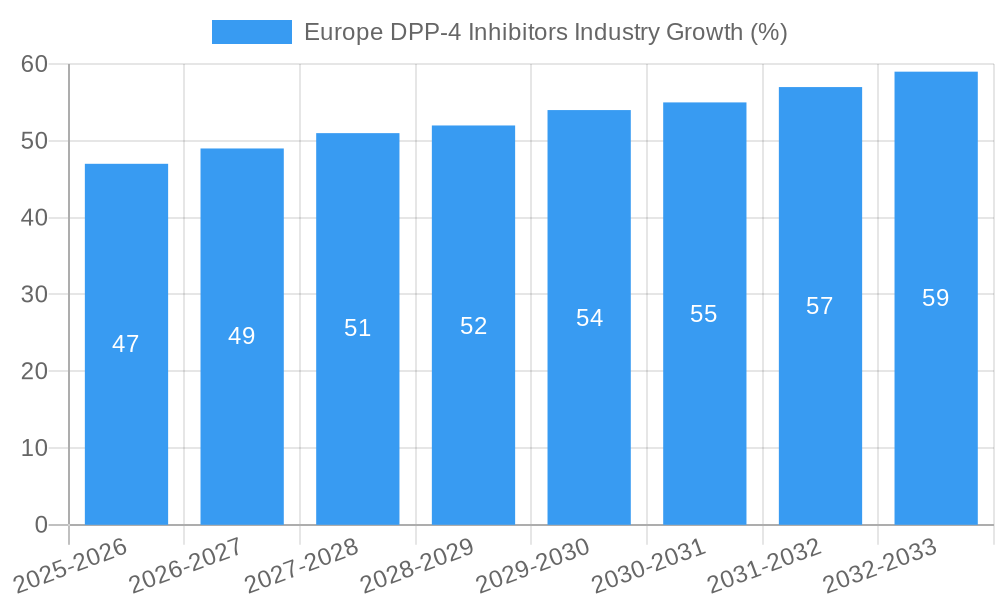

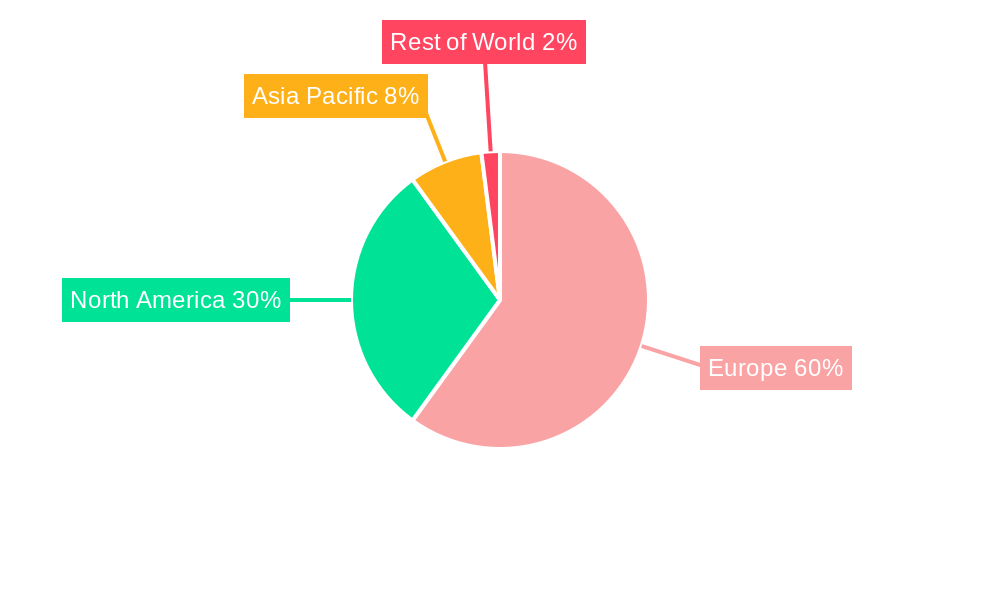

The European DPP-4 inhibitors market, valued at €1.79 billion in 2025, is projected to experience steady growth with a compound annual growth rate (CAGR) of 2.73% from 2025 to 2033. This growth is driven by the increasing prevalence of type 2 diabetes mellitus (T2DM) across Europe, particularly in aging populations. The rising awareness of the benefits of DPP-4 inhibitors, such as their efficacy in lowering blood glucose levels with a relatively low risk of hypoglycemia compared to other antidiabetic drugs, fuels market expansion. Furthermore, the continued launch of novel formulations and the ongoing research into the combination therapies involving DPP-4 inhibitors contribute positively to market dynamics. However, the market faces certain restraints including the emergence of competitive therapies like GLP-1 receptor agonists and SGLT2 inhibitors, as well as the potential for adverse effects associated with DPP-4 inhibitor use, such as pancreatitis and hypersensitivity reactions, leading to some patients switching treatments. Key market players like Eli Lilly, Novartis, Merck & Co., AstraZeneca, and others are actively engaged in competitive strategies including research and development of new formulations, pricing strategies, and expansion into new markets to maintain their positions. Germany, France, Italy, and the United Kingdom represent the largest market segments within Europe, driven by higher prevalence rates and increased healthcare expenditure in these regions.

The segment encompassing various DPP-4 inhibitor drugs, including Januvia (Sitagliptin), Onglyza (Saxagliptin), Tradjenta (Linagliptin), Vipidia (Alogliptin), and Galvus (Vildagliptin), demonstrates significant market share. The "Others" category accounts for emerging and niche DPP-4 inhibitors, potentially offering new treatment options and contributing to future market growth. The competitive landscape necessitates continuous innovation and strategic market positioning by pharmaceutical companies to capture the market share. The forecast period indicates sustained growth, largely contingent upon managing the challenges posed by competing therapies and ensuring robust post-market surveillance of safety profiles. The European market is expected to show consistent growth, mirroring global trends in diabetes management, with potential for higher growth rates in regions witnessing increasing T2DM prevalence.

Europe DPP-4 Inhibitors Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe DPP-4 Inhibitors industry, offering invaluable insights for stakeholders seeking to understand market dynamics, competitive landscapes, and future growth potential. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. It leverages extensive market research and data analysis to deliver actionable intelligence across various segments and key players.

Europe DPP-4 Inhibitors Industry Market Structure & Competitive Dynamics

The European DPP-4 inhibitors market exhibits a moderately concentrated structure, dominated by several multinational pharmaceutical giants. Key players, including Eli Lilly, Novartis, Merck & Co, AstraZeneca, Takeda Pharmaceuticals, Bristol Myers Squibb, and Boehringer Ingelheim, command significant market share due to their established product portfolios and extensive distribution networks. While precise figures are commercially sensitive, the market displays characteristics of an oligopoly, with a high concentration ratio (estimated at approximately [Insert Estimated Percentage]% in 2025). The competitive landscape is highly dynamic, marked by continuous innovation, strategic alliances, and mergers and acquisitions (M&A) activity that significantly shape market trends.

Innovation within the ecosystem is largely fostered through collaborations between pharmaceutical companies and research institutions, focused on developing next-generation DPP-4 inhibitors with superior efficacy, enhanced safety profiles, and improved patient convenience. The regulatory framework, primarily overseen by the European Medicines Agency (EMA), plays a pivotal role in determining market access and product approvals, directly influencing the pace of innovation and market entry of new products. The market faces competitive pressure from substitute therapies such as SGLT2 inhibitors and GLP-1 receptor agonists, impacting the overall market share of DPP-4 inhibitors. Growth is further fueled by rising awareness of type 2 diabetes and increasing demand for convenient and effective treatment options amongst the end-user population. Although M&A activity has been relatively subdued in recent years, further consolidation is anticipated as companies seek to expand their product portfolios and enhance their market positioning. The total value of M&A deals within the European DPP-4 inhibitors market during the period 2019-2024 is estimated at [Insert Estimated Value in Millions] €.

- Key Market Dynamics: Market concentration, innovation, regulatory approvals, competitive pressures from substitute therapies, evolving end-user preferences, M&A activity.

- Key Players' Estimated Market Share (2025): [Insert Percentage Estimates for each company: Eli Lilly, Novartis, Merck & Co, AstraZeneca, Takeda Pharmaceuticals, Bristol Myers Squibb, Boehringer Ingelheim]. Note: Market share estimates are subject to ongoing market fluctuations.

- Estimated M&A Deal Value (2019-2024): [Insert Estimated Value in Millions] €

Europe DPP-4 Inhibitors Industry Industry Trends & Insights

The European DPP-4 inhibitors market is experiencing moderate growth, driven by several factors. The increasing prevalence of type 2 diabetes across Europe is a key growth driver, alongside rising healthcare expenditure and improved diagnostic capabilities. Technological advancements, such as the development of more effective and safer DPP-4 inhibitors with improved delivery systems, are further stimulating market growth. Consumer preferences are shifting towards more convenient and efficacious treatment options, favoring the adoption of once-daily formulations over multiple-daily regimens. However, the competitive landscape and the emergence of alternative therapies pose challenges to market expansion. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of DPP-4 inhibitors within the type 2 diabetes population remains relatively high in key European markets, but further expansion is anticipated due to increased awareness campaigns and improved access to healthcare. The impact of pricing pressures and cost-containment measures implemented by healthcare systems across Europe will also influence market dynamics and affect the overall growth trajectory in the forecast period.

Dominant Markets & Segments in Europe DPP-4 Inhibitors Industry

Within Europe, the dominant markets for DPP-4 inhibitors are concentrated in countries characterized by a high prevalence of type 2 diabetes and a well-developed healthcare infrastructure. Germany, France, the United Kingdom, Italy, and Spain represent key markets. This dominance is attributable to several interconnected factors:

- Supportive Economic Policies: Government initiatives promoting effective diabetes management and favorable reimbursement policies for DPP-4 inhibitors.

- Robust Healthcare Infrastructure: Well-established healthcare systems, including comprehensive primary and specialized care networks, ensuring better access to diagnosis and treatment.

- Aging Demographics: A high prevalence of type 2 diabetes within the aging population segments across these countries.

Detailed Dominance Analysis: Germany’s established healthcare infrastructure and high prevalence of type 2 diabetes solidify its position as the leading market. France and the UK also hold substantial market shares, driven by their advanced healthcare systems and significant diabetic populations. Southern European countries, such as Italy and Spain, exhibit comparatively smaller market shares, potentially due to variations in healthcare spending and access to newer medications. Further granular analysis by country, incorporating factors such as per capita GDP and healthcare expenditure, could provide additional insights.

- Key DPP-4 Inhibitor Drugs:

- Januvia (Sitagliptin): Maintains a significant market share due to its long-standing presence and established brand recognition.

- Onglyza (Saxagliptin): A major contributor to the overall market, recognized for its efficacy and favorable safety profile.

- Tradjenta (Linagliptin): Holds a moderate market share, competing effectively on factors such as once-daily dosing and a favorable side-effect profile.

- Vipidia (Alogliptin): Occupies a smaller but steadily growing market segment.

- Galvus (Vildagliptin): Contributes moderately to the overall market size.

- Other DPP-4 Inhibitors and Combination Therapies: This segment encompasses newer DPP-4 inhibitors and combination therapies with significant growth potential.

Europe DPP-4 Inhibitors Industry Product Innovations

Recent product innovations in the European DPP-4 inhibitor market focus on improving efficacy, safety, and patient convenience. This includes the development of fixed-dose combinations with other antidiabetic agents (e.g., metformin), once-daily formulations, and novel delivery systems to enhance patient adherence. Technological advancements in drug delivery mechanisms are improving bioavailability and reducing side effects. These innovations aim to meet evolving patient needs and enhance competitive advantages in a dynamic market.

Report Segmentation & Scope

This report segments the European DPP-4 inhibitors market based on drug type, including Januvia (Sitagliptin), Onglyza (Saxagliptin), Tradjenta (Linagliptin), Vipidia (Alogliptin), Galvus (Vildagliptin), and Others. Each segment's growth projections, market size (in Million), and competitive dynamics are analyzed extensively within the report. Growth in the "Others" category is expected to be driven by the introduction of new DPP-4 inhibitors and fixed-dose combination therapies. Each individual drug segment displays a varying growth trajectory based on its specific characteristics, brand recognition, and market competition. Competitive dynamics are further shaped by patent expiries and the entry of generic competitors.

Key Drivers of Europe DPP-4 Inhibitors Industry Growth

Several key factors drive growth in the European DPP-4 inhibitors market. The rising prevalence of type 2 diabetes, fueled by factors such as aging populations, lifestyle changes (obesity, sedentary lifestyles), and genetic predisposition, remains a significant driver. Technological advancements in drug development lead to improved efficacy and safety profiles, boosting market adoption. Supportive regulatory frameworks that facilitate market access and reimbursement policies also contribute positively to growth. Finally, increased awareness and education campaigns aimed at raising awareness about diabetes and its management play a key role.

Challenges in the Europe DPP-4 Inhibitors Industry Sector

The European DPP-4 inhibitors market faces several challenges. The emergence of competing therapies, such as SGLT2 inhibitors and GLP-1 receptor agonists, presents significant competitive pressure, potentially impacting market share. Regulatory hurdles, including stringent approval processes and evolving pricing policies, pose significant constraints. Supply chain disruptions and fluctuations in raw material costs also pose challenges to profitability and consistent drug availability. Finally, patent expiries for existing DPP-4 inhibitors introduce competition from generic drugs, placing downward pressure on prices.

Leading Players in the Europe DPP-4 Inhibitors Industry Market

- Eli Lilly

- Novartis

- Merck & Co

- AstraZeneca

- Takeda Pharmaceuticals

- Bristol Myers Squibb

- Boehringer Ingelheim

Key Developments in Europe DPP-4 Inhibitors Industry Sector

- July 2022: The European Commission granted marketing authorization for "Sitagliptin/Metformin hydrochloride Accord - sitagliptin/metformin hydrochloride," expanding treatment options and increasing market competition.

- March 2024: The marketing alliance agreement between Daiichi Sankyo and Mitsubishi Tanabe Pharma Corp. for Tenelia (DPP-4 inhibitor) and Canaglu (SGLT2 inhibitor), set to expire in September, presents a potential shift in market dynamics. The impact of this expiry requires further monitoring.

- [Add other relevant key developments with dates and brief descriptions]

Strategic Europe DPP-4 Inhibitors Industry Market Outlook

The future of the European DPP-4 inhibitors market presents both substantial opportunities and significant challenges. Sustained innovation, focused on improving efficacy, safety profiles, and overall patient convenience, is crucial for maintaining market competitiveness against rival therapies. Strategic partnerships and collaborations among pharmaceutical companies are essential for accelerating product development and ensuring streamlined market access. Companies that proactively address regulatory hurdles and effectively manage supply chain risks are best positioned for future growth. The market’s trajectory will be profoundly influenced by evolving healthcare policies, reimbursement models, and the dynamic prevalence of type 2 diabetes across Europe. The long-term outlook suggests a steady growth trajectory, driven by ongoing innovation and the persistent, unmet need for effective type 2 diabetes management. However, this growth is contingent upon successful navigation of the competitive landscape and addressing the challenges posed by substitute therapies.

Europe DPP-4 Inhibitors Industry Segmentation

-

1. Drugs

- 1.1. Januvia (Sitagliptin)

- 1.2. Onglyza (Saxagliptin)

- 1.3. Tradjenta (Linagliptin)

- 1.4. Vipidia (Alogliptin)

- 1.5. Galvus (Vildagliptin)

- 1.6. Others

Europe DPP-4 Inhibitors Industry Segmentation By Geography

- 1. France

- 2. Germany

- 3. Italy

- 4. Spain

- 5. United Kingdom

- 6. Russia

- 7. Rest of Europe

Europe DPP-4 Inhibitors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Respiratory Disease; Growing Demand for OTC Medications

- 3.3. Market Restrains

- 3.3.1. Governments and Regulatory Bodies Impose Strict Guidelines

- 3.4. Market Trends

- 3.4.1. Increasing diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 5.1.1. Januvia (Sitagliptin)

- 5.1.2. Onglyza (Saxagliptin)

- 5.1.3. Tradjenta (Linagliptin)

- 5.1.4. Vipidia (Alogliptin)

- 5.1.5. Galvus (Vildagliptin)

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.2.2. Germany

- 5.2.3. Italy

- 5.2.4. Spain

- 5.2.5. United Kingdom

- 5.2.6. Russia

- 5.2.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 6. France Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 6.1.1. Januvia (Sitagliptin)

- 6.1.2. Onglyza (Saxagliptin)

- 6.1.3. Tradjenta (Linagliptin)

- 6.1.4. Vipidia (Alogliptin)

- 6.1.5. Galvus (Vildagliptin)

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 7. Germany Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 7.1.1. Januvia (Sitagliptin)

- 7.1.2. Onglyza (Saxagliptin)

- 7.1.3. Tradjenta (Linagliptin)

- 7.1.4. Vipidia (Alogliptin)

- 7.1.5. Galvus (Vildagliptin)

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 8. Italy Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 8.1.1. Januvia (Sitagliptin)

- 8.1.2. Onglyza (Saxagliptin)

- 8.1.3. Tradjenta (Linagliptin)

- 8.1.4. Vipidia (Alogliptin)

- 8.1.5. Galvus (Vildagliptin)

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 9. Spain Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Drugs

- 9.1.1. Januvia (Sitagliptin)

- 9.1.2. Onglyza (Saxagliptin)

- 9.1.3. Tradjenta (Linagliptin)

- 9.1.4. Vipidia (Alogliptin)

- 9.1.5. Galvus (Vildagliptin)

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Drugs

- 10. United Kingdom Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Drugs

- 10.1.1. Januvia (Sitagliptin)

- 10.1.2. Onglyza (Saxagliptin)

- 10.1.3. Tradjenta (Linagliptin)

- 10.1.4. Vipidia (Alogliptin)

- 10.1.5. Galvus (Vildagliptin)

- 10.1.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Drugs

- 11. Russia Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Drugs

- 11.1.1. Januvia (Sitagliptin)

- 11.1.2. Onglyza (Saxagliptin)

- 11.1.3. Tradjenta (Linagliptin)

- 11.1.4. Vipidia (Alogliptin)

- 11.1.5. Galvus (Vildagliptin)

- 11.1.6. Others

- 11.1. Market Analysis, Insights and Forecast - by Drugs

- 12. Rest of Europe Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Drugs

- 12.1.1. Januvia (Sitagliptin)

- 12.1.2. Onglyza (Saxagliptin)

- 12.1.3. Tradjenta (Linagliptin)

- 12.1.4. Vipidia (Alogliptin)

- 12.1.5. Galvus (Vildagliptin)

- 12.1.6. Others

- 12.1. Market Analysis, Insights and Forecast - by Drugs

- 13. Germany Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 14. France Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe DPP-4 Inhibitors Industry Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Eli Lilly

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Novartis

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Merck and Co

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 AstraZeneca

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Takeda Pharmaceuticals

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Bristol Myers Squibb

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Boehringer Ingelheim

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.1 Eli Lilly

List of Figures

- Figure 1: Europe DPP-4 Inhibitors Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe DPP-4 Inhibitors Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Drugs 2019 & 2032

- Table 4: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 5: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Germany Europe DPP-4 Inhibitors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Europe DPP-4 Inhibitors Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: France Europe DPP-4 Inhibitors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Europe DPP-4 Inhibitors Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Italy Europe DPP-4 Inhibitors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Europe DPP-4 Inhibitors Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Europe DPP-4 Inhibitors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Europe DPP-4 Inhibitors Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Netherlands Europe DPP-4 Inhibitors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherlands Europe DPP-4 Inhibitors Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Sweden Europe DPP-4 Inhibitors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Sweden Europe DPP-4 Inhibitors Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe DPP-4 Inhibitors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Europe DPP-4 Inhibitors Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Drugs 2019 & 2032

- Table 24: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 25: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Drugs 2019 & 2032

- Table 28: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 29: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Drugs 2019 & 2032

- Table 32: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 33: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Drugs 2019 & 2032

- Table 36: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 37: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Drugs 2019 & 2032

- Table 40: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 41: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Drugs 2019 & 2032

- Table 44: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 45: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Drugs 2019 & 2032

- Table 48: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 49: Europe DPP-4 Inhibitors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Europe DPP-4 Inhibitors Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe DPP-4 Inhibitors Industry?

The projected CAGR is approximately 2.73%.

2. Which companies are prominent players in the Europe DPP-4 Inhibitors Industry?

Key companies in the market include Eli Lilly, Novartis, Merck and Co, AstraZeneca, Takeda Pharmaceuticals, Bristol Myers Squibb, Boehringer Ingelheim.

3. What are the main segments of the Europe DPP-4 Inhibitors Industry?

The market segments include Drugs.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Respiratory Disease; Growing Demand for OTC Medications.

6. What are the notable trends driving market growth?

Increasing diabetes prevalence.

7. Are there any restraints impacting market growth?

Governments and Regulatory Bodies Impose Strict Guidelines.

8. Can you provide examples of recent developments in the market?

March 2024: Daiichi Sankyo made marketing alliance agreement with Mitsubishi Tanabe Pharma Corp for its DPP-4 inhibitor tablets, under the brand name Tenelia, will expire in September. The marketing deal for its SGLT2 inhibitor or Canaglu tablets will also expire that month.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe DPP-4 Inhibitors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe DPP-4 Inhibitors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe DPP-4 Inhibitors Industry?

To stay informed about further developments, trends, and reports in the Europe DPP-4 Inhibitors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence