Key Insights

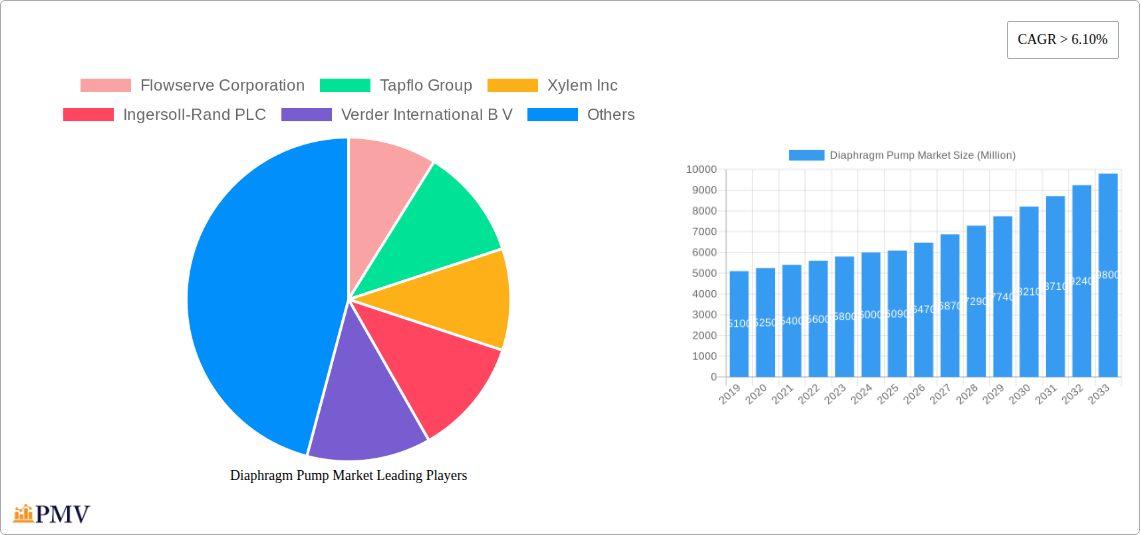

The global diaphragm pump market is poised for substantial expansion, with an estimated market size of $6090 million in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) exceeding 6.10% through 2033. This growth is propelled by critical industrial demands across diverse sectors. In the water and wastewater treatment industry, the increasing need for efficient and reliable fluid transfer for processes like chemical dosing, sludge transfer, and filtration is a primary driver. Similarly, the burgeoning oil and gas sector, with its upstream, midstream, and downstream operations requiring robust pumping solutions for exploration, extraction, and refining, significantly contributes to market demand. The chemical and petrochemical industries, reliant on diaphragm pumps for handling corrosive and abrasive fluids with precision, also represent a significant market segment. Furthermore, the stringent hygiene and containment requirements in the pharmaceutical and food and beverage industries necessitate the use of specialized diaphragm pumps, fueling their adoption.

Diaphragm Pump Market Market Size (In Billion)

The market's dynamism is further shaped by evolving technological advancements and operational considerations. Electrically operated diaphragm pumps are gaining traction due to their energy efficiency, precise control, and lower maintenance requirements compared to their air-operated counterparts. This trend is particularly evident in applications demanding sophisticated automation and variable flow rates. Conversely, air-operated diaphragm pumps continue to hold a strong position in hazardous environments due to their inherent safety features, such as spark-free operation and intrinsic safety. The diverse range of discharge pressure requirements, from low-pressure applications up to 80 bar for general transfer to high-pressure scenarios exceeding 200 bar for specialized industrial processes, allows for a broad spectrum of pump solutions. Key players like Flowserve Corporation, Tapflo Group, Xylem Inc., and Ingersoll-Rand PLC are continuously innovating to offer advanced, durable, and application-specific diaphragm pumps, catering to the evolving needs of these critical industries and solidifying the market's upward trajectory.

Diaphragm Pump Market Company Market Share

This in-depth diaphragm pump market report provides a detailed analysis of the global diaphragm pump industry, covering market size, segmentation, trends, drivers, challenges, and competitive landscape. With a study period spanning from 2019 to 2033, featuring a base year of 2025, this report offers invaluable insights for stakeholders seeking to capitalize on the burgeoning demand for robust and versatile pumping solutions. Our meticulously researched data and expert analysis will empower you to make informed strategic decisions in this dynamic industrial pump market. The report includes comprehensive coverage of leading diaphragm pump manufacturers and their innovative product portfolios.

Diaphragm Pump Market Market Structure & Competitive Dynamics

The global diaphragm pump market exhibits a moderately concentrated structure, with several key players like Flowserve Corporation, Tapflo Group, Xylem Inc., Ingersoll-Rand PLC, Verder International B V, Graco Inc., LEWA Group, Idex Corporation, Dover Corporation, SPX FLOW Inc, Yamada Corporation, and Grundfos AS holding significant market share. Innovation is a critical differentiator, with companies heavily investing in R&D to develop pumps with enhanced efficiency, durability, and application-specific features. Regulatory frameworks, particularly concerning environmental discharge and safety standards in industries such as oil and gas and chemical processing, significantly influence product development and adoption. The market benefits from a lack of direct, widely adopted product substitutes that offer the same versatility and self-priming capabilities. End-user trends, such as the increasing demand for reliable fluid transfer in water treatment, pharmaceutical manufacturing, and food and beverage processing, are shaping market strategies. Merger and acquisition (M&A) activities are observed, indicating a consolidation trend as larger companies seek to expand their product offerings and market reach. For instance, in the historical period, M&A deals valued in the hundreds of millions of dollars have been recorded, aiming to acquire innovative technologies or expand geographical presence.

Diaphragm Pump Market Industry Trends & Insights

The diaphragm pump market is poised for robust growth, driven by several interconnected trends. The increasing global focus on water and wastewater management, coupled with stringent regulations regarding effluent discharge, is a primary growth accelerator, boosting the adoption of air-operated diaphragm pumps (AODP) and electrically operated diaphragm pumps in treatment facilities. The expanding oil and gas sector, particularly in upstream exploration and downstream refining, necessitates reliable and robust pumps for handling corrosive and abrasive fluids, further fueling market demand. Technological advancements are a significant disruptor, with manufacturers continuously innovating to enhance pump efficiency, reduce energy consumption, and improve material compatibility for handling a wider range of chemicals and pharmaceutical ingredients. The rise of the pharmaceutical and biopharmaceutical industries, with their stringent requirements for aseptic processing and precision fluid handling, is creating substantial opportunities for specialized diaphragm pumps. Consumer preferences are shifting towards more sustainable and energy-efficient pumping solutions, prompting the development of advanced electric diaphragm pumps with lower power footprints. Competitive dynamics are characterized by intense product differentiation, with companies focusing on developing pumps tailored to specific end-user needs. The overall CAGR for the diaphragm pump market is projected to be around 5.5% to 6.5% over the forecast period. Market penetration is high in mature economies and steadily increasing in emerging markets due to industrialization and infrastructure development. The increasing adoption of automation and smart technologies in industrial processes is also driving the demand for intelligent diaphragm pumps with advanced monitoring and control capabilities.

Dominant Markets & Segments in Diaphragm Pump Market

The diaphragm pump market is experiencing significant growth across various regions and segments. Geographically, North America and Europe currently dominate the market due to their well-established industrial infrastructure, stringent environmental regulations, and high adoption of advanced technologies. However, the Asia-Pacific region is projected to witness the fastest growth, driven by rapid industrialization, increasing investments in water and wastewater treatment projects, and a burgeoning chemical and petrochemical industry.

Mechanism:

- Air Operated Diaphragm Pumps (AODP): These pumps are dominant in applications requiring high reliability, portability, and the ability to handle solids and abrasives. Their inherent safety in hazardous environments and relatively lower initial cost contribute to their widespread use in the oil and gas, chemical, and mining sectors. Key drivers include their robust design and ease of maintenance.

- Electrically Operated Diaphragm Pumps: Gaining traction due to energy efficiency and precise control capabilities, these pumps are increasingly favored in applications where compressed air is not readily available or where energy savings are paramount, particularly in the pharmaceutical and food and beverage sectors. Their technological advancements and integration with smart systems are key growth drivers.

Discharge Pressure:

- Up to 80 bar: This segment commands a significant market share due to its broad applicability across various industries, including water and wastewater treatment, general chemical transfer, and food processing. The demand is driven by the need for efficient and reliable low-to-medium pressure fluid handling.

- Between 80 to 200 bar: This segment is experiencing steady growth, catering to more demanding applications in the chemical and petrochemical industries where higher pressures are required for efficient processing and transfer.

- Above 200 bar: While a niche segment, it is crucial for specialized applications in high-pressure chemical injection, oil and gas exploration, and certain industrial cleaning processes, with growth driven by specialized industry needs.

End-User:

- Water and Wastewater: This is a leading end-user segment, driven by global efforts towards clean water access and stringent wastewater discharge regulations. Both AODP and electric diaphragm pumps are extensively used for chemical dosing, sludge transfer, and general fluid management.

- Oil and Gas: A significant market due to the need for robust and chemically resistant pumps for exploration, production, and refining processes, handling crude oil, produced water, and various chemicals.

- Chemical and Petrochemical: This segment is a major consumer of diaphragm pumps due to their ability to handle corrosive, abrasive, and volatile fluids safely and efficiently, with a strong emphasis on material compatibility and leak-free operation.

- Pharmaceutical: Experiencing substantial growth due to the demand for hygienic, precise, and contamination-free fluid transfer in drug manufacturing and processing. Electrically operated diaphragm pumps with specialized materials are particularly favored.

- Food and Beverage: This segment relies on diaphragm pumps for hygienic fluid transfer, ingredient dosing, and cleaning-in-place (CIP) applications. Compliance with food safety standards is a key driver.

- Other End-Users: This includes sectors like mining, general manufacturing, and agriculture, where diaphragm pumps are utilized for various fluid transfer needs.

Diaphragm Pump Market Product Innovations

Product innovation in the diaphragm pump market is intensely focused on enhancing efficiency, durability, and application-specific performance. Manufacturers are developing advanced materials for diaphragms and valve seats to improve chemical resistance and extend pump lifespan. The integration of smart technologies, such as IoT sensors for real-time monitoring of pump performance, predictive maintenance capabilities, and remote diagnostics, is a significant trend, offering enhanced operational intelligence and reduced downtime. Electrically operated diaphragm pumps are seeing advancements in motor technology for improved energy efficiency and variable speed drives for precise flow control. The development of specialized pumps for hygienic applications in the pharmaceutical and food & beverage industries, adhering to strict regulatory standards like FDA and EHEDG, is a key competitive advantage.

Report Segmentation & Scope

This report segments the global diaphragm pump market across critical parameters to provide a granular understanding of market dynamics.

- Mechanism: The market is segmented into Air Operated Diaphragm Pumps and Electrically Operated Diaphragm Pumps. Air-operated diaphragm pumps are expected to hold a larger market share due to their established presence in hazardous environments and a wider range of industrial applications. Electric diaphragm pumps are projected to witness higher growth rates driven by energy efficiency demands and technological advancements.

- Discharge Pressure: The segmentation includes Up to 80 bar, Between 80 to 200 bar, and Above 200 bar. The "Up to 80 bar" segment represents the largest market share, catering to a broad spectrum of general industrial applications. The higher pressure segments are expected to see steady growth driven by specialized industrial demands.

- End-User: The market is analyzed across Water and Wastewater, Oil and Gas, Chemical and Petrochemical, Pharmaceutical, Food and Beverage, and Other End-Users. The Water and Wastewater and Chemical and Petrochemical segments are anticipated to be the largest contributors to market revenue. The Pharmaceutical segment is projected to exhibit the highest growth rate due to increasing investments in drug manufacturing and bioprocessing.

Key Drivers of Diaphragm Pump Market Growth

The growth of the diaphragm pump market is propelled by several pivotal factors.

- Increasing Global Demand for Water and Wastewater Treatment: Stringent environmental regulations and growing populations necessitate advanced fluid handling solutions for water purification and wastewater management.

- Expansion of the Oil and Gas Industry: The continuous need for reliable and robust pumps to handle crude oil, chemicals, and produced water in exploration, production, and refining operations.

- Growth in Pharmaceutical and Biopharmaceutical Manufacturing: The demand for hygienic, precise, and contamination-free fluid transfer solutions in drug development and production.

- Technological Advancements and Product Innovation: Development of more energy-efficient, durable, and application-specific diaphragm pumps, including smart functionalities.

- Industrialization in Emerging Economies: Rapid industrial growth in regions like Asia-Pacific drives the demand for various industrial equipment, including diaphragm pumps.

Challenges in the Diaphragm Pump Market Sector

Despite the positive growth trajectory, the diaphragm pump market faces certain challenges.

- High Initial Cost of Advanced Electric Diaphragm Pumps: While offering long-term energy savings, the upfront investment for sophisticated electric models can be a deterrent for some small and medium-sized enterprises.

- Maintenance and Repair Complexity: Certain specialized diaphragm pumps can require specific technical expertise for maintenance and repair, potentially increasing operational costs.

- Competition from Other Pump Technologies: While unique in their capabilities, diaphragm pumps face indirect competition from centrifugal and positive displacement pumps in certain applications where their specific advantages may not be critical.

- Supply Chain Disruptions: Global events can impact the availability of raw materials and components, potentially affecting production timelines and costs.

Leading Players in the Diaphragm Pump Market Market

- Flowserve Corporation

- Tapflo Group

- Xylem Inc.

- Ingersoll-Rand PLC

- Verder International B V

- Graco Inc.

- LEWA Group

- Idex Corporation

- Dover Corporation

- SPX FLOW Inc

- Yamada Corporation

- Grundfos AS

Key Developments in Diaphragm Pump Market Sector

- August 2021: Graco Inc. launched its new Husky 3300e electric double diaphragm pump. This pump is designed for transferring industrial fluids and offers plant managers high-volume fluid transfer (up to 220 gpm) while significantly reducing power consumption, enhancing operational efficiency.

- April 2020: Quattroflow, part of PSG and Dover Corporation, announced the extension of its multiple- and single-use pump line with the introduction of the Quattroflow QF2500 Quaternary Diaphragm Pump. With a maximum flow rate of 2,500 lph (660 gph), this new pump is ideally suited for demanding biopharmaceutical applications, addressing critical needs for high-purity fluid handling.

Strategic Diaphragm Pump Market Market Outlook

The future outlook for the diaphragm pump market is highly promising, fueled by ongoing industrial expansion and a persistent need for efficient and reliable fluid transfer solutions. Key growth accelerators include the increasing focus on sustainability and energy efficiency, driving the adoption of advanced electric diaphragm pumps. The continued growth of the pharmaceutical and biopharmaceutical sectors, with their stringent demands for sterile and precise fluid handling, presents significant opportunities. Moreover, the digitalization trend, leading to the integration of smart technologies and IoT capabilities into diaphragm pumps, will enhance their value proposition by enabling predictive maintenance and optimized performance. Strategic opportunities lie in developing application-specific solutions for emerging industries and geographical markets, along with a continued emphasis on material science to handle increasingly aggressive chemicals. The market is expected to witness sustained innovation and strategic partnerships as key players vie for market leadership.

Diaphragm Pump Market Segmentation

-

1. Mechanism

- 1.1. Air Operated

- 1.2. Electrically Operated

-

2. Discharge Pressure

- 2.1. Up to 80 bar

- 2.2. Between 80 to 200 bar

- 2.3. Above 200 bar

-

3. End-User

- 3.1. Water and Wastewater

- 3.2. Oil and Gas

- 3.3. Chemical and Petrochemical

- 3.4. Pharmaceutical

- 3.5. Food and Beverage

- 3.6. Other End-Users

Diaphragm Pump Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Diaphragm Pump Market Regional Market Share

Geographic Coverage of Diaphragm Pump Market

Diaphragm Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Costs of Solar Technologies4.; Demand for Decentralized Solar Energy Systems

- 3.3. Market Restrains

- 3.3.1. 4.; Absence of Any New Initiatives in the Country

- 3.4. Market Trends

- 3.4.1. Water and Wastewater Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Diaphragm Pump Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mechanism

- 5.1.1. Air Operated

- 5.1.2. Electrically Operated

- 5.2. Market Analysis, Insights and Forecast - by Discharge Pressure

- 5.2.1. Up to 80 bar

- 5.2.2. Between 80 to 200 bar

- 5.2.3. Above 200 bar

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Water and Wastewater

- 5.3.2. Oil and Gas

- 5.3.3. Chemical and Petrochemical

- 5.3.4. Pharmaceutical

- 5.3.5. Food and Beverage

- 5.3.6. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Mechanism

- 6. North America Diaphragm Pump Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mechanism

- 6.1.1. Air Operated

- 6.1.2. Electrically Operated

- 6.2. Market Analysis, Insights and Forecast - by Discharge Pressure

- 6.2.1. Up to 80 bar

- 6.2.2. Between 80 to 200 bar

- 6.2.3. Above 200 bar

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Water and Wastewater

- 6.3.2. Oil and Gas

- 6.3.3. Chemical and Petrochemical

- 6.3.4. Pharmaceutical

- 6.3.5. Food and Beverage

- 6.3.6. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Mechanism

- 7. Europe Diaphragm Pump Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mechanism

- 7.1.1. Air Operated

- 7.1.2. Electrically Operated

- 7.2. Market Analysis, Insights and Forecast - by Discharge Pressure

- 7.2.1. Up to 80 bar

- 7.2.2. Between 80 to 200 bar

- 7.2.3. Above 200 bar

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Water and Wastewater

- 7.3.2. Oil and Gas

- 7.3.3. Chemical and Petrochemical

- 7.3.4. Pharmaceutical

- 7.3.5. Food and Beverage

- 7.3.6. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Mechanism

- 8. Asia Pacific Diaphragm Pump Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mechanism

- 8.1.1. Air Operated

- 8.1.2. Electrically Operated

- 8.2. Market Analysis, Insights and Forecast - by Discharge Pressure

- 8.2.1. Up to 80 bar

- 8.2.2. Between 80 to 200 bar

- 8.2.3. Above 200 bar

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Water and Wastewater

- 8.3.2. Oil and Gas

- 8.3.3. Chemical and Petrochemical

- 8.3.4. Pharmaceutical

- 8.3.5. Food and Beverage

- 8.3.6. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Mechanism

- 9. South America Diaphragm Pump Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mechanism

- 9.1.1. Air Operated

- 9.1.2. Electrically Operated

- 9.2. Market Analysis, Insights and Forecast - by Discharge Pressure

- 9.2.1. Up to 80 bar

- 9.2.2. Between 80 to 200 bar

- 9.2.3. Above 200 bar

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Water and Wastewater

- 9.3.2. Oil and Gas

- 9.3.3. Chemical and Petrochemical

- 9.3.4. Pharmaceutical

- 9.3.5. Food and Beverage

- 9.3.6. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Mechanism

- 10. Middle East and Africa Diaphragm Pump Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mechanism

- 10.1.1. Air Operated

- 10.1.2. Electrically Operated

- 10.2. Market Analysis, Insights and Forecast - by Discharge Pressure

- 10.2.1. Up to 80 bar

- 10.2.2. Between 80 to 200 bar

- 10.2.3. Above 200 bar

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Water and Wastewater

- 10.3.2. Oil and Gas

- 10.3.3. Chemical and Petrochemical

- 10.3.4. Pharmaceutical

- 10.3.5. Food and Beverage

- 10.3.6. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Mechanism

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Flowserve Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tapflo Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Xylem Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ingersoll-Rand PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Verder International B V

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Graco Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LEWA Group*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Idex Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dover Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SPX FLOW Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Yamada Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Grundfos AS

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Flowserve Corporation

List of Figures

- Figure 1: Global Diaphragm Pump Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Diaphragm Pump Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: North America Diaphragm Pump Market Revenue (Million), by Mechanism 2025 & 2033

- Figure 4: North America Diaphragm Pump Market Volume (K Tons), by Mechanism 2025 & 2033

- Figure 5: North America Diaphragm Pump Market Revenue Share (%), by Mechanism 2025 & 2033

- Figure 6: North America Diaphragm Pump Market Volume Share (%), by Mechanism 2025 & 2033

- Figure 7: North America Diaphragm Pump Market Revenue (Million), by Discharge Pressure 2025 & 2033

- Figure 8: North America Diaphragm Pump Market Volume (K Tons), by Discharge Pressure 2025 & 2033

- Figure 9: North America Diaphragm Pump Market Revenue Share (%), by Discharge Pressure 2025 & 2033

- Figure 10: North America Diaphragm Pump Market Volume Share (%), by Discharge Pressure 2025 & 2033

- Figure 11: North America Diaphragm Pump Market Revenue (Million), by End-User 2025 & 2033

- Figure 12: North America Diaphragm Pump Market Volume (K Tons), by End-User 2025 & 2033

- Figure 13: North America Diaphragm Pump Market Revenue Share (%), by End-User 2025 & 2033

- Figure 14: North America Diaphragm Pump Market Volume Share (%), by End-User 2025 & 2033

- Figure 15: North America Diaphragm Pump Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Diaphragm Pump Market Volume (K Tons), by Country 2025 & 2033

- Figure 17: North America Diaphragm Pump Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Diaphragm Pump Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Diaphragm Pump Market Revenue (Million), by Mechanism 2025 & 2033

- Figure 20: Europe Diaphragm Pump Market Volume (K Tons), by Mechanism 2025 & 2033

- Figure 21: Europe Diaphragm Pump Market Revenue Share (%), by Mechanism 2025 & 2033

- Figure 22: Europe Diaphragm Pump Market Volume Share (%), by Mechanism 2025 & 2033

- Figure 23: Europe Diaphragm Pump Market Revenue (Million), by Discharge Pressure 2025 & 2033

- Figure 24: Europe Diaphragm Pump Market Volume (K Tons), by Discharge Pressure 2025 & 2033

- Figure 25: Europe Diaphragm Pump Market Revenue Share (%), by Discharge Pressure 2025 & 2033

- Figure 26: Europe Diaphragm Pump Market Volume Share (%), by Discharge Pressure 2025 & 2033

- Figure 27: Europe Diaphragm Pump Market Revenue (Million), by End-User 2025 & 2033

- Figure 28: Europe Diaphragm Pump Market Volume (K Tons), by End-User 2025 & 2033

- Figure 29: Europe Diaphragm Pump Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe Diaphragm Pump Market Volume Share (%), by End-User 2025 & 2033

- Figure 31: Europe Diaphragm Pump Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Diaphragm Pump Market Volume (K Tons), by Country 2025 & 2033

- Figure 33: Europe Diaphragm Pump Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Diaphragm Pump Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Diaphragm Pump Market Revenue (Million), by Mechanism 2025 & 2033

- Figure 36: Asia Pacific Diaphragm Pump Market Volume (K Tons), by Mechanism 2025 & 2033

- Figure 37: Asia Pacific Diaphragm Pump Market Revenue Share (%), by Mechanism 2025 & 2033

- Figure 38: Asia Pacific Diaphragm Pump Market Volume Share (%), by Mechanism 2025 & 2033

- Figure 39: Asia Pacific Diaphragm Pump Market Revenue (Million), by Discharge Pressure 2025 & 2033

- Figure 40: Asia Pacific Diaphragm Pump Market Volume (K Tons), by Discharge Pressure 2025 & 2033

- Figure 41: Asia Pacific Diaphragm Pump Market Revenue Share (%), by Discharge Pressure 2025 & 2033

- Figure 42: Asia Pacific Diaphragm Pump Market Volume Share (%), by Discharge Pressure 2025 & 2033

- Figure 43: Asia Pacific Diaphragm Pump Market Revenue (Million), by End-User 2025 & 2033

- Figure 44: Asia Pacific Diaphragm Pump Market Volume (K Tons), by End-User 2025 & 2033

- Figure 45: Asia Pacific Diaphragm Pump Market Revenue Share (%), by End-User 2025 & 2033

- Figure 46: Asia Pacific Diaphragm Pump Market Volume Share (%), by End-User 2025 & 2033

- Figure 47: Asia Pacific Diaphragm Pump Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Diaphragm Pump Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: Asia Pacific Diaphragm Pump Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Diaphragm Pump Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Diaphragm Pump Market Revenue (Million), by Mechanism 2025 & 2033

- Figure 52: South America Diaphragm Pump Market Volume (K Tons), by Mechanism 2025 & 2033

- Figure 53: South America Diaphragm Pump Market Revenue Share (%), by Mechanism 2025 & 2033

- Figure 54: South America Diaphragm Pump Market Volume Share (%), by Mechanism 2025 & 2033

- Figure 55: South America Diaphragm Pump Market Revenue (Million), by Discharge Pressure 2025 & 2033

- Figure 56: South America Diaphragm Pump Market Volume (K Tons), by Discharge Pressure 2025 & 2033

- Figure 57: South America Diaphragm Pump Market Revenue Share (%), by Discharge Pressure 2025 & 2033

- Figure 58: South America Diaphragm Pump Market Volume Share (%), by Discharge Pressure 2025 & 2033

- Figure 59: South America Diaphragm Pump Market Revenue (Million), by End-User 2025 & 2033

- Figure 60: South America Diaphragm Pump Market Volume (K Tons), by End-User 2025 & 2033

- Figure 61: South America Diaphragm Pump Market Revenue Share (%), by End-User 2025 & 2033

- Figure 62: South America Diaphragm Pump Market Volume Share (%), by End-User 2025 & 2033

- Figure 63: South America Diaphragm Pump Market Revenue (Million), by Country 2025 & 2033

- Figure 64: South America Diaphragm Pump Market Volume (K Tons), by Country 2025 & 2033

- Figure 65: South America Diaphragm Pump Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Diaphragm Pump Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Diaphragm Pump Market Revenue (Million), by Mechanism 2025 & 2033

- Figure 68: Middle East and Africa Diaphragm Pump Market Volume (K Tons), by Mechanism 2025 & 2033

- Figure 69: Middle East and Africa Diaphragm Pump Market Revenue Share (%), by Mechanism 2025 & 2033

- Figure 70: Middle East and Africa Diaphragm Pump Market Volume Share (%), by Mechanism 2025 & 2033

- Figure 71: Middle East and Africa Diaphragm Pump Market Revenue (Million), by Discharge Pressure 2025 & 2033

- Figure 72: Middle East and Africa Diaphragm Pump Market Volume (K Tons), by Discharge Pressure 2025 & 2033

- Figure 73: Middle East and Africa Diaphragm Pump Market Revenue Share (%), by Discharge Pressure 2025 & 2033

- Figure 74: Middle East and Africa Diaphragm Pump Market Volume Share (%), by Discharge Pressure 2025 & 2033

- Figure 75: Middle East and Africa Diaphragm Pump Market Revenue (Million), by End-User 2025 & 2033

- Figure 76: Middle East and Africa Diaphragm Pump Market Volume (K Tons), by End-User 2025 & 2033

- Figure 77: Middle East and Africa Diaphragm Pump Market Revenue Share (%), by End-User 2025 & 2033

- Figure 78: Middle East and Africa Diaphragm Pump Market Volume Share (%), by End-User 2025 & 2033

- Figure 79: Middle East and Africa Diaphragm Pump Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Diaphragm Pump Market Volume (K Tons), by Country 2025 & 2033

- Figure 81: Middle East and Africa Diaphragm Pump Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Diaphragm Pump Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Diaphragm Pump Market Revenue Million Forecast, by Mechanism 2020 & 2033

- Table 2: Global Diaphragm Pump Market Volume K Tons Forecast, by Mechanism 2020 & 2033

- Table 3: Global Diaphragm Pump Market Revenue Million Forecast, by Discharge Pressure 2020 & 2033

- Table 4: Global Diaphragm Pump Market Volume K Tons Forecast, by Discharge Pressure 2020 & 2033

- Table 5: Global Diaphragm Pump Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Diaphragm Pump Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 7: Global Diaphragm Pump Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Diaphragm Pump Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Global Diaphragm Pump Market Revenue Million Forecast, by Mechanism 2020 & 2033

- Table 10: Global Diaphragm Pump Market Volume K Tons Forecast, by Mechanism 2020 & 2033

- Table 11: Global Diaphragm Pump Market Revenue Million Forecast, by Discharge Pressure 2020 & 2033

- Table 12: Global Diaphragm Pump Market Volume K Tons Forecast, by Discharge Pressure 2020 & 2033

- Table 13: Global Diaphragm Pump Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 14: Global Diaphragm Pump Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 15: Global Diaphragm Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Diaphragm Pump Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Global Diaphragm Pump Market Revenue Million Forecast, by Mechanism 2020 & 2033

- Table 18: Global Diaphragm Pump Market Volume K Tons Forecast, by Mechanism 2020 & 2033

- Table 19: Global Diaphragm Pump Market Revenue Million Forecast, by Discharge Pressure 2020 & 2033

- Table 20: Global Diaphragm Pump Market Volume K Tons Forecast, by Discharge Pressure 2020 & 2033

- Table 21: Global Diaphragm Pump Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 22: Global Diaphragm Pump Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 23: Global Diaphragm Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Diaphragm Pump Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Global Diaphragm Pump Market Revenue Million Forecast, by Mechanism 2020 & 2033

- Table 26: Global Diaphragm Pump Market Volume K Tons Forecast, by Mechanism 2020 & 2033

- Table 27: Global Diaphragm Pump Market Revenue Million Forecast, by Discharge Pressure 2020 & 2033

- Table 28: Global Diaphragm Pump Market Volume K Tons Forecast, by Discharge Pressure 2020 & 2033

- Table 29: Global Diaphragm Pump Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 30: Global Diaphragm Pump Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 31: Global Diaphragm Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Diaphragm Pump Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Global Diaphragm Pump Market Revenue Million Forecast, by Mechanism 2020 & 2033

- Table 34: Global Diaphragm Pump Market Volume K Tons Forecast, by Mechanism 2020 & 2033

- Table 35: Global Diaphragm Pump Market Revenue Million Forecast, by Discharge Pressure 2020 & 2033

- Table 36: Global Diaphragm Pump Market Volume K Tons Forecast, by Discharge Pressure 2020 & 2033

- Table 37: Global Diaphragm Pump Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 38: Global Diaphragm Pump Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 39: Global Diaphragm Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Diaphragm Pump Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Global Diaphragm Pump Market Revenue Million Forecast, by Mechanism 2020 & 2033

- Table 42: Global Diaphragm Pump Market Volume K Tons Forecast, by Mechanism 2020 & 2033

- Table 43: Global Diaphragm Pump Market Revenue Million Forecast, by Discharge Pressure 2020 & 2033

- Table 44: Global Diaphragm Pump Market Volume K Tons Forecast, by Discharge Pressure 2020 & 2033

- Table 45: Global Diaphragm Pump Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 46: Global Diaphragm Pump Market Volume K Tons Forecast, by End-User 2020 & 2033

- Table 47: Global Diaphragm Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Diaphragm Pump Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Diaphragm Pump Market?

The projected CAGR is approximately > 6.10%.

2. Which companies are prominent players in the Diaphragm Pump Market?

Key companies in the market include Flowserve Corporation, Tapflo Group, Xylem Inc, Ingersoll-Rand PLC, Verder International B V, Graco Inc, LEWA Group*List Not Exhaustive, Idex Corporation, Dover Corporation, SPX FLOW Inc, Yamada Corporation, Grundfos AS.

3. What are the main segments of the Diaphragm Pump Market?

The market segments include Mechanism, Discharge Pressure, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6090 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Costs of Solar Technologies4.; Demand for Decentralized Solar Energy Systems.

6. What are the notable trends driving market growth?

Water and Wastewater Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Absence of Any New Initiatives in the Country.

8. Can you provide examples of recent developments in the market?

In August 2021, Graco Inc. announced the launch of its new Husky 3300e electric double diaphragm pump. The Husky 3300e pump transfers industrial fluids and offers plant managers high-volume fluid transfer (up 220 gpm) and drastically reduces power consumption.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Diaphragm Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Diaphragm Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Diaphragm Pump Market?

To stay informed about further developments, trends, and reports in the Diaphragm Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence