Key Insights

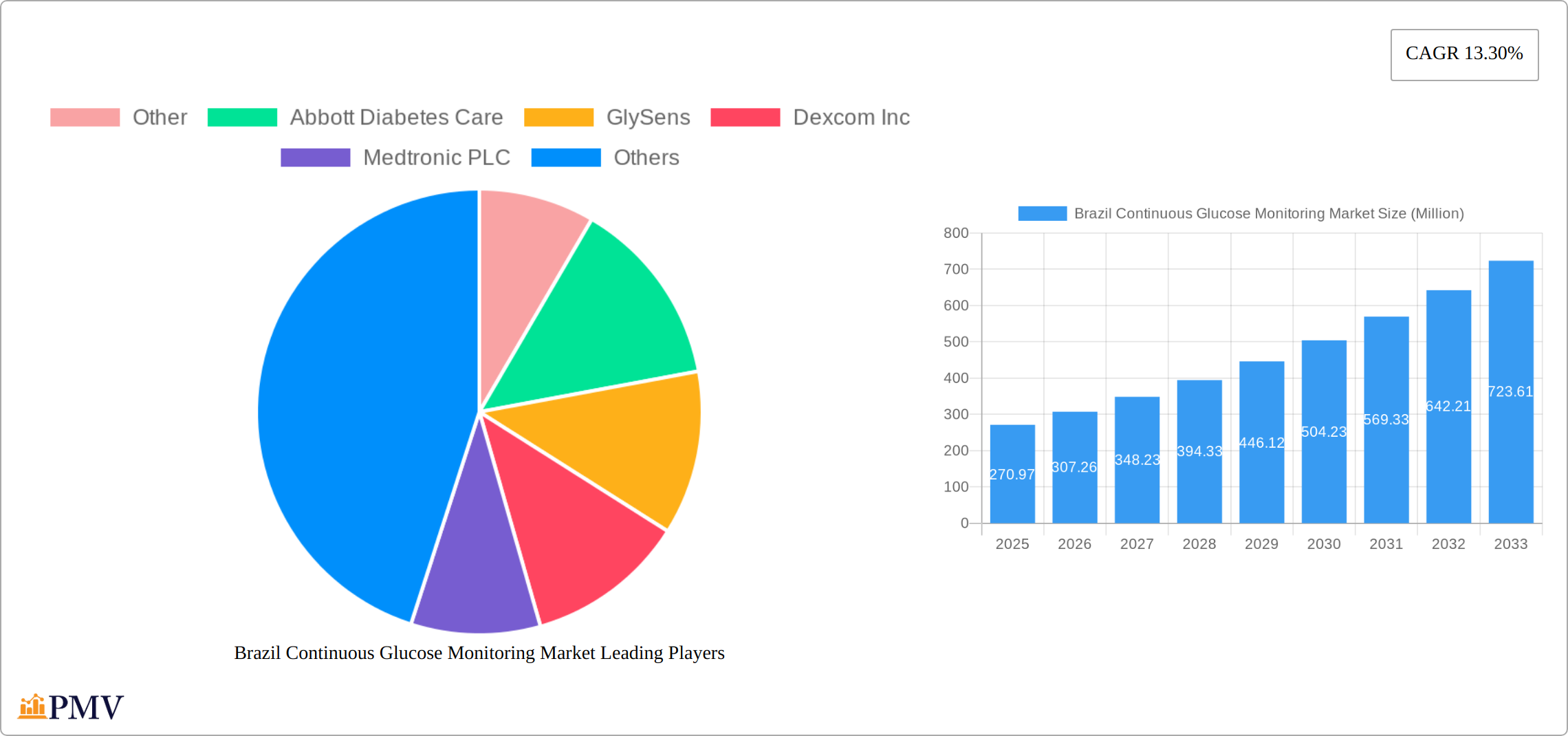

The Brazilian Continuous Glucose Monitoring (CGM) market is experiencing robust growth, projected to reach $270.97 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 13.30% from 2025 to 2033. This expansion is driven by several key factors. Rising prevalence of diabetes, particularly in Brazil's aging population, fuels demand for advanced glucose management technologies. Increased awareness of the benefits of CGM, including improved glycemic control and reduced hypoglycemic events, is also a significant driver. Furthermore, government initiatives to improve healthcare access and affordability, coupled with the increasing adoption of telehealth and remote patient monitoring, are contributing to market growth. Technological advancements leading to smaller, more user-friendly devices and improved accuracy are further enhancing market appeal. Competition among established players like Abbott Diabetes Care, Dexcom Inc., and Medtronic PLC, alongside emerging players like GlySens and Ascensia Diabetes Care, is fostering innovation and driving down costs, making CGM more accessible to a wider patient population. The market is segmented by component (sensors and durables), reflecting the distinct needs and cost structures within the CGM ecosystem.

Despite the positive outlook, challenges remain. High initial costs associated with CGM systems can present a barrier to entry for some patients, particularly those without comprehensive insurance coverage. Regulatory hurdles and reimbursement policies also influence market penetration. However, ongoing technological innovation, coupled with favorable government policies and the increasing emphasis on preventative healthcare, suggests that these challenges are likely to be mitigated over the forecast period. The focus on developing more affordable and accessible CGM solutions, alongside improved integration with existing diabetes management systems, will further propel market growth in Brazil throughout 2025-2033. The strong CAGR suggests significant growth potential, especially with continuous advancements in CGM technology and rising diabetes prevalence.

Brazil Continuous Glucose Monitoring (CGM) Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil Continuous Glucose Monitoring (CGM) market, covering the period from 2019 to 2033. It offers invaluable insights for stakeholders, including manufacturers, investors, and healthcare providers, seeking to understand the market dynamics, growth opportunities, and challenges within this rapidly evolving sector. The report leverages extensive market research and data analysis to deliver actionable intelligence for strategic decision-making. The base year for this report is 2025, with the estimated year also being 2025, and the forecast period spanning from 2025 to 2033. The historical period covered is 2019-2024.

Brazil Continuous Glucose Monitoring Market Market Structure & Competitive Dynamics

The Brazilian CGM market is characterized by a moderately concentrated structure, with key players like Abbott Diabetes Care, Dexcom Inc, Medtronic PLC, and Ascensia Diabetes Care holding significant market share. However, the presence of several smaller players ("Other") indicates a competitive landscape with potential for disruption. The market exhibits a robust innovation ecosystem, driven by advancements in sensor technology, data analytics, and mobile integration. Regulatory frameworks, while evolving, are generally supportive of CGM adoption, fostering market expansion. Product substitutes, primarily intermittent blood glucose monitoring, are gradually losing market share due to the convenience and continuous data provided by CGMs. End-user trends show a growing preference for user-friendly, accurate, and integrated CGM systems. Mergers and acquisitions (M&A) activity within the Brazilian CGM market has been relatively moderate in recent years, with deal values estimated at approximately XX Million over the historical period. Key M&A activities have focused on enhancing product portfolios and expanding market reach.

- Market Concentration: Moderately concentrated, with the top four players holding approximately xx% market share in 2024.

- Innovation Ecosystem: Strong focus on miniaturization, improved accuracy, and seamless integration with mobile apps and cloud platforms.

- Regulatory Framework: Supportive, with ongoing efforts to streamline approval processes and expand reimbursement coverage.

- Product Substitutes: Intermittent blood glucose monitoring systems; however, CGM is gaining significant market share due to its superior capabilities.

- End-User Trends: Preference for smaller, more comfortable devices with improved data analysis and integration with other health management tools.

- M&A Activity: Moderate activity, with an estimated XX Million in deal value from 2019 to 2024.

Brazil Continuous Glucose Monitoring Market Industry Trends & Insights

The Brazilian Continuous Glucose Monitoring (CGM) market is experiencing dynamic growth, propelled by a significant increase in diabetes prevalence and heightened awareness among patients and healthcare providers regarding effective diabetes management strategies. Technological innovations are playing a pivotal role, with the introduction of smaller, more precise, and user-friendly CGM devices that enhance patient experience and data reliability. There's a discernible shift in consumer preference towards CGM systems for their ability to offer continuous insights, leading to better disease control and improved overall health outcomes. The competitive landscape is characterized by a robust pace of innovation, with market players consistently introducing advanced features and enhanced functionalities to meet evolving patient needs. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately **15-20%** during the forecast period (2025-2033), with market penetration expected to rise from around **10-15%** in 2024 to an estimated **30-35%** by 2033.

Dominant Markets & Segments in Brazil Continuous Glucose Monitoring Market

While precise granular data on specific regional dominance within Brazil is still developing, current analysis indicates a strong concentration of CGM adoption in major urban centers. These regions typically boast more developed healthcare infrastructure, higher levels of disposable income, and greater access to specialized medical care, facilitating the adoption of advanced diabetes management technologies. Within the market's segmentation, the Sensors segment consistently emerges as the dominant force, accounting for an estimated **60-65%** of the total market value in 2024. This dominance is primarily attributed to the consumable nature of CGM sensors, which require regular replacement as part of routine patient use. The Durables segment, encompassing the main CGM device itself, also holds a substantial market share, though it trails slightly behind the Sensors segment.

- Key Drivers for Sensors Segment Dominance:

- High and sustained demand for accurate, reliable, and long-lasting glucose sensing technology.

- The mandatory and recurring need for sensor replacement drives consistent demand and market value.

- Continuous advancements in sensor technology lead to improved accuracy, enhanced comfort, and potentially shorter replacement cycles in future iterations.

- Key Drivers for Durables Segment:

- Sustained demand for the core CGM device, which is essential for data acquisition, processing, and transmission to connected devices or cloud platforms.

- Technological enhancements that improve device accuracy, sophisticated data analysis capabilities, seamless connectivity, and user-friendly interface design.

The current dominance analysis strongly suggests that the Sensors segment will maintain its leading position due to its inherent consumable nature and the ongoing innovation in sensor technology. The Durables segment, while commanding a significant market share, is expected to experience steady growth, primarily fueled by the adoption of new device generations, technological upgrades, and enhanced feature sets.

Brazil Continuous Glucose Monitoring Market Product Innovations

Recent innovations in the Brazilian CGM market include the development of smaller, more comfortable sensors, improved data analytics capabilities, and enhanced integration with mobile apps and cloud platforms. These advancements are enhancing user experience, improving accuracy, and providing valuable insights for better diabetes management. The focus is on developing more user-friendly devices with features like customizable alerts and improved data visualization, appealing to diverse end-user needs and preferences. Companies are competing on the basis of accuracy, ease of use, data insights, and seamless integration with other health management tools.

Report Segmentation & Scope

This report segments the Brazil CGM market by Component: Sensors and Durables.

Sensors: This segment encompasses the glucose-sensing elements of the CGM system. Growth projections indicate a CAGR of xx% during the forecast period, driven by the need for regular sensor replacements and improvements in sensor technology. Competitive dynamics are intense, with companies vying for market share based on sensor accuracy, longevity, and user comfort.

Durables: This segment includes the CGM device itself (the receiver or transmitter). This segment is projected to have a CAGR of xx% during the forecast period. Competition is focused on features like ease of use, battery life, data display, and integration capabilities.

Key Drivers of Brazil Continuous Glucose Monitoring Market Growth

Several factors are driving growth in the Brazil CGM market. The increasing prevalence of diabetes is a significant factor, creating a large and expanding target market. Government initiatives promoting diabetes management and improved healthcare access also contribute to market expansion. Technological advancements, leading to more accurate, user-friendly, and affordable CGMs, are crucial drivers. Furthermore, rising awareness among patients about the benefits of continuous glucose monitoring is fueling demand.

Challenges in the Brazil Continuous Glucose Monitoring Market Sector

The Brazilian CGM market faces several significant challenges that could impact its growth trajectory and widespread adoption. A primary hurdle is the high cost of CGM devices and associated sensors, which can be a substantial financial burden for a considerable segment of the Brazilian population, limiting affordability. Furthermore, inadequate healthcare infrastructure and limited access to specialized diabetes care in remote or less developed regions hinder the accessibility and uptake of CGM technology. Navigating complex regulatory frameworks and evolving reimbursement policies for these advanced medical devices can also present significant challenges for market players. Additionally, potential supply chain disruptions, geopolitical factors, and the emergence of disruptive or alternative innovative technologies could pose risks to market stability and growth. These collective factors may influence the pace of market penetration and the overall growth rate, potentially moderating the initially projected CAGR.

Leading Players in the Brazil Continuous Glucose Monitoring Market Market

- Other

- Abbott Diabetes Care

- GlySens

- Dexcom Inc

- Medtronic PLC

- Ascensia Diabetes Care

Key Developments in Brazil Continuous Glucose Monitoring Market Sector

October 2023: Molex company Phillips-Medisize and Finland-based medtech company GlucoModicum partnered on an advanced non-invasive, needle-free continuous glucose monitor (CGM). This development could significantly disrupt the market if successful, potentially leading to increased adoption and competition.

February 2023: Dexcom announced the launch of Dexcom G7 continuous glucose monitoring in South Africa. While not directly in Brazil, this highlights Dexcom's expansion strategy and indicates potential future launches in other Latin American markets, including Brazil. The enhanced features of the G7, including the share and follow features, could influence future product development within the Brazilian market.

Strategic Brazil Continuous Glucose Monitoring Market Market Outlook

The outlook for the Brazilian CGM market is decidedly positive, characterized by substantial growth potential. This optimistic forecast is underpinned by the persistently rising prevalence of diabetes, continuous advancements in CGM technology, and the gradual expansion and improvement of the nation's healthcare infrastructure. Strategic imperatives for companies aiming to capture a larger market share should focus on developing cost-effective solutions, enhancing accessibility across diverse socioeconomic groups, and prioritizing user-friendly device designs that cater to a broad range of patient technical proficiencies. Future market dynamics are likely to be significantly shaped by ongoing research and development in non-invasive glucose monitoring technologies and the refinement of sophisticated data analytics platforms that offer deeper insights for personalized diabetes management. These innovations are poised to drive further market expansion, foster increased competition, and promote a more integrated and effective approach to diabetes care within Brazil.

Brazil Continuous Glucose Monitoring Market Segmentation

-

1. Component

- 1.1. Sensors

- 1.2. Durables

Brazil Continuous Glucose Monitoring Market Segmentation By Geography

- 1. Brazil

Brazil Continuous Glucose Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market

- 3.3. Market Restrains

- 3.3.1. Monopolized Supply Chain and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Brazil is anticipated to boost the market studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Sensors

- 5.1.2. Durables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Other

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abbott Diabetes Care

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GlySens

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dexcom Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ascensia Diabetes Care

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Other

List of Figures

- Figure 1: Brazil Continuous Glucose Monitoring Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Continuous Glucose Monitoring Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Brazil Continuous Glucose Monitoring Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Brazil Continuous Glucose Monitoring Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 5: Brazil Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Brazil Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Brazil Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Brazil Continuous Glucose Monitoring Market Revenue Million Forecast, by Component 2019 & 2032

- Table 10: Brazil Continuous Glucose Monitoring Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 11: Brazil Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Continuous Glucose Monitoring Market?

The projected CAGR is approximately 13.30%.

2. Which companies are prominent players in the Brazil Continuous Glucose Monitoring Market?

Key companies in the market include Other, Abbott Diabetes Care, GlySens, Dexcom Inc, Medtronic PLC, Ascensia Diabetes Care.

3. What are the main segments of the Brazil Continuous Glucose Monitoring Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 270.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Brazil is anticipated to boost the market studied.

7. Are there any restraints impacting market growth?

Monopolized Supply Chain and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

October 2023: Molex company Phillips-Medisize and Finland-based medtech company GlucoModicum have partnered on an advanced non-invasive, needle-free continuous glucose monitor (CGM).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Continuous Glucose Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Continuous Glucose Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Continuous Glucose Monitoring Market?

To stay informed about further developments, trends, and reports in the Brazil Continuous Glucose Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence