Key Insights

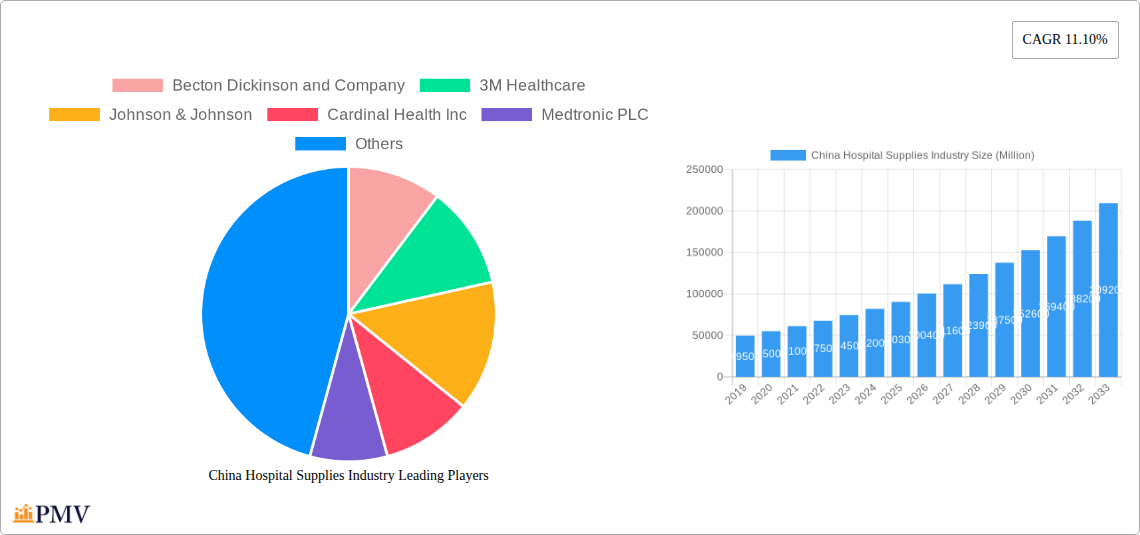

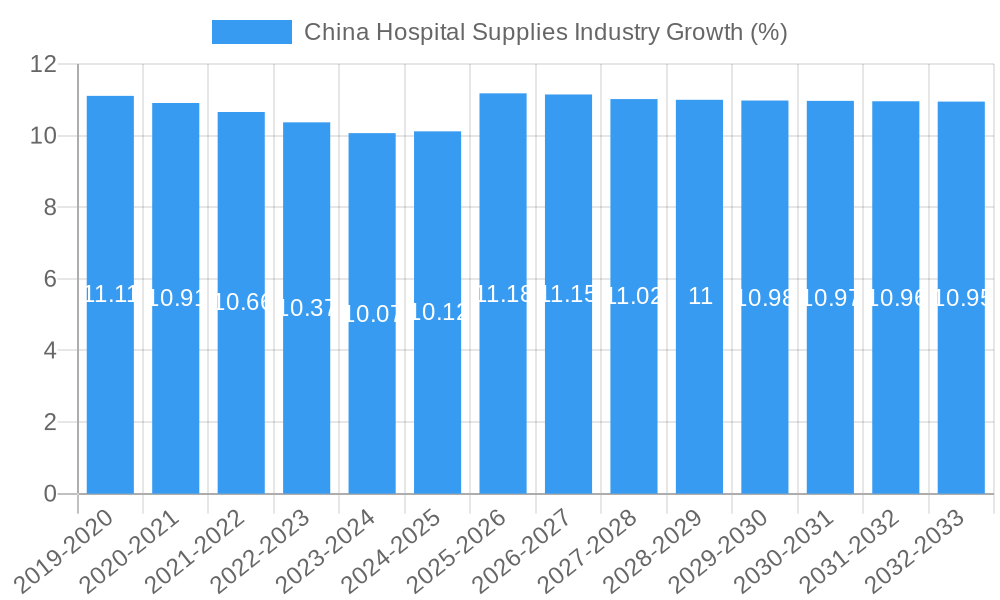

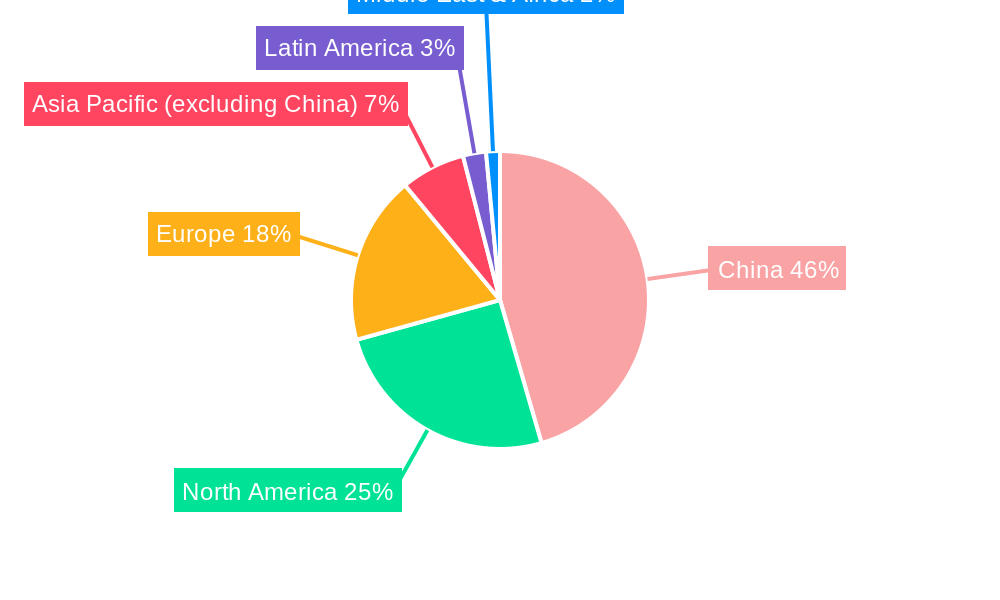

The China hospital supplies industry is poised for significant growth, projected to reach a substantial market size of approximately $97,100 million by 2025. This impressive expansion is fueled by a robust Compound Annual Growth Rate (CAGR) of 11.10% between 2019 and 2033, indicating sustained and dynamic market development. Key drivers propelling this surge include the nation's rapidly aging population, which consequently increases the demand for healthcare services and associated supplies. Furthermore, the government's continuous investment in healthcare infrastructure, coupled with rising disposable incomes leading to greater healthcare expenditure, are pivotal factors. The ongoing advancements in medical technology and a growing emphasis on preventative healthcare are also contributing to the escalating consumption of a diverse range of hospital supplies, from sophisticated operating room equipment to essential disposable medical items.

The market is segmented across various critical categories, with Patient Examination Devices, Operating Room Equipment, and Disposable Hospital Supplies expected to lead in demand. The Sterilization and Disinfectant Equipment segment will also see considerable traction, driven by stringent infection control protocols. While the market exhibits strong growth, potential restraints such as increasing price pressures from government procurement policies and the high cost of advanced medical technologies could pose challenges. Nevertheless, leading global and domestic players like Becton Dickinson and Company, 3M Healthcare, Johnson & Johnson, Cardinal Health Inc., Medtronic PLC, B Braun Melsungen AG, Boston Scientific Corporation, and Baxter International Inc. are actively participating, leveraging innovation and strategic partnerships to capture market share. The forecast period from 2025-2033 indicates a sustained upward trajectory, underscoring China's growing importance as a global hub for hospital supplies consumption and manufacturing.

This comprehensive report provides an in-depth analysis of the China Hospital Supplies Industry, offering critical insights for stakeholders navigating this dynamic and rapidly expanding market. Covering the study period of 2019–2033, with a base and estimated year of 2025, this report delves into market structure, competitive dynamics, key trends, dominant segments, product innovations, and strategic outlooks. The global hospital supplies market is witnessing significant growth, and China stands at the forefront of this expansion, driven by robust healthcare infrastructure development, increasing healthcare expenditure, and a growing demand for advanced medical devices and consumables. This China medical devices market report is essential for understanding the future trajectory of healthcare supplies in China.

China Hospital Supplies Industry Market Structure & Competitive Dynamics

The China Hospital Supplies Industry exhibits a moderately concentrated market structure, characterized by the presence of both multinational giants and burgeoning domestic players. Innovation ecosystems are flourishing, fueled by government initiatives promoting R&D and increased investment in advanced manufacturing capabilities. The regulatory framework, while evolving, is increasingly aligned with international standards, creating both opportunities and challenges for market participants. Product substitutes are readily available across various segments, necessitating a strong focus on quality, cost-effectiveness, and differentiation. End-user trends are shifting towards demand for minimally invasive devices, smart medical technologies, and sustainable disposable supplies. Mergers and acquisitions (M&A) activities are on the rise as companies seek to consolidate market share, acquire new technologies, and expand their product portfolios. For instance, M&A deal values are projected to reach xx Million within the forecast period, indicating significant consolidation. Key players are actively investing in strategic alliances and partnerships to enhance their competitive edge. The market share of leading companies is meticulously analyzed, providing a clear picture of the competitive landscape.

- Market Concentration: Moderately concentrated, with increasing consolidation expected.

- Innovation Ecosystems: Robust, driven by R&D investment and government support for high-tech manufacturing.

- Regulatory Frameworks: Evolving towards international standards, impacting product approvals and market access.

- Product Substitutes: Abundant, requiring strong competitive strategies based on quality and cost.

- End-User Trends: Growing demand for smart medical devices, minimally invasive solutions, and sustainable products.

- M&A Activities: Significant and growing, driven by strategic objectives like market expansion and technology acquisition.

China Hospital Supplies Industry Industry Trends & Insights

The China Hospital Supplies Industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This remarkable growth is propelled by several interconnected trends. Firstly, the increasing prevalence of chronic diseases and an aging population are creating sustained demand for a wide array of hospital supplies. Government investments in expanding healthcare access and upgrading medical infrastructure, particularly in Tier 2 and Tier 3 cities, are significantly boosting market penetration for medical devices and consumables. Technological disruptions are transforming the industry, with a rising adoption of Artificial Intelligence (AI) in diagnostic tools, robotic surgery systems, and smart connected devices that enable remote patient monitoring and data analytics. Consumer preferences are evolving towards higher quality, safer, and more personalized healthcare solutions. The competitive dynamics are intensifying, with both domestic and international players vying for market share. The focus is increasingly shifting from basic supplies to advanced medical equipment and specialized consumables. The expanding middle class in China is also contributing to higher disposable incomes, leading to increased out-of-pocket spending on healthcare, which further fuels the demand for premium hospital supplies. The digitalization of healthcare services and the growing emphasis on preventative care are also key drivers shaping the industry's trajectory. The penetration of advanced technologies like telemedicine and e-health platforms is creating new avenues for the distribution and application of hospital supplies. Furthermore, the government's "Healthy China 2030" initiative is a significant policy driver, emphasizing the need for a robust and modern healthcare system, which directly translates to increased demand for quality hospital supplies. The COVID-19 pandemic also highlighted the critical importance of a resilient supply chain for essential medical consumables, leading to increased domestic production and strategic stockpiling, further bolstering the industry. The focus on value-based healthcare is also influencing purchasing decisions, with hospitals seeking solutions that offer improved patient outcomes and cost efficiencies.

Dominant Markets & Segments in China Hospital Supplies Industry

The China Hospital Supplies Industry is characterized by dominant regions and segments, each contributing significantly to the overall market expansion. Eastern China, including provinces like Guangdong, Jiangsu, and Zhejiang, stands out as the leading region due to its advanced economic development, high concentration of top-tier hospitals, and robust healthcare infrastructure. This region benefits from favorable economic policies, substantial foreign direct investment, and a well-established logistics network, facilitating the widespread adoption of advanced hospital supplies.

Among the product segments, Disposable Hospital Supplies and Syringes and Needles are currently the largest and fastest-growing segments.

- Disposable Hospital Supplies: This segment's dominance is driven by the sheer volume of consumption in hospitals, coupled with an increasing emphasis on infection control and patient safety. The rising number of surgical procedures, outpatient visits, and the growing prevalence of hospital-acquired infections necessitate a continuous supply of disposable items like gloves, gowns, masks, and dressings. Market growth is further fueled by technological advancements leading to more specialized and comfortable disposable products. The projected market size for this segment is estimated to reach xx Million by 2033.

- Syringes and Needles: This segment's strong performance is attributed to the ongoing demand for drug delivery, vaccinations, and diagnostic procedures. The increasing adoption of pre-filled syringes, safety syringes, and specialized needles for various medical applications contributes to its sustained growth. The rising vaccination rates and the expanding pharmaceutical industry are key drivers. The market size for this segment is expected to grow to xx Million by 2033.

Other significant segments include:

- Patient Examination Devices: Driven by the growing demand for diagnostics and regular health check-ups, this segment includes stethoscopes, thermometers, blood pressure monitors, and diagnostic imaging equipment.

- Operating Room Equipment: This segment encompasses surgical instruments, anesthesia machines, patient monitoring systems, and lighting systems, all experiencing steady growth due to the expansion of surgical capacities and the adoption of advanced surgical technologies.

- Mobility Aids and Transportation Equipment: With an aging population and increased focus on rehabilitation, this segment, including wheelchairs, walkers, and hospital beds, is witnessing consistent demand.

- Sterilization and Disinfectant Equipment: Essential for maintaining hospital hygiene and preventing infections, this segment is crucial and shows steady growth, particularly with enhanced infection control protocols.

- Other Products: This broad category includes a diverse range of items like wound care products, respiratory devices, and urological supplies, each contributing to the overall market diversification.

China Hospital Supplies Industry Product Innovations

Product innovation in the China Hospital Supplies Industry is rapidly advancing, focusing on enhancing patient outcomes, improving operational efficiency, and reducing healthcare costs. Key developments include the integration of smart technologies, such as connected devices for real-time data monitoring and AI-powered diagnostic tools. For instance, advancements in disposable hospital supplies are leading to more ergonomic designs and improved material science for enhanced comfort and safety. Operating room equipment is seeing the introduction of robotic-assisted surgical systems and advanced imaging technologies that enable minimally invasive procedures with faster recovery times. In the realm of patient examination devices, the trend is towards portable, high-accuracy, and user-friendly digital devices. The competitive advantage lies in offering innovative solutions that address unmet clinical needs and align with the evolving demands of healthcare providers and patients.

Report Segmentation & Scope

This report segments the China Hospital Supplies Industry based on key product categories to provide granular insights into market dynamics. The segmentation includes:

- Patient Examination Devices: This segment encompasses diagnostic tools and monitoring equipment essential for patient assessment. Growth projections indicate a market size of xx Million by 2033, driven by the increasing demand for early disease detection and chronic disease management.

- Operating Room Equipment: This segment covers a wide range of instruments and machinery used in surgical settings. The market is expected to reach xx Million by 2033, fueled by technological advancements in minimally invasive surgery and hospital infrastructure upgrades.

- Mobility Aids and Transportation Equipment: This segment includes devices that assist patients with movement and hospital transport. With an aging population, this segment is projected to reach xx Million by 2033.

- Sterilization and Disinfectant Equipment: Critical for infection control, this segment is forecast to grow to xx Million by 2033, driven by stringent hygiene standards.

- Disposable Hospital Supplies: This high-volume segment is projected to reach xx Million by 2033, owing to continuous consumption and advancements in material science.

- Syringes and Needles: Essential for drug administration and diagnostics, this segment is expected to reach xx Million by 2033, with growth bolstered by vaccination programs and pharmaceutical advancements.

- Other Products: This segment includes a diverse range of medical consumables and devices, projected to reach xx Million by 2033, reflecting the broad spectrum of healthcare needs.

Key Drivers of China Hospital Supplies Industry Growth

The growth of the China Hospital Supplies Industry is propelled by a confluence of powerful drivers. Technological advancements are at the forefront, with the adoption of AI, IoT, and advanced manufacturing techniques leading to innovative and efficient medical devices. Economic growth and increasing disposable incomes in China translate to higher healthcare expenditure and a greater demand for quality medical supplies. Government initiatives, such as the "Healthy China 2030" plan, are actively promoting the modernization of the healthcare system, leading to significant investments in infrastructure and medical equipment. Furthermore, the expanding healthcare infrastructure, particularly the development of new hospitals and clinics, directly fuels the demand for a comprehensive range of hospital supplies. The aging population and the rising prevalence of chronic diseases create a sustained need for medical devices and consumables for long-term care and management.

Challenges in the China Hospital Supplies Industry Sector

Despite robust growth prospects, the China Hospital Supplies Industry faces several challenges. Regulatory hurdles can be complex and time-consuming, impacting the speed of product approvals and market entry for new innovations. Intense competitive pressures, both from domestic and international players, lead to price erosion and necessitate continuous investment in R&D and market differentiation. Supply chain disruptions, as highlighted by global events, pose a risk to the availability of raw materials and finished goods, requiring strategic inventory management and diversification of suppliers. Intellectual property protection remains a concern, necessitating robust strategies for safeguarding innovations. The cost of advanced technologies can also be a barrier to adoption for smaller healthcare facilities.

Leading Players in the China Hospital Supplies Industry Market

- Becton Dickinson and Company

- 3M Healthcare

- Johnson & Johnson

- Cardinal Health Inc

- Medtronic PLC

- B Braun Melsungen AG

- Boston Scientific Corporation

- Baxter International Inc

Key Developments in China Hospital Supplies Industry Sector

- 2023: Increased government investment in domestic medical device manufacturing to reduce reliance on imports.

- 2022: Launch of advanced AI-powered diagnostic imaging solutions by leading players.

- 2021: Significant growth in the adoption of telehealth platforms, driving demand for remote patient monitoring devices.

- 2020: Heightened focus on manufacturing and supply of personal protective equipment (PPE) and infection control products due to the pandemic.

- 2019: Expansion of regulatory pathways for innovative medical technologies to accelerate market access.

Strategic China Hospital Supplies Industry Market Outlook

- 2023: Increased government investment in domestic medical device manufacturing to reduce reliance on imports.

- 2022: Launch of advanced AI-powered diagnostic imaging solutions by leading players.

- 2021: Significant growth in the adoption of telehealth platforms, driving demand for remote patient monitoring devices.

- 2020: Heightened focus on manufacturing and supply of personal protective equipment (PPE) and infection control products due to the pandemic.

- 2019: Expansion of regulatory pathways for innovative medical technologies to accelerate market access.

Strategic China Hospital Supplies Industry Market Outlook

The strategic outlook for the China Hospital Supplies Industry is exceptionally positive, driven by sustained demand, technological innovation, and supportive government policies. Growth accelerators include the continued expansion of healthcare infrastructure, the increasing adoption of digital health solutions, and a growing consumer preference for advanced and personalized medical care. Companies that focus on developing innovative, cost-effective, and high-quality medical devices and consumables, while navigating the evolving regulatory landscape and strengthening their supply chains, are well-positioned for success. Strategic partnerships and a commitment to R&D will be crucial for maintaining a competitive edge in this rapidly evolving market. The market is expected to witness further consolidation and specialization, creating significant opportunities for both established players and agile newcomers.

China Hospital Supplies Industry Segmentation

-

1. Product

- 1.1. Patient Examination Devices

- 1.2. Operating Room Equipment

- 1.3. Mobility Aids and Transportation Equipment

- 1.4. Sterilization and Disinfectant Equipment

- 1.5. Disposable Hospital Supplies

- 1.6. Syringes and Needles

- 1.7. Other Products

China Hospital Supplies Industry Segmentation By Geography

- 1. China

China Hospital Supplies Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The aging population in China is leading to a higher prevalence of chronic diseases

- 3.2.2 such as diabetes

- 3.2.3 hypertension

- 3.2.4 and cardiovascular diseases. This demographic shift drives demand for hospital supplies and medical services.

- 3.3. Market Restrains

- 3.3.1. The hospital supplies market in China is subject to strict regulatory requirements from the National Medical Products Administration (NMPA). Compliance with these regulations can complicate the approval process for new products and slow down market entry.

- 3.4. Market Trends

- 3.4.1 There is a growing trend toward the use of disposable medical supplies in hospitals due to infection control concerns and convenience. The demand for single-use products is expected to rise

- 3.4.2 particularly in surgical and emergency care settings.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Patient Examination Devices

- 5.1.2. Operating Room Equipment

- 5.1.3. Mobility Aids and Transportation Equipment

- 5.1.4. Sterilization and Disinfectant Equipment

- 5.1.5. Disposable Hospital Supplies

- 5.1.6. Syringes and Needles

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3M Healthcare

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson & Johnson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cardinal Health Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 B Braun Melsungen AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boston Scientific Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Baxter International Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: China Hospital Supplies Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Hospital Supplies Industry Share (%) by Company 2024

List of Tables

- Table 1: China Hospital Supplies Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Hospital Supplies Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: China Hospital Supplies Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: China Hospital Supplies Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 5: China Hospital Supplies Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China Hospital Supplies Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 7: China Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Hospital Supplies Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 9: China Hospital Supplies Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 10: China Hospital Supplies Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 11: China Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: China Hospital Supplies Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Hospital Supplies Industry?

The projected CAGR is approximately 11.10%.

2. Which companies are prominent players in the China Hospital Supplies Industry?

Key companies in the market include Becton Dickinson and Company, 3M Healthcare, Johnson & Johnson, Cardinal Health Inc, Medtronic PLC, B Braun Melsungen AG, Boston Scientific Corporation, Baxter International Inc.

3. What are the main segments of the China Hospital Supplies Industry?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The aging population in China is leading to a higher prevalence of chronic diseases. such as diabetes. hypertension. and cardiovascular diseases. This demographic shift drives demand for hospital supplies and medical services..

6. What are the notable trends driving market growth?

There is a growing trend toward the use of disposable medical supplies in hospitals due to infection control concerns and convenience. The demand for single-use products is expected to rise. particularly in surgical and emergency care settings..

7. Are there any restraints impacting market growth?

The hospital supplies market in China is subject to strict regulatory requirements from the National Medical Products Administration (NMPA). Compliance with these regulations can complicate the approval process for new products and slow down market entry..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Hospital Supplies Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Hospital Supplies Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Hospital Supplies Industry?

To stay informed about further developments, trends, and reports in the China Hospital Supplies Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence