Key Insights

The Low Voltage DC Circuit Breaker market is projected for substantial growth, reaching a market size of $10.88 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 11.73% through 2033. This expansion is driven by increasing demand for dependable DC power distribution across critical sectors. Key growth catalysts include the widespread adoption of battery systems, fueled by the electric vehicle (EV) surge and renewable energy integration. Data centers, requiring robust power management, also contribute significantly. Furthermore, advancements in electric transportation, from trains to potential urban air mobility, necessitate advanced low voltage DC circuit breakers for safety and efficiency. The market offers diverse product types, including Air Circuit Breakers and Molded Case Circuit Breakers, each suited for specific applications.

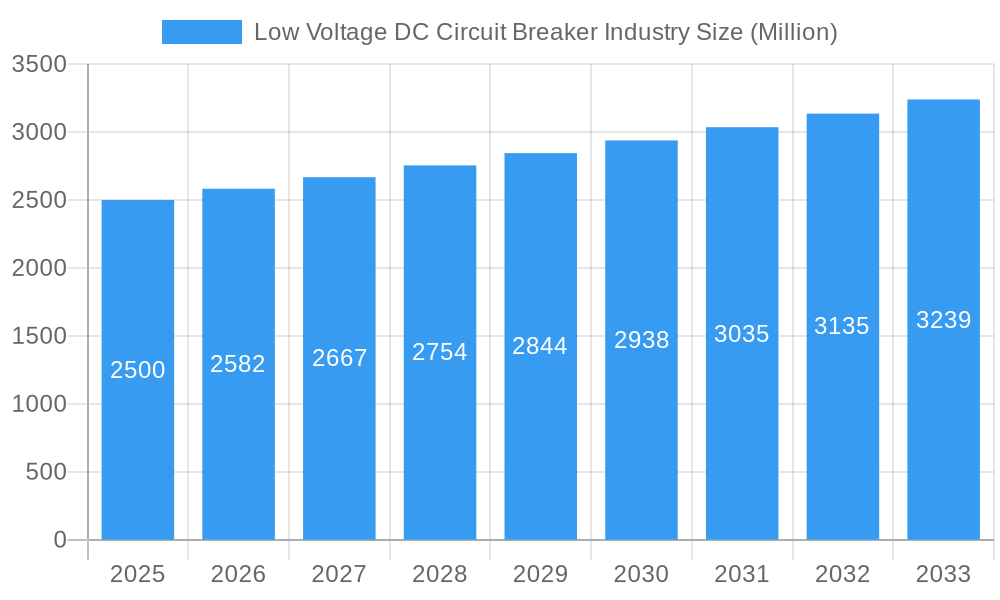

Low Voltage DC Circuit Breaker Industry Market Size (In Billion)

Market dynamics are shaped by trends toward miniaturization and enhanced protection features, particularly for space-constrained applications like EVs and portable electronics. The integration of smart technologies for remote monitoring, diagnostics, and predictive maintenance is also gaining momentum, especially in large-scale deployments like data centers and renewable energy farms. While growth prospects are strong, high initial investment costs for advanced DC circuit breaker technologies and the need for specialized installation expertise may present challenges. Nevertheless, the global shift towards electrification, decarbonization, and digitalization underpins sustained market growth, with the Asia Pacific region anticipated to become a major center for consumption and innovation due to rapid industrialization and supportive renewable energy policies.

Low Voltage DC Circuit Breaker Industry Company Market Share

Detailed Report Description: Low Voltage DC Circuit Breaker Industry Outlook 2025-2033

This comprehensive report delivers an in-depth analysis of the global Low Voltage DC Circuit Breaker Industry, providing a detailed market structure, competitive landscape, emerging trends, and strategic outlook for the period of 2019–2033. With a base year of 2025, this research offers actionable insights for stakeholders to navigate this dynamic sector. The report is meticulously segmented to cover critical aspects, empowering businesses with the knowledge to capitalize on opportunities and mitigate challenges within the DC circuit breaker market.

Low Voltage DC Circuit Breaker Industry Market Structure & Competitive Dynamics

The Low Voltage DC Circuit Breaker Industry exhibits a moderately concentrated market structure, with key players such as Siemens AG, Schneider Electric SE, and Eaton Corporation PLC holding significant market share, estimated at over 50% collectively. Innovation ecosystems are robust, driven by a consistent focus on miniaturization, enhanced safety features, and intelligent monitoring capabilities. Regulatory frameworks, particularly concerning electrical safety standards and grid integration, play a crucial role in shaping product development and market entry. While direct product substitutes are limited, the increasing efficiency of power electronics and advanced protection relays present indirect competitive pressures. End-user trends are increasingly dictating product specifications, with a strong demand for solutions supporting renewable energy integration and electrification of transportation. Merger and acquisition (M&A) activities have been moderate, with deal values in the range of XX Million to XX Million USD, primarily aimed at consolidating market presence or acquiring advanced technological capabilities. The industry's competitive dynamics are characterized by a balance between established giants and agile innovators.

Low Voltage DC Circuit Breaker Industry Industry Trends & Insights

The Low Voltage DC Circuit Breaker Industry is experiencing a robust growth trajectory, propelled by several intertwined trends. A primary growth driver is the accelerating global adoption of renewable energy sources, particularly solar power, which necessitates efficient and reliable DC circuit protection for energy storage systems and grid interconnection. The exponential growth of data centers, demanding stable and resilient power infrastructure, also significantly contributes to market expansion. Furthermore, the ongoing electrification of transportation, including electric vehicles and railway systems, creates a substantial demand for specialized low voltage DC circuit breakers. Technological disruptions, such as the integration of IoT capabilities for remote monitoring and predictive maintenance, are transforming traditional circuit breaker functionalities into smart protective devices. Consumer preferences are increasingly leaning towards compact, high-performance, and energy-efficient solutions that minimize operational downtime and enhance safety. The competitive landscape is characterized by a constant drive for product differentiation through enhanced breaking capacity, arc flash mitigation, and compliance with evolving international standards. The projected Compound Annual Growth Rate (CAGR) for the low voltage DC circuit breaker market is approximately XX% during the forecast period. Market penetration is expected to deepen across emerging economies as infrastructure development accelerates. The increasing focus on grid modernization and smart grid technologies further fuels the demand for advanced DC protection solutions, ensuring system stability and reliability in increasingly complex power networks.

Dominant Markets & Segments in Low Voltage DC Circuit Breaker Industry

The Low Voltage DC Circuit Breaker Industry sees significant dominance from specific regions and end-user segments. Geographically, Asia-Pacific, led by countries like China and India, is emerging as a dominant market due to rapid industrialization, extensive infrastructure development projects, and a burgeoning renewable energy sector. Economic policies supporting green energy initiatives and government investments in power grid upgrades further bolster this dominance.

- Type: Air Circuit Breaker: While traditionally prevalent, Air Circuit Breakers are seeing sustained demand in industrial applications requiring robust and high-capacity protection. Their proven reliability and cost-effectiveness continue to make them a preferred choice in many sectors.

- Type: Molded Case Circuit Breaker: Molded Case Circuit Breakers (MCCBs) are witnessing significant growth, driven by their versatility, compact design, and suitability for a wide range of applications, from commercial buildings to industrial machinery. Their enhanced performance and safety features align well with modern electrical system requirements.

- End User: Battery System: This segment is experiencing unparalleled growth, directly correlated with the expansion of energy storage systems, electric vehicle battery packs, and portable electronic devices. The need for precise and rapid DC protection in battery management systems is paramount.

- End User: Data Centers: The insatiable demand for digital services translates into a continuous expansion of data centers, each requiring highly reliable and efficient DC power distribution and protection. The criticality of uptime in these facilities makes advanced DC circuit breakers indispensable.

- End User: Solar Energy: The global push towards renewable energy has made the solar energy sector a major consumer of low voltage DC circuit breakers. These devices are essential for safeguarding solar inverters, battery storage units, and grid-tie systems, ensuring the safe and efficient harnessing of solar power.

- End User: Transportation: The electrification of transportation, including electric trains, electric buses, and electric vehicles, presents a substantial and rapidly growing market for DC circuit breakers. These components are crucial for the safety and performance of electric powertrains and charging infrastructure.

The dominance in these segments is a testament to the evolving energy landscape and the critical role of reliable DC power management.

Low Voltage DC Circuit Breaker Industry Product Innovations

Product innovations in the Low Voltage DC Circuit Breaker Industry are primarily focused on enhancing safety, improving efficiency, and enabling smarter grid functionalities. Key developments include the introduction of circuit breakers with higher breaking capacities to manage the increasing power demands of modern systems, alongside advanced arc flash mitigation technologies that significantly reduce the risk of electrical accidents. Miniaturization and increased power density are also crucial trends, allowing for more compact equipment designs. Furthermore, the integration of digital communication interfaces and sensor technologies is leading to the development of intelligent circuit breakers capable of real-time monitoring, diagnostics, and remote control, thereby optimizing system performance and facilitating predictive maintenance. These innovations provide a competitive advantage by addressing the evolving needs of end-users in sectors like renewable energy, data centers, and transportation.

Report Segmentation & Scope

This report meticulously segments the Low Voltage DC Circuit Breaker Industry across critical dimensions, providing granular market insights. The segmentation covers:

- Type: Air Circuit Breaker: This segment analyzes the market dynamics, growth projections, and competitive landscape for air circuit breakers, focusing on their applications and market size within the broader DC circuit breaker ecosystem.

- Type: Molded Case Circuit Breaker: This section delves into the molded case circuit breaker market, detailing its growth trajectory, key market drivers, and the competitive strategies employed by leading manufacturers.

- End User: Battery System: This segment provides an in-depth analysis of the demand for low voltage DC circuit breakers from battery system manufacturers and integrators, including market size and future growth prospects.

- End User: Data Centers: This part of the report examines the specific needs and market penetration of DC circuit breakers within the rapidly expanding data center industry, highlighting key trends and competitive factors.

- End User: Solar Energy: This section focuses on the significant market opportunities and growth drivers for DC circuit breakers within the solar energy sector, including their role in photovoltaic systems and energy storage.

- End User: Transportation: This segment analyzes the increasing demand for low voltage DC circuit breakers in the transportation sector, particularly driven by the electrification of vehicles and rail systems, detailing market size and competitive dynamics.

- End User: Other End Users: This inclusive category covers various other applications and emerging markets for DC circuit breakers, ensuring a holistic view of the industry's scope.

Key Drivers of Low Voltage DC Circuit Breaker Industry Growth

The Low Voltage DC Circuit Breaker Industry is experiencing significant growth fueled by several pivotal factors. The burgeoning renewable energy sector, particularly solar PV installations, necessitates robust DC protection for energy storage and grid integration, directly driving demand. The rapid expansion of data centers worldwide, requiring highly reliable and efficient DC power distribution, is another key accelerator. Furthermore, the global push towards electrification in the transportation sector, encompassing electric vehicles and railway systems, creates substantial new market opportunities. Technological advancements, such as the integration of smart grid functionalities and miniaturized designs, are enhancing product appeal and performance. Government initiatives promoting clean energy and infrastructure development also play a crucial role in stimulating market growth.

Challenges in the Low Voltage DC Circuit Breaker Industry Sector

Despite the positive growth outlook, the Low Voltage DC Circuit Breaker Industry faces several challenges. Intense price competition, particularly from manufacturers in emerging economies, can impact profit margins for established players. Stringent and evolving safety regulations across different regions can necessitate costly product redesigns and certifications, posing a barrier to market entry for smaller companies. Supply chain disruptions, as witnessed in recent years, can affect the availability of critical raw materials and components, leading to production delays and increased costs. The continuous need for R&D investment to keep pace with technological advancements and evolving end-user demands also presents a significant financial challenge. Furthermore, the availability of skilled labor for manufacturing and technical support remains a concern in some regions.

Leading Players in the Low Voltage DC Circuit Breaker Industry Market

The Low Voltage DC Circuit Breaker Industry market is characterized by the presence of several key global players, including:

ABB Ltd Powell Industries Inc Larsen & Toubro Limited Fuji Electric Co Ltd Hitachi Ltd Mitsubishi Electric Corporation Siemens AG Schneider Electric SE Sensata Technologies Holding PLC Eaton Corporation PLC Entec Electric & Electronic Co Ltd Rockwell Automation Inc CG Power and Industrial Solutions Ltd Hyundai Electric & Energy Systems Company

Key Developments in Low Voltage DC Circuit Breaker Industry Sector

- 2024 February: Siemens AG launched a new series of compact and intelligent DC circuit breakers for data center applications, offering enhanced energy efficiency and remote monitoring capabilities.

- 2023 October: Eaton Corporation PLC announced the acquisition of a specialized DC circuit breaker manufacturer, strengthening its product portfolio for renewable energy storage solutions.

- 2023 August: Schneider Electric SE introduced a novel arc flash mitigation technology for its molded case circuit breakers, significantly improving safety standards in industrial environments.

- 2023 May: Fuji Electric Co Ltd expanded its offerings for electric vehicle charging infrastructure with a new range of high-performance DC circuit breakers.

- 2022 December: Larsen & Toubro Limited secured a major contract to supply DC circuit breakers for a large-scale solar power project in India.

Strategic Low Voltage DC Circuit Breaker Industry Market Outlook

The strategic outlook for the Low Voltage DC Circuit Breaker Industry is exceptionally positive, driven by the accelerating global transition towards sustainable energy and digitalization. Growth accelerators include the continued expansion of renewable energy integration, the burgeoning demand from hyperscale data centers, and the rapid electrification of the transportation sector. Innovations in smart technologies, such as IoT integration for predictive maintenance and enhanced cybersecurity features, will further drive market adoption. Strategic opportunities lie in developing customized solutions for emerging applications, expanding presence in high-growth geographical markets, and forging partnerships to leverage technological advancements. The industry is poised for sustained growth as reliable and efficient DC power protection becomes increasingly critical across a multitude of vital sectors.

Low Voltage DC Circuit Breaker Industry Segmentation

-

1. Type

- 1.1. Air Circuit Breaker

- 1.2. Molded Case Circuit Breaker

-

2. End User

- 2.1. Battery System

- 2.2. Data Centers

- 2.3. Solar Energy

- 2.4. Transportation

- 2.5. Other End Users

Low Voltage DC Circuit Breaker Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Low Voltage DC Circuit Breaker Industry Regional Market Share

Geographic Coverage of Low Voltage DC Circuit Breaker Industry

Low Voltage DC Circuit Breaker Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Electricity Generation and Consumption4.; Rising Emphasis on Renewable Energy Generation

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Environmental and Safety Regulations

- 3.4. Market Trends

- 3.4.1. Solar Energy Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Low Voltage DC Circuit Breaker Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Air Circuit Breaker

- 5.1.2. Molded Case Circuit Breaker

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Battery System

- 5.2.2. Data Centers

- 5.2.3. Solar Energy

- 5.2.4. Transportation

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Low Voltage DC Circuit Breaker Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Air Circuit Breaker

- 6.1.2. Molded Case Circuit Breaker

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Battery System

- 6.2.2. Data Centers

- 6.2.3. Solar Energy

- 6.2.4. Transportation

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Low Voltage DC Circuit Breaker Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Air Circuit Breaker

- 7.1.2. Molded Case Circuit Breaker

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Battery System

- 7.2.2. Data Centers

- 7.2.3. Solar Energy

- 7.2.4. Transportation

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Low Voltage DC Circuit Breaker Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Air Circuit Breaker

- 8.1.2. Molded Case Circuit Breaker

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Battery System

- 8.2.2. Data Centers

- 8.2.3. Solar Energy

- 8.2.4. Transportation

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Low Voltage DC Circuit Breaker Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Air Circuit Breaker

- 9.1.2. Molded Case Circuit Breaker

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Battery System

- 9.2.2. Data Centers

- 9.2.3. Solar Energy

- 9.2.4. Transportation

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Low Voltage DC Circuit Breaker Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Air Circuit Breaker

- 10.1.2. Molded Case Circuit Breaker

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Battery System

- 10.2.2. Data Centers

- 10.2.3. Solar Energy

- 10.2.4. Transportation

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ABB Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Powell Industries Inc *List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Larsen & Toubro Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fuji Electric Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hitachi Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsubishi Electric Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schneider Electric SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sensata Technologies Holding PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eaton Corporation PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Entec Electric & Electronic Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Rockwell Automation Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CG Power and Industrial Solutions Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hyundai Electric & Energy Systems Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd

List of Figures

- Figure 1: Global Low Voltage DC Circuit Breaker Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Low Voltage DC Circuit Breaker Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Low Voltage DC Circuit Breaker Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Low Voltage DC Circuit Breaker Industry Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Low Voltage DC Circuit Breaker Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Low Voltage DC Circuit Breaker Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Low Voltage DC Circuit Breaker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Low Voltage DC Circuit Breaker Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Low Voltage DC Circuit Breaker Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Low Voltage DC Circuit Breaker Industry Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe Low Voltage DC Circuit Breaker Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Low Voltage DC Circuit Breaker Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Low Voltage DC Circuit Breaker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Low Voltage DC Circuit Breaker Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Low Voltage DC Circuit Breaker Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Low Voltage DC Circuit Breaker Industry Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific Low Voltage DC Circuit Breaker Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Low Voltage DC Circuit Breaker Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Low Voltage DC Circuit Breaker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Low Voltage DC Circuit Breaker Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Low Voltage DC Circuit Breaker Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Low Voltage DC Circuit Breaker Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: South America Low Voltage DC Circuit Breaker Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: South America Low Voltage DC Circuit Breaker Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Low Voltage DC Circuit Breaker Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Low Voltage DC Circuit Breaker Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Low Voltage DC Circuit Breaker Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Low Voltage DC Circuit Breaker Industry Revenue (billion), by End User 2025 & 2033

- Figure 29: Middle East and Africa Low Voltage DC Circuit Breaker Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Low Voltage DC Circuit Breaker Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Low Voltage DC Circuit Breaker Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global Low Voltage DC Circuit Breaker Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Low Voltage DC Circuit Breaker Industry?

The projected CAGR is approximately 11.73%.

2. Which companies are prominent players in the Low Voltage DC Circuit Breaker Industry?

Key companies in the market include ABB Ltd, Powell Industries Inc *List Not Exhaustive, Larsen & Toubro Limited, Fuji Electric Co Ltd, Hitachi Ltd, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Sensata Technologies Holding PLC, Eaton Corporation PLC, Entec Electric & Electronic Co Ltd, Rockwell Automation Inc, CG Power and Industrial Solutions Ltd, Hyundai Electric & Energy Systems Company.

3. What are the main segments of the Low Voltage DC Circuit Breaker Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.88 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Electricity Generation and Consumption4.; Rising Emphasis on Renewable Energy Generation.

6. What are the notable trends driving market growth?

Solar Energy Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Stringent Environmental and Safety Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Low Voltage DC Circuit Breaker Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Low Voltage DC Circuit Breaker Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Low Voltage DC Circuit Breaker Industry?

To stay informed about further developments, trends, and reports in the Low Voltage DC Circuit Breaker Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence