Key Insights

The United States refined petroleum products market is a robust sector, projected to reach a market size of $1610.72 billion by 2025. Anticipating a Compound Annual Growth Rate (CAGR) of 5.2% from 2025 to 2033, the market is driven by consistent demand across automotive fuels, aviation fuels, and Liquefied Petroleum Gas (LPG), supporting transportation, air travel, and residential/industrial energy needs. The nation's extensive refining infrastructure underpins this growth and global supply contributions. The market's resilience is further supported by key industry players' investments in refining capacity and innovation.

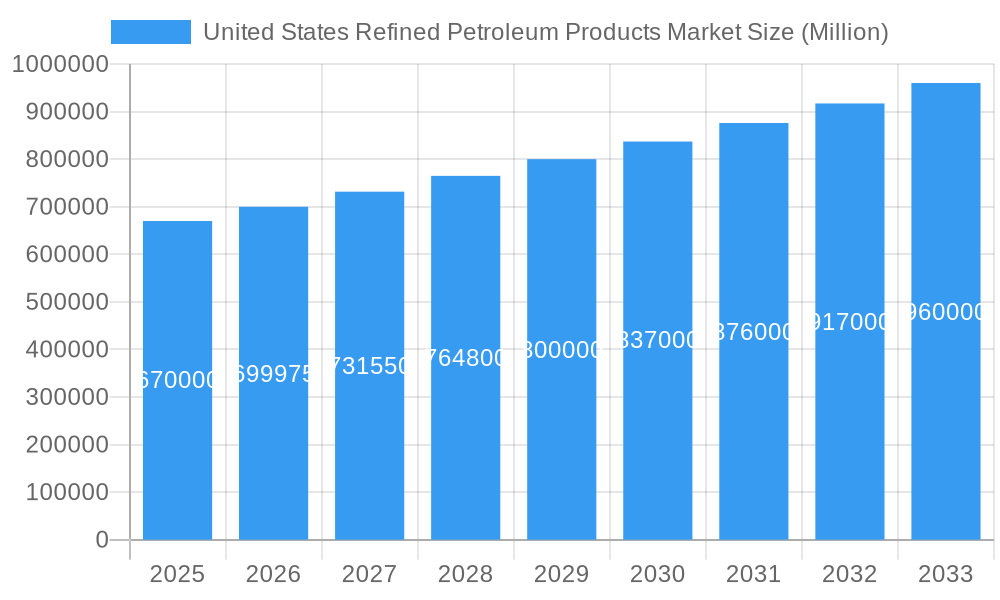

United States Refined Petroleum Products Market Market Size (In Million)

Challenges include increasing regulatory pressures for emissions reduction and the volatility of crude oil prices. However, ongoing modernization of refining processes, development of higher-quality fuels, and strategic geographical presence of leading companies ensure the market's continued evolution. The United States refined petroleum products market is poised for steady growth, emphasizing efficiency and adaptation to the evolving energy landscape.

United States Refined Petroleum Products Market Company Market Share

This comprehensive report offers a granular analysis of the United States refined petroleum products market, providing critical insights for stakeholders. Covering 2019-2033, with a base year of 2025, the study details market structure, industry trends, dominant segments, product innovations, key drivers, challenges, leading players, and strategic outlook. Leveraging essential SEO keywords like "US refined fuels market," "petroleum product analysis," "automotive fuels demand," "aviation fuel trends," and "LPG market share," this report is designed for maximum visibility and engagement.

United States Refined Petroleum Products Market Market Structure & Competitive Dynamics

The United States refined petroleum products market exhibits a moderately concentrated structure, characterized by the significant presence of major integrated oil and gas companies. Exxon Mobil Corporation, Chevron Corporation, BP PLC, and Royal Dutch Shell are key players, collectively holding substantial market share. Innovation ecosystems are driven by advancements in refining technologies, including catalytic cracking, hydrocracking, and alkylation, aimed at producing higher-octane fuels and cleaner emissions. The regulatory framework, spearheaded by the Environmental Protection Agency (EPA) and the Department of Energy (DOE), plays a pivotal role in shaping product specifications, environmental standards, and fuel efficiency mandates. Product substitutes, such as biofuels and electric vehicle adoption, pose an evolving threat, particularly in the automotive fuels segment. End-user trends indicate a sustained demand for transportation fuels, albeit with a gradual shift towards cleaner alternatives. Mergers and acquisition (M&A) activities, while not a constant feature, are strategic opportunities for consolidation and expansion. For instance, industry developments such as Contango Oil & Gas's acquisition of gas assets for USD 67 Million in July 2021, though not directly in refined products, reflect the broader consolidation trends within the energy sector. The market share of top players is estimated to be between 60-70% in the refined products segment.

United States Refined Petroleum Products Market Industry Trends & Insights

The United States refined petroleum products market is experiencing a complex interplay of growth drivers and disruptive forces. A primary growth driver remains the robust demand for automotive fuels, fueled by a large vehicle parc and a recovering economy post-pandemic. Aviation fuels are also seeing a resurgence as air travel normalizes, though efficiency improvements and alternative propulsion technologies present long-term challenges. Marine fuels demand is influenced by global trade volumes and increasingly stringent International Maritime Organization (IMO) regulations concerning sulfur content. The Liquefied Petroleum Gas (LPG) market is benefiting from its versatility as a heating, cooking, and industrial fuel, as well as its growing application as a cleaner alternative to other fossil fuels. Technological disruptions are centered on refinery optimization, including the adoption of digital twins, artificial intelligence for predictive maintenance, and advanced catalysts to enhance yield and reduce energy consumption. Consumer preferences are gradually shifting towards sustainability, impacting fuel choices and driving demand for lower-emission products. Competitive dynamics are characterized by intense price competition, strategic supply chain management, and investments in research and development for next-generation fuels. The Compound Annual Growth Rate (CAGR) for the overall market is projected to be around 2.5% during the forecast period. Market penetration of alternative fuels, while still relatively low for large-scale transportation, is steadily increasing, particularly in the light-duty vehicle segment. Refinery utilization rates, a key metric, are expected to remain strong, hovering around 90-92% during the forecast period, indicating robust operational activity. Investments in refinery upgrades and expansions, totaling an estimated USD 10-15 Billion annually, are crucial for maintaining competitiveness and meeting evolving demand patterns. The increasing adoption of advanced analytics in refinery operations is leading to an estimated 5-7% improvement in operational efficiency.

Dominant Markets & Segments in United States Refined Petroleum Products Market

The automotive fuels segment is undeniably the dominant market within the United States refined petroleum products market. This dominance is underpinned by several key drivers:

- Extensive Vehicle Parc: The sheer number of gasoline and diesel-powered vehicles on U.S. roads represents a massive and consistent demand base.

- Economic Policies: Government policies supporting the automotive industry, including infrastructure development and consumer incentives for vehicle purchases, indirectly bolster fuel demand.

- Infrastructure: An unparalleled network of gas stations and distribution infrastructure ensures easy accessibility for automotive fuels.

Automotive Fuels are projected to hold over 65% of the total market share during the forecast period. Gasoline and diesel remain the primary components, though the growing market penetration of hybrid and electric vehicles introduces a dynamic element. Despite the rise of alternatives, the internal combustion engine is expected to remain a significant power source for decades to come, especially in heavy-duty transportation and commercial fleets.

The aviation fuels segment, while smaller in volume compared to automotive fuels, represents a high-value market. Demand is intrinsically linked to the health of the airline industry and global air cargo volumes. Factors such as technological advancements in aircraft efficiency and the development of sustainable aviation fuels (SAFs) are key trends influencing this segment.

Liquefied Petroleum Gas (LPG) holds a significant position due to its versatility. Its use in residential heating, commercial cooking, industrial processes, and as a fuel for autogas vehicles contributes to its steady market presence. Favorable pricing compared to natural gas in certain regions and its cleaner-burning properties compared to some traditional fuels are key advantages. The market penetration of LPG as an alternative transportation fuel is expected to grow by approximately 8-10% over the forecast period, particularly in regions with established refueling infrastructure.

Marine fuels are vital for global trade, with demand directly correlated to shipping volumes. The implementation of IMO 2020 regulations, mandating lower sulfur content, has led to a significant shift towards low-sulfur marine fuels and increasing adoption of alternative fuels like LNG.

The Other Fuel Types segment encompasses a variety of refined products such as jet fuel (distinct from general aviation), kerosene, and specialized industrial fuels. Growth in this segment is often tied to specific industrial output and niche market demands.

United States Refined Petroleum Products Market Product Innovations

Product innovation in the United States refined petroleum products market is primarily focused on enhancing fuel efficiency, reducing emissions, and adapting to evolving regulatory landscapes. Advancements in refining processes yield higher-octane gasoline and ultra-low sulfur diesel (ULSD), meeting stringent environmental standards. Development of cleaner jet fuels and the exploration of sustainable aviation fuels (SAFs) are gaining traction. The competitive advantage lies in producing fuels that offer superior performance, lower environmental impact, and cost-effectiveness for end-users.

Report Segmentation & Scope

This report segments the United States refined petroleum products market by Type and Geography. The primary types analyzed include:

- Automotive Fuels: Encompassing gasoline and diesel, this segment is expected to witness steady growth, driven by the vast vehicle parc and economic activity.

- Marine Fuels: Influenced by global trade and environmental regulations, this segment is adapting to cleaner fuel alternatives.

- Aviation Fuels: Demand is recovering with increased air travel, while sustainability initiatives are driving innovation in SAFs.

- Liquefied Petroleum Gas (LPG): This versatile fuel is projected for continued growth due to its wide range of applications and cleaner-burning properties.

- Other Fuel Types: This segment includes niche fuels and industrial applications, with growth tied to specific sector performance.

Geographically, the report focuses on the United States, examining regional variations in demand, refining capacity, and regulatory impacts.

Key Drivers of United States Refined Petroleum Products Market Growth

The growth of the United States refined petroleum products market is propelled by several interconnected factors. A foundational driver is the sustained demand for transportation fuels, primarily automotive fuels, stemming from a large and growing vehicle fleet. Economic recovery and expansion, leading to increased industrial activity and consumer spending, directly correlate with higher consumption of refined products. Technological advancements in refining processes enable greater efficiency and the production of cleaner fuels, meeting evolving environmental regulations. Furthermore, government policies that support the energy sector, while also promoting cleaner alternatives, create a complex but ultimately growth-supportive environment. The strategic importance of petroleum products in the nation's energy security and economic infrastructure also plays a crucial role.

Challenges in the United States Refined Petroleum Products Market Sector

Despite robust growth drivers, the United States refined petroleum products market faces significant challenges. The escalating adoption of electric vehicles (EVs) poses a long-term threat to the demand for gasoline. Increasingly stringent environmental regulations, aimed at reducing greenhouse gas emissions, necessitate costly upgrades to refining facilities and can impact profitability. Supply chain disruptions, exacerbated by geopolitical events and extreme weather conditions, can lead to price volatility and impact operational continuity. Intense competitive pressures from both domestic and international players, coupled with the fluctuating prices of crude oil, create a challenging pricing environment. The aging infrastructure of some refineries also requires substantial investment for modernization.

Leading Players in the United States Refined Petroleum Products Market Market

- Exxon Mobil Corporation

- China Petroleum & Chemical Corporation

- BP PLC

- Chevron Corporation

- Royal Dutch Shell

Key Developments in United States Refined Petroleum Products Market Sector

- July 2021: Contango Oil & Gas agreed to acquire low-decline, conventional gas assets in the Wind River Basin of Wyoming, United States, from ConocoPhillips in a USD 67 million cash deal. (This development, while in upstream, indicates consolidation activity within the broader energy sector that can impact refined product supply chains).

Strategic United States Refined Petroleum Products Market Market Outlook

The United States refined petroleum products market presents a strategic outlook characterized by resilience and adaptation. While facing the long-term challenge of decarbonization and the rise of alternative energy sources, the market's near to medium-term future remains robust due to persistent demand for transportation fuels. Growth accelerators will stem from continued economic expansion, technological innovation in cleaner fuel production and refinery efficiency, and the strategic management of supply chains. Opportunities lie in developing and scaling sustainable aviation fuels, expanding the market for cleaner fuels like LPG, and optimizing refinery operations to meet evolving environmental standards and consumer preferences. Investments in advanced refining technologies and a focus on operational agility will be critical for market leaders to maintain their competitive edge and capitalize on emerging trends.

United States Refined Petroleum Products Market Segmentation

-

1. Type

- 1.1. Automotive Fuels

- 1.2. Marine Fuels

- 1.3. Aviation Fuels

- 1.4. Liquefied Petroleum Gas (LPG)

- 1.5. Other Fuel Types

- 2. Geography

United States Refined Petroleum Products Market Segmentation By Geography

- 1. United States

United States Refined Petroleum Products Market Regional Market Share

Geographic Coverage of United States Refined Petroleum Products Market

United States Refined Petroleum Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Aviation Fuel Usage to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Refined Petroleum Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Automotive Fuels

- 5.1.2. Marine Fuels

- 5.1.3. Aviation Fuels

- 5.1.4. Liquefied Petroleum Gas (LPG)

- 5.1.5. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Exxon Mobil Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Petroleum & Chemical Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BP PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chevron Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Royal Dutch Shell

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Exxon Mobil Corporation

List of Figures

- Figure 1: United States Refined Petroleum Products Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Refined Petroleum Products Market Share (%) by Company 2025

List of Tables

- Table 1: United States Refined Petroleum Products Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: United States Refined Petroleum Products Market Volume Litre Forecast, by Type 2020 & 2033

- Table 3: United States Refined Petroleum Products Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: United States Refined Petroleum Products Market Volume Litre Forecast, by Geography 2020 & 2033

- Table 5: United States Refined Petroleum Products Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United States Refined Petroleum Products Market Volume Litre Forecast, by Region 2020 & 2033

- Table 7: United States Refined Petroleum Products Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: United States Refined Petroleum Products Market Volume Litre Forecast, by Type 2020 & 2033

- Table 9: United States Refined Petroleum Products Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: United States Refined Petroleum Products Market Volume Litre Forecast, by Geography 2020 & 2033

- Table 11: United States Refined Petroleum Products Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States Refined Petroleum Products Market Volume Litre Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Refined Petroleum Products Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the United States Refined Petroleum Products Market?

Key companies in the market include Exxon Mobil Corporation, China Petroleum & Chemical Corporation, BP PLC, Chevron Corporation, Royal Dutch Shell.

3. What are the main segments of the United States Refined Petroleum Products Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1610.72 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Aviation Fuel Usage to Grow Significantly.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

July 2021: Contango Oil & Gas agreed to acquire low-decline, conventional gas assets in the Wind River Basin of Wyoming, United States, from ConocoPhillips in a USD 67 million cash deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Litre.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Refined Petroleum Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Refined Petroleum Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Refined Petroleum Products Market?

To stay informed about further developments, trends, and reports in the United States Refined Petroleum Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence